Finance

How Is A Line Of Credit Different From A Loan

Modified: February 21, 2024

Understand the key differences between a line of credit and a loan in the world of finance. Find out which one suits your needs best and make smarter financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Line of Credit

- Definition of a Loan

- Key Differences Between a Line of Credit and a Loan

- Purpose of a Line of Credit

- Purpose of a Loan

- Repayment Terms for a Line of Credit

- Repayment Terms for a Loan

- Interest Rates for a Line of Credit

- Interest Rates for a Loan

- Flexibility of a Line of Credit

- Flexibility of a Loan

- Application Process for a Line of Credit

- Application Process for a Loan

- Conclusion

Introduction

When it comes to financing options, you may have heard the terms “line of credit” and “loan.” Both of these options can provide the funds needed to meet various financial needs. However, it’s important to understand the differences between a line of credit and a loan to determine which option is best suited for your specific situation.

A line of credit and a loan are both forms of borrowing, but they function differently and serve different purposes. Understanding these differences will help you make informed decisions about your financial strategies and goals.

In this article, we will delve into the definitions of a line of credit and a loan and explore the key differences between the two. We will also examine the purposes, repayment terms, interest rates, flexibility, and application processes for both options. By the end of this article, you will have a clear understanding of the distinctions between a line of credit and a loan and be better equipped to make informed financial decisions.

Definition of a Line of Credit

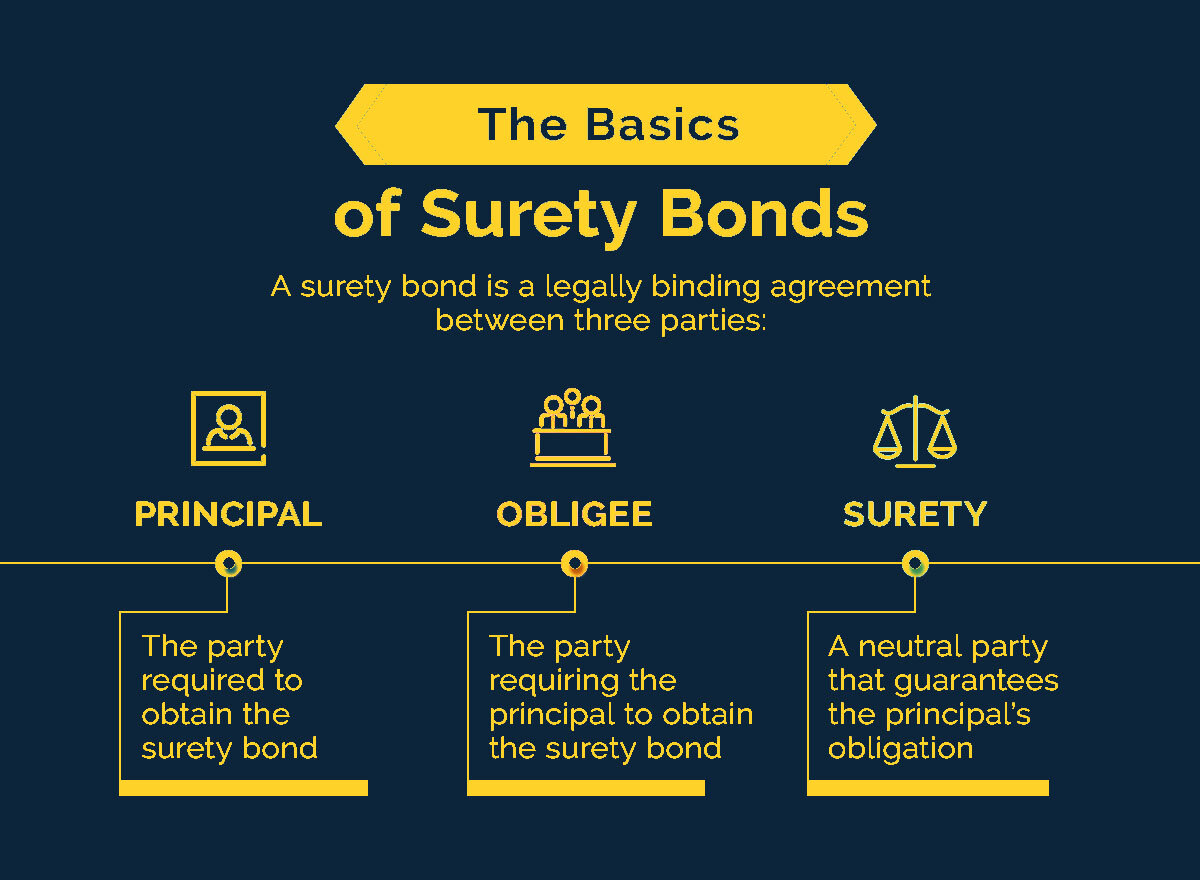

A line of credit is a flexible borrowing option that allows individuals or businesses to access a predetermined pool of funds whenever needed. It works similarly to a credit card, where borrowers have a set credit limit and can borrow any amount up to that limit. The borrower can then make purchases or withdraw cash from the line of credit as needed.

Unlike a traditional loan, a line of credit does not provide a lump sum of money upfront. Instead, it provides ongoing access to funds that can be used and repaid multiple times within a specified period, known as the draw period. The draw period can range from months to years, depending on the terms agreed upon with the lender.

When a borrower uses the funds from the line of credit, they only pay interest on the amount borrowed, not the entire credit limit. For example, if the borrower has a line of credit with a limit of $10,000 and they use $5,000, they will only pay interest on the $5,000 used. This flexibility allows borrowers to manage their cash flow efficiently.

It’s important to note that a line of credit can be either secured or unsecured. A secured line of credit requires collateral, such as a property or a vehicle, to secure the funds borrowed. On the other hand, an unsecured line of credit does not require collateral but may have stricter eligibility criteria and higher interest rates.

Definition of a Loan

A loan is a financial arrangement where a lender provides a borrower with a specific amount of money upfront, which is typically repaid over a set period with interest. Unlike a line of credit, a loan is a one-time lump sum disbursal of funds, rather than an ongoing access to a pool of money.

When obtaining a loan, borrowers receive the full loan amount at the beginning of the borrowing period and are obligated to make regular payments, usually on a monthly basis, until the loan is fully repaid. These payments consist of both the principal amount borrowed and the calculated interest. Loans can be used for various purposes, such as purchasing a home, financing a vehicle, or covering educational expenses.

Similar to a line of credit, loans can be secured or unsecured. A secured loan requires collateral, which serves as security for the lender in case the borrower defaults on the loan. Common types of secured loans include mortgages and car loans. Unsecured loans, on the other hand, do not require collateral but may have higher interest rates and stricter eligibility criteria. Credit cards and personal loans are examples of unsecured loans.

Unlike a line of credit, where borrowers can continuously draw and repay funds, a loan is typically repaid in equal monthly installments over a fixed period, known as the loan term. The loan term can range from a few years to several decades, depending on the type of loan and the repayment agreement with the lender.

It’s important to carefully consider your financial needs and repayment capabilities when applying for a loan, as the terms and conditions, including interest rates and repayment schedules, will dictate the overall cost and feasibility of the loan.

Key Differences Between a Line of Credit and a Loan

While both a line of credit and a loan involve borrowing money, there are several key differences between the two:

- Funds availability: A line of credit provides ongoing access to a predetermined pool of funds, which can be borrowed and repaid multiple times. In contrast, a loan provides a one-time lump sum disbursal of funds.

- Repayment structure: A line of credit typically has a draw period, during which borrowers can access funds and make interest-only payments. After the draw period ends, borrowers enter the repayment phase, where they must start repaying both the principal and interest. Loans, on the other hand, have a fixed repayment schedule from the beginning, with regular payments consisting of both principal and interest.

- Interest calculation: With a line of credit, borrowers only pay interest on the amount they have utilized, not the total credit limit. Loans, however, require interest payments on the entire loan amount.

- Flexibility: Lines of credit offer greater flexibility as borrowers can draw and repay funds as needed within the set credit limit. Loans, on the other hand, do not allow for additional borrowing once the initial amount is disbursed.

- Purpose: Lines of credit are often used for ongoing or unpredictable expenses, such as home improvement projects or covering business expenses. Loans are typically used for specific purposes, such as purchasing a car or financing education.

- Collateral: While both lines of credit and loans can be secured or unsecured, secured lines of credit and loans require collateral, such as a property or vehicle, to secure the borrowed funds. Unsecured lines of credit and loans do not require collateral.

- Interest rates: The interest rates for lines of credit are typically variable, meaning they can fluctuate over time. Loans, on the other hand, can have either fixed or variable interest rates, depending on the terms of the loan.

Understanding these key differences will help you assess your financial needs and make an informed decision on whether a line of credit or a loan is better suited for your specific situation.

Purpose of a Line of Credit

A line of credit serves various purposes and offers flexibility when it comes to managing financial needs. Here are some common purposes for utilizing a line of credit:

- Managing cash flow: A line of credit can help individuals and businesses manage their cash flow by providing access to funds during periods of fluctuating income or unexpected expenses. It serves as a financial safety net, allowing borrowers to bridge gaps between receivables and payables.

- Business operations: Businesses can use a line of credit to cover short-term operational expenses, such as purchasing inventory, meeting payroll obligations, or handling unexpected repairs or maintenance.

- Home improvements: A line of credit can be a convenient option for funding home improvement projects, as it allows borrowers to access funds as needed for renovations, repairs, or upgrades.

- Education expenses: Lines of credit can be used to finance education-related expenses, such as tuition fees, books, or living expenses. This can be particularly beneficial for individuals pursuing higher education or furthering their professional development.

- Debt consolidation: A line of credit can be used to consolidate higher-interest debts, such as credit card balances or personal loans, into a single, more manageable payment. This can potentially help borrowers save on interest costs and streamline their debt repayment process.

- Emergency situations: Having a line of credit in place can provide peace of mind in case of emergencies, such as medical expenses, car repairs, or unexpected home repair costs. Borrowers can quickly access funds when needed, without the need to apply for a new loan.

It’s important to note that while a line of credit offers flexibility for various purposes, borrowers should use the funds responsibly and ensure they have a plan for timely repayment. Understanding your specific financial needs and goals will help you determine if a line of credit aligns with your borrowing requirements.

Purpose of a Loan

A loan serves as a financial tool to fulfill specific financial needs and goals. Here are some common purposes for obtaining a loan:

- Home purchase: One of the most common reasons people seek loans is to finance the purchase of a home. Home loans, also known as mortgages, provide individuals with the necessary funds to acquire property or real estate.

- Vehicle financing: Loans can be used to finance the purchase of a car, motorcycle, or other vehicles. Auto loans allow borrowers to pay for the vehicle over time with fixed monthly payments, making it more affordable to own a vehicle.

- Education expenses: Loans can help cover the cost of higher education, such as tuition fees, books, and living expenses. Student loans provide individuals with the opportunity to invest in their education and future careers.

- Business expansion: Loans play a critical role in business growth and expansion. Business owners can secure loans to invest in new equipment, lease or purchase additional space, hire employees, or fund marketing initiatives.

- Debt consolidation: Individuals burdened with multiple high-interest debts, such as credit card balances or personal loans, may choose to consolidate their debts into a single loan. Debt consolidation loans help streamline repayments and reduce interest costs.

- Home renovations: Loans can be used to finance home improvement projects, such as remodeling the kitchen, adding an extension, or upgrading the bathrooms. These loans allow homeowners to enhance the value and functionality of their properties.

- Medical expenses: In cases where individuals face significant medical expenses that are not covered by insurance, loans can help cover these costs. Medical loans provide the necessary funds to manage emergency medical procedures or ongoing treatments.

A loan serves as a key financial tool for individuals and businesses to achieve their goals and meet their financial needs. When considering a loan, it is crucial to assess your current financial situation, repayment capability, and interest rates to ensure a responsible borrowing decision.

Repayment Terms for a Line of Credit

The repayment terms for a line of credit are different from those of a traditional loan. Here are some key aspects to consider:

- Draw period: A line of credit typically has a draw period in which borrowers can access funds. During this period, which can range from several months to several years, borrowers can make withdrawals from the line of credit as needed.

- Minimum monthly payments: During the draw period, borrowers are usually only required to make minimum monthly interest payments on the amount borrowed. This allows for flexibility in managing cash flow.

- Repayment phase: Once the draw period ends, borrowers transition into the repayment phase. At this point, they can no longer make withdrawals and must begin repaying both the principal amount borrowed and the interest on the outstanding balance.

- Repayment schedule: The repayment schedule for a line of credit can vary. Some lenders may require fixed monthly payments, while others may calculate payments based on a percentage of the outstanding balance.

- Interest-only payments: In some cases, borrowers may have the option to make interest-only payments during the draw period. This can help keep the initial monthly payment lower; however, it’s important to note that the principal balance will not decrease during this time.

- Flexible repayment: Unlike a traditional loan with fixed monthly payments, a line of credit offers flexibility in terms of repayment. Borrowers can choose to repay the outstanding balance in full or make additional payments at their discretion.

- Revolving credit: As payments are made towards the line of credit, the available credit limit is replenished. This means that borrowers can continue to borrow and repay funds as long as the line of credit remains open.

It’s important to read and understand the terms and conditions of the line of credit to ensure that you know the specifics of repayments and can plan accordingly. Making timely payments and managing your outstanding balance responsibly will help you maintain a healthy credit score and ensure a positive borrowing experience.

Repayment Terms for a Loan

Repayment terms for a loan differ from those of a line of credit. Here are some key aspects to consider:

- Fixed loan amount: A loan provides borrowers with a fixed lump sum amount at the beginning of the borrowing period. This means that borrowers have a predetermined loan amount and cannot make additional withdrawals.

- Regular monthly payments: Borrowers are required to make regular monthly payments towards a loan. These payments consist of both the principal amount borrowed and the interest calculated based on the outstanding loan balance.

- Loan term: Loans have a predetermined term during which the borrower must repay the loan in full. The term can range from a few years to several decades, depending on the type of loan and the agreement with the lender.

- Amortization schedule: Most loans have an amortization schedule that outlines the specific payment amounts and due dates over the course of the loan term. This schedule helps borrowers understand how their payments are applied towards the principal and interest portions of the loan.

- Fixed monthly payments: Loans typically require fixed monthly payments, meaning the payment amount remains the same throughout the loan term. This provides borrowers with a predictable repayment schedule.

- Principal reduction: With each monthly payment, a portion goes towards reducing the principal balance of the loan. Over time, this helps to gradually decrease the outstanding loan amount and build equity.

- Interest calculation: The interest on a loan is typically calculated based on the outstanding loan balance. As the loan balance decreases with each payment, the interest charged on subsequent payments also decreases.

- Early repayment: In some cases, borrowers may have the option to make additional payments towards the loan principal, allowing them to repay the loan earlier than the scheduled term. However, it’s important to review the terms and conditions to ensure there are no prepayment penalties.

Understanding the repayment terms of your loan is crucial for budgeting and managing your finances. Adhering to the agreed-upon payment schedule and making regular, timely payments will help you complete your loan obligations successfully.

Interest Rates for a Line of Credit

Interest rates for a line of credit can vary depending on various factors, including the type of line of credit, the borrower’s creditworthiness, and the current market conditions. Here are some key points to consider:

- Variable interest rates: Lines of credit often feature variable interest rates. This means that the interest rate can fluctuate over time based on changes in the market, such as the prime lending rate or an index specified in the loan agreement.

- Prime rate: Many lines of credit are tied to the prime rate, which is the interest rate that banks charge their most creditworthy customers. As the prime rate changes, the interest rate on the line of credit will also adjust accordingly.

- Margin: In addition to the prime rate, the lender may add a margin, which is a percentage added to the prime rate that represents their profit. For instance, if the prime rate is 4% and the margin is 2%, the interest rate on the line of credit would be 6%.

- Credit risk: Lenders determine interest rates based on the borrower’s creditworthiness and risk profile. Individuals with a strong credit history and high credit scores may qualify for lower interest rates, while those with credit challenges might face higher rates.

- Interest calculation: Interest on a line of credit is typically calculated based on the average daily balance during the billing cycle. This means that the interest expense may vary from month to month depending on the amount borrowed and the timing of withdrawals and repayments.

- Promotional rates: Some lines of credit may offer promotional interest rates for an initial period. These rates are often lower than the standard rates and can be an attractive option for borrowers seeking temporary financing.

- Introductory offers: In certain cases, lenders may provide introductory offers where a line of credit comes with a low-interest or even 0% interest rate for a specified period. It is important to understand the terms and conditions of these offers, as the rates may increase after the introductory period ends.

It is essential to review the terms and conditions of a line of credit thoroughly, including the interest rate provisions, to understand the cost of borrowing. Comparing interest rates from different lenders and considering your own financial situation will help you make an informed decision when choosing a line of credit.

Interest Rates for a Loan

Interest rates for a loan can vary based on several factors, including the type of loan, the borrower’s creditworthiness, and the prevailing market conditions. Here are some key points to consider:

- Fixed or variable rates: Loans can have either fixed interest rates or variable interest rates. A fixed interest rate remains the same throughout the loan term, providing certainty in monthly payments. A variable interest rate, on the other hand, may change periodically based on market fluctuations.

- Prime rate or benchmark index: Some loans, particularly those tied to mortgages, may be influenced by the prime lending rate or a benchmark index. Changes in these rates can impact the interest rate on the loan.

- Creditworthiness: Lenders assess a borrower’s creditworthiness to determine the interest rate they qualify for. Those with a higher credit score and solid credit history are often offered lower interest rates as they are considered less risky borrowers.

- Loan term: The term, or length, of the loan can also affect the interest rate. Loans with longer terms may have higher interest rates due to the increased risk for the lender over an extended repayment period.

- Loan type: Different types of loans, such as personal loans, auto loans, or student loans, may have varying interest rates. The characteristics of the loan, such as collateral requirements and loan purpose, can influence the interest rate offered.

- Market conditions: Overall market conditions, including economic factors and the prevailing interest rate environment, can impact the interest rates on loans. In times of economic volatility or higher interest rates, borrowers may experience higher loan interest rates.

- Interest calculation: The interest on a loan is typically calculated based on the loan’s outstanding balance. The interest expense is calculated using various amortization methods, such as simple interest or compound interest, which determine how much interest is paid over the life of the loan.

- Discounts or promotions: In some cases, lenders may offer discounts or promotions on loan interest rates. For example, a borrower may receive a lower interest rate for setting up automatic payments or for being an existing customer of the lending institution.

It is essential to carefully review the terms and conditions, including the interest rate provisions, when obtaining a loan. Comparing offers from different lenders and considering your credit profile and financial situation will help you secure the most favorable interest rate for your loan.

Flexibility of a Line of Credit

One of the key advantages of a line of credit is its flexibility, which sets it apart from traditional loans. Here are some aspects that highlight the flexibility of a line of credit:

- Borrowing as needed: With a line of credit, borrowers have the flexibility to access funds as and when they need them. They can choose to borrow the entire credit limit at once or make smaller withdrawals over time.

- Pay interest on what is borrowed: Unlike a loan, a line of credit allows borrowers to pay interest only on the amount they have borrowed, rather than the full credit limit. This can result in lower interest costs if only a portion of the available credit is utilized.

- Revolving credit: A line of credit is considered revolving credit, meaning as payments are made towards the outstanding balance, the available credit limit is replenished. This allows borrowers to use the line of credit repeatedly as long as it remains open.

- Flexible repayment options: During the draw period, borrowers often have the flexibility to make interest-only payments. This provides more control over cash flow and allows borrowers to manage their finances effectively.

- No need for reapplication: Once approved, borrowers do not need to reapply for a line of credit each time they require funds. They can continue to access funds as long as they are within the credit limit and have made payments as agreed.

- Variable withdrawal amounts: A line of credit allows borrowers to choose how much they want to withdraw at any given time, as long as it is within the credit limit set by the lender. This provides the flexibility to address financial needs of different magnitudes.

- Flexibility in usage: There are usually no restrictions on how the borrowed funds from a line of credit can be used. Borrowers have the freedom to allocate the funds based on their specific needs, whether it’s for personal expenses, business operations, or unexpected costs.

The flexibility of a line of credit enables borrowers to have a financial safety net and access funds when needed. It provides greater control and customization in managing their financial obligations, making it an attractive option for those who require ongoing access to funds.

Flexibility of a Loan

When it comes to flexibility, loans may not offer the same level of adaptability as a line of credit. However, they still provide certain advantages and options for borrowers. Here are some aspects that highlight the flexibility of a loan:

- Fixed loan amount: Loans offer borrowers a fixed amount of money that can be useful for achieving specific financial goals, such as buying a home or financing a car. This predetermined amount allows borrowers to plan and budget accordingly.

- Predictable repayment schedule: With a loan, borrowers know the exact repayment schedule from the beginning. This fixed repayment schedule provides clarity and allows borrowers to plan their finances accordingly.

- Customized loan terms: Loans often offer the ability to choose the loan term that best fits the borrower’s financial situation. Longer loan terms result in lower monthly payments, while shorter terms may lead to faster loan repayment but higher monthly payments.

- Structured payments: Loans have a structured repayment plan where borrowers make regular monthly payments consisting of both principal and interest. This allows for better financial planning and helps borrowers track progress towards paying off the loan.

- Partial prepayment: Depending on the loan agreement, borrowers may have the option to make partial prepayments towards the loan principal. This flexibility allows borrowers to reduce the outstanding balance and potentially save on interest costs over the loan term.

- Additional repayments: In some cases, borrowers may have the ability to make additional repayments towards the loan, above the required monthly payments. This allows borrowers to pay off the loan faster and potentially save on interest charges.

- Secured options: Loans can be secured with collateral, such as a home or vehicle. Secured loans often offer more flexible terms, higher borrowing limits, and potentially lower interest rates compared to unsecured loans.

- Purpose-specific loans: Loans are often designed for specific purposes, such as mortgage loans, auto loans, or education loans. These purpose-specific loans have unique terms and features tailored to the borrower’s specific needs.

While loans may not provide the same level of ongoing flexibility as a line of credit, they offer structured repayment plans and the ability to customize loan terms to suit specific financial objectives. Borrowers should carefully evaluate their financial needs and goals to determine which loan options provide the flexibility they require.

Application Process for a Line of Credit

The application process for a line of credit typically involves several steps. While specific requirements and procedures may vary between lenders, here is a general overview of what to expect:

- Research and comparison: Start by researching different financial institutions or lenders that offer lines of credit. Compare their terms, interest rates, fees, and eligibility criteria to find the one that best suits your needs.

- Check eligibility: Review the eligibility requirements set by the lender. These criteria may include factors such as credit score, income level, employment history, and debt-to-income ratio. Ensure that you meet the minimum qualifications before proceeding.

- Gather necessary documents: Prepare the required documents, which may include identification proof, proof of income, bank statements, tax returns, and any other documentation requested by the lender. Having these documents ready will streamline the application process.

- Submit an application: Complete the application form provided by the lender. The form will typically ask for personal information, financial details, and the desired credit limit. Submit the application along with the necessary documents as instructed by the lender.

- Verification process: The lender will review your application and verify the provided information. They may contact you for additional documents or clarification if needed. They will also assess your creditworthiness during this stage.

- Approval and credit limit determination: If your application is approved, the lender will determine the credit limit they are willing to extend to you. This limit will be based on various factors, including your credit history, income, and the lender’s internal policies.

- Terms and conditions: Review and understand the terms and conditions of the line of credit, including the interest rate, repayment schedule, any fees or charges, and other key details. If you agree with the terms, accept the offer provided by the lender.

- Account setup: Once you have accepted the offer, the lender will establish an account for your line of credit. They will provide you with the necessary account details, such as account number and access information, to manage and track your line of credit.

It’s important to note that the application process may take some time, as the lender needs to assess your application and conduct the necessary verifications. Stay in touch with the lender throughout the process and provide any requested information promptly to expedite the application assessment.

Application Process for a Loan

The application process for a loan typically involves several steps. While the specific requirements and procedures may vary depending on the lender and the type of loan, here is a general overview of what to expect:

- Research and comparison: Begin by researching different lenders or financial institutions that offer the type of loan you are seeking. Compare interest rates, loan terms, fees, and eligibility criteria to find the best fit for your needs.

- Gather necessary documents: Prepare the required documents, such as identification proof, proof of income, bank statements, tax returns, credit history, and any other documentation specified by the lender. Having these documents ready will streamline the application process.

- Submit an application: Complete the loan application form provided by the lender. The application form will typically require personal information, financial details, employment history, and the amount you wish to borrow. Ensure that all information provided is accurate and up-to-date.

- Documentation review: The lender will review your loan application and verify the information provided. They may contact you for additional documents or clarification if needed. They will also evaluate your creditworthiness based on your credit history and financial situation.

- Loan approval and terms: If your application is approved, the lender will provide you with an offer outlining the loan amount, interest rate, repayment term, and any associated fees or charges. Carefully review and understand the terms and conditions before accepting the loan offer.

- Accepting the loan offer: Once you have reviewed and agreed to the loan terms, accept the loan offer from the lender. This typically involves signing the loan agreement and any other relevant documents.

- Funds disbursal: After accepting the loan offer, the lender will disburse the approved loan amount. The funds can be transferred to your designated bank account or issued via a check depending on the lender’s procedures.

- Repayment schedule: Familiarize yourself with the repayment schedule outlined in the loan agreement. This will specify the frequency of payments (e.g., monthly, bi-weekly) and the due dates. Ensure that you understand your repayment obligations and make timely payments accordingly.

Remember, it is important to carefully review the loan terms and conditions, including interest rates, loan term, and repayment schedule. If you have any questions or concerns, reach out to the lender for clarification before accepting the loan offer. Responsible loan management and timely repayments will help you build a positive credit history and maintain a healthy financial position.

Conclusion

Understanding the differences between a line of credit and a loan is essential in making informed financial decisions. Both options have their unique features and serve different purposes.

A line of credit offers flexibility, allowing borrowers to access funds as needed and only pay interest on the amount borrowed. It is beneficial for managing cash flow, addressing unpredictable expenses, and providing a financial safety net.

A loan, on the other hand, provides borrowers with a lump sum amount upfront that is repaid over a fixed period with interest. Loans are ideal for specific purposes such as home purchases, vehicle financing, or funding higher education.

When considering which option is best for you, carefully evaluate your financial needs, repayment capabilities, and preferences. Additionally, take into account factors such as interest rates, repayment terms, flexibility, and eligibility requirements.

It’s crucial to conduct thorough research, compare offers from different lenders, and review the terms and conditions of each option before making a decision. Consider seeking advice from financial professionals if needed to ensure you make the best choice for your circumstances.

Remember, responsible borrowing and timely repayment are key to maintaining a healthy financial position. By understanding the differences between a line of credit and a loan, you’ll be able to choose the most suitable option that aligns with your financial goals and needs.