Finance

How Do Revolving Credit Facilities Work?

Modified: March 1, 2024

Learn how revolving credit facilities function in finance, including their benefits and drawbacks. Understand how these facilities can impact your financial strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Introduction

Welcome to the world of revolving credit facilities, where financial flexibility meets strategic borrowing. In the realm of personal and business finance, revolving credit facilities play a pivotal role in providing access to funds on an as-needed basis. Whether it’s managing cash flow, seizing investment opportunities, or addressing unexpected expenses, revolving credit facilities offer a dynamic solution that adapts to the evolving financial needs of individuals and organizations.

Understanding the mechanics of revolving credit facilities is essential for anyone navigating the complex landscape of borrowing and lending. From credit cards to home equity lines of credit (HELOCs) and corporate lines of credit, these financial instruments empower borrowers to access a predetermined amount of funds, repay the borrowed amount, and then borrow again, all within the predefined credit limit. This revolving nature sets them apart from traditional term loans, providing unparalleled flexibility and convenience.

As we delve into the intricacies of revolving credit facilities, you’ll gain a comprehensive understanding of how they work, the advantages they offer, and the potential drawbacks to consider. Whether you’re a seasoned financial professional or someone exploring borrowing options for the first time, this exploration of revolving credit facilities will equip you with the knowledge to make informed financial decisions and leverage these facilities to your advantage.

Understanding Revolving Credit Facilities

Understanding Revolving Credit Facilities

Revolving credit facilities encompass a diverse array of financial products designed to provide flexible access to funds. At their core, these facilities enable borrowers to repeatedly borrow and repay funds within a predetermined credit limit. One of the most common examples of revolving credit facilities is the ubiquitous credit card, which allows cardholders to make purchases up to a certain credit limit and repay the borrowed amount over time, with the option to borrow again once payments are made.

Home equity lines of credit (HELOCs) represent another prevalent form of revolving credit, leveraging the equity in a property to provide a revolving source of funds. Similarly, corporate lines of credit offer businesses the flexibility to access funds as needed, making them invaluable for managing working capital and seizing growth opportunities.

Unlike traditional term loans, revolving credit facilities do not have a fixed repayment term. Instead, borrowers have the freedom to carry a balance from one month to the next, paying interest only on the outstanding amount. This dynamic repayment structure aligns with the ebb and flow of personal and business finances, allowing borrowers to navigate fluctuations in income and expenses with greater ease.

Understanding the nuances of revolving credit facilities involves grasping key terms such as credit limit, minimum payments, interest rates, and potential fees. By comprehending these elements, borrowers can make informed decisions about when and how to utilize their revolving credit lines, optimizing their financial strategies while managing costs effectively.

How Revolving Credit Facilities Work

How Revolving Credit Facilities Work

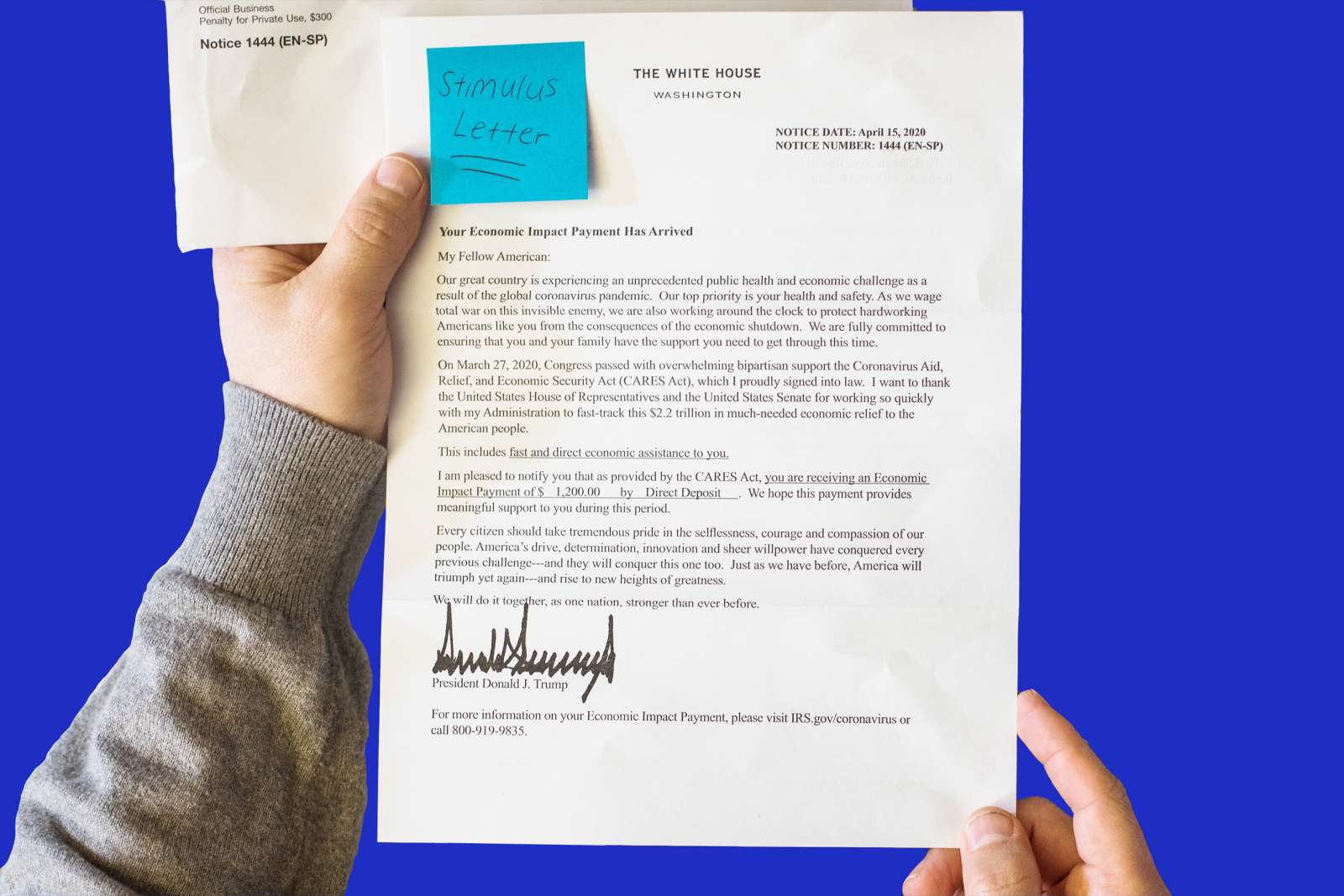

Revolving credit facilities operate on a cyclical basis, offering borrowers the flexibility to borrow, repay, and borrow again within the predefined credit limit. When a borrower accesses funds from a revolving credit line, they can choose to repay the entire balance or make minimum payments, carrying the remaining balance to the next billing cycle. This revolving nature distinguishes these facilities from traditional term loans, providing a continuous source of funding as long as the borrower stays within the credit limit.

Upon opening a revolving credit account, whether it’s a credit card, HELOC, or corporate line of credit, the lender establishes a maximum credit limit based on the borrower’s creditworthiness and financial capacity. This credit limit represents the ceiling for borrowing, and the borrower can utilize funds up to this predefined threshold. As the borrower repays the borrowed amount, the available credit replenishes, allowing for future borrowing as needed.

Interest accrues on the outstanding balance of a revolving credit facility, typically calculated based on the average daily balance. This interest expense represents the cost of borrowing and varies based on the prevailing interest rates and the borrower’s credit profile. By managing the outstanding balance and making timely payments, borrowers can minimize interest costs and optimize the utility of their revolving credit lines.

Furthermore, revolving credit facilities often entail additional fees, such as annual fees for credit cards or origination fees for HELOCs and corporate lines of credit. Understanding these fees and their impact on the overall cost of borrowing is crucial for borrowers seeking to maximize the value of their revolving credit facilities.

Overall, the operational framework of revolving credit facilities empowers borrowers to harness the benefits of ongoing access to funds while navigating the associated costs and financial responsibilities. By strategically leveraging these facilities, borrowers can seize opportunities, manage cash flow, and address financial needs with agility and control.

Advantages of Revolving Credit Facilities

Advantages of Revolving Credit Facilities

Revolving credit facilities offer a host of advantages that cater to the diverse financial needs of individuals and businesses. These flexible financial instruments provide a range of benefits, including:

- Financial Flexibility: Revolving credit facilities empower borrowers with the flexibility to access funds as needed, without the constraints of a fixed repayment schedule. Whether it’s addressing unexpected expenses, seizing investment opportunities, or managing cash flow fluctuations, the ability to borrow and repay within the credit limit offers unparalleled financial agility.

- Continuous Access to Funds: Unlike traditional term loans that involve a one-time disbursement of funds, revolving credit facilities provide ongoing access to a predetermined credit limit. This perpetual source of funding ensures that borrowers can tap into resources whenever the need arises, fostering a sense of financial security and readiness.

- Interest Cost Management: With revolving credit facilities, borrowers have the flexibility to manage interest costs by controlling the amount and timing of their repayments. By paying off balances promptly and strategically borrowing when advantageous, individuals and businesses can optimize their interest expenses and minimize the overall cost of borrowing.

- Strategic Financial Planning: The dynamic nature of revolving credit facilities aligns with the evolving financial landscape, enabling borrowers to adapt their borrowing and repayment strategies based on changing needs and opportunities. This adaptability facilitates proactive financial planning and decision-making, empowering borrowers to make the most of their financial resources.

- Establishing and Building Credit: For individuals, responsibly managing revolving credit facilities, such as credit cards, can contribute to building a positive credit history. Timely payments and prudent credit utilization can enhance credit scores, laying the groundwork for future borrowing and favorable financial opportunities.

These advantages underscore the intrinsic value of revolving credit facilities in fostering financial resilience, strategic resource management, and responsive borrowing capabilities. Whether utilized for personal finance management or corporate financial strategies, these facilities serve as dynamic tools for navigating the complexities of the modern financial landscape.

Disadvantages of Revolving Credit Facilities

Disadvantages of Revolving Credit Facilities

While revolving credit facilities offer compelling benefits, they also present certain drawbacks and considerations that warrant careful assessment. It’s essential to recognize the potential downsides associated with these financial instruments, including:

- Interest Accumulation: The revolving nature of these credit facilities can lead to interest accruing on outstanding balances over time. Without disciplined repayment strategies, borrowers may face increasing interest costs, especially if they carry high balances from month to month.

- Debt Accumulation Risk: The accessibility of revolving credit funds can pose a risk of accumulating excessive debt, particularly if borrowers continually rely on these facilities without a clear repayment plan. Unchecked borrowing can lead to financial strain and a cycle of debt accumulation, impacting long-term financial stability.

- Variable Interest Rates: Many revolving credit facilities feature variable interest rates, subject to fluctuations based on market conditions. While this can offer opportunities for lower interest costs in favorable environments, it also introduces the potential for increased borrowing expenses during periods of rising interest rates.

- Fee Structure: Revolving credit facilities often entail various fees, such as annual fees, balance transfer fees, and late payment penalties. These fees can contribute to the overall cost of borrowing and require careful consideration to mitigate their impact on financial management.

- Credit Score Impact: Mismanagement of revolving credit facilities, including high credit utilization and late payments, can adversely affect credit scores. This can limit access to favorable borrowing terms and financial opportunities, underscoring the importance of prudent credit management.

By acknowledging these potential disadvantages, borrowers can approach revolving credit facilities with informed decision-making and proactive risk management. Understanding the intricacies of these drawbacks empowers individuals and businesses to navigate the complexities of borrowing responsibly and harness the benefits of these facilities while mitigating their associated risks.

Conclusion

Conclusion

Revolving credit facilities represent a dynamic and versatile framework for accessing funds, offering a spectrum of advantages and considerations for borrowers to evaluate. From the financial flexibility and continuous access to funds to the nuances of interest cost management and credit impact, these facilities embody a multifaceted toolset for addressing diverse financial needs.

By understanding the operational mechanics, advantages, and potential drawbacks of revolving credit facilities, individuals and businesses can navigate the borrowing landscape with clarity and strategic intent. The interplay of financial agility, risk awareness, and proactive planning underscores the significance of informed decision-making when leveraging these facilities.

Ultimately, the prudent utilization of revolving credit facilities hinges on a balanced approach that integrates the benefits of flexibility and access with astute risk management and financial responsibility. Whether it’s seizing opportunities, managing cash flow, or strategically building credit, these facilities offer a dynamic platform for shaping financial strategies and responding to evolving needs.

As borrowers engage with revolving credit facilities, a proactive mindset that encompasses disciplined repayment practices, prudent borrowing decisions, and a keen awareness of associated costs can amplify the value derived from these financial instruments. By embracing these principles, individuals and businesses can harness the potential of revolving credit facilities as a cornerstone of their financial toolkit, fostering resilience, adaptability, and strategic resource management.

Embracing the intricacies of revolving credit facilities empowers borrowers to navigate the complexities of the modern financial landscape with confidence, leveraging these dynamic instruments to achieve their diverse financial goals and aspirations.