Home>Finance>How Long Does It Take Chime To Give Provisional Credit

Finance

How Long Does It Take Chime To Give Provisional Credit

Published: January 13, 2024

Get a quick answer to your finance question: How long does it take Chime to give provisional credit? Learn more about Chime's credit process and timelines.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

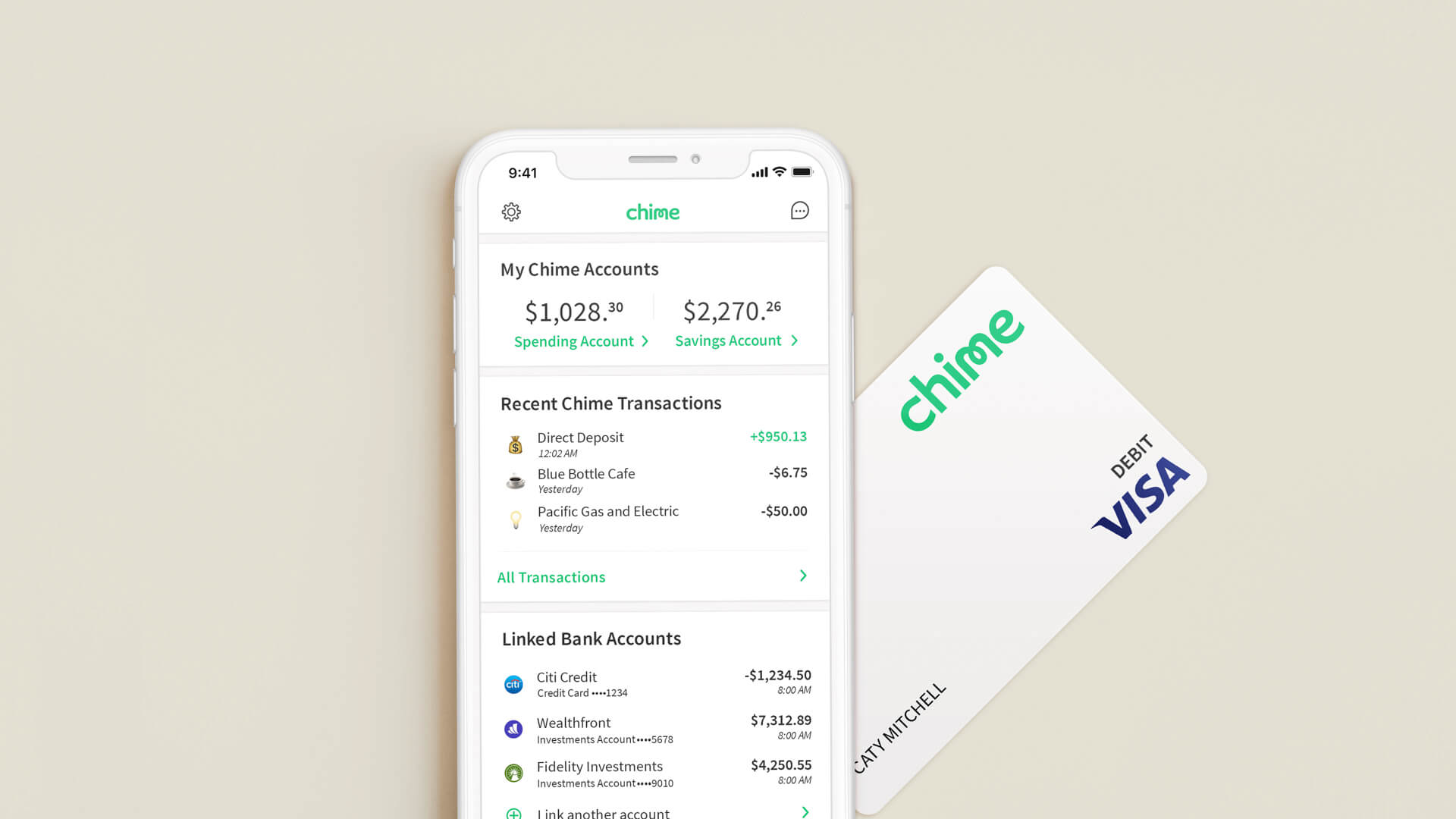

Welcome to the world of Chime, a modern online banking platform that offers users a seamless banking experience with no hidden fees. Whether you’re an avid Chime user or just considering opening an account, it’s important to understand how Chime handles provisional credit – a key feature that can provide a buffer for unexpected financial situations.

Provisional credit is a temporary credit that is provided to customers while a financial institution investigates and resolves a dispute or fraudulent activity on their account. It serves as a lifeline, ensuring that customers have access to their funds while the investigation takes place. Chime, like many other banks, offers provisional credit to its customers.

In this article, we will explore the factors that affect the timeline for Chime to provide provisional credit, understand the processing time involved, and provide suggestions on how to expedite the process. Additionally, we will highlight the importance of timely provisional credit for Chime users.

So, if you’ve ever wondered how long it takes for Chime to give provisional credit, this article will demystify the process and empower you with the knowledge you need to navigate any potential financial hurdles with ease.

Understanding Chime and Provisional Credit

Chime is an innovative online banking platform that has gained popularity for its user-friendly interface, unparalleled convenience, and commitment to eliminating unnecessary fees. Through Chime, customers can access a range of financial services, including checking and savings accounts, money management tools, and even early direct deposit. One of the key features that sets Chime apart is its provision of provisional credit.

Provisional credit is a safety net that offers temporary funds to Chime customers during the investigation of a dispute or suspected fraudulent activity on their account. When a customer notices an unauthorized charge or a discrepancy in their account, they can report the issue to Chime, and the bank initiates an investigation to resolve the matter promptly. During this investigation period, Chime provides provisional credit to the customer, ensuring that they have access to their funds while the issue is being resolved.

The purpose of provisional credit is to minimize the impact on customers’ financial well-being during a dispute or fraudulent incident. It offers a sense of security and confidence, knowing that Chime is actively working to resolve the issue while customers can continue with their financial activities. Without provisional credit, customers may face difficulties in conducting day-to-day financial transactions, paying bills, or meeting their financial obligations.

It’s important to note that provisional credit is not a guarantee that the disputed funds will be permanently credited back to the customer’s account. The investigation process determines the final outcome. If the investigation proves that the disputed transactions were indeed unauthorized or fraudulent, the provisional credit becomes permanent, and the customer’s account is adjusted accordingly. However, if the investigation reveals that the customer is responsible for the disputed transactions, the provisional credit may be reversed, and the customer is liable for the charges.

Now that we have a clearer understanding of what Chime’s provisional credit entails, let’s explore the various factors that can influence the timeline for receiving provisional credit.

Factors Affecting Provisional Credit Timeline

While Chime strives to provide timely provisional credit to its customers, the exact timeline can vary due to several factors. It’s important to be aware of these factors to set realistic expectations and understand potential delays in receiving provisional credit. Here are some of the key factors that can affect the timeline:

- Nature and complexity of the dispute: The complexity of the dispute can impact the time it takes for Chime to thoroughly investigate and resolve the issue. If the investigation requires extensive analysis or involves multiple parties, it may take additional time before provisional credit is provided.

- Evidence and documentation: The availability and accuracy of supporting evidence and documentation from the customer can significantly impact the timeline. Providing clear and comprehensive information about the disputed transaction can streamline the investigation process and expedite the provision of provisional credit.

- Communication with Chime: Timely and effective communication with Chime is crucial in expediting the provisional credit timeline. Promptly reporting the dispute, responding to any requests for additional information or clarification, and staying engaged with the investigation process can help ensure a faster resolution.

- Volume of disputes: The number of disputes being handled by Chime at any given time can affect the overall timeline. If there is a high volume of disputes, it may take longer for the bank to allocate resources and address each case individually.

- Banking regulations and procedures: Chime, like any other financial institution, must adhere to banking regulations and internal procedures. These regulations and procedures may impose certain timeframes for the investigation and resolution of disputes, which can impact the timeline for provisional credit.

It’s important to remember that while these factors can influence the provisional credit timeline, Chime is committed to resolving disputes in a timely manner. The bank understands the importance of providing provisional credit to customers promptly, and it strives to minimize any delays in the process.

Now that we’ve explored the factors that can impact the provisional credit timeline, let’s dive into how long it typically takes for Chime to process and provide provisional credit to its customers.

Chime’s Processing Time for Provisional Credit

Chime takes the provision of provisional credit seriously and aims to process and provide it as quickly as possible. While the exact processing time can vary depending on the factors mentioned earlier, Chime generally strives to resolve disputes and provide provisional credit within 10 business days.

Upon receiving a dispute report from a customer, Chime initiates an investigation to gather all necessary information and evidence. The bank analyzes the details of the disputed transaction, communicates with relevant parties, and reviews any supporting documentation provided by the customer. This thorough investigation ensures a fair and accurate resolution.

Throughout the investigation process, Chime keeps the customer informed of any progress and may request additional information as needed. Clear and prompt communication with Chime during this time can help expedite the provisional credit timeline.

Once the investigation is complete, and if the dispute is found to be in favor of the customer, Chime will provide provisional credit to the customer’s account. This allows the customer to access the disputed funds while the final resolution is determined. It’s important to note that the timeline for receiving the provisional credit may vary based on the specific circumstances of the dispute.

If there are any delays in the provision of provisional credit, Chime will notify the customer of the extended timeline and the reasons behind it. Transparency and keeping customers informed is a key priority for Chime.

It’s important to understand that Chime’s processing time for provisional credit is subject to the complexities and variables associated with each individual dispute. While the goal is to resolve disputes promptly, some cases may require additional time for a thorough investigation to ensure a fair and accurate resolution.

Now that we have a better understanding of Chime’s provisional credit processing time, let’s explore some suggestions on how to expedite the process and receive your provisional credit sooner.

Suggestions to Expedite Provisional Credit

If you’re looking to expedite the process of receiving provisional credit from Chime, here are some suggestions that can help:

- Report the dispute promptly: As soon as you notice an unauthorized charge or discrepancy in your Chime account, it’s crucial to report the issue to Chime immediately. The earlier you report the dispute, the sooner the investigation can begin, and provisional credit can be provided.

- Provide complete and accurate information: When reporting the dispute to Chime, ensure that you provide all relevant details, including the transaction date, amount, and any supporting documentation you may have. The more comprehensive and accurate the information you provide, the faster Chime can investigate and resolve the issue.

- Respond promptly to requests: During the investigation process, Chime may request additional information or documentation from you. It’s essential to respond to these requests promptly and provide the requested information to avoid any unnecessary delays in the provisional credit timeline.

- Stay in communication with Chime: Regularly check for updates from Chime regarding the investigation status and promptly respond to any inquiries or requests for information. Staying engaged in the process can help expedite the resolution and provision of provisional credit.

- Be proactive: If you haven’t received an update or provisional credit within the expected timeframe, consider reaching out to Chime’s customer support to inquire about the progress of your dispute. They can provide you with any necessary updates and address any concerns or questions you may have.

- Maintain accurate records: Keep a record of all communication and documentation related to the dispute. This can include emails, phone call records, reference numbers, and any other relevant information. These records can serve as evidence and assist in the resolution process.

Following these suggestions can help streamline the provisional credit process and increase the chances of receiving your provisional credit sooner. However, it’s important to keep in mind that the provisional credit timeline may still vary based on the complexity of the dispute and other factors outside of your control.

Now let’s discuss the importance of timely provisional credit for Chime users.

The Importance of Timely Provisional Credit

Timely provision of provisional credit is of paramount importance for Chime users. Here’s why:

1. Financial Stability: Provisional credit acts as a financial safety net for Chime users during the resolution of a dispute or fraudulent activity. It ensures that customers have access to their funds and can continue with their day-to-day financial activities, such as paying bills, making purchases, or withdrawing cash. The ability to maintain financial stability during such situations can alleviate stress and prevent further financial difficulties.

2. Protection Against Unauthorized Transactions: Provisional credit provides Chime users with immediate protection against unauthorized transactions. It prevents fraudulent activity from impacting their financial well-being while the investigation is underway. In cases of identity theft or unauthorized charges, timely provision of credit can help avoid additional financial losses and limit the impact on a customer’s overall financial health.

3. Customer Confidence: Timely provision of credit demonstrates Chime’s commitment to its customers’ financial well-being and serves to build trust and confidence. When customers know that Chime will promptly address and resolve disputes, it enhances their faith in the bank’s commitment to their financial security. This, in turn, fosters long-term loyalty and satisfaction among Chime users.

4. Efficient Resolution: Timely provision of provisional credit expedites the resolution process as customers can continue their financial activities without disruption. It allows Chime to investigate the dispute thoroughly and determine the appropriate course of action without causing significant inconvenience to customers. This swift resolution benefits both the customer and Chime, ensuring a smooth and efficient process for all parties involved.

5. Enhanced Customer Experience: A seamless and efficient provisional credit process contributes to an overall positive customer experience. When Chime users experience quick and hassle-free resolution of disputes, they are more likely to appreciate the bank’s services and recommend it to others. This positive word-of-mouth can help Chime attract new customers and cement its position as a trusted online banking platform.

In summary, timely provision of provisional credit is essential for Chime users’ financial stability, protection against unauthorized transactions, customer confidence, efficient dispute resolution, and an overall positive customer experience. By prioritizing the prompt provision of provisional credit, Chime demonstrates its commitment to ensuring a seamless and secure banking experience for its users.

Now, let’s wrap up the article.

Conclusion

Understanding how long it takes for Chime to provide provisional credit is crucial for Chime users to navigate any potential financial hurdles with confidence. Provisional credit serves as a temporary lifeline, offering customers access to their funds while disputes or fraudulent activities are investigated and resolved. While Chime strives to provide timely provisional credit, the exact timeline can vary due to factors such as the nature and complexity of the dispute, evidence provided, communication with Chime, volume of disputes, and banking regulations and procedures.

Chime’s processing time for provisional credit typically ranges within 10 business days. However, it’s important to remember that each case is unique, and complex disputes may require additional time for a thorough investigation. That being said, there are steps you can take to expedite the provisional credit process, such as reporting the dispute promptly, providing complete and accurate information, responding promptly to requests, staying in communication with Chime, and maintaining accurate records.

Timely provision of provisional credit holds great importance for Chime users. It ensures financial stability during disputes, protects against unauthorized transactions, enhances customer confidence, facilitates efficient resolution, and contributes to a positive customer experience. By prioritizing the prompt provision of provisional credit, Chime demonstrates its commitment to its customers’ financial well-being and solidifies its reputation as a trusted online banking platform.

So, whether you’re already a Chime user or considering opening an account, rest assured that Chime has implemented processes to efficiently handle provisional credit and provide the necessary support during any financial disputes. By familiarizing yourself with Chime’s provisional credit timeline and following the suggestions to expedite the process, you can confidently manage your finances and navigate any unexpected challenges that may arise.

Remember, Chime is committed to providing an exceptional banking experience, and timely provision of provisional credit is just one of the ways it ensures the financial well-being of its customers.