Finance

How Does Inflation Affect The Stock Market?

Published: October 19, 2023

Understand the impact of inflation on the stock market and make informed financial decisions. Discover how inflation influences the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Inflation

- Relationship between Inflation and Stock Market

- Impact of Inflation on Stock Market Returns

- Influence of Inflation on Stock Market Volatility

- Effects of Inflation on Different Sectors of the Stock Market

- How Investors Can Navigate Inflationary Environments in the Stock Market

- Conclusion

Introduction

The stock market is a complex and ever-changing arena, influenced by a multitude of factors. One such factor that plays a significant role in shaping the stock market’s performance is inflation. Inflation refers to the sustained increase in the general price level of goods and services in an economy over time. It erodes the purchasing power of money and affects various aspects of the economy, including the stock market. Understanding the relationship between inflation and the stock market is crucial for investors to make informed decisions and navigate market fluctuations.

In this article, we will explore how inflation impacts the stock market and its implications for investors. We will examine the relationship between inflation and stock market returns, the influence of inflation on stock market volatility, and the effects of inflation on different sectors of the stock market. Additionally, we will provide insights on how investors can navigate inflationary environments in the stock market for better financial outcomes.

It’s important to note that the relationship between inflation and the stock market is not always straightforward. While inflation can have both positive and negative effects, its impact on the stock market largely depends on the prevailing economic conditions and market dynamics.

Now, let’s dig deeper into the complexities of inflation and its interaction with the stock market.

Understanding Inflation

Inflation is a fundamental concept in economics that refers to the sustained increase in the general price level of goods and services in an economy over a period of time. It measures the decrease in the purchasing power of money, as it takes more currency to buy the same amount of goods and services.

There are various causes of inflation, including an increase in the money supply, demand-pull factors, and cost-push factors. When there is an excessive increase in the money supply, often caused by central banks, it can lead to inflation as more money is chasing the same amount of goods and services. Demand-pull factors occur when there is an increase in aggregate demand, causing prices to rise. On the other hand, cost-push factors result from an increase in production costs, such as wages or raw materials, putting upward pressure on prices.

Inflation is typically measured using an inflation index, such as the Consumer Price Index (CPI), which tracks the changes in the prices of a basket of goods and services commonly purchased by households. Governments and central banks closely monitor inflation rates as part of their monetary policy to ensure price stability and sustainable economic growth.

Inflation can have both positive and negative effects on an economy. A moderate level of inflation, often targeted by central banks, can be beneficial as it encourages spending and investment. It can also help reduce the burden of debts and stimulate economic growth. However, high levels of inflation, known as hyperinflation, can have severe consequences, such as eroding savings, increasing uncertainty, and causing economic instability.

Understanding inflation is essential for investors as it affects various aspects of the economy, including the stock market. The relationship between inflation and the stock market is complex and multifaceted. In the next section, we will explore how inflation impacts stock market returns and volatility.

Relationship between Inflation and Stock Market

The relationship between inflation and the stock market is a topic of great interest among investors and economists. Understanding this relationship is crucial for investors to assess the potential impact of inflation on their investment portfolios. While the relationship can be influenced by various factors, there are some general trends that can be observed.

Historically, there has been a negative correlation between inflation and stock market returns. This means that when inflation is high, stock market returns tend to be lower, and vice versa. The main reason behind this negative correlation is the effect of inflation on interest rates.

During periods of high inflation, central banks often employ tight monetary policies to combat rising prices. This includes increasing interest rates to reduce borrowing and spending. Higher interest rates make borrowing more expensive for businesses, leading to reduced investment and lower profitability. As a result, stock market returns may decrease as companies face challenges in generating profits.

On the other hand, when inflation is low, central banks may implement looser monetary policies, such as lowering interest rates, to stimulate economic activity. Lower interest rates make borrowing cheaper, encouraging businesses to invest and expand. This can lead to higher profitability and potentially higher stock market returns.

It’s important to note, however, that the relationship between inflation and stock market returns is not always consistent or predictable. Other factors, such as economic conditions, market sentiment, geopolitical events, and company-specific factors, also play a significant role in determining stock market performance.

Furthermore, the impact of inflation on different sectors of the stock market can vary. Some sectors, such as utilities and consumer staples, are often considered more defensive and less sensitive to inflation. These sectors may be better able to pass on increased costs to consumers, maintaining their profitability during inflationary periods. On the other hand, sectors such as technology or industrials may be more vulnerable to inflationary pressures as their costs, such as raw materials or labor, may increase.

Next, we will explore the impact of inflation on stock market returns and volatility in more detail to gain a deeper understanding of the relationship between these two key factors.

Impact of Inflation on Stock Market Returns

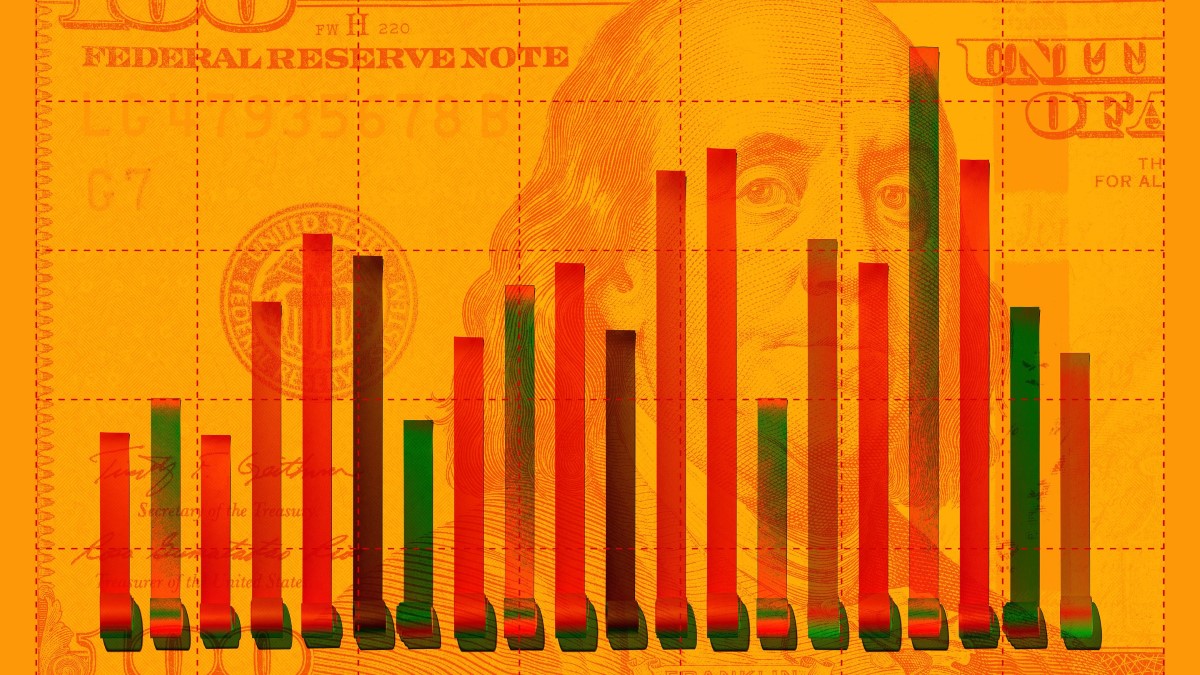

The impact of inflation on stock market returns is a topic of significant interest for investors. While the relationship between inflation and stock market returns can be complex and influenced by various factors, there are some general trends that can be observed.

During periods of high inflation, stock market returns tend to be lower. This is mainly due to the effect of inflation on interest rates. When inflation rises, central banks often implement tight monetary policies to combat rising prices. These policies typically involve increasing interest rates, which can have a negative impact on stock market returns.

Higher interest rates make borrowing more expensive for businesses, resulting in reduced investment and lower profitability. Companies may face challenges in generating profits as the costs of borrowing and doing business increase. Consequently, stock market returns may be negatively affected.

On the other hand, during periods of low inflation, stock market returns may be higher. Inflationary pressures are generally low when central banks implement loose monetary policies, such as lowering interest rates. Lower interest rates make borrowing cheaper, which encourages businesses to invest, expand, and potentially generate higher profitability. This can contribute to higher stock market returns.

It’s important to note that the relationship between inflation and stock market returns is not always consistent or predictable. Other factors, such as economic conditions, market sentiment, geopolitical events, and company-specific factors, also play a significant role in determining stock market performance.

It is worth mentioning that long-term investors should not base their investment decisions solely on short-term fluctuations in stock market returns due to inflation. Investing in a diversified portfolio, focusing on quality companies with strong fundamentals, and maintaining a long-term perspective can help navigate the effects of inflation on stock market returns.

Additionally, investors can consider other asset classes that have historically acted as inflation hedges, such as real estate, commodities, and inflation-protected securities. These assets may provide protection against inflation and offer an alternative investment opportunity to diversify risk and potentially enhance returns.

Ultimately, understanding the impact of inflation on stock market returns can help investors make informed decisions and adjust their investment strategies accordingly. Monitoring economic indicators, central bank actions, and market dynamics can provide valuable insights into the potential effects of inflation on stock market performance.

Influence of Inflation on Stock Market Volatility

Inflation can have a significant impact on stock market volatility, which refers to the degree of variation in stock prices over time. Understanding the relationship between inflation and stock market volatility is crucial for investors, as it can impact the level of risk and uncertainty in the market.

One key way in which inflation influences stock market volatility is through its effect on interest rates. When inflation rises, central banks often respond by implementing tight monetary policies, including increasing interest rates. Higher interest rates can increase the cost of borrowing for businesses, leading to reduced investment and profitability. This can create uncertainty and volatility in the stock market, as investors become more cautious about the future prospects of companies.

Additionally, inflation can also impact investor sentiment and market expectations. High levels of inflation can erode the purchasing power of individuals, leading to diminished consumer spending and economic uncertainty. This can create a negative sentiment in the stock market, resulting in increased volatility as investors become more risk-averse.

Furthermore, inflation can affect different sectors of the stock market in varying ways, which can contribute to overall market volatility. Some sectors, such as utilities and consumer staples, are often considered more defensive and less sensitive to inflation. These sectors provide essential goods and services that are in demand regardless of inflationary pressures. As a result, their stock prices may be more stable, leading to lower volatility. On the other hand, sectors such as technology or industrials may be more sensitive to inflation, as increased costs of raw materials or labor can impact their profitability. This can result in higher volatility within these sectors and potentially in the overall stock market.

It is worth noting that periods of low inflation can also contribute to stock market volatility. In an environment of low inflation, central banks may implement loose monetary policies, such as lowering interest rates, to stimulate economic activity. While this can lead to higher stock market returns, it can also result in excessive risk-taking and speculative behavior, which can increase market volatility.

Overall, the influence of inflation on stock market volatility is complex and can be influenced by a range of factors. Investors should carefully monitor economic indicators, central bank actions, and market dynamics to assess the potential impact of inflation on stock market volatility. Diversifying investments, staying informed about market trends, and maintaining a long-term perspective can help investors navigate the fluctuations and uncertainties caused by inflation in the stock market.

Effects of Inflation on Different Sectors of the Stock Market

Inflation can have varied effects on different sectors of the stock market. Some sectors may be more resilient to inflationary pressures, while others may face challenges and uncertainties. Understanding these effects can help investors make informed decisions and effectively navigate the stock market in times of inflation.

1. Consumer Staples: Consumer staples refer to essential goods and products that individuals continue to purchase regardless of inflationary pressures. These include items such as food, beverages, household products, and personal care items. Consumer staples companies tend to be less affected by inflation, as they can pass on increased costs to consumers without significantly impacting demand. Hence, their stock prices may remain relatively stable during periods of inflation.

2. Utilities: Utility companies provide essential services such as electricity, gas, and water. These services are in constant demand, regardless of inflation. While utility companies may face increased costs due to inflation, they are often regulated and have the ability to pass on these costs to consumers through pricing adjustments. As a result, utility stocks are often considered defensive investments that can provide stability during inflationary periods.

3. Technology: The technology sector can be influenced by inflation in various ways. Increased costs of raw materials and labor can impact technology companies’ profitability. Additionally, high inflation can lead to an increase in interest rates, affecting borrowing costs for technology companies focused on innovation and expansion. However, some technology companies may also benefit from technological advancements that can help them streamline operations and reduce costs. The impact of inflation on technology stocks can differ depending on the specific company and industry niche.

4. Materials and Commodities: The materials and commodities sector includes industries involved in extracting and processing natural resources like metals, energy, and agriculture. Inflation can have mixed effects on this sector. On one hand, the prices of raw materials, such as oil or metals, tend to rise with inflation, which can benefit companies engaged in their production. On the other hand, increased costs of production and transportation can impact profitability. Additionally, demand for commodities can be influenced by economic conditions, which may be affected by inflation.

5. Financial Services: The financial services sector, including banks, insurance companies, and asset management firms, can be impacted by inflation in several ways. Higher inflation rates can result in increased interest rates, which can affect the cost of borrowing and lending for financial institutions. However, financial services companies may also benefit from inflation if they can adjust their pricing and interest rates accordingly. The impact of inflation on financial services stocks can vary depending on the prevailing interest rate environment and the performance of the broader economy.

It is important to note that the effects of inflation on sectors of the stock market can vary based on factors such as market conditions, specific company dynamics, and the overall economic landscape. Additionally, sector performance can be influenced by company-specific factors that may outweigh the impact of inflation. Therefore, investors should conduct thorough research and analysis to assess the potential impacts of inflation on individual sectors and select investments accordingly.

How Investors Can Navigate Inflationary Environments in the Stock Market

Navigating the stock market during inflationary environments requires careful consideration and a strategic approach. While inflation can create challenges and uncertainties, there are several strategies that investors can employ to navigate these conditions and potentially protect their portfolios.

1. Diversification: Building a well-diversified portfolio is crucial in any market environment, including inflationary periods. Diversification helps spread risk and reduces exposure to any single sector or asset class. Investors can consider holding a mix of stocks from different sectors, as well as other asset classes such as bonds, real estate, and commodities. Diversification can help mitigate the impact of inflation on specific sectors or industries.

2. Inflation-Protected Securities: Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), are bonds that adjust their value based on inflation. These securities provide a hedge against inflation, as their principal value increases with rising inflation. Including TIPS in a portfolio can help investors maintain the purchasing power of their investments during inflationary periods.

3. Focus on Quality: Investing in quality companies with strong fundamentals can be a prudent strategy during inflationary environments. Companies with stable cash flows, low levels of debt, and competitive advantages may be better positioned to weather inflationary pressures. These companies tend to have the ability to pass on increased costs to consumers and maintain profitability, making them more resilient during inflationary periods.

4. Consider Inflation-Resistant Sectors: Some sectors tend to perform relatively well during inflationary periods. Sectors such as consumer staples, utilities, and materials/commodities may have more stable earnings and pricing power that can help them navigate the impacts of inflation. Investing in companies within these sectors can provide a potential hedge against inflation.

5. Monitor Interest Rates: Inflation is closely linked to interest rates, so monitoring interest rate movements and central bank policies is essential during inflationary periods. Higher interest rates can impact borrowing costs for businesses and influence consumer spending. By staying informed about interest rate trends, investors can adjust their portfolio strategies accordingly.

6. Stay Informed and Adapt: Inflationary environments can be dynamic and evolve over time. It is important for investors to stay informed about economic indicators, inflation data, and market trends. Being aware of changing conditions can allow investors to adapt their strategies and make informed decisions as the market landscape shifts.

7. Long-Term Perspective: Lastly, maintaining a long-term perspective is vital during inflationary periods. Short-term market fluctuations driven by inflation should not deter investors from their long-term investment goals. Historically, the stock market has shown resilience over the long term, even in the face of inflation. Having a disciplined approach and avoiding knee-jerk reactions can help investors stay focused on their financial objectives.

In summary, navigating inflationary environments in the stock market requires a combination of diversification, strategic asset allocation, and staying informed about market dynamics. By considering inflation-resistant sectors, focusing on quality companies, and adapting investment strategies to changing conditions, investors can potentially navigate the challenges and uncertainties posed by inflation while seeking long-term investment success.

Conclusion

Inflation is a critical factor that can significantly impact the stock market. Understanding the relationship between inflation and the stock market is essential for investors to make informed decisions and successfully navigate market fluctuations.

While inflation can have both positive and negative effects on the stock market, historical trends suggest a negative correlation between high inflation and stock market returns. This is primarily attributed to the impact of inflation on interest rates, which can reduce profitability and investment in businesses, thereby affecting stock market performance.

Furthermore, inflation can influence stock market volatility, as it creates uncertainty and affects investor sentiment. Different sectors of the stock market can be affected by inflation in various ways, with some sectors being more resilient than others. Consumer staples and utilities are often considered defensive sectors that can maintain stability during inflationary periods. Technology and materials/commodities sectors may experience more variability, depending on the specific dynamics of companies operating within those sectors.

To navigate inflationary environments in the stock market, investors can employ various strategies. Diversification across different asset classes and sectors can help spread risk. Additionally, considering inflation-protected securities and focusing on quality companies with strong fundamentals can provide a potential hedge against inflation’s impact. Monitoring interest rates, staying informed, and maintaining a long-term perspective are also essential.

It’s important to note that the relationship between inflation and the stock market is not always predictable, as other factors such as economic conditions, market sentiment, and company-specific dynamics also play significant roles. Therefore, ongoing research and adaptive strategies are necessary to respond to changing market conditions.

In conclusion, by understanding the effects of inflation on the stock market and implementing appropriate investment strategies, investors can better position themselves to navigate inflationary environments and mitigate potential risks. The stock market can offer opportunities for growth and wealth accumulation even in the presence of inflation, making it a vital component of a well-rounded investment portfolio.