Finance

How Many Credit Hours To Receive Financial Aid

Published: January 5, 2024

Find out how many credit hours you need to be eligible for financial aid

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our guide on how credit hours can impact your eligibility for financial aid. If you’re a student pursuing higher education, you know that funding your education can be a significant concern. Many students rely on financial aid to help cover the costs of tuition, books, and living expenses. Understanding how credit hours play a role in determining your eligibility for financial aid is crucial for maximizing your funding options.

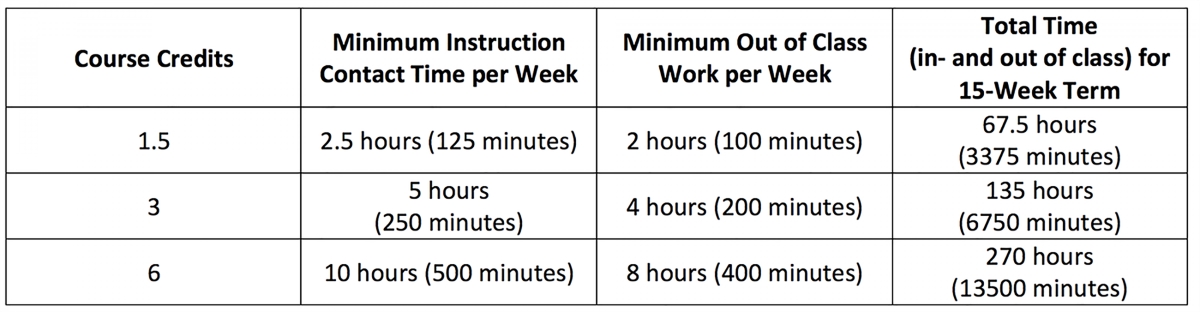

Financial aid programs are designed to assist students who demonstrate financial need, as well as academic progress towards their degree. One important factor that institutions consider when awarding financial aid is the number of credit hours a student is enrolled in. Credit hours are a way to measure the amount of academic work you are expected to complete in a given course. Different credit hour requirements apply to full-time and part-time students, and understanding the specific requirements can help you plan your course load accordingly.

In this guide, we will explore the eligibility requirements for financial aid, discuss how credit hours play a role in determining financial aid, and provide tips on maximizing your financial aid opportunities. Whether you’re just starting your college journey or looking for ways to optimize your financial aid, this comprehensive guide will provide you with the necessary information to make informed decisions.

So, let’s dive into the world of credit hours and financial aid, and discover how to make the most of your funding opportunities!

Eligibility Requirements for Financial Aid

Before delving into how credit hours impact financial aid, it’s important to understand the eligibility requirements for receiving financial assistance. Financial aid programs typically have specific criteria that students must meet to qualify for funding. While these requirements may vary depending on the institution and the type of financial aid program, there are some common factors that are considered across the board.

First and foremost, financial need is a key factor in determining eligibility for most financial aid programs. This is assessed by evaluating your family’s income, assets, and other relevant financial information. Students from low-income backgrounds generally have a higher chance of receiving financial aid due to their demonstrated financial need.

Academic progress is another important criterion. Most financial aid programs require students to maintain a minimum GPA and make satisfactory academic progress towards their degree. This ensures that the funds are awarded to students who are actively working towards their educational goals.

Additional eligibility requirements may include being a U.S. citizen or eligible non-citizen, having a valid Social Security number, and being registered with the Selective Service System (for male students). It’s important to carefully review the specific eligibility criteria for the financial aid programs you are interested in to ensure you meet all requirements.

Lastly, many financial aid programs have specific deadlines for application submission. Missing these deadlines may result in a loss of financial aid opportunities. Therefore, it is essential to stay organized and well-informed of the application process to maximize your chances of receiving financial assistance.

Now that we have a good understanding of the general eligibility requirements for financial aid, let’s explore how credit hours come into play and affect the distribution of these funds.

Credit Hours Required for Financial Aid

When it comes to determining eligibility for financial aid, one crucial factor is the number of credit hours you are enrolled in. Credit hours serve as a measure of your course workload and academic progress. The specific credit hour requirements for financial aid can vary depending on the institution and the type of aid program you are applying for.

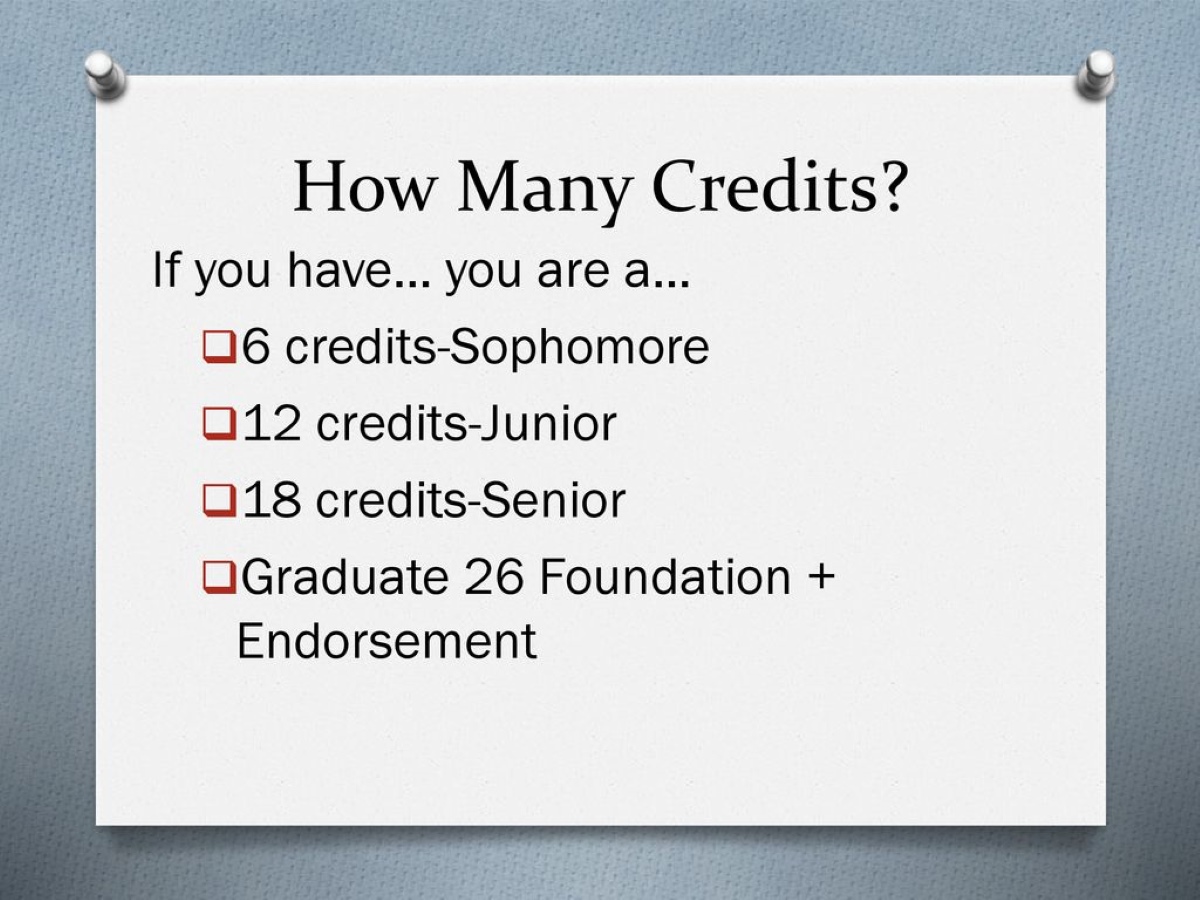

Typically, financial aid programs have a minimum credit hour requirement for both full-time and part-time status. Full-time students are usually required to be enrolled in a certain number of credit hours per semester, usually around 12 credits or more. Part-time students, on the other hand, have a lower credit hour requirement, typically around 6-8 credits. It’s important to note that these credit hour requirements may differ between undergraduate and graduate students.

Why do institutions set credit hour requirements for financial aid? One reason is to ensure that students are maintaining a sufficient level of academic engagement to warrant the distribution of funds. By defining minimum credit hour thresholds, institutions can ensure that students are actively progressing towards their degree and making timely completion of their educational program.

Meeting the minimum credit hour requirement for financial aid is crucial, as falling below the specified threshold can result in the reduction or cancellation of your funding. For example, if you are receiving full-time financial aid and drop below the required credit hours to be considered a full-time student, your aid may be adjusted to reflect your part-time status. This can have a significant impact on your ability to cover your educational expenses.

It’s worth noting that credit hour requirements may also determine the type of financial aid you are eligible for. Some forms of aid, such as scholarships or grants, may require full-time enrollment, while others, like federal work-study programs, may have more flexibility for part-time students.

Overall, understanding the credit hour requirements for financial aid is essential for planning your course load and managing your eligibility. It’s recommended to consult with your institution’s financial aid office to get specific information about credit hour requirements and how they relate to the financial aid programs you are applying for.

Now, let’s explore the differences between full-time and part-time student status and how it impacts financial aid eligibility.

Full-time and Part-time Status

When it comes to determining financial aid eligibility, your enrollment status as a full-time or part-time student plays a significant role. Colleges and universities typically classify students based on the number of credit hours they are enrolled in per semester.

A full-time student is generally defined as someone who is enrolled in a certain number of credit hours per semester, typically 12 or more. Full-time status is commonly associated with benefits such as access to a wider range of financial aid options and the ability to meet academic requirements for scholarships and grants. Additionally, full-time students often have access to resources and services offered by the institution, such as campus facilities and extracurricular activities.

On the other hand, a part-time student is someone who is taking fewer credit hours per semester, usually between 6 and 8 credits. Part-time students often have limited access to certain types of financial aid, scholarships, and grants, as these are often reserved for full-time students. However, part-time students may still be eligible for other forms of financial assistance, such as federal student loans or work-study programs.

While full-time status generally offers more financial aid opportunities, it’s important to consider your individual circumstances before deciding on your enrollment status. Factors such as work or family responsibilities, personal commitments, and financial constraints may influence your decision to study full-time or part-time.

Keep in mind that transitioning from part-time to full-time status or vice versa can have implications on your financial aid. If you are receiving financial aid as a full-time student and decide to switch to part-time status, you may need to adjust your financial aid package accordingly. Conversely, if you switch from part-time to full-time status, you may become eligible for additional financial aid opportunities.

It’s important to communicate any changes in your enrollment status to your institution’s financial aid office as soon as possible. They will guide you through the process of adjusting your financial aid package based on your new status.

Remember, the decision to enroll as a full-time or part-time student is a personal one, and it should align with your academic goals, financial circumstances, and other commitments. Take the time to evaluate your options and consult with academic advisors and financial aid professionals to make an informed decision.

Next, let’s explore any exceptions that exist for credit hour requirements and how they may impact your financial aid eligibility.

Exceptions for Credit Hour Requirements

While institutions generally have specific credit hour requirements for financial aid eligibility, there are certain exceptions that can apply in certain circumstances. These exceptions take into account situations where students may not be able to meet the regular credit hour requirements due to various factors.

One common exception is for students with disabilities or medical conditions. If a student’s disability or medical condition prevents them from being able to handle a full-time course load, they may qualify for accommodations, which can include a reduced credit hour requirement for financial aid purposes. The specific accommodations and procedures may vary from institution to institution, but it’s important for eligible students to communicate their needs and work with the disability support office or the financial aid office to explore available options.

Another exception applies to students who are in their final semester or year of study. In certain cases, students who have completed the majority of their coursework and are nearing graduation may be eligible for financial aid while taking fewer than the required number of credit hours. This exception allows them to focus on their remaining required courses or final project, ensuring a smooth transition to graduation.

Furthermore, some financial aid programs may have specific provisions for students who are enrolled in internships, clinical rotations, or other approved experiential learning opportunities. These programs understand that these experiences often require a significant amount of time and commitment, which may impact the ability to take a full course load. Students participating in these types of programs may receive financial aid even if they are not enrolled in the standard number of credit hours.

It’s important to note that the availability and requirements for these exceptions may vary among institutions and financial aid programs. Therefore, it is crucial to consult with your institution’s financial aid office to discuss your specific circumstances and explore any available exceptions that may apply to you.

By understanding and utilizing these exceptions, you can ensure that your financial aid eligibility is evaluated in a fair and flexible manner, taking into account any special circumstances that may impact your ability to meet the standard credit hour requirements.

Next, let’s delve into how credit hours affect the disbursement of financial aid funds.

How Credit Hours Affect Financial Aid Disbursement

Understanding how credit hours impact the disbursement of financial aid is crucial for effectively managing your funding. The number of credit hours you are enrolled in can affect the amount of financial aid you receive and how it is distributed throughout the academic year.

Financial aid disbursement is typically based on the concept of “full-time equivalent” (FTE) enrollment. This means that financial aid awards are calculated based on the assumption that you are enrolled as a full-time student. If you are enrolled in the required number of credit hours to be considered a full-time student, your financial aid will be disbursed at the full-time rate.

If you are enrolled as a part-time student, your financial aid will be adjusted to reflect your part-time status. The aid amount will be prorated based on the number of credit hours you are taking compared to the full-time credit hour requirement. For example, if you are enrolled in 6 credits in a semester and the full-time requirement is 12 credits, you may receive only half of the financial aid you would be eligible for as a full-time student.

It’s important to note that the timing of financial aid disbursement may also be affected by credit hours. Generally, financial aid is disbursed on a per-semester basis. If you are a full-time student, your aid may be disbursed in one lump sum at the beginning of the semester. However, part-time students may have their aid disbursed in multiple installments throughout the semester or academic year.

Another important consideration is the potential impact of adding or dropping credit hours during the semester. If you add credits after receiving the initial disbursement of financial aid, your aid may be adjusted to reflect the additional credit hours. Conversely, if you drop credits, you may be required to repay a portion of the aid that was disbursed based on the original enrollment information.

It’s crucial to review and understand your institution’s policies regarding credit hours and aid disbursement to avoid any unexpected changes or financial obligations. Make sure to communicate any changes in your enrollment status to the financial aid office and consult with them to understand the potential impact on your financial aid package.

By being aware of how credit hours affect financial aid disbursement, you can plan your course load strategically and make informed decisions to maximize your financial assistance throughout your academic journey.

Next, let’s explore some tips for maximizing your financial aid opportunities.

Tips for Maximizing Financial Aid Opportunities

Securing financial aid to fund your education is a valuable opportunity. To maximize your chances of receiving the most financial aid possible, consider the following tips:

- Complete the FAFSA: The Free Application for Federal Student Aid (FAFSA) is a critical step in determining your eligibility for federal and state financial aid programs. Be sure to complete and submit the FAFSA as early as possible to secure your aid.

- Apply for Scholarships: Explore and apply for scholarships that match your interests, background, or academic achievements. Scholarships can provide additional financial support and do not have to be repaid.

- Research Institutional Aid: Many colleges and universities have their own institutional aid programs. Research and reach out to your institution’s financial aid office to learn about any additional aid opportunities they offer.

- Maintain Strong Academics: Maintaining a high GPA and making satisfactory academic progress can increase your chances of qualifying for merit-based scholarships and other academic awards.

- Seek Out Work-Study Programs: Federal work-study programs allow you to work part-time on-campus or in a community service job to earn income while also gaining valuable experience. These programs can help offset your educational expenses.

- Enroll Full-Time if Possible: If your circumstances allow, consider enrolling as a full-time student to maximize your eligibility for financial aid. Full-time status often offers access to a wider range of aid options.

- Communicate Changes: Inform your institution’s financial aid office of any changes in your circumstances, such as financial hardship or changes in enrollment status. They may be able to reassess your aid package based on the new information.

- Plan Course Load Carefully: Plan your course load strategically to ensure you meet the credit hour requirements for financial aid eligibility. Dropping below the required credit hours can have a negative impact on your aid.

- Stay Informed: Regularly check your email, online student portal, and financial aid website for important updates, deadlines, and opportunities. Staying informed can help you take advantage of any additional aid options that may become available.

- Explore Other Financial Assistance: If you find that your financial aid package is insufficient, consider alternative options such as private student loans, community scholarships, or part-time employment to help cover the remaining costs.

Remember, each financial aid program may have its own application deadlines and eligibility criteria. It’s important to plan ahead, stay organized, and be proactive in seeking out opportunities for financial aid.

By leveraging these tips and being proactive in your approach to financial aid, you can increase your chances of maximizing the resources available to you and minimizing the financial burden of your education.

Finally, let’s summarize the key points covered in this guide.

Conclusion

As you navigate the world of financial aid, understanding the role of credit hours is essential for maximizing your funding opportunities. Credit hours play a significant role in determining your eligibility for financial aid and can impact the amount and timing of your aid disbursement.

By meeting the credit hour requirements and maintaining full-time or part-time status, you can ensure that you remain eligible for financial aid and receive the appropriate amount of funding to support your educational journey. Remember to communicate any changes in your enrollment status to your institution’s financial aid office to avoid any surprises or potential adjustments to your aid package.

Additionally, be proactive in researching and applying for scholarships, exploring institutional aid programs, and taking advantage of work-study opportunities. By expanding your financial aid options beyond federal and state programs, you can maximize your funding and potentially reduce the need for student loans.

Lastly, stay informed about the specific requirements, deadlines, and opportunities related to financial aid at your institution. Regularly communicate with financial aid professionals, check your student portal, and stay updated on any changes or new opportunities.

Remember, receiving financial aid is not only about the financial support, but also about the responsibility it entails. Make sure to manage your funds wisely, seek academic success, and make progress toward your educational goals throughout your college journey.

By understanding how credit hours impact financial aid and implementing the tips provided in this guide, you can position yourself for success in obtaining and maximizing financial aid opportunities. Your education deserves the best financial support available, so take advantage of the resources and opportunities that are available to you.

Good luck in your pursuit of financial aid and your educational goals!