Home>Finance>How Are Grants And Scholarships Different From Student Loans

Finance

How Are Grants And Scholarships Different From Student Loans

Modified: February 21, 2024

Learn the key differences between grants, scholarships, and student loans in the realm of finance. Discover how each option can help fund your education.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to financing higher education, there are several options available to students. Two common forms of financial support are grants and scholarships, while another option is student loans. While all three can provide much-needed assistance to students, it’s essential to understand the differences between them.

In this article, we will delve into the characteristics and distinctions of grants, scholarships, and student loans. By understanding how they differ, you can make informed decisions about the best way to fund your education.

A grant is a type of financial aid that does not need to be repaid. It is essentially a gift given to students to cover their educational expenses. Grants are typically awarded based on financial need, academic achievements, or specific criteria set by the grant provider. They can come from various sources, including the government, educational institutions, or private organizations.

A scholarship, on the other hand, is also a form of financial aid that does not require repayment. However, scholarships are typically awarded based on merit rather than solely on financial need. They are often granted for exceptional academic achievements, leadership skills, athletic abilities, or other specific talents. Scholarships can be offered by universities, foundations, corporations, or other organizations.

On the flip side, student loans are a form of financial assistance that must be repaid with interest. Unlike grants and scholarships, student loans are borrowed money that students must repay after completing their education. These loans can come from the government or private lenders, with varying interest rates and repayment terms.

Understanding the differences between grants, scholarships, and student loans is crucial in determining which option is right for you. It is essential to evaluate your financial situation, academic achievements, and long-term goals to make the best decision for funding your education.

In the following sections, we will explore each of these forms of financial assistance in more detail to provide a comprehensive overview of grants, scholarships, and student loans. By the end of this article, you will have a better understanding of how these options can help you achieve your educational ambitions.

Grants

Grants are a type of financial aid that is awarded to students based on specific criteria, such as financial need, academic achievements, or demographic factors. Unlike loans, grants do not need to be repaid, making them an attractive form of assistance for students pursuing higher education.

Grants can come from various sources, including the government, educational institutions, or private organizations. Government grants, such as the Federal Pell Grant in the United States, are awarded based on a student’s financial need as determined by the Free Application for Federal Student Aid (FAFSA) form. These grants can provide significant financial support to eligible students.

In addition to government grants, educational institutions often offer their own grants to students. These grants may be based on academic achievements, artistic talents, or other criteria set by the institution. Universities and colleges may provide grants to attract high-achieving students or to support students from underrepresented backgrounds.

Private organizations, such as foundations, corporations, and non-profit entities, also offer grants to students. These grants may have specific requirements, such as being a member of a certain demographic group, pursuing a particular field of study, or demonstrating exceptional talent in a specific area. Students can seek out these grants through research and by applying to relevant organizations.

One of the benefits of grants is that they do not accrue interest, unlike loans. This means that students do not have to worry about increasing their debt burden or making monthly payments towards their grants. However, it is important to note that grant amounts can vary and may not cover the entire cost of tuition and other expenses. Students may need to supplement their grants with other forms of financial aid or personal funds to meet their educational costs.

Overall, grants are an excellent form of financial support for students who demonstrate financial need or meet specific criteria set by the grant provider. They can help reduce the financial burden of pursuing higher education and make it more accessible to a wider range of students.

Scholarships

Scholarships are a form of financial aid that is awarded to students based on their merits and achievements. Unlike grants, scholarships are typically based on academic excellence, leadership skills, athletic abilities, or other specific talents. They are often given as recognition for outstanding achievements and provide financial assistance to students pursuing higher education.

Scholarships can be offered by universities, foundations, corporations, or other organizations. Educational institutions may provide scholarships to attract exceptional students, promote diversity, or support students in specific fields of study. They often have specific requirements, such as maintaining a certain GPA or participating in extracurricular activities, to maintain scholarship eligibility.

There are also numerous external scholarships available from private organizations. These scholarships can be highly competitive and have specific eligibility criteria, such as being a member of a particular ethnic group, pursuing a specific major, or demonstrating exceptional talent in a specific area. Students can search for external scholarships through scholarship search engines, websites, or by reaching out to relevant organizations.

One of the significant benefits of scholarships is that they do not need to be repaid. This makes scholarships highly sought after as they provide financial support without adding to the student’s debt burden. Students who receive scholarships can focus on their education and career goals without the stress of loan repayments.

Another advantage of scholarships is that they can often cover a significant portion or even the entire cost of tuition and fees. This can have a profound impact on a student’s ability to pursue higher education, especially if they come from low-income backgrounds or face financial constraints.

Moreover, scholarships can provide additional benefits beyond financial support. They can enhance a student’s resume and academic portfolio, making them stand out in college applications and future employment opportunities. Scholarships can also offer networking opportunities, mentorship programs, or access to exclusive events or resources, further supporting a student’s academic and professional development.

It’s important for students to actively search for scholarships and carefully review eligibility requirements and application deadlines. Applying for scholarships can require time and effort, including writing essays, submitting recommendation letters, and providing proof of achievements. However, the potential rewards and financial assistance make the scholarship application process well worth it.

Overall, scholarships are a valuable form of financial aid that recognize and reward students’ exceptional achievements. They provide opportunities for students to pursue higher education without the burden of loan debt, and can significantly impact their educational and career success.

Student Loans

Student loans are a common form of financial assistance that many students rely on to fund their higher education. Unlike grants and scholarships, student loans are borrowed money that must be repaid with interest after the student completes their education.

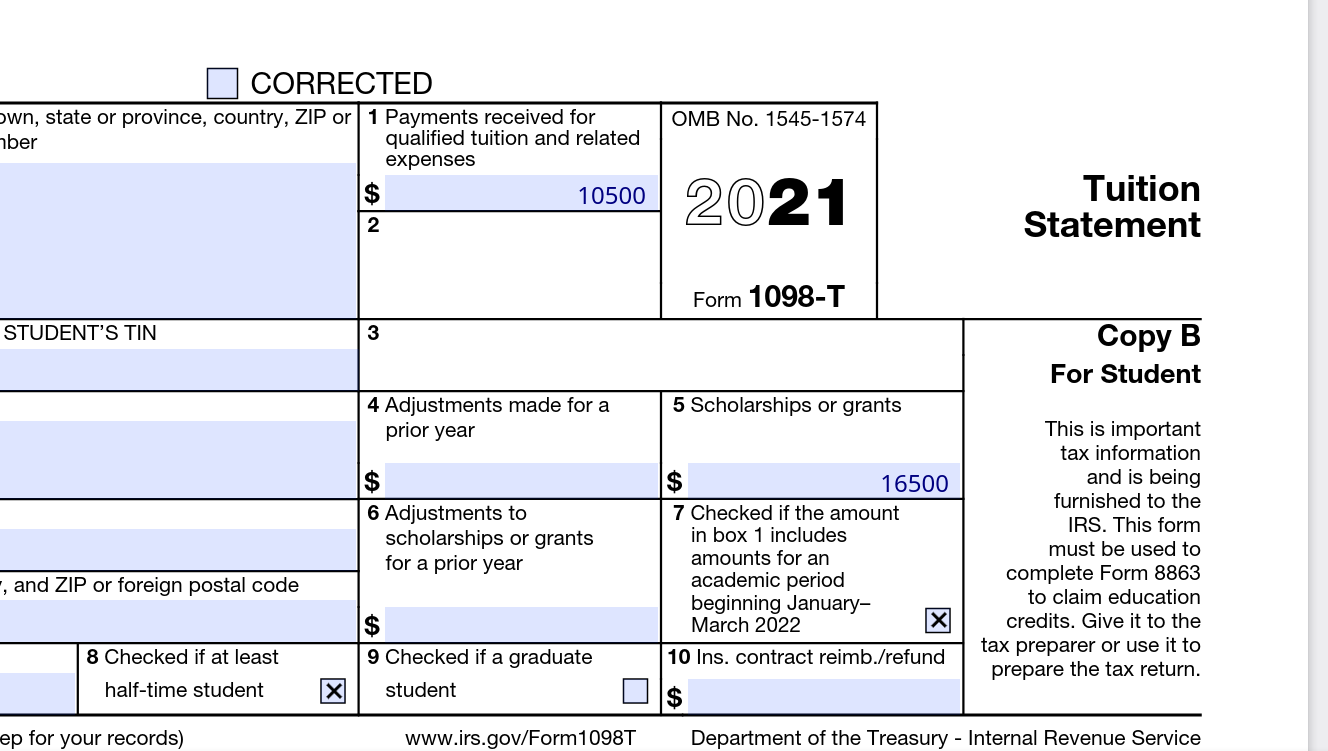

There are two main types of student loans: federal loans and private loans. Federal loans are issued by the government and have fixed interest rates and flexible repayment options. They are typically more favorable than private loans and come in various forms, such as Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans. Federal loans have certain eligibility requirements and may require filling out the Free Application for Federal Student Aid (FAFSA).

Private loans, on the other hand, are issued by private lenders such as banks, credit unions, or online lenders. Private student loans may have variable interest rates and varying repayment terms. They often require a credit check, and the interest rates and terms are based on the borrower’s creditworthiness and other factors.

While student loans can be a valuable resource for financing education, it is important to carefully consider the terms and implications before borrowing. It is easy to accumulate substantial debt through student loans, so it is essential to borrow only what is necessary and have a plan for repayment.

One of the key aspects of student loans is the concept of interest. Interest is the cost of borrowing money, and it is added to the loan amount, increasing the overall repayment amount over time. The interest rates for student loans can vary based on the loan type, lender, and the borrower’s credit history. Federal loans typically have lower interest rates compared to private loans.

Repayment of student loans typically begins after the student completes their education, although there may be different grace periods depending on the loan type. Repayment options can vary and may include fixed monthly payments or income-driven repayment plans where monthly payments are based on the borrower’s income and family size.

It’s important for borrowers to understand that student loans are legally binding agreements, and failure to repay them can have serious consequences, including damaged credit scores and potential legal actions by lenders. Therefore, it is crucial to carefully plan and manage student loans, considering factors such as future earnings potential, career prospects, and other financial obligations.

While student loans do require repayment, they can also provide flexibility and accessibility to education for many individuals who may not have the means to pay for it upfront. For students who choose this option, it’s important to approach student loans with a clear financial plan and awareness of the long-term implications.

Overall, student loans are a significant component of higher education financing. They provide a means of funding education when other forms of financial aid may not be sufficient. However, borrowers should exercise caution and carefully consider the long-term impact of student loan debt.

Key Differences

Grants, scholarships, and student loans are all forms of financial aid for students, but they differ in several key aspects. Understanding these differences can help students make informed decisions about their funding options for higher education.

Repayment: Grants and scholarships are forms of “free money” that do not need to be repaid. They are essentially gifts given to students to cover educational expenses. On the other hand, student loans are borrowed money that must be repaid with interest after the student completes their education. Repayment of student loans can vary in terms of interest rates, repayment options, and grace periods, depending on whether they are federal or private loans.

Criteria: Grants are typically awarded based on financial need, academic achievements, or specific criteria set by the grant provider. Scholarships, on the other hand, are usually based on merit and can be awarded for exceptional academic achievements, leadership skills, athletic abilities, or other specific talents. Scholarships may also have specific requirements, such as maintaining a certain GPA or participating in certain activities. Student loans, on the other hand, do not have specific eligibility criteria related to financial need or merit. They are generally available to any student who meets the lender’s requirements.

Source: Grants can come from various sources, including the government, educational institutions, or private organizations. Government grants, such as the Federal Pell Grant in the United States, are awarded based on a student’s financial need. Educational institutions may also offer their own grants to attract high-achieving or underrepresented students. Scholarships can be offered by educational institutions, foundations, corporations, or other organizations. They may have specific eligibility requirements and application processes. Student loans can come from the government or private lenders, and their terms and conditions can vary.

Repayment Terms: Grants and scholarships do not require repayment, so there are no terms or conditions associated with them. However, student loans have specific repayment terms that vary based on the loan type, lender, and borrower’s credit history. This includes interest rates, grace periods, and repayment plans.

Financial Impact: Grants and scholarships can significantly reduce the financial burden of education by covering some or all of the tuition and other expenses. This can make education more accessible for students who may not have the means to pay for it upfront. Student loans, on the other hand, can provide immediate financial assistance but can also result in significant debt that must be repaid in the future. Borrowers need to carefully consider the implications of taking on student loan debt, including the long-term financial impact and potential limitations on future financial decisions.

Overall, understanding the differences between grants, scholarships, and student loans is crucial for students navigating the financial aspects of higher education. Each option has its own advantages and considerations, and students should carefully evaluate their own circumstances, financial needs, and long-term goals to determine the best fit for their educational and financial journey.

Conclusion

Choosing the right financial aid option for higher education is a significant decision that can have a long-term impact on students’ financial well-being. Grants, scholarships, and student loans are three common forms of assistance that students can utilize, but they differ in key aspects.

Grants and scholarships offer financial support without the burden of repayment. They can provide opportunities for students to pursue their educational goals without worrying about the financial strain. Grants are typically awarded based on financial need or specific criteria set by the grant provider, while scholarships are awarded based on merit or specific talents.

Student loans, on the other hand, provide immediate financial assistance but come with the responsibility of repayment. While they can be a valuable resource for financing education, it’s crucial for students to carefully consider the terms, interest rates, and repayment options before borrowing.

Understanding the differences between grants, scholarships, and student loans is essential for making informed decisions about financing one’s education. It’s important for students to evaluate their financial circumstances, academic achievements, and long-term goals to determine the best option for their individual needs.

Grants and scholarships can help reduce the financial burden of education and make higher education more accessible to students from diverse backgrounds. They also often come with additional benefits, such as networking opportunities or mentorship programs.

Student loans can provide immediate financial support, but they come with the responsibility of repayment, which can impact a student’s financial future. Borrowing only what is necessary and having a clear plan for repayment is crucial to managing student loan debt effectively.

In conclusion, grants, scholarships, and student loans each have their own advantages and considerations. Students should carefully weigh their options, considering factors such as financial need, academic achievements, and long-term financial goals, to choose the best approach to fund their higher education journey.