Finance

How Are Surety Bonds Different From Insurance?

Published: October 11, 2023

Learn how surety bonds differ from insurance and why they are crucial in the world of finance. Understand their unique benefits and safeguards.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing risks and protecting your financial interests, two terms that often come up are “surety bonds” and “insurance.” While both serve as means of mitigating potential losses, they are distinct in their purpose, parties involved, and claims process. Understanding the differences between surety bonds and insurance is essential for individuals and businesses alike.

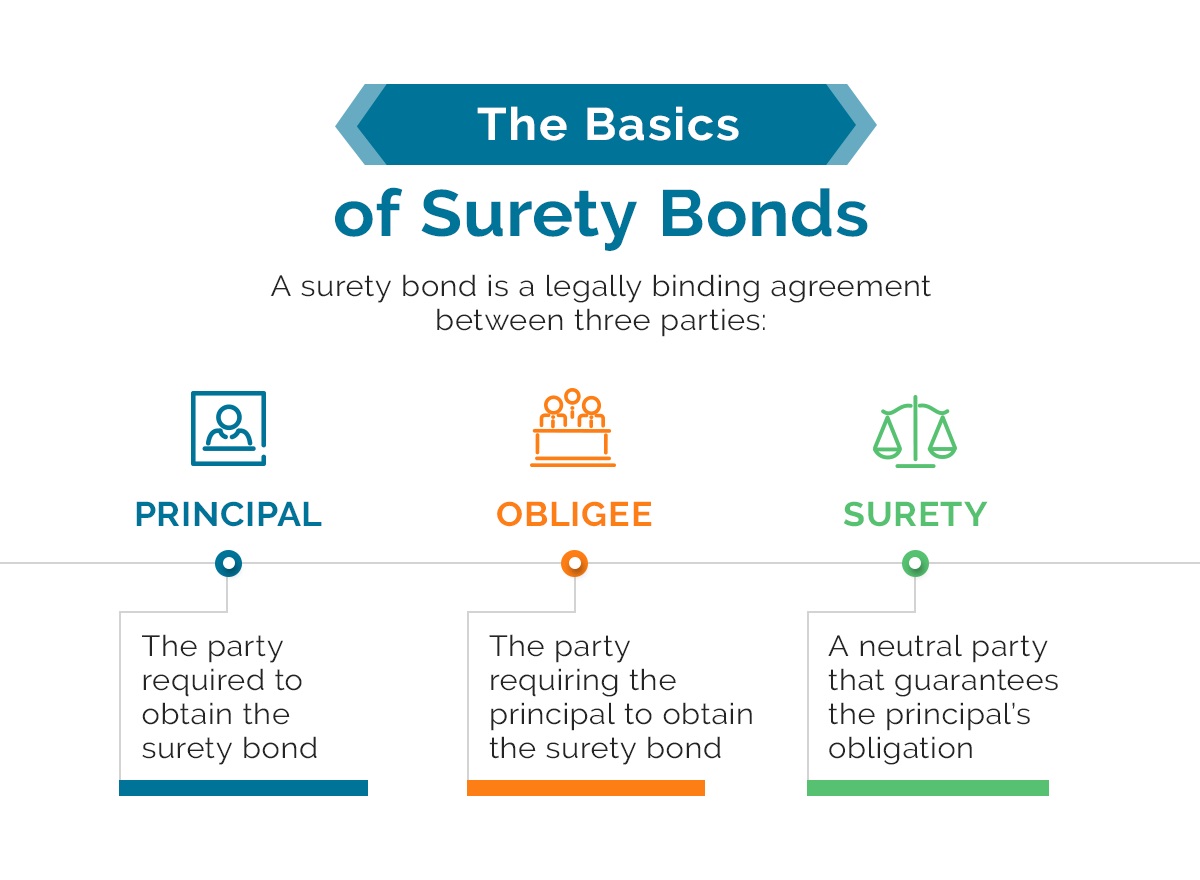

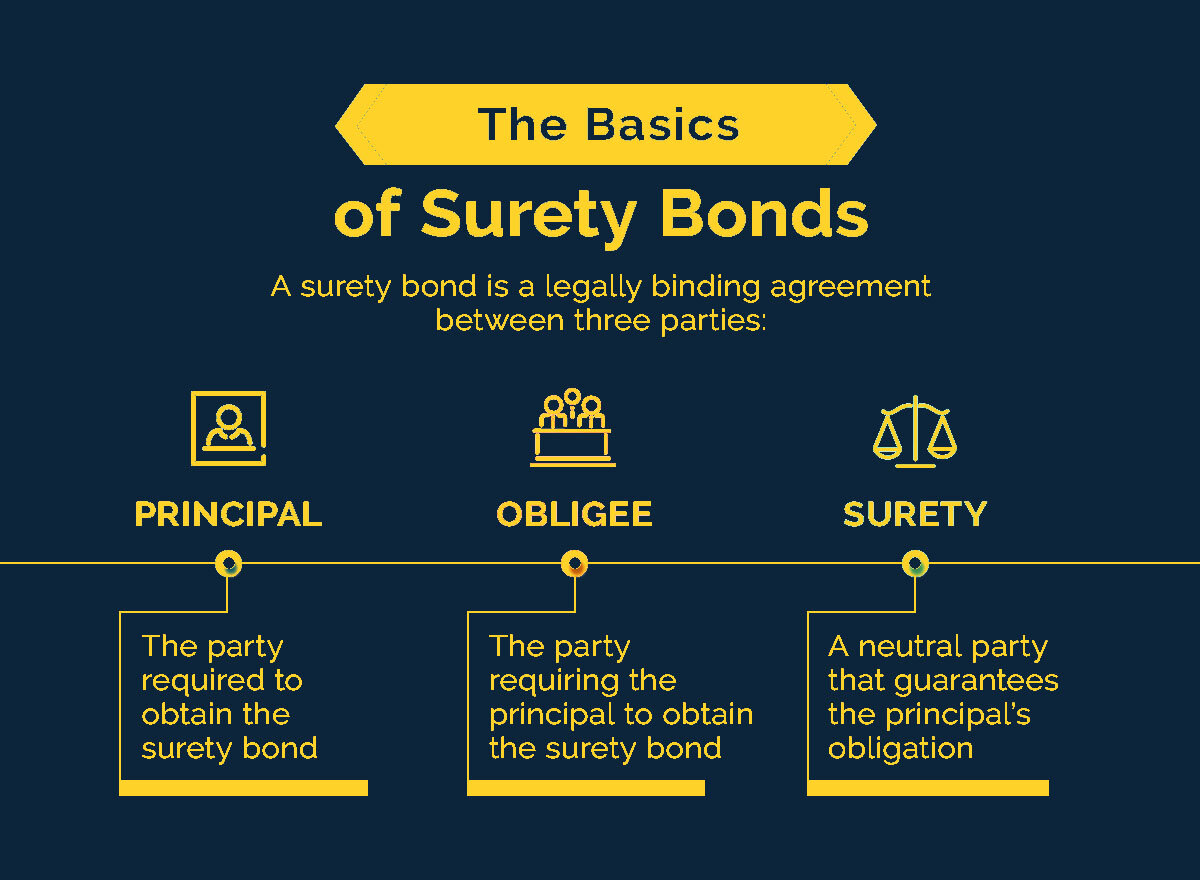

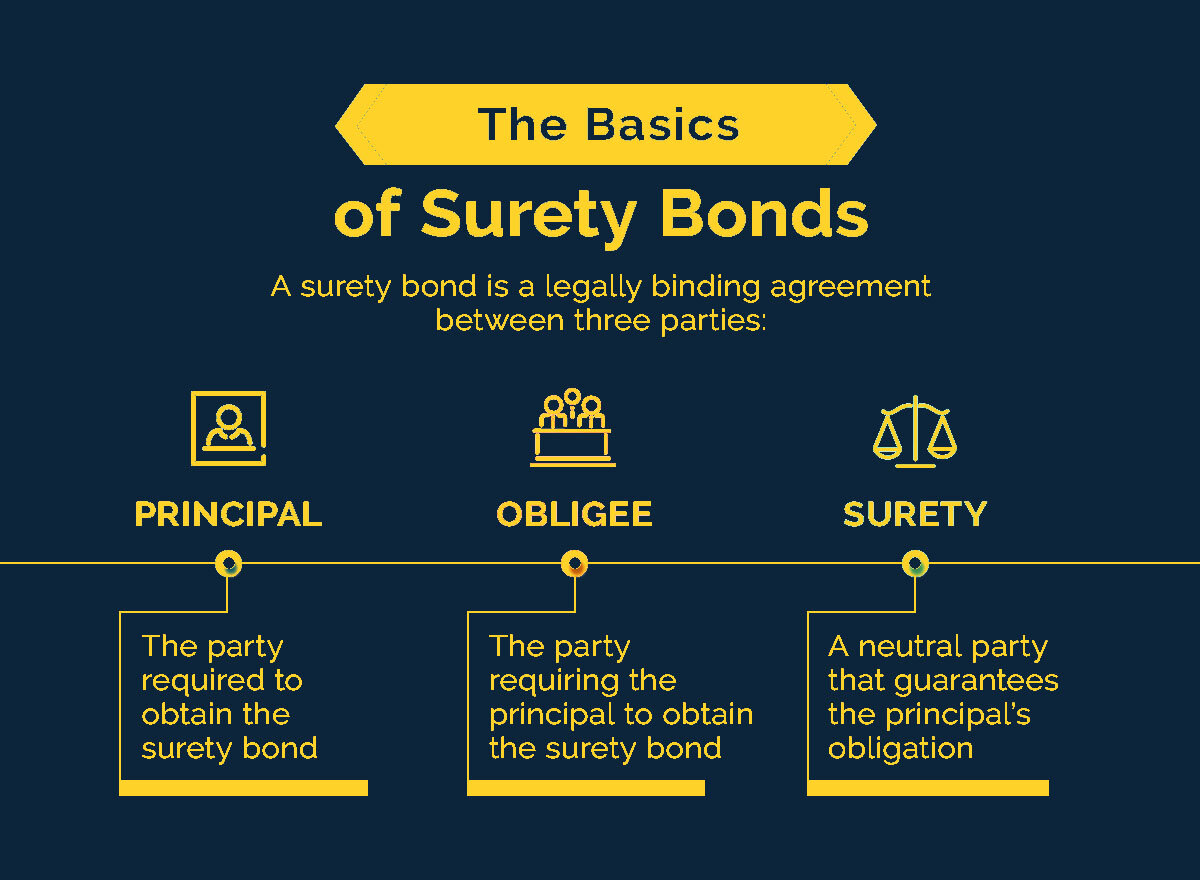

A surety bond is a legally binding agreement between three parties: the principal, the obligee, and the surety. The principal is the individual or entity obligated to perform a specific task or fulfill certain obligations. The obligee is the party requiring the bond as a form of assurance that the principal will meet their obligations. The surety, often an insurance company, acts as a guarantor, providing financial backing and ensuring that the principal fulfills their responsibilities.

On the other hand, insurance is a contract between an individual or business (referred to as the policyholder) and an insurance company. The policyholder pays a premium to the insurance company in exchange for coverage against certain risks outlined in the policy. In case of a covered loss, the insurance company compensates the policyholder based on the terms and conditions of the policy.

The purpose of surety bonds is to protect the obligee from financial loss if the principal fails to meet their obligations. These obligations can include adhering to contracts, complying with regulations, or fulfilling financial responsibilities. Surety bonds provide a guarantee that the principal will perform as agreed, and if they don’t, the surety will step in to cover any resulting damages or losses.

On the other hand, insurance is designed to provide financial protection against unforeseen events or losses. It helps individuals and businesses manage risks by providing coverage for property damage, liability claims, medical expenses, and other specified perils. Insurance policies typically compensate the policyholder for the covered losses based on the policy terms, limits, and deductibles.

Now that we have a basic understanding of surety bonds and insurance, let’s explore the key differences between the two. Understanding these differences will help you determine when and why you might need one or the other in various situations.

Definition of Surety Bonds

A surety bond is a contractual agreement between three parties: the principal, the obligee, and the surety. The principal is the party that promises to fulfill certain obligations, such as completing a construction project, adhering to regulations, or fulfilling financial obligations. The obligee is the party that requires the bond as a form of assurance that the principal will meet their obligations. The surety is the third party that provides a financial guarantee or backing for the principal, ensuring that they fulfill their responsibilities.

Surety bonds are commonly used in various industries and sectors, including construction, finance, real estate, licensing, and government projects. They serve as a form of protection for the obligee, providing financial compensation in case the principal fails to fulfill their obligations.

There are different types of surety bonds, each serving a specific purpose:

- Contract Bonds: These bonds are typically used in construction projects and ensure that the principal fulfills the terms of the contract, including completing the project on time and within budget.

- License and Permit Bonds: These bonds are required by government agencies, ensuring that individuals or businesses comply with regulations and laws related to their specific licenses or permits.

- Performance Bonds: These bonds guarantee that the principal will perform their obligations as specified in a contract, such as delivering goods or services as agreed upon.

- Payment Bonds: These bonds provide assurance to subcontractors, suppliers, and laborers that they will be paid for their work or supplies on a construction project.

- Judicial Bonds: These bonds are required by courts and ensure that individuals involved in legal proceedings, such as defendants or plaintiffs, meet their obligations.

Surety bonds are different from insurance policies in that they protect the obligee, not the principal. If the principal fails to fulfill their obligations, the surety steps in and compensates the obligee for any resulting damages or losses. The principal, in turn, is ultimately responsible for reimbursing the surety for any paid claims.

The cost of a surety bond, known as the bond premium, is typically a small percentage of the bond amount. It is determined based on factors such as the principal’s creditworthiness, the nature of the bond, and the bond amount itself.

In summary, surety bonds act as financial guarantees that ensure the principal will fulfill their obligations to the obligee. They provide a level of security for the obligee, protecting them from potential financial losses if the principal fails to meet their responsibilities.

Definition of Insurance

Insurance is a contract between an individual or business (referred to as the policyholder) and an insurance company. In this contract, the policyholder pays a premium to the insurance company in exchange for coverage against certain risks outlined in the policy.

The purpose of insurance is to provide financial protection against unforeseen events or losses. It helps individuals and businesses manage risks by transferring the potential financial burden to the insurance company. In the event of a covered loss, the insurance company compensates the policyholder based on the terms and conditions of the policy.

Insurance policies cover a wide range of risks and perils, including but not limited to:

- Property Insurance: This type of insurance provides coverage for damage or loss to physical property, such as homes, buildings, personal belongings, or vehicles.

- Liability Insurance: Liability insurance protects individuals and businesses from claims against them for injuries or damages caused to others. It typically covers legal defense costs and potential settlements or judgments.

- Health Insurance: Health insurance provides coverage for medical expenses, including doctor visits, hospital stays, medications, and other healthcare services.

- Life Insurance: Life insurance offers financial protection to beneficiaries in the event of the policyholder’s death. It can help cover funeral expenses, pay off debts, and provide income replacement for dependents.

- Auto Insurance: Auto insurance covers damages or losses resulting from accidents or theft involving vehicles. It can provide coverage for property damage, bodily injury, and medical expenses.

Insurance policies have specific terms and conditions that define the scope of coverage, exclusions, deductibles, limits, and premiums. Policyholders must pay regular premiums to maintain their insurance coverage.

Unlike surety bonds, insurance policies primarily protect the policyholder, rather than a third party. The policyholder receives financial compensation from the insurance company in the event of a covered loss. Insurance helps individuals and businesses manage risks by providing a safety net in case of unfortunate events, reducing the financial impact and providing peace of mind.

The cost of insurance is determined by various factors, such as the type of coverage, the insured’s risk profile, the deductible amount, and the policy limits. Insurance companies assess the potential risks and calculate premiums based on these factors.

In summary, insurance provides financial protection against specific risks by transferring the potential financial burden from the policyholder to the insurance company. It covers a wide range of risks and helps individuals and businesses mitigate the financial impact of unexpected events or losses.

Purpose of Surety Bonds

The purpose of surety bonds is to provide a form of assurance and financial protection for the obligee, who requires the bond. Surety bonds are commonly used in various industries and sectors to ensure that the principal fulfills their obligations.

One of the key purposes of surety bonds is to ensure that projects are completed as agreed upon. In construction projects, for example, a surety bond acts as a guarantee that the contractor will fulfill their obligations, including completing the project on time, adhering to specifications, and paying subcontractors and suppliers. This instills confidence in the project owner or developer, as they have financial recourse if the contractor fails to meet their obligations.

Surety bonds also serve as a means of regulatory compliance. Licensing and permit bonds are often required by government agencies to ensure that individuals or businesses meet the necessary regulations and standards associated with their specific licenses or permits. For instance, a contractor may need a license bond to demonstrate their compliance with state regulations and provide financial protection for clients in case of negligence or non-compliance.

Another purpose of surety bonds is to protect against financial loss resulting from non-payment or non-performance. Payment bonds guarantee that subcontractors, suppliers, and laborers will be paid for their work or supplies on a construction project, even if the contractor defaults. This promotes fair and ethical business practices within the construction industry and reduces the risk of financial loss for those involved in the project.

Similarly, performance bonds ensure that the principal fulfills their contractual obligations, such as delivering goods or services as agreed upon. These bonds provide financial compensation to the obligee if the principal fails to perform or breaches the contract, ensuring that the obligee is not left with financial losses.

Surety bonds also play a role in legal proceedings. Judicial bonds, such as appeal bonds or probate bonds, are required by courts to ensure that individuals involved in legal matters fulfill their obligations. For example, an appeal bond guarantees that a defendant will pay the awarded judgment if an appeal is unsuccessful.

Overall, the purpose of surety bonds is to provide security and peace of mind for the obligee. They offer a financial guarantee that the principal will fulfill their obligations, and if they fail to do so, the surety will step in to compensate the obligee for any resulting damages or losses. Surety bonds promote trust, fairness, and accountability in various industries and sectors, providing a safety net for all parties involved.

Purpose of Insurance

The purpose of insurance is to provide individuals and businesses with financial protection against unforeseen events or losses. Insurance helps manage risks by transferring the potential financial burden to an insurance company in exchange for regular premium payments.

One of the primary purposes of insurance is to protect against property damage or loss. Property insurance, such as homeowners insurance or commercial property insurance, provides coverage for damage to physical assets caused by perils like fire, theft, natural disasters, or vandalism. This ensures that individuals and businesses can recover financially and rebuild or replace their damaged property.

Liability insurance is another important purpose of insurance. It protects individuals and businesses from legal claims and financial repercussions if they are found responsible for causing injuries or damages to others. Liability insurance covers legal defense costs, settlements, judgments, and other related expenses. This type of insurance is crucial for businesses, as it safeguards their financial well-being in case of lawsuits or liability claims.

Health insurance serves the purpose of providing individuals and families with access to necessary medical care. It covers a range of healthcare expenses, including doctor visits, hospital stays, medications, and other medical services. Health insurance aims to alleviate the financial burden of healthcare costs, ensuring that individuals can receive the care they need without worrying about substantial out-of-pocket expenses.

Life insurance has the purpose of providing financial security to beneficiaries in the event of the policyholder’s death. It serves multiple purposes, including covering funeral expenses, paying off debts, and providing income replacement for dependents. Life insurance ensures that loved ones are financially protected and can maintain their quality of life even after the policyholder’s passing.

Auto insurance serves the purpose of protecting individuals from financial loss due to accidents or theft involving their vehicles. It provides coverage for property damage, bodily injury, medical expenses, and legal costs resulting from car accidents. Auto insurance offers peace of mind by mitigating financial risks associated with vehicle ownership.

Overall, the purpose of insurance is to provide financial protection and peace of mind to individuals and businesses. It helps manage risks by transferring potential financial burdens to insurance companies, allowing policyholders to recover from losses, access necessary medical care, protect assets, and safeguard against legal claims. Insurance plays a vital role in mitigating uncertainties and providing a safety net for individuals, families, and businesses in times of need.

Differences in Parties Involved

One of the key differences between surety bonds and insurance lies in the parties involved in the agreement. Surety bonds involve three parties: the principal, the obligee, and the surety. Insurance, on the other hand, involves two parties: the policyholder and the insurance company.

In surety bonds, the principal is the party that promises to fulfill certain obligations. It can be an individual or a business entity. The obligee is the party that requires the bond and is typically the recipient of the promised obligations. The surety is the third party, often an insurance company, that provides financial backing and guarantees the performance of the principal. If the principal fails to meet their obligations, the surety steps in and compensates the obligee.

In contrast, insurance involves the policyholder, who is the individual or business that purchases the insurance coverage. The policyholder pays regular premiums to the insurance company in exchange for coverage against specified risks. The insurance company assumes the financial risk and responsibility for providing compensation to the policyholder in case of covered losses.

The relationship between the parties also differs. In surety bonds, the surety acts as a guarantor on behalf of the principal, providing a financial guarantee that the obligations will be fulfilled. The surety’s primary responsibility is to the obligee, ensuring that they are compensated if the principal fails to perform. The principal, in turn, is ultimately responsible for reimbursing the surety for any claims paid.

In insurance, the relationship is between the policyholder and the insurance company. The insurance company assumes the risk and provides financial compensation to the policyholder in the event of covered losses. The policyholder’s responsibility is to pay the required premiums and comply with the terms and conditions of the insurance policy.

Overall, the parties involved in surety bonds are the principal, the obligee, and the surety, whereas insurance involves the policyholder and the insurance company. Surety bonds rely on a tripartite agreement to ensure fulfillment of obligations, while insurance is a contractual relationship between the policyholder and the insurance company, where the company assumes the financial risk and provides compensation to the policyholder.

Differences in Financial Responsibility

One of the significant differences between surety bonds and insurance is the financial responsibility borne by the parties involved. In surety bonds, the principal ultimately bears the financial responsibility, while in insurance, the burden falls on the insurance company.

In surety bonds, the principal is the party responsible for fulfilling specific obligations outlined in the bond agreement. If the principal fails to meet these obligations, the surety steps in to compensate the obligee for any resulting damages or losses. However, the principal is ultimately responsible for reimbursing the surety for any claims paid.

This financial responsibility is a crucial aspect of surety bonds. It ensures that the principal has a vested interest in fulfilling their obligations and minimizing the risk of default. The principal’s financial well-being and reputation are at stake, as they will be held accountable for any claims paid by the surety.

In insurance, the financial responsibility lies primarily with the insurance company. The policyholder, or insured, pays regular premiums to the insurance company in exchange for coverage against specified risks. In case of covered losses, the insurance company compensates the policyholder according to the terms and conditions of the policy.

The insurance company assumes the financial risk associated with providing coverage and must set premiums at a level that adequately covers potential losses. If an insured individual or business experiences a covered loss, they submit a claim to the insurance company, which assesses the claim and disburses the appropriate compensation.

Unlike surety bonds, where the principal is ultimately responsible for reimbursing the surety, the policyholder in insurance does not have direct financial responsibility beyond paying the agreed-upon premiums. Once the insurance company compensates the policyholder for covered losses, the financial burden shifts entirely to the insurance company.

This difference in financial responsibility has implications for the premiums charged in surety bonds and insurance policies. Surety bond premiums are typically calculated based on factors such as the principal’s creditworthiness, the bond amount, and the nature of the obligations. Insurance premiums, on the other hand, are determined based on factors such as the insured’s risk profile, coverage limits, deductibles, and the type of insurance policy.

In summary, surety bonds place the financial responsibility on the principal, who is obligated to reimburse the surety for any claims paid. Insurance, on the other hand, shifts the financial burden entirely to the insurance company, with the policyholder being responsible for paying premiums. The allocation of financial responsibility is a fundamental distinction between surety bonds and insurance.

Differences in Risk Coverage

One of the significant differences between surety bonds and insurance is the scope of risk coverage they provide. While they both involve risk management, they differ in the types of risks they cover and the parties protected.

Surety bonds are specifically designed to manage risks associated with the performance of obligations. They provide assurance to the obligee that the principal will fulfill their contractual, regulatory, or financial responsibilities. Surety bonds cover risks related to the specific obligations outlined in the bond agreement. For example, a construction performance bond covers risks associated with the completion of a construction project, while a license bond covers risks related to regulatory compliance within a specific professional field.

The focus of surety bond coverage is on the obligations of the principal and the protection of the obligee. If the principal fails to meet their obligations, the surety steps in to compensate the obligee for any resulting damages or losses. The coverage is limited to the specific obligations stated in the bond agreement and does not extend to other risks or perils.

On the other hand, insurance policies offer broader coverage for a range of risks and perils. Insurance is designed to protect individuals and businesses from unexpected events or losses that may occur in various aspects of life. Different types of insurance policies provide coverage for risks such as property damage, liability claims, health-related expenses, life events, and automobile accidents.

For example, property insurance provides coverage against risks like fire, theft, or natural disasters that can cause damage to physical property. Liability insurance protects individuals or businesses against claims for injuries or damages caused to others. Health insurance covers medical expenses, while life insurance offers financial protection to beneficiaries in case of the policyholder’s death. Auto insurance covers damages or losses resulting from accidents or theft involving vehicles.

Insurance coverage is usually outlined in the insurance policy, detailing the specific risks covered, exclusions, limits, deductibles, and other terms. The purpose of insurance is to provide a safety net for individuals and businesses, protecting them from financial losses resulting from the covered risks specified in the policy.

In summary, surety bonds provide coverage for specific obligations and risks related to the performance of duties, while insurance offers more comprehensive coverage for a broader range of risks and perils. Surety bonds focus on protecting the obligee from the failure of the principal to fulfill obligations, whereas insurance aims to protect the policyholder from various types of risks and potential financial losses.

Differences in Claims Process

When it comes to the claims process, there are notable differences between surety bonds and insurance. The process of filing and resolving a claim varies depending on the type of bond or insurance policy involved.

In surety bonds, the claims process typically begins when the obligee believes that the principal has failed to fulfill their obligations. The obligee must provide notice to the surety, indicating the nature of the claim and the alleged failure by the principal. The surety then investigates the claim to determine if the principal has indeed breached their obligations.

If the surety finds that there has been a valid breach, they will compensate the obligee for any damages or losses incurred as a result. The surety may also make efforts to remedy the situation by working with the principal to resolve the issue and fulfill the obligations. Once the surety has paid a claim, they will seek reimbursement from the principal, as the principal is ultimately responsible for reimbursing the surety for any claims paid out.

The claims process in insurance involves the policyholder reporting a covered loss to the insurance company. The policyholder must provide details of the incident or damage and submit the necessary documentation to support the claim. This can include photographs, police reports, medical records, or any other relevant evidence.

Upon receiving the claim, the insurance company assigns a claims adjuster to evaluate the claim and determine the coverage and payout. The adjuster may request additional information or conduct investigations to assess the validity of the claim. Once the claim is approved, the insurance company will compensate the policyholder based on the terms and conditions outlined in the insurance policy.

Unlike surety bonds, where the principal’s responsibility is to reimburse the surety for any claims paid, the policyholder in insurance does not have a direct obligation to reimburse the insurance company. The insurance company assumes the financial responsibility and covers the costs associated with the claim, as outlined in the insurance policy.

The timing of claims resolution can also differ between surety bonds and insurance. Surety bond claims are typically resolved as quickly as possible to minimize any disruptions caused by the principal’s failure to perform. Insurance claims, on the other hand, may require a more extensive evaluation process, especially for complex or high-value claims, resulting in a longer timeframe for resolution.

In summary, the claims process for surety bonds involves the obligee filing a claim with the surety, who then investigates and compensates the obligee if the claim is valid. The principal is responsible for reimbursing the surety for any claims paid. In insurance, the policyholder reports a covered loss to the insurance company, which evaluates and compensates the policyholder based on the terms of the policy. The policyholder does not have a direct obligation to reimburse the insurance company for claims paid.

Conclusion

In summary, surety bonds and insurance serve different purposes and have distinct characteristics when it comes to risk management and financial protection. Surety bonds act as financial guarantees that ensure the principal fulfills their obligations to the obligee, and the surety compensates the obligee if the principal fails to perform. Insurance, on the other hand, provides broader coverage for a range of risks and perils, compensating the policyholder for covered losses.

The parties involved in surety bonds include the principal, obligee, and surety, while insurance involves the policyholder and the insurance company. Surety bonds place the financial responsibility on the principal, who reimburses the surety for any claims paid, whereas insurance places the financial burden on the insurance company, with the policyholder paying premiums but without direct responsibility for reimbursing claims.

Furthermore, surety bonds provide coverage for specific obligations and risks related to performance, regulatory compliance, or financial responsibilities, while insurance policies offer broader coverage for risks such as property damage, liability claims, health-related expenses, life events, and automobile accidents.

The claims process also differs between surety bonds and insurance. Surety bond claims involve the obligee filing a claim with the surety, who investigates and compensates the obligee, with the principal ultimately responsible for reimbursing the surety. Insurance claims require the policyholder reporting a covered loss to the insurance company, which evaluates and compensates the policyholder based on the terms of the policy, without the policyholder having a direct obligation to reimburse the insurance company.

Understanding the differences between surety bonds and insurance is crucial for individuals and businesses when assessing their risk management and financial protection needs. Whether in the construction industry, licensing and permits, or other sectors, surety bonds provide assurance to the obligee that obligations will be fulfilled. Insurance, on the other hand, offers broader coverage for various risks and perils, protecting individuals and businesses from unexpected financial losses.

By recognizing the distinctions in purpose, parties involved, financial responsibility, risk coverage, and claims process between surety bonds and insurance, individuals and businesses can make informed decisions when determining the most suitable risk management strategies for their specific needs.