Finance

What Is Hedging In Accounting

Published: January 15, 2024

Discover the importance of hedging in accounting and its impact on the finance industry. Learn how hedging strategies can mitigate financial risks and ensure stability in financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where managing risks is a crucial aspect of ensuring the stability and success of businesses. In accounting, one of the key strategies employed to mitigate financial risks is hedging. Hedging in accounting refers to the practice of using financial instruments to offset potential losses or gains that may arise from changes in the value of assets, liabilities, or future cash flows.

While the concept of hedging may seem complex, it plays a vital role in providing companies with a level of certainty in an uncertain financial environment. By employing hedging strategies, businesses can safeguard their financial positions, protect their profits, and make more informed decisions based on reliable projections.

In this article, we will explore the definition of hedging in accounting, the various types of hedging instruments, the purpose of hedging, the accounting treatment of hedging transactions, and provide examples to illustrate the concept. We will also delve into the challenges and risks associated with hedging in accounting.

Whether you are a finance professional, a business owner, or simply curious about the world of accounting, understanding hedging is essential to effectively manage financial risks and ensure the long-term sustainability of your organization.

Definition of Hedging in Accounting

In the realm of accounting, hedging is a risk management strategy that involves the use of financial instruments to reduce or eliminate the potential impact of unfavorable price or rate fluctuations on assets, liabilities, or future cash flows. It is a proactive approach taken by businesses to protect themselves from potential losses and ensure the stability of their financial positions.

Hedging in accounting is primarily aimed at mitigating various types of financial risks, including currency exchange rate risk, interest rate risk, commodity price risk, and market risk. By employing hedging strategies, companies can minimize the uncertainty associated with these risks and gain more control over their financial outcomes.

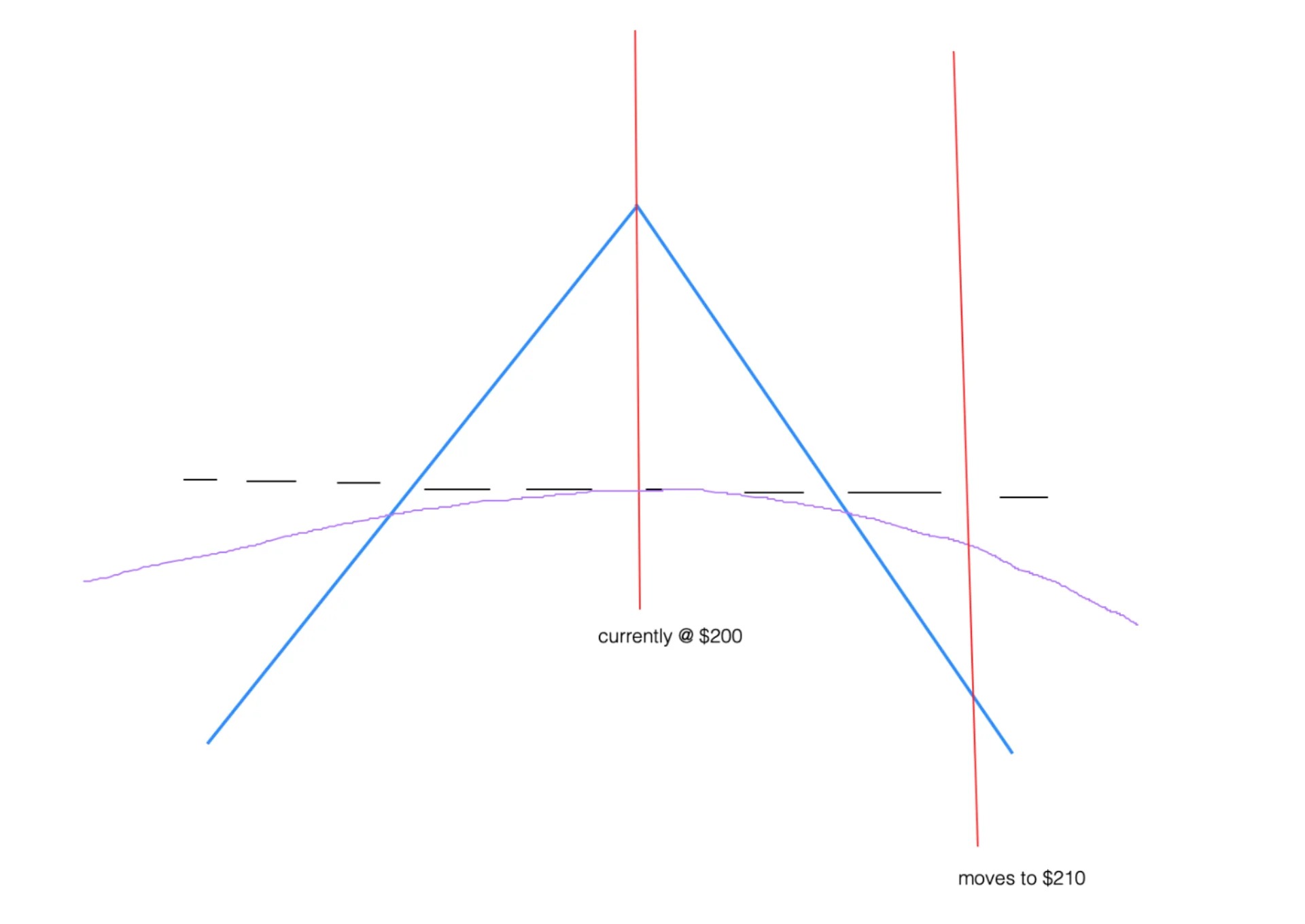

The concept of hedging functions on the principle of offsetting potential losses or gains in one financial position with corresponding gains or losses in another position. In other words, a company enters into a hedging arrangement to neutralize the impact of adverse price movements on certain assets or liabilities by taking an offsetting position.

To implement hedging in accounting, businesses use various financial instruments, including futures contracts, options contracts, swaps, and forwards. These instruments are used to create a hedge or a counterbalancing position that will offset any potential losses incurred due to market fluctuations.

It’s important to note that the goal of hedging is not to generate additional profits; rather, it is to minimize the potential losses that could occur from adverse price movements. Hedging acts as a form of insurance that protects a company’s financial position and ensures a more predictable outcome, even in volatile market conditions.

Overall, the definition of hedging in accounting can be summarized as a risk management strategy that aims to minimize financial uncertainties by using financial instruments to offset potential losses or gains arising from market fluctuations.

Types of Hedging Instruments

In the world of finance, there are various types of hedging instruments available to businesses seeking to mitigate risks and protect their financial positions. These instruments serve as tools to effectively hedge against different types of financial risks. Let’s explore some of the commonly used hedging instruments:

- Futures Contracts: Futures contracts are standardized agreements to buy or sell a specific asset at a predetermined price and date in the future. These contracts enable businesses to lock in a future price, thereby protecting themselves against fluctuations in asset prices. For example, a company may enter into a futures contract to hedge against potential increases in the price of a commodity it relies on for its operations.

- Options Contracts: Options contracts provide the holder with the right, but not the obligation, to buy (call option) or sell (put option) an asset at a predetermined price within a specified period. Options can be used to hedge against price movements in assets, such as stocks or currencies. For instance, a company holding foreign currency may purchase put options to hedge against potential depreciation of that currency.

- Swaps: Swaps are agreements between two parties to exchange cash flows based on different variables, such as interest rates or currencies. They enable businesses to manage interest rate risks and exchange rate risks. For example, a company with a variable rate loan may enter into an interest rate swap to protect against potential increases in interest rates.

- Forwards: Forward contracts are similar to futures contracts in that they involve the agreement to buy or sell an asset at a future date and price. However, forwards are typically customized contracts between two parties, whereas futures are standardized and traded on exchanges. Businesses often use forwards to hedge against foreign currency risks when engaging in international trade.

- Options on Futures: Options on futures contracts combine the characteristics of options contracts and futures contracts. These instruments provide the holder with the right, but not the obligation, to buy or sell a futures contract at a predetermined price within a specified period. Options on futures offer businesses flexibility in managing risks associated with asset price fluctuations.

These are just a few examples of the wide range of hedging instruments available to businesses. The choice of instrument depends on the specific risks being hedged and the desired level of protection. It’s important for organizations to carefully evaluate their financial exposures and select the most suitable hedging instruments to achieve their risk management objectives.

Purpose of Hedging in Accounting

The main purpose of hedging in accounting is to manage and mitigate financial risks that businesses face in an increasingly volatile and uncertain market environment. By employing hedging strategies, companies aim to achieve several objectives:

- Risk Reduction: Hedging is primarily used to reduce or minimize potential losses that may arise from adverse price movements in assets, liabilities, or future cash flows. It acts as a form of insurance, providing protection against fluctuations in currency exchange rates, interest rates, commodity prices, and other market risks. By hedging, businesses can stabilize their financial positions and safeguard their profitability even in turbulent market conditions.

- Profit Protection: Hedging helps protect the profits of businesses by providing a level of certainty in uncertain financial circumstances. By hedging against potential risks, companies can mitigate the impact of unfavorable price movements on their assets or liabilities, and ensure that their earnings and cash flows remain stable. This enables them to avoid sudden and unexpected financial losses that could significantly impact their bottom line.

- Financial Planning and Forecasting: Hedging plays a critical role in supporting effective financial planning and forecasting. By employing hedging strategies, businesses can have a clearer picture of their future financial outcomes. It allows them to project more accurate budgeting, cash flow projections, and financial statements by incorporating the anticipated impact of hedging transactions. This, in turn, enables better decision-making and strategic planning for the organization.

- Enhanced Competitiveness: Hedging can provide companies with a competitive advantage by reducing their exposure to financial risks. By actively managing and hedging against risks, businesses can confidently engage in various activities such as international trade, long-term borrowing, or investing in volatile markets. This enhanced risk management capability allows organizations to focus on their core operations and pursue growth opportunities without the fear of significant financial losses.

- Stakeholder Confidence: Demonstrating effective risk management through hedging can instill confidence in stakeholders, including investors, creditors, and regulatory bodies. It shows that a company has taken proactive measures to protect its financial position and ensure stability. This can lead to increased investor trust, improved access to capital, and better relationships with key stakeholders, ultimately contributing to the long-term success of the organization.

In summary, the purpose of hedging in accounting is multifaceted. It encompasses risk reduction, profit protection, financial planning, enhanced competitiveness, and stakeholder confidence. By strategically employing hedging strategies, businesses can better navigate volatile market conditions, protect their financial interests, and ensure long-term sustainability.

Accounting Treatment of Hedging Transactions

Accounting treatment of hedging transactions involves specific rules and guidelines to accurately capture the impact of these transactions in a company’s financial statements. The main objective is to provide transparency and reflect the economic substance of the hedging relationship. Let’s explore the key aspects of accounting treatment for hedging transactions:

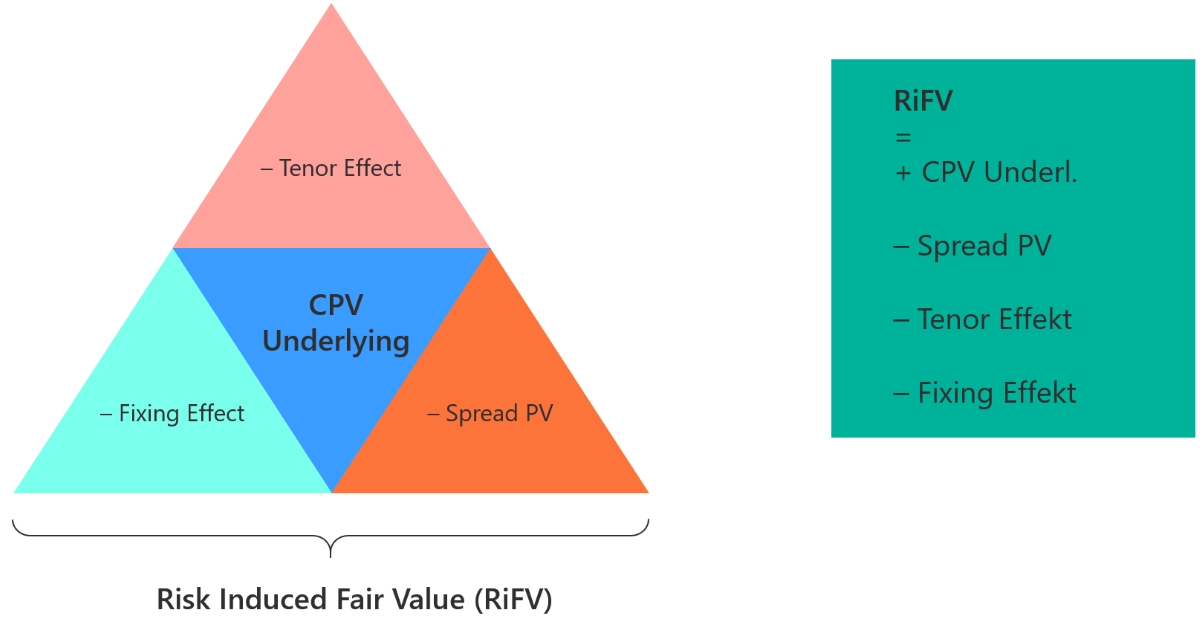

1. Fair Value Hedge: When a company uses hedging instruments to offset changes in the fair value of a recognized asset or liability, it is classified as a fair value hedge. The changes in fair value of both the hedging instrument and the hedged item are recognized in the income statement, which helps offset the impact of the changes in value. This ensures that the financial statements reflect the economic impact of the hedging relationship.

2. Cash Flow Hedge: When a company uses hedging instruments to protect against fluctuations in future cash flows, it is deemed as a cash flow hedge. The effective portion of the hedging instrument’s gain or loss is initially recognized in other comprehensive income (OCI) and subsequently reclassified to the income statement when the hedged item affects profit or loss. The ineffective portion is recognized directly in the income statement.

3. Net Investment Hedge: A net investment hedge is used to offset exchange rate fluctuations that arise from foreign currency investments or subsidiaries. The gain or loss on the hedging instrument is recognized in OCI and is accumulated in a separate component of equity known as the cumulative translation adjustment account. When the net investment is disposed of, the accumulated gain or loss is recycled to the income statement.

4. Effectiveness Testing: Accounting standards require entities to assess and demonstrate the effectiveness of their hedging relationships. Effectiveness testing ensures that the hedging instrument is capable of offsetting changes in the fair value or cash flows of the hedged item to a significant extent. Documentation and measurement techniques are used to assess the hedge’s effectiveness and ensure compliance with accounting regulations.

5. Disclosure Requirements: To promote transparency, companies are required to provide extensive disclosures about their hedging activities in the financial statements. These disclosures include information on the objectives, strategies, and risks associated with the hedging instruments, as well as details about the fair value and cash flow hedges and the impact on the financial statements. These disclosures help users understand the nature and extent of the company’s hedging activities.

It is important for companies to comply with accounting standards and accurately reflect the impact of hedging transactions in their financial statements. By doing so, stakeholders can gain a comprehensive understanding of the company’s risk management strategies, the effectiveness of these strategies, and the potential impact on financial performance.

Examples of Hedging in Accounting

To better understand how hedging works in accounting, let’s explore a few examples that illustrate the application of hedging strategies in real-world scenarios:

1. Currency Hedging: A multinational company, XYZ Inc., has significant operations in Europe and is exposed to exchange rate fluctuations between the euro and the U.S. dollar. To mitigate this risk, XYZ enters into a forward contract to sell euros and buy U.S. dollars at a predetermined exchange rate. This allows XYZ to lock in a favorable exchange rate and protect its anticipated euro-denominated cash flows. As the exchange rate fluctuates, the gains or losses from the forward contract offset the changes in the value of XYZ’s euro-denominated assets or liabilities, minimizing the impact on its financial statements.

2. Commodity Hedging: An airline company, ABC Airlines, is highly dependent on jet fuel for its operations. As the price of jet fuel is subject to volatility, ABC Airlines uses futures contracts to hedge against potential increases in fuel prices. By purchasing futures contracts at a predetermined price, ABC Airlines can secure the cost of its jet fuel and protect its profit margins. If the price of jet fuel rises, the gains on the futures contracts offset the increased expenses, thereby reducing the financial impact on ABC Airlines.

3. Interest Rate Hedging: A manufacturing company, XYZ Manufacturing, has a variable rate loan that exposes it to fluctuations in interest rates. To protect against potential interest rate hikes, XYZ Manufacturing enters into an interest rate swap agreement. Under this agreement, XYZ agrees to exchange its variable interest rate payments for fixed interest rate payments with another party. If interest rates rise, the fixed rate payments received from the swap offset the increased interest expenses on the loan, helping XYZ Manufacturing maintain a stable interest expense and mitigate the impact on its financial statements.

4. Cash Flow Hedging: A software company, ABC Software, anticipates receiving a payment in a foreign currency six months from now. To protect against potential currency fluctuations, ABC Software enters into a currency options contract. If the value of the foreign currency decreases, ABC Software can exercise the option and sell the currency at the predetermined exchange rate, minimizing the impact on its cash flow. However, if the value of the foreign currency increases, ABC Software can let the option expire and benefit from the favorable exchange rate, thereby reducing the risk of currency volatility.

These examples demonstrate how companies can use various hedging instruments to manage risks and protect their financial positions. By strategically implementing hedging strategies, businesses can mitigate the impact of market fluctuations, safeguard their profitability, and make more informed financial decisions.

Challenges and Risks of Hedging in Accounting

While hedging is an effective risk management strategy, it is not without its challenges and risks. Understanding and addressing these potential pitfalls is crucial for businesses to ensure the success of their hedging activities. Let’s explore some of the main challenges and risks associated with hedging in accounting:

1. Complexity: Hedging can be complex, particularly when accounting for the various types of hedging instruments and their specific rules and regulations. Companies need to have a deep understanding of accounting standards and ensure they have the necessary expertise to accurately account for hedging transactions. Failure to properly account for hedging activities can lead to misrepresentation of financial positions and non-compliance with accounting regulations.

2. Ineffectiveness: Hedging strategies may not always be entirely effective in offsetting risks due to discrepancies between the hedging instrument and the hedged item. The difference in movements or timing can result in imperfect hedges, leading to potential losses. Companies need to carefully assess the effectiveness of their hedging relationships and evaluate the impact of any ineffectiveness on their financial statements.

3. Costs and Liquidity: Entering into hedging transactions often incurs costs, including transaction fees, margin requirements, and bid-ask spreads. These costs can impact the profitability of the hedged position and should be carefully considered. Additionally, hedging activities may require access to liquid markets or counterparties, which can present challenges, particularly for smaller companies or less liquid assets.

4. Market Volatility: Hedging involves predicting future market movements and seeking to protect against potential risks. However, market conditions can be highly volatile and unpredictable, making it challenging to accurately anticipate changes and effectively mitigate risks. Sudden market fluctuations or unexpected events can disrupt hedging strategies and result in financial losses.

5. Accounting Standards Changes: Accounting standards for hedging can evolve and change over time, requiring companies to adapt their hedging practices. Changes in regulations and accounting standards may impact the effectiveness and accounting treatment of existing hedging relationships. Companies need to stay informed about any accounting standard updates and ensure compliance with the latest requirements.

6. Counterparty Risk: Hedging transactions involve entering into agreements with counterparties, such as financial institutions or brokers. There is a risk that the counterparty may fail to fulfill their obligations, leading to potential financial losses for the company. Companies should carefully evaluate the creditworthiness and reputation of their counterparties and establish risk mitigation strategies, such as diversifying counterparties or using credit derivatives.

It is important for businesses to have robust risk management processes in place to address these challenges and risks associated with hedging. This includes having a clear understanding of the accounting treatment, regularly assessing the effectiveness of hedging relationships, monitoring market conditions, and establishing strong relationships with reliable counterparties.

By proactively managing these challenges and risks, businesses can optimize the effectiveness of their hedging strategies, protect their financial positions, and make well-informed decisions to navigate the uncertainties of today’s financial landscape.

Conclusion

Hedging in accounting is a vital risk management strategy that allows businesses to mitigate the impact of market fluctuations and protect their financial positions. By using various hedging instruments, such as futures contracts, options contracts, swaps, and forwards, companies can offset potential losses or gains in assets, liabilities, or future cash flows. The purpose of hedging in accounting is to reduce risk, protect profits, enhance financial planning, and increase competitiveness.

The accounting treatment of hedging transactions involves following specific guidelines to accurately reflect the impact of hedging relationships in financial statements. Companies must classify their hedges as fair value hedges, cash flow hedges, or net investment hedges, and demonstrate the effectiveness of these relationships. Additionally, thorough disclosure of hedging activities is required to provide transparency to stakeholders.

Despite the benefits, hedging in accounting is not without challenges and risks. Complexity, ineffectiveness, costs, market volatility, accounting standards changes, and counterparty risk are some of the hurdles businesses may encounter. However, with proper risk management processes and a comprehensive understanding of accounting standards, companies can navigate these challenges and effectively employ hedging strategies to protect their financial interests.

In conclusion, hedging in accounting plays a crucial role in managing financial risks and ensuring stability within organizations. It reduces uncertainty, protects profits, enhances financial planning, and instills confidence in stakeholders. By carefully implementing and accounting for hedging transactions, companies can safeguard their financial positions, make informed decisions, and navigate the complexities of the ever-changing financial landscape.