Finance

How Does Tomo Credit Work

Modified: February 21, 2024

Learn how Tomo Credit works and get the financial freedom you desire. Explore our innovative finance solutions for easier access to credit today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of Tomo Credit, a cutting-edge financial technology company that aims to revolutionize the way people access credit. In today’s fast-paced world, where financial constraints can limit opportunities, Tomo Credit offers a fresh and innovative solution.

Founded on the principle of inclusivity, Tomo Credit is committed to providing access to credit for individuals who may otherwise face challenges in obtaining traditional credit cards. By leveraging advanced technology and data analytics, Tomo Credit aims to assess creditworthiness in a more comprehensive and inclusive manner.

In this article, we will delve into the workings of Tomo Credit, exploring how this innovative platform functions and the benefits it offers. Whether you are a young professional building credit, an international student studying abroad, or someone with limited credit history, Tomo Credit has tailored solutions to meet your individual needs.

Let’s dive in and discover how Tomo Credit works and why it might be the perfect fit for you.

What is Tomo Credit?

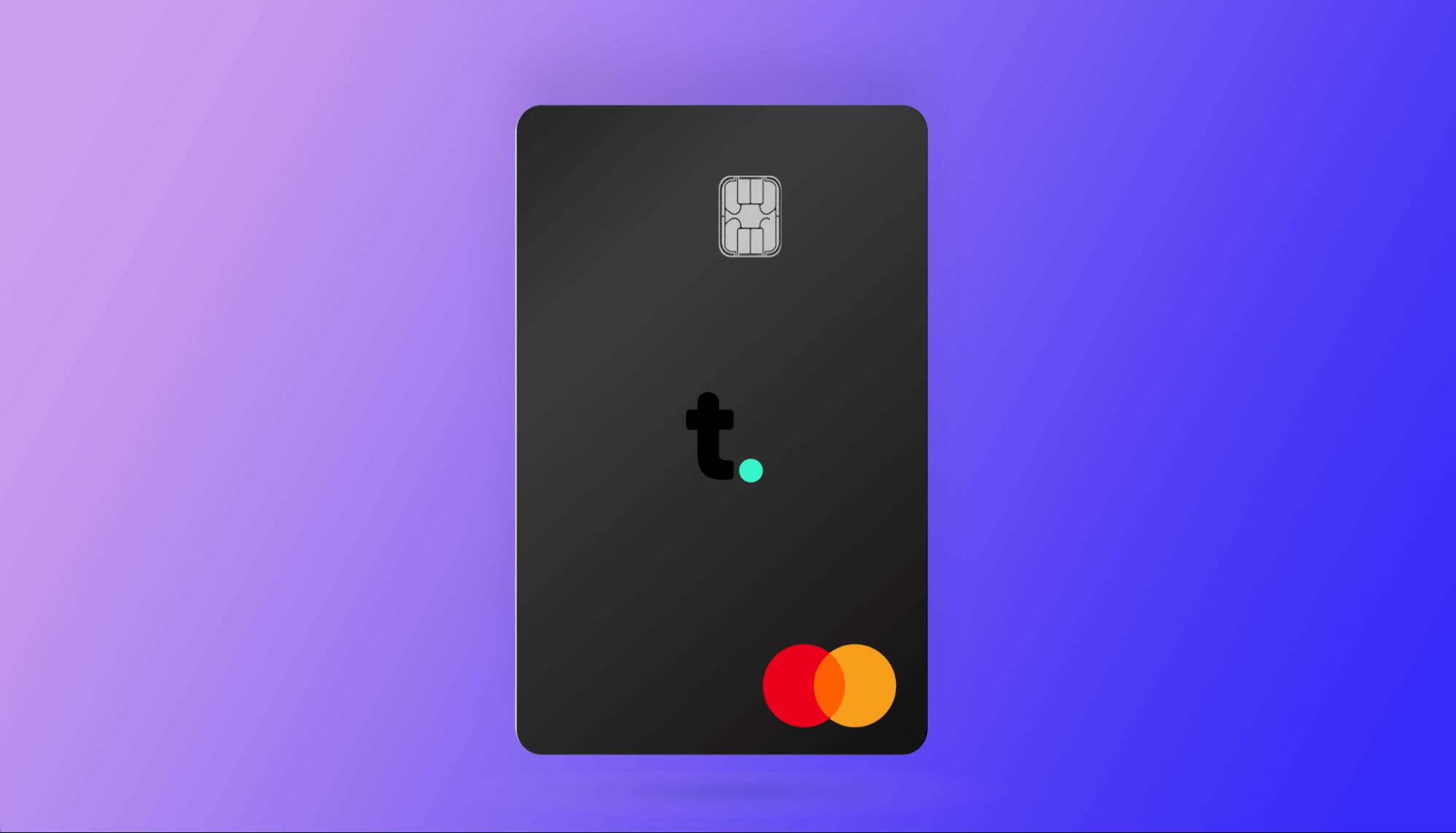

Tomo Credit is a financial technology company that provides an alternative approach to traditional credit cards. It aims to bridge the gap between individuals with limited credit history or insufficient credit scores and the ability to access credit for their financial needs. Tomo Credit offers a unique and inclusive credit solution, putting financial freedom within reach for a wide range of individuals.

Unlike traditional credit card applications that heavily rely on credit history and credit scores, Tomo Credit takes a holistic view of an individual’s financial situation. The company leverages advanced algorithms and machine learning to assess creditworthiness based on various factors beyond traditional credit metrics.

By considering alternative data sources such as income, banking history, and payment behavior, Tomo Credit can provide credit options to individuals who may have been turned away by traditional lenders. This approach allows for a fair and comprehensive evaluation of an individual’s creditworthiness, ensuring that deserving individuals can access the credit they need.

Tomo Credit offers these credit cards in collaboration with partner banks and financial institutions. This partnership allows Tomo Credit to provide users with the convenience and functionality of a traditional credit card while also offering a unique set of features and benefits tailored to individual needs.

Whether you are a student, a young professional, or someone looking to build credit, Tomo Credit offers flexible credit options that can help you achieve your financial goals. With its focus on inclusivity and innovative credit assessment methods, Tomo Credit is changing the game when it comes to credit accessibility.

In the following sections, we will explore the step-by-step process of how Tomo Credit works, from the application process to credit limit determination, usage, and payments. Let’s delve deeper into the mechanics of this groundbreaking financial platform.

How does Tomo Credit work?

Tomo Credit operates through a streamlined process that allows individuals to access credit easily and responsibly. From the initial application to credit limit determination and card usage, Tomo Credit offers a straightforward and user-friendly experience. Let’s explore the step-by-step process of how Tomo Credit works:

Step 1: Application process

The first step in obtaining Tomo Credit is to complete the online application. The application requires basic personal information, such as your name, address, and social security number. Additionally, you will need to provide details about your income and employment. This information is used to assess your creditworthiness using Tomo Credit’s innovative algorithms.

Step 2: Credit assessment

Once you have submitted your application, Tomo Credit begins the credit assessment process. Unlike traditional credit card applications that primarily rely on credit scores, Tomo Credit considers a range of factors, such as income, banking history, and payment behavior. This holistic approach allows for a more comprehensive evaluation of your creditworthiness, especially if you have limited credit history or no credit score.

Step 3: Credit limit determination

After the credit assessment, Tomo Credit determines the credit limit for your card. The credit limit is based on various factors, including your income, financial obligations, and the results of the credit evaluation. This personalized approach ensures that the credit limit aligns with your financial capacity and enables responsible usage.

Step 4: Credit card usage

Once your Tomo Credit card is issued, you can start using it for your financial needs. The card can be used for online and in-person purchases, bill payments, and other transactions where credit cards are accepted. With your personalized credit limit, you can make purchases within that defined amount, providing you with the flexibility and convenience of traditional credit cards.

Step 5: Payment and interest

As a responsible credit user, it’s crucial to make timely payments to maintain a good credit standing. Tomo Credit provides different payment options, allowing you to choose the method that suits you best. It is important to note that interest rates may apply to outstanding balances, so it’s advisable to make full payments whenever possible to avoid accruing unnecessary interest charges.

By following these steps, individuals can access credit through Tomo Credit in a secure and responsible manner. The platform’s innovative approach to credit assessment ensures that more people can gain access to credit, even if they have limited credit history or no credit score.

In the next section, we will explore the benefits of using Tomo Credit and why it may be the right choice for your financial needs.

Step 1: Application process

The first step in accessing credit through Tomo Credit is completing the straightforward online application process. This process is designed to be user-friendly, ensuring a seamless experience for individuals seeking credit.

When applying for Tomo Credit, you will need to provide some basic personal information, including your name, address, and social security number. This information is necessary to verify your identity and perform background checks. Rest assured that Tomo Credit values your privacy and employs robust security measures to protect your personal information.

In addition to personal details, you will also be required to provide information about your income and employment. This information plays a significant role in the credit assessment process. Tomo Credit takes into account your income and employment stability to gauge your ability to manage credit responsibly.

The application process is completed entirely online, saving you time and avoiding the hassle of traditional paperwork. The online format allows for a quick and efficient application process, ensuring that you can access credit when you need it most.

Once you have submitted your application, Tomo Credit’s advanced algorithms and machine learning technologies evaluate your information. This process considers various factors beyond traditional credit metrics, such as income and banking history. The aim is to provide a more comprehensive assessment of your creditworthiness, especially for individuals with limited credit history or no credit score.

Tomo Credit aims to make the application process as inclusive as possible, considering those who may face challenges obtaining credit through conventional means. By leveraging alternative data points, Tomo Credit provides an opportunity for individuals to access credit based on their overall financial situation, beyond just their credit score.

After you have completed the application and undergone the credit assessment process, you will receive a decision on your credit application. If approved, you can move forward to the next steps and begin utilizing your Tomo Credit card.

The application process with Tomo Credit is designed to be user-friendly, efficient, and inclusive. By simplifying the process and considering a broader range of factors, Tomo Credit aims to provide credit options to those who may have been overlooked by traditional lenders.

Now that you understand the first step in accessing credit through Tomo Credit, let’s move on to exploring the subsequent steps in the process.

Step 2: Credit assessment

Once you have completed the application process for Tomo Credit, the next step is the credit assessment phase. This step is crucial in determining your creditworthiness and the credit options available to you.

Unlike traditional credit card applications that heavily rely on credit scores, Tomo Credit takes a more holistic approach to assess creditworthiness. The company utilizes advanced algorithms and machine learning to evaluate various factors beyond just credit history.

During the credit assessment process, Tomo Credit considers a range of factors, including your income, banking history, and payment behavior. By analyzing these different data points, Tomo Credit aims to gain a comprehensive understanding of your financial situation.

This approach is particularly beneficial for individuals who have limited credit history or may not have a credit score. Traditional lenders often overlook these individuals, making it difficult for them to access credit. However, Tomo Credit’s innovative credit assessment process aims to provide credit options to as many deserving individuals as possible.

By considering alternative data points, Tomo Credit can assess your creditworthiness more accurately. For example, your income plays a significant role in the credit assessment process. By evaluating your income stability and capacity to manage credit, Tomo Credit can determine the appropriate credit limit for you.

Furthermore, Tomo Credit considers your banking history. This includes examining your transaction patterns, bill payments, and overall financial behavior. By analyzing these factors, Tomo Credit gains insights into your financial responsibility and ability to handle credit.

It’s important to note that Tomo Credit’s credit assessment process is transparent and fair. The company aims to provide credit options that align with your financial situation and capacity. This tailored approach ensures that you are not burdened with excessive credit or put at risk of overextending yourself financially.

By employing advanced algorithms and considering a broader range of factors, Tomo Credit strives to offer a more inclusive and comprehensive credit assessment process. This enables individuals with limited credit history or no credit score to access credit options that suit their needs and financial capabilities.

Now that we’ve explored the credit assessment process, let’s move on to the next step in accessing credit through Tomo Credit: credit limit determination.

Step 3: Credit limit determination

Once your credit assessment is complete, the next step in obtaining credit through Tomo Credit is the determination of your credit limit. Tomo Credit takes into account various factors to ensure that the credit limit assigned to you is appropriate for your financial situation.

Your credit limit is the maximum amount of credit that you can borrow using your Tomo Credit card. It represents the level of trust and confidence that Tomo Credit has in your ability to manage credit responsibly.

One of the main factors considered in credit limit determination is your income. Tomo Credit takes into account your income stability and capacity to repay the credit extended to you. A higher income generally indicates a greater ability to manage credit, which may result in a higher credit limit.

In addition to your income, Tomo Credit considers other financial obligations you may have, such as loans or other credit card balances. These obligations are assessed to ensure that your credit limit is set at a level that is manageable for you.

The credit limit determination process with Tomo Credit is personalized, taking into account your individual financial circumstances. This approach helps ensure that your credit limit aligns with your financial capacity and reduces the risk of overextending yourself financially.

It is important to note that the credit limit assigned to you initially may not be the maximum limit you can eventually have. As you demonstrate responsible credit usage and make timely payments, Tomo Credit may increase your credit limit over time. This increase in credit limit provides you with more flexibility and purchasing power as your creditworthiness improves.

Tomo Credit’s credit limit determination process aims to strike a balance between providing you with sufficient credit for your needs while also promoting responsible credit usage. This personalized and dynamic approach sets Tomo Credit apart from traditional credit card providers, allowing for a more tailored credit experience.

Now that we’ve covered the credit limit determination process, let’s move on to the next step in accessing credit through Tomo Credit: credit card usage.

Step 4: Credit card usage

Once your credit limit has been determined, you can start using your Tomo Credit card for your financial needs. This step allows you to enjoy the convenience and flexibility of a traditional credit card, while also benefiting from the unique features and benefits offered by Tomo Credit.

Your Tomo Credit card can be used for online and in-person purchases, bill payments, and other transactions wherever credit cards are accepted. This allows you to seamlessly integrate Tomo Credit into your daily financial activities.

With your personalized credit limit, you have the freedom to make purchases up to that maximum amount. This provides you with the flexibility to manage your expenses and fulfill your financial obligations without relying solely on cash or debit options.

Using your Tomo Credit card responsibly is crucial to building and maintaining a positive credit history. Make sure to follow these best practices when it comes to credit card usage:

- Stick to a budget: Establish a budget for your expenses and ensure that your credit card usage aligns with your financial situation.

- Pay on time: Make timely payments on your credit card bill to avoid late fees and potential damage to your credit score.

- Avoid unnecessary debt: Use your Tomo Credit card responsibly and avoid accumulating excessive debt that may become difficult to manage.

- Monitor your credit: Regularly check your credit statements and monitor your transactions to detect any unauthorized charges or errors.

- Stay within your credit limit: It’s important to manage your credit utilization and avoid maxing out your credit limit to maintain a healthy credit profile.

By following these guidelines, you can make the most of your Tomo Credit card and use it as a tool for building positive credit history. Responsible usage will not only enable you to access credit when needed but also enhance your financial well-being in the long run.

In addition to the convenience and flexibility of credit card usage, Tomo Credit offers additional benefits that make it an attractive choice for individuals seeking credit. In the next section, we will explore some of the key advantages of using Tomo Credit.

Step 5: Payment and Interest

When it comes to using your Tomo Credit card, making timely payments and understanding the interest terms are essential. Managing your payments responsibly ensures that you maintain a good credit standing and avoid unnecessary interest charges.

Here’s what you need to know about payment and interest with Tomo Credit:

Payment Options

Tomo Credit offers various payment options to suit your preferences and ensure a convenient payment process. You can choose to make payments online through the Tomo Credit website or app, set up automatic payments, or make manual payments by mailing a check or money order.

It’s important to make your payments on time to avoid late fees and potential negative impacts on your credit history. Set up reminders or enable notifications to ensure that you never miss a payment deadline.

Minimum Payment vs. Full Payment

When it comes to your Tomo Credit card, you will have the option to make either the minimum payment or the full payment each billing cycle.

The minimum payment is the minimum amount you need to pay each month to keep your account in good standing. It’s important to note that making only the minimum payment may result in the accrual of interest charges on the remaining balance. Paying only the minimum amount can also extend the time it takes to pay off the full balance, potentially costing you more in interest over time.

Making the full payment, on the other hand, allows you to avoid interest charges as long as the payment is made within the grace period. The grace period is the period between the end of the billing cycle and the due date when you can pay your balance in full without incurring interest.

Interest Charges

Interest charges may apply if you carry a balance on your Tomo Credit card. The interest rate, also known as the annual percentage rate (APR), is the cost of borrowing money on your outstanding balance.

It’s important to review and understand the interest rates associated with your Tomo Credit card. This will help you make informed decisions about your spending and repayment strategy. By paying off your balance in full each month, you can avoid accruing interest charges, allowing you to make the most of your credit card without unnecessary fees or costs.

By managing your payments responsibly and staying aware of the interest terms, you can use your Tomo Credit card to build credit and maintain a healthy financial profile.

In the next section, we will explore the benefits of using Tomo Credit and why it might be the right choice for your credit needs.

Benefits of Using Tomo Credit

Using Tomo Credit comes with a range of benefits that set it apart from traditional credit cards and make it an attractive option for individuals seeking credit. Let’s explore some of the key advantages:

1. Inclusivity

Tomo Credit is committed to inclusivity, providing credit access to individuals who may have been overlooked by traditional lenders. By considering alternative data points and taking a holistic approach to creditworthiness, Tomo Credit opens doors to credit options for those with limited credit history or no credit score.

2. Credit Building Opportunity

Tomo Credit offers individuals the chance to build positive credit history. By using your Tomo Credit card responsibly, making timely payments, and managing your credit utilization, you can demonstrate your creditworthiness and improve your overall credit profile.

3. Personalized Credit Limit

Tomo Credit determines your credit limit based on your individual financial situation. The personalized credit limit ensures that you have access to credit that aligns with your income and financial capacity, helping you avoid excessive debt or overextension.

4. Flexible Usage

With a Tomo Credit card, you have the flexibility to make online and in-person purchases, pay bills, and engage in other financial transactions wherever credit cards are accepted. This gives you the convenience and functionality of a traditional credit card.

5. Innovative Credit Assessment

Tomo Credit’s use of advanced algorithms and machine learning for credit assessment sets it apart from traditional lenders. By considering various factors beyond credit scores, Tomo Credit provides a more comprehensive evaluation of your creditworthiness, giving individuals with limited credit history or no credit score the opportunity to access credit.

6. Potential Credit Limit Increase

As you demonstrate responsible credit usage and make timely payments, Tomo Credit may increase your credit limit over time. This provides you with more flexibility and purchasing power as your creditworthiness improves.

7. User-Friendly Platform

Tomo Credit offers a user-friendly digital platform that makes it easy to manage your credit account. Through the Tomo Credit app or website, you can conveniently view your transactions, make payments, and track your credit activity.

These are just a few of the benefits that come with using Tomo Credit. The platform is designed to provide an inclusive, user-friendly, and responsible approach to credit access, empowering individuals to meet their financial needs and build a brighter financial future.

In the next section, we will discuss some considerations to keep in mind before applying for Tomo Credit.

Considerations before Applying for Tomo Credit

Before you apply for Tomo Credit, it’s important to consider a few key factors to ensure that it aligns with your financial needs and goals. Let’s explore some of the considerations to keep in mind:

1. Credit Needs

Assess your credit needs and determine if Tomo Credit is the right fit for you. Consider whether you have limited credit history or no credit score. Tomo Credit is designed to provide credit options to individuals who may face challenges with traditional lenders.

2. Financial Stability

Evaluate your financial stability and capacity to manage credit. Tomo Credit takes into account factors such as income, employment stability, and financial obligations during the credit assessment process. Ensure that you can comfortably handle the credit offered and make timely payments.

3. Interest Rates and Fees

Understand the interest rates associated with Tomo Credit. Although responsible credit usage can help you avoid interest charges, it’s important to be aware of the rates in case you carry a balance. Additionally, familiarize yourself with any applicable fees, such as annual fees or late payment fees.

4. Responsible Credit Management

Consider your commitment to responsible credit management. Using your Tomo Credit card responsibly, making timely payments, and keeping your credit utilization in check are crucial for building positive credit history and maintaining a good credit profile.

5. Digital Platform Comfortability

Assess your comfort level with managing your credit account through a digital platform. Tomo Credit operates through a user-friendly app and website, and it is essential to determine if you are comfortable with online account management.

6. Alternative Credit Options

Explore other credit options available to you. Consider traditional credit cards as well as other alternative credit providers. Compare the features, benefits, and terms to ensure that Tomo Credit is the best fit for your specific financial needs.

By considering these factors, you can make an informed decision about whether Tomo Credit is the right choice for you. It’s essential to thoroughly evaluate your credit needs, financial stability, and comfort level before proceeding with the application process.

Now that we’ve discussed the considerations, let’s wrap up this article and summarize the key points we’ve covered.

Conclusion

Tomo Credit offers a groundbreaking approach to credit access, providing individuals with limited credit history or no credit score the opportunity to access credit in a fair and inclusive manner. By leveraging advanced technology and innovative credit assessment methods, Tomo Credit aims to bridge the gap between individuals and the credit they need.

Throughout this article, we have delved into the workings of Tomo Credit, exploring each step of the process, from the application to credit limit determination, card usage, and payment. We have also highlighted the benefits of using Tomo Credit, such as its inclusivity, personalized credit limits, credit building opportunity, and user-friendly platform.

Before applying for Tomo Credit, it’s important to consider factors such as your credit needs, financial stability, interest rates, responsible credit management, comfort with digital platforms, and alternative credit options.

Tomo Credit is not just a credit card; it’s a gateway to financial empowerment. It gives individuals the chance to build credit history, access credit based on their overall financial situation, and manage their financial lives more effectively.

To get started with Tomo Credit, visit their website or download the app, and begin the application process. Remember to use your Tomo Credit card responsibly, making timely payments and monitoring your credit activity to achieve your financial goals.

With Tomo Credit, financial freedom is within reach. It’s time to embrace a new era of credit access. Apply for Tomo Credit today and embark on a journey toward a brighter financial future.