Finance

How Do I Cancel My Gap Insurance?

Modified: February 21, 2024

Learn how to cancel your gap insurance and save on your finance costs. Take control of your finances by following our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

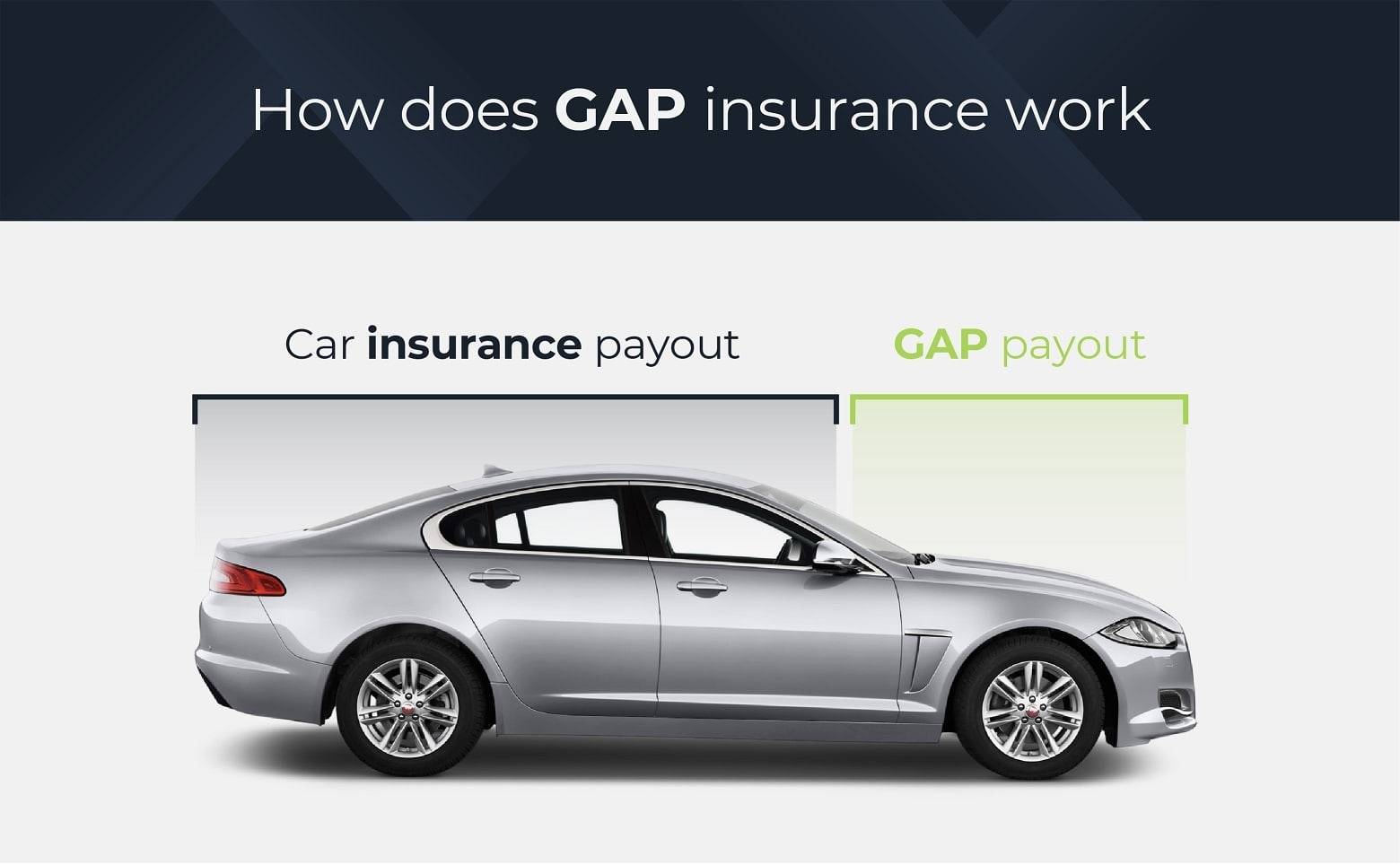

Gap insurance, also known as Guaranteed Asset Protection insurance, is a type of coverage that protects you financially if your vehicle is totaled or stolen. It covers the difference, or “gap,” between what you owe on your car loan or lease and the actual cash value of your vehicle. While gap insurance can provide valuable protection during the early years of car ownership, there may come a time when you no longer need it.

If you find yourself in a situation where you no longer need gap insurance, whether due to paying off your loan or selling your vehicle, it’s important to know how to cancel it properly. This article will guide you through the process of cancelling your gap insurance, ensuring a smooth transition and potentially saving you some money in the process.

Understanding gap insurance and its purpose is essential before moving forward with cancellation. Gap insurance primarily benefits those who owe more on their car loan or lease than the actual value of the vehicle. In the event of a total loss or theft, your primary auto insurance will typically only cover the actual cash value of your vehicle, leaving you responsible for the remaining balance. Gap insurance bridges that gap and prevents you from being financially burdened during such situations.

Now, let’s delve into the reasons why you might consider cancelling your gap insurance and how to go about doing it.

Understanding Gap Insurance

Gap insurance is a type of insurance coverage that exists to protect car owners from financial loss in case their vehicle is stolen or declared a total loss. The purpose of gap insurance is to cover the “gap” between the outstanding balance on a car loan or lease and the actual cash value of the vehicle.

When you purchase a new car, its value starts to depreciate the moment you drive it off the lot. In the unfortunate event that your car is involved in an accident and deemed a total loss, your primary auto insurance policy will only provide coverage up to the actual cash value of the vehicle at the time of the accident. This means that if you owe more on your car loan or lease than the vehicle is worth, you will be left with a financial shortfall.

This is where gap insurance comes into play. Gap insurance helps protect you by paying the difference between what your primary insurance covers and what you still owe on your vehicle. It can be particularly beneficial for individuals who have low down payments, a long financing term, or who drive a vehicle that significantly depreciates in value.

Gap insurance typically comes into effect when a vehicle is declared a total loss by the insurance company, which can occur in situations such as accidents, theft, vandalism, or natural disasters. While gap insurance is not mandatory, it can provide peace of mind and financial protection in case of unforeseen circumstances.

It is important to note that gap insurance coverage varies depending on the terms of the policy and the insurance provider. Therefore, it is crucial to read and understand the terms and conditions of your specific policy to ensure you have the coverage you need.

Now that we have a clear understanding of what gap insurance is and its purpose, let’s explore the reasons why you may want to consider cancelling your gap insurance coverage.

Reasons for Canceling Gap Insurance

While gap insurance provides valuable coverage in certain situations, there may come a time when you no longer need it. Here are some common reasons why you might consider canceling your gap insurance:

- Paid off your loan: If you have paid off your car loan or reached a point where the outstanding balance is equal to or less than the actual cash value of your vehicle, you may no longer need gap insurance. Since there is no longer a gap between what you owe and the value of your car, you can cancel the coverage and save on insurance costs.

- Sold or traded your vehicle: If you have sold or traded your vehicle, you no longer have ownership and financial responsibility for that car. In this case, gap insurance would no longer be necessary, as you are no longer at risk of being responsible for any remaining loan balance in the event of a total loss or theft.

- Vehicle depreciation: As time goes on, the gap between the outstanding loan balance and the actual cash value of a vehicle tends to decrease. If you notice that the gap has significantly closed due to the depreciation of your car, you may decide to cancel your gap insurance to avoid paying unnecessary premiums.

- Refinanced your loan: If you have refinanced your car loan and the new loan amount is equal to or less than the vehicle’s actual cash value, you may no longer need gap insurance. It’s important to review your refinanced loan agreement and assess whether gap insurance is still necessary in this new loan structure.

It is crucial to evaluate your individual circumstances and assess whether you still require gap insurance coverage. By canceling your gap insurance when it is no longer needed, you can potentially save money on insurance premiums. However, it is essential to consider the potential risks and financial implications before making a decision.

Now that we understand the reasons why you might consider canceling gap insurance, let’s move on to the steps involved in canceling your gap insurance policy.

Steps to Cancel Gap Insurance

If you’ve determined that you no longer need gap insurance, follow these steps to cancel your coverage:

- Contact your gap insurance provider: Begin the cancellation process by reaching out to your gap insurance provider. Look for the contact information provided in your policy documents or on their website.

- Request a cancellation form: Once you have contacted your gap insurance provider, request a cancellation form. They may provide a form to fill out online or send you a physical form via mail or email.

- Fill out the cancellation form: Complete the cancellation form with accurate and up-to-date information. This may include your policy number, vehicle details, personal information, and reasons for canceling.

- Submit the completed form: Once you have filled out the cancellation form, submit it to your gap insurance provider through the preferred method mentioned by them. This may be through an online submission, mailing the form, or sending it via email.

- Check for refund or adjustment: After submitting the cancellation form, your gap insurance provider will process your request. They will inform you of any refunds or adjustments that you may be eligible for, based on the specific terms of your policy. It’s important to review the details provided by your provider and ensure that any owed refunds are promptly issued.

- Keep documentation for future reference: Once the cancellation process is complete, it is advisable to keep copies of all relevant documents, including the cancellation form, communication with the provider, and any refund or adjustment information. This documentation may be useful for future reference or in case of any discrepancies.

Remember, each gap insurance provider may have their own specific procedures and requirements for cancellation. It is essential to carefully follow their instructions to ensure a smooth and successful cancellation process.

Now that you know how to cancel your gap insurance coverage, you can move forward with confidence if you decide it’s the right choice for your current situation. However, it’s always a good idea to reassess your insurance needs periodically to ensure you have adequate coverage to protect your financial interests.

Contact Your Gap Insurance Provider

The first step in canceling your gap insurance is to contact your gap insurance provider directly. You can usually find the contact information for your provider in your policy documents or on their website. It’s important to reach out to them and inform them of your intention to cancel your gap insurance coverage.

When contacting your gap insurance provider, you can choose to either call their customer service hotline or send them an email. Be sure to have your policy information readily available, as they may ask for details such as your policy number and vehicle identification number (VIN) to locate your account.

When speaking with a representative or writing an email, clearly state your desire to cancel your gap insurance coverage and request guidance on the cancellation process. The customer service representative will provide you with the necessary instructions and guidance on how to proceed.

It’s worth noting that some gap insurance providers may require written notice of cancellation. In this case, they may direct you to submit a cancellation form or letter stating your request to cancel. Be sure to clarify with them whether a written notice is necessary and, if so, the procedure for submitting it.

Contacting your gap insurance provider directly is the most efficient way to initiate the cancellation process. Their customer service team is trained to handle cancellation requests and will guide you through the necessary steps to ensure a smooth cancellation process.

Now that you know the first step is to contact your gap insurance provider, let’s move on to the next step in canceling your gap insurance coverage.

Request a Cancellation Form

After you have contacted your gap insurance provider and expressed your intention to cancel your coverage, the next step is to request a cancellation form. This form will serve as an official document confirming your cancellation request and providing the necessary information for processing.

Depending on your gap insurance provider, there are a few different ways to request a cancellation form:

- Online request: Many gap insurance providers offer online access to policyholders, where you can log in to your account and request a cancellation form directly. Look for a section on their website dedicated to policy management or contact their customer service for guidance.

- Phone request: If online access is not available or you prefer to handle the request over the phone, you can call your gap insurance provider’s customer service hotline and ask them to send you a cancellation form. Be prepared to provide them with your policy information, such as your policy number and vehicle details.

- Email or mail request: In some cases, your gap insurance provider may require you to request a cancellation form via email or mail. If this is the case, inquire with the customer service representative on the appropriate email address or mailing address to send your request. Make sure to include all necessary information in your request to ensure a prompt response.

When requesting a cancellation form, it’s important to ensure that you are providing accurate and up-to-date information. Double-check your policy details, including your name, policy number, and vehicle information, to avoid any discrepancies in the cancellation process.

Once you have requested the cancellation form, your gap insurance provider will provide you with the necessary document, either digitally or physically. Now that you have the cancellation form in hand, the next step is to fill it out accurately and completely.

Fill Out the Cancellation Form

Now that you have received the cancellation form from your gap insurance provider, it’s time to fill it out. The cancellation form serves as an official document confirming your request to cancel your gap insurance coverage. It is important to complete the form accurately and thoroughly to ensure a smooth cancellation process.

The cancellation form typically contains fields and sections that require specific information. Some common fields you may encounter include:

- Policyholder information: This section will require you to provide your personal details, including your name, address, and contact information. Double-check this information to ensure accuracy.

- Policy details: Fill in the necessary information related to your gap insurance policy, such as your policy number, effective date, and any other information specific to your coverage.

- Vehicle information: Provide details about the vehicle covered by the gap insurance, including the make, model, VIN (Vehicle Identification Number), and any other relevant information.

- Reason for cancellation: Indicate the reason for canceling your gap insurance coverage. This could include reasons such as paying off your loan, selling or trading the vehicle, or simply no longer needing the coverage.

- Signature and date: Sign and date the cancellation form to authenticate your request. Ensure that you sign using the name listed as the policyholder.

It is important to read the cancellation form carefully and provide accurate information. Incomplete or incorrect information may delay the cancellation process or result in complications later on.

If you have any questions or concerns while filling out the cancellation form, do not hesitate to contact your gap insurance provider’s customer service. They will be able to provide guidance and clarification to ensure that you complete the form correctly.

Once you have finished filling out the cancellation form, it’s time to move on to the next step: submitting the completed form to your gap insurance provider.

Submit the Completed Form

After you have filled out the cancellation form provided by your gap insurance provider, the next step is to submit the completed form. This is a crucial step in the cancellation process, as it formally notifies your provider of your request to cancel your gap insurance coverage.

Depending on your gap insurance provider, there are a few different methods for submitting the completed form:

- Online submission: If your provider offers online access to policyholders, you may be able to submit the completed cancellation form electronically. Look for a section on their website where you can upload the form or follow the instructions provided by your provider.

- Mailing the form: Your provider may require you to physically mail the completed form to their designated address. Ensure that you have the correct mailing address, as provided by your provider, to avoid any delays or miscommunication.

- Email submission: In some cases, your gap insurance provider may accept the completed form via email. If this is the case, inquire with their customer service representative about the appropriate email address to send the form to.

When submitting the completed form, it is important to ensure that all sections are filled out accurately and legibly. Double-check that you have signed and dated the form, and that all required information is provided. Any missing or inaccurate information may delay the cancellation process.

It is recommended to keep a copy of the completed form for your records. This ensures that you have a record of your submission in case of any future disputes or inquiries.

After you have submitted the form, your gap insurance provider will begin processing your cancellation request. They will review the information provided and initiate any necessary adjustments or refunds based on the terms of your policy.

Now that you have submitted the completed cancellation form, the next step is to wait for any potential refund or adjustment from your gap insurance provider. We will explore this in the next section.

Check for Refund or Adjustment

After submitting the completed cancellation form to your gap insurance provider, it’s important to check for any potential refund or adjustment that you may be eligible for. The specific process and timeline for refunds or adjustments may vary depending on your provider and the terms of your gap insurance policy.

Here are a few key points to keep in mind:

- Review policy terms: Take the time to review the terms and conditions of your gap insurance policy. Look for any provisions or guidelines regarding the cancellation process, including any potential refunds or adjustments.

- Communication from your provider: After receiving your cancellation form, your gap insurance provider will typically reach out to you to confirm the cancellation and provide instructions regarding any refunds or adjustments. This communication may come in the form of an email, letter, or phone call. Pay close attention to the information they provide.

- Processing time: The time it takes for your provider to process your cancellation and issue any refunds or adjustments can vary. Some providers may process it quickly, while others may require additional time for review. If you have not received any communication within a reasonable timeframe, it is advisable to reach out to your provider for an update.

- Refunds and prorated adjustments: Depending on your policy, you may be entitled to a refund of unused premium or a prorated adjustment for the remaining term of your coverage. This means that you would receive a portion of your premium back corresponding to the unused duration of your gap insurance coverage.

It is important to note that the refunded amount may vary based on factors such as the cancellation date, the remaining term of the policy, and any applicable fees or deductions outlined in your policy. It’s important to carefully review the calculations provided by your provider to ensure accuracy.

Once you have confirmed the refund amount or adjustment, it is advisable to keep documentation as proof of the transaction. This can include any refund statements, adjustment calculations, or correspondence with your gap insurance provider. Having this documentation will be helpful for future reference or in case of any discrepancies.

Now that you have checked for any potential refunds or adjustments, it’s time to conclude the cancellation process and keep the necessary documentation for future reference.

Keep Documentation for Future Reference

After completing the cancellation process for your gap insurance coverage, it’s important to keep all relevant documentation for future reference. This documentation includes the cancellation form, communication with your gap insurance provider, and any refund or adjustment information you received.

Here are a few reasons why keeping documentation is important:

- Proof of cancellation: Your cancellation form serves as proof that you requested to cancel your gap insurance coverage. Keeping a copy of this form will allow you to demonstrate that you followed the proper procedures in case any issues or disputes arise in the future.

- Refund or adjustment information: It’s important to retain any documentation related to refunds or prorated adjustments you received. This includes refund statements, adjustment calculations, or any other communication from your gap insurance provider. Having this documentation will be helpful in case of any discrepancies or questions that may arise later on.

- Insurance history: Keeping documentation related to your gap insurance coverage helps to maintain a comprehensive insurance history. This can be valuable for future reference, especially if you require proof of insurance coverage for a loan or other purposes.

- Renewal or re-enrollment considerations: If you ever find yourself in a situation where you need to consider gap insurance coverage again, having previous documentation can be helpful. It can serve as a reference point for comparing coverage options, policy terms, or even potential discounts that may be available.

It is always recommended to keep your documentation in a safe and organized manner. Consider creating a dedicated folder or file where you can store all relevant documents related to your gap insurance cancellation. This way, you can easily access and refer to them whenever needed.

By keeping the necessary documentation, you can ensure that you have a clear record of the cancellation process and any associated transactions. This will provide you with peace of mind and confidence in your insurance history and future insurance needs.

Now that you understand the importance of keeping documentation, you can conclude the cancellation process with confidence.

Conclusion

Cancelling your gap insurance coverage can be a straightforward process if you follow the necessary steps and communicate effectively with your gap insurance provider. Understanding when and why to cancel your gap insurance is essential to making informed decisions about your coverage needs.

In this article, we discussed the purpose of gap insurance and the reasons why you may want to consider canceling it. We explored the steps involved in canceling your gap insurance, including contacting your provider, requesting a cancellation form, filling out the form, and submitting it. We also highlighted the importance of checking for any potential refunds or adjustments and keeping documentation for future reference.

Remember to reach out to your gap insurance provider directly to initiate the cancellation process. Request a cancellation form and complete it accurately, providing all the required information. Once you’ve submitted the completed form, monitor your communication for any refund or adjustment information. Finally, keep all relevant documentation for your records, as it can be helpful in the future should any questions or disputes arise.

It’s important to review your individual circumstances and reassess your insurance needs periodically to ensure you have the right coverage in place. If you have any concerns or questions regarding your specific gap insurance policy, it’s always best to consult with your provider directly.

By being proactive and understanding the process, you can cancel your gap insurance coverage effectively and potentially save money on insurance premiums. As always, make sure to evaluate your options and make informed decisions that align with your specific financial situation and goals.