Finance

How To Get Your Pin For The IRS

Published: October 30, 2023

Learn how to obtain your PIN for the IRS and manage your finances effectively. Take control of your tax obligations and secure your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Importance of an IRS PIN

- Methods to Retrieve Your IRS PIN

- Step 1: Logging in to the IRS Website

- Step 2: Verifying Your Identity

- Step 3: Requesting Your IRS PIN

- Step 4: Receiving Your IRS PIN

- Step 5: Using Your IRS PIN for Tax Filing

- Common Issues and Troubleshooting Tips

- Conclusion

Introduction

Welcome to our comprehensive guide on how to get your Personal Identification Number (PIN) for the Internal Revenue Service (IRS). The IRS PIN is a crucial component in securing your sensitive financial information and helps to prevent tax-related identity theft. In this article, we will walk you through the importance of an IRS PIN and provide you with step-by-step instructions on how to retrieve it.

As technology continues to advance, so do the techniques used by cybercriminals to steal personal information. This has led to an increase in tax-related identity theft, where individuals fraudulently file tax returns using stolen personal information. To combat this issue, the IRS introduced the PIN system to provide an extra layer of security.

Your IRS PIN acts as a unique identifier, ensuring that only you can access and file your tax returns. It is important to note that obtaining an IRS PIN is not only applicable to victims of identity theft but is encouraged for all taxpayers. This proactive measure helps to safeguard your financial information and prevent potential issues in the future.

In the following sections, we will explore the various methods to retrieve your IRS PIN, the steps involved in the process, and common troubleshooting tips to overcome any obstacles you may encounter. With this information at your disposal, you will be equipped to secure your tax filings and protect your financial well-being.

Understanding the Importance of an IRS PIN

The IRS PIN serves as a critical safeguard to protect your personal and financial information. It adds an extra layer of security by ensuring that only you can access and file your tax returns. Here’s why having an IRS PIN is so important:

- Prevents Tax-Related Identity Theft: Tax-related identity theft is a growing concern. Criminals may use your Social Security number and other personal details to file fraudulent tax returns and claim refunds in your name. By having an IRS PIN, you significantly reduce the risk of falling victim to this type of identity theft.

- Ensures Secure access to Your Tax Information: When you have an IRS PIN, it helps to verify your identity when accessing your tax information online. This additional security measure minimizes the chances of unauthorized individuals gaining access to your personal and financial data.

- Avoids Processing Delays: Without an IRS PIN, the IRS may subject your tax return to additional scrutiny to confirm your identity. This can cause delays in processing your return and receiving any refunds you may be owed. By providing your IRS PIN, you expedite the processing of your return, potentially avoiding unnecessary delays.

- Protects Against Future Issues: Obtaining an IRS PIN is not limited to individuals who have already experienced identity theft. It is a proactive measure that helps safeguard your financial information, preventing potential issues down the line. By securing your tax filings with an IRS PIN, you reduce the risk of fraudulent activity compromising your finances.

Now that you understand the importance of an IRS PIN, let’s explore the different methods available to retrieve your PIN in the next section.

Methods to Retrieve Your IRS PIN

Retrieving your IRS PIN is a straightforward process that can be done through various methods. Here are the primary methods available:

- Online Retrieval: The IRS provides an online tool for individuals to retrieve their IRS PIN. This method is convenient and accessible 24/7. It requires you to go through a verification process to prove your identity before obtaining your PIN.

- Requesting via Phone: Another option is to request your IRS PIN over the phone. You can call the IRS helpline and provide the necessary information to verify your identity. Once verified, they will provide you with your PIN.

- Mailing Request: If you prefer a mailed option, you can complete Form 4506-T, Request for Transcript of Tax Return, and mail it to the IRS. This form includes a section for requesting your IRS PIN. The IRS will process your request and send your PIN via mail.

- In-Person Assistance: If you prefer face-to-face assistance, you can visit a local IRS Taxpayer Assistance Center. An IRS representative will guide you through the process and help retrieve your IRS PIN.

Each method has its own benefits and considerations. Online retrieval offers convenience, while phone and in-person assistance provide personalized support. Mailing a request can be preferred for those who are more comfortable with traditional forms of communication.

Next, we will walk you through step-by-step instructions for retrieving your IRS PIN using the online method.

Step 1: Logging in to the IRS Website

The first step in retrieving your IRS PIN is to log in to the official IRS website. Follow these instructions:

- Open your preferred web browser and navigate to the official IRS website at https://www.irs.gov/.

- Once on the IRS website, locate and click on the “Get Your IP PIN” or “Retrieve Your IP PIN” option. This will direct you to the IRS Identity Protection PIN page.

- On the Identity Protection PIN page, click on the “Get An IP PIN” button. This will start the process of retrieving your IRS PIN.

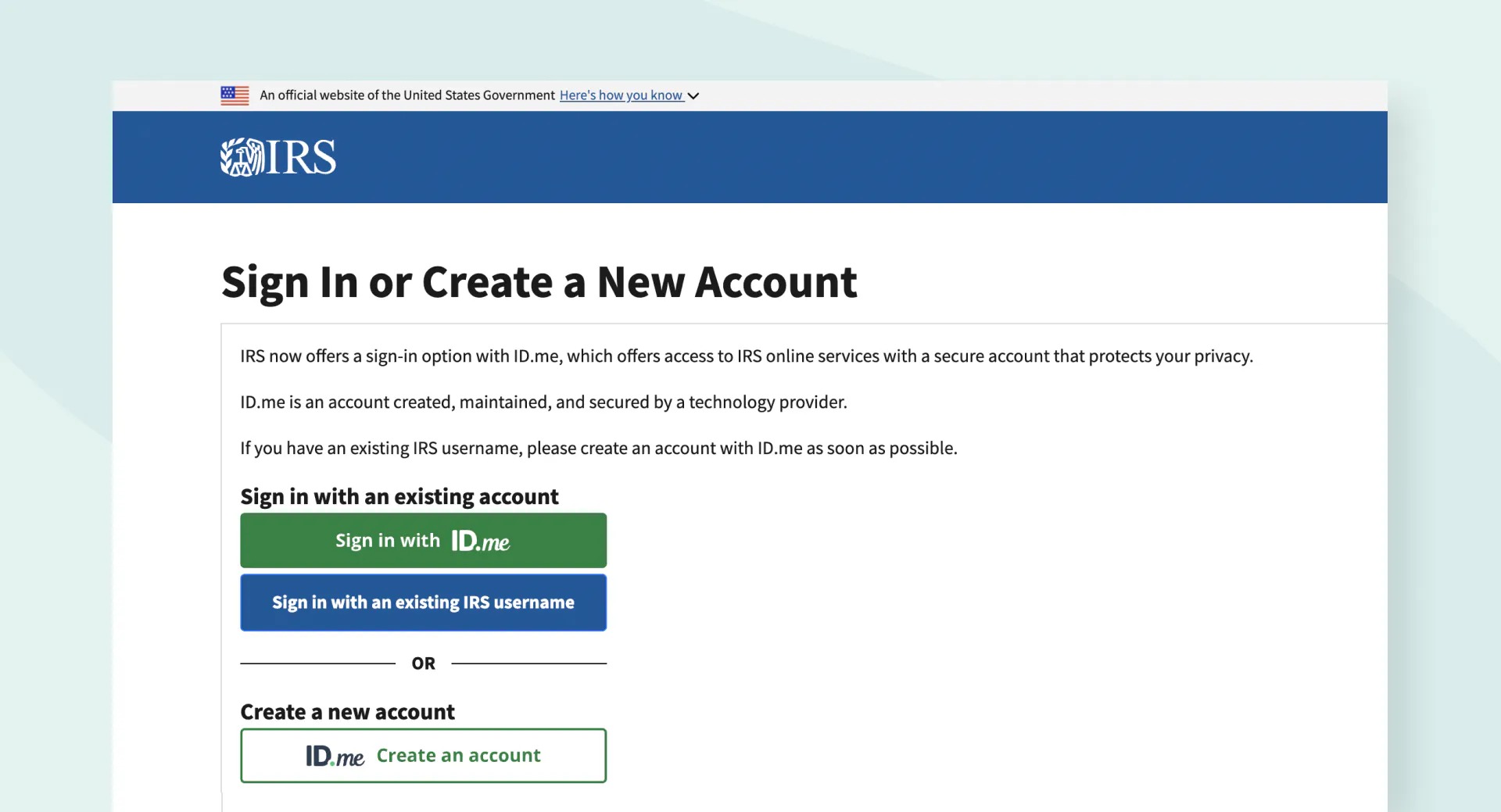

- If you have an existing IRS online account, click on the “Sign In” button and enter your credentials to log in. If you do not have an account, click on the “Create Account” button and follow the prompts to set up your account.

- Once logged in, you will be prompted to verify your identity using various security measures. This may include providing personal information and answering security questions. Follow the instructions provided and complete the verification process.

- After successfully verifying your identity, you will be able to view and retrieve your IRS PIN. Take note of the PIN as you will need it for future tax filings.

By logging in to the IRS website and completing the identity verification process, you are one step closer to obtaining your IRS PIN. In the next section, we will discuss the steps involved in verifying your identity.

Step 2: Verifying Your Identity

Verifying your identity is a crucial step in the process of retrieving your IRS PIN. The IRS has implemented various security measures to ensure that only authorized individuals can access their PIN. Follow these steps to verify your identity:

- Once you have logged in to the IRS website, you will be prompted to provide personal information to verify your identity. This information may include your Social Security number, date of birth, filing status, and mailing address.

- Follow the instructions on the screen to enter the required information accurately. It is important to double-check all the details to avoid any errors.

- In addition to providing personal information, you may also be asked to answer a series of security questions. These questions are designed to verify your identity further. Take your time and answer the questions correctly to proceed.

- In some cases, the IRS may require additional documentation to verify your identity. This can include scanned copies of your identification documents, such as a driver’s license or passport. Follow the specific instructions provided by the IRS to submit the necessary documents.

- After providing all the requested information and completing the identity verification process, you will receive confirmation that your identity has been successfully verified.

It is important to note that the verification process may vary depending on the method you choose to retrieve your IRS PIN. Online retrieval typically involves answering security questions and providing personal information, while phone or in-person assistance may require additional documentation. Follow the instructions provided by the IRS to ensure a smooth verification process.

Once your identity is verified, you can proceed to the next step of requesting and receiving your IRS PIN, which we will cover in the following sections.

Step 3: Requesting Your IRS PIN

After successfully verifying your identity, you are now ready to request your IRS PIN. Follow these instructions to initiate the request:

- Once your identity is verified, you will be directed to the IRS PIN request page. Here, you will find a form or prompt to request your PIN. Fill out the required information accurately to ensure a seamless process.

- The information you may need to provide to request your IRS PIN can include your Social Security number, name, date of birth, and mailing address. Ensure all the details are entered correctly before proceeding.

- In some cases, the request form may require additional information, such as your filing status and the tax year for which you need the IRS PIN. Make sure to provide the requested information accurately to avoid any delays.

- Review the form or prompt before submitting to ensure all the information is accurate and complete. Double-check for any errors or omissions.

- Once you have reviewed the information and ensured its accuracy, submit the form or prompt to request your IRS PIN.

After completing the request process, the IRS will begin processing your request and generate your IRS PIN. The time it takes to receive your IRS PIN can vary, so it is important to be patient. In the next step, we will discuss how you will receive your IRS PIN once it is generated.

Step 4: Receiving Your IRS PIN

Once you have successfully requested your IRS PIN, the IRS will process your request and generate your unique PIN. Here’s what you can expect in terms of receiving your IRS PIN:

- Upon submitting your request, the IRS will start the process of generating your IRS PIN. The time it takes to generate the PIN can vary, but in most cases, the IRS aims to complete this step within a few weeks.

- Once your IRS PIN is generated, the IRS will send it to you via mail. The PIN will be sent to the address you provided during the request process, so it is crucial to ensure that your mailing address is accurate.

- Be on the lookout for an official IRS envelope containing your IRS PIN. It is important to safeguard this envelope and treat the information within it with the utmost confidentiality.

- Upon receiving your IRS PIN, carefully open the envelope and take note of the PIN. Store it in a secure location for future reference.

- It is important to remember that your IRS PIN is unique to you and should not be shared with anyone. Treat it as confidential information and avoid storing it in easily accessible or unprotected digital platforms.

By following these steps, you will soon receive your IRS PIN and be ready to use it for your tax filings. Keep in mind that the process may take some time, so be patient and check your mail regularly for the arrival of your IRS PIN.

In the next section, we will explore how to use your IRS PIN when filing your taxes.

Step 5: Using Your IRS PIN for Tax Filing

Now that you have successfully received your IRS PIN, it’s time to understand how to use it when filing your taxes. Here are the steps to follow:

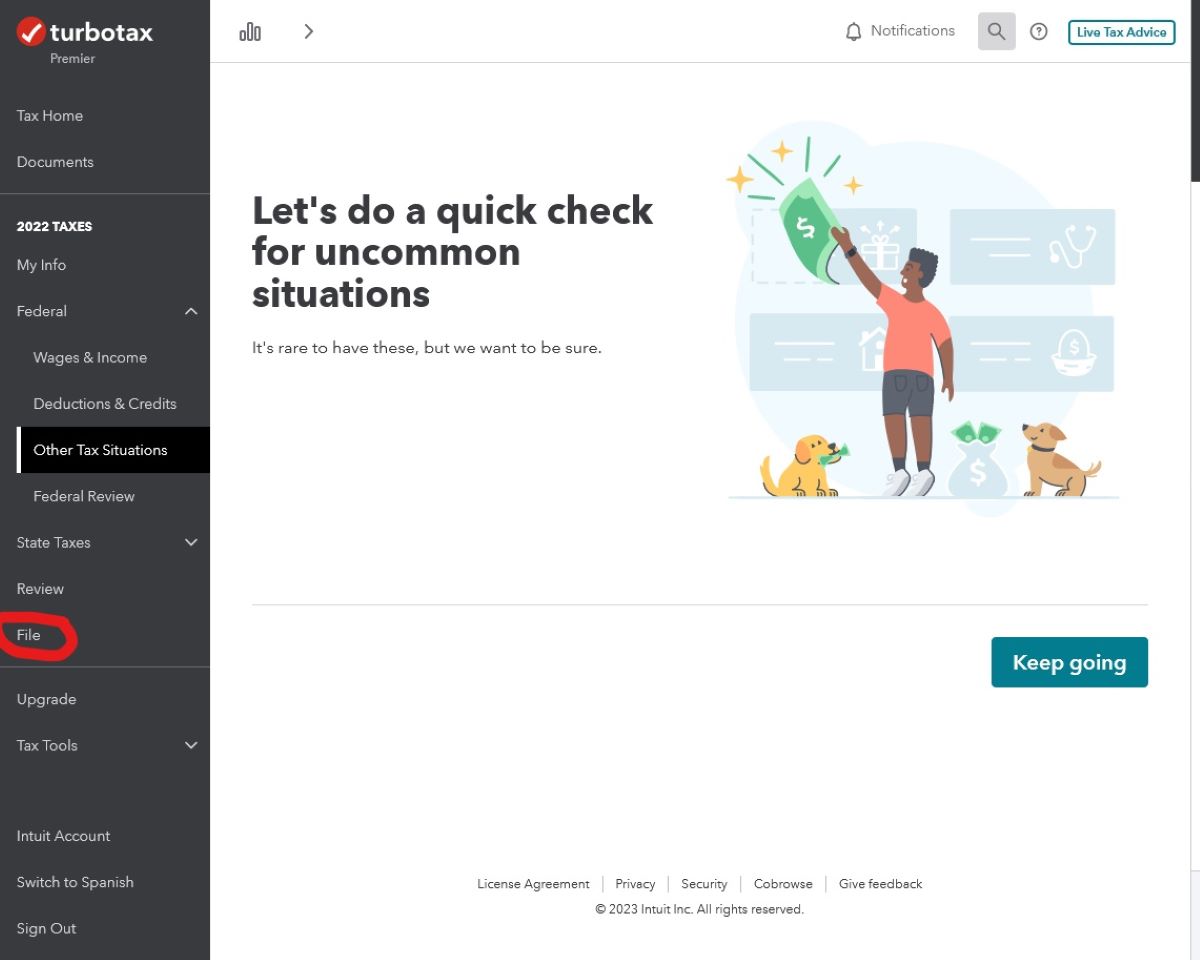

- When it’s time to file your tax return, ensure that you have your IRS PIN readily available. This PIN will be required during the e-filing process to validate your identity.

- Choose a trusted and secure tax preparation software or hire a professional tax preparer to assist you with filing your taxes.

- During the tax filing process, you will reach a section where you need to enter your IRS PIN. Look for the designated field or prompt that asks for your PIN.

- Carefully enter your IRS PIN into the designated field or prompt. Double-check the accuracy of the PIN before proceeding.

- Continue with the tax filing process as guided by the software or tax preparer. Ensure that all the necessary information is provided accurately.

- Once you have completed the tax filing process and reviewed all the information for accuracy, you can submit your tax return using your IRS PIN.

- By using your IRS PIN, you add an extra layer of security to your tax return. It helps the IRS validate your identity and ensures that only you can file using your personal information.

- After filing your tax return, make sure to keep a copy of your tax return for your records. Store it securely along with your IRS PIN and other tax-related documents.

By following these steps and using your IRS PIN correctly, you enhance the security of your tax filing process. It helps protect your personal and financial information from being misused or accessed by unauthorized individuals.

Now that you are familiar with the process of using your IRS PIN for tax filing, let’s move on to the next section to address common issues and provide troubleshooting tips.

Common Issues and Troubleshooting Tips

While retrieving and using your IRS PIN is typically a straightforward process, there may be instances where you encounter common issues or face challenges. Here are some common issues and troubleshooting tips to help you navigate these situations:

- Forgot PIN: If you forget your IRS PIN, you can use the online retrieval process to get a new PIN. Follow the steps outlined in the previous sections to retrieve your PIN using the online method.

- Incorrect Information: Ensure that you enter all the required information accurately when requesting your IRS PIN. Double-check your personal details, such as your Social Security number and date of birth, to avoid any discrepancies that may lead to delays or rejections.

- Lost or Not Received IRS PIN: If you have lost or not received your IRS PIN, you can initiate the process again. Contact the IRS helpline or visit a local Taxpayer Assistance Center for guidance on how to proceed.

- Difficulty Verifying Identity: If you face difficulty verifying your identity during the online process, you may opt for alternative methods, such as requesting your IRS PIN via phone or through in-person assistance at an IRS Taxpayer Assistance Center. Be prepared to provide additional documentation and be patient throughout the process.

- IRS PIN Not Working: If your IRS PIN is not working, ensure that you are entering the correct PIN. It is also recommended to clear your browser cache and try again. If the issue persists, contact the IRS helpline for further assistance.

- Expired PIN: Your IRS PIN is valid for one year and will need to be renewed annually. The IRS will send you a new PIN each year if you are eligible. Keep track of the expiration date of your current PIN and be prepared to request a new one when needed.

In case you encounter any issues or have specific questions regarding your IRS PIN, it is best to reach out to the IRS directly. They have dedicated resources and knowledgeable staff available to assist you in resolving any concerns or providing further guidance.

By being aware of these common issues and armed with troubleshooting tips, you can navigate the process of retrieving and using your IRS PIN with ease.

Next, let’s conclude with a summary of the key points covered in this guide.

Conclusion

Obtaining and using your IRS PIN is an essential step in protecting your personal and financial information during the tax filing process. By following the steps outlined in this comprehensive guide, you can successfully retrieve your IRS PIN and utilize it to enhance the security of your tax returns.

We started by highlighting the importance of an IRS PIN in preventing tax-related identity theft and ensuring secure access to your tax information. We then delved into the different methods available for retrieving your IRS PIN, including online retrieval, phone requests, mailed requests, and in-person assistance.

You learned how to log in to the IRS website, verify your identity, and request your IRS PIN. Additionally, we provided instructions on how to receive your IRS PIN through mail and discussed the significance of keeping it confidential and secure.

We also addressed the process of using your IRS PIN when filing your taxes, emphasizing the added layer of security it provides and the importance of accurate entry. Lastly, we covered common issues that may arise during the process and offered troubleshooting tips to overcome them.

Remember, your IRS PIN is a valuable tool in safeguarding your financial information and preventing identity theft. Treat it with care, store it securely, and use it responsibly during tax filing season.

If you encounter any challenges or have specific questions regarding your IRS PIN, it is always recommended to reach out to the IRS for further assistance. Their dedicated resources and knowledgeable staff can help address any concerns you may have.

By staying proactive and mindful of the importance of your IRS PIN, you are taking a significant step towards securing your financial well-being and protecting yourself from identity theft.