Home>Finance>How Do I Know If I Have Gap Insurance On My Car?

Finance

How Do I Know If I Have Gap Insurance On My Car?

Published: November 8, 2023

Discover how to determine if you have gap insurance on your car with our helpful finance guide. Don't miss out on this essential coverage!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

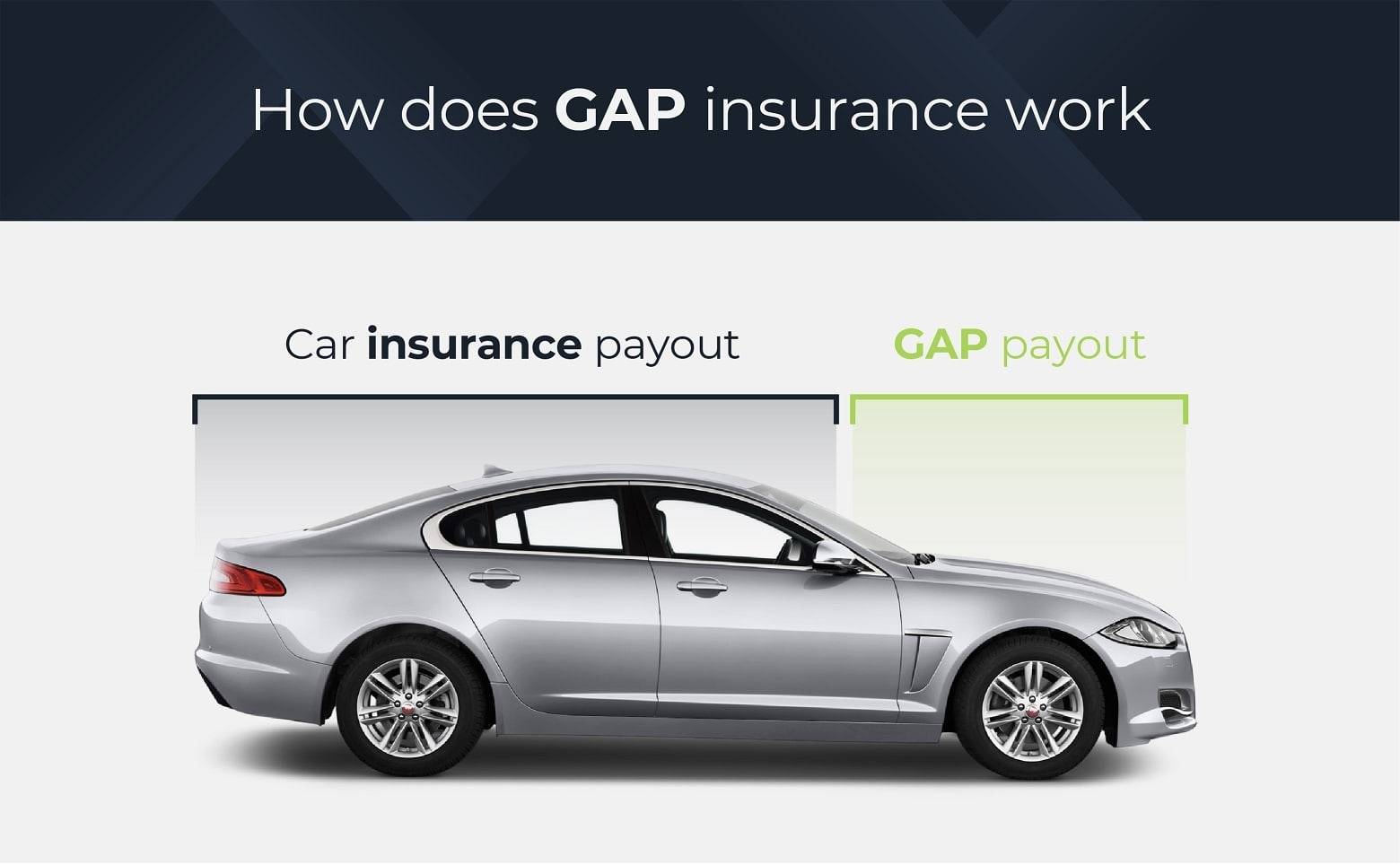

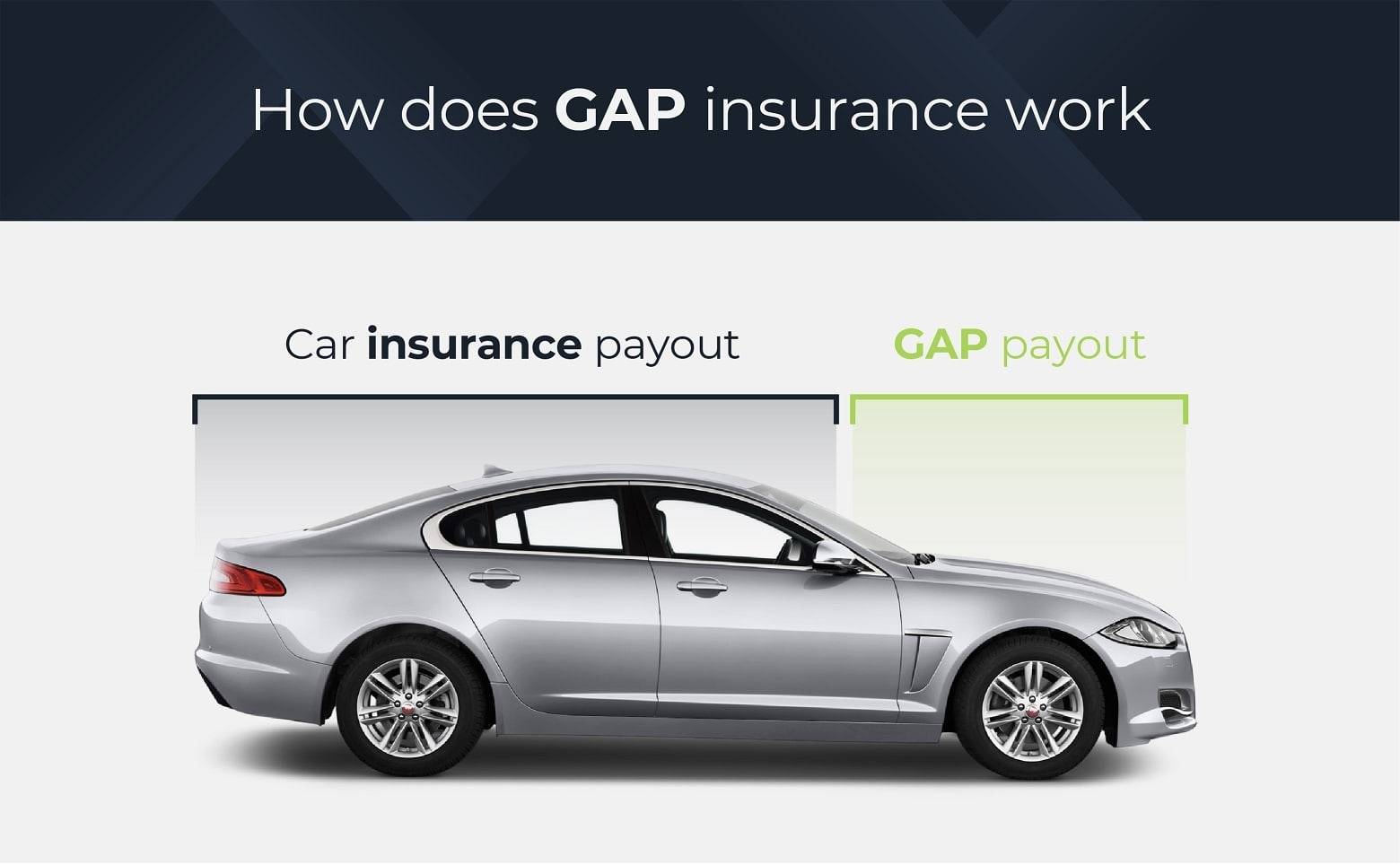

When it comes to car insurance, it’s important to understand what coverage you have and what you may be missing. One type of coverage that is often overlooked is gap insurance. Gap insurance, also known as guaranteed asset protection insurance, is designed to protect you financially if your car is totaled or stolen and the actual cash value of the vehicle is less than what you owe on your loan or lease.

Accidents happen, and unfortunately, the value of a car can depreciate quickly. If your car is totaled, your insurance provider will typically pay you the actual cash value of the vehicle at the time of the accident. However, this amount may not be enough to cover the outstanding balance on your loan or lease. This is where gap insurance comes in.

Gap insurance bridges the gap between what you owe on your car and what your car is actually worth. Without gap insurance, you could find yourself in a difficult financial situation, having to continue making payments on a car you no longer have, or even worse, having to pay off the remaining balance in one lump sum.

In this article, we will explore the importance of gap insurance, how it works, and how you can determine if you have this coverage in your auto insurance policy.

Understanding Gap Insurance

Before diving into whether or not you have gap insurance, it’s crucial to have a clear understanding of what it entails. Gap insurance is an optional coverage that helps protect you from financial loss in the event of a total loss accident.

When you purchase a new car, its value begins to depreciate as soon as you drive it off the lot. In the event of an accident or theft, your insurance company will typically reimburse you for the actual cash value of the car at the time of the incident. However, if you owe more on your car loan or lease than the car is worth, you are left responsible for the remaining balance.

This is where gap insurance can be a lifesaver. Gap insurance covers the “gap” between what you owe on your car loan or lease and the actual cash value of the car. It ensures you aren’t stuck with a hefty financial burden if your car is deemed a total loss.

Gap insurance is especially beneficial for individuals who have a high loan-to-value ratio on their vehicles. This is often the case for individuals who make a small down payment or finance a longer-term loan.

It’s important to note that gap insurance only covers the difference between the car’s actual cash value and the amount you owe on your loan or lease. It does not cover any other expenses such as deductibles, late fees, or mechanical repairs.

Now that you have a basic understanding of what gap insurance is and why it’s important, let’s explore how it works in more detail.

How Gap Insurance Works

Gap insurance is a relatively straightforward concept. If you have gap insurance and your car is deemed a total loss, your insurance provider will pay the difference between the actual cash value of the car and the amount you still owe on your loan or lease.

Here’s an example to illustrate how gap insurance works:

Let’s say you purchase a new car for $30,000 and take out a loan for $25,000. A few months later, your car is involved in an accident and is declared a total loss. At the time of the accident, the actual cash value of the car is determined to be $20,000. However, you still owe $23,000 on your loan.

In this scenario, without gap insurance, you would be responsible for paying off the remaining $3,000 out of pocket, even though you no longer have the car. However, if you have gap insurance, your provider would cover the $3,000, bridging the gap between the actual cash value and the loan balance.

It’s important to understand that gap insurance coverage is typically only available for newer cars that are within a certain age and mileage limit. The terms and conditions of gap insurance coverage may vary depending on your insurance provider, so it’s essential to review your policy to know exactly what is covered.

Additionally, it’s worth noting that gap insurance is separate from your standard auto insurance policy. It is an optional add-on that you can purchase either from your insurance provider or from the dealership when you buy or lease a car.

Now that you have a clear understanding of how gap insurance works, let’s explore why it is important to have this coverage.

Why Gap Insurance is Important

Gap insurance is an important coverage to consider for several reasons. Let’s delve into the key reasons why having gap insurance can provide you with valuable financial protection.

1. Protecting Against Depreciation: As mentioned earlier, cars depreciate in value over time. In the first few years of ownership, a new car can lose a significant portion of its value. If your car is totaled during this time, the payout from your regular insurance coverage might not be enough to cover the remaining balance on your loan or lease. Gap insurance ensures that you are not left responsible for paying off a car that you no longer have.

2. Avoiding Out-of-Pocket Expenses: Without gap insurance, you could be on the hook for paying the difference between the actual cash value of your car and the remaining balance on your loan or lease. This can result in unexpected out-of-pocket expenses, potentially causing financial strain. Gap insurance protects you from these expenses, providing peace of mind and financial security.

3. Managing Negative Equity: If you rolled over negative equity from a previous car loan into your current loan, you may find yourself in a situation where you owe more on your car than it is worth. Gap insurance can cover this negative equity, protecting you from bearing the burden if your car is totaled or stolen.

4. Lease Obligations: If you lease a car, gap insurance is often required by the leasing company. This ensures that you are protected in the event of a total loss, and that you are not left with outstanding lease payments for a car you no longer have.

5. It’s Affordable: Gap insurance is generally affordable, especially when compared to the potential financial burden of paying for a totaled car without this coverage. The cost can vary depending on factors such as the value of the car, the length of the loan or lease, and your insurance provider. However, the peace of mind and financial protection it provides make it a worthwhile investment.

Having gap insurance can save you from significant financial stress and uncertainty in the event of an accident or theft. It’s crucial to carefully consider your car’s value, your loan or lease obligations, and your insurance coverage to determine if gap insurance is necessary for your situation.

Now that you understand the importance of having gap insurance, let’s explore how you can determine if you already have this coverage.

How to Determine If You Have Gap Insurance

If you’re unsure whether or not you have gap insurance, there are a few steps you can take to find out. It’s important to carefully review your auto insurance policy and contact your insurance provider for clarification.

1. Reviewing Your Auto Insurance Policy: Start by taking a close look at your auto insurance policy documents. Gap insurance is typically listed as an optional coverage. Look for any mention of “gap insurance” or “guaranteed asset protection” in your policy. Pay attention to the coverage details, including any limitations or exclusions.

2. Contacting Your Insurance Provider: If you can’t find information about gap insurance in your policy documents or you have specific questions, reach out to your insurance provider directly. They will be able to provide you with accurate and up-to-date information about your coverage. Prepare a list of questions beforehand to ensure you gather all the details you need.

When contacting your insurance provider, it can be helpful to provide them with specific information about your car, such as the make, model, year, and any remaining balance on your loan or lease. This will allow them to quickly access your policy and provide you with accurate information.

It’s worth mentioning that some insurance providers include gap insurance as part of their standard auto insurance policies, especially for newer vehicles. In this case, you may have gap insurance without even realizing it.

If you find that you do not have gap insurance, don’t panic. There are still options available to you to protect yourself financially in the event of a total loss.

In the next section, we will explore additional options you can consider if you do not have gap insurance.

Reviewing Your Auto Insurance Policy

When it comes to determining if you have gap insurance, a crucial step is thoroughly reviewing your auto insurance policy. By carefully examining the details of your policy, you can gain clarity on the coverage and determine if gap insurance is included.

Here are a few key components to focus on while reviewing your auto insurance policy:

1. Coverage Summary: Start by looking at the coverage summary section of your policy. This section will provide an overview of the types of coverage you have, including liability, collision, comprehensive, and any optional coverages like gap insurance. Look for any mention of gap insurance or guaranteed asset protection in this section.

2. Policy Declarations: The policy declarations page is where you can find specific information about your coverage limits, deductibles, and premiums. Look for any line items that indicate an additional premium for gap insurance. It may be listed separately or included as part of a package or endorsement.

3. Definitions and Exclusions: Read the definitions section of your policy to understand how gap insurance is defined and what it covers. Additionally, check the exclusions section to see if there are any specific circumstances or conditions that may limit the coverage provided by gap insurance.

4. Contact Information: Take note of the contact information for your insurance provider. This will be helpful if you need to reach out for further clarification or to inquire about adding gap insurance to your policy.

If you have difficulty understanding certain terms or provisions in your policy, don’t hesitate to contact your insurance provider for clarification. They will be able to explain the details of your coverage and answer any questions you may have.

It’s important to note that even if you don’t find gap insurance listed in your policy, it doesn’t necessarily mean you don’t have coverage. Some insurance providers may include gap insurance as a standard feature in their auto insurance policies, especially for newer vehicles or under certain circumstances.

If you determine that gap insurance is not included in your policy, don’t worry. There are additional options available to you, which we will explore in the next section.

Contacting Your Insurance Provider

If you’re unsure about your gap insurance coverage, it’s a good idea to reach out to your insurance provider for clarification. By contacting them directly, you can get accurate and up-to-date information about your policy and discuss your options moving forward.

Here are some steps to follow when contacting your insurance provider regarding gap insurance:

1. Gather Your Policy Information: Before making the call, gather all the relevant information about your policy. This includes your policy number, the make and model of your car, and any specific questions or concerns you have about gap insurance.

2. Call Customer Service: Get in touch with the customer service department of your insurance provider. The phone number can typically be found on your policy documents or on the provider’s website. Explain that you are calling to inquire about your coverage and specifically ask about gap insurance.

3. Ask Specific Questions: Be prepared with a list of specific questions regarding your policy and gap insurance. Some questions you may want to ask include:

- Do I have gap insurance included in my policy?

- What are the coverage limits of my gap insurance?

- Are there any conditions or exclusions that apply to the gap insurance coverage?

- How much does it cost to add or include gap insurance in my current policy?

4. Evaluate Your Options: Based on the information provided by your insurance provider, carefully consider your options. If you do not have gap insurance, consider whether it would be beneficial for your situation and if you would like to add it to your policy.

It’s important to remember that adding gap insurance to your policy may result in an additional premium. Consider the cost of the coverage versus the potential financial risk of being without it. This will help you make an informed decision about whether to include gap insurance in your policy.

By contacting your insurance provider, you can gain a clear understanding of your coverage and ensure that you have the necessary protection in the unfortunate event of a total loss.

Additional Options If You Don’t Have Gap Insurance

If you find that you don’t have gap insurance included in your auto insurance policy, don’t worry. There are still options available to protect yourself financially in the event of a total loss. Here are a few alternatives to consider:

1. Purchase Gap Insurance Separately: While many insurance providers offer gap insurance as an optional coverage, you may have the option to purchase it separately. Research different insurance providers and inquire about standalone gap insurance policies. Compare the coverage and costs to find the best option for your needs.

2. Explore Loan/Lease Payoff Coverage: Some insurance providers offer loan/lease payoff coverage as an alternative to gap insurance. This coverage is designed to pay off the remaining balance on your loan or lease if your car is declared a total loss. It functions similarly to gap insurance but may have different terms and conditions. Consult with your insurance provider to determine if this type of coverage is available and suitable for your situation.

3. Consider Equity Protection Programs: Some car dealerships and financial institutions offer equity protection programs. These programs can provide coverage to bridge the gap between your car’s actual cash value and the remaining loan balance in the event of a total loss. Research and compare different programs to find one that suits your needs and offers the necessary protection.

4. Save for a Down Payment: If purchasing a new vehicle, consider saving for a larger down payment. Having a substantial down payment can help reduce the loan-to-value ratio, lowering the risk of being in a negative equity situation. This can mitigate the need for gap insurance or similar coverage options.

5. Regularly Check Your Car’s Value: Stay informed about your car’s value by regularly monitoring its depreciation. Websites and tools like Kelley Blue Book or Edmunds can help you estimate the current market value of your vehicle. By keeping track of your car’s value, you can have a better understanding of the potential gap between the actual cash value and the remaining loan balance.

It’s important to remember that each option comes with its own considerations and costs. Evaluate your specific circumstances, financial situation, and the value of your vehicle to determine which alternative option is right for you.

Having some form of coverage to bridge the gap between the actual cash value and the remaining loan balance is crucial to ensure you don’t face financial hardship in the event of a total loss. Research and explore these alternatives to find the best solution for your needs.

Now that we have covered the options available if you don’t have gap insurance, let’s wrap up our discussion.

Conclusion

Gap insurance is an often overlooked but important coverage to have in your auto insurance policy. It protects you from financial loss in the event of a total loss accident, ensuring that you are not left responsible for paying off a car loan or lease balance that exceeds the actual cash value of your vehicle.

Understanding whether or not you have gap insurance is crucial for your financial well-being. Start by reviewing your auto insurance policy to see if gap insurance is listed as an optional coverage. If you can’t find it or have specific questions, don’t hesitate to contact your insurance provider for clarification.

If you find that you don’t have gap insurance, consider purchasing it separately or explore alternatives such as loan/lease payoff coverage or equity protection programs. Regularly checking your car’s value and saving for a larger down payment can also help mitigate the need for gap insurance.

Remember, the cost of adding gap insurance to your policy is often outweighed by the potential financial burden of being without it. Taking the time to evaluate your options and ensure you have the right coverage in place is crucial for your peace of mind and financial security.

As with any insurance decision, it’s important to thoroughly review the terms, conditions, and costs associated with gap insurance or alternative options. Determine what works best for your specific needs and budget.

By understanding gap insurance, its importance, and how to determine if you have coverage, you can make informed decisions to protect yourself from potential financial hardships in the event of a total loss accident. Stay informed, review your policy regularly, and don’t hesitate to reach out to your insurance provider for guidance.

Remember, accidents happen, but with the right coverage, you can have peace of mind knowing that you are financially protected.