Home>Finance>How Long Does It Take For Merrick Bank To Increase Credit Limit

Finance

How Long Does It Take For Merrick Bank To Increase Credit Limit

Published: March 5, 2024

Looking to increase your credit limit with Merrick Bank? Find out how long it takes and manage your finances effectively. Reach your credit goals with our expert tips.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Merrick Bank is a well-established financial institution that offers credit cards to individuals seeking to build or rebuild their credit. One common concern for credit cardholders is the potential for increasing their credit limit over time. Understanding the process and timeframe for a credit limit increase with Merrick Bank is essential for managing one's financial resources effectively.

Increasing your credit limit can have several benefits, including improving your credit utilization ratio and enhancing your overall financial flexibility. However, the duration it takes for Merrick Bank to increase a credit limit can vary based on several factors. In this article, we will explore the factors influencing Merrick Bank's decision to increase credit limits, the process for requesting a credit limit increase, the typical timeframe for such an increase, and valuable tips for expediting the process.

By gaining insight into these aspects, you can navigate the credit limit increase process with confidence and make informed decisions to support your financial goals. Let's delve into the factors that influence Merrick Bank's credit limit increase decisions and the steps you can take to potentially expedite this process.

Factors Affecting Merrick Bank’s Credit Limit Increase

Several key factors influence Merrick Bank’s decision to increase a cardholder’s credit limit. Understanding these factors is crucial for individuals seeking a credit limit increase and can help manage expectations regarding the likelihood and timing of such an increase.

- Payment History: One of the most significant factors that Merrick Bank considers is a cardholder’s payment history. Consistently making on-time payments and managing credit responsibly can demonstrate to the bank that you are a low-risk borrower, potentially increasing the likelihood of a credit limit increase.

- Credit Utilization Ratio: Merrick Bank also evaluates a cardholder’s credit utilization ratio, which is the amount of credit being used relative to the total available credit. Maintaining a low credit utilization ratio, ideally below 30%, signals responsible credit management and may positively impact the decision to increase the credit limit.

- Income and Employment Stability: Cardholders’ income and employment stability are essential considerations for credit limit increases. A steady income and stable employment history can instill confidence in the bank regarding your ability to manage increased credit limits effectively.

- Credit Score: Merrick Bank assesses cardholders’ credit scores to gauge their overall creditworthiness. A higher credit score typically indicates lower credit risk, potentially increasing the likelihood of a credit limit increase.

- Account History: The length of time a cardholder has held an account with Merrick Bank and their account management history are also influential factors. A positive account history, coupled with a longer tenure, can contribute to a favorable decision regarding a credit limit increase.

By considering these factors, individuals can proactively manage their financial behaviors to align with Merrick Bank’s criteria for credit limit increases. In the following sections, we will explore the process for requesting a credit limit increase with Merrick Bank and the typical timeframe for such requests to be processed.

Process for Requesting a Credit Limit Increase

Requesting a credit limit increase with Merrick Bank involves a straightforward process that allows cardholders to express their desire for a higher credit limit. While Merrick Bank may periodically review accounts for potential credit limit increases, cardholders can also take the initiative to request an increase based on their financial needs and responsible credit management.

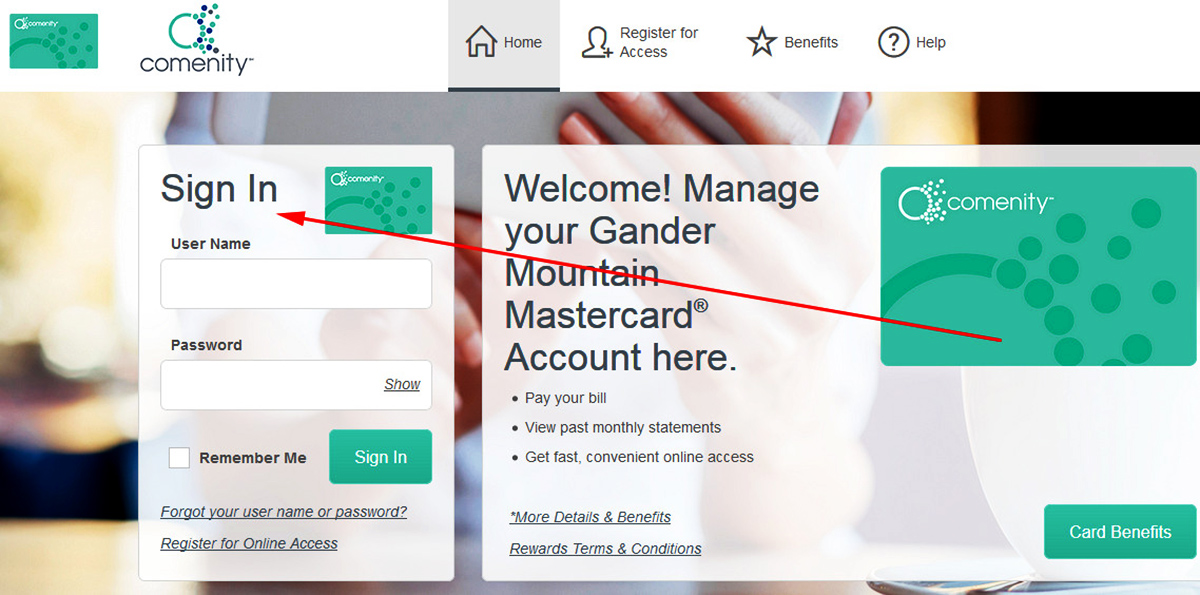

Cardholders can typically initiate a credit limit increase request through their online account management portal or by contacting Merrick Bank’s customer service. When submitting a request, it’s essential to provide accurate and updated financial information, including income details and any relevant changes in employment status. Additionally, cardholders may be required to consent to a credit inquiry, which allows Merrick Bank to assess their current financial circumstances and creditworthiness.

Upon receiving a credit limit increase request, Merrick Bank will review the cardholder’s account based on the factors mentioned earlier, such as payment history, credit utilization ratio, income stability, credit score, and account history. This comprehensive evaluation helps the bank make informed decisions regarding credit limit increases that align with responsible lending practices and the cardholder’s financial capacity.

It’s important to note that while requesting a credit limit increase does not guarantee approval, providing accurate and up-to-date financial information, coupled with a history of responsible credit management, can bolster the likelihood of a favorable outcome. In the subsequent section, we will explore the typical timeframe for Merrick Bank to process and implement a credit limit increase.

Typical Timeframe for Merrick Bank to Increase Credit Limit

The timeframe for Merrick Bank to process and implement a credit limit increase can vary based on several factors, including the cardholder’s individual financial profile and the bank’s internal review processes. While there is no definitive timeline for a credit limit increase, understanding the typical timeframe can help manage expectations and provide insight into the potential waiting period.

After a cardholder submits a credit limit increase request, Merrick Bank will conduct a thorough review of the account, considering factors such as payment history, credit utilization ratio, income stability, credit score, and account history. This review process is designed to assess the cardholder’s creditworthiness and financial capacity to manage a higher credit limit responsibly.

Once the review is complete, Merrick Bank will communicate its decision to the cardholder. If the request is approved, the new credit limit will typically be reflected in the cardholder’s account shortly thereafter. However, if the request is declined, the bank will provide reasons for the decision, allowing the cardholder to understand the factors that influenced the outcome.

While the specific timeframe for Merrick Bank to increase a credit limit may vary, cardholders can generally expect the review process to take a few weeks. It’s important to remain patient during this period and continue practicing responsible credit management, such as making on-time payments and maintaining a healthy credit utilization ratio.

By understanding the typical timeframe for a credit limit increase with Merrick Bank, cardholders can plan their financial activities and anticipate any adjustments to their available credit. In the following section, we will explore valuable tips for potentially expediting the credit limit increase process with Merrick Bank.

Tips for Increasing Credit Limit Faster

While the timeframe for a credit limit increase with Merrick Bank is influenced by various factors, there are proactive steps that cardholders can take to potentially expedite the process and improve their chances of a favorable outcome. Implementing these tips can help individuals demonstrate responsible credit management and enhance their creditworthiness in the eyes of the bank.

- Maintain a Positive Payment History: Consistently making on-time payments on existing credit card balances and other financial obligations is crucial. A strong payment history can demonstrate reliability and financial responsibility, potentially increasing the likelihood of a credit limit increase.

- Manage Credit Utilization Ratio: Keeping credit card balances low relative to the credit limits can positively impact credit utilization ratio. Aim to maintain a utilization ratio below 30% to signal responsible credit usage and potentially enhance the prospects of a credit limit increase.

- Regularly Update Income Information: Providing updated income information to Merrick Bank, especially if there has been a positive change in employment or income, can strengthen the case for a credit limit increase. This information allows the bank to assess the cardholder’s improved financial capacity.

- Monitor and Improve Credit Score: Regularly monitoring and working to improve one’s credit score can contribute to a positive credit limit increase outcome. Responsible credit behavior, such as reducing outstanding balances and addressing any credit report inaccuracies, can positively impact the credit score over time.

- Engage in Responsible Spending and Payment Habits: Continuing to use credit responsibly and avoiding excessive spending can demonstrate financial prudence. Additionally, paying more than the minimum amount due and reducing outstanding balances can reflect positively on the cardholder’s financial discipline.

By implementing these tips, cardholders can actively contribute to their creditworthiness and potentially expedite the credit limit increase process with Merrick Bank. It’s important to maintain open communication with the bank, provide accurate financial information, and demonstrate a commitment to responsible credit management.

Understanding the impact of these proactive measures can empower individuals to navigate the credit limit increase process with confidence and work towards achieving their financial objectives. In the subsequent section, we will summarize the key insights and considerations discussed in this article.

Conclusion

Navigating the process of increasing a credit limit with Merrick Bank involves understanding the key factors that influence the bank’s decision-making, the steps for requesting a credit limit increase, the typical timeframe for such requests to be processed, and valuable tips for potentially expediting the process.

Factors such as payment history, credit utilization ratio, income stability, credit score, and account history play a pivotal role in Merrick Bank’s assessment of a cardholder’s creditworthiness and their eligibility for a credit limit increase. By proactively managing these factors, individuals can enhance their prospects of a favorable outcome when requesting a credit limit increase.

The process for requesting a credit limit increase with Merrick Bank is straightforward, typically involving an online request or direct communication with customer service. Providing accurate and updated financial information, coupled with a history of responsible credit management, can bolster the likelihood of a favorable decision.

While the timeframe for Merrick Bank to process and implement a credit limit increase may vary, cardholders can generally expect the review process to take a few weeks. During this period, maintaining responsible credit habits and staying patient can contribute to a positive outcome.

Implementing proactive measures, such as maintaining a positive payment history, managing credit utilization ratio, updating income information, monitoring and improving credit score, and engaging in responsible spending and payment habits, can potentially expedite the credit limit increase process and strengthen the cardholder’s creditworthiness.

By understanding these key insights and taking proactive steps, individuals can navigate the credit limit increase process with confidence, work towards their financial goals, and effectively manage their credit resources. It’s essential to remain patient and committed to responsible credit management while awaiting a decision from Merrick Bank regarding a credit limit increase.