Finance

How Bad Is A 560 Credit Score

Published: October 21, 2023

Discover the impact of a 560 credit score on your personal finance. Understand how it affects your borrowing options and steps to improve it.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on credit scores and their impact on financial health. In this article, we will be delving into the world of credit scores and specifically focusing on a 560 credit score. Understanding credit scores is crucial for anyone looking to borrow money, apply for a credit card, or even rent an apartment.

A credit score is a numerical representation of an individual’s creditworthiness, calculated based on their credit history. Lenders use credit scores to assess the level of risk involved in lending money to an individual. A higher credit score indicates a lower risk, while a lower credit score implies a higher risk.

Now, let’s zoom in on a 560 credit score. This credit score falls within the “poor” range on the standard 300 to 850 FICO credit score scale. A 560 credit score suggests a history of missed or late payments, excessive debt, or even bankruptcy. It’s important to note that this score can have a significant impact on various aspects of your financial life.

In the following sections, we will explore the implications of having a 560 credit score, such as difficulties in obtaining loans, higher interest rates, and limited financial opportunities. We will also provide guidance on how to improve a 560 credit score and answer some frequently asked questions related to credit scores. So, let’s dive in and unravel the world of 560 credit scores!

Understanding Credit Scores

Before we delve deeper into what a 560 credit score means, let’s first understand how credit scores are calculated and what factors influence them. Credit scores are typically generated by credit reporting agencies such as Experian, Equifax, and TransUnion, using complex algorithms that analyze an individual’s credit history and financial behavior.

The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850. The higher the score, the better the creditworthiness. Here are the general ranges for FICO scores:

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Exceptional: 800-850

Credit scores are influenced by various factors, including:

- Payment history: The consistency of on-time payments and any history of missed payments or defaults.

- Amounts owed: The total debt owed and the utilization of credit limits.

- Length of credit history: The length of time since accounts were opened and the time since activity on those accounts.

- New credit: The number of recent credit inquiries and newly opened accounts.

- Credit mix: The variety of credit types such as credit cards, loans, and mortgages.

Each credit reporting agency may have its own scoring models and specific weightage given to these factors.

Understanding how credit scores are calculated is essential for anyone striving to improve their creditworthiness. It’s important to note that while a low credit score can make it challenging to access credit or favorable interest rates, it’s not necessarily a permanent situation. With discipline and smart financial decisions, it’s possible to improve a credit score over time.

Now that we have a basic understanding of credit scores, let’s dig deeper into the impact of having a 560 credit score.

What is a 560 Credit Score?

A 560 credit score is considered “poor” on the FICO credit score scale. It indicates a history of financial mismanagement, missed or late payments, high levels of debt, or even bankruptcy. Lenders and creditors view a 560 credit score as a sign of increased risk when extending credit to an individual.

With a 560 credit score, it’s important to understand that you may face significant challenges when it comes to obtaining new credit, such as loans or credit cards. Lenders may be hesitant to approve your application or may require high interest rates, strict terms, or collateral to mitigate the perceived risk.

A 560 credit score can also have implications beyond borrowing. Landlords may view it as a red flag when considering rental applications, potentially leading to difficulties in securing a lease on an apartment or rental property. Additionally, insurance companies may charge higher premiums based on credit scores, affecting the cost of auto, home, or life insurance policies.

It’s crucial to monitor your credit score regularly and take steps to improve it. By doing so, you can expand your financial opportunities, qualify for better loan terms, and enjoy lower interest rates. In the next section, we will explore the impact a 560 credit score can have on your financial life.

Impact of a 560 Credit Score

A 560 credit score can have a significant impact on various aspects of your financial life. Here are some key areas where you may experience the repercussions of having a low credit score:

Difficulty in obtaining loans:

With a 560 credit score, getting approved for a loan becomes challenging. Traditional lenders, such as banks and credit unions, may view you as a high-risk borrower and be hesitant to lend you money. If you do manage to secure a loan, you may face higher interest rates and less favorable terms compared to someone with a higher credit score.

Higher interest rates:

A low credit score often translates into higher interest rates on loans, credit cards, and other forms of credit. Lenders view borrowers with low credit scores as more likely to default, and they compensate for this risk by charging higher interest rates. This can result in increased monthly payments and overall higher costs over the life of the loan.

Limited financial opportunities:

Having a 560 credit score can limit your access to various financial opportunities. For example, you may struggle to qualify for credit cards with favorable rewards programs or low APRs. Additionally, you may face difficulty in obtaining certain types of mortgages, such as conventional loans, as they typically require higher credit scores.

Impact on employment and housing:

Some employers and landlords perform credit checks as part of their screening process. A 560 credit score could raise concerns about your financial responsibility and potentially affect your chances of being hired or securing a desirable rental property.

Difficulty in starting a business:

If you plan to start a business and need financing, a low credit score can make it challenging to find lenders or investors willing to provide capital. Many lenders see a low credit score as a potential indicator of future financial stress, which can discourage them from supporting your entrepreneurial endeavors.

It’s important to recognize that a low credit score is not a permanent situation. By taking proactive steps to improve your creditworthiness, such as making consistent on-time payments, reducing debt, and addressing any errors on your credit report, you can gradually raise your credit score and expand your financial opportunities. In the next section, we will explore strategies for improving a 560 credit score.

Getting a Loan with a 560 Credit Score

Obtaining a loan with a 560 credit score can be a challenge, as traditional lenders may consider you a high-risk borrower. However, there are still some options available to explore:

Alternative lenders:

Consider seeking out alternative lenders, such as online lenders or credit unions, who may be more willing to work with individuals with lower credit scores. These lenders often have more flexible criteria and may offer loans with higher interest rates or shorter repayment terms.

Secured loans:

A secured loan requires collateral, such as a car or property, to secure the loan. Since there is less risk for the lender, they may be more open to approving your loan application despite your low credit score. It’s important to carefully consider the potential consequences of defaulting on a secured loan, as it could result in the loss of the collateral.

Cosigner:

You may also consider finding a cosigner with a stronger credit profile to increase your chances of loan approval. A cosigner essentially guarantees the loan and agrees to assume responsibility for the debt if you default. Keep in mind that both you and the cosigner are equally liable for the loan, so it’s crucial to have open communication and ensure you can meet your repayment obligations.

Credit unions:

Joining a credit union can provide access to more lenient lending guidelines and lower interest rates. Credit unions often prioritize serving their members’ financial needs over profit, which can work in your favor even with a lower credit score.

Build your credit:

If you’re unable to secure a loan with a 560 credit score, focus on improving your creditworthiness over time. Make consistent, on-time payments on all your existing debts, reduce your overall debt, and avoid applying for new credit unless necessary. As you demonstrate responsible financial behavior, your credit score will gradually improve, increasing your chances of being approved for loans in the future.

Remember, while it may be challenging to get a loan with a 560 credit score, it’s not impossible. By exploring alternative options and taking steps to improve your credit, you can increase your chances of obtaining a loan and work towards improving your overall financial health. In the next section, we will discuss strategies for improving a 560 credit score.

Improving a 560 Credit Score

If you have a 560 credit score, it’s essential to take proactive steps to improve your creditworthiness. While it may take time and effort, the following strategies can help you raise your credit score:

1. Make all payments on time:

Paying your bills and debts on time is crucial for improving your credit score. Late or missed payments can have a significant negative impact on your credit. Set up reminders, automate payments, or create a budget to ensure timely payments each month.

2. Reduce your debt:

High levels of debt can negatively affect your credit score. Focus on paying down your debts, starting with those with the highest interest rates. Create a repayment plan and allocate extra funds towards debt reduction whenever possible.

3. Correct any errors on your credit report:

Regularly review your credit report and dispute any inaccuracies you find. Mistakes or incorrect information can drag down your credit score. Contact the credit reporting agencies to dispute errors and provide supporting documentation to rectify the issue.

4. Keep credit card balances low:

Reduce your credit card balances to improve your credit utilization ratio. Aim to keep your balances below 30% of your available credit limit. Paying off your credit cards in full each month can have a positive impact on your credit score.

5. Avoid applying for new credit:

While you work on improving your credit score, try to avoid applying for new credit. Each new application can result in a hard inquiry, which temporarily lowers your credit score. Only apply for new credit when necessary and be selective in your applications.

6. Build a positive credit history:

Establishing a positive credit history is essential for improving your credit score. If you don’t have much credit history, consider opening a secure credit card, becoming an authorized user on someone else’s credit card, or obtaining a credit builder loan. Remember to use credit responsibly and make all payments on time.

7. Be patient and persistent:

Improving your credit score takes time, so be patient and stay persistent with your efforts. Consistently practicing good credit habits and making responsible financial choices will gradually improve your creditworthiness.

By implementing these strategies, you can begin to raise your credit score over time. Remember that rebuilding credit is a journey, and staying committed to improving your financial habits is key. The higher your credit score climbs, the more opportunities you’ll have for better loan terms, lower interest rates, and a more secure financial future.

Frequently Asked Questions about 560 Credit Scores

Here are some common questions that people often have about 560 credit scores:

1. Is a 560 credit score considered bad?

Yes, a 560 credit score is considered “poor” on the FICO credit score scale. It suggests a history of financial mismanagement and can make it challenging to obtain credit or favorable loan terms.

2. How long does it take to improve a 560 credit score?

The time it takes to improve a credit score varies depending on individual circumstances. With consistent responsible financial behavior, such as making on-time payments and reducing debt, you can gradually raise your credit score over time. However, significant improvements may take several months or even years.

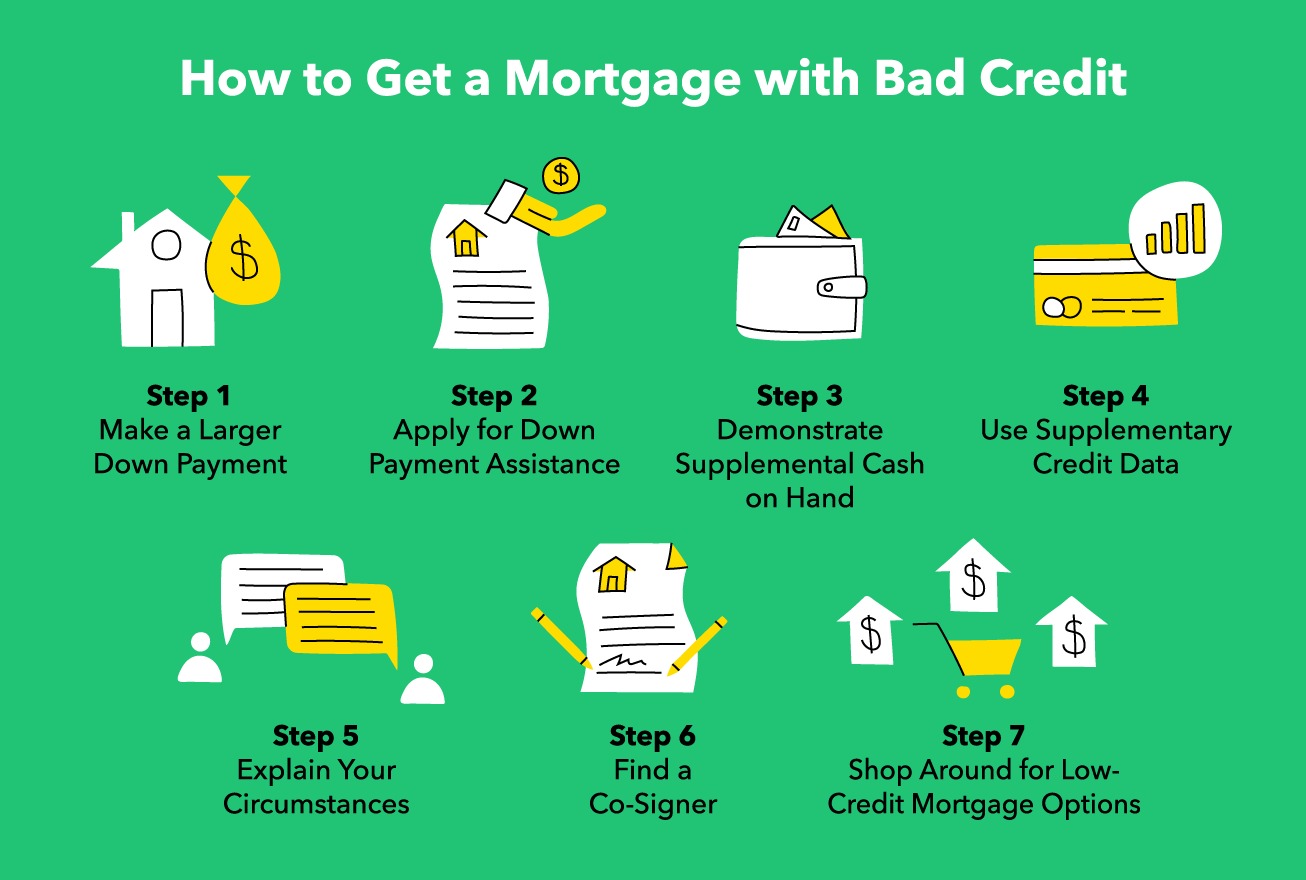

3. Can I get a mortgage with a 560 credit score?

Obtaining a mortgage with a 560 credit score may be challenging. Conventional lenders typically prefer higher credit scores for mortgage approvals. However, some lenders specialize in providing loans to individuals with lower credit scores, though these loans may come with higher interest rates and stricter terms.

4. Can I rent an apartment with a 560 credit score?

Having a 560 credit score may make it more difficult to rent an apartment. Landlords often run credit checks during the application process, and a low credit score may raise concerns about financial responsibility. Some landlords may require a larger security deposit or request additional income verification.

5. Can I get a car loan with a 560 credit score?

You may be able to get a car loan with a 560 credit score, but you will likely face higher interest rates and less favorable terms. Consider exploring alternative lenders or working to improve your credit before applying for a car loan to increase your chances of securing more favorable loan terms.

6. Will my credit score improve if I pay off all my debt?

Paying off your debt can have a positive impact on your credit score by reducing your overall debt utilization ratio. However, other factors, such as on-time payment history and the length of your credit history, also influence your credit score. It’s important to practice responsible financial habits consistently to see significant improvements in your credit score.

Remember that individual situations can vary, so it’s always a good idea to consult with a financial professional for personalized advice regarding your credit score and financial goals.

Conclusion

Having a 560 credit score can present various challenges and limitations in the realm of finance. It signifies a poor credit history and may result in difficulties obtaining loans, higher interest rates, and restricted financial opportunities. However, it’s essential to remember that a low credit score is not a life sentence. With dedication, discipline, and smart financial choices, it is possible to improve your creditworthiness over time.

By making timely payments, reducing debt, correcting errors on your credit report, and practicing responsible financial habits, you can gradually raise your credit score and open up doors to better financial opportunities. It may require patience and persistence, but the effort will be well worth it in the long run as you regain control of your financial future.

Remember, your credit score is just one element of your overall financial health. It’s also important to adopt good money management habits, such as budgeting, saving, and building an emergency fund. These actions, combined with an improved credit score, will position you for a brighter financial future.

If you need guidance or assistance in improving your credit score, consider seeking help from credit counseling agencies or financial advisors who specialize in credit repair. They can provide personalized advice and strategies to help you on your journey towards a better credit score.

In conclusion, while a 560 credit score may present challenges, it’s not the end of the road. With determination and financial responsibility, you can overcome the obstacles and work towards rebuilding your creditworthiness, setting the stage for a more secure and prosperous financial future.