Finance

How Many Hours Does An Investment Banker Work?

Modified: December 30, 2023

Discover the average work hours of an investment banker in the finance industry. Learn how the demands of this dynamic profession impact their daily schedule.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Investment banking is a dynamic and fast-paced industry that plays a crucial role in the global financial market. Aspiring investment bankers are often intrigued by the lucrative compensation and prestige associated with the profession. However, one of the primary concerns potential candidates have is the work hours that come with this demanding role. Understanding the typical work schedule of an investment banker is essential for anyone considering a career in this field.

Investment bankers are professionals who work for financial institutions and assist clients in raising capital, providing financial advice, and facilitating mergers and acquisitions. They are involved in complex financial transactions that require meticulous attention to detail, analytical skills, and a rigorous work ethic. Given the high-pressure nature of the job and the critical role investment bankers play in the success of their clients, it is no surprise that long hours are expected in this industry.

In this article, we will delve into the typical work schedule of an investment banker, exploring the factors that influence the number of hours worked, the average weekly working hours, the challenges of maintaining work-life balance in this profession, and some tips for managing work hours effectively.

Definition of an Investment Banker

An investment banker is a financial professional who works in the field of investment banking. Investment banking involves providing financial services to corporations, governments, and other entities. Investment bankers help clients raise capital by issuing securities such as stocks and bonds, provide advice on mergers and acquisitions, and assist with various financial transactions.

Investment bankers are typically employed by large financial institutions such as commercial banks or investment banks. They work closely with clients to understand their financial needs and goals, and then develop strategies to meet those objectives. Investment bankers play a critical role in the success of their clients by helping them secure funding, navigate complex financial markets, and make strategic business decisions.

Investment banking is a highly competitive field that requires a strong foundation in finance, economics, and business principles. Investment bankers need to have a deep understanding of financial markets, risk management, and corporate finance. They must be skilled in financial analysis, valuation techniques, and negotiation. In addition to technical expertise, investment bankers must possess strong communication and interpersonal skills as they often interact with clients, colleagues, and other stakeholders.

Given the challenging nature of the work, investment bankers are known for their long hours and intense work ethic. They are often required to work late nights and weekends, especially during peak deal-making periods. The demanding work schedule in investment banking reflects the level of dedication and commitment required to meet client expectations and deliver exceptional results.

Overall, investment banking is a rewarding yet demanding profession that offers exciting opportunities for individuals interested in the intersection of finance and business. The role of an investment banker is multifaceted, involving financial analysis, advisory services, and strategic decision-making. Understanding the definition and responsibilities of an investment banker sets the stage for exploring the typical work schedule in this field.

Typical Work Schedule of an Investment Banker

The work schedule of an investment banker is notorious for being intense and demanding. The nature of the job often requires long hours and a commitment to meeting strict deadlines. While there is no universal standard for the work hours of an investment banker, there are some common expectations and patterns that can be observed.

Investment bankers commonly start their workday early in the morning, typically around 8 or 9 AM. This early start allows them to review the latest market updates, news, and research reports before the markets open. They use this time to stay ahead of market trends, analyze financial data, and prepare for client meetings.

Throughout the day, investment bankers are engaged in a range of activities, which may include conducting financial analysis, preparing pitch materials, meeting with clients, participating in conference calls, and negotiating deals. They are constantly multitasking and navigating a high-pressure environment.

As the day progresses, investment bankers often find themselves working well into the evening. Late nights are common in this profession as they strive to meet client demands and manage multiple projects simultaneously. It is not uncommon for investment bankers to work past midnight, especially during critical deal-making periods.

Weekends are also not immune to work in investment banking. Saturdays and Sundays are frequently reserved for catching up on unfinished work, attending meetings or conference calls, and preparing for the following week. While not every weekend is fully occupied with work, it is important for investment bankers to remain flexible and be prepared to put in extra hours when necessary.

It’s worth noting that the work schedule of an investment banker can vary depending on the specific role, seniority level, and the current deal flow. Junior investment bankers often work the longest hours, as they are responsible for tasks such as financial modeling, data analysis, and managing administrative duties. Senior bankers may have a more flexible schedule, as they primarily focus on relationship management and strategic decision-making.

In summary, the typical work schedule of an investment banker involves early mornings, long days filled with various tasks, and the occasional late nights and weekends. The demands of the job require a high level of commitment, dedication, and the ability to thrive in a fast-paced environment.

Factors Influencing Working Hours

The long working hours in investment banking are influenced by several factors that contribute to the demanding nature of the job. Understanding these factors can provide insight into why investment bankers often have intense work schedules:

Client Demand:

Investment bankers operate in a client-driven industry where meeting client deadlines and expectations is paramount. Clients may require immediate responses, especially during critical deal-making periods. This demand for responsiveness can lead to long work hours as investment bankers strive to deliver results within tight timelines.

Deal Flow:

The volume and complexity of deals in the investment banking industry can fluctuate. During busy periods, such as when multiple deals are closing simultaneously, investment bankers may need to dedicate more time and effort to ensure successful execution. This can result in extended work hours to manage the increased workload.

Global Operations:

Investment banking operates on a global scale, with deals and transactions spanning different time zones. Investment bankers may need to collaborate with teams located in different regions, necessitating flexibility in working hours to accommodate international communication and coordination.

Market Conditions:

The financial markets are highly interconnected and sensitive to global events and economic factors. Investment bankers must closely monitor market developments and stay alert to capitalize on emerging opportunities or mitigate risks. This constant vigilance can contribute to extended work hours, particularly during periods of market volatility.

Company Culture:

The culture within investment banking firms often emphasizes a strong work ethic and dedication to the job. While this can foster a high-performing environment, it can also create a norm of long working hours as individuals strive to meet or exceed expectations.

While these factors contribute to the long working hours in investment banking, it’s important to recognize that not all investment banks or teams have the same work culture. Some firms may prioritize work-life balance and actively promote policies to mitigate excessive working hours. Nonetheless, the demanding nature of the industry often means that investment bankers should be prepared for a significant time commitment to their work.

Average Weekly Working Hours

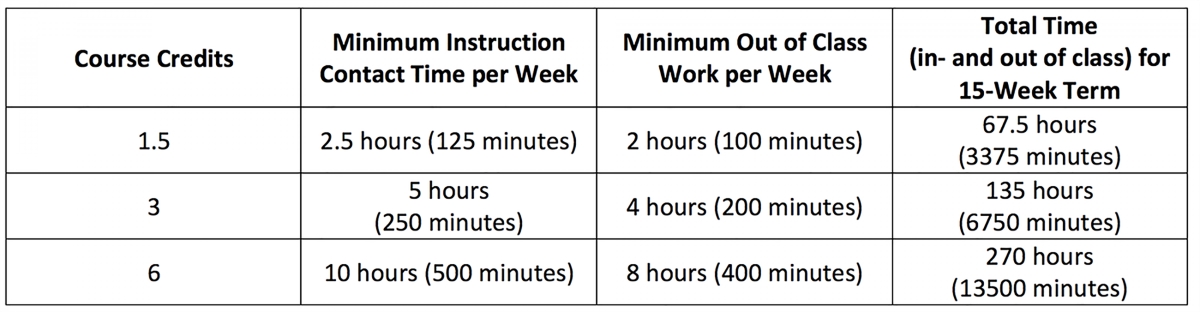

The average weekly working hours of an investment banker can vary depending on factors such as the specific firm, role, seniority level, and current workload. While it is difficult to pinpoint an exact number, it is widely recognized that investment banking professionals typically work well beyond the standard 40-hour workweek.

Junior investment bankers, especially analysts and associates, are known to have the longest work hours. It is not uncommon for them to work 70 to 100 hours per week or more, particularly during busy periods. These long hours can stem from the need to complete financial modeling, market research, and other time-intensive tasks.

As investment bankers progress in their careers and assume more senior positions, their working hours may become slightly more manageable. However, it is important to note that even senior-level investment bankers still often work well above the standard 40-hour workweek. They may still find themselves putting in 50 to 80 hours or more per week, depending on the demands of their clients and the specific deals they are working on.

It is crucial to understand that the average weekly working hours in investment banking can be highly unpredictable. Factors such as deal flow, market conditions, and client demands can significantly impact the workload at any given time. Thus, an investment banker’s workload may vary from week to week, and there may be periods of extreme intensity followed by relatively quieter periods.

It is worth mentioning that some investment banks have made efforts in recent years to address the issue of excessive work hours. They have implemented policies and initiatives aimed at promoting work-life balance and reducing the strain on their employees. However, it remains true that the demands of the job often necessitate a significant time commitment.

Ultimately, investment banking is an industry known for its demanding work hours. While the exact number of working hours can vary, it is safe to say that investment bankers should expect to work well beyond the traditional 40-hour workweek. Flexibility, time management, and a strong work ethic are therefore crucial in order to thrive in this challenging yet rewarding profession.

Work-Life Balance in Investment Banking

Work-life balance is a topic of great importance in modern society, and investment banking is an industry often criticized for its demanding work hours and limited time for personal pursuits. Achieving work-life balance can be challenging in investment banking due to the high-pressure nature of the job and the long work hours. However, it is not impossible, and there are strategies that can help investment bankers strike a better balance between their professional and personal lives.

One key aspect of improving work-life balance is effective time management. Investment bankers should prioritize their tasks, set realistic deadlines, and delegate responsibilities when possible. By efficiently managing their time, they can maximize productivity during working hours and create opportunities for personal time outside of work.

Additionally, communication and transparency are crucial in maintaining work-life balance. Investment bankers should openly communicate with their colleagues and superiors about their workload and capacity. By setting clear boundaries and expectations, it becomes easier to maintain a healthy work-life balance and prevent burnout.

Investment bankers should also take advantage of any available flexible work arrangements offered by their firms. Flexibility in work hours and remote work options can provide some flexibility to accommodate personal commitments and improve work-life balance. It is important to discuss and negotiate these arrangements with employers to find a suitable balance for both parties.

Another crucial aspect is self-care. Investment bankers should prioritize their physical and mental well-being by practicing self-care activities such as exercise, meditation, and maintaining a healthy lifestyle. Taking breaks and engaging in hobbies or activities outside of work can help reduce stress and promote a sense of fulfillment beyond the office.

Mentoring and networking can also play a significant role in work-life balance. Building a strong support system within the industry can provide guidance, advice, and insights into managing work demands while maintaining personal well-being. Mentors can share their experiences and provide valuable tips on achieving work-life balance in the investment banking field.

Lastly, it is essential to remember that work-life balance is a personal journey, and what works for one individual may not work for another. Each investment banker will have different priorities and preferences. It is crucial to identify what truly matters and create a balance that aligns with personal and professional goals.

While work-life balance can be challenging in investment banking, it is not impossible. By implementing effective time management, setting boundaries, practicing self-care, and seeking support, investment bankers can strive to achieve a more harmonious balance between their work and personal lives. Prioritizing well-being and personal fulfillment is essential for long-term success and satisfaction in this demanding industry.

Tips for Managing Work Hours in Investment Banking

Managing work hours effectively is crucial for maintaining a healthy work-life balance in investment banking. While the nature of the job often requires long hours, there are strategies and tips that can help investment bankers navigate their workload more efficiently. Here are some tips for managing work hours in the demanding field of investment banking:

- Set Priorities: Start each day by identifying the most crucial tasks. Prioritize your workload based on deadlines, client needs, and importance. This will help you focus on the most important tasks and ensure that critical work is completed first.

- Delegate When Possible: Learn to delegate tasks that can be done by others. Effective delegation not only helps lighten your workload but also allows you to focus on high-priority and strategic tasks. Trusting your team and promoting collaboration can lead to better efficiency and time management.

- Manage Distractions: Minimize distractions during work hours to maximize productivity. Avoid excessive email checking, social media browsing, or non-essential meetings. Create a focused work environment and allocate specific time slots for tasks that require deep concentration.

- Practice Time Blocking: Allocate specific time blocks for different types of tasks. For example, designate blocks for client meetings, financial analysis, email correspondence, and personal breaks. This structured approach will help you organize your day and stay on track.

- Communicate Effectively: Keep open lines of communication with your team and clients. Be proactive in managing expectations and setting realistic deadlines. Clear communication can prevent misunderstandings and reduce unnecessary stress.

- Take Advantage of Technology: Utilize technology tools and apps that can assist in streamlining your work processes. Project management tools, time-tracking apps, and communication platforms can enhance collaboration and help you stay organized.

- Set Boundaries: Establish boundaries between work and personal life. Make a conscious effort to disconnect from work during your personal time. Set aside dedicated time for relaxation, hobbies, and spending quality time with loved ones.

- Prioritize Self-Care: Take care of your physical and mental well-being. Engage in regular exercise, get enough sleep, and maintain a balanced diet. Taking care of yourself will positively impact your performance and energy levels.

- Be Realistic: Understand that there will be times when work hours may be longer, especially during critical deals. Be prepared to adapt and manage your time based on the demands of your role. Look for opportunities to regain balance during quieter periods.

- Seek Support: Connect with colleagues, mentors, or support groups within the industry. Sharing experiences, seeking advice, and learning from others can provide valuable insights and help in managing work hours effectively.

Remember, achieving work-life balance in investment banking is an ongoing effort that requires self-awareness, discipline, and adaptability. Implementing these tips and finding strategies that work for you can contribute to a more productive and fulfilling career in investment banking.

Conclusion

Investment banking is a demanding and fast-paced industry that often requires long working hours. The typical work schedule of an investment banker can be intense, with early mornings, late nights, and occasional weekend work. Factors such as client demands, deal flow, and market conditions contribute to the extended hours investment bankers face.

While achieving work-life balance in investment banking can be challenging, it is not impossible. By implementing effective time management, setting boundaries, practicing self-care, and seeking support, investment bankers can strive for a better balance between their professional and personal lives. Prioritizing tasks, delegating responsibilities, and communicating openly with colleagues and superiors can also aid in managing work hours more effectively.

It is important for investment bankers to remember that work-life balance is a personal journey that may look different for each individual. Taking advantage of flexible work arrangements, utilizing technology tools, and setting realistic expectations are strategies that can contribute to better work-life integration.

While the demanding nature of investment banking cannot be negated, finding ways to manage work hours can lead to a more sustainable and fulfilling career. By prioritizing well-being, setting boundaries, and being proactive in time management, investment bankers can navigate their work schedules more effectively, reducing stress and burnout.

In conclusion, work-life balance in investment banking requires a combination of effective time management, self-care practices, open communication, and a keen focus on personal priorities. It’s a continuous effort to strike a balance between demanding work hours and personal well-being. With the right strategies and mindset, investment bankers can maintain a healthier work-life balance, leading to greater satisfaction and success in their careers.