Home>Finance>How Many Options Contracts Can I Buy At One Time?

Finance

How Many Options Contracts Can I Buy At One Time?

Published: February 28, 2024

Discover the ideal number of options contracts you can purchase at once in the finance market. Maximize your investment potential with strategic buying strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

So, you're considering delving into the world of options trading, and you're eager to understand the dynamics of buying options contracts. Options trading can be an exciting and potentially lucrative venture, but it's essential to grasp the fundamentals before taking the plunge. One of the key questions that often arises is, "How many options contracts can I buy at one time?" This query is pivotal, as it directly impacts the potential risk and reward of your options trading endeavors.

Options contracts provide the holder with the right, but not the obligation, to buy or sell a specified asset at a predetermined price within a set time frame. They are versatile financial instruments that can be utilized for various strategies, including hedging, speculation, and income generation. However, the quantity of contracts you can purchase at a given time is influenced by several factors, and understanding these dynamics is crucial for making informed and prudent trading decisions.

In this comprehensive guide, we will delve into the intricacies of options trading and explore the considerations that come into play when determining the maximum number of options contracts you can buy at one time. By gaining insights into these factors, you will be better equipped to navigate the world of options trading with confidence and precision. So, let's embark on this enlightening journey to unravel the mysteries of options contracts and discover the optimal strategies for maximizing your trading potential.

Understanding Options Contracts

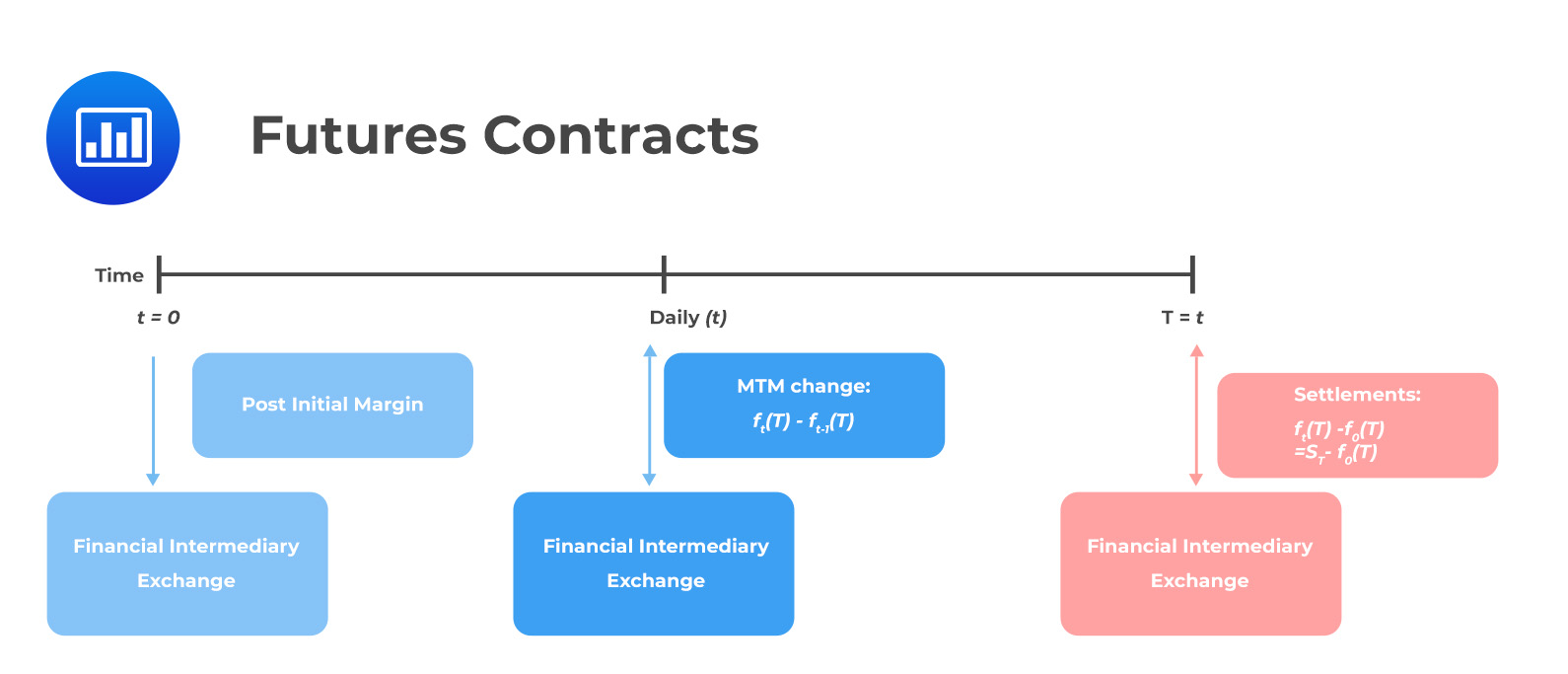

Options contracts are derivative securities that grant the holder the right, but not the obligation, to buy or sell a specific asset at a predetermined price, known as the strike price, within a specified time period. These contracts are categorized as either call options, which provide the right to buy the underlying asset, or put options, which grant the right to sell the underlying asset. The price at which the underlying asset can be bought or sold is known as the exercise price.

When an investor purchases an options contract, they pay a premium to the seller, also known as the writer, in exchange for the rights conveyed by the contract. The premium amount is influenced by factors such as the current market price of the underlying asset, the contract’s expiration date, implied volatility, and prevailing interest rates.

Options contracts are valuable tools for implementing various trading strategies. For instance, a call option can be utilized to speculate on the price appreciation of an underlying asset, while a put option can be used to hedge against potential downside risk or to profit from a decline in the asset’s value. Additionally, options trading allows for leveraging capital and managing risk more effectively than trading the underlying asset directly.

It’s important to note that options trading involves inherent risks, including the potential for loss of the entire premium paid for the contract. Therefore, understanding the nuances of options contracts and the associated risks is paramount for any investor or trader seeking to engage in options trading.

By comprehending the mechanics of options contracts and the strategic possibilities they offer, you can make informed decisions regarding the quantity of contracts to purchase, taking into account your risk tolerance, investment objectives, and market outlook. As we delve deeper into the factors influencing the maximum number of contracts you can buy at one time, you will gain a more comprehensive understanding of how to optimize your options trading endeavors while managing potential risks effectively.

Factors to Consider

When contemplating the number of options contracts to purchase, several critical factors come into play, shaping the decision-making process and influencing the overall risk-reward dynamics of options trading. Understanding these factors is essential for devising a well-informed and effective options trading strategy. Let’s explore the key considerations that should factor into your decision:

- Market Volatility: The level of volatility in the underlying asset’s price can significantly impact options pricing. Higher volatility generally leads to increased options premiums, affecting the affordability and risk exposure associated with purchasing multiple contracts.

- Liquidity: The liquidity of the options market is a crucial consideration, as it directly affects the ease of entering and exiting positions. Higher liquidity generally translates to narrower bid-ask spreads and better execution prices, particularly when dealing with a large number of contracts.

- Account Size and Capital Allocation: Your available trading capital and the portion of it allocated to options trading play a pivotal role in determining the number of contracts you can reasonably purchase. Overleveraging or allocating a disproportionate amount of capital to options can expose you to excessive risk.

- Risk Tolerance: Your individual risk tolerance and risk management strategy are fundamental considerations. Buying a larger number of contracts amplifies both potential gains and losses, so aligning the quantity of contracts with your risk tolerance is crucial.

- Underlying Asset Price and Contract Size: The price of the underlying asset and the contract size relative to your trading capital are important factors. For instance, purchasing a large quantity of contracts on a high-priced asset may require substantial capital.

- Time Horizon and Strategy: Your investment time horizon and the specific options trading strategy employed, whether it’s speculative, hedging, or income generation, will influence the appropriate quantity of contracts. Longer time horizons may warrant a different approach than short-term trading strategies.

By carefully evaluating these factors and their implications, you can make well-informed decisions regarding the maximum number of options contracts to purchase, aligning your trading activities with your financial goals and risk tolerance. As we proceed, we will delve into how these considerations interplay to determine the optimal quantity of contracts for your options trading endeavors.

Maximum Number of Contracts

Determining the maximum number of options contracts to purchase involves a nuanced evaluation of various factors to ensure that your trading activities align with your risk tolerance, investment objectives, and market conditions. While there is no one-size-fits-all approach, several guidelines and considerations can help you arrive at a reasonable and prudent quantity of contracts to buy.

One crucial aspect to consider is the size of your trading account and the portion of it allocated to options trading. Overleveraging by purchasing an excessive number of contracts relative to your account size can expose you to heightened risk, potentially leading to significant losses if the market moves unfavorably. Therefore, it’s prudent to adhere to position sizing principles and avoid overextending your options trading exposure.

Additionally, the liquidity of the options market and the bid-ask spreads play a pivotal role in determining the maximum number of contracts you can buy. In markets with high liquidity, executing trades involving a large number of contracts is generally more feasible and cost-effective due to narrower spreads and improved order execution. Conversely, lower liquidity can impede the execution of large orders and lead to less favorable pricing.

Market volatility is another essential consideration, as it directly impacts options pricing. Higher volatility tends to inflate options premiums, potentially making it more costly to purchase a larger quantity of contracts. Moreover, heightened volatility can increase the overall risk exposure associated with holding multiple contracts, necessitating a careful assessment of your risk tolerance and risk management strategies.

Furthermore, your investment time horizon and the specific options trading strategy employed should inform the maximum number of contracts you purchase. For instance, a long-term investor implementing a conservative covered call strategy may opt for a different quantity of contracts compared to a short-term speculator seeking to capitalize on near-term price movements.

Ultimately, the maximum number of contracts you can buy at one time should be determined through a comprehensive analysis of these factors, taking into account your risk tolerance, account size, market conditions, and investment objectives. By aligning the quantity of contracts with these considerations, you can optimize your options trading endeavors and mitigate potential risks effectively.

Risks and Considerations

Engaging in options trading entails inherent risks that necessitate a thorough understanding of the potential pitfalls and considerations associated with purchasing multiple contracts. By comprehensively assessing these risks, you can make informed decisions and implement risk management strategies to safeguard your trading capital. Let’s delve into the key risks and considerations relevant to buying a significant number of options contracts:

- Market Risk: Holding a large number of options contracts exposes you to market risk, as adverse movements in the underlying asset’s price can lead to substantial losses. It’s essential to assess the prevailing market conditions and the potential impact of volatility on your options positions.

- Liquidity Risk: In markets with lower liquidity, executing trades involving a significant number of contracts can be challenging, potentially resulting in wider bid-ask spreads and less favorable execution prices. This liquidity risk should be carefully evaluated, especially when dealing with large orders.

- Capital Allocation: Allocating a disproportionate amount of your trading capital to purchasing multiple contracts can lead to overleveraging and heightened exposure to options-related risks. Prudent capital allocation and position sizing are crucial for managing risk effectively.

- Volatility and Options Pricing: Heightened volatility can inflate options premiums, impacting the affordability and risk exposure associated with buying a larger quantity of contracts. Understanding the interplay between volatility and options pricing is essential for assessing the potential risks involved.

- Assignment and Exercise Risk: When holding multiple options contracts, there is a possibility of being assigned or exercised, particularly as the contracts approach expiration. This assignment risk should be factored into your decision-making process, especially if you intend to hold the contracts until expiration.

- Risk Management: Implementing robust risk management strategies, such as setting stop-loss orders, diversifying your options positions, and maintaining a disciplined approach to trading, is crucial for mitigating the risks associated with holding a significant number of contracts.

By conscientiously evaluating these risks and considerations, you can navigate the complexities of options trading with prudence and foresight, aligning your trading activities with your risk tolerance and investment objectives. Implementing a well-defined risk management plan and staying abreast of market developments can help you mitigate potential downsides while capitalizing on the opportunities presented by options trading.

Conclusion

As you embark on your options trading journey, the question of how many options contracts you can buy at one time is a pivotal consideration that demands careful assessment and informed decision-making. By delving into the intricacies of options contracts and the factors influencing the maximum number of contracts you can purchase, you have gained valuable insights into the dynamics of options trading and the associated risks and considerations.

Understanding the nuances of options pricing, market volatility, liquidity, and risk management is paramount for devising a prudent and effective options trading strategy. Balancing the potential rewards with the inherent risks, you can optimize your options trading endeavors by aligning the quantity of contracts with your risk tolerance, investment objectives, and prevailing market conditions.

It’s essential to approach options trading with a disciplined mindset, leveraging your understanding of the factors at play to make well-informed decisions. Prudent capital allocation, risk management, and a comprehensive evaluation of market dynamics will empower you to navigate the complexities of options trading with confidence and precision.

By carefully weighing the risks and considerations associated with purchasing multiple contracts, you can mitigate potential downsides and capitalize on the strategic possibilities offered by options trading. Whether you’re a seasoned trader or a novice investor, the knowledge gained from this exploration of options contracts and their implications will serve as a valuable compass as you navigate the dynamic landscape of options trading.

Armed with these insights, you are well-positioned to embark on your options trading endeavors with clarity and foresight, leveraging the potential of options contracts to achieve your financial goals while prudently managing risk. As you apply these principles and considerations to your trading activities, may your options trading journey be marked by informed decision-making, strategic acumen, and the fulfillment of your investment aspirations.