Home>Finance>How Do I Check My Settlement Figure On My Standard Bank Revolving Credit?

Finance

How Do I Check My Settlement Figure On My Standard Bank Revolving Credit?

Published: February 29, 2024

Learn how to easily check your settlement figure on your Standard Bank revolving credit. Manage your finances with confidence.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where credit facilities like revolving credit play a pivotal role in managing personal and business finances. As a Standard Bank customer, you may have availed yourself of the convenience and flexibility offered by the Standard Bank Revolving Credit facility. However, navigating the intricacies of this financial tool, particularly when it comes to understanding and managing settlement figures, can be a daunting task.

In this comprehensive guide, we will delve into the concept of settlement figures and specifically explore how to check your settlement figure on your Standard Bank Revolving Credit. By the end of this article, you will have a clear understanding of settlement figures, how they are calculated, and the steps involved in accessing this crucial information through Standard Bank's platform.

Understanding settlement figures is essential for effectively managing your revolving credit and making informed financial decisions. Whether you're considering early settlement, refinancing, or simply staying informed about your financial obligations, having a grasp of settlement figures empowers you to take control of your financial well-being.

So, let's embark on this enlightening journey to unravel the mysteries of settlement figures and equip ourselves with the knowledge to navigate the complexities of the Standard Bank Revolving Credit with confidence and clarity.

Understanding Settlement Figures

Settlement figures are pivotal components of credit facilities, representing the total amount required to pay off a debt or loan at a specific point in time. In the context of Standard Bank Revolving Credit, the settlement figure encompasses the outstanding balance, accrued interest, and any applicable fees or charges, providing a comprehensive snapshot of the amount needed to fully settle the revolving credit account.

It’s important to recognize that settlement figures are dynamic, evolving with each passing day due to the accrual of interest and potential changes in outstanding balances. This dynamic nature necessitates a precise and up-to-date method for accessing settlement figures, enabling borrowers to make well-informed decisions regarding their financial commitments.

When assessing settlement figures, borrowers should be mindful of the distinction between the settlement amount and the outstanding balance. While the outstanding balance reflects the current amount owed on the revolving credit account, the settlement figure encapsulates additional factors such as accrued interest and potential early settlement penalties, providing a holistic view of the financial obligation.

Furthermore, understanding the components that contribute to the calculation of settlement figures is crucial. Interest accrual methods, fee structures, and potential adjustments based on early settlement scenarios all influence the final settlement figure. By comprehending these elements, borrowers can gain clarity on the financial implications of various actions, whether it involves making additional payments, refinancing, or exploring early settlement options.

Ultimately, a thorough understanding of settlement figures empowers borrowers to make informed financial decisions, effectively manage their revolving credit, and navigate the complexities of debt management with confidence and foresight.

Accessing Settlement Figure on Standard Bank Revolving Credit

As a Standard Bank customer with a Revolving Credit facility, accessing your settlement figure is a straightforward yet crucial process. Standard Bank provides multiple channels through which customers can obtain this essential financial information, ensuring accessibility and convenience.

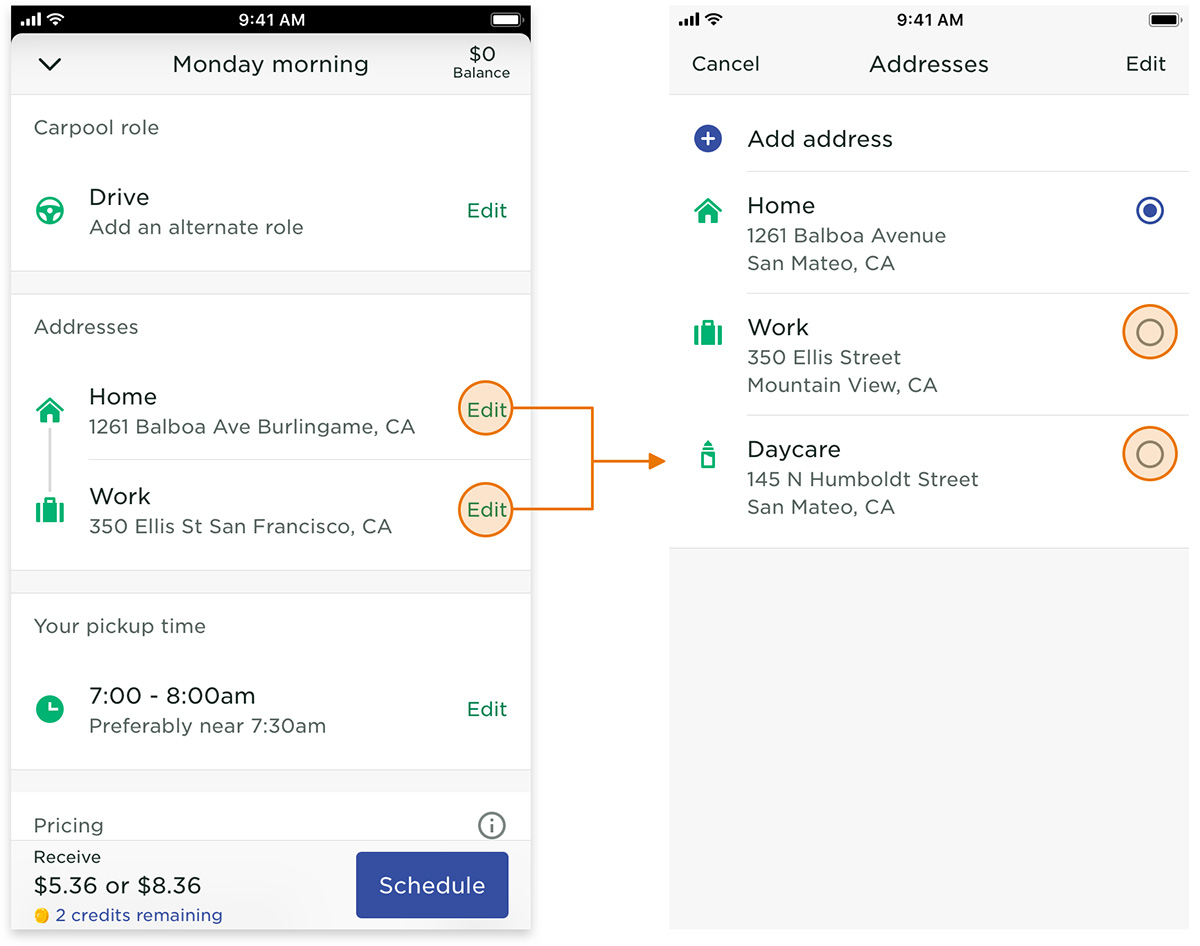

One of the primary avenues for accessing your settlement figure is through Standard Bank’s online banking platform. By logging into your online banking account, you can navigate to the section dedicated to your Revolving Credit facility. Within this interface, you will typically find a dedicated option to view your settlement figure, providing you with real-time access to this vital financial information.

Additionally, Standard Bank’s mobile banking application offers a seamless and intuitive method for checking your settlement figure on the go. With the mobile app, customers can conveniently access their Revolving Credit details, including the current settlement figure, empowering them to stay informed about their financial obligations anytime, anywhere.

Moreover, for those who prefer direct interaction and personalized assistance, Standard Bank’s customer service channels, including phone support and in-branch assistance, serve as valuable resources for obtaining your settlement figure. Whether seeking clarification on the calculation of the settlement figure or needing immediate access to this information, the customer service team is equipped to provide the necessary guidance and support.

It’s important to note that Standard Bank prioritizes the security and confidentiality of customer information, ensuring that the process of accessing settlement figures adheres to stringent privacy standards and authentication protocols. This commitment to safeguarding customer data underscores the trust and reliability associated with obtaining sensitive financial details through Standard Bank’s designated channels.

By leveraging these accessible and secure avenues, Standard Bank customers can effortlessly retrieve their settlement figures, empowering them to make informed decisions and effectively manage their revolving credit obligations with clarity and confidence.

Factors Affecting Settlement Figures

Several key factors influence the calculation of settlement figures for Standard Bank Revolving Credit, shaping the total amount required to fully settle the outstanding debt. Understanding these factors is essential for borrowers seeking clarity on their financial obligations and contemplating potential early settlement or refinancing options.

- Outstanding Balance: The primary component of the settlement figure is the outstanding balance on the revolving credit account. This represents the current amount owed, encompassing the initial credit limit, utilized funds, and any accrued interest.

- Accrued Interest: Interest accrual significantly impacts the settlement figure, with the amount of accrued interest directly correlating to the outstanding balance and the prevailing interest rate. As time elapses, the accrued interest contributes to the total settlement figure, reflecting the cost of utilizing the revolving credit facility over the borrowing period.

- Early Settlement Penalties: For borrowers considering early settlement of their revolving credit, it’s essential to be aware of potential early settlement penalties that may affect the final settlement figure. These penalties, if applicable, are factored into the calculation, influencing the total amount required for early repayment.

- Fee Structures: Standard Bank’s fee structures, including administrative charges and service fees, can impact the settlement figure. It’s crucial for borrowers to understand the specific fees associated with their revolving credit facility and how these fees contribute to the overall settlement amount.

- Interest Accrual Methods: The method used to calculate interest accrual, such as daily compounding or monthly compounding, can affect the total accrued interest and, consequently, the settlement figure. Understanding the interest accrual method employed by Standard Bank is vital for accurately assessing the settlement amount.

By comprehending these factors and their respective influences on settlement figures, borrowers can gain insight into the financial dynamics of their revolving credit accounts. This knowledge empowers borrowers to make informed decisions, whether it involves managing the outstanding balance, exploring early settlement options, or evaluating the financial implications of continued credit utilization.

Ultimately, a nuanced understanding of the factors shaping settlement figures enables borrowers to navigate their revolving credit obligations with foresight and clarity, fostering responsible financial management and informed decision-making.

Tips for Managing Settlement Figures

Effectively managing settlement figures is integral to maintaining financial stability and making informed decisions regarding your Standard Bank Revolving Credit. By implementing strategic approaches and leveraging available resources, borrowers can navigate the dynamics of settlement figures with confidence and foresight.

- Regular Monitoring: Stay proactive by regularly monitoring your revolving credit account and staying informed about changes in your outstanding balance and accrued interest. This proactive approach enables you to anticipate fluctuations in the settlement figure and make timely adjustments to your financial planning.

- Understanding Fee Structures: Familiarize yourself with the fee structures associated with your revolving credit facility, including administrative charges, service fees, and potential early settlement penalties. Understanding these fees empowers you to factor them into your financial decisions and accurately assess the total settlement amount.

- Exploring Early Settlement Options: If considering early settlement of your revolving credit, engage with Standard Bank to gain clarity on the early settlement process, including any applicable penalties and the impact on the settlement figure. This proactive approach enables you to evaluate the feasibility of early repayment and make informed decisions aligned with your financial goals.

- Utilizing Online Resources: Leverage Standard Bank’s online banking platform and mobile app to conveniently access your settlement figure, review transaction details, and stay updated on your revolving credit account. The accessibility of online resources empowers you to stay informed and engaged with your financial obligations.

- Seeking Financial Guidance: If navigating settlement figures and managing your revolving credit presents challenges, consider seeking financial guidance from Standard Bank’s customer service professionals. Their expertise and insights can provide valuable clarity on settlement figures, fee structures, and strategic approaches to managing your revolving credit effectively.

By incorporating these tips into your financial management practices, you can proactively engage with your Standard Bank Revolving Credit, navigate settlement figures with confidence, and make informed decisions that align with your long-term financial well-being.

Conclusion

Embarking on the journey to comprehend and manage settlement figures within the realm of Standard Bank Revolving Credit equips borrowers with the knowledge and insights necessary to navigate their financial obligations with confidence and clarity. Understanding the intricacies of settlement figures, accessing this critical financial information, and effectively managing the factors that influence settlement amounts are essential components of responsible financial stewardship.

By grasping the dynamic nature of settlement figures and the myriad factors that contribute to their calculation, borrowers are empowered to make informed decisions aligned with their financial goals. Whether considering early settlement, monitoring accrued interest, or evaluating the impact of fee structures, a nuanced understanding of settlement figures fosters financial acumen and strategic decision-making.

Standard Bank’s commitment to providing accessible channels for accessing settlement figures, coupled with robust online and mobile banking resources, enhances the convenience and transparency of managing revolving credit obligations. Customers can leverage these resources to stay informed, engage with their financial details, and proactively monitor their settlement figures, contributing to a proactive and empowered approach to financial management.

As borrowers navigate the complexities of settlement figures, they are encouraged to embrace a proactive mindset, regularly monitor their revolving credit accounts, and leverage available resources to gain clarity on their financial obligations. By doing so, borrowers can cultivate a sense of financial empowerment, enabling them to make well-informed decisions and effectively manage their revolving credit with confidence and foresight.

In conclusion, the journey to understand and manage settlement figures on Standard Bank Revolving Credit is a testament to the commitment to financial literacy and responsible financial management. By embracing the insights and strategies outlined in this guide, borrowers can embark on a path of financial empowerment, equipped with the knowledge and tools to navigate their revolving credit obligations with confidence and informed decision-making.