Finance

How Do I Get My Gap Insurance Refund

Published: November 24, 2023

Looking to get a refund for your gap insurance? Find out how to navigate the process and get your money back. Get expert tips on managing your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

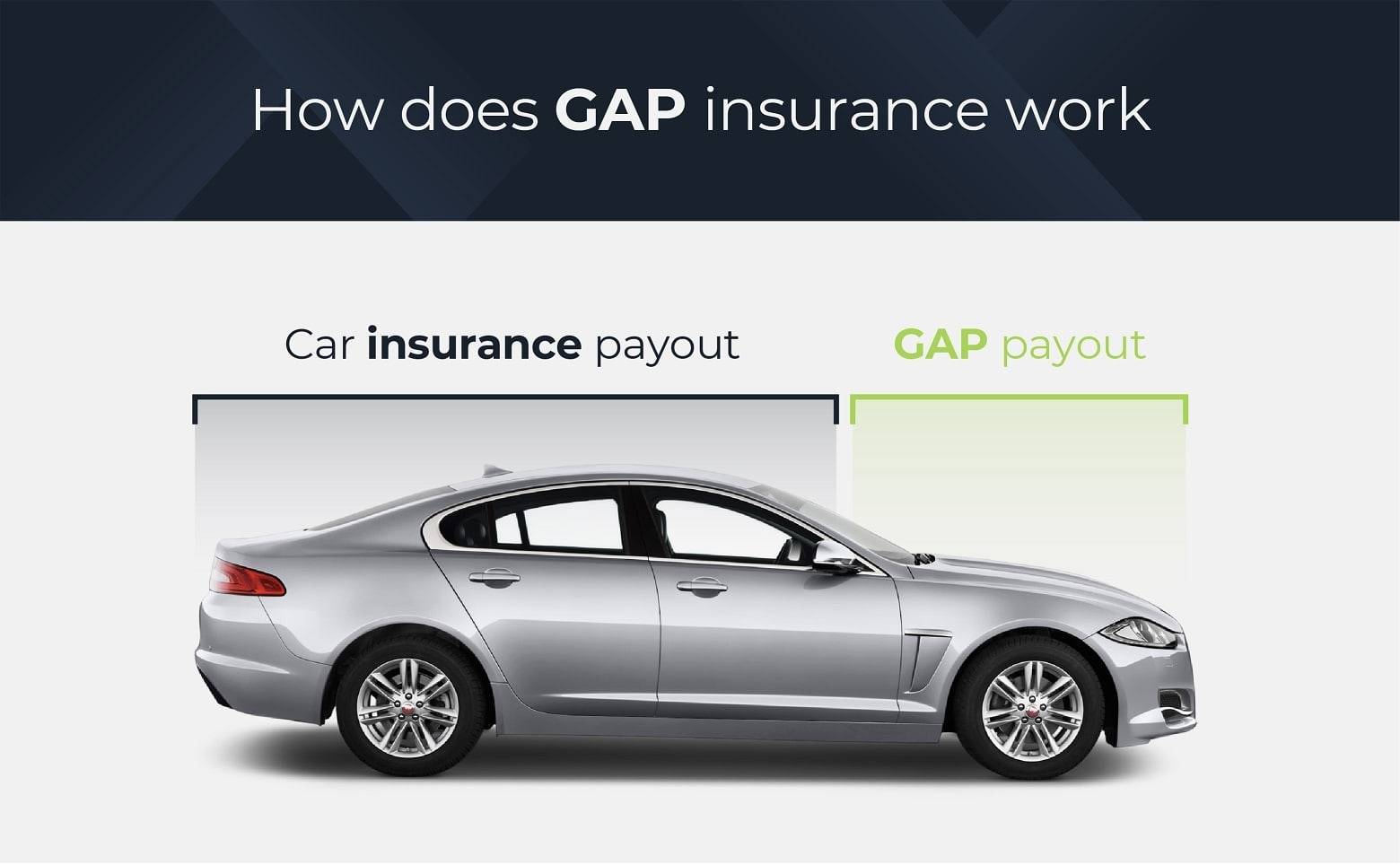

Gap insurance is a type of insurance coverage that helps protect borrowers from financial loss if their car is totaled or stolen and the insurance payout is not enough to cover the remaining balance on their auto loan or lease. It bridges the gap between the actual cash value of the vehicle and the outstanding loan amount, ensuring that borrowers are not left with a hefty debt burden in the event of a total loss.

There are various reasons why you may be entitled to a gap insurance refund. Perhaps you paid off your loan or lease early, sold your vehicle, or refinanced your loan to a lower interest rate. These scenarios may result in an overpayment of your gap insurance premium, warranting a refund from your insurance provider.

Getting a gap insurance refund is a fairly straightforward process, but it is important to understand the steps involved. In this article, we will walk you through the process of requesting a gap insurance refund and provide you with the necessary information to expedite the refund process.

Understanding Gap Insurance

Before diving into the process of obtaining a gap insurance refund, it’s crucial to have a clear understanding of what gap insurance is and how it works. Gap insurance, also known as guaranteed asset protection insurance, is designed to protect borrowers in the event of a total loss on their vehicle.

When you purchase a new car, its value starts depreciating as soon as you drive it off the lot. This means that if your car is stolen or totaled in an accident, your insurance company will typically offer a settlement based on the actual cash value (ACV) of the vehicle at the time of the loss. However, the ACV may be significantly lower than the outstanding balance on your auto loan or lease.

This is where gap insurance comes into play. Gap insurance covers the difference between the ACV payout from your insurance company and the outstanding balance on your loan or lease agreement. It ensures that you won’t be left with a large debt to repay out of pocket.

Gap insurance can be purchased from various sources, including car dealerships, insurance companies, and specialty gap insurance providers. The cost of gap insurance can vary depending on factors such as the value of the vehicle and the length of the loan or lease term.

It’s important to note that gap insurance is typically only available for new and leased cars, as these vehicles tend to depreciate rapidly in the early years. Additionally, not all lenders require or offer gap insurance, so it’s essential to check with your lender or insurance provider to determine if you have gap insurance coverage.

Now that you have a basic understanding of gap insurance, let’s explore the reasons why you may be eligible for a gap insurance refund and how to go about obtaining it.

Reasons for Gap Insurance Refunds

There are several scenarios in which you may be entitled to a gap insurance refund. Understanding these circumstances will help you determine if you qualify for a refund and guide you through the necessary steps to initiate the refund process.

1. Paying off your loan or lease early: If you decide to pay off your auto loan or lease earlier than the agreed-upon term, you may be eligible for a gap insurance refund. Since the outstanding loan balance will be reduced or paid off entirely, there will no longer be a need for gap insurance coverage. In this case, you can request a refund for the remaining unused portion of your gap insurance premium.

2. Selling your vehicle: If you sell your car before the loan or lease term ends, you may be eligible for a gap insurance refund. Just like paying off your loan early, selling your vehicle means that there is no longer a need for gap insurance coverage. You can contact your insurance provider to inquire about the refund process and provide the necessary documentation.

3. Refinancing your loan at a lower interest rate: If you decide to refinance your auto loan to secure a lower interest rate, it could result in a decrease in your outstanding loan balance. In this case, you may be eligible for a refund of the unused portion of your gap insurance premium. Notify your gap insurance provider about the loan refinancing and provide them with the updated loan details to initiate the refund process.

It’s important to note that the specific refund policies and procedures may vary between insurance providers. Some providers may require additional documentation or have specific refund request forms to be filled out. It’s recommended to review your policy or contact your gap insurance provider directly to understand their refund policies and to ensure a smooth refund process.

Now that you are familiar with the reasons for gap insurance refunds, let’s move on to the steps involved in requesting a refund.

Requesting a Gap Insurance Refund

When you find yourself in a situation where you are eligible for a gap insurance refund, it’s important to follow the proper steps to request the refund from your insurance provider. Here is a guide on how to proceed:

1. Contact your gap insurance provider: Begin by reaching out to your insurance provider to inform them of your eligibility for a refund. You can typically find their contact information on your gap insurance policy documents or on their website. Give them a call or send an email to initiate the refund process. Be prepared to provide your policy details and any necessary documentation to support your refund request.

2. Gather the required documentation: Different insurance providers may have varying requirements for refund requests. Generally, you will need to provide documents such as proof of loan or lease payoff, bill of sale if you sold the vehicle, or documentation of loan refinancing if applicable. Make sure to carefully review the refund requirements provided by your insurance provider and gather the necessary documentation to support your case.

3. Submit the refund request: Once you have all the required documentation, submit your refund request to your gap insurance provider. This can usually be done either through an online portal provided by the insurance company or by mailing the documentation to their designated address. Follow the instructions provided by your insurance provider to ensure your refund request is processed promptly.

4. Follow up on the refund status: After submitting your refund request, it’s important to follow up with your insurance provider to check on the status of your refund. They may require additional information or documentation to process your request. Stay proactive and engaged with your insurer to ensure a smooth and timely refund process.

5. Wait for the refund: Depending on the insurance provider and the specific circumstances of your refund request, the processing time may vary. You may receive the refund as a check in the mail or as a direct deposit to your bank account. Be patient and allow the insurance company a reasonable amount of time to process and issue the refund.

Remember, each insurance provider may have their own specific procedures and requirements for requesting a gap insurance refund. It’s crucial to familiarize yourself with your provider’s refund policy and follow their instructions to ensure a successful refund process.

Now that you understand the steps involved in requesting a gap insurance refund, let’s move on to the next section: contacting your gap insurance provider.

Contacting Your Gap Insurance Provider

When it comes to requesting a gap insurance refund, contacting your insurance provider is an essential step. By reaching out to them, you can inform them of your eligibility for a refund and gather the necessary information and instructions to initiate the refund process. Here’s how to contact your gap insurance provider:

1. Locate the contact information: Begin by locating the contact information for your gap insurance provider. This information can typically be found on your gap insurance policy documents, insurance card, or on their website. Look for a customer service phone number or an email address that you can use to get in touch with them.

2. Call customer service: If you have a phone number available, calling customer service is often the most direct way to contact your gap insurance provider. Prepare your policy details and any relevant information about your eligibility for a refund. Clearly explain your situation and ask them for guidance on how to proceed with your refund request.

3. Send an email: If you prefer written communication or do not have a phone number available, sending an email to the designated contact address is another option. Write a clear and concise email explaining your eligibility for a refund and requesting instructions on how to initiate the refund process. Be sure to include your policy number and any supporting documentation required by your provider.

4. Online contact form: Some insurance providers may offer an online contact form on their website. This form allows you to submit your refund request and any necessary information directly through their website. Fill out the form accurately, providing all the requested details and documentation, and submit it for review by the provider’s customer service team.

Regardless of the method you choose, make sure to keep a record of your communication with the gap insurance provider. Note down the date and time of your call or email, the name of the representative you spoke to, and a summary of your discussion. This information may be helpful for future reference or in case of any discrepancies during the refund process.

Stay proactive and persistent in your communication with your gap insurance provider. If you don’t receive a timely response, follow up on your initial contact to ensure that your refund request is being processed. It’s important to maintain open lines of communication to ensure a smooth and efficient refund process.

Now that you know how to contact your gap insurance provider, let’s move on to the next section: providing the required documentation.

Providing Required Documentation

When requesting a gap insurance refund, it is crucial to provide the necessary documentation to support your case. Each insurance provider may have specific requirements, so it’s important to review your policy or contact your provider to understand exactly what documents you need to submit. Here are some common documents that may be required:

1. Proof of loan or lease payoff: If you paid off your auto loan or lease early, you will likely need to provide proof of the payoff. This could include a letter from your lender stating that the loan has been satisfied or a statement showing a zero balance on the loan. Make sure the document clearly indicates the date of the payoff and the loan account number.

2. Bill of sale: If you sold your vehicle before the loan or lease term ended, you may need to submit a bill of sale as proof of the sale. This document should include the buyer’s information, vehicle details, sale price, and date of the sale. It’s important to provide documentation that verifies the transfer of ownership and indicates that you no longer have a financial interest in the vehicle.

3. Loan refinancing documentation: If you refinanced your auto loan to a lower interest rate, you may need to provide documentation of the loan refinancing. This could include a new loan agreement or a statement from the new lender showing the updated loan details. Make sure the documentation clearly indicates the new loan terms, loan balance, and interest rate, as this will help establish your eligibility for a refund.

4. Gap insurance policy information: Along with the specific documentation related to your eligibility for a refund, you will likely need to provide your gap insurance policy details. This can include your policy number, the effective dates of coverage, and any other information that helps identify your policy within the insurance provider’s system.

Ensure that all the required documentation is accurate, complete, and properly organized before submitting it to your gap insurance provider. Keep copies of all the documents for your records and make note of the date when you submitted them. This will help you keep track of the refund process and provide evidence if needed.

If you have any doubts about the required documentation or need further clarification, don’t hesitate to contact your insurance provider directly. They will be able to guide you through the process and give you specific instructions based on your policy and circumstances.

Now that you understand the importance of providing the required documentation, let’s move on to the next step: submitting the refund request.

Submitting the Refund Request

Once you have gathered all the necessary documentation, it’s time to submit your gap insurance refund request. The process may vary depending on your insurance provider, but here are the general steps involved:

1. Review the refund requirements: Carefully review the refund requirements provided by your insurance provider. This will ensure that you have all the necessary documentation and information before submitting your request. Take note of any specific forms that need to be filled out or additional details that need to be included.

2. Fill out the refund request form: If your insurance provider requires a specific refund request form, fill it out accurately and provide all the requested information. Include your policy details, any relevant loan or vehicle information, and details about why you are eligible for a refund. Double-check the form for any errors or missing information before submitting it.

3. Attach supporting documentation: Along with the refund request form, attach copies of the required documentation to support your refund request. This can include proof of loan or lease payoff, bill of sale, loan refinancing documentation, and any other documents requested by your provider. Ensure that all documents are legible and organized.

4. Submit the refund request: Depending on the preference of your insurance provider, you may be able to submit the refund request form and supporting documents through various channels. This can include submitting them online through a customer portal, mailing physical copies to a designated address, or emailing them to a specific contact address. Follow the instructions provided by your provider to ensure your refund request is properly received.

5. Keep records of submission: After submitting your refund request, it’s crucial to keep records of the submission for your own reference. Note down the date you submitted the request and make a copy of the completed form and the attached documents. These records will come in handy in case of any dispute or for tracking the progress of your refund request.

6. Follow up on the refund status: Once you have submitted your refund request, it’s important to follow up with your insurance provider to check on the status of your request. Keep track of the expected processing time provided by your provider and follow up if the refund seems delayed. Stay engaged in the process and be proactive in seeking updates.

Remember, each insurance provider may have their own specific procedures for submitting a gap insurance refund request. It’s important to carefully follow their instructions and provide all the requested documents and information to ensure a smooth refund process.

Now that you know how to submit the refund request, let’s move on to the next step: waiting for the refund.

Waiting for the Refund

After submitting your gap insurance refund request, it’s time to be patient and wait for the refund to be processed by your insurance provider. The exact timeline for receiving the refund may vary depending on various factors, such as the specific policies of the provider and the complexity of your case. Here are a few important points to keep in mind during the waiting period:

1. Be aware of the processing time: Review the information provided by your insurance provider regarding the expected processing time for refund requests. This will give you an idea of how long it may take for the refund to be issued. If you haven’t received your refund within the specified timeframe, you can reach out to your provider to inquire about the status of your request.

2. Follow up with your provider: Stay proactive in following up with your insurance provider regarding the status of your refund. If the processing time has passed and you haven’t received any communication or the refund, reach out to your provider to inquire about the progress. Be polite yet assertive in your communication, providing the necessary details about your refund request.

3. Keep copies of all documentation: During the waiting period, it’s important to keep copies of all the documentation you submitted for the refund request. This includes the refund request form, supporting documentation, and any additional correspondence with your provider. These records will be helpful in case there are any discrepancies or if you need to escalate the issue in the future.

4. Stay persistent and patient: The refund process may take some time, so it’s essential to remain patient and persistent. While it’s important to follow up with your provider if there are delays, it’s equally crucial to give them a reasonable amount of time to process the refund. Stay in regular communication with your provider to stay informed about any updates or further actions you may need to take.

5. Verify the refund amount: Once you receive the refund, carefully review the amount to ensure it matches your expectations. If you believe there is an error or discrepancy in the refund amount, reach out to your provider for clarification. It’s important to verify the accuracy of the refund to avoid any potential issues or misunderstandings.

Remember, the waiting period for a gap insurance refund can vary, and it’s natural to feel a sense of anticipation during this time. By being proactive, organized, and patient, you can navigate the refund process smoothly and secure the refund you are entitled to.

Now that you understand the waiting process, let’s conclude this article.

Conclusion

Obtaining a gap insurance refund is a straightforward process that requires understanding the reasons for eligibility, contacting your insurance provider, providing the required documentation, submitting the refund request, and patiently waiting for the refund to be processed. By following these steps and maintaining open lines of communication with your provider, you can ensure a smooth and successful refund process.

Gap insurance serves as valuable protection for borrowers, bridging the gap between the actual cash value of a vehicle and the outstanding loan or lease balance. Understanding the purpose of gap insurance and the circumstances that warrant a refund is essential for borrowers seeking financial reimbursement.

When you find yourself in a situation where you no longer need gap insurance coverage, such as paying off your loan early, selling your vehicle, or refinancing your loan, it’s important to contact your gap insurance provider and initiate the refund process. Be prepared to provide the necessary documentation to support your refund request, including proof of loan or lease payoff, bill of sale, or loan refinancing documentation.

Once you’ve submitted your refund request, remain patient as your insurance provider processes your request. Keep copies of all submitted documents and stay in regular communication with your provider to check on the status of your refund. If necessary, follow up on any delays or discrepancies to ensure a smooth refund process.

In conclusion, if you find yourself in a situation where you are eligible for a gap insurance refund, understanding the steps involved and effectively communicating with your provider will help facilitate a timely and hassle-free refund process. By staying proactive, organized, and patient, you can successfully navigate the process and receive the refund you are entitled to.