Finance

What If I Overpaid The IRS?

Published: November 1, 2023

Discover the consequences and solutions if you have overpaid the IRS. Update your finances and learn how to handle this situation effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Reasons for Overpayment

- Consequences of Overpaying the IRS

- Steps to Take if You Overpaid the IRS

- Option 1: Requesting a Refund

- Option 2: Applying Overpayment to Future Taxes

- Option 3: Donating the Overpayment to Charity

- Option 4: Adjusting the Overpayment on Next Year’s Taxes

- Option 5: Seeking Professional Assistance

- Tips to Avoid Overpaying in the Future

- Conclusion

Introduction

Dealing with taxes can be a complex and often stressful process. There are times when individuals or businesses may inadvertently overpay the Internal Revenue Service (IRS) beyond their tax liability. While it may seem like a mistake with no consequences, it’s essential to understand the implications and options available in such a situation.

Overpaying the IRS occurs when the amount paid in taxes exceeds the actual tax liability. This can happen due to various reasons, such as errors in calculating deductions or credits, misunderstanding of tax laws, or simply being conservative in estimates. Regardless of the cause, it’s vital to take appropriate steps to address the overpayment and ensure any excess funds are appropriately handled.

In this article, we will explore the reasons for overpaying the IRS, the potential consequences of doing so, and the steps you can take if you find yourself in this predicament. It’s important to note that this article is for informational purposes only and does not constitute tax advice. Consulting with a qualified tax professional is always recommended when dealing with specific tax situations.

Reasons for Overpayment

There are several reasons why individuals or businesses may overpay the IRS. Understanding these reasons can help identify areas where errors or miscalculations may have occurred, preventing future overpayments. Here are some common reasons for overpayment:

- Conservative Estimates: To avoid penalties or unexpected tax bills, some taxpayers intentionally overestimate their tax liability. While this may provide a sense of security, it can lead to overpayment if the actual tax liability is less than anticipated.

- Errors in Calculating Deductions: Tax deductions play a crucial role in reducing taxable income. However, miscalculations or misunderstandings of deduction rules can result in overpayment. Careful attention should be given to ensure accurate deduction calculations.

- Errors in Claiming Credits: Tax credits are designed to provide direct reductions in tax liability. However, errors or omissions in claiming eligible credits can lead to overpayment. It’s important to review eligibility criteria and claim all applicable credits to avoid overpaying.

- Misinterpretation of Tax Laws: The tax code is complex, and misinterpretation of tax laws can lead to overpayment. Lack of understanding or relying on outdated information can result in overpaying the IRS.

- Failure to Account for Changes in Income: Changes in income, such as a job change or fluctuations in self-employment income, can impact tax liability. Failure to account for these changes when estimating taxes can result in overpayment.

These are just a few examples of the reasons behind overpayment. Each taxpayer’s situation may be unique, and it’s important to carefully review records, seek professional advice if needed, and take steps to rectify any overpayment.

Consequences of Overpaying the IRS

While overpaying the IRS may seem like a harmless mistake, it’s important to be aware of the potential consequences that can arise. Understanding these consequences can help individuals and businesses take the necessary steps to address the overpayment and mitigate any negative impacts. Here are some potential consequences of overpaying the IRS:

- Loss of Cash Flow: Overpaying the IRS means that you have provided them with more funds than necessary. This can lead to a temporary loss of cash flow, as the excess funds are tied up with the IRS and not available for other purposes.

- Delayed Refunds: If you are entitled to a refund due to the overpayment, it will take time for the IRS to process and issue the refund. This can result in delays in receiving the funds that rightfully belong to you.

- Lack of Investment Opportunities: If the overpaid amount could have been invested or used for other financial activities, it represents a missed opportunity for potential growth or utilization of the funds.

- Minimal or No Interest Earned: The IRS pays interest on refunds only if the refund is issued after a certain period. If the overpayment is discovered and refunded quickly, the interest earned on the excess funds will be minimal or nonexistent.

- Error in Tax Records: Overpaying the IRS can create errors in your tax records, especially if the overpayment is not properly documented or reconciled. This can potentially lead to complications and confusion when filing future tax returns.

- Opportunity Cost: Overpaying the IRS means that the excess funds are not available for other financial obligations or opportunities. This opportunity cost can impact your overall financial planning and goals.

It’s important to note that the specific consequences can vary depending on the individual or business’s circumstances. If you have overpaid the IRS, it’s crucial to take appropriate steps to rectify the situation and mitigate any negative impacts.

Steps to Take if You Overpaid the IRS

If you find yourself in a situation where you have overpaid the IRS, it’s crucial to take prompt action to address the issue. Here are some steps you can take if you have overpaid the IRS:

- Review Your Tax Return: Carefully review your tax return to identify any errors or miscalculations that may have led to the overpayment. Double-check deductions, credits, and income figures to ensure accuracy.

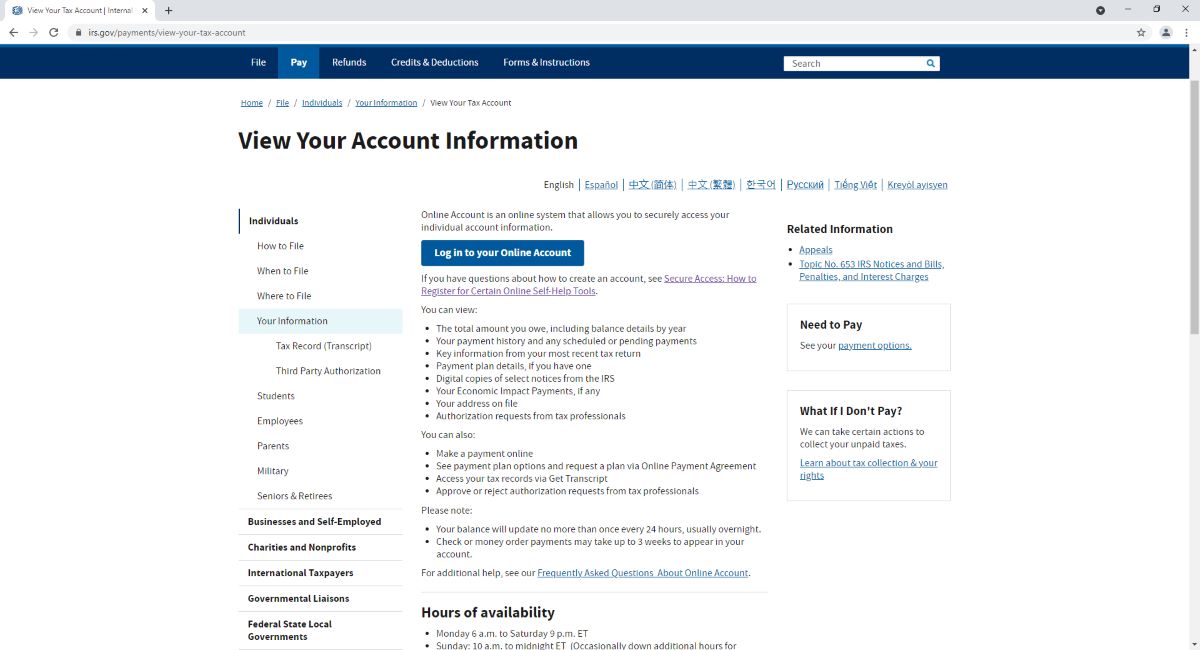

- Contact the IRS: Reach out to the IRS to inform them about the overpayment. You can contact their taxpayer assistance line or visit their website for guidance on how to proceed.

- Option 1: Requesting a Refund: The most common option is to request a refund of the overpaid amount. You can do this by filing an amended tax return (Form 1040X) or by contacting the IRS and requesting a refund directly.

- Option 2: Applying Overpayment to Future Taxes: If you anticipate owing taxes in the future, you may choose to apply the overpayment as a credit toward your next year’s tax liability. This can help offset future tax bills.

- Option 3: Donating the Overpayment to Charity: Another option is to donate the overpaid amount to a qualified charity. This can not only help a worthy cause but also provide tax benefits in the form of deductions.

- Option 4: Adjusting the Overpayment on Next Year’s Taxes: If you prefer not to request a refund or apply the overpayment as a credit, you can adjust your withholding or estimated tax payments for the following tax year to account for the excess funds.

- Option 5: Seeking Professional Assistance: If you feel overwhelmed or unsure about how to handle the overpayment, consider seeking professional assistance from a qualified tax professional. They can guide you through the process and ensure that you take the appropriate steps.

It’s important to note that the specific steps to take may vary depending on your individual circumstances. Consulting with a tax professional is always recommended to ensure that you choose the best course of action for your situation.

Option 1: Requesting a Refund

If you have overpaid the IRS and would like to have the excess funds returned to you, the most common option is to request a refund. Here is a breakdown of the process for requesting a refund of your overpayment:

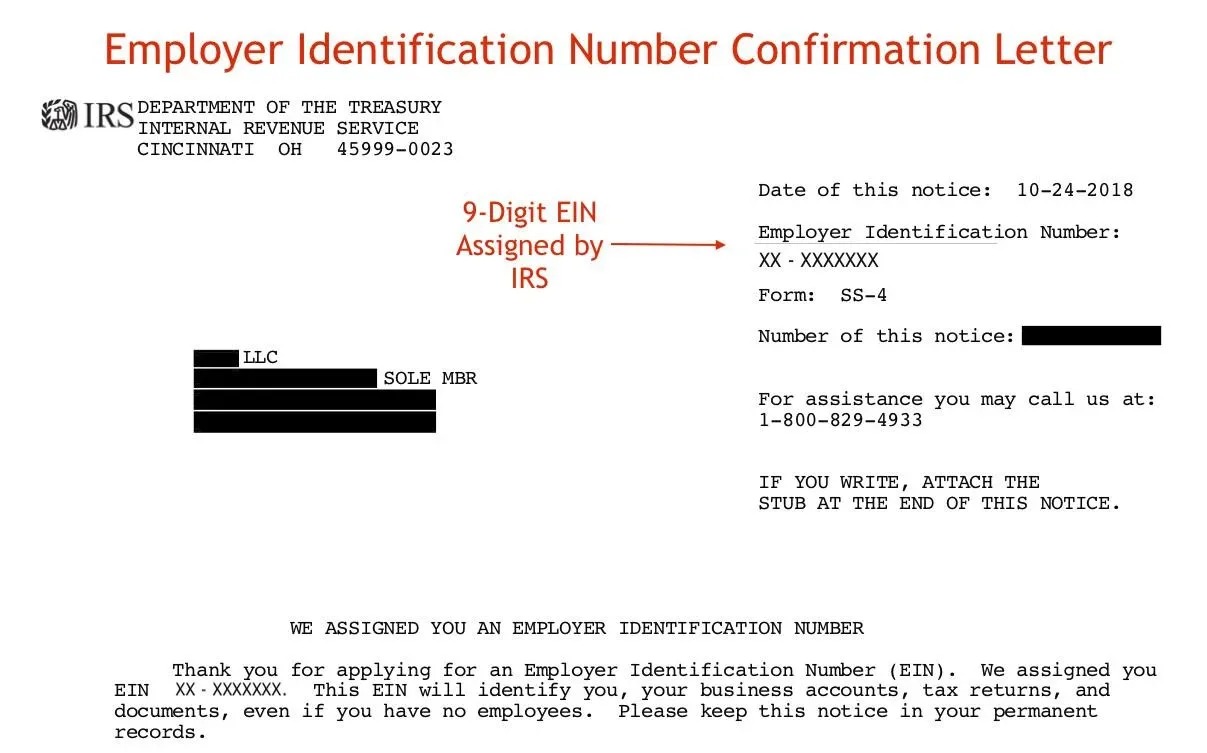

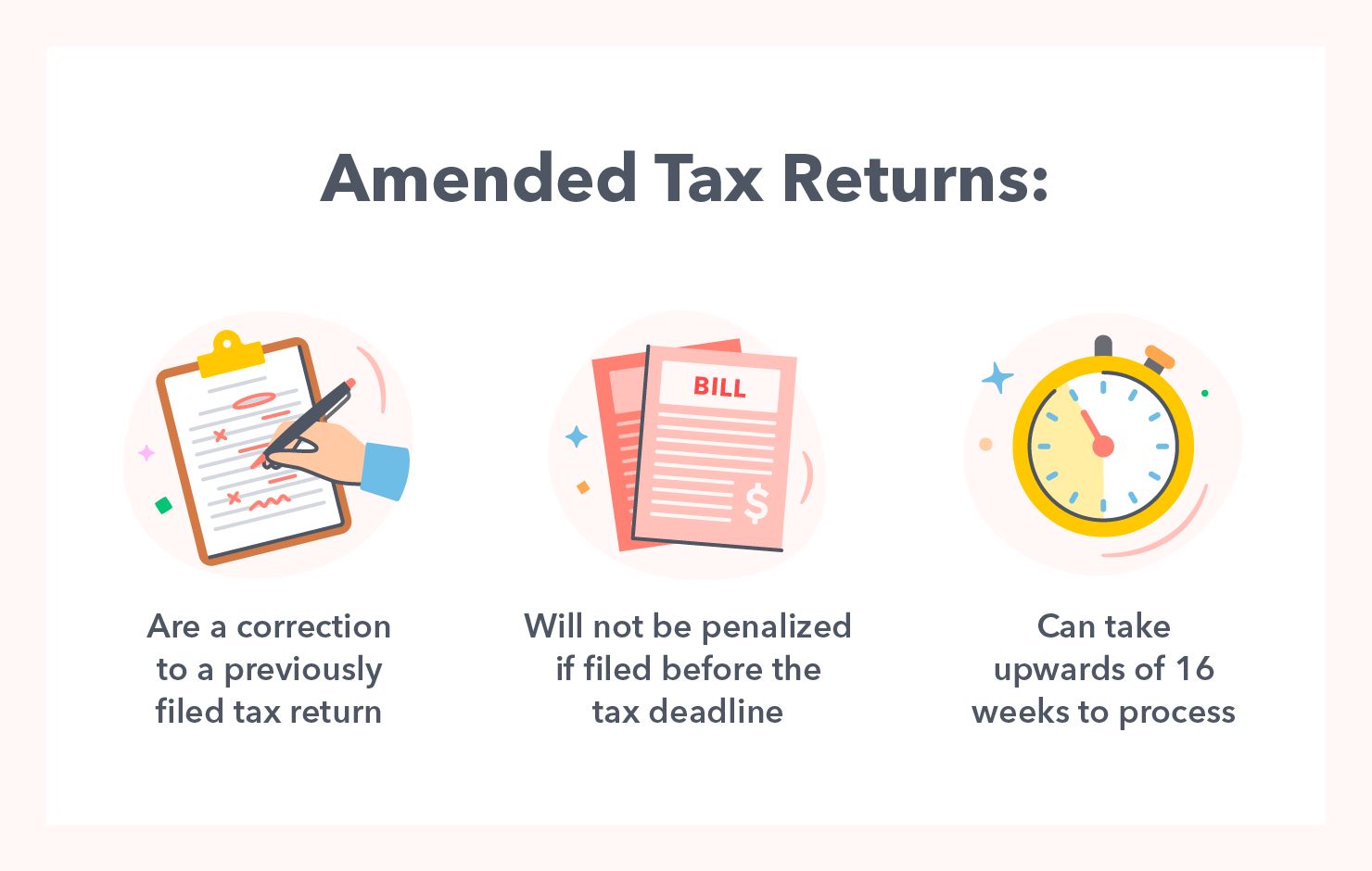

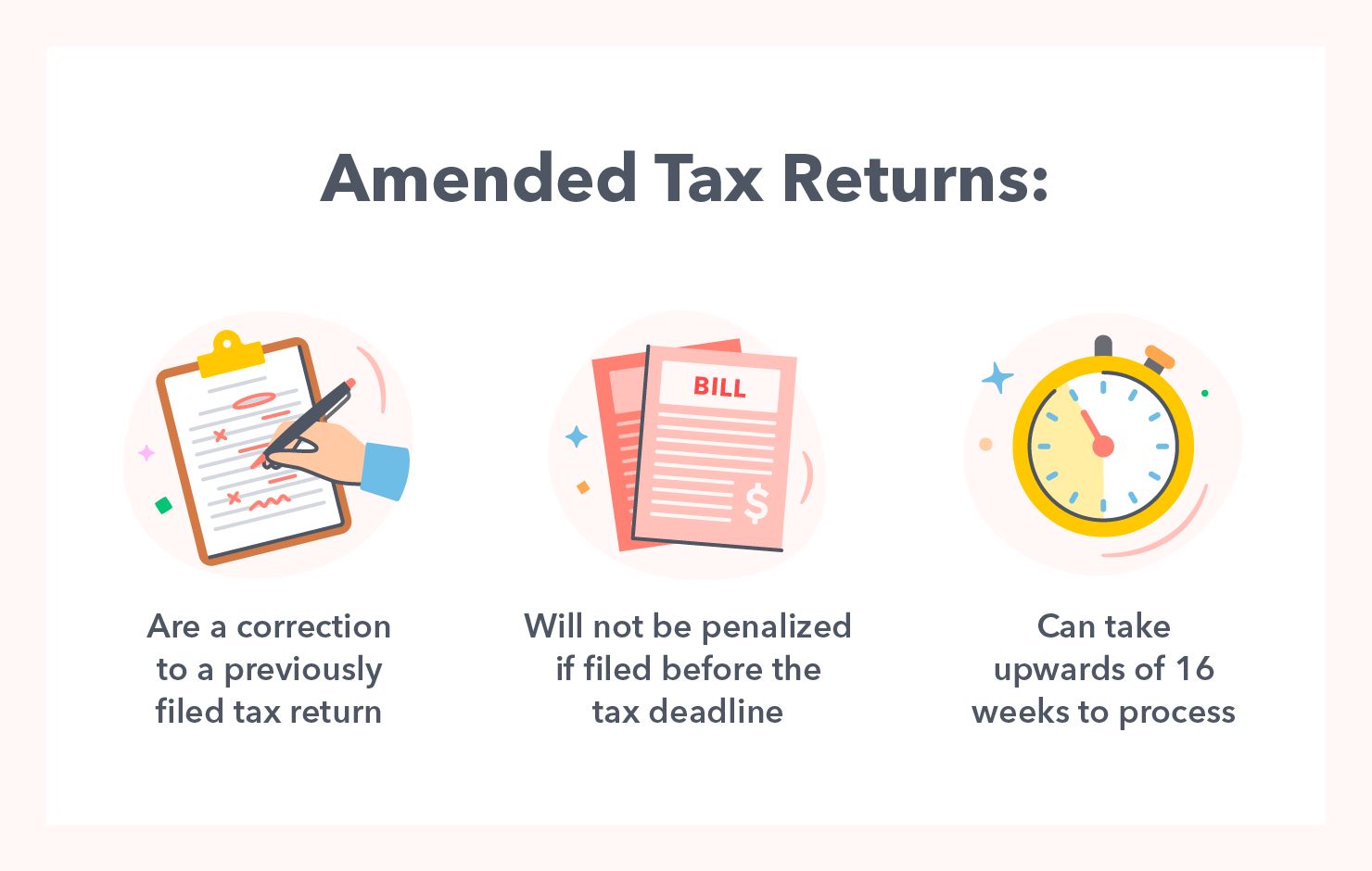

- Filing an Amended Tax Return: The first step is to file an amended tax return using Form 1040X. This form allows you to correct any errors or make revisions to your original return. On Form 1040X, you will need to provide the corrected figures and indicate the amount of overpayment you are requesting to be refunded.

- Timing: It’s important to note that there is a time limit for requesting a refund. Generally, you have three years from the original due date of your tax return or two years from the date you paid the tax, whichever is later, to file an amended return and claim a refund.

- Documentation: Make sure to gather all necessary documentation to support your amended tax return. This includes documents such as income statements, deduction records, and any other relevant information that supports the changes you are making.

- Mailing the Amended Return: Once you have completed the amended tax return and attached all required documentation, you will need to mail it to the IRS. The address to which you should send the amended return can be found in the instructions for Form 1040X.

- Refund Timing: After you have filed the amended return, it may take some time for the IRS to process your request and issue the refund. Refunds are typically issued within 21 days if filed electronically, or within 12 weeks if filed by mail.

- Direct Deposit: You can choose to have your refund directly deposited into your bank account for faster access to the funds. This option is convenient and eliminates the risk of lost or stolen refund checks.

- Checking Refund Status: If you would like to check the status of your refund, you can use the “Where’s My Amended Return?” tool available on the IRS website. This tool provides updates on the progress of your amended return and refund.

It’s important to accurately complete the amended tax return and provide all necessary documentation to ensure a smooth refund process. If you need assistance with filing an amended return or have questions about the process, consulting a tax professional can provide valuable guidance.

Option 2: Applying Overpayment to Future Taxes

If you have overpaid the IRS but anticipate owing taxes in the future, you have the option to apply the overpayment as a credit towards your next year’s tax liability. This can help offset your future tax bills and potentially reduce the amount you will owe. Here is a step-by-step guide on how to apply your overpayment to future taxes:

- Calculate Your Estimated Tax Liability: Estimate your tax liability for the upcoming tax year. This can be done by considering anticipated income, deductions, credits, and any other relevant factors that may impact your tax liability.

- Complete Form 1040-ES: To apply the overpayment as a credit towards your estimated tax liability, you will need to complete Form 1040-ES, which is used to calculate and pay estimated taxes. On this form, you will indicate the amount of the overpayment you want to apply as a credit.

- Submit Form 1040-ES: Once you have completed Form 1040-ES, you can submit it along with your estimated tax payment for the quarter. Ensure that you accurately provide all requested information and follow the instructions provided by the IRS.

- Track the Applied Credit: The IRS will track the credit you have applied from your overpayment and adjust your future tax liability accordingly. Keep records of the applied credit to ensure accurate calculations and to avoid any potential discrepancies.

- Review Estimated Payment Schedule: Throughout the year, review your estimated tax payment schedule to ensure that you are accounting for the applied credit appropriately. Adjust your payments if necessary to reflect your updated tax liability.

- Consult a Tax Professional: If you are uncertain about the estimated tax calculation or need guidance on applying the overpayment as a credit, it is advisable to consult a tax professional. They can help ensure accuracy and provide guidance tailored to your specific tax situation.

Applying your overpayment as a credit towards future taxes is a strategic option that can help minimize your tax liability and optimize your cash flow. However, it is important to accurately estimate your tax liability and make timely estimated tax payments to avoid any potential penalties or interest.

Option 3: Donating the Overpayment to Charity

If you have overpaid the IRS and would like to put the excess funds to good use, you have the option to donate the overpayment to a qualified charity. This not only allows you to support a cause you believe in but can also provide potential tax benefits in the form of deductions. Here are the steps to consider when donating the overpayment to charity:

- Choose a Qualified Charity: Select a charity that is recognized by the IRS as a tax-exempt organization. Ensure that your chosen charity meets the necessary criteria to qualify for tax-deductible donations.

- Verify Deductibility: Confirm that your overpayment can be treated as a charitable donation. Generally, only the portion of the overpayment that exceeds your tax liability can be considered a donation and eligible for a deduction.

- Obtain Documentation: Request a written acknowledgment from the charity for your donation. This acknowledgment should include the charity’s name, the amount donated, and a statement that no goods or services were provided in exchange for the donation.

- Keep Records: Maintain accurate records of your donation, including the acknowledgment letter, bank statements, or canceled checks. These records will be necessary when filing your tax return and claiming the charitable deduction.

- Claim the Deduction: When filing your tax return, itemize your deductions and include the amount of the overpayment donated to the charity. This deduction can help reduce your taxable income and potentially lower your overall tax liability.

- Consult a Tax Professional: If you have questions or uncertainties about charitable deductions or need assistance navigating the specific tax requirements, it’s advisable to consult a tax professional. They can provide guidance tailored to your individual circumstances and ensure compliance with IRS regulations.

Donating your overpayment to a qualified charity allows you to make a positive impact while potentially benefiting from tax deductions. However, it is important to ensure that the chosen charity meets the IRS requirements and that you follow the proper procedures for claiming the deduction on your tax return.

Option 4: Adjusting the Overpayment on Next Year’s Taxes

If you have overpaid the IRS and do not wish to request a refund or apply the overpayment to future taxes, you can adjust your withholding or estimated tax payments for the following tax year. This option allows you to account for the excess funds and reduce the amount of tax withheld from your income or the estimated tax payments you make. Here’s how you can adjust the overpayment on next year’s taxes:

- Evaluate Your Tax Situation: Review your current tax situation and estimate the amount of overpayment that you would like to adjust on your future taxes. This can be the entire amount of overpayment or a portion of it.

- Adjust Your Withholding: If you are an employee, you can adjust the withholding from your paycheck by submitting a new Form W-4 to your employer. Increase the number of allowances or specify an additional amount to be withheld each pay period to reflect the overpayment.

- Adjust Your Estimated Tax Payments: If you are self-employed or receive income that is not subject to withholding, you can adjust your estimated tax payments for the upcoming tax year. Reduce the amount of estimated tax payments to reflect the overpayment.

- Monitor Your Tax Payments: Keep track of your withholding or estimated tax payments throughout the year to ensure that the adjustment accurately reflects the overpayment. Make any necessary adjustments if there are changes in your income or tax situation.

- Consult a Tax Professional: If you are unsure about how to adjust your withholding or estimated tax payments, or if you have questions about the best approach given your specific circumstances, it’s wise to seek guidance from a tax professional. They can help you navigate the process and ensure that you comply with IRS regulations.

Adjusting the overpayment on next year’s taxes allows you to effectively utilize the excess funds while ensuring that it is applied towards your future tax obligations. Keep in mind that accurately adjusting your withholding or estimated tax payments is crucial to avoid underpayment penalties or large tax bills at the end of the tax year.

Option 5: Seeking Professional Assistance

If you have overpaid the IRS and are unsure about the best course of action or need help navigating the process, seeking professional assistance from a qualified tax professional is highly recommended. Here are some reasons why you may consider seeking professional assistance:

- Expert Guidance: Tax professionals have in-depth knowledge and expertise in tax laws and regulations. They can provide you with accurate and up-to-date information, ensuring that you make informed decisions regarding your overpayment.

- Individualized Advice: Every taxpayer’s situation is unique, and a tax professional can provide personalized advice based on your specific circumstances. They can assess your overpayment and recommend the best course of action tailored to your needs and goals.

- Efficiency and Accuracy: Tax professionals are experienced in dealing with complex tax matters. They can ensure that your overpayment is handled efficiently and accurately, minimizing the risk of errors or delays in processing.

- Maximize Benefits: A tax professional can help you explore all available options and guide you to choose the one that maximizes your benefits. Whether it’s requesting a refund, applying the overpayment to future taxes, or considering charitable donations, they can help you make the most strategic decision.

- Assistance with Paperwork: Dealing with the IRS can involve a significant amount of paperwork and documentation. A tax professional can help you navigate this process, ensuring that you complete and submit all necessary forms accurately and on time.

- IRS Communication: If you prefer to have a tax professional handle communication with the IRS on your behalf, they can act as your representative. This can save you time and alleviate potential stress associated with communicating with the IRS directly.

When choosing a tax professional, consider their qualifications, experience, and reputation. Look for certified public accountants (CPAs) or enrolled agents (EAs) who specialize in tax matters. Be sure to discuss your overpayment situation and clarify any fees or costs associated with their services.

Overall, seeking professional assistance can provide you with peace of mind, expert guidance, and ensure that your overpayment is properly managed and addressed in the most advantageous way for your specific tax situation.

Tips to Avoid Overpaying in the Future

To prevent overpaying the IRS in the future, it’s important to implement strategies and practices that ensure accurate tax calculations and minimize errors. Here are some helpful tips to avoid overpaying on your taxes:

- Maintain Updated Tax Knowledge: Stay informed about changes to tax laws and regulations. Keeping up with current tax information will help you make accurate calculations and take advantage of any available deductions or credits.

- Organize Your Financial Records: Establish a system to organize your financial records throughout the year. This includes keeping track of income statements, receipts, and any other relevant documents that will assist you in accurately reporting your income and deductions.

- Use Tax Software or Hire a Professional: Consider using tax software or engaging the services of a qualified tax professional. These resources can help ensure accurate calculations and provide guidance specific to your tax situation.

- Review Your Withholding: Regularly review your withholding allowances to ensure they align with your current tax situation. Life events such as marriage, divorce, or the birth of a child can impact your tax liability and should prompt a review of your withholding status.

- Carefully Calculate Deductions and Credits: Take the time to understand the rules and eligibility criteria for deductions and credits. Pay close attention to the details to ensure that you are claiming all applicable deductions and credits accurately.

- Estimate Taxes Accurately: If you are self-employed or have income not subject to withholding, make sure to estimate your taxes accurately. Consider consulting a tax professional or using an online estimator to help you calculate your estimated tax payments.

- Review Your Tax Return Before Filing: Carefully review your tax return for any errors or omissions before filing. Double-check all figures, calculations, and supporting documentation to ensure accuracy.

- Seek Professional Advice when Uncertain: If you are unsure about any aspect of your tax return or have questions about specific deductions or credits, consider consulting a tax professional. They can provide guidance and help you make informed decisions.

- Stay Organized for Future Tax Seasons: Establish good habits for future tax seasons by maintaining organized records, staying informed about tax changes, and regularly reviewing your financial situation to make accurate estimations and avoid overpayment.

By following these tips, you can minimize the chances of overpaying the IRS in the future and ensure that your tax obligations are calculated accurately. Remember, it’s always a good idea to consult a tax professional for personalized advice specific to your financial situation.

Conclusion

Overpaying the IRS may happen unintentionally or as a result of conservative estimates, errors in tax calculations, or misinterpretation of tax laws. While it may initially seem like a harmless mistake, it’s crucial to understand the consequences and take appropriate steps to address the overpayment.

In this article, we explored various options for handling an overpayment to the IRS. These options include requesting a refund, applying the overpayment to future taxes, donating the overpayment to charity, adjusting the overpayment on next year’s taxes, or seeking professional assistance. Each option has its benefits and considerations, and the choice depends on individual circumstances and preferences.

To avoid overpaying the IRS in the future, maintaining up-to-date tax knowledge, organizing financial records, reviewing withholding allowances, and accurately calculating deductions and credits are important steps. Seeking professional advice when uncertain and using tax software or professional services can also help prevent overpayment and ensure accurate tax calculations.

Remember, this article provides general guidance and information. It is always recommended to consult with a qualified tax professional for personalized advice. By being proactive in managing your tax obligations and taking appropriate actions, you can navigate the tax system effectively, optimize your financial situation, and avoid unnecessary overpayment to the IRS.