Finance

Is Health Insurance Cheaper When Married?

Modified: December 30, 2023

Discover if health insurance is more affordable for married couples and how it can impact your finances. Explore the benefits of joint coverage and potential savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

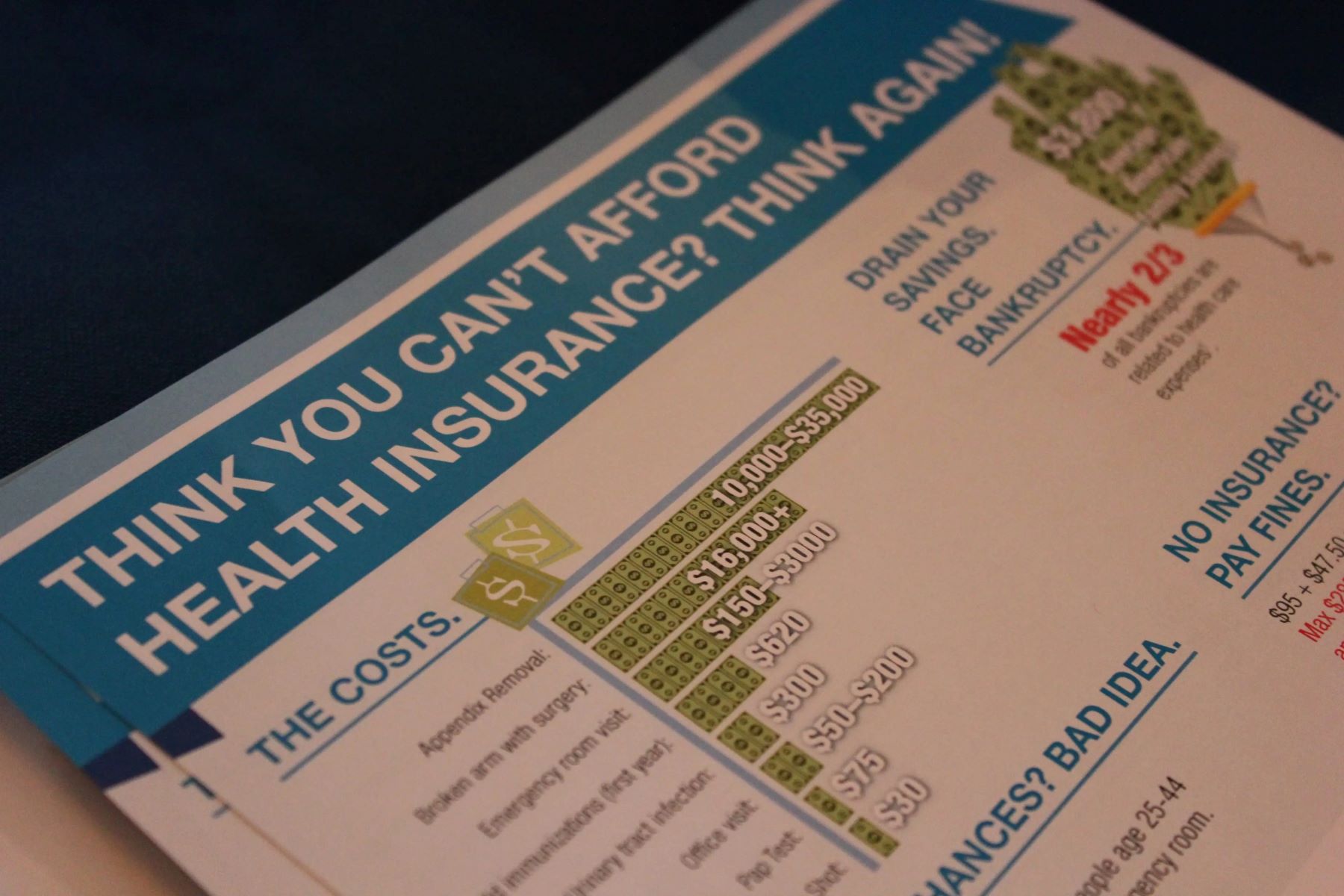

Health insurance is a critical aspect of financial planning, offering protection against soaring medical costs. Many factors influence health insurance rates, making it essential to understand the various considerations that insurers take into account when determining premiums. One such consideration is marital status. Couples often wonder if health insurance becomes cheaper when they tie the knot. While marriage can have an impact on health insurance costs, it is essential to delve deeper into the factors involved to gain a comprehensive understanding.

In this article, we will explore the relationship between marital status and health insurance rates. We will discuss the factors that affect health insurance costs, the specific impact of being married on premiums, as well as the benefits and drawbacks of getting married for health insurance purposes. Additionally, we will highlight alternative options for accessing affordable health insurance, ensuring that you have all the necessary knowledge to make informed decisions regarding your coverage.

Understanding how health insurance rates are determined can help you navigate the complexities of the insurance market and secure the best coverage at the most affordable price. So, let’s dive into the factors that influence health insurance rates before exploring the impact that marriage can have on your premiums.

Factors Affecting Health Insurance Rates

Health insurance rates are determined by a range of factors, each playing a significant role in calculating premiums. While marital status is one variable that insurers consider, it is important to understand that it is just one piece of the puzzle. Here are some of the key factors that can affect health insurance rates:

- Age: Younger individuals typically have lower health insurance rates since they are generally healthier and require less medical care. As individuals grow older, the risk of chronic health conditions and the need for medical treatments increase, leading to higher premiums.

- Geographic location: The cost of living and healthcare services vary across different regions, resulting in differences in health insurance rates. Areas with higher healthcare costs typically have higher premiums.

- Medical history and pre-existing conditions: Insurers assess an individual’s medical history and any pre-existing conditions they may have. Certain medical conditions and chronic illnesses can lead to higher premiums or exclusions from coverage.

- Lifestyle habits: Factors such as tobacco or alcohol consumption, obesity, and participation in risky activities like extreme sports can impact health insurance premiums. Unhealthy lifestyle choices may lead to higher rates due to the increased risk of medical issues.

- Income: In some cases, income level can affect health insurance rates. Individuals with lower incomes may qualify for government subsidies or assistance programs that can lower their premiums.

These are just a few of the many factors that insurers take into account when determining health insurance rates. Marital status is another consideration, and we will now examine how being married can impact health insurance costs.

Impact of Marital Status on Health Insurance Costs

Marital status can have an effect on health insurance costs, but the specifics can vary depending on the insurance provider and the type of plan you choose. Here are some ways in which being married can impact health insurance premiums:

- Shared Coverage: Many employers provide health insurance plans that extend coverage to an employee’s spouse. This means that, as a married couple, you can often share a single policy, reducing the overall cost compared to having separate individual plans.

- Family Deductibles: With shared coverage, the deductible—the amount you must pay out-of-pocket before insurance coverage kicks in—is often combined for the entire family. Consequently, reaching the deductible threshold collectively may be more manageable than if each individual had to meet their own deductible.

- Dependent Coverage: If you have children, being married can also impact health insurance costs as you can include your children as dependents on your policy. This allows for broader coverage and often leads to more affordable premiums when compared to obtaining separate plans for each family member.

- More Plan Options: Marriage can provide access to a wider range of health insurance plans. Some employers offer exclusive plan options or discounts to married couples, giving you greater choice in selecting a plan that suits your specific needs and budget.

- Spousal Discounts: In certain cases, insurers may offer spousal discounts, enabling married couples to enjoy reduced premiums. These discounts can provide additional savings and make health insurance more affordable for married individuals.

While being married can have its advantages in terms of health insurance costs, it is important to note that these benefits may not apply universally. Certain factors, such as the specific insurance provider, the state you reside in, and the size of your employer, can influence whether these cost-saving benefits apply to your situation.

It is crucial to review your health insurance options carefully and compare the cost and coverage of various plans available to you as a married individual or couple. By doing so, you can make an informed decision about which plan offers the most suitable coverage at the most affordable price.

Benefits of Getting Married for Health Insurance

Getting married can offer several advantages when it comes to health insurance coverage. Let’s explore some of the benefits:

- Shared Premiums: One significant advantage of being married is the ability to share a health insurance plan. This often results in lower premiums compared to having separate individual plans. Sharing a plan not only saves money but also simplifies the administrative process of managing health insurance coverage.

- Lower Deductibles: When you are married and have a family health insurance plan, the deductible is typically combined for all family members. This means that collectively reaching the deductible threshold is generally more attainable than if each family member had their own individual deductible to meet.

- Wider Coverage for Dependents: If you have children or plan to have children in the future, being married provides the opportunity to include them as dependents on your health insurance plan. This ensures that your entire family has access to quality healthcare and can result in more affordable premiums compared to individual plans for each family member.

- Access to More Plan Options: Being married can open doors to a wider range of health insurance plan options. Some employers offer exclusive plans or special discounts for married couples, allowing you to choose a plan that best meets your family’s specific needs and budget.

- Coverage for Spouses without Employer-Sponsored Plans: If your spouse does not have access to employer-sponsored health insurance or works for a company that does not provide coverage, getting married may enable them to be covered under your employer-sponsored plan. This can provide peace of mind and ensure that both you and your spouse have access to essential healthcare services.

It is important to note that while there are many benefits of getting married for health insurance, it is crucial to carefully evaluate your options and assess the specific offerings of each plan. Factors such as the cost, coverage, and network of healthcare providers should be considered to ensure that the plan you choose adequately meets your needs as a couple or family.

By leveraging the advantages of being married, you can potentially reduce your health insurance costs, gain access to better coverage, and provide comprehensive healthcare protection for yourself and your loved ones.

Drawbacks of Getting Married for Health Insurance

While there are benefits to getting married for health insurance, it is important to consider potential drawbacks that may arise. Here are a few disadvantages that you should keep in mind:

- Loss of Subsidies: If you or your spouse currently receive subsidies for health insurance through the Affordable Care Act (ACA) marketplace, getting married may change your eligibility. Combining incomes as a married couple can lead to higher household income, which may disqualify you from receiving certain subsidies.

- Increased Costs: While sharing a health insurance plan can often lead to cost savings, there are instances where getting married may increase your overall health insurance costs. If one spouse has access to a highly subsidized or low-cost employer-sponsored plan, adding them to the other spouse’s plan may result in higher premiums.

- Coverage Limitations: Some health insurance plans may impose limitations on coverage for spouses. For example, certain plans may require the spouse to have their own employer-sponsored coverage and only offer spousal coverage if the spouse does not have access to other insurance options. These limitations could impact your ability to secure the desired coverage for your spouse.

- Loss of Independence: When you marry and share a health insurance plan, you lose a level of individual freedom and independence. Both partners must consider each other’s healthcare needs and make decisions together, potentially limiting individual choices.

It is crucial to thoroughly assess your specific situation and evaluate the potential drawbacks alongside the benefits of getting married for health insurance. Consider factors such as income, current subsidies, the cost of adding a spouse to a plan, and any coverage limitations that may exist.

Additionally, it is essential to review the terms and conditions of a plan before making any decisions. Understanding the network of healthcare providers, coverage limits, and any policy restrictions will help you make an informed choice.

In some cases, the drawbacks of getting married for health insurance may outweigh the benefits. Exploring alternative options for securing affordable health insurance may be worth considering to ensure that you have optimal coverage at the most reasonable cost.

Alternative Options for Accessing Affordable Health Insurance

If getting married for health insurance does not align with your current situation or preferences, there are alternative options available to access affordable coverage. Here are a few alternatives you can consider:

- Employer-Sponsored Plans: If you are employed, explore the health insurance options provided by your employer. Many companies offer comprehensive and cost-effective plans for their employees. Compare the coverage, premiums, and network of providers to ensure you choose the best option for your needs.

- Health Insurance Marketplaces: The Affordable Care Act (ACA) created health insurance marketplaces where individuals and families can shop for coverage. These marketplaces offer a range of plans with different benefits and costs. Depending on your income, you may also qualify for subsidies that can help reduce your premiums.

- Medicaid and CHIP: Medicaid is a government program that provides health coverage for low-income individuals and families. The Children’s Health Insurance Program (CHIP) offers low-cost or free health coverage for children in low-income families. If you meet the eligibility criteria, these programs can provide you with affordable or even no-cost health insurance.

- COBRA Coverage: If you recently lost your job or experienced a reduction in work hours, you may be eligible for COBRA coverage. COBRA allows you to continue your employer-sponsored health insurance plan for a limited time, though it can be more expensive since you will be responsible for the full premium.

- Association Health Plans: Some industries or professional organizations offer association health plans that provide coverage to members. These plans can often provide more affordable options for individuals or small businesses that may not have access to group coverage. Research if there are any associations or organizations relevant to your field that offer these plans.

- Short-term Health Insurance: Short-term health insurance plans are designed to provide temporary coverage for specific periods, typically less than a year. These plans may have more limited coverage compared to traditional plans, but they can be a viable option if you are in a transitional phase and need temporary coverage.

When exploring alternative options, carefully evaluate the coverage, premiums, and network of healthcare providers. Consider factors such as your health needs, budget, and any specific requirements or limitations of each option.

It is recommended to research and compare multiple alternatives to ensure you choose the most suitable and affordable health insurance option for your unique circumstances. Consulting with a licensed insurance professional can also provide valuable guidance and help you navigate the complexities of the insurance landscape.

Conclusion

When it comes to health insurance rates, marital status can play a role in determining premiums. Being married can offer several advantages, such as shared coverage, lower deductibles, and access to more plan options, which can ultimately lead to cost savings and comprehensive coverage for both spouses and dependents. However, there can also be drawbacks to consider, including potential loss of subsidies, increased costs, and coverage limitations.

If getting married for health insurance is not the best option for you, there are alternative avenues to explore. Employer-sponsored plans, health insurance marketplaces, Medicaid and CHIP, COBRA coverage, association health plans, and short-term health insurance are all viable alternatives to access affordable coverage. Each option has its own set of benefits and considerations, so it is important to carefully evaluate and compare them based on your specific needs and circumstances.

Ultimately, the decision regarding whether to get married for health insurance or pursue alternative options should be based on a thorough understanding of the benefits, drawbacks, and available alternatives. Consider factors such as coverage, premiums, network of providers, and eligibility for subsidies or assistance programs.

Remember to review and compare multiple options, and consult with insurance professionals if needed, to ensure that you make an informed decision and select the most suitable and affordable health insurance solution for you and your loved ones.