Finance

How To Refinance My Car With Bad Credit

Modified: February 21, 2024

Are you wondering how to refinance your car with bad credit? Learn how to finance your vehicle even with poor credit scores and get the best rates.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

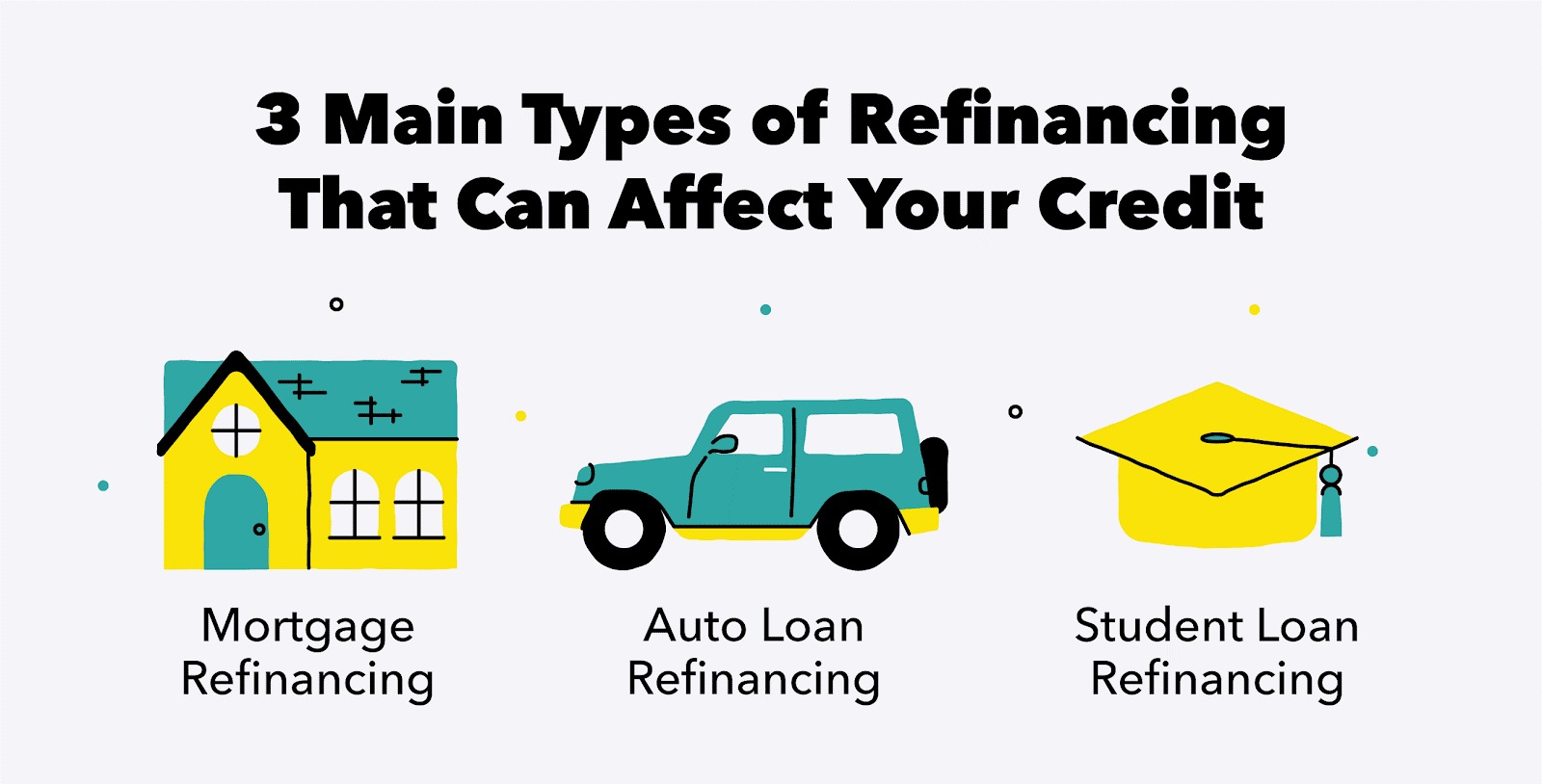

- Understanding Bad Credit and Car Refinancing

- Steps to Refinancing a Car with Bad Credit

- Determine if Refinancing is Right for You

- Improve Your Credit Score

- Research and Compare Lenders

- Gather Necessary Documentation

- Apply for Refinancing

- Evaluate Loan Offers

- Finalize the Refinancing Process

- Potential Benefits and Drawbacks of Refinancing with Bad Credit

- Conclusion

Introduction

Welcome to the world of car refinancing! If you find yourself with bad credit and struggling to make payments on your current car loan, you may be wondering if there’s a way to improve your situation. The good news is that even with bad credit, it is possible to refinance your car loan and potentially save money in the process.

Bad credit can be a result of various circumstances such as missed payments, high credit utilization, or even a history of bankruptcy. It can make it challenging to secure favorable loan terms and interest rates. However, by refinancing your car loan, you have the opportunity to negotiate new loan terms and potentially lower your monthly payments.

Refinancing a car loan involves replacing your current loan with a new one from a different lender. The new loan will have its own terms, interest rate, and repayment schedule. This process can help you lower your interest rate, extend your loan term, or both, making it more manageable for you to keep up with your monthly payments.

However, it’s important to note that refinancing with bad credit may not always lead to the most favorable loan terms. Lenders typically consider your credit score and financial history when evaluating your application. While refinancing can sometimes provide relief, it’s crucial to carefully assess your options, considering both the potential benefits and drawbacks.

In this article, we will guide you through the steps you need to take in order to refinance your car loan with bad credit. We’ll cover how to improve your credit score, research and compare lenders, gather necessary documentation, and finalize the refinancing process. By following these steps, you will be better equipped to navigate the refinancing journey and make an informed decision that suits your financial needs.

Understanding Bad Credit and Car Refinancing

Before diving into the process of refinancing your car with bad credit, it’s important to have a solid understanding of what bad credit entails and how refinancing works.

Bad credit is typically a result of a low credit score, which is a numerical representation of your creditworthiness. Lenders use credit scores to assess the risk of lending you money. Factors such as late payments, high credit utilization, and a history of bankruptcy or foreclosure can all contribute to a lower credit score. When you have bad credit, it becomes challenging to secure favorable loan terms and interest rates.

Car refinancing, on the other hand, involves replacing your existing car loan with a new loan from a different lender. The goal is to obtain better loan terms and potentially lower your monthly payments. This can be achieved by qualifying for a lower interest rate, extending the loan term, or both.

When deciding to refinance your car loan, keep in mind the following key points:

- Lower Interest Rates: One of the main advantages of refinancing is the potential to secure a lower interest rate. With bad credit, your original loan may have come with a high interest rate due to the perceived risk. By refinancing, you can take advantage of improved credit and possibly qualify for a lower rate.

- Extended Loan Term: Refinancing can also allow you to extend the duration of your loan. While this may result in higher overall interest costs, it can help lower your monthly payments and provide immediate financial relief.

- Improved Cash Flow: By securing a lower interest rate or extending the loan term, refinancing can free up some cash each month. This extra money can be used to cover other expenses or be put towards savings or debt repayment.

- Additional Fees: Keep in mind that refinancing may come with certain fees, such as application fees, origination fees, or prepayment penalties. Be sure to consider these costs when evaluating the potential savings from refinancing.

Understanding the fundamentals of bad credit and car refinancing will empower you to make informed decisions throughout the refinancing process. It’s important to weigh the potential benefits against the costs and carefully assess your financial situation before proceeding.

Steps to Refinancing a Car with Bad Credit

Refinancing your car loan with bad credit may seem like a daunting task, but with the right approach, it’s entirely possible. Follow these steps to increase your chances of successfully refinancing your car loan:

- Determine if Refinancing is Right for You: Assess your current financial situation and evaluate whether refinancing your car loan aligns with your goals. Consider factors such as your credit score, the current interest rate on your loan, and the potential savings you could achieve through refinancing.

- Improve Your Credit Score: Before applying for refinancing, take steps to improve your credit score. Pay your bills on time, reduce your credit card balances, and check your credit report for any errors to dispute. Improving your credit score can increase your chances of getting approved for a favorable refinancing offer.

- Research and Compare Lenders: Shop around and research different lenders that specialize in refinancing car loans for individuals with bad credit. Compare interest rates, loan terms, and customer reviews to find a reputable lender that suits your needs.

- Gather Necessary Documentation: Prepare the required documents such as your current car loan information, proof of income, proof of residence, and valid identification. Having these documents ready will expedite the application process.

- Apply for Refinancing: Complete the refinancing application with the chosen lender. Provide accurate and up-to-date information to increase your chances of approval. Be prepared for a hard credit inquiry, which may temporarily impact your credit score.

- Evaluate Loan Offers: Once you receive loan offers, carefully review and compare them. Pay attention to interest rates, loan terms, monthly payments, and any additional fees. Consider the long-term impact of each offer and choose the one that aligns best with your financial goals.

- Finalize the Refinancing Process: If you’re satisfied with a loan offer, complete the necessary paperwork to finalize the refinancing process. Make sure to read and understand the terms and conditions before signing any agreements.

Remember, each step is crucial in the refinancing process. Taking the time to research, improve your credit score, and carefully assess loan offers can lead to a successful refinancing experience, even with bad credit. By following these steps, you can potentially lower your monthly payments, save money in interest, and improve your overall financial situation.

Determine if Refinancing is Right for You

Before diving into the process of refinancing your car loan with bad credit, it’s important to evaluate whether refinancing is the right move for you. Consider the following factors to make an informed decision:

- Current Interest Rate: Begin by checking the interest rate on your current car loan. If it is already low or comparable to the rates offered by refinancing lenders, it may not be worthwhile to go through the refinancing process. However, if the interest rate is high, refinancing can potentially save you money in the long run.

- Loan Term: Assess the remaining term on your current car loan. If there are only a few months left, it may not be beneficial to refinance as you will restart the loan with a new term. On the other hand, if you have a long loan term remaining, refinancing can allow you to extend the term and lower your monthly payments.

- Financial Goals: Consider your financial goals and how refinancing fits into them. Are you looking to reduce your monthly payments, save money on interest, or both? Clarify your goals to determine if refinancing aligns with your objectives.

- Long-Term Savings: Calculate the potential savings from refinancing. Look at how much you could save over the life of the loan by comparing the new loan terms, including the interest rate and loan term, with your existing loan. While refinancing may lead to lower monthly payments, it’s important to evaluate the overall cost and determine if the long-term savings outweigh any associated fees.

- Financial Stability: Assess your financial stability and ability to make regular loan payments. Refinancing may lead to lower monthly payments, but it also means extending the loan term, potentially resulting in higher overall interest costs. Ensure that refinancing aligns with your ability to make payments and does not put you at risk of further financial strain.

By considering these factors, you can determine if refinancing your car loan is the right decision for your specific circumstances. Ensure that refinancing aligns with your financial goals and will lead to long-term savings. Remember to weigh both the potential benefits and drawbacks to make an informed choice that supports your financial well-being.

Improve Your Credit Score

Improving your credit score is a crucial step before refinancing your car loan with bad credit. A higher credit score can increase your chances of getting approved for a favorable refinancing offer. Here are some strategies to help improve your credit score:

- Pay Bills on Time: Your payment history has a significant impact on your credit score. Make sure to pay all your bills, including credit card payments, utilities, and loans, on time. Set up reminders or automatic payments to avoid missed payments.

- Reduce Credit Utilization: Aim to keep your credit card balances low in comparison to your credit limit. High credit card balances can negatively affect your credit score. Pay down your debts and make regular payments to reduce your credit utilization ratio.

- Check Your Credit Report: Request a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) and review it for any errors. Dispute any inaccuracies to have them corrected, as they can impact your credit score.

- Avoid Opening New Credit Accounts: Opening new credit accounts can temporarily lower your credit score. Avoid unnecessary credit inquiries and focus on improving your existing credit accounts instead.

- Manage Existing Credit Responsibly: Use your existing credit responsibly by making regular payments and keeping your balances low. Consistent, responsible credit usage can positively impact your credit score over time.

- Prioritize Debt Repayment: If you have outstanding debts, prioritize repayment. Paying off debts can reduce your overall credit utilization and showcase your ability to manage your finances responsibly.

- Build a Positive Credit History: If you have limited or no credit history, consider opening a secured credit card or becoming an authorized user on someone else’s credit card. Make regular payments and establish a positive credit history to boost your credit score.

Improving your credit score takes time and discipline, but it can significantly impact your ability to refinance your car loan with bad credit. Focus on responsible credit management, timely bill payments, and reducing your credit utilization to gradually raise your credit score. By improving your creditworthiness, you will be in a better position to secure favorable loan terms when refinancing your car loan.

Research and Compare Lenders

When refinancing your car loan with bad credit, it’s crucial to conduct thorough research and compare lenders to find the best refinancing options available. Here are some steps to guide you through this process:

- Check Online Reviews and Ratings: Begin by searching for reputable lenders that specialize in refinancing car loans for individuals with bad credit. Read online reviews and check ratings from trusted sources to get an idea of their reputation and customer satisfaction levels.

- Compare Interest Rates: Review the interest rates offered by different lenders. Remember that with bad credit, you may not qualify for the lowest rates, but comparing rates will help you find the most competitive options available to you.

- Consider Loan Terms: Assess the loan terms offered by each lender. Look out for factors such as the loan term length, any prepayment penalties, and the potential impact on your monthly payments. Choose a loan term that best aligns with your financial goals and flexibility.

- Explore Fees and Charges: Inquire about any applicable fees or charges associated with refinancing. These may include application fees, origination fees, and administrative charges. Take these costs into account when evaluating the potential savings of refinancing.

- Look for Flexible Repayment Options: Consider lenders that offer flexible repayment options, such as the ability to make bi-weekly or accelerated payments. These options can help you pay off your loan faster and save on interest.

- Seek Professional Advice: If you’re uncertain about the terms and conditions or require clarification, don’t hesitate to seek advice from a financial professional or credit counselor. They can provide valuable insights and help you make an informed decision.

- Customer Service: Evaluate the quality of customer service provided by the lenders. Prompt and responsive customer support can make the refinancing process smoother and more convenient.

By carefully researching and comparing lenders, you can find the most suitable refinancing options for your bad credit car loan. Keep in mind that while interest rates and loan terms are crucial, it’s also essential to consider factors such as fees, flexibility, and customer service. Ultimately, choose a lender that offers competitive rates, favorable terms, and excellent customer support to ensure a positive refinancing experience.

Gather Necessary Documentation

Before proceeding with the car refinancing process, it’s essential to gather all the necessary documentation. Having these documents ready will streamline the application process and help expedite the approval of your refinancing request. Here are the key documents you’ll likely need:

- Current Car Loan Information: Collect all the details of your current car loan, including the lender’s name, loan balance, interest rate, and remaining term. This information will help the new lender understand your existing loan terms and make an informed refinancing offer.

- Proof of Income: Provide documentation to verify your income. This can include recent pay stubs, W-2 forms, or a letter from your employer. Lenders will assess your income to determine your eligibility and ability to make timely loan repayments.

- Proof of Residence: Confirm your residential address through documents such as utility bills, a lease agreement, or a mortgage statement. Lenders may require proof to verify your stability and address history.

- Valid Identification: Have a valid government-issued ID, such as a driver’s license or passport, ready for identification verification purposes. This ensures that you are the authorized individual applying for the refinancing.

- Vehicle Information: Gather the necessary details about your vehicle, including the VIN (Vehicle Identification Number), make, model, year, and mileage. Lenders typically require this information to assess the value of the vehicle for refinancing purposes.

- Insurance Verification: Some lenders might require proof of auto insurance. Ensure that your insurance policy meets the lender’s minimum requirements and have your insurance information readily available.

- Other Financial Documents: Depending on the lender’s requirements, you may need additional financial documentation. This could include bank statements, tax returns, or proof of other assets or liabilities.

By gathering these necessary documents in advance, you’ll be well-prepared to complete the refinancing application smoothly. Remember to organize these documents securely and keep copies for your records. Having all the required documentation readily available will help simplify the application process and increase your chances of a successful car loan refinancing with bad credit.

Apply for Refinancing

Once you have completed the necessary preparation steps, it’s time to apply for refinancing your car loan with bad credit. Here’s what you need to do:

- Choose a Lender: Based on your research and comparison of lenders, select the one that offers the most favorable terms and fits your financial needs. Begin the application process with your chosen lender.

- Complete the Application: Fill out the refinancing application accurately and thoroughly. Provide the required personal information, loan details, and any additional documentation as requested by the lender. Double-check your application for any errors or missing information before submitting it.

- Authorization for Credit Check: Provide consent for the lender to perform a credit check as part of the application process. This allows them to assess your creditworthiness and determine if they can offer you favorable refinancing terms despite your bad credit.

- Review Loan Terms: Upon submitting your application, patiently await the lender’s response. Once you receive loan offers, carefully review and compare them. Pay attention to the interest rate, loan term, monthly payments, and any additional fees or charges associated with each offer.

- Consider Impact on Credit Score: Keep in mind that each application for refinancing may result in a hard credit inquiry, which can temporarily lower your credit score. However, multiple inquiries within a short period for the same purpose are typically treated as a single inquiry to minimize the impact.

- Ask for Clarifications: If you have any questions or concerns about the loan terms or conditions, reach out to the lender for clarification. It’s crucial to have a clear understanding of the terms before proceeding.

- Choose the Best Offer: Evaluate all the loan offers you have received and choose the one that best fits your financial goals and offers the most favorable terms. Consider the interest rate, loan term, monthly payments, fees, and any other factors that are important to you.

- Accept the Offer: Once you have made your decision, inform the chosen lender that you accept their refinancing offer. They will guide you through the necessary steps to finalize the refinancing process.

By carefully completing the refinancing application and weighing the various loan offers, you can choose the best option available to you. Remember to review the terms and conditions thoroughly before accepting an offer. With careful consideration and the right lender, you can successfully refinance your car loan with bad credit and improve your financial situation.

Evaluate Loan Offers

Receiving loan offers is an exciting stage in the car refinancing process. However, it’s essential to carefully evaluate each offer to make an informed decision. Here’s how to evaluate loan offers when refinancing your car loan with bad credit:

- Review the Interest Rate: Compare the interest rates offered by different lenders. Remember that with bad credit, you may not qualify for the lowest rates. However, aim to choose the offer with the lowest interest rate to save on your monthly payments and overall loan costs.

- Consider the Loan Term: Assess the loan term options provided by each lender. A longer loan term may result in lower monthly payments, but it can also mean paying more in interest over the life of the loan. Choose a loan term that strikes a balance between manageable monthly payments and minimizing your overall interest costs.

- Calculate Monthly Payments: Use a loan calculator or speak to the lender to determine the monthly payment amount for each loan offer. Ensure that the payment is affordable and fits within your budget. Consider how it will impact your overall financial situation.

- Factor in Additional Fees: Take into account any additional fees or charges associated with each loan offer. These may include application fees, origination fees, or prepayment penalties. Compare the fees and consider how they will affect the overall cost of refinancing.

- Assess Flexibility: Look for flexibility in the loan terms. Consider if the lender allows for payment adjustments, such as making extra payments or paying off the loan early without penalties. Flexibility can provide you with options to save on interest and pay off the loan sooner.

- Read and Understand the Terms and Conditions: Carefully review the terms and conditions of each loan offer. Pay attention to any limitations, clauses, or requirements. Ensure that you understand the implications and obligations associated with the loan before making a decision.

- Consider Customer Service: Take into account the reputation and customer service of the lender. Read reviews and testimonials to gauge the experiences of other borrowers. A lender with excellent customer service can provide you with support and address any concerns or issues that may arise during the loan term.

By evaluating loan offers based on interest rates, loan terms, monthly payments, fees, flexibility, and customer service, you can determine the most suitable refinancing option for your bad credit car loan. Remember, it’s important not to rush the decision-making process. Take your time to consider all the factors and choose the offer that aligns with your financial goals and allows you to save money in the long run.

Finalize the Refinancing Process

Once you have evaluated and chosen the best refinancing offer for your car loan with bad credit, you’re ready to finalize the refinancing process. Here’s what you need to do:

- Read and Understand the Loan Agreement: Carefully review the loan agreement provided by the lender. Read through all the terms and conditions, including the interest rate, loan term, monthly payments, and any additional fees or charges. Ensure that you understand the obligations and responsibilities outlined in the agreement.

- Contact the Lender: Reach out to the lender to discuss any questions or concerns you have regarding the loan agreement. Clarify any doubts and seek further explanation if needed. It’s important to have a clear understanding of the terms before proceeding.

- Provide Additional Documentation, If Required: The lender may request additional documentation to finalize the refinancing process. Be prompt in providing any requested information and submit it according to their instructions.

- Sign the Loan Agreement: Once you are satisfied with the loan agreement and have all the necessary documents in order, sign the agreement as instructed by the lender. Ensure that all signatures and initials are placed correctly and legibly.

- Review the Payoff Process: Inquire about the payoff process for your current car loan. If necessary, the new lender may handle the payoff directly. Understand the timeline and any steps you need to take to ensure a smooth transition from your old loan to the new refinanced loan.

- Monitor the Transition: Stay in touch with the new lender throughout the transition process. Ensure that the refinancing is progressing as expected and that your old loan is being paid off according to the agreed-upon terms.

- Update Payment Information: Update your payment information with the new lender. Provide any necessary details for setting up automatic payments or arranging a preferred payment method. This will help you stay on top of your loan payments without any inconvenience.

- Continue Making Payments: Until the refinancing process is fully completed, continue making payments on your current car loan. Avoid missed or late payments to maintain a good payment history.

- Keep Copies of All Documents: Throughout the process, make copies of all documents related to the refinancing. Keep these copies in a safe place for future reference and record-keeping purposes.

By following these steps to finalize the refinancing process, you can successfully transition from your old car loan to the new refinanced loan. Stay proactive and maintain communication with the new lender to ensure a smooth and seamless transition. Once everything is in place, you can begin making payments on your new loan and enjoy the potential benefits of lower interest rates or adjusted loan terms.

Potential Benefits and Drawbacks of Refinancing with Bad Credit

Refinancing your car loan with bad credit can bring about both benefits and drawbacks. It’s important to consider these factors before making a decision. Here’s a look at some potential benefits and drawbacks:

Potential Benefits:

- Lower Interest Rate: One of the main advantages of refinancing is the potential to secure a lower interest rate. With improved credit or favorable market conditions, refinancing can save you money in the long run by reducing the total interest paid over the loan term.

- Lower Monthly Payments: Refinancing may allow you to extend your loan term, resulting in lower monthly payments. This can provide immediate financial relief and improve your cash flow, making it easier to manage your expenses.

- Improved Credit Score: Making timely payments on your refinanced loan can have a positive impact on your credit score. As you build a positive payment history, your creditworthiness may improve over time, opening doors to better loan terms and more favorable credit opportunities in the future.

- Option for Adjusting Loan Terms: Refinancing enables you to adjust various loan terms, such as the interest rate, loan term, or monthly payments. This flexibility can help bring your loan in line with your current financial situation and make it more manageable.

- Potential for Debt Consolidation: If you have other high-interest debts, refinancing can provide an opportunity to consolidate them into a single loan. This can simplify your financial obligations and potentially save you money on interest payments.

Potential Drawbacks:

- Higher Overall Interest Costs: While refinancing can lead to lower monthly payments, keep in mind that extending the loan term may result in higher overall interest costs. It’s essential to consider the long-term financial implications and calculate the total cost of the refinanced loan.

- Possible Fees and Charges: Refinancing may come with certain fees, such as application fees, origination fees, or prepayment penalties. Be sure to understand and factor in these costs when evaluating the potential savings of refinancing. Determine if the savings outweigh the associated fees.

- No Guarantee of Approval: Despite refinancing being an option, there is no guarantee that you will be approved for a favorable loan. Bad credit can be a significant consideration for lenders, which may result in higher interest rates or stricter loan terms.

- Potential Impact on Credit Score: The refinancing process typically involves a hard credit inquiry, which can temporarily impact your credit score. However, multiple inquiries for the same purpose within a specified time frame are typically treated as a single inquiry to minimize the impact.

- Resetting Loan Term: If you’ve already made significant progress in paying off your current car loan, refinancing may require you to start over with a new loan term. While this can reduce monthly payments, it can also mean a longer time commitment to repay the loan.

Considering both the potential benefits and drawbacks of refinancing with bad credit is crucial in making an informed decision. Assess your unique financial situation, weigh the pros and cons, and determine if refinancing aligns with your short-term and long-term financial goals.

Conclusion

Refinancing your car loan with bad credit may seem challenging, but with careful planning and research, it can be a viable option to improve your financial situation. By following the steps outlined in this guide, you can navigate the refinancing process more confidently and make informed decisions that align with your goals.

Throughout this article, we discussed the importance of understanding bad credit and how it affects car refinancing. We explored the steps involved, such as determining if refinancing is right for you, improving your credit score, researching and comparing lenders, gathering necessary documentation, applying for refinancing, evaluating loan offers, and finalizing the refinancing process.

While refinancing with bad credit can bring potential benefits such as lower interest rates, lower monthly payments, and improved flexibility, it’s essential to consider the possible drawbacks, including higher overall interest costs and associated fees. Careful evaluation of loan offers and understanding the terms and conditions can help you make the best decision for your financial situation.

Remember, refinancing is not a one-size-fits-all solution. It’s vital to assess your individual circumstances, financial goals, and the potential impact of refinancing on your credit score and long-term financial well-being. Seeking advice from financial professionals or credit counselors can provide additional insight and guidance.

By making a well-informed decision and leveraging refinancing with bad credit, you may be able to secure a better loan arrangement, save on interest payments, and potentially improve your creditworthiness over time. Take control of your finances, explore refinancing options, and make a decision that puts you on the path to financial success.