Home>Finance>Holdings: Definition In Investing And Their Role In Diversity

Finance

Holdings: Definition In Investing And Their Role In Diversity

Published: December 5, 2023

Learn about holdings in finance and their crucial role in diversifying investment portfolios. Find the definition and explore why holdings are essential for long-term financial growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Holdings in Finance and Their Role in Diversity

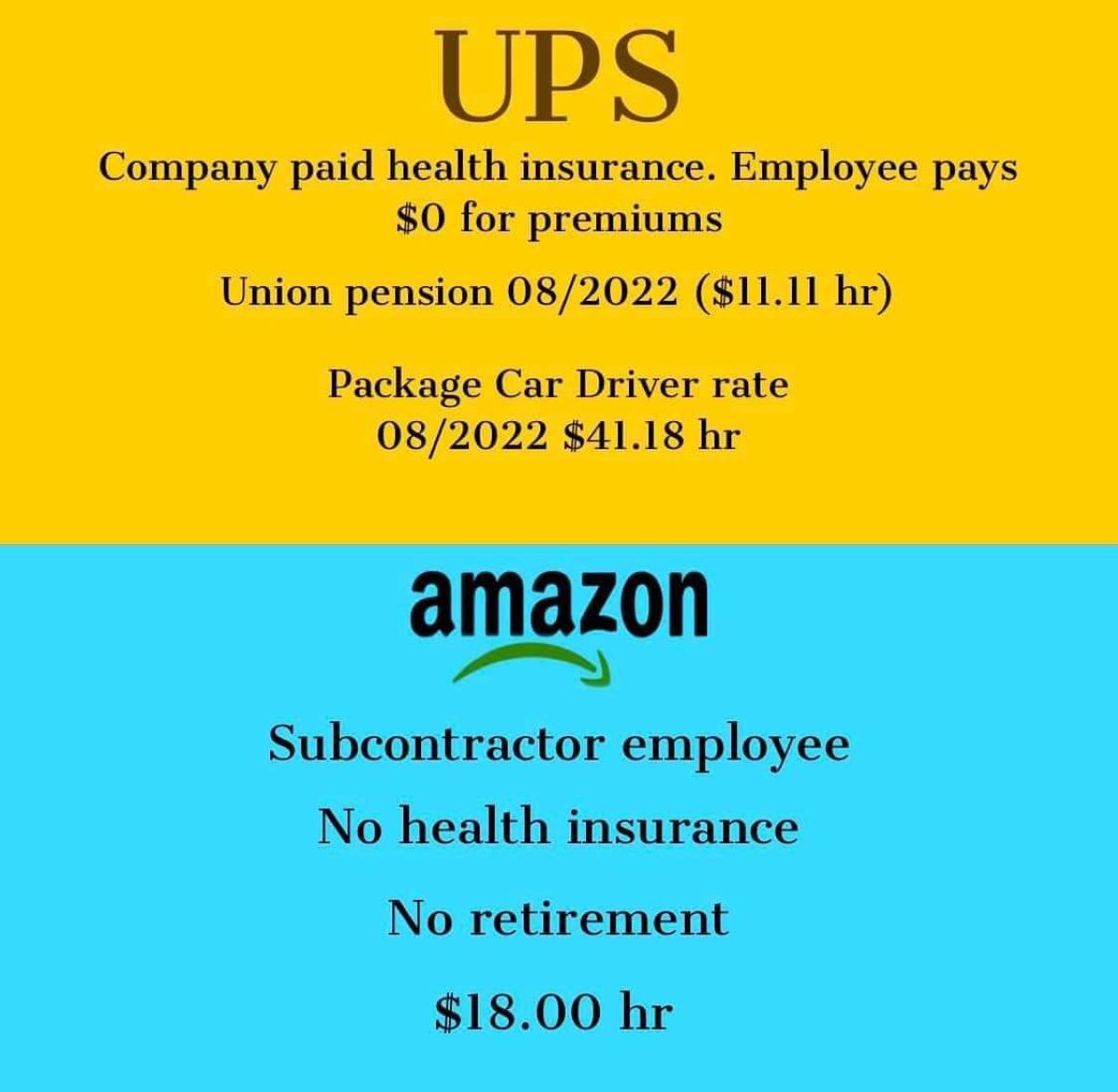

When it comes to investing, understanding the concept of holdings is crucial. Holdings refer to the securities, such as stocks, bonds, or mutual funds, that an individual or an entity owns within their investment portfolio. Holding’s diversity, or the variety of securities held, plays a significant role in managing risk and maximizing returns. In this blog post, we will delve into the definition of holdings in investing and explore their role in promoting diversity within a portfolio.

Key Takeaways:

- Holdings are the securities that make up an individual or entity’s investment portfolio.

- Diversifying holdings is essential for managing risk and maximizing returns.

Now, let’s dive deeper into what holdings mean and why diversity is crucial in the world of finance.

What Are Holdings and Why Are They Important?

Holdings represent the various financial assets owned by individuals, companies, or investment funds. These assets can include stocks, bonds, mutual funds, exchange-traded funds (ETFs), or even physical assets like real estate or commodities.

The importance of holdings lies in their ability to generate income and growth. By diversifying holdings across different asset classes, sectors, geographic regions, and industries, investors can mitigate risk associated with the fluctuation of any single security or sector. Diversification is the key to long-term success in the world of investing.

The Role of Diversity in Holdings

Diversity within holdings refers to the practice of investing in a wide range of securities to reduce risk and increase the potential for higher returns. Here are a few reasons why diversity is vital in holdings:

- Risk Management: By investing in diverse securities, investors can spread their risk across multiple asset classes and industries. This helps protect against substantial losses that might occur if they were heavily invested in a single security or sector.

- Enhanced Returns: Diversification can lead to enhanced returns by capitalizing on the growth potential of various sectors and regions. Holding a mix of assets that perform differently during different market conditions can help balance out losses and generate profits.

- Opportunities for Growth: Diversity in holdings allows investors to tap into unique opportunities across different sectors and asset classes. It enables them to participate in the growth of emerging industries while maintaining exposure to stable sectors.

- Improved Resilience: A diverse portfolio is better equipped to withstand market volatility and economic downturns. By holding a mix of assets that react differently to changes in the market, investors can reduce overall risk and protect their investments.

In conclusion, holdings play a crucial role in investment portfolios. Diversifying holdings across different asset classes, sectors, and industries mitigates risk and enhances the potential for higher returns. By understanding the importance of diversity within holdings, investors can build robust portfolios that can weather market fluctuations and achieve long-term financial success.

Remember, when it comes to investing, diversity within holdings is the key to unlocking opportunities while reducing risk. So, whether you are a beginner investor or an experienced one, make sure to maintain diversity within your holdings for a stronger and more resilient investment journey.