Home>Finance>How Does Platinum Card Calculate The Minimum Payment

Finance

How Does Platinum Card Calculate The Minimum Payment

Published: February 26, 2024

Learn how the Platinum Card calculates the minimum payment and manage your finances effectively. Find out the details you need to know.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Minimum Payment Calculation by Platinum Card

Welcome to the world of credit cards, where convenience meets responsibility. When you hold a prestigious Platinum Card, you gain access to a myriad of benefits and privileges. However, it's crucial to comprehend the nitty-gritty details associated with credit card usage, including the calculation of the minimum payment.

As a responsible cardholder, understanding how the minimum payment is calculated by your Platinum Card is paramount. This knowledge empowers you to make informed financial decisions and maintain a healthy credit profile. In this comprehensive guide, we will delve into the intricate process of minimum payment calculation, shedding light on the factors considered by Platinum Card and the methodology employed for this crucial financial aspect.

By the end of this article, you will gain a deeper understanding of the minimum payment calculation process, enabling you to navigate your credit card usage with confidence and prudence. So, let's embark on this enlightening journey to unravel the mysteries behind how your Platinum Card determines the minimum payment.

Understanding the Minimum Payment

Before delving into the specifics of how Platinum Card calculates the minimum payment, it’s essential to grasp the concept of the minimum payment itself. The minimum payment represents the lowest amount that a cardholder must pay by a specified due date to maintain their account in good standing. It is a crucial aspect of credit card usage, as failing to meet this minimum requirement can result in late fees, penalty interest rates, and a negative impact on the cardholder’s credit score.

While the minimum payment may seem like a fixed amount, it is typically calculated as a percentage of the outstanding balance, often with a minimum floor amount. This means that as the balance fluctuates, the minimum payment will also vary accordingly. Understanding the minimum payment is essential for responsible financial management, as it provides insight into the ongoing commitment required to manage credit card debt effectively.

Moreover, comprehending the minimum payment empowers cardholders to make informed decisions regarding their repayment strategy. By understanding how the minimum payment is determined, individuals can assess the impact of their spending and borrowing habits on their financial obligations. This knowledge serves as a foundation for prudent financial planning and fosters a proactive approach to managing credit card balances.

Overall, understanding the minimum payment is pivotal for maintaining financial discipline and optimizing the benefits of credit card usage. It serves as a gateway to responsible financial management and empowers cardholders to navigate their credit obligations with confidence and foresight.

Factors Considered by Platinum Card for Minimum Payment Calculation

When it comes to calculating the minimum payment for Platinum Card holders, several key factors come into play. Understanding these factors provides valuable insight into the methodology employed by the card issuer and sheds light on the nuances of minimum payment determination.

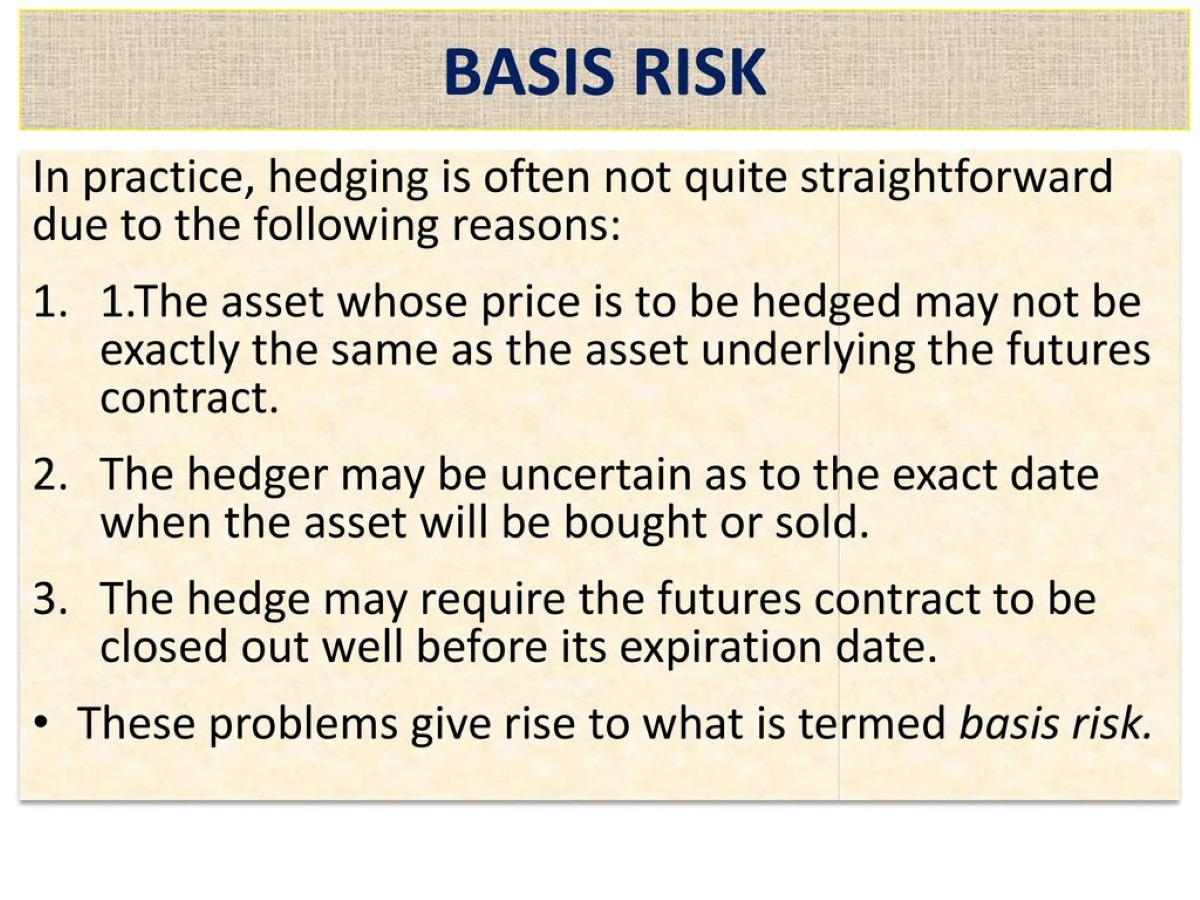

1. Outstanding Balance: The outstanding balance on the Platinum Card is a primary factor in minimum payment calculation. This balance includes the total amount owed on purchases, cash advances, and any applicable fees or finance charges. The minimum payment is often calculated as a percentage of this outstanding balance, typically ranging from 1% to 3% of the total amount due.

2. Interest Rate: The interest rate associated with the Platinum Card plays a significant role in minimum payment calculation. Higher interest rates can result in larger minimum payment requirements, especially when the outstanding balance is substantial. Cardholders with higher interest rates may face increased minimum payment obligations, emphasizing the importance of managing interest charges through timely repayment.

3. Fixed Minimum Amount: In addition to being calculated as a percentage of the outstanding balance, the minimum payment often includes a fixed minimum amount specified by the card issuer. This ensures that even if the calculated percentage results in a minimal figure, the minimum payment meets a predetermined threshold, safeguarding the issuer’s interests and promoting responsible repayment habits.

4. Regulatory Requirements: Regulatory guidelines and industry standards also influence the factors considered for minimum payment calculation. Card issuers, including those offering Platinum Cards, must adhere to legal and regulatory requirements governing minimum payment determination. These guidelines aim to protect consumers from predatory lending practices and ensure transparent and fair treatment in credit card management.

Understanding these factors provides cardholders with a comprehensive view of the elements that contribute to their minimum payment obligations. By recognizing the interplay between the outstanding balance, interest rates, fixed minimum amounts, and regulatory considerations, Platinum Card holders can navigate their financial responsibilities with clarity and foresight.

How Platinum Card Calculates the Minimum Payment

Understanding the methodology behind how Platinum Card calculates the minimum payment is crucial for cardholders seeking to manage their financial obligations effectively. The calculation process involves a combination of specific parameters and formulas that determine the minimum amount due each billing cycle.

1. Percentage of Outstanding Balance: One of the primary components in the minimum payment calculation is the percentage of the outstanding balance. This percentage, typically ranging from 1% to 3%, represents the portion of the total balance that cardholders are required to pay as a minimum. As the outstanding balance fluctuates, the minimum payment adjusts accordingly based on this predetermined percentage.

2. Fixed Minimum Amount: In addition to the percentage-based calculation, Platinum Card minimum payments often include a fixed minimum amount specified by the card issuer. This fixed amount serves as a safety net, ensuring that the minimum payment meets a predetermined threshold, regardless of the outstanding balance. By incorporating this fixed minimum, the issuer promotes responsible repayment practices and mitigates the risk of minimal payments on substantial balances.

3. Interest Charges and Fees: The calculation of the minimum payment also takes into account any accrued interest charges and applicable fees. These additional costs contribute to the total amount due and influence the minimum payment requirement. Cardholders with higher interest rates or outstanding fees may experience a larger minimum payment as a result of these financial factors.

4. Regulatory Compliance: The minimum payment calculation by Platinum Card issuers adheres to regulatory guidelines and industry standards. These standards ensure that the calculation process is transparent, fair, and compliant with legal requirements. By aligning with regulatory mandates, the minimum payment calculation maintains integrity and fosters trust between the card issuer and the cardholder.

By considering these elements, the Platinum Card calculates the minimum payment for each billing cycle, providing cardholders with a clear understanding of their financial obligations. This calculation process reflects a balance between the cardholder’s repayment capacity and the issuer’s risk management, aiming to facilitate responsible credit card usage while safeguarding the interests of both parties.

Importance of Understanding Minimum Payment Calculation

Comprehending the intricacies of minimum payment calculation holds significant importance for Platinum Card holders, as it directly impacts their financial well-being and credit management. By gaining a thorough understanding of this process, cardholders can make informed decisions, mitigate potential risks, and foster responsible financial habits.

1. Financial Planning: Understanding the minimum payment calculation empowers cardholders to engage in effective financial planning. By anticipating the minimum payment obligations based on their outstanding balance and interest rates, individuals can proactively allocate funds for repayment, ensuring that they meet their credit card obligations in a timely manner without incurring unnecessary financial strain.

2. Credit Score Management: The minimum payment calculation directly influences a cardholder’s credit score. Failing to meet the minimum payment requirement can result in negative repercussions, including late payment notations on credit reports and potential credit score damage. By comprehending the minimum payment calculation, cardholders can prioritize timely payments and safeguard their creditworthiness.

3. Debt Management: For individuals carrying a balance on their Platinum Card, understanding the minimum payment calculation is instrumental in effective debt management. By recognizing how the minimum payment fluctuates based on the outstanding balance and interest charges, cardholders can strategize their repayment approach, aiming to reduce debt efficiently and minimize interest costs over time.

4. Financial Literacy: The process of understanding minimum payment calculation fosters financial literacy among cardholders. It equips individuals with the knowledge and insight necessary to navigate the complexities of credit card usage, interest accrual, and repayment dynamics. This enhanced financial literacy promotes responsible financial decision-making and empowers cardholders to take control of their financial future.

5. Risk Mitigation: By understanding the minimum payment calculation, cardholders can mitigate the risk of incurring penalty fees, higher interest rates, and credit score damage. This awareness enables individuals to stay informed about their financial obligations, reducing the likelihood of missed payments and associated consequences.

Overall, the importance of understanding minimum payment calculation lies in its capacity to promote financial responsibility, empower informed decision-making, and facilitate prudent credit management. By embracing this knowledge, Platinum Card holders can navigate their credit obligations with confidence and foresight, ultimately contributing to their long-term financial well-being.

Conclusion

As we conclude our exploration of the minimum payment calculation process by Platinum Card, it becomes evident that a comprehensive understanding of this financial aspect is paramount for cardholders. By unraveling the intricacies of minimum payment calculation, individuals can embark on a journey toward responsible credit management, informed decision-making, and long-term financial well-being.

Through our examination, we have shed light on the factors considered by Platinum Card for minimum payment calculation, emphasizing the interplay between the outstanding balance, interest rates, fixed minimum amounts, and regulatory compliance. This holistic view provides cardholders with valuable insights into the dynamics shaping their minimum payment obligations, fostering transparency and clarity in credit card usage.

Moreover, we have delved into the methodology employed by Platinum Card in calculating the minimum payment, highlighting the role of the outstanding balance percentage, fixed minimum amount, interest charges, and regulatory compliance. This understanding equips cardholders with the knowledge necessary to navigate their financial responsibilities with prudence and foresight, ultimately contributing to their financial literacy and risk mitigation.

By recognizing the importance of understanding minimum payment calculation, cardholders can engage in effective financial planning, credit score management, debt management, and risk mitigation. This knowledge serves as a catalyst for informed decision-making, empowering individuals to proactively manage their credit card obligations and safeguard their financial well-being.

In essence, the journey toward understanding minimum payment calculation by Platinum Card transcends mere financial mechanics; it represents a commitment to financial literacy, responsibility, and empowerment. Armed with this knowledge, cardholders can navigate the world of credit cards with confidence, leveraging the benefits of their Platinum Card while maintaining a steadfast focus on prudent financial management.

As you continue your financial journey, may this understanding of minimum payment calculation serve as a guiding light, illuminating the path toward financial resilience and prosperity.