Finance

How Do I Cancel My Life Insurance Policy?

Published: October 14, 2023

Looking for a way to cancel your life insurance policy? Our finance experts provide step-by-step guidance to help you navigate the process smoothly.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Reasons for Cancelling a Life Insurance Policy

- Steps to Cancel a Life Insurance Policy

- Review the Policy Terms and Conditions

- Contact the Insurance Company

- Gather the Required Documents

- Submit the Cancellation Request

- Confirming Policy Cancellation

- Considerations Before Cancelling a Life Insurance Policy

- Alternatives to Cancelling a Life Insurance Policy

- Conclusion

Introduction

Life insurance is an essential financial tool that provides protection and peace of mind to individuals and their loved ones. It offers financial security by paying out a predetermined amount upon the policyholder’s death. However, there may be situations where policyholders consider cancelling their life insurance policies. Whether due to changing financial circumstances or a reevaluation of insurance needs, knowing how to cancel a life insurance policy can be valuable knowledge.

In this article, we will guide you through the process of cancelling a life insurance policy. From understanding the reasons for cancellation to the necessary steps involved, we will provide you with the information you need to make an informed decision. It’s important to note that cancelling a life insurance policy is a serious decision and should not be taken lightly. It’s crucial to carefully consider the implications and explore alternative options before proceeding.

By the end of this article, you will have a clear understanding of the steps involved in cancelling a life insurance policy and the considerations to keep in mind. So, if you find yourself contemplating cancelling your life insurance policy, read on to learn how to navigate the process effectively.

Reasons for Cancelling a Life Insurance Policy

Life insurance provides valuable coverage, but there are circumstances where policyholders may need to consider cancelling their policies. While it’s important to evaluate the situation thoroughly, here are some common reasons why individuals choose to cancel their life insurance policies:

1. Changing Financial Circumstances: Life is unpredictable, and economic conditions can fluctuate. If you are facing financial difficulties and struggling to pay your premiums, you may choose to cancel your life insurance policy to free up some much-needed cash flow.

2. Improved Financial Security: Sometimes, policyholders may cancel their life insurance policies if they have achieved a higher level of financial stability. For example, you may have accumulated enough savings, eliminated debt, or built a robust retirement plan that provides sufficient financial security without the need for life insurance.

3. Policy No Longer Meets Your Needs: Life insurance needs can change over time. You may have initially purchased a policy to protect your young family, but as they grow older and become financially independent, the need for coverage decreases. In such cases, cancelling the policy can save you from paying unnecessary premiums for coverage you no longer require.

4. Switching to Better Coverage: As your financial situation evolves, you may find that your current life insurance policy no longer offers the best coverage or value. In this scenario, cancelling your existing policy and moving to a new one that better suits your needs can be a wise decision.

5. Unsatisfactory Policy Performance: If you are dissatisfied with the performance of your life insurance policy or the insurer’s customer service, you may opt to cancel the policy and switch to a different provider that better meets your expectations.

6. Life Changes: Significant life events such as divorce, remarriage, or the death of a beneficiary may prompt a reevaluation of your life insurance needs. In such cases, cancelling a policy and starting fresh with a new policy that aligns with your current circumstances can be the right move.

While these are common reasons for cancelling a life insurance policy, it is crucial to carefully evaluate your situation and consult with a financial advisor to determine the best course of action for your specific needs.

Steps to Cancel a Life Insurance Policy

If you have decided to cancel your life insurance policy, it’s important to follow the proper steps to ensure a smooth and successful cancellation. Here is a step-by-step guide to help you through the process:

1. Review the Policy Terms and Conditions: Before proceeding with cancellation, carefully review the policy documents to understand the terms and conditions, including any cancellation provisions or penalties. Familiarize yourself with the policy’s grace period and any potential refunds or surrender values.

2. Contact the Insurance Company: Reach out to your insurance company’s customer service or your insurance agent to inform them of your intention to cancel the policy. They will guide you through the cancellation process and provide you with the necessary forms and instructions.

3. Gather the Required Documents: The insurance company will likely require specific documentation to process your cancellation request. This may include a surrender form, a copy of the policy, identification documents, and any other supporting paperwork they request. Ensure you have all the necessary documents before proceeding.

4. Submit the Cancellation Request: Complete the required forms accurately and provide all the requested information. Make sure to follow the instructions provided by the insurance company regarding how to submit the request. You may need to mail the documents or submit them electronically, depending on the company’s procedures.

5. Confirming Policy Cancellation: After submitting the cancellation request, the insurance company will initiate the policy cancellation process. They will review your request, verify the information, and process the cancellation accordingly. You should receive confirmation of the policy cancellation in writing. Keep this document for your records.

6. Notify Your Financial Institutions: If you have set up automatic premium payments from your bank account or credit card, remember to notify your financial institutions to stop any future deductions related to the insurance policy. This will prevent any unexpected charges from occurring.

It’s important to note that the cancellation process may vary slightly depending on the insurance company and the policy terms. Always reach out to your insurance provider for specific instructions and guidance tailored to your policy.

Next, we will discuss some considerations to keep in mind before cancelling a life insurance policy. Understanding these factors will help you make an informed decision and explore alternative options when necessary.

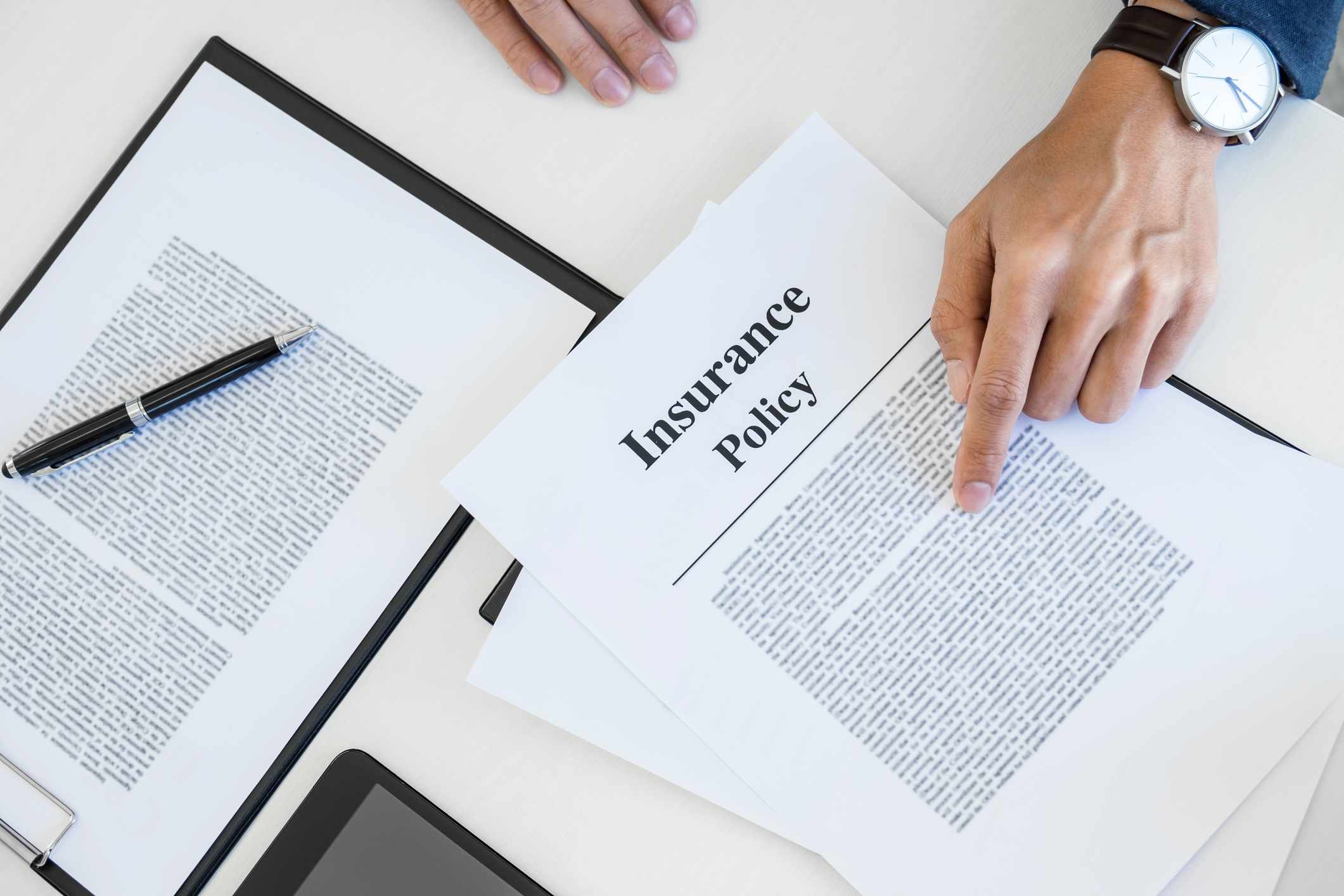

Review the Policy Terms and Conditions

Before proceeding with the cancellation of your life insurance policy, it is crucial to thoroughly review the terms and conditions outlined in your policy documents. Understanding these details will help you make an informed decision and navigate the cancellation process smoothly. Here are some key aspects to consider:

1. Cancellation Provisions: Take note of any specific provisions related to policy cancellation. Some policies may have a specified waiting period or a minimum term before cancellation is allowed. Additionally, there may be penalties or fees associated with early termination. Familiarize yourself with these provisions to avoid any surprises.

2. Grace Period: Most life insurance policies have a grace period during which premiums can be paid even if they are overdue. This is typically a specified number of days after the premium due date. If you are considering cancellation due to non-payment, make sure to check if you are still within the grace period to avoid any penalties or coverage lapses.

3. Surrender Value: Permanent life insurance policies, such as whole life or universal life, may have a cash value component that accumulates over time. If you have a policy with cash value and are considering cancellation, it’s important to understand the surrender value – the amount you would receive upon surrendering the policy. This value may be subject to surrender charges and taxes, so be sure to factor those in when weighing the financial implications of cancellation.

4. Term Life Insurance: If you have a term life insurance policy, it does not accumulate cash value. Therefore, the process of cancelling a term policy is typically straightforward, without the need to consider surrender value or penalties. However, it is still important to review the specific terms and conditions of your policy to understand any potential requirements or restrictions for cancellation.

5. Beneficiary Designation: Take the opportunity to review and update your beneficiary designation, if necessary. Life changes such as marriage, divorce, or the birth of children can impact your desired beneficiaries. Ensure that the policy reflects your current wishes to avoid any complications or disputes in the future.

By carefully reviewing the policy terms and conditions, you can better understand the implications of cancelling your life insurance policy. It is also recommended to consult with a financial advisor or insurance professional to clarify any questions or concerns you may have.

Next, we will discuss the process of contacting the insurance company to initiate the cancellation of your life insurance policy.

Contact the Insurance Company

Once you have thoroughly reviewed the terms and conditions of your life insurance policy and are ready to proceed with cancellation, the next step is to contact your insurance company. Initiating direct communication with the insurer is essential to ensure a smooth and efficient cancellation process. Here’s how to get in touch:

1. Customer Service: Begin by reaching out to the customer service department of your insurance company. Most insurance companies have dedicated customer service lines that policyholders can contact for assistance. The customer service representative will guide you through the cancellation process and provide you with the necessary instructions and forms.

2. Insurance Agent: If you have an insurance agent who assisted you in purchasing the policy, you can also contact them directly. They can provide valuable guidance and answer any specific questions you may have regarding the cancellation process. Your agent may also be able to explore alternative options or suggest modifications to your policy that align with your changing needs.

3. Communicate Clearly: When contacting the insurance company, clearly communicate your intention to cancel the life insurance policy. Provide your policy number, personal details, and any other information requested by the customer service representative or agent. Be prepared to answer questions regarding your reason for cancellation and any alternatives you may have considered.

4. Request Required Forms: The insurance company will provide you with the necessary forms and documentation to initiate the cancellation process. These forms may include a surrender form, cancellation request form, or any other specific documents required by your insurer. Make sure to request these forms and carefully review the instructions for completion.

5. Document Your Communication: Keep track of all communication with the insurance company. Take notes of the date, time, and details of your conversations. This documentation may be useful in case of any discrepancies or issues that arise during the cancellation process.

Remember to be patient and understanding during your communication with the insurance company. The cancellation process may take some time, and it is essential to follow the instructions provided by the insurer to ensure a successful cancellation of your life insurance policy.

Next, let’s move on to the step of gathering the required documents for the policy cancellation process.

Gather the Required Documents

When cancelling a life insurance policy, it is important to gather and prepare the necessary documents required by your insurance company. Having all the required documentation ready will help streamline the cancellation process and ensure that your request is processed accurately. Here are the common documents you may need to collect:

1. Policy Documents: Locate and collect the original policy documents, including the policy contract and any amendments or riders that were issued throughout the coverage period. These documents contain crucial information that will be required for the cancellation process.

2. Identification Documents: Prepare a copy of your identification documents, such as a valid government-issued ID (e.g., driver’s license or passport). The insurance company may require these documents to verify your identity and ensure that the cancellation request is legitimate.

3. Policyholder Information: Prepare a document or note that includes your policyholder information, such as your full name, address, phone number, and email address. This information will be used for correspondence and to update your contact details in their records, if needed.

4. Authorization Form (If Applicable): In some cases, the insurance company may require an authorization form signed by the policyholder. This form authorizes the insurance company to cancel the policy on your behalf. Check with your insurer to see if this document is necessary.

5. Beneficiary Designation Form (If Applicable): If you wish to update your beneficiary designation during the cancellation process, gather the appropriate beneficiary designation form. This form allows you to name or update the individuals or entities who will receive the insurance proceeds in the event of your death.

6. Additional Forms: Depending on your specific insurance policy and the requirements of your insurance company, there may be additional forms or documents needed. These could include surrender forms, cancelation request forms, or any other forms specific to your insurer’s cancellation process. Consult with your insurer or agent to ensure that you have all the necessary documents prepared.

It is important to keep all the original documents intact and provide copies to the insurance company when required. Additionally, follow any instructions provided by the insurance company regarding document submission, whether it be via mail, email, or online portal.

Once you have gathered the required documents, you will be ready to submit your cancellation request. The next section will guide you through the process of submitting the cancellation request to your insurance company.

Submit the Cancellation Request

After gathering all the necessary documents and completing the required forms, the next step in cancelling your life insurance policy is to submit the cancellation request to your insurance company. Here’s how to ensure a smooth submission process:

1. Double-Check the Forms: Before submitting the cancellation request, carefully review all the forms and documents to ensure that they are completed accurately and legibly. Any errors or missing information can cause delays in processing your request.

2. Organize the Documents: Arrange all the documents in the order specified by your insurance company. This will help the processing team easily locate and review the necessary information. Consider creating a cover letter that lists the included documents and provides a brief overview of your cancellation request.

3. Choose the Submission Method: Depending on the preferences and procedures of your insurance company, you may have various options for submitting your cancellation request. Common methods include mailing the documents, submitting them electronically through a secure online portal, or personally delivering them at the insurance company’s office. Follow the instructions provided by your insurer to choose the appropriate submission method.

4. Keep Copies for Your Records: Before sending or submitting the documents, make copies of everything for your own records. This includes the completed forms, policy documents, and any other supporting documentation. These copies will serve as proof of your cancellation request and can be referenced in case of any discrepancies or issues that may arise.

5. Keep Track of Submission: Maintain a record of when and how you submitted your cancellation request. If mailing the documents, consider using a certified mail or tracking service to ensure delivery confirmation. If submitting online or in person, keep a copy of any confirmation or receipt provided by the insurance company.

Once you have submitted the cancellation request, the insurance company will begin the process of reviewing your request and processing the cancellation. Be patient during this stage, as the time it takes to process a cancellation request may vary depending on the insurer and the complexity of your policy.

In the next section, we will discuss confirming the cancellation of your life insurance policy and what steps to take afterward.

Confirming Policy Cancellation

After submitting the cancellation request for your life insurance policy, it is important to obtain confirmation from the insurance company to ensure that the policy has been successfully cancelled. Here are some steps to take to confirm the cancellation:

1. Wait for Communication: Once the insurance company receives your cancellation request, they will review the documents and process the cancellation accordingly. Be patient and wait for them to communicate with you regarding the status of your cancellation. This communication may come in the form of an email, letter, or online notification.

2. Review the Confirmation Documents: When you receive confirmation from the insurance company, carefully review the documents to ensure that they accurately state the cancellation of your policy. Check for any additional information provided, such as the effective date of cancellation or any refund details if applicable.

3. Clarify Any Concerns: If there are any discrepancies or concerns with the confirmation documents, contact the insurance company immediately to seek clarification and rectify any issues. It is crucial to address any discrepancies promptly to ensure that the cancellation has been processed correctly.

4. Confirm Premium Cancellation: If you had set up automatic premium payments for your policy, verify with your bank or credit card company that the premium deductions have been stopped. This will help prevent any further charges related to the cancelled policy.

5. Retain the Confirmation Documents: Keep the confirmation documents in a safe place for future reference. These documents serve as proof of the cancellation and can be essential in case of any misunderstandings or disputes regarding the policy status.

Confirming the cancellation of your life insurance policy is crucial to ensure that you are no longer obligated to pay premiums and that the coverage has ceased. Following these steps will help provide peace of mind and ensure that the cancellation process has been successfully completed.

Next, we will discuss important considerations to keep in mind before cancelling a life insurance policy.

Considerations Before Cancelling a Life Insurance Policy

Deciding to cancel a life insurance policy is a significant financial decision that should not be taken lightly. Before proceeding with cancellation, it is essential to carefully consider the following factors:

1. Insurance Needs: Analyze your current and future insurance needs. Assess whether you have alternative means of financial protection in place, such as savings, investments, or other insurance policies. Consider the financial impact on your family and dependents if you were to pass away without life insurance coverage.

2. Future Insurability: Keep in mind that your insurability may change over time. If you cancel your policy now and try to obtain coverage in the future, you may face higher premiums or limited availability due to changes in your health or age. Evaluate the potential difficulty of securing a new policy if you were to need coverage in the future.

3. Policy Alternatives: Before cancelling, explore alternative options that may better suit your needs. This could include modifying your existing policy, reducing the coverage amount, or exploring policy conversion options. Consulting with a financial advisor or insurance professional can provide valuable insights into these alternatives.

4. Financial Implications: Understand the financial implications of cancelling your life insurance policy. Consider surrender charges, potential tax consequences, and the loss of any cash value or death benefits associated with the policy. Evaluating the impact on your overall financial outlook will help you make an informed decision.

5. Policy Reinstatement: If you are cancelling due to non-payment or temporary financial difficulties, speak with your insurance company about options for policy reinstatement. They may offer alternative payment arrangements or grace periods to help you maintain coverage.

6. Review Periodic Evaluations: Periodically reassess your insurance needs to ensure that your policy aligns with your current circumstances. Major life events, such as marriage, divorce, the birth of a child, or the purchase of a home, may necessitate adjustments to your coverage rather than complete cancellation.

Considering these factors will help you weigh the potential benefits and risks before making a final decision to cancel your life insurance policy. It is recommended to consult with a financial advisor or insurance expert to get personalized advice based on your specific situation.

Lastly, let’s explore some alternatives to cancelling a life insurance policy in case they better suit your needs.

Alternatives to Cancelling a Life Insurance Policy

If you find yourself considering cancelling your life insurance policy, it is important to explore alternative options before making a final decision. Here are some alternatives to cancelling a life insurance policy that may better suit your needs:

1. Policy Modification: Instead of cancelling the policy altogether, consider modifying the coverage amount or adjusting the policy’s terms. This allows you to maintain some level of protection while aligning the policy more closely with your current needs and budget.

2. Reduced Coverage: If you are struggling with the cost of premiums, reducing the coverage amount can be an option. Assess your insurance needs and determine if a lower death benefit would still provide the necessary financial protection for your loved ones.

3. Policy Conversion: Some life insurance policies offer conversion options that allow you to convert a term policy into a permanent policy without undergoing a medical examination. This can be a valuable alternative if you still require life insurance coverage but prefer a different policy type.

4. Policy Riders: Explore the possibility of adding policy riders to enhance your existing coverage. Riders can provide additional benefits such as accelerated death benefits, critical illness coverage, or long-term care benefits without the need to cancel the policy.

5. Policy Lapse Prevention: If you are considering cancelling due to non-payment of premiums, discuss potential solutions with your insurance company. They may offer options such as premium deferral, modifying the payment schedule, or utilizing any available policy cash values to keep the policy in force.

6. Supplemental Insurance: Instead of cancelling, consider adding supplemental insurance coverage for specific needs. For example, if you have a term life insurance policy, you could complement it with disability insurance, long-term care insurance, or personal accident insurance to address other potential risks.

Exploring these alternatives with the guidance of a financial advisor or insurance professional will help you make an informed decision that aligns with your specific goals and circumstances. They can provide personalized advice and assist in finding the best solution without the need for complete policy cancellation.

Next, we will conclude with a summary of the key points discussed in this article.

Conclusion

Cancelling a life insurance policy is a significant financial decision that should be approached with careful consideration. Throughout this article, we have provided you with a comprehensive guide on how to cancel a life insurance policy, highlighting important steps and considerations along the way.

Before proceeding with cancellation, it is essential to review the policy terms and conditions, understanding any cancellation provisions, grace periods, or surrender values that may apply. Contacting the insurance company and gathering the necessary documents are crucial steps in initiating the cancellation process.

While cancelling your life insurance policy may seem like the best option at times, it’s important to explore alternatives first. Modifying the policy, reducing coverage, or adding riders can help meet your changing needs without losing the protection entirely. Consulting with a financial advisor or insurance professional can provide valuable insights and guidance tailored to your specific situation.

Lastly, we encourage you to review the key factors before proceeding with cancellation, such as assessing your insurance needs, considering future insurability, and evaluating the financial implications of the decision. By carefully weighing these factors, you can make an informed decision that aligns with your long-term goals.

Remember, cancelling a life insurance policy is a personal decision based on individual circumstances. It is essential to consider your unique needs and consult with professionals to make the best choice for your financial well-being and the future security of your loved ones.

We hope this article has provided you with valuable insights and guidance on how to navigate the process of cancelling a life insurance policy. Remember to seek personalized advice and thoroughly evaluate your options before making a final decision.