Finance

How Bad Is A 524 Credit Score

Modified: March 10, 2024

Learn about the impact of a 524 credit score on your finances. Discover how it may affect your loan options and steps to improve your credit.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Credit scores play a significant role in our financial lives. They provide lenders with a quick snapshot of our creditworthiness and are often used to determine our eligibility for loans, credit cards, and other financial products. A credit score can range from 300 to 850, with higher scores indicating better creditworthiness.

But what happens if your credit score is on the lower end of the spectrum, like a 524 credit score? How does that impact your financial options and what steps can you take to improve it? In this article, we will explore the implications of a 524 credit score and provide tips to help you manage and improve your credit health.

It’s important to remember that credit scores are not set in stone. While a lower credit score may present challenges, it’s not an insurmountable hurdle. With the right knowledge and actions, you can work towards improving your credit score and opening up more financial opportunities.

So, let’s dive in and examine what a 524 credit score means and how you can navigate through it.

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness. It is a measure of how likely you are to repay your debts on time based on your past financial behavior. Credit scores are calculated by credit reporting agencies using a variety of factors, including your payment history, credit utilization, length of credit history, types of credit used, and new credit applications.

These credit scores are widely used by lenders, landlords, insurance companies, and even employers to assess your risk as a borrower or tenant. The higher your credit score, the more favorable terms and interest rates you are likely to receive when applying for loans or credit.

There are several credit scoring models used by different credit reporting agencies, but the most commonly used is the FICO Score. FICO Scores range from 300 to 850, with higher scores indicating better creditworthiness. Other scoring models, such as VantageScore, have a similar range.

A credit score is not a static number – it can fluctuate over time based on your financial habits and behaviors. Regularly monitoring and managing your credit score is important to ensure you maintain a healthy credit profile.

Now that we have a basic understanding of what a credit score is, let’s take a closer look at the credit score ranges and where a 524 credit score falls.

Understanding Credit Score Ranges

Credit scores are typically categorized into different ranges, which provide an indication of your creditworthiness. While the specific ranges may vary slightly among different scoring models, here is a generally accepted breakdown:

- Excellent: 750 and above

- Good: 700-749

- Fair: 650-699

- Poor: 600-649

- Bad: Below 600

Based on this breakdown, a credit score of 524 would fall within the “Poor” range. While it’s not the lowest credit score possible, it still suggests to lenders and creditors that you may pose a higher risk of defaulting on your financial obligations.

It’s important to note that credit score ranges can vary depending on the lender or the specific purpose for which the credit score is being used. For example, some lenders may have their own scoring models and criteria for assessing creditworthiness.

Now that we have a clear picture of where a 524 credit score stands in the credit score ranges, let’s explore the potential impact of such a score on your financial options.

The Impact of a 524 Credit Score

A 524 credit score can have a significant impact on your financial options and opportunities. Here are some potential consequences:

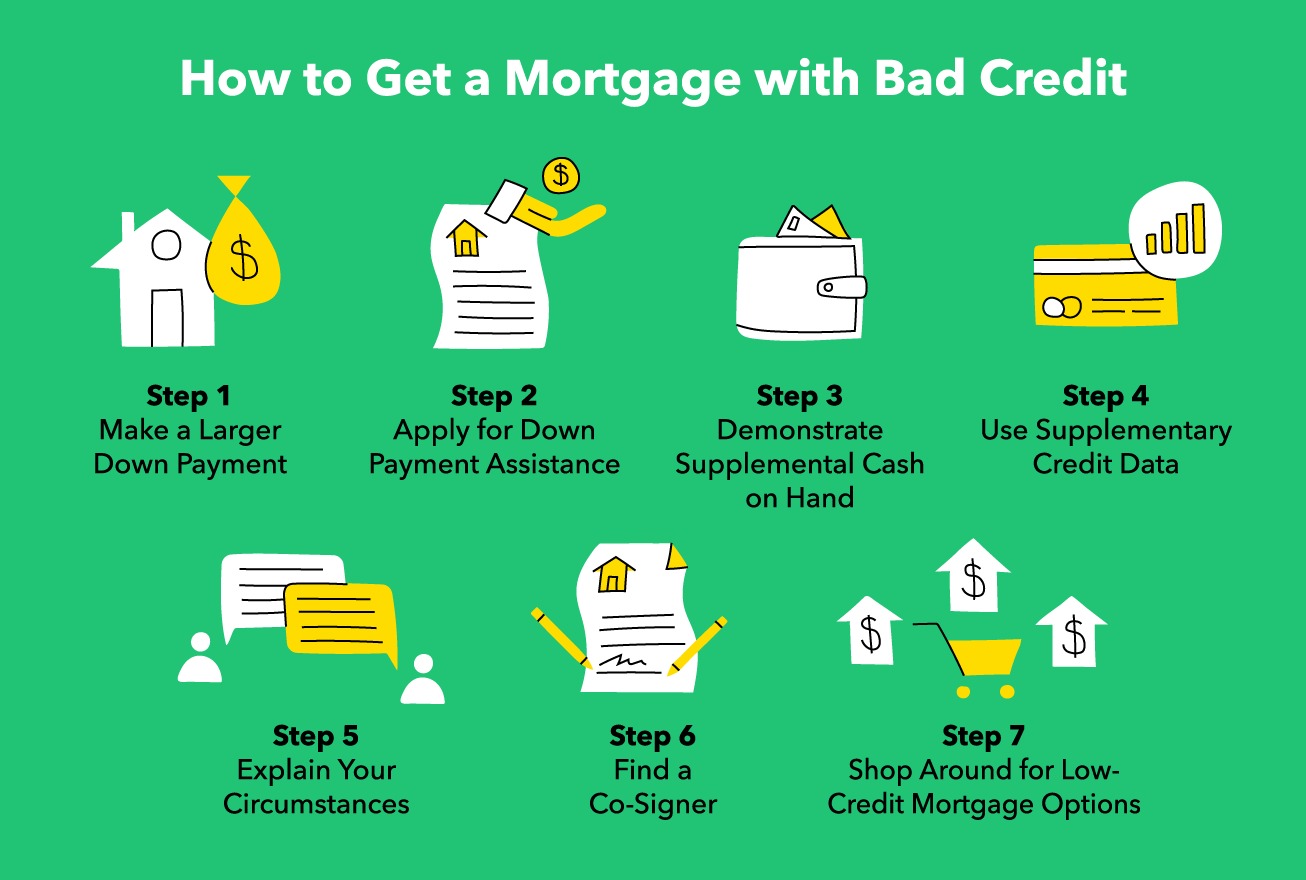

- Limited Loan Options: With a low credit score, lenders may view you as a higher credit risk and be hesitant to approve your loan applications. You may have limited access to traditional loans, such as personal loans or mortgages, and may be required to provide additional collateral or pay higher interest rates to secure a loan.

- Higher Interest Rates: Even if you are approved for a loan or credit card, your low credit score can result in higher interest rates. This means you may end up paying more in interest over the life of the loan, making it more difficult to manage your debt.

- Difficulty Obtaining Credit Cards: Credit card issuers may be hesitant to approve your application or may only offer you credit cards with low credit limits and less favorable terms. Additionally, you may not qualify for cards with rewards programs or other perks.

- Impact on Housing: If you’re looking to rent a home or apartment, landlords often conduct credit checks before approving an application. A low credit score may make it challenging to secure a lease, and you may need to provide additional security deposits or find a cosigner.

- Difficulty Getting Utilities: Some utility providers may require a credit check when setting up new accounts. Having a low credit score may make it more difficult to get utilities in your name without paying a higher deposit.

It’s essential to understand that a 524 credit score does not mean you are destined for financial hardship. While it may present challenges, there are steps you can take to improve your credit score and regain financial stability. We’ll discuss these strategies later in the article.

Now that we understand the potential impact of a 524 credit score, let’s explore the factors that contribute to such a score.

Factors Contributing to a 524 Credit Score

Several factors contribute to a credit score of 524. Understanding these factors can help you identify areas of improvement and take necessary steps to enhance your creditworthiness. Here are some common factors that may have contributed to your 524 credit score:

- Payment History: Your payment history has a significant impact on your credit score. Late payments, missed payments, or defaults on loans or credit cards can have a detrimental effect on your creditworthiness.

- High Credit Utilization: Credit utilization refers to the percentage of your available credit that you are currently using. If you have high credit card balances relative to your credit limits, it can negatively impact your credit score.

- Limited Credit History: An insufficient credit history can also lead to a lower credit score. Lenders prefer borrowers with a longer and more established credit history to assess their creditworthiness accurately.

- Derogatory Marks: Negative items such as bankruptcies, foreclosures, or collections can significantly impact your credit score and lower it to 524.

- Recent Late Payments: Even if you may have had a good credit history in the past, recent late payments can still have a negative effect on your score.

These factors are not exhaustive, and the specific circumstances of each individual will vary. It’s important to review your credit report to identify any inaccuracies or areas where you can make improvements.

Now that we have examined the contributing factors, let’s discuss the limitations of relying solely on a 524 credit score to assess creditworthiness.

Limitations of a 524 Credit Score

While a credit score serves as a valuable tool for lenders to assess creditworthiness, it is essential to recognize its limitations. Here are some limitations of relying solely on a 524 credit score:

- Doesn’t Consider Individual Circumstances: A credit score does not take into account your individual circumstances or the reasons behind your credit challenges. It provides a broad overview of your credit history but may not provide a complete picture of your financial situation.

- Doesn’t Reflect Income or Assets: A credit score does not consider your income, savings, or assets. These factors can play a crucial role in determining your ability to repay debts, and their omission from the credit score can limit the assessment of your overall financial health.

- Limited Historical View: A credit score is based on your past financial behavior but may not reflect your current financial status. It does not consider positive financial changes or improvements you may have made recently.

- Doesn’t Capture Non-Traditional Credit History: If you have a limited traditional credit history, such as no credit cards or loans, or primarily rely on alternative financial services, your credit score may not accurately represent your creditworthiness.

While a low credit score like 524 may pose challenges, it’s important to remember that it is not the sole determinant of your financial future. Lenders and financial institutions may consider additional factors, such as employment history or references, when making lending decisions.

Now that we understand the limitations of relying solely on a credit score, let’s explore some practical tips to improve a 524 credit score.

Tips for Improving a 524 Credit Score

A 524 credit score may seem challenging, but with dedication and a solid plan, you can work towards improving it and rebuilding your creditworthiness. Here are some tips to help you improve your credit score:

- Make Timely Payments: Paying your bills on time is one of the most significant factors in improving your credit score. Set up payment reminders or automatic payments to ensure you don’t miss any due dates.

- Reduce Credit Card Balances: Paying down high credit card balances can help lower your credit utilization ratio and demonstrate responsible credit management. Aim to keep your credit card balances below 30% of your available credit.

- Address Negative Items: If you have any derogatory marks on your credit report, such as bankruptcies or collections, consider addressing them. You can work with creditors or seek professional assistance to negotiate settlements or develop a repayment plan.

- Establish Positive Credit History: If you have limited credit history, consider opening a secured credit card or becoming an authorized user on someone else’s credit card. Making timely payments and keeping your credit utilization low will gradually build a positive credit history.

- Check Your Credit Report: Regularly review your credit report to identify any errors or discrepancies that may be negatively impacting your score. Dispute any incorrect information and follow up to ensure it is corrected.

- Be Patient and Persistent: Improving credit takes time and perseverance. Be consistent with your positive credit habits and avoid any new negative marks. Over time, your credit score will gradually improve.

Improving a credit score requires discipline and patience. It’s essential to stay committed to good financial habits and avoid taking on additional debt while you work on rebuilding your credit.

Now that we have discussed tips for improving a 524 credit score, let’s wrap up our article.

Conclusion

A 524 credit score may present challenges when it comes to accessing loans, obtaining favorable interest rates, or securing rental agreements. However, it is essential to remember that your credit score is not permanent and can be improved with time and effort.

By utilizing strategies such as making timely payments, reducing credit card balances, addressing negative items, and establishing positive credit history, you can gradually improve your creditworthiness. It’s important to be patient and persistent throughout this process.

While a credit score provides an assessment of your creditworthiness, it has its limitations. Other factors, such as income, assets, and individual circumstances, also play a significant role in evaluating your financial health.

Remember to regularly monitor your credit report for errors and inaccuracies that may be impacting your score. By addressing these discrepancies and maintaining responsible financial habits, you can regain control of your credit health.

Improving your credit score is a journey, and it requires discipline and determination. Stay focused on your financial goals, seek guidance if needed, and take the necessary steps to rebuild your credit.

With time and consistent effort, you can raise your credit score and unlock more financial opportunities. Don’t be discouraged by a 524 credit score; instead, use it as motivation to build a stronger financial foundation.

Remember, your credit score is just one aspect of your overall financial well-being. With good financial habits and a strategic plan, you can overcome the challenges associated with a lower credit score and navigate towards a brighter financial future.