Finance

How Do Interest Rates Affect Pensions?

Published: January 22, 2024

Learn how interest rates impact pensions and retirement savings. Understand the financial implications and make informed decisions. Explore more with our finance experts.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the complex and dynamic world of pensions and interest rates. As individuals plan for their retirement, understanding the intricate relationship between interest rates and pensions becomes crucial. Interest rates play a significant role in shaping the financial landscape, impacting various aspects of the economy, including pension funds. In this article, we will delve into the profound influence of interest rates on pensions, exploring how fluctuations in interest rates can affect pension funds and the strategies employed to manage interest rate risk.

As we embark on this journey, it’s important to recognize that pensions serve as a vital component of retirement planning for countless individuals worldwide. Pension funds are designed to provide financial security during retirement, ensuring that individuals can maintain a certain standard of living once they exit the workforce. However, the performance of pension funds is intricately linked to prevailing interest rates, making it essential for both pension fund managers and beneficiaries to comprehend the impact of interest rate fluctuations.

Throughout this article, we will unravel the implications of both low and high interest rates on pension funds, shedding light on the challenges and opportunities that arise in each scenario. Furthermore, we will explore the strategies employed to mitigate interest rate risk within pension funds, offering insights into the proactive measures taken to navigate the complexities of the financial landscape.

Join us as we navigate the intersection of finance and retirement planning, gaining a deeper understanding of how interest rates can significantly influence the sustainability and performance of pension funds.

Understanding Interest Rates and Pensions

Before delving into the impact of interest rates on pensions, it’s essential to grasp the fundamental relationship between these two critical elements of the financial world. Interest rates, set by central banks or determined by market forces, serve as the cost of borrowing money and the return on invested capital. These rates have a far-reaching impact, influencing consumer spending, investment decisions, and the overall health of the economy.

When it comes to pensions, the connection to interest rates is profound. Pension funds typically consist of a diversified portfolio of assets, including stocks, bonds, and other investment vehicles. The performance of these assets is heavily influenced by interest rates. For instance, when interest rates rise, the value of existing bonds in a pension fund may decline, impacting the overall fund performance. Conversely, when interest rates fall, bond prices tend to rise, leading to potential gains within the fund.

Moreover, the discount rate used to calculate the present value of future pension liabilities is closely tied to interest rates. A lower discount rate, resulting from lower interest rates, increases the present value of pension liabilities, potentially straining the financial health of pension funds. Conversely, higher interest rates can alleviate the burden on pension funds by reducing the present value of future liabilities.

Understanding the intricate interplay between interest rates and pension funds is paramount for both fund managers and beneficiaries. The dynamic nature of interest rates necessitates a proactive approach to managing the associated risks and opportunities within pension funds. As we proceed, we will explore the impact of low and high interest rates on pension funds, providing valuable insights into the strategies employed to navigate these fluctuations and safeguard the sustainability of pension funds.

Impact of Low Interest Rates on Pension Funds

Low interest rates have become a prevailing economic reality in many parts of the world, presenting both challenges and opportunities for pension funds. One of the most significant repercussions of low interest rates is the increased present value of future pension liabilities. As the discount rate used to calculate these liabilities decreases in tandem with falling interest rates, the financial burden on pension funds intensifies. This can lead to funding shortfalls and heightened pressure on pension fund managers to meet their obligations.

Furthermore, the investment returns generated by fixed-income securities, such as bonds, tend to diminish in a low interest rate environment. Pension funds heavily rely on these assets to generate income and mitigate risk. Consequently, the reduced returns on fixed-income investments can hinder the overall performance of pension funds, potentially impacting the ability to meet future pension obligations.

Low interest rates also compel pension funds to seek higher-yielding assets to bolster their returns, often leading to increased exposure to riskier investments. While this pursuit of higher returns may offer the potential for increased profitability, it also amplifies the vulnerability of pension funds to market volatility and downturns, posing a threat to the long-term stability of these funds.

Moreover, the prolonged low interest rate environment can erode the purchasing power of pension funds, making it challenging to preserve the real value of assets over time. This can have profound implications for retirees who rely on these funds to sustain their standard of living throughout their retirement years.

In response to the impact of low interest rates, pension fund managers often adopt a range of strategies to mitigate these challenges. These may include diversifying investment portfolios, incorporating alternative assets, and implementing risk management techniques to navigate the complexities of a low interest rate environment. By proactively addressing these challenges, pension funds strive to uphold their long-term sustainability and fulfill their crucial role in providing financial security for retirees.

Impact of High Interest Rates on Pension Funds

High interest rates can exert a profound influence on the dynamics of pension funds, presenting a unique set of challenges and opportunities for fund managers and beneficiaries alike. One of the primary implications of high interest rates is the potential for decreased bond prices within pension fund portfolios. As interest rates rise, the value of existing bonds tends to decline, impacting the overall performance of the fund and potentially leading to capital losses.

Moreover, the higher discount rate used to calculate the present value of future pension liabilities can reduce the overall financial burden on pension funds. This can alleviate the strain on fund managers and enhance the financial health of pension funds, as the present value of future obligations decreases with higher interest rates.

High interest rates also offer the potential for increased returns on fixed-income investments, such as bonds, within pension fund portfolios. This can bolster the overall performance of the fund and enhance the ability to meet future pension obligations. Additionally, the higher returns on fixed-income assets can contribute to the stability and sustainability of pension funds, providing a source of income to fulfill pension commitments.

However, the pursuit of higher returns in a high interest rate environment may prompt pension funds to allocate a larger portion of their portfolios to fixed-income investments, potentially limiting diversification and exposing the funds to concentration risk. Moreover, the potential for increased returns on fixed-income assets must be balanced against the impact of rising interest rates on other components of the fund’s investment portfolio, such as equities and alternative assets.

Furthermore, high interest rates can influence the behavior of retirees and pension beneficiaries. The opportunity to secure higher yields on retirement savings may influence the decisions of individuals nearing retirement, potentially impacting the flow of funds into and out of pension schemes.

In navigating the impact of high interest rates, pension fund managers often employ strategies to optimize the performance and resilience of their funds. These may include adjusting the asset allocation to balance risk and return, implementing interest rate hedging strategies, and conducting rigorous stress testing to assess the fund’s resilience to interest rate fluctuations. By proactively addressing the challenges and opportunities presented by high interest rates, pension funds aim to uphold their long-term sustainability and fulfill their crucial role in providing financial security for retirees.

Strategies for Managing Interest Rate Risk in Pensions

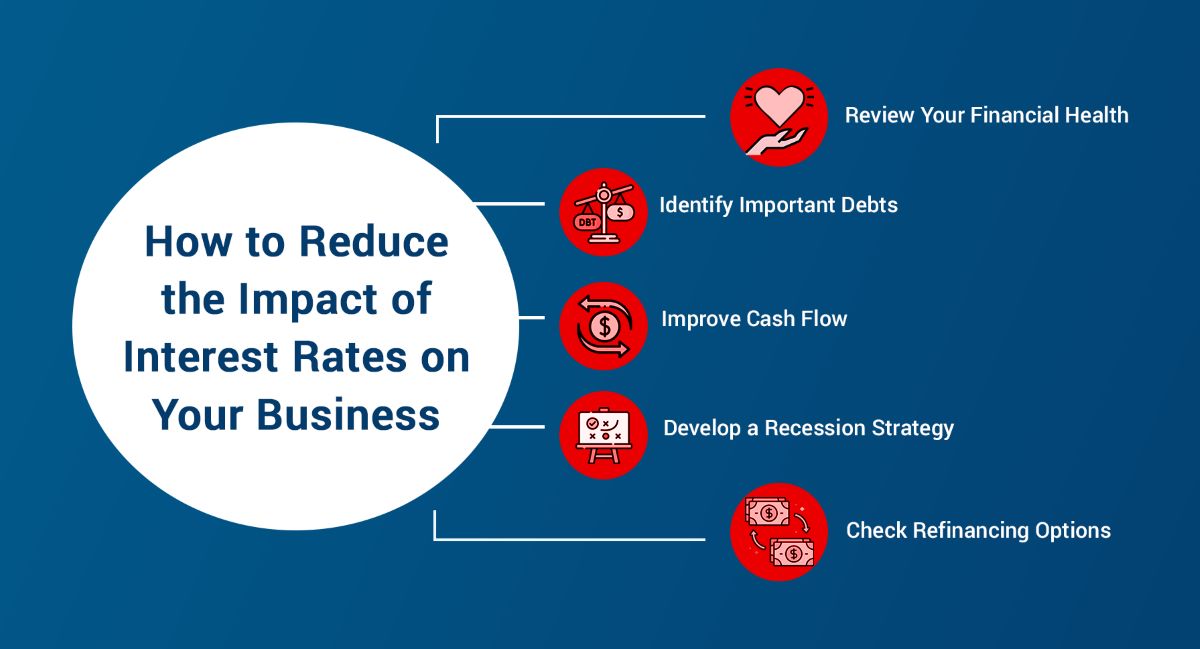

Managing interest rate risk is a critical endeavor for pension funds, requiring a proactive and comprehensive approach to navigate the complexities of the financial landscape. As interest rates fluctuate, pension fund managers employ a range of strategies to mitigate risk and optimize the performance and sustainability of their funds.

One prevalent strategy for managing interest rate risk involves diversifying the investment portfolio. By allocating assets across various investment classes, including equities, fixed-income securities, and alternative investments, pension funds aim to reduce the impact of interest rate fluctuations on the overall performance of the fund. Diversification can help mitigate the potential losses incurred from changes in interest rates and enhance the resilience of the fund in varying market conditions.

Additionally, pension fund managers often utilize interest rate hedging strategies to mitigate the impact of interest rate fluctuations on the fund’s liabilities. This may involve employing derivative instruments, such as interest rate swaps or options, to offset the risk associated with changes in interest rates. By hedging against adverse interest rate movements, pension funds seek to protect the present value of their liabilities and maintain financial stability.

Furthermore, implementing dynamic asset allocation strategies allows pension fund managers to adjust the fund’s investment mix in response to changing interest rate environments. This adaptive approach enables funds to capitalize on opportunities presented by interest rate fluctuations while mitigating potential risks. By actively rebalancing the portfolio in alignment with prevailing interest rate trends, pension funds strive to optimize their performance and manage interest rate risk effectively.

Conducting rigorous stress testing and scenario analysis is another integral aspect of managing interest rate risk in pensions. By simulating various interest rate scenarios and assessing the potential impact on the fund’s assets and liabilities, pension fund managers gain valuable insights into the fund’s resilience and vulnerability. This proactive approach empowers fund managers to make informed decisions and implement strategic adjustments to mitigate the adverse effects of interest rate fluctuations.

Moreover, fostering a robust risk management culture within pension funds is essential for effectively navigating interest rate risk. This involves establishing clear risk management frameworks, fostering transparency, and promoting a thorough understanding of the fund’s exposure to interest rate fluctuations among all stakeholders. By promoting a risk-aware culture, pension funds can enhance their ability to identify, assess, and mitigate interest rate risk effectively.

By embracing these proactive strategies and maintaining a keen awareness of prevailing interest rate dynamics, pension funds endeavor to navigate the complexities of the financial landscape, optimize their performance, and uphold their pivotal role in providing financial security for retirees.

Conclusion

Interest rates exert a profound influence on the sustainability and performance of pension funds, shaping the intricate dynamics of retirement planning and fund management. The impact of low and high interest rates presents a multifaceted landscape of challenges and opportunities for pension fund managers and beneficiaries, necessitating a proactive and strategic approach to manage interest rate risk effectively.

Low interest rates pose significant challenges for pension funds, elevating the present value of future liabilities and diminishing returns on fixed-income investments. This underscores the importance of diversification, risk management, and proactive strategies to mitigate the adverse effects of low interest rates and safeguard the long-term sustainability of pension funds.

Conversely, high interest rates introduce a distinct set of considerations for pension funds, influencing the performance of fixed-income assets, the present value of liabilities, and the behavior of retirees. Employing dynamic asset allocation, interest rate hedging, and robust risk management practices enables pension funds to navigate the complexities of high interest rate environments and optimize their resilience in the face of fluctuating interest rates.

Strategies for managing interest rate risk in pensions encompass a comprehensive array of proactive measures, including diversification, interest rate hedging, dynamic asset allocation, stress testing, and risk management. By embracing these strategies, pension funds endeavor to mitigate the impact of interest rate fluctuations, optimize their performance, and fulfill their crucial role in providing financial security for retirees.

As interest rates continue to evolve in response to economic dynamics, the proactive management of interest rate risk remains paramount for pension funds. By fostering a nuanced understanding of interest rate dynamics, embracing strategic risk management practices, and adapting to prevailing market conditions, pension funds strive to navigate the complexities of the financial landscape and uphold their commitment to providing sustainable and reliable retirement benefits for individuals.

Ultimately, the symbiotic relationship between interest rates and pensions underscores the intricate interplay between the financial markets and retirement planning, emphasizing the importance of a proactive and adaptive approach to managing interest rate risk within pension funds.