Finance

How Good Is Otto Insurance?

Modified: December 30, 2023

Find out how good Otto Insurance is in the world of finance. Discover their financial products and services to make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to protecting our assets and financial well-being, insurance plays a vital role. With numerous insurance providers in the market, it can be overwhelming to choose the right one that meets our specific needs. One notable name in the industry is Otto Insurance, a company renowned for its comprehensive coverage options and exceptional customer service.

In this article, we will delve into the details of Otto Insurance and evaluate its overall performance. From understanding its company overview to exploring its insurance products, coverage options, pricing, and customer satisfaction, we aim to provide an insightful assessment of this insurance provider.

Whether you are in search of auto insurance, home insurance, or life insurance, it is crucial to make an informed decision based on the reliability and credibility of the insurance company. By evaluating the features and benefits offered by Otto Insurance, you can determine if it is the right fit for your insurance needs.

Continue reading to discover more about Otto Insurance and gain a comprehensive understanding of its services, pricing, customer satisfaction, and more. By the end of this article, you will have a well-rounded perspective to determine if Otto Insurance is the right insurance provider for you.

Company Overview

Otto Insurance has been a trusted insurance provider for over 20 years, offering a wide range of insurance products to individuals and businesses. With a strong reputation for reliability and financial stability, Otto Insurance has established itself as a leading player in the insurance industry.

The company prides itself on its strong commitment to customer satisfaction, providing personalized insurance solutions tailored to meet the unique needs of each policyholder. With a team of experienced insurance professionals, Otto Insurance aims to deliver excellent service and support throughout the insurance process.

One of the key factors that sets Otto Insurance apart from its competitors is its extensive network of insurance carriers. This allows the company to offer a diverse range of insurance products, ensuring customers have access to a variety of coverage options.

Furthermore, Otto Insurance understands the ever-changing dynamics of the insurance industry, and therefore regularly evaluates and updates its insurance offerings to meet the evolving needs of its customers. Whether you require auto insurance, home insurance, life insurance, or commercial insurance, Otto Insurance has you covered.

With a strong emphasis on transparency and integrity, Otto Insurance strives to build long-term relationships with its customers based on trust and reliability. The company aims to provide peace of mind to policyholders by offering comprehensive coverage and timely claims processing.

Overall, Otto Insurance is a reputable insurance provider that combines a rich history, extensive network, and customer-centric approach to deliver exceptional insurance solutions. With its commitment to excellence and personalized service, Otto Insurance is a reliable choice for individuals and businesses seeking comprehensive insurance coverage.

Insurance Products

Otto Insurance offers a wide array of insurance products to suit the diverse needs of its customers. Whether you are looking for personal coverage or business protection, Otto Insurance has a solution for you. Let’s explore some of the key insurance products offered by Otto Insurance:

- Auto Insurance: Otto Insurance provides comprehensive coverage for auto insurance, ensuring protection for your vehicle in case of accidents, theft, or damage. Their policies include liability coverage, collision coverage, and comprehensive coverage to meet the specific needs of drivers.

- Home Insurance: Protecting one of your most valuable assets, Otto Insurance offers home insurance that covers damages to your property, personal belongings, and liability for accidents that happen at home. Additional options for coverage include flood insurance, earthquake insurance, and valuable item coverage.

- Life Insurance: Safeguarding the financial security of your loved ones, Otto Insurance provides various life insurance products, including term life insurance, whole life insurance, and universal life insurance. These policies offer benefits and financial protection in the event of the policyholder’s death.

- Commercial Insurance: For business owners, Otto Insurance offers commercial insurance policies to protect your business assets, employees, and liabilities. Their coverage options include general liability insurance, commercial property insurance, professional liability insurance, and workers’ compensation insurance.

- Health Insurance: Recognizing the importance of health coverage, Otto Insurance also offers health insurance plans to individuals and families. These policies cover medical expenses, including hospital stays, doctor visits, prescription medications, and more.

By providing a wide range of insurance products, Otto Insurance aims to cater to the diverse needs of its customers. Whether you are a driver, homeowner, business owner, or someone seeking health coverage, Otto Insurance has options to meet your specific requirements.

It is important to note that the availability of these insurance products might vary based on your geographical location. Make sure to consult with an Otto Insurance representative or visit their website to explore the specific insurance products available in your area.

Coverage Options

When it comes to insurance coverage, having options that suit your specific needs is crucial. Otto Insurance understands this and offers a range of coverage options to ensure policyholders can customize their insurance plans to provide the desired level of protection. Here are some of the coverage options available:

- Liability Coverage: Liability coverage is a fundamental part of insurance policies, and Otto Insurance provides comprehensive liability coverage options. This protects you financially in case you are held responsible for causing bodily injury or property damage to others.

- Collision Coverage: Collision coverage is particularly important for auto insurance policies. It covers damages to your vehicle in the event of a collision, regardless of who is at fault. This coverage can help you pay for repairs or replacement of your vehicle.

- Comprehensive Coverage: This coverage protects against damage to your vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters. Comprehensive coverage provides peace of mind, knowing that your vehicle is protected in various situations.

- Property Coverage: For homeowners, Otto Insurance offers property coverage options that protect the physical structure of your home and your personal belongings. This coverage extends to damages caused by fire, theft, storms, and other covered events.

- Medical Coverage: Health insurance policies from Otto Insurance typically include medical coverage, which helps cover the cost of medical care, hospital stays, doctor visits, and prescription medications. Having adequate medical coverage ensures that you can access the care you need without incurring exorbitant expenses.

- Business Interruption Coverage: For business owners, Otto Insurance offers business interruption coverage. This coverage helps compensate for lost income and additional expenses in the event that your business operations are temporarily disrupted due to unforeseen events, such as a fire or natural disaster.

These are just a few examples of the coverage options available through Otto Insurance. Each insurance product has its own set of coverage options and add-ons, allowing policyholders to tailor their coverage to their specific needs.

It is important to note that coverage options and availability may vary based on the type of insurance and your location. Consult with an Otto Insurance representative or visit their website to understand the specific coverage options available to you.

Pricing and Premiums

When considering an insurance provider, understanding the pricing structure and premiums is essential. Otto Insurance strives to offer competitive rates while providing comprehensive coverage options. Here are some factors that can influence the pricing and premiums for Otto Insurance policies:

- Insurance Coverage: The type and level of coverage you choose will directly impact your premiums. Policies with higher coverage limits and additional features may have higher premiums compared to basic coverage options.

- Deductibles: The deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. Generally, policies with higher deductibles will have lower premiums, while policies with lower deductibles will have higher premiums.

- Location: Your geographical location can also affect the pricing of insurance policies. Factors such as the cost of living, crime rates, and weather-related risks can influence the premiums for auto and home insurance policies.

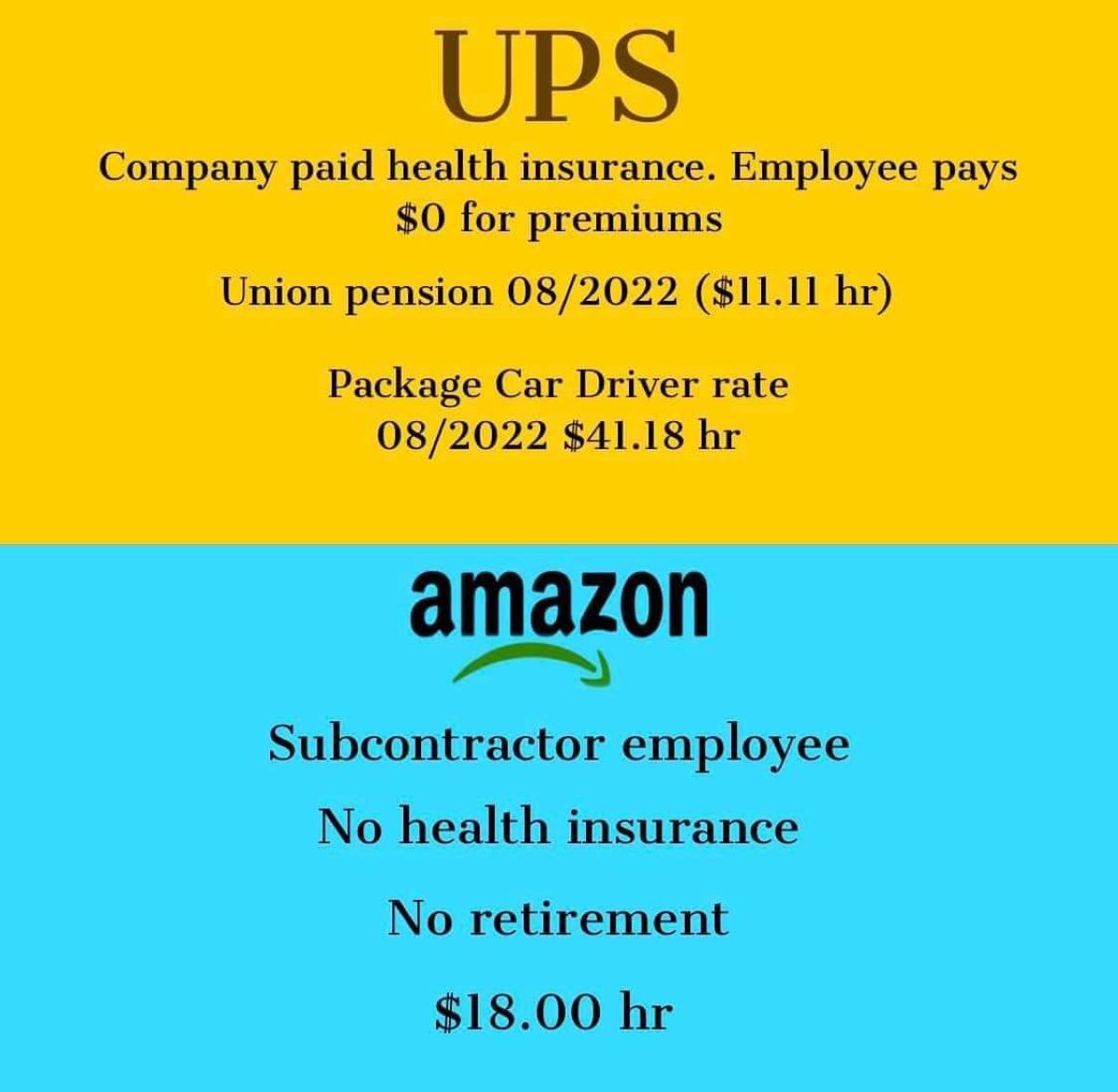

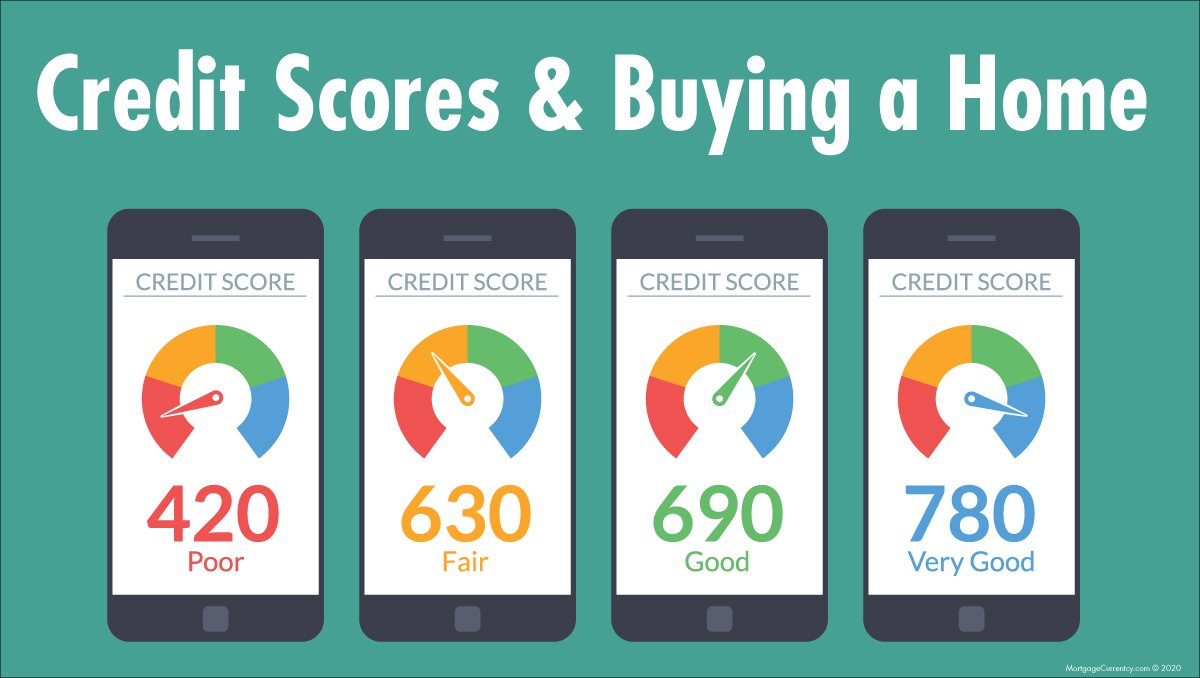

- Personal Factors: Personal factors such as age, gender, driving history, and credit score may be taken into consideration when determining your insurance premiums. Those with a clean driving record and a higher credit score may be eligible for lower premiums.

- Discounts: Otto Insurance offers various discounts that can help reduce your premiums. These may include bundling multiple policies, having a good driving record, installing security systems, or being a loyal customer. Taking advantage of these discounts can lead to significant savings on your insurance premiums.

It is important to note that the pricing and premiums for insurance policies can vary based on individual circumstances and the specific insurance product. It is recommended to obtain a personalized quote from Otto Insurance to get an accurate understanding of the pricing and premiums associated with your desired coverage.

While price is an important factor when choosing an insurance provider, it is equally essential to consider the level of coverage, customer service, and overall value offered by the company. Balancing affordability with comprehensive coverage is key to ensuring that you have adequate protection without compromising your budget.

Customer Satisfaction

Customer satisfaction is a crucial aspect to consider when choosing an insurance provider. Otto Insurance prioritizes the needs of its policyholders and strives to deliver excellent customer service. Here are some factors that contribute to the overall customer satisfaction with Otto Insurance:

- Claims Process: The claims process is a critical aspect of insurance and can significantly impact customer satisfaction. Otto Insurance aims to make the claims process as smooth and efficient as possible. They have streamlined procedures and dedicated claims representatives who guide policyholders through the process, ensuring prompt claim settlements.

- Customer Support: Otto Insurance places a strong emphasis on delivering exceptional customer support. Their customer service representatives are knowledgeable, friendly, and ready to assist policyholders with any inquiries or concerns they may have. The company values open communication and strives to provide timely responses to customer inquiries.

- Transparency and Clarity: Transparent communication is crucial in the insurance industry, and Otto Insurance understands this. They provide policyholders with clear and concise information about their coverage, terms, and conditions. By fostering transparency, Otto Insurance ensures that customers have a comprehensive understanding of their policies.

- Online Tools and Resources: To enhance the customer experience, Otto Insurance offers a range of online tools and resources. Their user-friendly website allows policyholders to manage their policies, make payments, and access important documents easily. Additionally, they may provide educational resources and FAQs to help policyholders make informed decisions.

- Positive Customer Feedback: Customer reviews and feedback can provide valuable insights into the level of satisfaction with an insurance provider. While individual experiences may vary, Otto Insurance has received positive feedback for its responsive customer service and efficient claims resolution.

While no insurance provider is perfect, Otto Insurance’s commitment to customer satisfaction is evident in its efforts to provide seamless claims processing, exceptional customer support, and transparent communication. By placing the needs of its policyholders at the forefront, Otto Insurance strives to create a positive customer experience.

It is recommended to review customer feedback, consult with a representative, and request personalized quotes to assess whether Otto Insurance is the right fit for your insurance needs.

Claim Process

When it comes to filing an insurance claim, the ease and efficiency of the process are crucial factors for policyholders. Otto Insurance understands the importance of a smooth claims experience and aims to simplify and expedite the process for its customers. Here is an overview of the claim process with Otto Insurance:

Filing a Claim: In the event of an incident or loss covered by your insurance policy, the first step is to contact Otto Insurance to initiate the claims process. This can typically be done through their website, over the phone, or via a mobile app, depending on their available channels.

Claims Evaluation: Once you have filed a claim, a dedicated claims representative will be assigned to your case. They will guide you through the process, answer any questions you may have, and evaluate the damages or losses covered by your policy. The claims representative will gather all the necessary information to assess the validity and coverage of the claim.

Documentation and Evidence: To support your claim, you will be required to provide relevant documentation and evidence. This may include photos of the damages, police reports, medical bills, or any other relevant information. The claims representative will guide you on the specific documentation required for your claim.

Claims Settlement: Once the evaluation is complete and the necessary documentation has been submitted, Otto Insurance will process your claim. They aim to provide timely claim settlements, ensuring that you receive the compensation or reimbursement that you are entitled to under your policy.

Payment or Repairs: Depending on the nature of your claim, Otto Insurance will either make a direct payment to you or arrange for repairs to be carried out. For example, in an auto insurance claim, they may directly cover the cost of repairs to your vehicle or reimburse you based on the agreed-upon terms of your policy.

Claims Follow-Up: Throughout the claims process, the assigned claims representative will keep you informed about the progress of your claim. They will address any additional requirements or queries you may have and ensure that the claim is processed efficiently.

It is important to note that the specific details and steps of the claims process may vary depending on the type of insurance policy and the nature of the claim. It is recommended to review your policy documents or consult with an Otto Insurance representative to fully understand the claims process and requirements specific to your situation.

By prioritizing customer satisfaction and streamlining the claims process, Otto Insurance aims to provide a hassle-free experience for policyholders when it comes to filing and resolving insurance claims.

Pros and Cons of Otto Insurance

When considering insurance providers, it is important to weigh the pros and cons to make an informed decision. Here are some notable advantages and potential drawbacks of choosing Otto Insurance:

Pros:

- Comprehensive Coverage Options: Otto Insurance offers a wide range of insurance products, allowing individuals and businesses to find coverage that suits their specific needs.

- Strong Reputation: With over 20 years of experience, Otto Insurance has established a strong reputation for reliability and financial stability in the insurance industry.

- Customer-Centric Approach: The company is known for its customer-centric approach, focusing on providing personalized solutions, excellent customer service, and timely claims processing.

- Competitive Pricing: While insurance premiums can vary based on individual circumstances, Otto Insurance aims to offer competitive rates, making their policies affordable for many policyholders.

- Transparent Communication: Otto Insurance emphasizes transparency and strives to provide clear and concise information about their coverage options, terms, and conditions.

- Extensive Network: With a broad network of insurance carriers, Otto Insurance can offer a wide variety of coverage options to cater to different customer needs.

Cons:

- Availability: The availability of insurance products may vary depending on your geographical location. Some coverage options or discounts may not be available in certain areas.

- Individual Experience: The level of customer satisfaction can vary based on individual experiences and specific circumstances. While many customers have positive experiences with Otto Insurance, there may be instances where some customers encounter issues or challenges.

- Policy Limitations: Like any insurance provider, Otto Insurance may have certain limitations and exclusions in their policies. It is vital to thoroughly review the terms and conditions to understand the scope of coverage and any potential limitations.

It is important to carefully consider these pros and cons in relation to your specific insurance needs and preferences. Conducting thorough research, comparing options, and consulting with an Otto Insurance representative can help you determine whether it is the right insurance provider for you.

Conclusion

After evaluating the various aspects of Otto Insurance, it is evident that they possess several qualities that make them a reputable insurance provider. With a strong track record in the industry, comprehensive coverage options, and a customer-centric approach, Otto Insurance strives to meet the diverse insurance needs of individuals and businesses.

Their commitment to excellent customer service, transparent communication, and timely claims processing sets them apart from their competitors. With a wide range of insurance products, from auto and home insurance to life and commercial insurance, Otto Insurance offers solutions for various aspects of life and business.

While there may be limitations and variances in availability based on geographical locations, overall, the company has positioned itself as a reliable insurance provider. Their competitive pricing and extensive network of insurance carriers allow customers to find suitable coverage at affordable rates.

It is important, however, to consider individual experiences and preferences when making a decision about insurance coverage. Conducting thorough research, reading policy terms and conditions, and consulting with an Otto Insurance representative can provide the necessary information to make an informed choice.

In conclusion, Otto Insurance proves to be a trusted and customer-focused insurance provider, offering a wide range of coverage options for individuals and businesses alike. Their commitment to customer satisfaction, transparency, and reliability makes them a viable option for those seeking comprehensive insurance protection.

Please note that insurance needs vary from person to person, so it is advisable to assess your specific requirements and compare options to ensure that Otto Insurance aligns with your individual insurance needs and preferences.