Finance

How Bad Is A 530 Credit Score

Published: October 22, 2023

Find out how bad a 530 credit score can be and learn about the impact it can have on your finances. Begin your journey to financial recovery today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Scores

- What Does a 530 Credit Score Mean?

- Impact on Loans and Credit Applications

- Difficulty Securing Credit Cards

- Challenges with Renting or Leasing

- Higher Interest Rates on Loans

- Limited Access to Mortgage Options

- Difficulty Getting Approved for Insurance

- Employment and Job Opportunities

- Steps to Improve a 530 Credit Score

- Conclusion

Introduction

Credit scores play a crucial role in our financial lives, influencing our ability to obtain loans, credit cards, and even secure housing. While a high credit score is a sign of financial responsibility and can open doors to better interest rates and loan options, a low credit score can present challenges and limitations. In this article, we will focus on one specific credit score – 530.

A 530 credit score is considered poor and can often lead to difficulties in obtaining credit, facing higher interest rates, and experiencing limited opportunities. Understanding the implications of this credit score is important for individuals who may find themselves in this situation and want to take steps to improve their financial standing.

In the following sections, we will delve deeper into what a 530 credit score means, its impact on loans and credit applications, challenges with obtaining credit cards and renting or leasing, higher interest rates on loans, limited access to mortgage options, difficulty getting approved for insurance, and even potential effects on employment and job opportunities.

Finally, we will explore actionable steps to improve a 530 credit score and work towards a stronger financial future. It’s crucial to remember that while a 530 credit score presents challenges, it is not a permanent situation, and with dedication and smart financial choices, individuals can rebuild their credit and improve their overall financial well-being.

Understanding Credit Scores

Credit scores are numerical values that reflect an individual’s creditworthiness. They are calculated based on information in the individual’s credit report, which includes factors such as payment history, credit utilization, length of credit history, credit mix, and new credit accounts.

The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850. A higher credit score signifies a lower risk to lenders, while a lower credit score indicates a higher risk.

Understanding the different credit score ranges is essential in evaluating one’s financial standing. Typically, credit scores can be categorized as follows:

- Poor: 300 – 579

- Fair: 580 – 669

- Good: 670 – 739

- Very Good: 740 – 799

- Exceptional: 800 – 850

Credit scores are used by lenders, credit card issuers, and other financial institutions when assessing an individual’s creditworthiness. A higher credit score increases the likelihood of being approved for credit applications and secures better loan terms with lower interest rates.

It is important to note that credit scores can fluctuate over time as new information is added to the credit report. Regularly monitoring credit scores and maintaining a positive credit history is essential for financial stability and opportunities.

What Does a 530 Credit Score Mean?

A 530 credit score is considered poor and falls into the lower range of credit scores. This score indicates a high level of credit risk to lenders and can have significant implications for individuals seeking loans, credit cards, and other forms of credit. Let’s explore the meaning and impact of a 530 credit score:

Limited borrowing options: With a 530 credit score, individuals may find it difficult to secure loans from traditional lenders. Banks and credit unions may be hesitant to extend credit due to the increased risk associated with low credit scores. This can result in limited borrowing options, making it challenging to obtain financing for various purposes such as purchasing a car or starting a business.

Higher interest rates: Even if individuals with a 530 credit score manage to obtain a loan, they are likely to face higher interest rates. Lenders offset the risk associated with low credit scores by charging higher interest rates. This not only increases the cost of borrowing but also adds to the financial burden and makes it harder to repay the loan in a timely manner.

Difficulty obtaining credit cards: Credit card companies typically extend credit based on creditworthiness, and a 530 credit score makes it challenging to get approved for traditional credit cards. Individuals may need to explore alternative options such as secured credit cards or subprime credit cards with higher fees and limited spending limits.

Struggles with renting or leasing: Landlords and leasing companies often perform credit checks on prospective tenants. With a 530 credit score, individuals may face difficulties in securing rental properties or may be required to pay higher security deposits or provide a co-signer as a condition for approval.

Limited access to mortgage options: Buying a home becomes significantly challenging with a 530 credit score. Most lenders require higher credit scores to qualify for mortgages, and individuals with a 530 score may have limited options or may need to explore alternative financing methods such as FHA loans.

Affected insurance premiums: Credit scores can also impact insurance premiums. Insurance companies may consider a low credit score as an indication of higher risk and charge higher premiums for auto, home, or other types of insurance coverage.

A 530 credit score is a clear signal that there is room for improvement in managing one’s credit. Although the challenges may seem daunting, there are steps individuals can take to improve their credit scores and enhance their financial prospects.

Impact on Loans and Credit Applications

A 530 credit score can have a significant impact on an individual’s ability to obtain loans and credit. Lenders consider credit scores as a measure of creditworthiness, and a low score indicates a higher risk of default. Here are some ways a 530 credit score can affect loans and credit applications:

Difficulty in loan approval: With a 530 credit score, individuals may face challenges in getting approved for loans from traditional lenders such as banks or credit unions. These institutions typically have strict criteria for lending and may consider a score of 530 as too risky.

Higher interest rates: If individuals with a 530 credit score are approved for a loan, they will likely face higher interest rates. Lenders offset the increased risk associated with low credit scores by charging higher rates. This means individuals will end up paying more in interest over the life of the loan, making it more difficult to manage debt.

Limited loan options: Individuals with a 530 credit score may have limited options when it comes to loan types. They may not qualify for traditional unsecured loans and may need to explore alternative options such as secured loans. Secured loans require collateral, which can come in the form of a vehicle, property, or other valuable assets.

Cosigner requirements: In some cases, lenders may require individuals with a 530 credit score to provide a cosigner when applying for a loan. A cosigner is a person with a stronger credit history who agrees to take responsibility for the loan if the primary borrower fails to make payments. This adds an extra layer of assurance for the lender.

Increased loan scrutiny: Lenders may scrutinize loan applications more closely for individuals with a 530 credit score. They may request additional documentation, such as proof of income, employment verification, or a detailed explanation of how the funds will be used. The higher level of scrutiny can prolong the loan approval process.

While a 530 credit score may present challenges in obtaining loans and credit, it’s important to remember that it is not a permanent situation. Taking proactive steps to improve credit can improve future borrowing prospects and pave the way for better loan terms and options.

Difficulty Securing Credit Cards

Having a 530 credit score can make it challenging to secure traditional credit cards. Credit card companies use credit scores as a measure of creditworthiness, and a low score indicates higher risk. Here are some difficulties individuals with a 530 credit score may encounter when trying to secure credit cards:

Limited approval options: Most major credit card companies have strict criteria for approving credit card applications. With a 530 credit score, individuals may not meet the minimum requirements to be approved for these cards. This limitation means they may need to explore alternative options specifically designed for individuals with lower credit scores.

Higher fees and interest rates: If individuals with a 530 credit score manage to get approved for a credit card, they will likely be offered cards with higher fees and interest rates. Credit card companies offset the increased risk associated with low credit scores by charging higher fees and rates. This can make credit card debt more expensive and harder to manage.

Secured credit cards: One option for individuals with a 530 credit score is to apply for secured credit cards. These cards require a security deposit, which serves as collateral for the credit limit. The credit limit is typically equal to the deposit amount. While these types of cards can help individuals build or rebuild credit, they often come with higher fees and limited spending capabilities.

Subprime credit cards: Subprime credit cards are specifically designed for individuals with lower credit scores. These cards may have lower credit limits, higher interest rates, and annual fees. However, they can provide individuals with a way to start rebuilding credit and demonstrate responsible credit usage.

Prepaid or debit cards: As an alternative to traditional credit cards, individuals with a 530 credit score may consider using prepaid or debit cards. These cards are not credit cards since they do not allow individuals to borrow money. However, they can be used for online purchases and certain transactions. It’s important to note that using prepaid or debit cards does not directly impact credit scores.

While securing a credit card with a 530 credit score may present challenges, it’s important for individuals in this situation to explore their options and choose cards that align with their financial goals. Making timely payments and demonstrating responsible credit usage can help improve credit scores over time, opening up more credit card options in the future.

Challenges with Renting or Leasing

A 530 credit score can present challenges when it comes to renting or leasing housing. Landlords and leasing companies often use credit scores as a factor in the tenant selection process. Here are some of the challenges individuals with a 530 credit score may face when renting or leasing:

Difficulty getting approved: Many landlords conduct credit checks as part of the rental application process. With a 530 credit score, individuals may struggle to get approved for rental properties. Landlords may view a low credit score as an indication of financial irresponsibility or a potential risk for late rent payments.

Higher security deposits: In cases where individuals are approved for rental properties with a 530 credit score, landlords may require a higher security deposit as a precautionary measure. This is done to mitigate the perceived risk associated with low credit scores. The higher deposit can put pressure on tenants’ finances and make it more challenging to secure a rental property.

Limited housing options: Individuals with a 530 credit score may also face limited housing options. Landlords who have stricter credit requirements may reject applicants with low credit scores altogether. This can significantly reduce the available pool of rental properties, making it harder to find suitable housing.

Cosigners or guarantors: Some landlords may require individuals with a 530 credit score to provide a cosigner or guarantor. A cosigner is a person with a stronger credit profile who agrees to take responsibility for the rent payments if the tenant defaults. The presence of a cosigner reassures landlords about the tenant’s ability to fulfill their rental obligations.

Higher risk perception: Individuals with a 530 credit score may be perceived as higher risk tenants by landlords. This perception can lead to landlords prioritizing other applicants with stronger credit profiles. Even if individuals are approved for a rental property, landlords may impose additional restrictions or conditions due to the perceived risk.

While a 530 credit score may present challenges when renting or leasing, it’s important for individuals to be proactive in their housing search. Exploring apartments managed by individual landlords rather than large property management companies may provide more flexibility. Additionally, providing documentation to demonstrate income stability and references from previous landlords can help alleviate concerns related to low credit scores.

Higher Interest Rates on Loans

One of the major consequences of having a 530 credit score is the impact it can have on the interest rates individuals are charged when borrowing money. Lenders consider credit scores as an indicator of risk, and a lower credit score implies a higher risk. As a result, individuals with a 530 credit score can expect to face higher interest rates on loans. Here’s how this can affect their borrowing experience:

More expensive borrowing: When individuals with a 530 credit score borrow money, they are typically offered loans with higher interest rates. This means they end up paying more in interest over the life of the loan compared to someone with a higher credit score. The higher interest rates can make borrowing more expensive and increase the overall cost of the loan.

Financial burden: Higher interest rates translate to higher monthly payments. Individuals with a 530 credit score may find it challenging to manage the increased financial burden that comes with higher interest rates. This can lead to difficulties in keeping up with loan payments, potentially exacerbating their credit situation.

Limited loan options: Lenders may be reluctant to offer competitive loan terms to individuals with a 530 credit score. This means individuals may have limited options when it comes to borrowing, and the loans they do qualify for may not offer favorable terms or flexibility. They may have to settle for loans with shorter repayment terms or higher monthly payments.

Impact on debt repayment: Higher interest rates can make it harder to pay off existing debt. With a significant portion of the monthly payment going towards interest, individuals may find it challenging to make meaningful progress in reducing their debt balances. This can lead to a cycle of debt and hinder their ability to improve their credit score.

Long-term financial implications: The impact of higher interest rates extends beyond the immediate borrowing experience. It can affect individuals’ ability to save money, invest in their future, and achieve their financial goals. The extra money spent on interest could be used for other purposes, such as saving for a down payment on a home or building an emergency fund.

While higher interest rates on loans can be discouraging, it’s important for individuals with a 530 credit score to understand that their credit situation is not permanent. By taking steps to improve their credit score, such as making timely payments, reducing debt, and avoiding new credit applications, they can gradually qualify for loans with more favorable interest rates in the future.

Limited Access to Mortgage Options

Securing a mortgage is a significant milestone for many individuals, but for those with a 530 credit score, it can be a major challenge. A low credit score can limit access to mortgage options and make it difficult to qualify for traditional home loans. Here are some of the ways a 530 credit score can impact an individual’s ability to obtain a mortgage:

Difficulty in loan approval: Lenders consider credit scores a crucial factor in determining a borrower’s creditworthiness. A 530 credit score is indicative of a higher risk borrower, making it more challenging to get approved for a mortgage. Lenders may have stricter requirements and may be more hesitant to lend to individuals with lower credit scores.

Higher interest rates: Even if individuals with a 530 credit score are able to secure a mortgage, they are likely to face higher interest rates. Higher interest rates are a result of the increased risk associated with lower credit scores. These rates can significantly increase the cost of borrowing, making homeownership less affordable in the long run.

Limited loan options: Traditional mortgage lenders may have minimum credit score requirements that exclude those with a 530 credit score. This limitation reduces the number of loan options available to individuals with lower credit scores. They may need to explore alternative financing options such as government-backed loans or non-traditional lenders.

Higher down payment requirements: Lenders may require a larger down payment from individuals with a 530 credit score. A larger down payment reduces the lender’s risk and provides them with more confidence in the borrower’s commitment to the loan. However, a higher down payment requirement can be a significant financial hurdle for many potential homebuyers.

Private mortgage insurance (PMI) need: If individuals with a 530 credit score are able to secure a mortgage, they may be required to pay for private mortgage insurance (PMI). PMI is an extra cost that protects the lender in case the borrower defaults on the loan. This additional expense adds to the overall cost of homeownership.

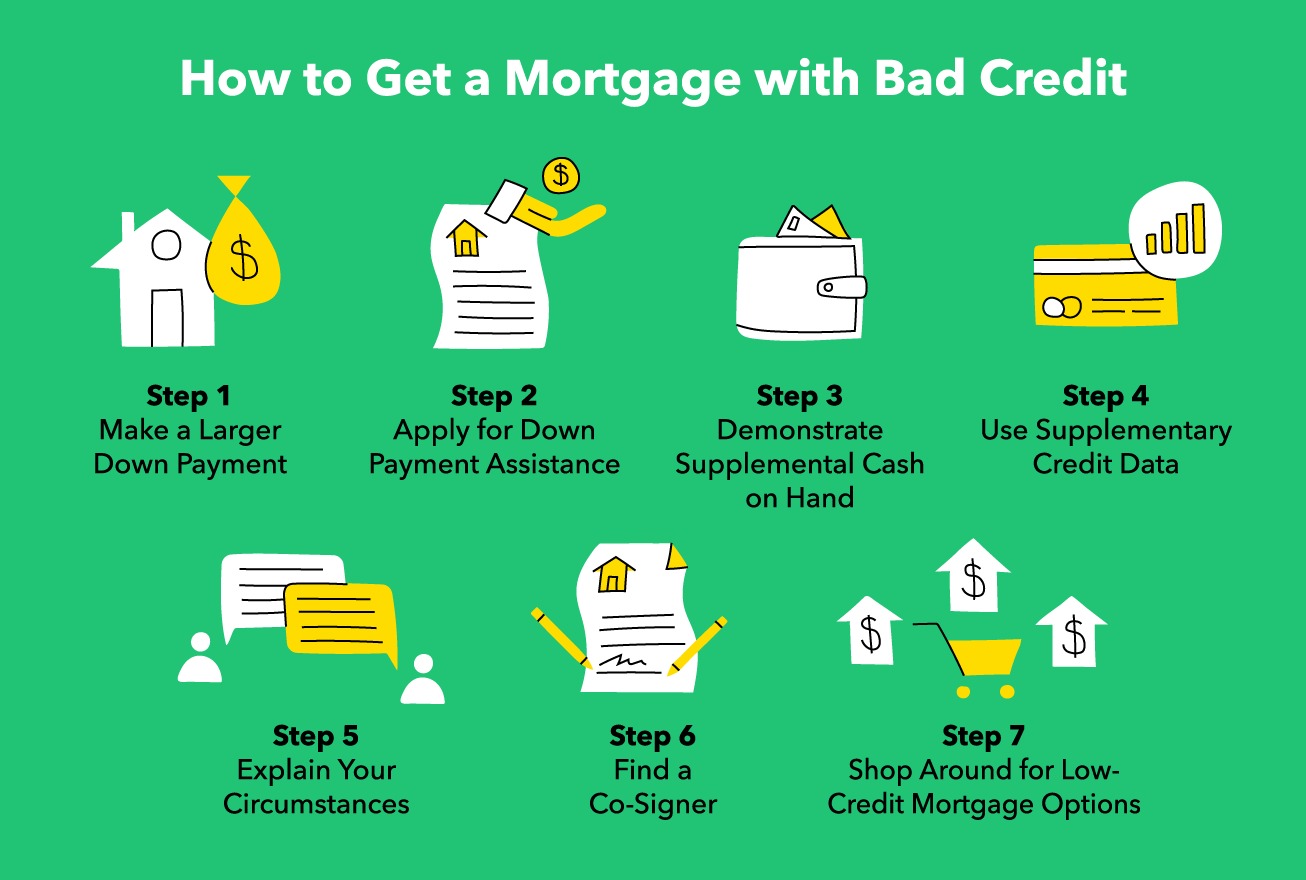

It’s important for individuals with a 530 credit score to explore their options and consider steps they can take to improve their creditworthiness over time. This includes making consistent on-time payments, reducing existing debt, and addressing any errors on their credit reports. Additionally, working with a reputable mortgage broker or lender who specializes in working with lower credit scores can help individuals navigate the process and explore potential mortgage options.

Difficulty Getting Approved for Insurance

Having a 530 credit score can also pose difficulties when it comes to obtaining insurance coverage. Insurance companies often use credit scores to assess an individual’s level of risk and determine the premiums they will charge. Here are some ways a 530 credit score can impact an individual’s ability to get approved for insurance:

Limited insurance options: Insurance companies may have strict underwriting guidelines that result in limited options for individuals with a 530 credit score. Some insurance companies may choose not to offer coverage to individuals with lower credit scores, while others may offer coverage at higher rates due to the perceived level of risk.

Higher insurance premiums: Individuals with a 530 credit score may face higher insurance premiums. Insurance companies consider credit scores as an indicator of an individual’s financial responsibility and level of risk. A lower credit score is often associated with a higher likelihood of filing claims, which can result in increased premiums as insurance providers seek to offset potential losses.

Limited coverage benefits: Individuals with a 530 credit score may find that their insurance coverage comes with limited benefits or higher deductibles. Insurance companies may impose additional restrictions or reduce the coverage limits for individuals with lower credit scores to minimize their potential exposure.

Impact on multiple insurance policies: A low credit score can impact not only the ability to secure one type of insurance but also multiple insurance policies. Whether it is auto insurance, home insurance, or other types of coverage, individuals with a 530 credit score may face challenges in securing affordable and comprehensive coverage across multiple insurance policies.

Difficulty obtaining certain types of insurance: Some types of insurance, such as life insurance or certain forms of business insurance, may require a higher credit score for approval. Insurance providers want assurance that individuals will be able to meet ongoing premium payments, and a lower credit score can raise concerns about financial stability and ability to fulfill payment obligations.

While a 530 credit score may present obstacles in obtaining insurance coverage, it’s important to explore different insurance providers and policies. Some companies may place less emphasis on credit scores or offer specialized insurance products for individuals with lower credit scores. Taking steps to improve credit over time can also lead to better insurance options and more favorable premiums.

Employment and Job Opportunities

While a 530 credit score primarily affects financial aspects, it can also have implications for employment and job opportunities. Some employers may take credit history into consideration during the hiring process, particularly for positions that involve financial responsibility or access to sensitive information. Here’s how a 530 credit score can impact employment:

Pre-employment credit checks: Certain employers may conduct credit checks as part of their background screening process. A poor credit score like 530 may raise concerns about an individual’s financial stability and responsibility. This can potentially impact their chances of being hired, especially for positions related to finance, accounting, or positions that involve handling company finances.

Loss of job opportunities: With a 530 credit score, individuals may face competition from candidates with higher credit scores. Employers may view candidates with better credit scores as more financially responsible and trustworthy, giving them an edge in the hiring process. This can result in individuals with lower credit scores missing out on job opportunities.

Financial positions: Job roles that involve handling money, financial transactions, or access to sensitive financial information may be more likely to conduct credit checks. This is because employers in these roles prioritize trustworthiness and financial responsibility. A low credit score can be seen as a red flag and potentially disqualify individuals from consideration for these positions.

Security clearance: Some government or government-contracted positions may require security clearances. As part of the clearance process, credit history may be evaluated. A 530 credit score can raise concerns about an individual’s financial vulnerabilities, potentially impacting their eligibility for security clearances and related positions.

High-level positions: Executive or leadership positions within organizations may undergo more thorough background checks, which may include credit history. A low credit score can lead employers to question an individual’s judgment, decision-making abilities, and financial management skills, possibly influencing their candidacy for these positions.

It’s important to note that not all employers conduct credit checks, and the impact of a credit score on employment prospects can vary widely across industries and positions. Additionally, some jurisdictions have restrictions and regulations on the use of credit checks in employment decisions. Individuals with a low credit score can focus on showcasing their skills, experiences, and positive attributes during the job search process, as these can outweigh credit score-related concerns for some employers.

Steps to Improve a 530 Credit Score

While a 530 credit score may present challenges, it is important to remember that credit scores are not fixed and can be improved over time. With dedication and smart financial choices, individuals can take steps to enhance their creditworthiness and work towards a stronger financial future. Here are some important steps to consider:

1. Review your credit reports: Start by obtaining copies of your credit reports from the major credit bureaus (Equifax, Experian, and TransUnion). Review them carefully to identify any errors, inaccuracies, or fraudulent activities. Dispute any incorrect information that may be negatively impacting your credit score.

2. Pay bills on time: Consistently paying your bills on time is crucial for improving your credit score. Late payments can have a significant negative impact. Set reminders or enroll in automatic payments to avoid missing due dates.

3. Reduce credit card balances: Aim to keep your credit card balances low, ideally below 30% of your available credit limit. High credit utilization can negatively impact your credit score. Consider creating a plan to pay down your balances and avoid using credit cards excessively.

4. Pay off debt: Paying off outstanding debts can have a positive impact on your credit score. Focus on tackling high-interest debts first and consider debt repayment strategies such as the snowball or avalanche method to effectively eliminate debt over time.

5. Build a positive credit history: Establish a positive credit history by using credit responsibly. This can include opening a secured credit card or becoming an authorized user on someone else’s credit card. Make consistent on-time payments and keep credit utilization low.

6. Avoid new credit applications: Limit new credit applications, especially if you have a low credit score. Each application can result in a hard inquiry which temporarily lowers your credit score. Only apply for credit when necessary and try to spread out applications over time.

7. Seek credit counseling or assistance: If you feel overwhelmed or need guidance, consider seeking assistance from nonprofit credit counseling agencies. These organizations can offer personalized advice and assistance in creating a plan to improve your credit and manage your finances more effectively.

8. Be patient and consistent: Improving a credit score takes time and consistency. Stay committed to practicing responsible financial habits and monitor your progress regularly. Remember that positive changes in credit behavior will gradually reflect in an improved credit score over time.

By following these steps and maintaining discipline in managing your finances, you can gradually raise your credit score and improve your overall financial health. It’s important to remember that there are no quick fixes, but the effort put into rebuilding your credit will pay off in the long run.

Conclusion

A 530 credit score may present challenges when it comes to obtaining loans, credit cards, and insurance, as well as affect housing options and even employment prospects. However, it’s vital to recognize that this score does not define one’s financial future. With dedication, persistence, and adopting responsible financial habits, individuals can improve their credit scores over time.

Understandably, rebuilding credit takes time, and there are no quick fixes. It involves consistently making payments on time, reducing debt, and practicing responsible credit usage. Monitoring credit reports for errors and disputing inaccuracies is also important in maintaining a healthy credit profile.

While improving a low credit score may seem daunting, it’s crucial to stay positive and focused on long-term goals. Taking steps to improve financial habits and seeking guidance from credit counseling agencies can provide valuable support during the journey toward a better credit score.

It’s important to remember that credit scores can be fluid, and positive changes will eventually be reflected in improved creditworthiness. As credit scores increase, individuals gain access to better loan terms, lower interest rates, and more financial opportunities.

Ultimately, a 530 credit score is not a permanent predicament. By implementing the steps mentioned in this article, individuals can rebuild their credit, open doors to broader financial options, and pave the way for a more secure and prosperous financial future.