Home>Finance>How Long Does It Take For A Credit Line Increase On A Discover It Secured Card?

Finance

How Long Does It Take For A Credit Line Increase On A Discover It Secured Card?

Published: March 1, 2024

Find out how long it takes to secure a credit line increase on your Discover It Secured Card. Learn about the process and timeline. Improve your finances today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit cards, where financial institutions offer a myriad of products tailored to meet the diverse needs of consumers. For individuals who are looking to build or rebuild their credit history, secured credit cards can serve as a valuable tool. One such option is the Discover It Secured Card, which provides an avenue for individuals to establish or improve their creditworthiness.

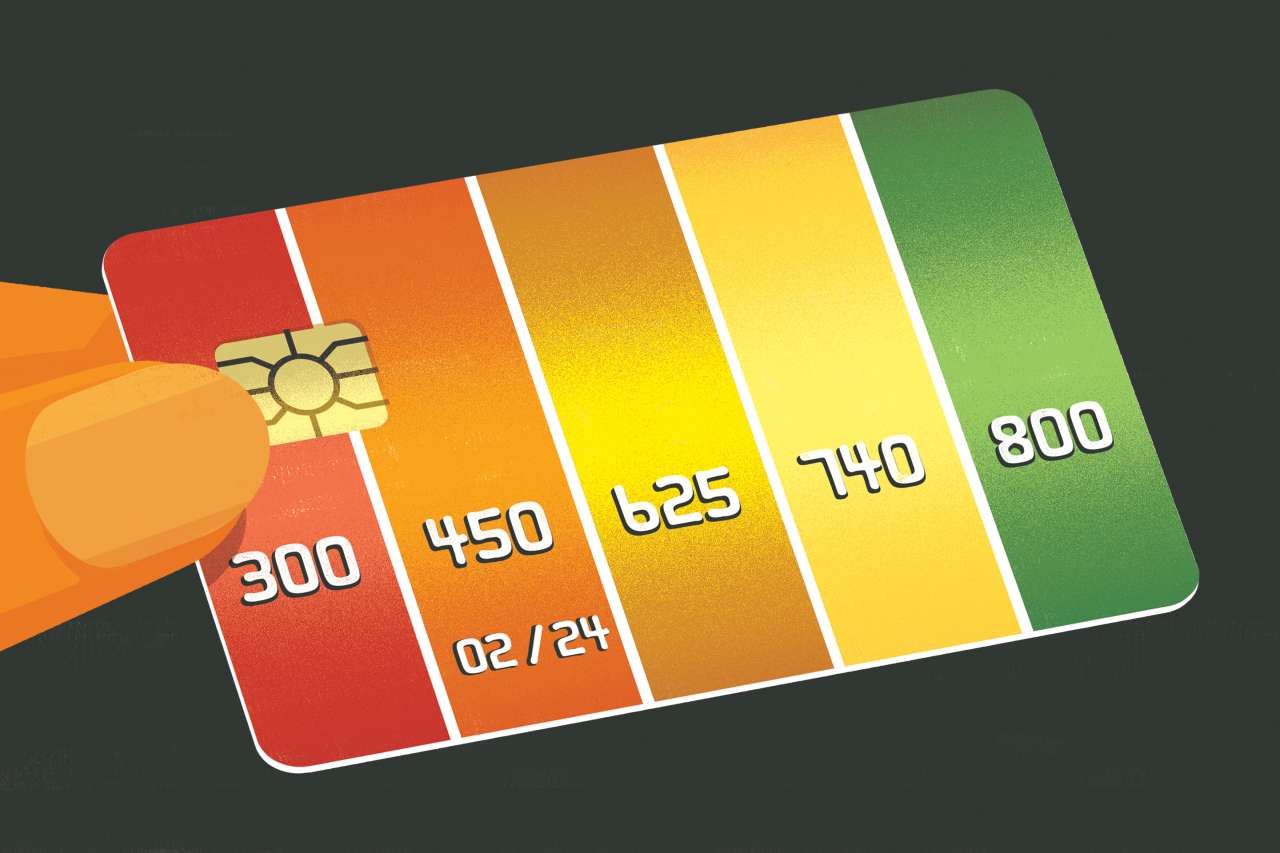

One of the key features that cardholders often seek is the ability to increase their credit line over time. A higher credit limit not only offers greater purchasing power but also contributes to an improved credit utilization ratio, a crucial factor in credit scoring models. As such, understanding the process and timeframe for securing a credit line increase on a Discover It Secured Card is of paramount importance for cardholders.

In this comprehensive guide, we will delve into the intricacies of credit line increases, specifically focusing on the Discover It Secured Card. By gaining insights into the process, factors affecting the timeframe, and the approval timeline, you will be equipped with the knowledge needed to navigate and optimize your credit-building journey.

Understanding Credit Line Increases

Before delving into the specifics of credit line increases on a Discover It Secured Card, it’s essential to grasp the fundamental concept of this financial tool. A credit line increase refers to the adjustment of the maximum amount of credit extended to a cardholder by the issuing financial institution. This increase can be initiated by the cardholder or may be offered proactively by the card issuer based on the cardholder’s credit behavior and financial standing.

For individuals with a Discover It Secured Card, a credit line increase holds significant benefits. It provides the opportunity to access additional funds for purchases, emergencies, or other financial needs, thereby enhancing financial flexibility. Moreover, a higher credit limit can positively impact the cardholder’s credit score, particularly by improving the credit utilization ratio, which compares the amount of credit used to the total credit available.

It’s important to note that the decision to grant a credit line increase is influenced by various factors, including the cardholder’s payment history, credit utilization, length of credit history, and overall financial stability. By comprehending the rationale behind credit line increases and their implications, cardholders can make informed decisions and take proactive steps to enhance their credit profile.

Process for Requesting a Credit Line Increase on a Discover It Secured Card

Requesting a credit line increase on a Discover It Secured Card involves a straightforward process that allows cardholders to take proactive steps in managing their credit limits. The following steps outline the typical process for initiating a credit line increase:

- Assess Eligibility: Before requesting a credit line increase, cardholders should evaluate their eligibility based on their credit behavior and financial standing. This includes maintaining a record of timely payments, managing credit utilization, and demonstrating responsible financial habits.

- Access Account Management: Cardholders can access their Discover account online or through the mobile app to navigate to the “Credit Line Increase” section. This feature enables them to submit a request for a higher credit limit.

- Provide Financial Information: During the request process, cardholders may be required to furnish updated financial information, including income details and any changes in their financial circumstances that may impact their creditworthiness.

- Submit Request: Upon completing the necessary steps and providing the requested information, cardholders can submit their credit line increase request through the designated platform.

- Review and Confirmation: Once the request is submitted, Discover will review the application, considering the cardholder’s credit history, payment behavior, and overall financial stability. The cardholder will receive a confirmation of the request submission and will be notified of the decision within a specified timeframe.

It’s important for cardholders to approach the credit line increase request process diligently, ensuring that they meet the eligibility criteria and provide accurate and updated financial information. By proactively managing their credit limits, cardholders can work towards achieving their financial goals and optimizing their credit-building journey.

Factors Affecting the Timeframe for a Credit Line Increase

Several factors come into play when considering the timeframe for a credit line increase on a Discover It Secured Card. Understanding these elements can provide insights into the duration it may take for a cardholder to receive approval for a higher credit limit. The following factors influence the timeframe for a credit line increase:

- Credit History and Payment Behavior: A cardholder’s credit history and payment behavior significantly impact the timeframe for a credit line increase. Consistent, on-time payments and responsible credit management can expedite the approval process, showcasing the cardholder’s creditworthiness.

- Financial Stability and Income: Discover may assess the cardholder’s financial stability and income to determine their ability to manage a higher credit limit. A stable income and improved financial standing can positively influence the timeframe for a credit line increase.

- Credit Utilization Ratio: The utilization of existing credit plays a pivotal role in the decision-making process for a credit line increase. Maintaining a low credit utilization ratio demonstrates prudent credit management and can lead to a quicker approval timeframe.

- Account History and Relationship with Discover: Long-standing relationships with Discover, coupled with a positive account history, can contribute to a shorter timeframe for a credit line increase. Consistent, positive interactions with the financial institution may expedite the approval process.

- Market Conditions and Economic Factors: External factors, such as prevailing market conditions and economic stability, can indirectly influence the timeframe for a credit line increase. Discover may adjust its credit policies based on economic trends, impacting the approval timeline for credit limit adjustments.

By considering these factors, cardholders can gain a comprehensive understanding of the elements that shape the approval timeframe for a credit line increase. Proactively managing these aspects can contribute to a smoother and more efficient process in securing a higher credit limit on their Discover It Secured Card.

Timeframe for Credit Line Increase Approval

Upon submitting a request for a credit line increase on a Discover It Secured Card, cardholders may wonder about the timeline for receiving a decision. While the exact timeframe can vary based on individual circumstances and issuer policies, understanding the typical approval timeline can provide valuable insights. The following factors contribute to the timeframe for credit line increase approval:

- Internal Review Process: Discover initiates an internal review process upon receiving a credit line increase request. This involves evaluating the cardholder’s credit history, payment behavior, and financial stability to assess their eligibility for a higher credit limit.

- Notification Period: After the review process, Discover notifies the cardholder of the decision regarding their credit line increase request. This notification period typically ranges from a few business days to a few weeks, during which the issuer analyzes the provided information and makes a determination.

- Consideration of Financial Factors: The approval timeline is influenced by various financial factors, including the cardholder’s income, credit utilization, and overall creditworthiness. Discover carefully considers these aspects to make an informed decision regarding the credit line increase.

- Communication Channels: Discover communicates the decision to the cardholder through their preferred communication channel, which may include online account notifications, email, or traditional mail. The chosen communication method can impact the speed at which the cardholder receives the approval decision.

- Proactive Follow-Up: In some instances, cardholders may choose to proactively follow up on their credit line increase request to gain insights into the status of their application. While this does not expedite the approval process, it can provide clarity and transparency regarding the timeline.

It’s important for cardholders to remain patient during the approval process, as the timeframe for credit line increase approval is influenced by a combination of internal review procedures, financial assessments, and communication protocols. By understanding these factors, cardholders can manage their expectations and navigate the credit line increase journey with informed awareness of the typical approval timeline.

Conclusion

Securing a credit line increase on a Discover It Secured Card is a pivotal aspect of managing one’s credit and financial stability. By comprehending the process, factors influencing the approval timeframe, and the typical timeline for credit line increase approval, cardholders can navigate this journey with clarity and informed awareness.

Understanding the significance of credit line increases and their impact on credit utilization and financial flexibility empowers cardholders to make strategic decisions in managing their credit limits. Proactive steps, such as maintaining a positive payment history, managing credit utilization, and providing updated financial information, can contribute to a smoother and potentially expedited approval process for a credit line increase.

As cardholders embark on their credit-building journey with the Discover It Secured Card, they should approach the credit line increase request process with diligence and patience. By aligning with responsible credit management practices and demonstrating financial stability, cardholders can position themselves favorably for a potential credit line increase, enhancing their credit profile and financial well-being in the process.

Ultimately, the journey towards a credit line increase is a testament to a cardholder’s commitment to responsible credit usage and financial growth. By leveraging the insights provided in this guide, cardholders can navigate the process with confidence, understanding the factors at play and managing their expectations regarding the approval timeline.

As cardholders harness the potential of a higher credit limit, they are poised to unlock new opportunities and strengthen their financial foundation, paving the way for enhanced purchasing power and a more robust credit profile.