Home>Finance>Hedge Accounting: Definition, Different Models, And Purpose

Finance

Hedge Accounting: Definition, Different Models, And Purpose

Modified: December 30, 2023

Learn about hedge accounting in finance, including its definition, different models, and purpose. Enhance your understanding of this vital financial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Hedge Accounting: Definition, Different Models, and Purpose

Have you ever heard of hedge accounting? If you are in the financial world, you might be familiar with this term. But for those who aren’t, don’t worry – I’ve got you covered! In this article, we will explore the definition, different models, and the purpose of hedge accounting.

Key Takeaways

- Hedge accounting is a financial reporting practice that allows companies to mitigate the impact of changes in the fair value of assets and liabilities.

- There are three main models of hedge accounting: fair value hedge, cash flow hedge, and hedge of a net investment in a foreign operation.

What is Hedge Accounting?

Hedge accounting is a specialized accounting practice that aims to reduce volatility in a company’s financial statements by offsetting gains or losses from specific financial instruments or transactions. It is mainly used to minimize the impact of changes in the fair value of assets and liabilities caused by fluctuations in market prices or exchange rates.

Hedge accounting allows companies to match the recognition of gains or losses on the hedging instrument with the recognition of gains or losses on the hedged item. This matching helps to eliminate the distortion caused by changes in fair value that are unrelated to the company’s core business operations.

Now that we understand the concept of hedge accounting, let’s take a closer look at the different models that companies use.

Different Models of Hedge Accounting

There are three main models of hedge accounting:

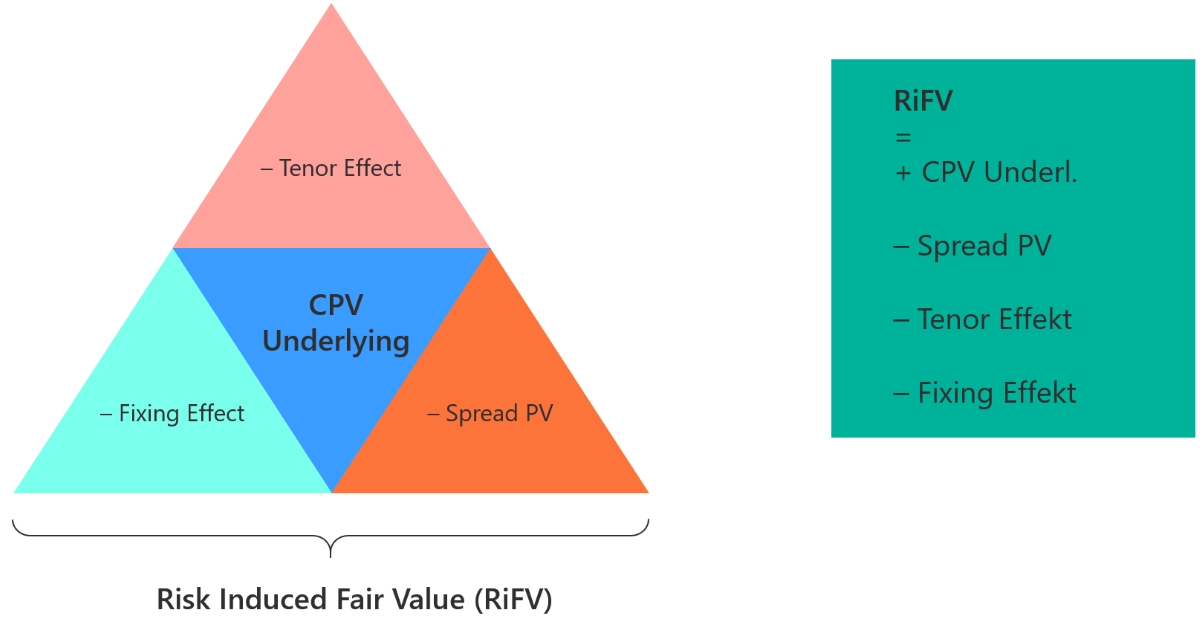

- Fair Value Hedge: This model is used when a company wants to hedge against changes in the fair value of a recognized asset or liability. By using hedging instruments such as derivatives, the company can offset the changes in value and limit the impact on its financial statements.

- Cash Flow Hedge: This model focuses on hedging against future cash flow uncertainties. Companies use cash flow hedging when they want to protect themselves from fluctuations in interest rates, foreign exchange rates, or commodity prices that can affect future cash flows.

- Hedge of a Net Investment in a Foreign Operation: This model is used by multinational companies that have investments in foreign subsidiaries. It aims to protect the company’s investment in a foreign operation from fluctuations in exchange rates.

Each model of hedge accounting has its own specific requirements and guidelines. Companies need to carefully evaluate their hedging strategies and select the most appropriate model based on their specific needs and objectives.

Purpose of Hedge Accounting

The main purpose of hedge accounting is to provide companies with a more accurate and transparent representation of their financial position and performance. By reducing the volatility in financial statements, companies can better reflect the economic substance of their transactions.

Some of the key benefits and purposes of hedge accounting include:

- Minimizing earnings volatility: Hedge accounting helps companies eliminate or minimize the impact of market-driven changes on their financial statements, allowing for a smoother and more stable earnings profile.

- Improved risk management: By using hedge accounting, companies can effectively manage the risks associated with changes in market prices, interest rates, currency exchange rates, and commodity prices.

- Enhanced financial reporting: Hedge accounting promotes more accurate and transparent financial reporting by aligning the recognition of gains or losses on hedging instruments with the recognition of gains or losses on the hedged items.

In conclusion, hedge accounting is an essential practice for companies looking to mitigate the impact of market-driven fluctuations in their financial statements. By using different models of hedge accounting, companies can effectively manage risks and provide more accurate financial reporting. So, if you ever come across the term “hedge accounting,” you’ll now have a better understanding of what it entails!