Finance

How Many SPY Options Contracts Are There?

Published: February 29, 2024

Discover the total number of SPY options contracts available for trading and make informed finance decisions with this comprehensive guide. Explore the latest data and insights.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Introduction

Options contracts are a vital component of the financial market, offering investors the opportunity to hedge risks, speculate on price movements, and diversify their portfolios. Within this realm, SPY options contracts hold particular significance due to the popularity of the SPDR S&P 500 ETF Trust (SPY) as a benchmark for the overall stock market. Understanding the dynamics of SPY options contracts is crucial for investors seeking to navigate the complexities of the options market and capitalize on diverse trading strategies.

Options contracts, including those linked to the SPY, provide the right, but not the obligation, to buy or sell a specified asset at a predetermined price within a set timeframe. This flexibility makes them a powerful tool for managing risk and leveraging market movements. The sheer volume and variety of SPY options contracts available in the market underscore their pivotal role in the financial landscape.

As we delve into the realm of SPY options contracts, it becomes evident that various factors influence their availability and pricing. From market demand and volatility to macroeconomic indicators and investor sentiment, a multitude of elements shape the landscape of SPY options contracts. By examining these factors, investors can gain valuable insights into the dynamics of the options market and make informed decisions regarding their investment strategies.

In the following sections, we will explore the intricacies of options contracts, shed light on the specific characteristics of SPY options, and delve into the factors that impact the availability and pricing of SPY options contracts. By unraveling these aspects, investors can enhance their understanding of this dynamic market segment and harness its potential to achieve their financial objectives.

Understanding Options Contracts

Understanding Options Contracts

Options contracts are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. These contracts are categorized into two primary types: call options and put options. Call options provide the holder with the right to buy the underlying asset, while put options grant the right to sell it.

One of the defining features of options contracts is their leverage potential. With a relatively small upfront investment, an investor can control a more substantial position in the underlying asset through options. This amplifies the potential returns, but it also exposes the investor to heightened risk, as options have expiration dates and can lose their value over time.

Options contracts are associated with various key terms and parameters that dictate their behavior and value. These include the strike price, which is the price at which the underlying asset can be bought or sold; the expiration date, which marks the end of the contract’s validity; and the premium, which is the price paid to acquire the option.

Moreover, options contracts are influenced by factors such as the current price of the underlying asset, the contract’s intrinsic value, implied volatility, and prevailing interest rates. Understanding these factors is essential for investors aiming to assess the potential risks and rewards associated with options trading.

Given the versatility of options contracts, investors can employ various strategies to capitalize on market movements and manage risk. These strategies include buying call options to benefit from anticipated price increases, purchasing put options to hedge against potential declines, and engaging in complex combinations of options to construct tailored risk management approaches.

As investors navigate the intricacies of options contracts, they must also consider the concept of open interest, which represents the total number of outstanding options contracts for a particular strike price and expiration date. This metric provides insights into market sentiment and the degree of participation in options trading for a specific asset.

By comprehending the fundamental principles and mechanics of options contracts, investors can harness their potential to enhance portfolio diversification, mitigate risk, and capitalize on market opportunities. The next section will focus specifically on options contracts linked to the SPDR S&P 500 ETF Trust (SPY), shedding light on their unique characteristics and significance in the financial landscape.

SPY Options Contracts

SPY Options Contracts

SPY options contracts are derivative instruments linked to the SPDR S&P 500 ETF Trust (SPY), which is renowned as one of the most widely traded exchange-traded funds. As a key player in the financial markets, SPY serves as a barometer for the overall performance of the U.S. stock market, making its options contracts highly sought after by traders and investors.

These options contracts enable market participants to gain exposure to the price movements of the S&P 500 index through the SPY ETF, offering a convenient and liquid avenue for implementing diverse trading strategies. With SPY options, investors can capitalize on bullish or bearish market expectations, hedge existing positions, or engage in speculative trading based on their outlook for the broader market.

SPY options contracts are available in various expiration dates, allowing investors to tailor their positions according to their specific time horizons and market outlook. Furthermore, the availability of both call and put options on SPY provides flexibility for constructing nuanced trading strategies that align with diverse market scenarios.

Given the widespread popularity of SPY and its options contracts, the liquidity and trading volume in the options market for SPY are notably high. This liquidity facilitates efficient price discovery and narrow bid-ask spreads, enhancing the overall appeal of SPY options for market participants seeking seamless execution and competitive pricing.

Moreover, SPY options contracts exhibit standardized contract sizes, making them easily accessible to a broad spectrum of investors. This standardized structure contributes to the widespread appeal of SPY options and fosters a robust options market, characterized by active participation and ample liquidity.

As a cornerstone of the options market, SPY options contracts play an integral role in providing market participants with a means to express their market views, manage risk, and leverage trading opportunities within the context of the broader U.S. equity market. The next section will delve into the factors that influence the availability and dynamics of SPY options contracts, shedding light on the multifaceted forces that shape this critical segment of the financial landscape.

Factors Affecting SPY Options Contracts

Factors Affecting SPY Options Contracts

Several key factors exert influence on the availability, pricing, and dynamics of SPY options contracts, shaping their behavior within the options market. Understanding these factors is pivotal for investors and traders seeking to navigate the complexities of SPY options and formulate informed trading strategies.

Market Volatility: The level of volatility in the broader equity market, as reflected by indicators such as the CBOE Volatility Index (VIX), significantly impacts the pricing of SPY options contracts. Heightened market volatility often leads to increased options premiums, as the potential for larger price swings in the underlying asset amplifies the perceived value of options as risk management tools.

Underlying Asset Price Movements: The price movements of the S&P 500 index, which serves as the underlying asset for SPY options, directly influence the pricing and attractiveness of SPY options contracts. Bullish or bearish trends in the S&P 500 can drive shifts in options pricing and trading volumes, as market participants adjust their positions in response to evolving market conditions.

Interest Rates and Dividends: The prevailing interest rate environment and dividend expectations for the underlying stocks held by the SPY ETF play a role in shaping the pricing of SPY options contracts. Changes in interest rates can impact the cost of carry for options positions, while dividend expectations can influence the attractiveness of options strategies, particularly around ex-dividend dates.

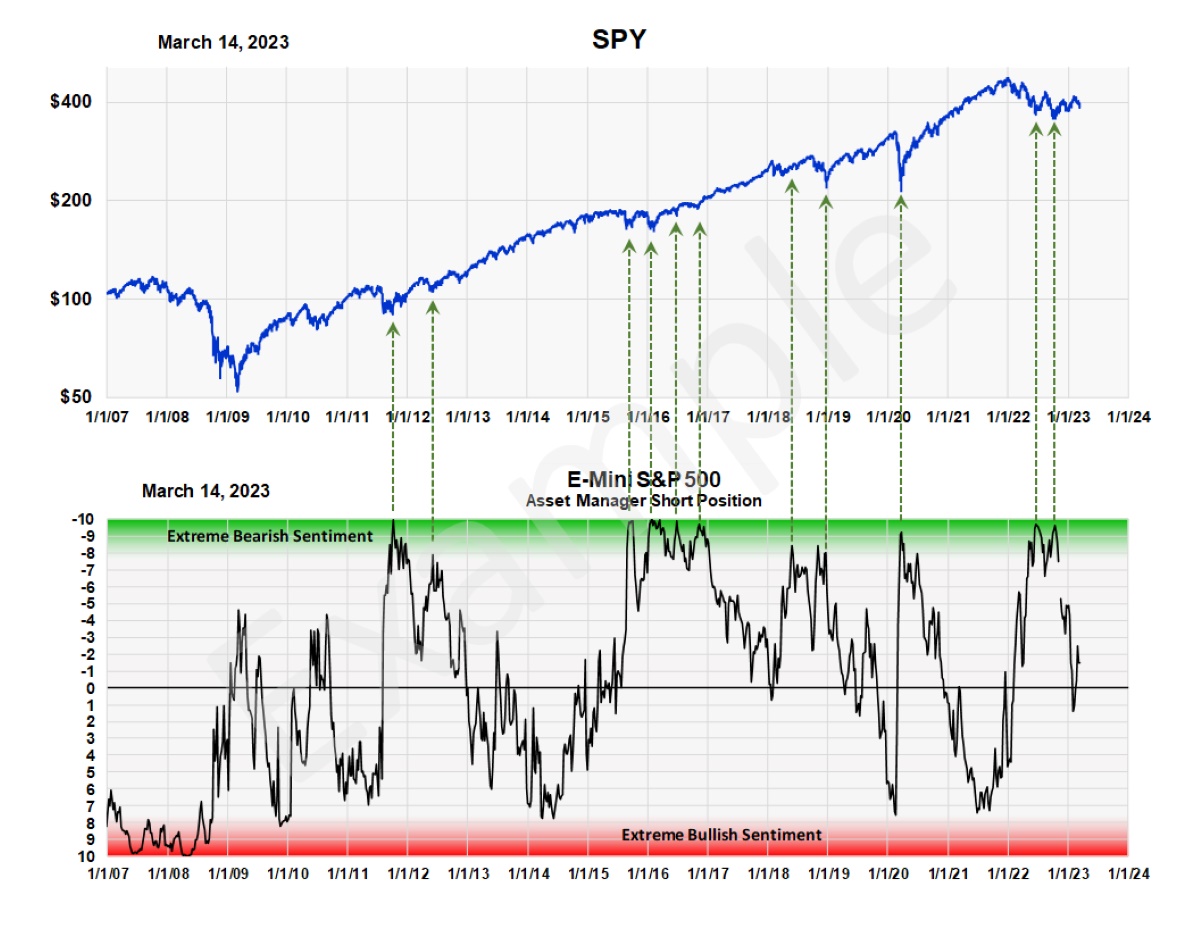

Market Sentiment and Macroeconomic Factors: Investor sentiment, macroeconomic indicators, and geopolitical developments can impact the demand for SPY options contracts, reflecting market participants’ perceptions of future market movements and risk exposures. Economic data releases, geopolitical tensions, and shifts in monetary policy can all contribute to fluctuations in options pricing and open interest levels.

Options Expiration Cycles: The expiration cycles available for SPY options contracts, including weekly, monthly, and quarterly expirations, offer investors a range of choices for aligning their options strategies with specific time horizons and market events. The availability of different expiration cycles influences trading volumes and the overall dynamics of SPY options contracts.

By monitoring and analyzing these factors, market participants can gain valuable insights into the underlying forces shaping the availability and pricing of SPY options contracts. This understanding empowers investors to adapt their options trading strategies in response to evolving market conditions and seize opportunities within the dynamic landscape of SPY options.

Conclusion

Conclusion

In conclusion, SPY options contracts represent a vital and dynamic segment of the financial markets, offering investors a gateway to participate in the price movements of the S&P 500 index through the SPDR S&P 500 ETF Trust. These derivative instruments provide market participants with a versatile toolkit for expressing market views, managing risk, and capitalizing on trading opportunities within the context of the broader U.S. equity market.

Understanding the fundamental principles of options contracts, including their leverage potential, key parameters, and various trading strategies, is essential for investors aiming to harness the potential of SPY options. With their ability to control exposure to the S&P 500 index through a liquid and accessible vehicle, SPY options contracts empower market participants to navigate diverse market scenarios and tailor their positions to specific time horizons and risk profiles.

Moreover, the availability of SPY options contracts in various expiration cycles, coupled with their standardized contract sizes and robust liquidity, contributes to the appeal and functionality of SPY options within the options market. The high liquidity and trading volume in SPY options facilitate efficient price discovery and provide market participants with seamless execution and competitive pricing, enhancing the overall accessibility and attractiveness of SPY options.

Factors such as market volatility, underlying asset price movements, interest rates, market sentiment, and expiration cycles exert significant influence on the availability and dynamics of SPY options contracts. By monitoring and analyzing these factors, investors can gain valuable insights into the forces shaping the options market, enabling them to adapt their trading strategies and capitalize on market opportunities.

As investors continue to navigate the complexities of the financial markets, SPY options contracts stand as a cornerstone of options trading, offering a gateway to the broader U.S. equity market and providing a platform for diverse trading strategies and risk management approaches. By comprehending the intricacies of SPY options and the factors that influence their behavior, investors can position themselves to optimize their participation in the dynamic and ever-evolving landscape of options trading.