Home>Finance>What Is The Accepted Normal Late Fee For Rent In South Carolina?

Finance

What Is The Accepted Normal Late Fee For Rent In South Carolina?

Published: February 22, 2024

Learn about the accepted late fee for rent in South Carolina. Understand the financial implications of late payments and how to avoid them. Gain insights into late fee regulations and best practices in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Renting a property is a common practice in South Carolina, offering individuals and families the flexibility and convenience of residing in a space without the long-term commitment of ownership. However, timely payment of rent is a crucial aspect of this arrangement, and late fees serve as a means to encourage tenants to fulfill their financial obligations punctually. Understanding the accepted normal late fees for rent in South Carolina is essential for both landlords and tenants to ensure a fair and transparent rental agreement.

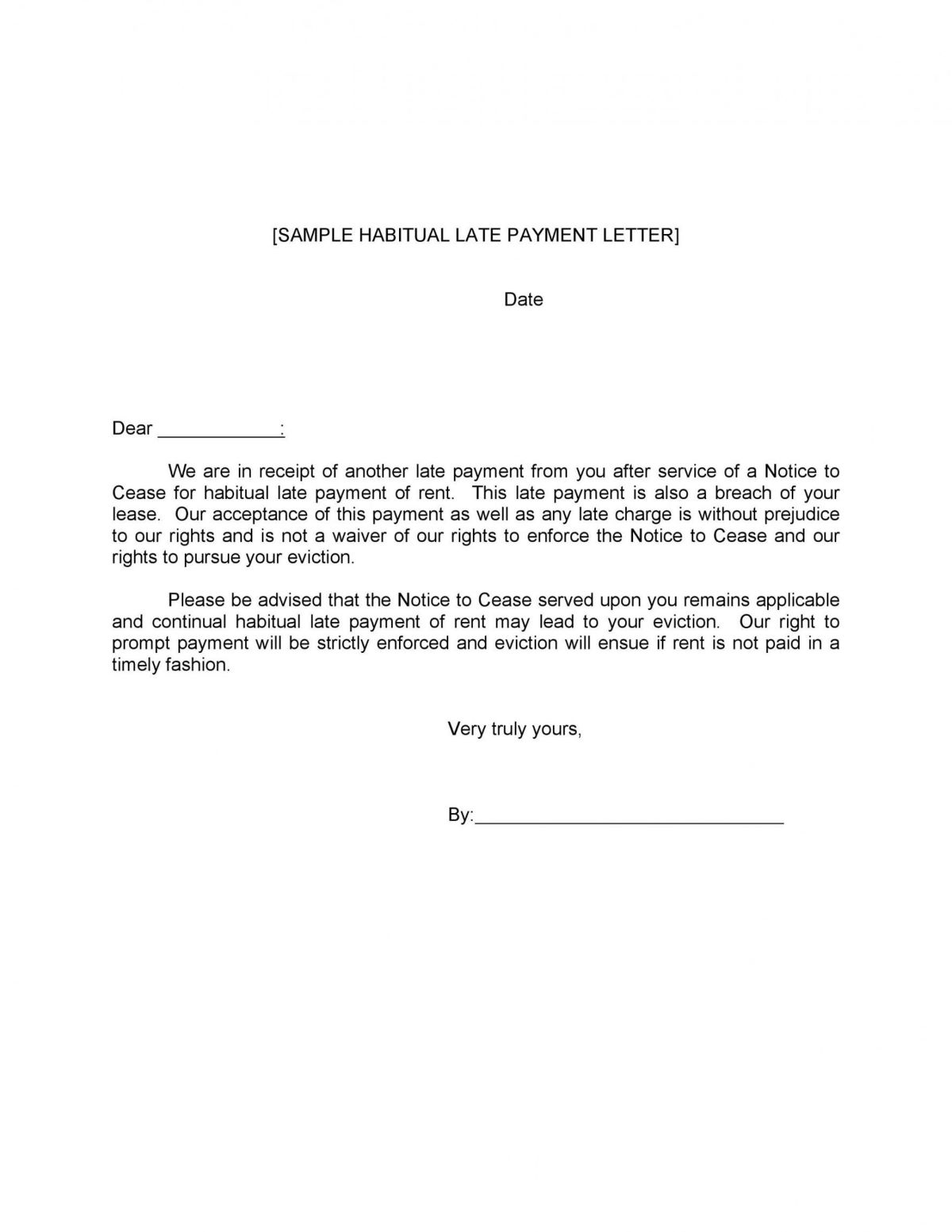

Late fees are charges imposed by landlords when tenants fail to pay their rent on time. These fees are typically outlined in the lease agreement and serve as a form of compensation for the inconvenience caused by late payments. It is important for both landlords and tenants to comprehend the factors that influence late fees, as well as the legal regulations governing these fees in South Carolina.

In this comprehensive guide, we will delve into the intricacies of late fees for rent in South Carolina, exploring the factors that affect these fees, the legal framework surrounding late fees, and the recommended late fee amounts. By shedding light on these aspects, we aim to provide landlords and tenants with valuable insights to navigate the realm of late fees in the rental landscape of South Carolina.

Understanding Late Fees for Rent in South Carolina

Late fees are a fundamental component of the landlord-tenant relationship, serving as a deterrent against delayed rent payments. In South Carolina, late fees are typically specified in the lease agreement, outlining the amount charged and the grace period provided before these fees take effect. Landlords often utilize late fees as a means to encourage tenants to prioritize timely rent payments, thereby ensuring consistent cash flow to maintain the property and cover related expenses.

It is essential for tenants to grasp the implications of late fees, as failure to adhere to the stipulated payment deadlines can lead to financial repercussions. Conversely, landlords must establish reasonable late fee policies that strike a balance between incentivizing prompt payments and avoiding exorbitant penalties that may burden tenants unfairly.

Moreover, late fees can vary based on the rental property type and the terms of the lease. For instance, residential and commercial properties may entail distinct late fee structures, with commercial leases often featuring higher late fees due to the typically larger financial stakes involved. Understanding the specific late fee provisions within the lease agreement is crucial for both landlords and tenants to foster a transparent and harmonious rental arrangement.

By comprehending the rationale behind late fees, tenants can appreciate the importance of fulfilling their financial obligations punctually, thereby contributing to a positive landlord-tenant dynamic. Likewise, landlords can implement late fee policies that align with industry standards and legal requirements, fostering a fair and sustainable rental framework in South Carolina.

Factors Affecting Late Fees

Several factors influence the determination of late fees for rent in South Carolina, shaping the policies implemented by landlords and the financial implications for tenants. Understanding these factors is pivotal for both parties to navigate the late fee landscape effectively.

- Grace Period: The presence and duration of a grace period significantly impact late fee assessments. A grace period allows tenants a window of time after the due date to submit their rent without incurring late fees. Landlords may opt for a standard grace period, typically ranging from a few days to a week, or choose to waive this period altogether.

- Rental Amount: The total rent amount can influence the late fee percentage or flat rate. Landlords may implement a tiered late fee structure, where higher rent amounts correspond to proportionally higher late fees. This approach aims to align the late fee with the financial impact of delayed payments on the landlord.

- Local Regulations: South Carolina may have specific statutes or regulations governing late fees, dictating the maximum allowable amount and any additional requirements, such as written late fee notices. Landlords must adhere to these legal parameters when setting late fees to avoid potential disputes or legal repercussions.

- Property Type: Distinctions between residential and commercial properties can influence late fee policies. Commercial leases, often involving higher financial stakes, may warrant more substantial late fees to offset the potential impact of delayed payments on the landlord’s operations and financial obligations.

- Market Norms: Prevailing market norms and industry standards within South Carolina’s rental landscape can inform the reasonableness of late fees. Landlords may benchmark their late fee structures against local practices to ensure competitiveness and fairness.

By considering these factors, landlords can tailor late fee policies that align with the specific dynamics of their rental properties while fostering a balanced approach to incentivizing timely rent payments. Tenants, in turn, can gain insight into the variables shaping late fees, empowering them to fulfill their financial responsibilities in accordance with the lease terms and prevailing regulations.

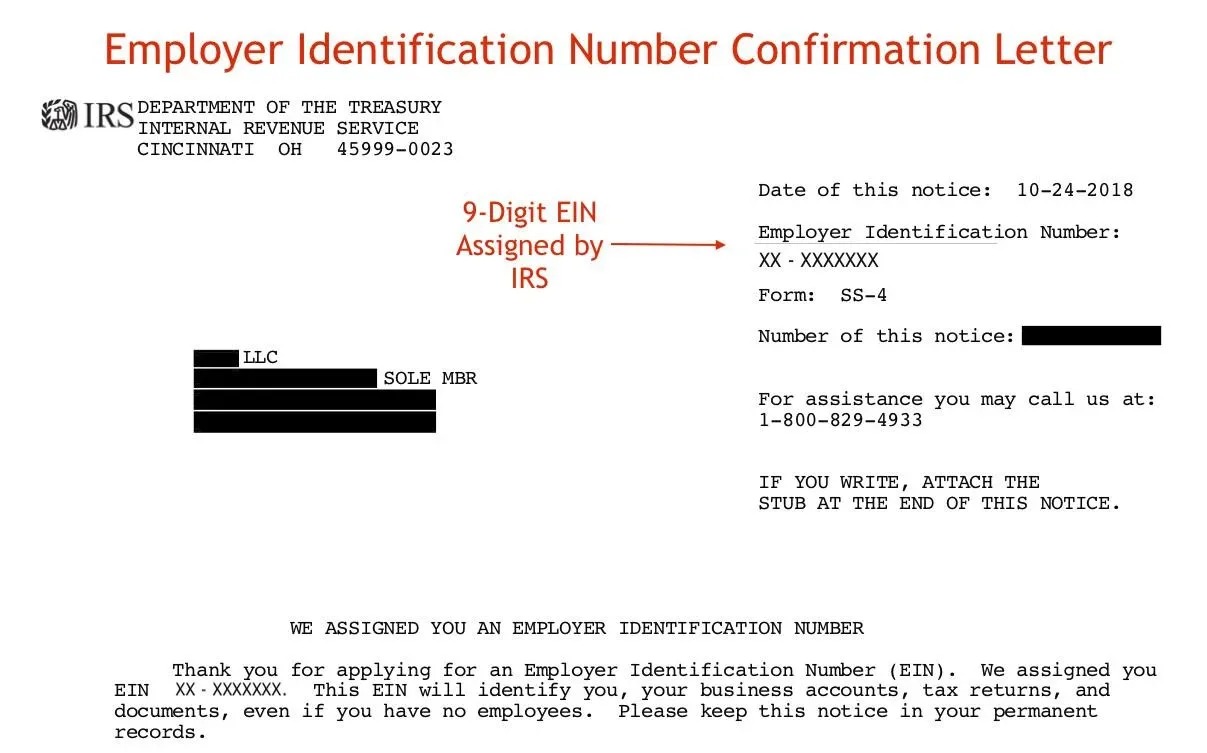

Legal Regulations on Late Fees in South Carolina

South Carolina imposes specific legal regulations regarding late fees to safeguard the rights of both landlords and tenants and ensure fair and transparent rental practices. Understanding these regulations is imperative for landlords to establish compliant late fee policies and for tenants to recognize their rights and obligations concerning late payments.

In South Carolina, the state’s landlord-tenant laws govern the permissible late fee amounts and related procedures. Landlords must adhere to these regulations when implementing late fees to avoid potential disputes and legal complications. It is essential for both parties to review and comprehend the pertinent statutes to foster a harmonious and legally sound rental relationship.

Key legal regulations on late fees in South Carolina may encompass:

- Maximum Late Fee Amount: South Carolina may impose a maximum allowable late fee amount or percentage of the rent. Landlords must ensure that their late fee structures comply with these limitations to avoid overstepping legal boundaries.

- Written Notice Requirements: State laws may mandate specific written notice requirements for late fees, outlining the procedures for notifying tenants of overdue rent and the associated late fees. Compliance with these notice provisions is essential to uphold the legality of late fee assessments.

- Grace Period Regulations: South Carolina’s landlord-tenant laws may address grace periods and any associated regulations, such as the duration of the grace period and whether it is mandatory or discretionary for landlords to provide this allowance.

- Prohibited Practices: Certain practices related to late fees, such as imposing punitive or excessive fees, may be prohibited under South Carolina law. Landlords must refrain from engaging in such practices to maintain legal and ethical rental operations.

By familiarizing themselves with the legal regulations governing late fees in South Carolina, landlords can establish late fee policies that align with statutory requirements, promoting compliance and fairness. Tenants, on the other hand, can benefit from the protection afforded by these regulations, ensuring that late fee assessments adhere to legal parameters and procedural standards.

Recommended Late Fee Amounts in South Carolina

While South Carolina may not prescribe specific late fee amounts through state statutes, landlords and property managers often consider industry standards and practical considerations when determining recommended late fee amounts. These recommendations aim to strike a balance between incentivizing timely rent payments and avoiding unduly burdensome penalties for tenants.

Several factors may influence the determination of recommended late fee amounts in South Carolina:

- Market Norms: Landlords often benchmark their late fee structures against prevailing market norms within South Carolina’s rental landscape. This practice ensures that late fees remain competitive and reasonable relative to similar properties in the local market.

- Property Type: Distinctions between residential and commercial properties can impact recommended late fee amounts. Commercial leases, typically involving higher financial stakes, may warrant more substantial late fees to offset the potential impact of delayed payments on the landlord’s operations and financial obligations.

- Grace Period Considerations: The presence and duration of a grace period can influence the recommended late fee amounts. A longer grace period may warrant a higher late fee to incentivize timely payments, while a shorter or nonexistent grace period may necessitate a more moderate late fee to accommodate tenants’ payment schedules.

- Financial Impact: Landlords may consider the financial impact of late payments on their operations when determining recommended late fee amounts. This assessment aims to ensure that late fees adequately offset the inconvenience and financial strain caused by delayed rent payments.

It is important for landlords to exercise prudence and fairness when establishing recommended late fee amounts, taking into account the aforementioned factors and the overarching goal of fostering a mutually beneficial landlord-tenant relationship. By aligning late fee policies with industry standards and practical considerations, landlords can promote a rental framework that encourages timely rent payments while respecting tenants’ financial circumstances.

Conclusion

Understanding the dynamics of late fees for rent in South Carolina is essential for both landlords and tenants to navigate the rental landscape with clarity and fairness. Late fees serve as a vital mechanism to incentivize timely rent payments while compensating landlords for the inconvenience caused by delayed remittances. By comprehending the factors influencing late fees, the legal regulations governing these fees, and the recommended late fee amounts, both parties can foster a transparent and harmonious rental relationship.

For landlords, it is crucial to establish late fee policies that align with industry standards, legal requirements, and practical considerations. This entails considering factors such as grace periods, property types, and market norms when determining late fee amounts. Adhering to South Carolina’s legal regulations on late fees is paramount to ensure compliance and ethical rental practices.

Tenants, on the other hand, benefit from a clear understanding of their rights and obligations regarding late fees. Familiarizing themselves with the lease agreement’s late fee provisions and South Carolina’s landlord-tenant laws empowers tenants to fulfill their financial responsibilities while advocating for fair and reasonable late fee assessments.

By promoting transparency, fairness, and compliance with legal regulations, both landlords and tenants contribute to a rental environment characterized by mutual respect and adherence to established norms. This collaborative approach fosters a positive landlord-tenant dynamic, ensuring that late fees serve their intended purpose without unduly burdening tenants.

In conclusion, a comprehensive understanding of late fees for rent in South Carolina is instrumental in promoting a balanced and equitable rental framework. By embracing industry best practices, legal compliance, and mutual respect, landlords and tenants can navigate late fee considerations with confidence, thereby fostering a sustainable and harmonious rental landscape in South Carolina.