Finance

How Does The Stock Market Affect The Economy

Published: November 24, 2023

Learn how the stock market impacts the economy and find out the crucial role of finance in driving economic growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of the stock market

- The importance of the stock market in the economy

- How stock market fluctuations impact consumer confidence

- Impact of the stock market on business investment

- Stock market’s role in wealth creation and distribution

- Stock market’s influence on inflation and interest rates

- The link between the stock market and employment

- Government policies to regulate stock market volatility

- Conclusion

Introduction

The stock market is a complex and fascinating entity that plays a significant role in shaping the global economy. It is the place where individuals and institutions trade shares of publicly traded companies. While many people see the stock market as a separate entity from the economy, the reality is that the two are intricately connected. Understanding how the stock market affects the economy is crucial for investors, policymakers, and everyday citizens alike.

In this article, we will explore the relationship between the stock market and the economy, and how fluctuations in the stock market can have far-reaching implications. We will examine the impact of the stock market on consumer confidence, business investment, wealth creation, inflation, interest rates, employment, and the role of government in regulating stock market volatility.

By delving into these aspects, we will gain a deeper appreciation for the interconnectedness of the stock market and the economy. Moreover, this understanding will empower individuals to make informed investment decisions, help policymakers develop effective economic policies, and provide the general public with a clearer picture of the forces shaping their financial well-being.

Overview of the stock market

The stock market refers to the collection of exchanges and markets where buying and selling of stocks, also known as shares or equities, takes place. It provides a platform for companies to raise capital by selling ownership stakes to investors. Additionally, it allows individuals and institutions to buy and sell these ownership stakes, providing liquidity and facilitating price discovery.

There are several key players in the stock market. Companies that want to raise funds issue shares, which represent a portion of their ownership. These shares are bought by individual and institutional investors, such as mutual funds, pension funds, and hedge funds. Investors can trade these shares through various exchanges, such as the New York Stock Exchange (NYSE) or Nasdaq.

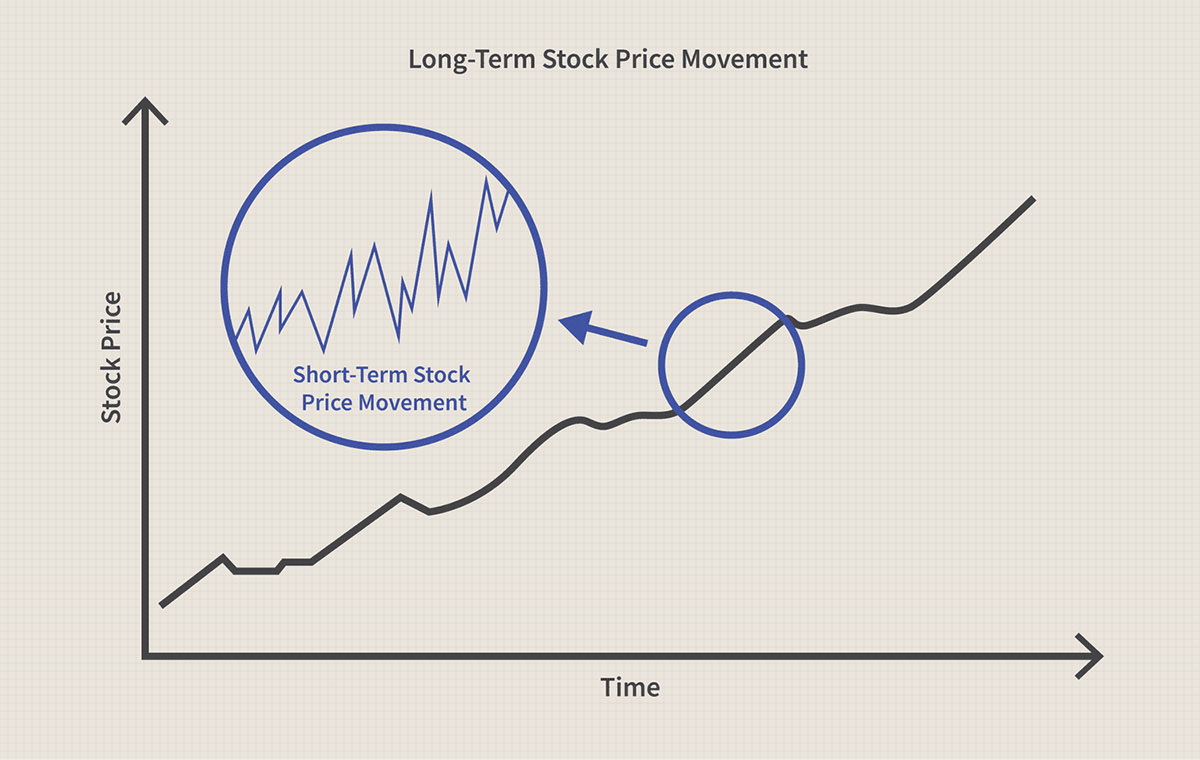

The stock market operates based on the principle of supply and demand. When there is high demand for a particular stock, its price tends to rise. Conversely, if there is an abundance of supply, the price may decline. The constantly changing prices reflect the collective opinions and expectations of investors, driven by factors such as company performance, economic indicators, geopolitical events, and investor sentiment.

Stocks are classified into different categories based on various criteria. For example, companies may be categorized by industry sectors, market capitalization (the total value of a company’s outstanding shares), or geographic location. Some common types of stocks include blue-chip stocks (shares of large, stable companies), growth stocks (shares of companies expected to experience rapid growth), and dividend stocks (shares that pay regular dividends to shareholders).

It’s important to note that the stock market is not limited to domestic exchanges. Globalization and advancements in technology have enabled investors to trade stocks from around the world, providing opportunities for diversification and exposure to different markets and economies.

Overall, the stock market serves as a vital component of the global financial system, enabling companies to raise capital, providing liquidity to investors, and facilitating investment opportunities and wealth creation for individuals and institutions alike. Its importance extends beyond just the financial sector, as it influences economic activity, investor confidence, and overall market sentiment, making it a key barometer of economic health.

The importance of the stock market in the economy

The stock market plays a crucial role in the economy by fulfilling several important functions. It facilitates the efficient allocation of capital, promotes economic growth, and serves as an indicator of overall market sentiment and economic health.

One of the primary functions of the stock market is to allocate capital efficiently. When companies need to raise funds for expansion or investment, they can issue shares to the public through initial public offerings (IPOs) or secondary offerings. By selling ownership stakes to investors, companies can obtain the necessary capital to fuel their growth, innovate, and create jobs. This process of capital formation is essential for economic development and enables businesses to expand their operations and contribute to GDP growth.

Furthermore, the stock market promotes economic growth by providing a platform for entrepreneurs and startups to access funding. By listing their shares on the stock market, small and medium-sized enterprises (SMEs) can attract investment and expand their operations. This promotes entrepreneurship, fosters innovation, and drives job creation. Additionally, the stock market can act as a signaling mechanism for investors, indicating the confidence and potential of a company. This can attract further investment and support the development of new enterprises.

The stock market also serves as an indicator of overall market sentiment and economic health. Stock indices, such as the S&P 500 or Dow Jones Industrial Average, provide a snapshot of how the broader market is performing. Changes in stock prices can reflect investor expectations and sentiment about the economy. For example, a rising stock market can indicate optimism and confidence, which can spur consumer spending and business investment. Conversely, a declining stock market may lead to caution and reduced spending, potentially dampening economic activity.

Moreover, the stock market influences consumer behavior and confidence. Many individuals’ wealth is tied to the performance of their investment portfolios, including retirement accounts and mutual funds. When the stock market performs well, it can lead to increased wealth and disposable income, boosting consumer spending. On the other hand, a downturn in the market can erode confidence, leading to reduced consumption and potential economic contraction.

In summary, the stock market is a critical component of the economy, driving capital formation, promoting economic growth, and influencing market sentiment. Its ability to efficiently allocate resources, provide funding to businesses, and serve as a barometer of economic health make it an invaluable tool for investors, entrepreneurs, policymakers, and all those with a stake in the economy.

How stock market fluctuations impact consumer confidence

Consumer confidence is a key driver of economic activity. When consumers feel optimistic about their financial well-being and the overall state of the economy, they are more likely to spend money on goods and services. Conversely, when consumer confidence is low, individuals tend to be more cautious with their spending, which can have a negative impact on economic growth. The stock market plays a significant role in shaping consumer confidence, as fluctuations in stock prices can have a direct impact on households’ wealth and perception of economic conditions.

A rising stock market can have a positive effect on consumer confidence. When stock prices increase, individuals who own stocks or have investments in mutual funds or retirement accounts experience a boost in their wealth. This “wealth effect” can lead to increased consumer spending as individuals feel more financially secure and confident in their future. Higher consumer spending, in turn, stimulates economic growth by driving demand and supporting business revenue.

On the other hand, a declining stock market can have a dampening effect on consumer confidence. Falling stock prices can erode individuals’ investment portfolios, leading to a decrease in their perceived wealth. This can result in reduced consumer spending as individuals become more cautious about their financial situation. The fear of further losses can lead to a “wait and see” approach, where consumers delay discretionary purchases and focus on saving or paying down debt. This decrease in consumer spending can create a ripple effect throughout the economy, impacting businesses and potentially leading to a slowdown in economic growth.

Not only do stock market fluctuations directly impact consumer wealth, but they can also indirectly influence consumer sentiment. Media coverage of stock market volatility and negative economic outlooks can create a sense of uncertainty and anxiety among consumers. This can further contribute to a decline in consumer confidence, as individuals may worry about the stability of their jobs, future income prospects, and ability to meet financial obligations. The psychological impact of negative news and market turbulence can influence consumer behavior, leading to reduced spending and a more cautious approach to financial decisions.

It is worth noting that consumer confidence is influenced by a multitude of factors, including employment rates, wage growth, inflation, and government policies. However, the stock market has a unique ability to capture public attention and shape perceptions of the economy. Its influence on consumer confidence underscores the importance of monitoring and understanding stock market fluctuations, as they can have significant implications for economic growth and stability.

In summary, stock market fluctuations have a direct and indirect impact on consumer confidence. A rising stock market can boost consumer wealth and stimulate spending, while a declining market can erode wealth and lead to cautious consumer behavior. Understanding the relationship between the stock market and consumer confidence is crucial for policymakers, businesses, and individuals, as it provides insights into the dynamics of consumer spending and overall economic health.

Impact of the stock market on business investment

The stock market plays a significant role in influencing business investment decisions. Fluctuations in stock prices can have both direct and indirect effects on the willingness of companies to invest in expanding their operations, developing new products, and exploring innovative opportunities. Understanding the impact of the stock market on business investment is crucial for policymakers and investors, as it can provide insights into the overall investment climate and economic growth prospects.

One of the key ways in which the stock market affects business investment is through its influence on the cost of capital. When stock prices are high and market conditions are favorable, companies may find it easier to raise capital through equity issuance. This can provide them with the necessary funds to invest in research and development, acquire new assets, or expand their production capacity. Conversely, during periods of market downturn or low investor confidence, companies may face challenges in raising capital, which can hinder their investment plans.

Stock market performance can also impact business investment decisions by affecting investor sentiment and corporate earnings expectations. A positive stock market can create a sense of optimism and confidence among investors, leading to increased demand for shares of publicly traded companies. This can result in higher stock valuations and market capitalization for these companies, providing them with a stronger financial position to pursue investment opportunities. Conversely, a declining stock market can create a more cautious investment climate, leading companies to scale back on their investment plans and focus on cost-cutting measures.

Furthermore, the stock market acts as an important barometer and signaling mechanism for businesses and investors. Stock prices reflect market expectations and perceptions of company performance and future prospects. When the stock market is performing well, it can indicate robust economic conditions and growth opportunities, which can encourage companies to invest in new projects and expand their operations. Conversely, a bearish market can signal economic uncertainty or contraction, leading companies to take a more conservative approach to investment and focus on maintaining financial stability.

Another way in which the stock market influences business investment is through its impact on mergers and acquisitions (M&A) activity. During periods of favorable market conditions, companies may be more inclined to engage in M&A deals as a means of growth and diversification. Higher stock prices can drive up the value of potential acquisition targets, making such deals more attractive. M&A activity can result in increased investment in the form of capital expenditures and research and development, as companies combine resources and expertise to drive innovation and efficiency.

It is important to note that the impact of the stock market on business investment is not always straightforward or immediate. Other factors such as interest rates, government policies, industry-specific dynamics, and technological advancements also influence investment decisions. Nonetheless, the stock market’s role in shaping investor sentiment, providing access to capital, and acting as a signaling mechanism make it a crucial factor in driving business investment and economic growth.

In summary, the stock market has a significant impact on business investment decisions. It influences the cost of capital, investor sentiment, corporate earnings expectations, and M&A activity. Understanding the relationship between the stock market and business investment is essential for policymakers and investors alike, as it can provide insights into the overall investment climate and economic prospects.

Stock market’s role in wealth creation and distribution

The stock market plays a crucial role in the creation and distribution of wealth, providing individuals and institutions with opportunities to grow their financial assets and participate in the success of businesses. By facilitating investments in publicly traded companies, the stock market offers individuals the potential to generate returns and build wealth over time. Moreover, it promotes the distribution of wealth by allowing investors of all backgrounds to access investment opportunities and share in the profits generated by companies.

One way in which the stock market contributes to wealth creation is through capital appreciation. When individuals invest in stocks, they have the opportunity to benefit from the increase in share prices over time. As companies grow and generate profits, their stock prices tend to rise, allowing investors to realize capital gains when they sell their shares. This capital appreciation can significantly contribute to the growth of individuals’ investment portfolios and overall net worth.

In addition to capital appreciation, the stock market offers the potential for income generation through dividends. Many publicly traded companies distribute a portion of their earnings to shareholders in the form of regular dividend payments. These dividends provide a steady stream of income for investors, particularly those seeking supplemental income or approaching retirement. Reinvesting dividends can also accelerate wealth creation, as compounding returns over time can lead to substantial growth in investment values.

Moreover, the stock market facilitates wealth distribution by providing individuals of all income levels with the opportunity to invest and participate in the financial markets. Through stock ownership, individuals can share in the profits and success of companies, regardless of their personal wealth. This allows for a more equitable distribution of wealth, as even small investments in stocks can yield meaningful returns and contribute to individuals’ financial well-being. The availability of platforms and technology that enable individuals to easily invest in stocks further promotes accessibility and inclusivity.

The stock market also promotes wealth distribution by encouraging participation from institutional investors such as pension funds, endowments, and mutual funds. These institutions manage large pools of capital on behalf of their beneficiaries or investors and invest in a diversified portfolio of stocks. As these institutional investors generate returns, their gains filter down to individual investors and beneficiaries, enhancing wealth creation and distribution across various segments of society.

Furthermore, the stock market promotes economic growth, which in turn contributes to overall wealth creation and distribution. When companies are able to raise capital through the stock market, they have the resources to expand their operations, develop new products, invest in research and development, and create job opportunities. This growth not only benefits shareholders but also has a broader positive impact on the economy, leading to increased employment, higher wages, and improved standards of living.

However, it’s important to note that the stock market’s role in wealth creation and distribution is not without its challenges. Market volatility, economic downturns, and disparities in financial literacy and access to capital can hinder the ability of individuals to fully participate and benefit from stock market investments. Additionally, the concentration of wealth among a select few individuals or institutions can contribute to income inequality. Therefore, it is important to continuously work towards creating an inclusive and fair stock market ecosystem that allows for widespread wealth creation and distribution.

In summary, the stock market plays a vital role in wealth creation and distribution. It offers individuals the opportunity to generate returns through capital appreciation and dividends, promotes access to investment opportunities for individuals of all income levels, and supports economic growth. By facilitating the accumulation and distribution of wealth, the stock market contributes to the prosperity of individuals, communities, and the overall economy.

Stock market’s influence on inflation and interest rates

The stock market can have a significant influence on inflation and interest rates, two key factors that shape the overall economic environment. Fluctuations in the stock market can impact inflation by affecting consumer spending, business investment, and market expectations. Additionally, the stock market plays a role in determining interest rates, as it reflects investor sentiment and market conditions that influence borrowing costs and monetary policy decisions.

One way in which the stock market influences inflation is through its impact on consumer spending. When the stock market performs well and stock prices increase, individuals may experience a boost in their wealth and financial assets. This “wealth effect” can lead to increased consumer confidence and higher spending levels. Higher consumer spending, in turn, can drive up aggregate demand for goods and services, potentially leading to increased prices and inflationary pressures.

Furthermore, the stock market’s influence on business investment can also impact inflation. When stock prices are high and market conditions are favorable, companies may be more inclined to invest in expanding their operations, developing new products, and hiring additional employees. Increased business investment can stimulate economic growth and potentially lead to higher demand for resources, labor, and raw materials. This increased demand can put upward pressure on prices and contribute to inflation.

In addition to its influence on inflation, the stock market can also affect interest rates. Central banks, such as the Federal Reserve in the United States, closely monitor stock market performance and take it into consideration when formulating monetary policy decisions. A booming stock market and high investor confidence can signal a strong economy, potentially prompting central banks to raise interest rates as a measure to control inflation and prevent overheating. On the other hand, a struggling stock market and declining investor confidence can signal economic weakness, leading central banks to lower interest rates to stimulate borrowing and investment.

Moreover, the stock market’s impact on interest rates extends beyond monetary policy decisions. Stock market performance influences investor sentiment, which in turn affects borrowing costs and financial conditions. When the stock market is performing well, investors tend to have a positive outlook on the economy and are more willing to take on risk. This can lead to lower borrowing costs, as lenders perceive lower risk in the market. Conversely, during periods of stock market volatility or negative investor sentiment, lenders may increase borrowing costs to compensate for perceived higher risk, which can contribute to higher interest rates for borrowers.

It’s important to note that the relationship between the stock market, inflation, and interest rates is complex, and other factors also play a significant role. Economic indicators, government policies, global market conditions, and supply and demand dynamics all interact to shape inflation and interest rates. Additionally, the stock market can also be influenced by inflation and interest rate expectations, creating a feedback loop between these variables.

In summary, the stock market has the potential to influence inflation and interest rates through its impact on consumer spending, business investment, market expectations, and monetary policy decisions. Understanding the interplay between the stock market and these macroeconomic factors is essential for policymakers, businesses, and investors, as it provides insights into the broader economic environment and future market conditions.

The link between the stock market and employment

The stock market and employment are closely interlinked, with fluctuations in the stock market having the potential to impact job creation, hiring decisions, and overall employment levels. As a barometer of economic health and investor sentiment, the stock market plays a significant role in shaping business confidence, investment decisions, and the labor market.

When the stock market is performing well and stock prices are rising, it can have a positive impact on employment. A bullish stock market often signals economic growth, which can lead companies to increase their investments, expand their operations, and hire new employees. Higher stock prices can boost the financial position of businesses, making it easier for them to access capital for investment and expansion. This can create a ripple effect, stimulating job creation across various sectors of the economy.

Moreover, a robust stock market can improve investor sentiment and overall market confidence. This can lead to increased consumer spending, as individuals feel more financially secure and confident in their future prospects. Higher consumer spending, in turn, can drive up demand for goods and services, prompting businesses to hire additional workers to meet this increased demand. Thus, a flourishing stock market can contribute to positive employment trends, reducing unemployment rates and improving labor market conditions.

Conversely, a decline in the stock market can have a dampening effect on employment. During periods of stock market volatility or bearish conditions, businesses may become more cautious and conservative in their hiring decisions. Heightened uncertainty and reduced investor confidence can lead to a slowdown in business investment, potentially resulting in hiring freezes, layoffs, or reduced job creation. This can contribute to an increase in unemployment rates and weaken the overall labor market.

Additionally, the stock market can impact employment through its influence on certain industries and sectors. For example, companies in the financial sector, such as banks and investment firms, are particularly sensitive to stock market fluctuations. In times of stock market turmoil, these firms may face challenges and implement cost-cutting measures, which can lead to job losses within the industry. Conversely, during a bull market, financial firms may experience growth and expansion, leading to increased hiring opportunities.

It’s important to note that the link between the stock market and employment is not always immediate or direct. Employment decisions are influenced by a multitude of factors, including long-term business strategies, productivity levels, industry-specific dynamics, and government policies. Moreover, the effects of stock market fluctuations on employment can vary across different countries and regions, depending on their economic structures and labor market conditions.

In summary, the stock market and employment are intertwined, with fluctuations in the stock market having the potential to impact job creation, hiring decisions, and overall labor market conditions. A robust stock market can contribute to positive employment trends, while a decline in the stock market can lead to job losses and weakened labor market conditions. Understanding the relationship between the stock market and employment is crucial for policymakers, businesses, and individuals alike, as it provides insights into the broader economic landscape and the factors influencing employment opportunities.

Government policies to regulate stock market volatility

Regulating stock market volatility is a crucial aspect of maintaining market stability and investor confidence. Governments around the world implement various policies and regulations to mitigate excessive volatility, prevent market manipulation, and protect investors. These policies aim to ensure fairness, transparency, and efficient functioning of the stock market. While approaches may differ across jurisdictions, some common government policies to regulate stock market volatility include market surveillance, circuit breakers, margin requirements, and enforcement of insider trading regulations.

One of the key government policies used to regulate stock market volatility is market surveillance. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, monitor and oversee market activities to detect any signs of manipulation, fraud, or disruptive trading practices. Through real-time monitoring, regulators can identify abnormal trading patterns or unusual activities that may indicate market manipulation or potential risks to market stability. By promptly investigating and taking appropriate actions, regulators can help maintain market integrity and prevent excessive volatility.

Circuit breakers are another tool used by governments to regulate stock market volatility. These are predetermined thresholds that trigger temporary halts in trading when the market experiences significant fluctuations within a short period. Circuit breakers provide a cooling-off period for investors and allow time for market participants to digest information and reassess their trading strategies. These temporary suspensions help prevent panic selling and provide an opportunity for market stabilization by limiting extreme price movements.

Margin requirements are regulations that dictate the amount of cash or collateral that an investor must deposit when trading on margin, which involves borrowing funds to purchase securities. By setting these requirements, governments aim to prevent excessive speculation and leverage in the stock market. Higher margin requirements make it more difficult for investors to take on large, risky positions, reducing the likelihood of destabilizing market activities and excessive volatility.

Enforcement of insider trading regulations is another critical aspect of government policies aimed at regulating stock market volatility. Insider trading refers to the illegal practice of trading on non-public information, giving an unfair advantage to those who possess this information. Governments enforce strict regulations to prevent insider trading and protect the integrity of the market. By detecting and punishing individuals engaged in insider trading, governments send a strong message that such unethical practices will not be tolerated. This helps maintain investor confidence and ensures a level playing field for all market participants.

In addition to these specific policies, governments also play a broader role in implementing and overseeing regulations and oversight of the financial industry. These regulations include practices related to corporate governance, accounting standards, disclosure requirements, and investor protection frameworks. By ensuring transparency and accountability in the financial system, governments aim to enhance market efficiency, reduce information asymmetry, and promote investor confidence.

However, it’s important to strike a balance between regulation and market efficiency. Excessive regulation or overly restrictive policies can stifle innovation, liquidity, and market participation. Therefore, governments need to continuously assess and adapt their regulatory frameworks to address emerging risks, technological advancements, and changing market dynamics while maintaining a fair and competitive market environment.

In summary, government policies play a crucial role in regulating stock market volatility. Market surveillance, circuit breakers, margin requirements, enforcement of insider trading regulations, and broader financial industry oversight are some of the tools used to maintain market stability and protect investors. By implementing effective regulations and enforcement mechanisms, governments can foster confidence, transparency, and a resilient stock market that supports economic growth and investor participation.

Conclusion

The stock market, with its complex dynamics and interconnectedness with the economy, plays a vital role in shaping our financial landscape and influencing economic outcomes. It serves as a platform for capital formation, wealth creation, and distribution, impacting various aspects of our lives, from employment to inflation and interest rates. Understanding the relationship between the stock market and the economy is crucial for investors, policymakers, and individuals seeking to navigate the financial world successfully.

The stock market’s impact on the economy is multifaceted. It influences consumer confidence, driving consumer spending and economic growth. Fluctuations in the stock market can shape business investment decisions, impacting job creation and employment levels. Additionally, the stock market helps create and distribute wealth, enabling individuals to participate in the success of businesses and benefit from capital appreciation and dividends. Its influence on inflation and interest rates highlights the indirect impact it has on the overall economic environment.

Government policies play a crucial role in regulating stock market volatility and ensuring market integrity. Market surveillance, circuit breakers, margin requirements, and enforcement of insider trading regulations are just a few examples of the policies implemented to maintain stability. Governments also have a broader responsibility to establish transparent and fair market regulations while supporting investor protection and fostering market efficiency.

To navigate the stock market effectively, individuals must stay informed, develop financial literacy, and make informed investment decisions. Being aware of the linkages between the stock market and the economy can help individuals better understand the implications of market fluctuations and make sound investment choices.

In conclusion, the stock market is a dynamic force that significantly influences the economy. Its role in capital formation, wealth creation, and distribution cannot be underestimated. By understanding the relationship between the stock market and the broader economic landscape, individuals and policymakers can make informed decisions that contribute to sustainable economic growth, financial stability, and prosperity for all.