Home>Finance>How Long Does It Take To Build Credit With A Secured Card?

Finance

How Long Does It Take To Build Credit With A Secured Card?

Published: March 1, 2024

Learn how to build credit with a secured card in this comprehensive guide. Understand the timeline and steps to improve your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

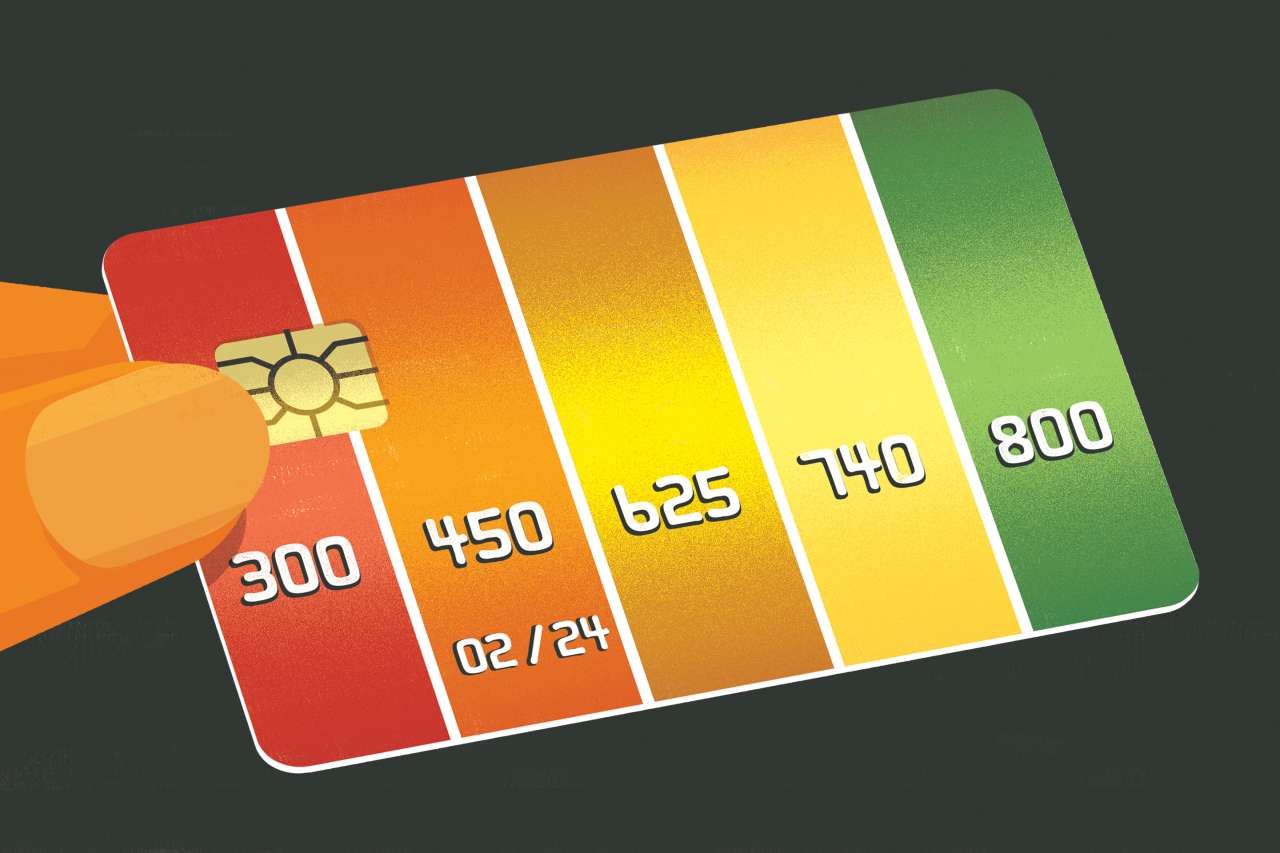

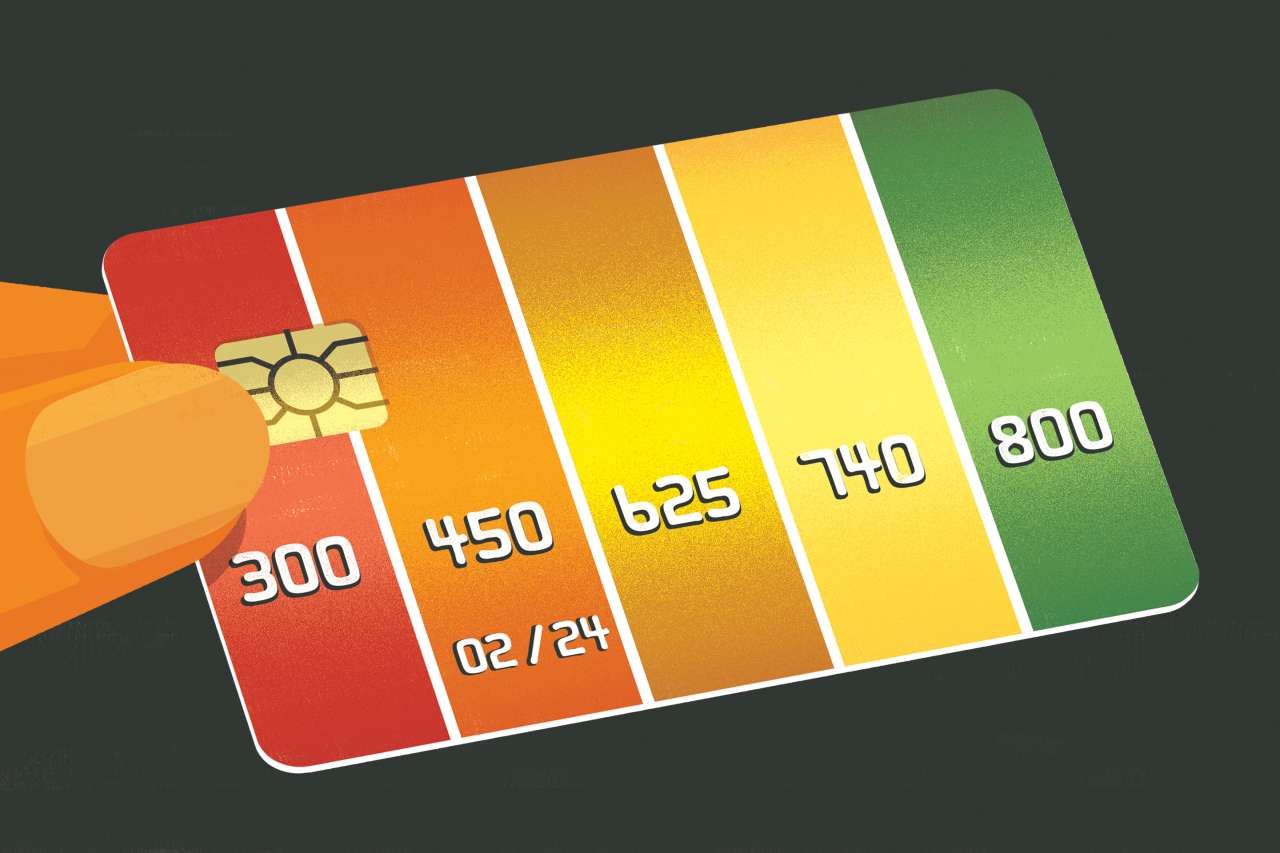

Building credit is a crucial step towards financial stability and freedom. It opens doors to better borrowing opportunities, lower interest rates, and improved financial security. However, for individuals with limited or damaged credit history, this can be a challenging endeavor. Fortunately, secured credit cards offer a viable solution to establish or rebuild credit.

Secured cards serve as a valuable tool for individuals who may not qualify for traditional unsecured credit cards due to a lack of credit history or a low credit score. By providing a cash deposit as collateral, cardholders can demonstrate their ability to manage credit responsibly, thereby laying a solid foundation for their creditworthiness.

In this article, we will delve into the intricacies of secured credit cards and their role in building credit. We will explore the factors that influence the time it takes to build credit with a secured card and provide actionable tips to expedite this process. Whether you're new to credit or looking to bounce back from past financial setbacks, understanding the dynamics of secured cards and their impact on credit building is essential for making informed financial decisions.

What is a Secured Card?

A secured credit card is a financial tool designed to help individuals establish or rebuild their credit. Unlike traditional unsecured cards, secured cards require the cardholder to provide a cash deposit as collateral, which typically determines the credit limit. This deposit serves as a form of security for the card issuer in case the cardholder defaults on payments. Essentially, the deposit reduces the risk for the issuer, making it possible for individuals with limited or damaged credit history to obtain a credit card.

Secured cards function much like regular credit cards, allowing cardholders to make purchases, build credit, and, in some cases, earn rewards. However, it’s important to note that the deposit is not used to pay off monthly charges unless the cardholder defaults. As the cardholder demonstrates responsible credit management over time, they may become eligible for an unsecured card, and in some cases, the issuer may refund the initial deposit.

These cards are typically recommended for individuals who are new to credit, have a limited credit history, or are working to rebuild their credit after past financial challenges. By using a secured card responsibly, individuals can showcase their creditworthiness and improve their credit scores, paving the way for future financial opportunities.

Secured cards are offered by various financial institutions, including banks and credit unions, and they function within the existing credit card infrastructure. This means that, like traditional credit cards, secured cards are reported to the major credit bureaus, allowing cardholders to establish a positive credit history when payments are made on time and balances are kept low.

How Does a Secured Card Help Build Credit?

A secured credit card serves as a valuable tool for building credit due to its ability to provide individuals with limited or damaged credit history the opportunity to demonstrate responsible credit management. When used wisely, a secured card can significantly impact an individual’s credit score and overall creditworthiness.

One of the primary ways in which a secured card helps build credit is through the reporting of payment history to the major credit bureaus. When cardholders make timely payments on their secured card, these positive behaviors are recorded and reflected in their credit reports. Consistent on-time payments contribute to establishing a positive payment history, which is a critical factor in determining an individual’s credit score.

Moreover, the utilization of a secured card influences the credit utilization ratio, which is the amount of credit being used relative to the total available credit. By maintaining a low balance relative to the credit limit, cardholders can keep their credit utilization ratio favorable, which can positively impact their credit score. Responsible utilization demonstrates financial discipline and can enhance creditworthiness over time.

Additionally, the length of credit history plays a significant role in credit scoring. By maintaining a secured card account in good standing over an extended period, individuals can contribute to the length of their credit history, which is a key factor in credit scoring models. This can ultimately bolster their credit scores and improve their overall credit profiles.

Furthermore, successfully managing a secured card can demonstrate to potential lenders and creditors that the cardholder is capable of responsibly handling credit, potentially increasing their chances of qualifying for other financial products in the future. As a result, a secured card can serve as a stepping stone towards accessing unsecured credit cards, loans, and other financial opportunities.

In essence, a secured credit card provides a practical and structured means for individuals to establish or rebuild their credit, offering a pathway towards improved financial stability and expanded access to credit in the long run.

Factors Affecting the Time to Build Credit

The time it takes to build credit with a secured card can vary based on several factors that influence credit scoring and financial behavior. Understanding these factors can provide insights into the timeline for achieving significant improvements in creditworthiness.

- Payment History: Timely payments on a secured card are a crucial factor in building credit. Consistent on-time payments demonstrate responsible credit management and contribute to a positive payment history, which can enhance credit scores over time.

- Credit Utilization: The utilization of credit on a secured card, relative to the credit limit, impacts the credit utilization ratio. Keeping credit utilization low can positively influence credit scores, so maintaining a low balance relative to the credit limit is advisable.

- Length of Credit History: The duration for which the secured card account is maintained in good standing contributes to the length of the cardholder’s credit history. A longer credit history can positively impact credit scores, so the longevity of responsible credit use is a significant factor.

- Overall Credit Profile: In addition to the secured card, the individual’s overall credit profile, including any other credit accounts or loans, can impact the time it takes to build credit. Positive financial behaviors across all credit accounts contribute to a robust credit profile.

- Financial Discipline: The cardholder’s ability to practice financial discipline, such as budgeting, managing expenses, and avoiding excessive debt, plays a pivotal role in building credit. Responsible financial habits can expedite the credit-building process.

- Credit Reporting: The frequency and accuracy of credit reporting by the card issuer to the major credit bureaus can affect the time it takes to build credit. Regular and accurate reporting ensures that positive credit behaviors are appropriately reflected in the cardholder’s credit reports.

It’s important to recognize that the impact of these factors on credit building is not immediate, and significant improvements in credit scores may take time to materialize. Patience and consistent, responsible credit management are essential for achieving lasting positive effects on creditworthiness. By understanding and addressing these factors, individuals can proactively work towards expediting the process of building credit with a secured card and positioning themselves for improved financial opportunities in the future.

Tips for Building Credit with a Secured Card

Maximizing the benefits of a secured credit card for building credit requires strategic and disciplined financial management. By implementing the following tips, individuals can optimize their credit-building journey and expedite the improvement of their credit scores.

- Timely Payments: Consistently making on-time payments is crucial for building credit. Setting up automatic payments or reminders can help ensure that payments are made promptly each month, contributing to a positive payment history.

- Low Credit Utilization: Keeping credit utilization low by maintaining a modest balance relative to the credit limit is advisable. This demonstrates responsible credit usage and can positively impact credit scores.

- Regular Monitoring: Monitoring the secured card account and credit reports regularly can help individuals stay informed about their credit status. Identifying and addressing any errors or discrepancies promptly is essential for maintaining accurate credit information.

- Gradual Credit Expansion: As credit scores improve, individuals may consider gradually expanding their credit portfolio by applying for additional credit accounts or loans. However, it’s crucial to manage these new accounts responsibly to avoid overextending credit.

- Financial Discipline: Practicing overall financial discipline, including budgeting, managing expenses, and avoiding excessive debt, is integral to building credit. Responsible financial habits contribute to a positive credit profile and long-term creditworthiness.

- Patience and Persistence: Building credit with a secured card is a gradual process, and significant improvements may take time to materialize. Maintaining patience and persistence while adhering to responsible credit management practices is key to long-term success.

- Regular Communication with the Issuer: Establishing open communication with the secured card issuer can be beneficial. Inquiring about the possibility of transitioning to an unsecured card or seeking potential credit limit increases demonstrates proactive credit management.

By integrating these tips into their financial routines, individuals can effectively leverage a secured credit card to build credit, enhance their credit profiles, and position themselves for broader financial opportunities in the future. It’s important to approach credit building with a long-term perspective, recognizing that consistent, responsible credit management yields enduring benefits.

Conclusion

Building credit with a secured card is a transformative journey that empowers individuals to establish or rebuild their creditworthiness, paving the way for enhanced financial stability and opportunities. The strategic use of a secured credit card, coupled with disciplined financial management, can yield significant improvements in credit scores and overall credit profiles over time.

By leveraging a secured card, individuals can demonstrate their ability to manage credit responsibly, as evidenced by timely payments, low credit utilization, and sustained financial discipline. These positive behaviors contribute to the development of a robust credit history and enhanced creditworthiness, positioning individuals for broader access to credit and favorable borrowing terms in the future.

Patience, persistence, and proactive credit management are essential components of the credit-building process with a secured card. It’s important for individuals to embrace these principles while adhering to prudent financial practices, such as regular monitoring of credit reports, gradual credit expansion, and maintaining open communication with the card issuer.

Ultimately, the journey of building credit with a secured card is a testament to the potential for positive financial transformation. As individuals commit to responsible credit management and leverage the tools available to them, they can achieve lasting improvements in their credit scores and unlock a myriad of financial opportunities.

Embracing the tips and insights shared in this article can empower individuals to navigate the credit-building process with confidence and purpose. By understanding the factors that influence credit building, implementing strategic tips, and maintaining a long-term perspective, individuals can harness the full potential of a secured credit card to fortify their financial foundation and embark on a path towards enduring credit success.