Home>Finance>How Many Point Does Removing Public Records Improve Credit Score?

Finance

How Many Point Does Removing Public Records Improve Credit Score?

Published: October 22, 2023

Learn how removing public records can improve your credit score in the finance industry. Find out how many points you can potentially gain from this beneficial action.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing personal finances, having a good credit score is of utmost importance. A credit score is a numerical representation of an individual’s creditworthiness, indicating their ability to repay loans and debts. Lenders, landlords, and even potential employers often use credit scores to evaluate an individual’s financial responsibility and reliability.

One factor that can significantly impact a credit score is the presence of public records on a person’s credit report. Public records, such as bankruptcies, tax liens, and civil judgments, reflect financial struggles or legal issues that an individual may have faced in the past. These records can have a detrimental effect on a credit score, making it more difficult to obtain credit or secure favorable terms.

However, there is often confusion surrounding the impact of removing public records on a credit score. Many people wonder how many points their credit score can improve by having public records removed. In this article, we will delve into this topic and explore the factors involved in credit score improvement.

It is essential to understand that credit scores are unique to each individual, and the impact of removing public records can vary depending on various factors. Nevertheless, gaining insight into this matter can provide valuable knowledge on how to improve one’s creditworthiness.

So, let’s dive deeper into understanding public records and their influence on credit scores, as well as explore how removing them can affect credit score improvement.

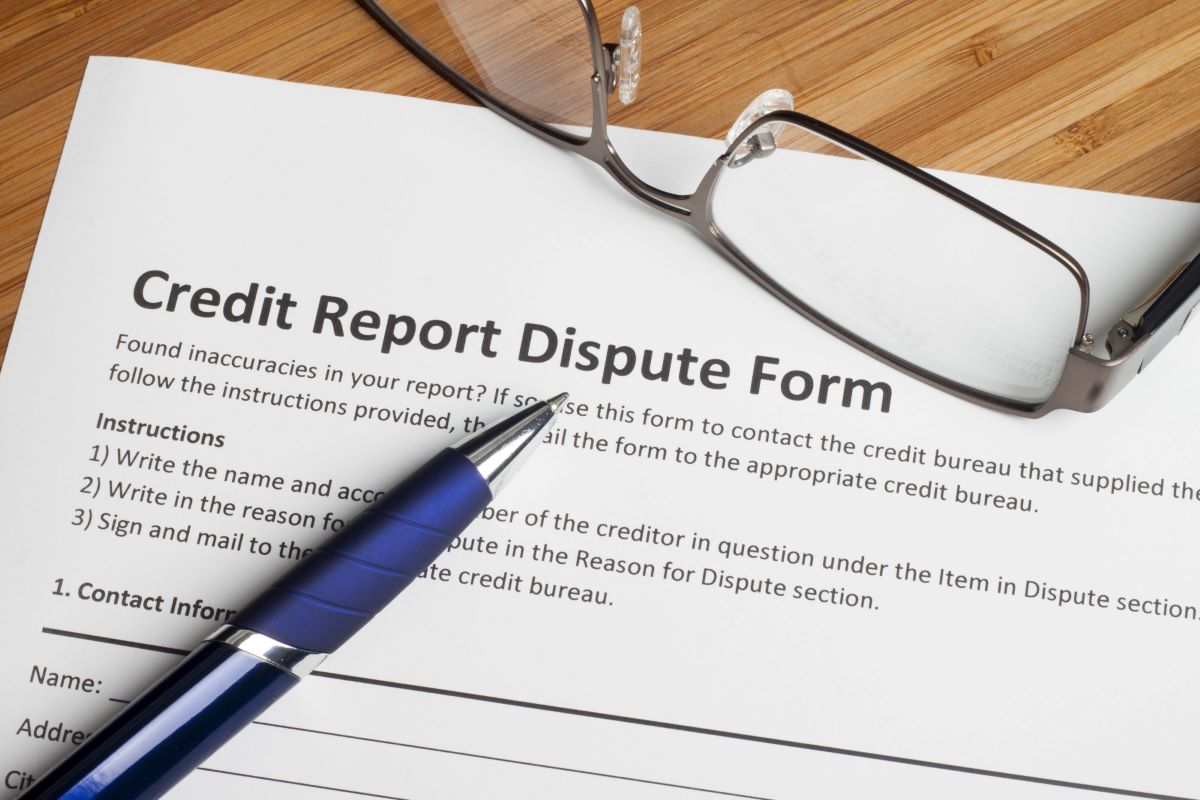

Understanding Public Records

Public records are legal documents or financial information that is available for public viewing. They include bankruptcy filings, tax liens, civil judgments, and other similar records. These records are created when an individual faces financial challenges or legal issues, and they can have a significant impact on their creditworthiness.

Bankruptcy filings: Bankruptcy is a legal process in which individuals or businesses declare their inability to repay their debts. A bankruptcy filing stays on a person’s credit report for a specified period of time, typically seven to ten years. This record can severely damage a credit score and make it difficult to secure loans or credit in the future.

Tax liens: Tax liens occur when individuals fail to pay their taxes owed to the government. These liens can be placed on personal property, real estate, or financial assets. Having a tax lien on your credit report can result in a significant decrease in your credit score.

Civil judgments: Civil judgments are court rulings against individuals who have failed to fulfill their financial obligations, such as unpaid loans, credit card debts, or medical bills. These judgments are typically issued as a result of a lawsuit filed by a creditor. They can have a negative impact on an individual’s credit score and make it challenging to obtain credit in the future.

It is important to note that public records can vary by jurisdiction, and the specific details and implications may differ accordingly. However, the general concept remains the same – public records indicate financial struggles or legal issues that can affect an individual’s creditworthiness.

Now that we have a clear understanding of public records and their significance, let’s move on to exploring how these records can impact credit scores.

Impact of Public Records on Credit Score

Public records can have a significant negative impact on an individual’s credit score. When credit bureaus calculate credit scores, they take into account various factors such as payment history, credit utilization, length of credit history, and the presence of any derogatory marks, including public records.

When public records are present on a credit report, they reflect financial hardships or legal issues that the individual has faced. Lenders and creditors see this as a red flag, indicating a higher risk of defaulting on payments or being unable to meet financial obligations in the future. As a result, credit scores can drop significantly.

Bankruptcy filings, for example, are seen as one of the most detrimental items to a credit score. A bankruptcy filing can cause credit scores to decrease by hundreds of points, making it extremely difficult to obtain credit or secure favorable terms. Tax liens and civil judgments have a similar negative impact, causing credit scores to plummet.

In addition to the immediate decrease in credit score, public records can also have long-lasting effects. They typically remain on a credit report for several years, depending on the specific type of record and the jurisdiction. During this time, they continue to weigh down a person’s credit score and hinder their ability to rebuild their creditworthiness.

Overall, the presence of public records on a credit report can make it challenging for individuals to obtain credit, secure loans, or receive favorable interest rates. It is important to be aware of these implications and take appropriate steps to address and improve one’s credit score.

Now that we understand the impact of public records on credit scores, let’s explore how removing these records can potentially improve credit scores.

How Removing Public Records Affects Credit Score

The removal of public records from a credit report can have a positive impact on an individual’s credit score. However, it is important to note that the exact increase in credit score can vary depending on several factors, including the severity and age of the public record and the individual’s overall credit history.

When public records are removed from a credit report, the negative impact they had on the credit score is eliminated. This can help improve the overall creditworthiness of an individual and increase their chances of qualifying for better interest rates and loan terms.

One of the key ways that removing public records can benefit a credit score is by reducing the credit utilization ratio. Public records often reflect outstanding debts or financial obligations, leading to a higher credit utilization ratio – the ratio of credit used to the total available credit. Lowering this ratio can positively affect credit scores, as it demonstrates a lower level of reliance on credit.

In addition, removing public records can improve the payment history aspect of a credit score. Public records such as bankruptcies and civil judgments often indicate a history of missed or late payments. By removing these records, an individual can have a cleaner payment history, which is a crucial factor in credit scoring models.

It is important to keep in mind that the removal of public records does not guarantee an immediate and significant increase in credit score. Other factors, such as the individual’s overall credit history and financial habits, continue to play a role in determining creditworthiness. However, removing public records is a positive step towards improving credit scores and rebuilding financial stability.

It is worth noting that the process of removing public records from a credit report can be complex and time-consuming. It often requires working with the credit bureaus and providing evidence of inaccuracies or outdated information. Seeking professional assistance from credit repair companies or financial advisors can be helpful in navigating the removal process and maximizing the potential credit score improvement.

Now that we understand how the removal of public records can impact credit scores, let’s move on to explore the various factors that can influence the degree of credit score improvement.

Factors Influencing Credit Score Improvement

Several factors can influence the degree of credit score improvement when public records are removed from a credit report. While the exact impact may vary from person to person, understanding these factors can provide insights into the potential credit score improvement.

1. Severity of Public Records: The severity of the public records plays a significant role in determining the impact on credit scores. Major derogatory marks such as bankruptcies or tax liens tend to have a more significant negative effect compared to smaller civil judgments or collection accounts. Removing more severe public records can lead to a more substantial credit score improvement.

2. Age of Public Records: The age of the public records is another crucial factor. Generally, the impact of public records on credit scores lessens over time. Removing older public records may have a lesser impact on credit score improvement compared to recent ones. However, it is still important to remove any inaccurate or outdated public records to maintain a clean credit history.

3. Overall Credit History: The overall credit history, including payment history, credit utilization, and length of credit, also influences credit score improvement. If an individual has a strong credit history, removing public records can have a more significant positive impact. Conversely, if there are other negative factors, such as late payments or high credit utilization, the improvement may be more modest.

4. Other Negative Items: It is important to consider other negative items on the credit report, in addition to public records. If there are other derogatory marks, such as late payments or collection accounts, their presence may reduce the overall impact of removing public records on credit score improvement. Addressing all negative items collectively can lead to more significant improvement.

5. Credit Utilization Ratio: As mentioned earlier, removing public records can lower the credit utilization ratio, which is the percentage of available credit being used. Lowering this ratio can have a positive impact on credit scores. It is important to maintain a low credit utilization ratio even after removing public records to continue improving the credit score.

It is crucial to remember that credit score improvement is not immediate and can take time. It requires consistent efforts to maintain healthy credit habits and address any negative factors. Regularly monitoring the credit report, paying bills on time, and keeping credit utilization low are essential steps towards long-term credit score improvement.

Now, let’s explore some case studies that illustrate how credit scores can improve after the removal of public records.

Case Studies: Before and After Public Records Removal

Examining real-life case studies can provide valuable insights into the potential credit score improvement that can occur after the removal of public records. While individual outcomes may vary, these examples illustrate the positive impact that can be achieved.

Case Study 1:

Before: John had a bankruptcy filing on his credit report that was five years old. He also had a few late payments and a high credit utilization ratio. His credit score was in the fair range, making it difficult for him to qualify for new credit or obtain favorable terms.

After: John decided to work with a credit repair agency to remove the bankruptcy from his credit report. After successfully removing the public record, John’s credit score improved by over 100 points. With the removal of the bankruptcy, his creditworthiness increased, and he was able to qualify for a new credit card with better terms.

Case Study 2:

Before: Sarah had a tax lien on her credit report due to unpaid taxes from several years ago. The tax lien had adversely affected her credit score, making it challenging for her to secure a mortgage loan for her dream home.

After: Sarah diligently worked with a tax professional to resolve her unpaid taxes and have the tax lien removed from her credit report. Once the tax lien was successfully removed, Sarah’s credit score saw a substantial improvement of around 150 points. With her improved creditworthiness, she was able to secure a mortgage loan for her dream home at a favorable interest rate.

Case Study 3:

Before: Mark had a civil judgment recorded on his credit report for an unpaid debt to a creditor. He had multiple other negative items, including collection accounts and late payments. His credit score was in the poor range, making it extremely challenging for him to obtain any new credit.

After: Mark took proactive steps to address and resolve all of his outstanding debts, including the civil judgment. With the successful removal of the civil judgment and other negative items from his credit report, Mark’s credit score significantly improved by approximately 200 points. His improved creditworthiness allowed him to qualify for a new credit card and start rebuilding his credit profile.

These case studies demonstrate the potential credit score improvement that can be achieved through the removal of public records. However, it is important to note that each situation is unique, and individual results may vary. Working with credit repair professionals and taking proactive steps to address other negative items on the credit report can further enhance the credit score improvement process.

Now, let’s summarize our findings in the concluding section.

Conclusion

Public records, such as bankruptcies, tax liens, and civil judgments, can have a detrimental impact on an individual’s credit score. These records reflect financial struggles or legal issues and can make it challenging to obtain credit or secure favorable terms. Therefore, many individuals seek to remove public records from their credit reports in order to improve their creditworthiness.

While the exact credit score improvement after removing public records can vary, there are several factors that influence the degree of improvement. Factors such as the severity and age of the public records, the overall credit history, and the credit utilization ratio play a significant role. Removing public records can positively affect credit scores by reducing the credit utilization ratio and improving the payment history aspect of the credit report.

Real-life case studies demonstrate the potential credit score improvement that can be achieved through the removal of public records. In many cases, individuals have seen their credit scores rise significantly, making it easier to obtain credit, secure loans, and receive better interest rates.

It is important to remember that credit score improvement is not immediate and requires consistent efforts. Maintaining healthy credit habits, addressing other negative items on the credit report, and seeking professional assistance when necessary can contribute to long-term creditworthiness.

In conclusion, while the exact credit score improvement after removing public records cannot be determined with certainty, it is clear that taking steps to remove these records can have a positive impact on an individual’s creditworthiness. By understanding the implications of public records and the factors influencing credit score improvement, individuals can make informed decisions to improve their financial standing and secure a brighter financial future.