Finance

How Good Is UPS Health Insurance?

Published: November 12, 2023

Discover the benefits of UPS health insurance for your financial well-being. Learn about coverage options and find out if it's the right fit for your finance needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to employee benefits, health insurance is often at the top of the list. For employees of UPS, the multinational package delivery and supply chain management company, the question arises – how good is their health insurance?

UPS understands the importance of providing comprehensive health insurance coverage to its employees. As one of the largest employers in the world, with a commitment to the well-being of its workforce, UPS offers a range of health insurance options.

In this article, we will delve into the details of UPS health insurance to give you a comprehensive understanding of its coverage and benefits. We will explore the medical services, prescription drug coverage, mental health coverage, dental and vision benefits, as well as the cost and premiums associated with UPS health insurance.

Additionally, we will discuss the network and providers associated with UPS health insurance and look at customer satisfaction and ratings to get a better idea of how well UPS health insurance performs.

By the end of this article, you will have a clear picture of the UPS health insurance offering and be better equipped to determine whether it meets your needs as an employee.

Overview of UPS Health Insurance

UPS offers a comprehensive health insurance plan to its employees, providing coverage for a wide range of medical services. The UPS health insurance plan is designed to ensure that employees have access to the care they need to maintain their health and well-being.

With UPS health insurance, employees have the flexibility to choose from different coverage options. These options may include plans with varying deductibles, copayments, and out-of-pocket maximums. By offering different plans, UPS aims to accommodate the diverse needs of its employees and their families.

One of the key advantages of UPS health insurance is its extensive network of healthcare providers. Employees have access to a large network of doctors, hospitals, and specialists, both nationally and internationally. This means that employees can receive quality healthcare services wherever they are located.

In addition to the network of providers, UPS also provides resources and tools to help employees navigate their healthcare options effectively. Whether it’s finding a doctor, understanding coverage options, or managing claims, UPS aims to make the process as seamless as possible.

Overall, the UPS health insurance plan aims to provide employees with comprehensive coverage and support their well-being. By offering a range of coverage options, a broad network of providers, and helpful resources, UPS strives to ensure that employees have access to the care they need when they need it.

Coverage and Benefits

UPS health insurance offers a wide range of coverage and benefits to its employees. Let’s take a closer look at the key areas of coverage provided by UPS health insurance.

- Medical Services: UPS health insurance covers a broad range of medical services, including preventive care, hospitalization, emergency care, surgery, and specialist visits. This coverage ensures that employees can access the necessary healthcare services to address their medical needs.

- Prescription Drug Coverage: UPS health insurance includes prescription drug coverage, allowing employees to obtain necessary medications at a reduced cost. This benefit ensures that employees have access to vital medications without incurring significant out-of-pocket expenses.

- Mental Health Coverage: UPS recognizes the importance of mental health and provides coverage for mental health services, including therapy and counseling. This coverage ensures that employees have access to the resources they need to maintain their mental well-being.

- Dental and Vision Coverage: In addition to medical coverage, UPS health insurance also includes dental and vision benefits. These benefits cover routine dental check-ups, preventive dental services, as well as vision exams, glasses, and contact lenses. This comprehensive coverage extends beyond just medical needs, ensuring employees’ overall health and well-being.

These coverage options and benefits provided by UPS health insurance enable employees to access the necessary healthcare services to address their health needs. Whether it’s medical services, prescription drugs, mental health support, or dental and vision care, UPS health insurance offers a comprehensive package to ensure employees’ well-being.

Medical Services

UPS health insurance covers a wide range of medical services, ensuring that employees have access to the care they need to maintain their health. Whether it’s preventive care, hospitalization, or specialized treatments, UPS health insurance provides comprehensive coverage.

Preventive care is an essential component of UPS health insurance. It includes routine check-ups, vaccinations, screenings, and preventive tests. By covering these services, UPS aims to promote preventive healthcare and early detection of potential health issues.

In the event of hospitalization, UPS health insurance covers the costs associated with inpatient care, including room and board, surgeries, and other necessary medical procedures. This coverage ensures that employees can receive the care and treatment they require during their hospital stay without incurring significant medical expenses.

UPS health insurance also provides coverage for specialized treatments and consultations with specialists. If an employee requires specialized care, such as visits to a cardiologist, dermatologist, or orthopedic surgeon, UPS health insurance will cover the expenses associated with these consultations and treatments.

Furthermore, UPS health insurance covers emergency care, ensuring that employees can receive immediate medical attention in the event of an urgent medical situation. This coverage provides peace of mind knowing that employees will be taken care of in emergency situations without having to worry about the financial burden.

By offering coverage for a wide range of medical services, UPS health insurance ensures that employees can access the necessary healthcare they need to stay healthy and address any medical concerns that may arise.

Prescription Drug Coverage

One of the essential components of UPS health insurance is its prescription drug coverage. UPS recognizes the importance of affordable access to necessary medications and therefore provides comprehensive coverage for prescription drugs.

With UPS health insurance, employees can obtain prescription medications at a reduced cost, making it more affordable to manage chronic conditions or receive necessary treatments. The coverage typically includes both generic and brand-name drugs, ensuring that employees have access to a wide range of medications.

UPS health insurance may have a tiered formulary system, where medications are classified into different tiers based on their cost. Generic drugs usually have the lowest copayment, followed by preferred brand-name drugs, and non-preferred brand-name drugs.

Employees can often obtain their prescription medications through participating pharmacies within the UPS health insurance network. This network includes a broad range of pharmacies, ensuring convenient access to medications at locations nationwide.

In some cases, employees may have the option to receive their medications through mail-order pharmacies, which can provide added convenience and potentially save costs on prescription drugs for chronic conditions.

It’s important to note that specific coverage details, copayments, and restrictions may vary based on the specific UPS health insurance plan and the medications prescribed. Employees should review their plan documents or reach out to the UPS benefits department for specific information regarding their prescription drug coverage.

Overall, UPS health insurance offers comprehensive prescription drug coverage, allowing employees to obtain necessary medications at an affordable cost and ensuring that they can manage their health conditions effectively.

Mental Health Coverage

Recognizing the importance of mental health, UPS health insurance includes coverage for mental health services. This inclusion ensures that employees have access to the resources and support they need to maintain their mental well-being.

UPS health insurance typically covers a range of mental health services, including therapy and counseling. Employees can seek help from licensed mental health professionals to address various mental health concerns, such as anxiety, depression, stress, or substance abuse.

The coverage for mental health services may extend to individual therapy sessions, group therapy, or family therapy, depending on the specific needs of the employee. This comprehensive approach allows individuals to receive personalized care to address their mental health challenges.

UPS health insurance may also cover psychiatric consultations and medications prescribed for mental health conditions. This ensures that employees have access to both therapeutic and pharmaceutical interventions, maximizing the effectiveness of their mental health treatment.

Additionally, UPS health insurance often provides resources and support tools to help employees manage their mental well-being. This may include access to online mental health platforms, helplines, or employee assistance programs (EAPs) that offer confidential counseling services.

It’s important to note that mental health coverage details can vary depending on the specific UPS health insurance plan. Employees should review their plan documents or contact the UPS benefits department for more information regarding the specific mental health services covered under their plan.

Overall, the inclusion of mental health coverage in UPS health insurance underscores the company’s commitment to the well-being of its employees, ensuring they have access to the support they need to maintain good mental health.

Dental and Vision Coverage

In addition to medical services, UPS health insurance also provides comprehensive coverage for dental and vision care. This coverage ensures that employees have access to essential services to maintain their oral and visual health.

UPS health insurance typically covers routine dental care, including preventive services such as dental exams, cleanings, and X-rays. This coverage helps employees maintain good oral hygiene and detect any dental issues early on.

Moreover, UPS health insurance often includes coverage for restorative dental treatments like fillings, root canals, and extractions. This ensures that employees can receive necessary dental treatments and address dental concerns promptly.

For vision care, UPS health insurance typically covers routine eye exams, allowing employees to have their vision checked regularly. This coverage helps identify any vision changes and enables employees to receive appropriate corrective measures such as contact lenses or eyeglasses.

Additionally, UPS health insurance may offer coverage for medically necessary treatments such as cataract surgery or other vision-related procedures. This ensures that employees can address any significant vision issues that may arise.

It’s important to note that the specific coverage details, copayments, and restrictions for dental and vision care can vary based on the UPS health insurance plan. Employees should carefully review their plan documents or contact the UPS benefits department for specific information regarding their dental and vision coverage.

By including dental and vision coverage, UPS health insurance goes beyond just medical services and addresses the broader needs of employees’ overall health and well-being.

Cost and Premiums

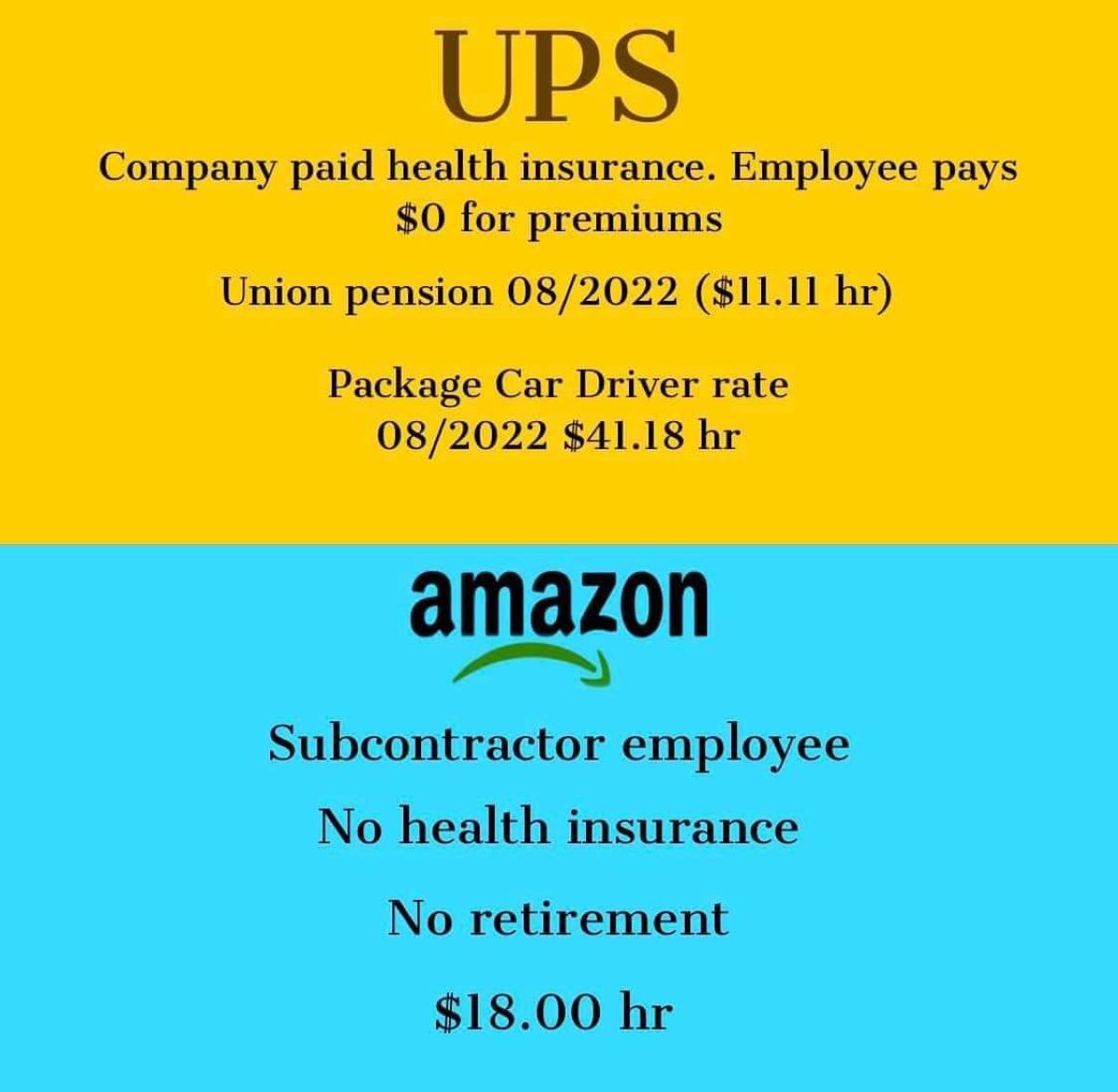

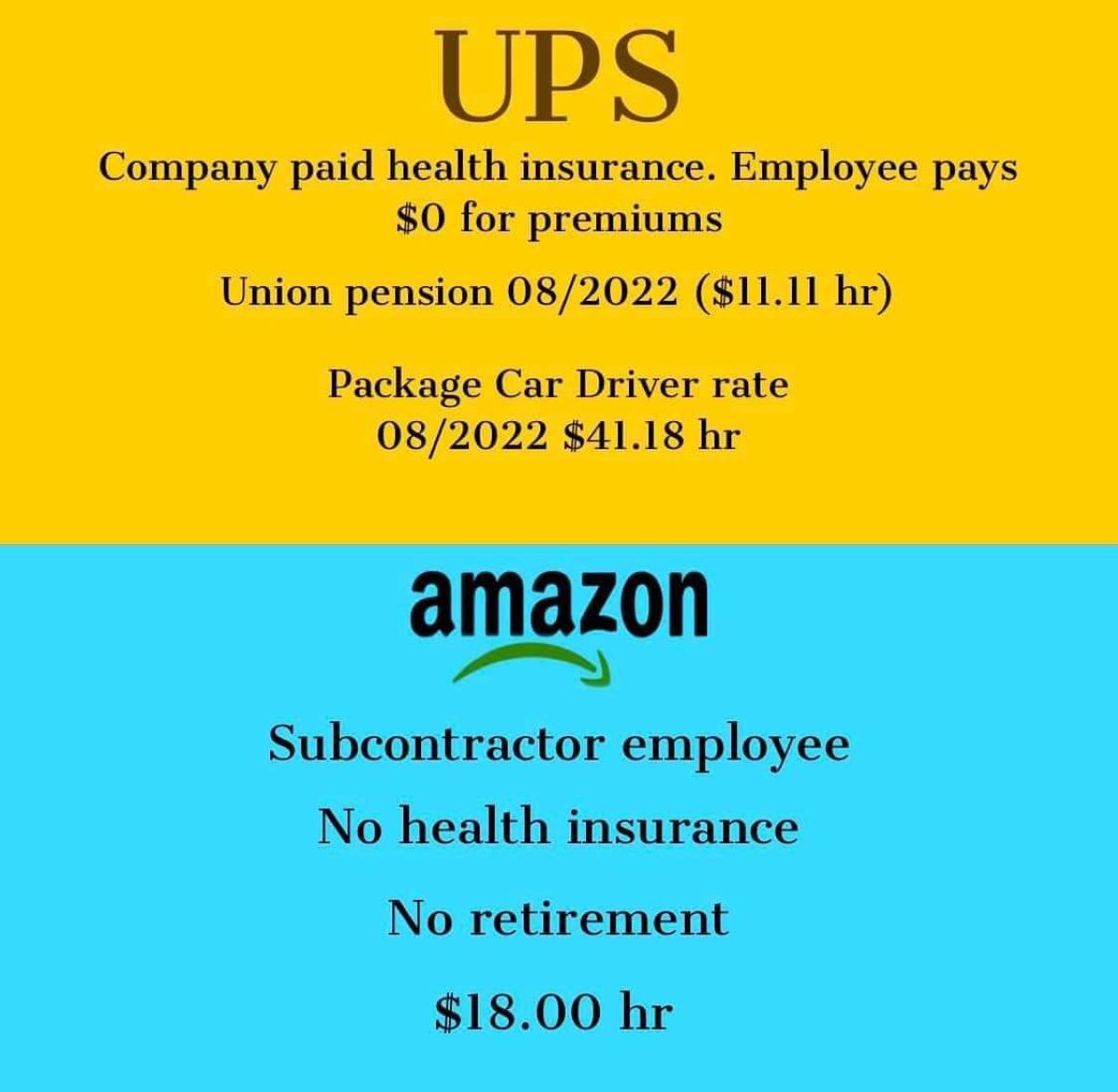

When considering any health insurance plan, understanding the cost and premiums is crucial. UPS health insurance offers different coverage options, each with its own associated costs and premiums.

The cost of UPS health insurance can vary based on factors such as the specific plan chosen, the level of coverage, and the number of dependents being covered. Typically, employees have the option to choose from different plans with varying deductibles, copayments, and out-of-pocket maximums.

Premiums for UPS health insurance are typically deducted from employees’ paychecks on a regular basis, such as monthly or bi-weekly. The amount of the premium can depend on factors like the selected coverage level and the number of individuals being covered under the plan.

In addition to premiums, employees may also be responsible for other costs when accessing healthcare services. This can include copayments, which are fixed amounts paid for specific services, as well as coinsurance, which is a percentage of the cost of the service that the employee is responsible for.

UPS health insurance plans may also have a deductible, which is the amount that the employee must pay out-of-pocket before the insurance coverage kicks in. Once the deductible is met, the insurance typically covers a percentage of the remaining costs, known as coinsurance, while the employee is responsible for the remaining portion.

It is important for employees to carefully review the details of their specific UPS health insurance plan regarding costs, premiums, copayments, and deductibles. This will enable them to budget for healthcare expenses and understand the financial responsibilities associated with utilizing their health insurance benefits.

Ultimately, UPS health insurance aims to provide employees with flexible coverage options while ensuring they understand the associated costs and premiums. By having a clear understanding of the financial aspects, employees can make informed decisions regarding their health insurance coverage.

Network and Providers

UPS health insurance offers employees access to a broad network of healthcare providers, ensuring that they have options when it comes to receiving healthcare services. The network typically includes a wide range of doctors, specialists, hospitals, and other healthcare facilities.

By having a robust network, UPS health insurance allows employees to choose from a diverse pool of healthcare providers. This flexibility enables employees to select providers who meet their specific needs, whether it’s a primary care physician, a specialist, or a hospital of their preference.

Within the network, employees can often find providers who specialize in various fields of medicine, ensuring comprehensive and specialized care for specific health conditions. This network coverage extends both within the United States and sometimes even internationally, allowing employees to seek healthcare services wherever they are located.

In some cases, UPS health insurance may require employees to obtain services from in-network providers to ensure maximum coverage and minimize out-of-pocket expenses. However, there may be options for out-of-network coverage, which might involve higher costs or different coverage levels.

It’s important for employees to review the details of their specific UPS health insurance plan to understand the extent of the network coverage and any requirements or guidelines related to provider selection.

By providing a broad network of healthcare providers, UPS health insurance ensures that employees have access to high-quality care from a wide range of specialists and facilities. This network empowers employees to make informed healthcare decisions and receive the appropriate services they need for their well-being.

Customer Satisfaction and Ratings

Customer satisfaction is an important indicator of the effectiveness and quality of a health insurance provider. While specific customer satisfaction ratings for UPS health insurance may vary, it is valuable to consider general trends and feedback from employees who have utilized their coverage.

UPS understands the significance of employee satisfaction and continuously strives to provide a positive healthcare experience for its workforce. By offering a range of coverage options, a comprehensive network of providers, and helpful resources, UPS aims to meet the diverse needs of its employees and ensure their satisfaction with the health insurance offerings.

Employee feedback and ratings indicate that UPS health insurance generally receives positive recognition for its network coverage, ease of use, and customer service. The broad network of providers allows employees to access quality healthcare services from reputable physicians and hospitals, offering convenience and peace of mind.

Furthermore, employees appreciate the user-friendly resources and tools provided by UPS health insurance, such as online portals or mobile apps, which enable them to manage their healthcare needs effectively. Timely and responsive customer service is also valued by employees, as it ensures that any concerns or inquiries are addressed promptly.

While it’s essential to acknowledge that individual experiences may vary, the overall satisfaction of employees with UPS health insurance indicates that the company places a strong emphasis on delivering a positive and supportive healthcare experience.

To gather more information about specific customer satisfaction ratings and reviews for UPS health insurance, employees can consult sources such as online reviews, employee feedback platforms, or industry publications that rank health insurance providers based on customer satisfaction metrics.

Ultimately, customer satisfaction ratings serve as a valuable measure of the quality and effectiveness of health insurance, and the positive feedback surrounding UPS health insurance suggests that it is well-regarded among employees.

Conclusion

UPS health insurance offers employees a comprehensive and valuable package of coverage options. With a focus on providing access to essential healthcare services, prescription drug coverage, mental health support, and dental and vision benefits, UPS prioritizes the well-being of its employees.

The range of medical services covered by UPS health insurance ensures that employees can receive preventive care, hospitalization, specialized treatments, and emergency services when needed. This comprehensive coverage promotes proactive healthcare and ensures that employees can address their medical needs without significant financial burden.

The inclusion of prescription drug coverage enables employees to access necessary medications at reduced costs, making it more accessible to manage their health conditions effectively.

Recognizing the importance of mental health, UPS health insurance also covers mental health services such as therapy and counseling, supporting employees’ mental well-being and overall health.

In addition to medical coverage, UPS health insurance provides dental and vision benefits to ensure employees’ oral and visual health is taken care of. Routine dental care, restorative treatments, and vision exams are included, allowing employees to maintain their oral hygiene and visual acuity.

While specific costs and premiums can vary based on individual plan selections, UPS health insurance aims to offer affordable options to employees, balancing comprehensive coverage with competitive pricing.

The extensive network of healthcare providers associated with UPS health insurance gives employees the flexibility to choose doctors, specialists, and hospitals based on their preferences and specific healthcare needs. This ensures that employees can receive care from reputable providers, whether they are in the United States or traveling internationally.

Overall, customer satisfaction ratings indicate that UPS health insurance has been well-received by employees, with positive feedback regarding network coverage, ease of use, and customer service. This underscores UPS’s commitment to providing comprehensive and supportive health insurance to its workforce.

In conclusion, UPS health insurance offers employees a robust and valuable package of coverage options, prioritizing their well-being and ensuring access to essential healthcare services. Whether it’s medical services, prescription drugs, mental health support, or dental and vision care, UPS health insurance provides a comprehensive solution that meets employees’ diverse needs.