Finance

How Many Years For Credit Card Scamming

Published: October 27, 2023

Discover the shocking truth about credit card scamming in the finance industry. Find out how many years scammers can be sentenced for this crime and protect yourself!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Card Scamming

- Tactics and Techniques Used in Credit Card Scamming

- The Role of Technology in Credit Card Scamming

- Consequences and Impact of Credit Card Scamming

- Legal Penalties and Sentencing for Credit Card Scamming

- Measures Taken to Combat Credit Card Scamming

- Tips for Protecting Yourself from Credit Card Scamming

- Conclusion

Introduction

Welcome to the world of credit card scamming. In today’s digital age, where financial transactions are increasingly carried out online, credit card scams have become a rampant problem. From stolen credit card information to unauthorized charges, consumers and businesses alike are at risk of falling victim to these fraudulent activities.

Credit card scamming refers to the illegal and unauthorized use of someone else’s credit card details for personal gain. These scams can take various forms, including identity theft, skimming, phishing, and hacking. The perpetrators behind these scams are often organized criminal networks, operating both online and offline, that target unsuspecting individuals and exploit vulnerabilities in the financial system.

As technology continues to advance, so do the tactics and techniques used by credit card scammers. It is important for consumers and businesses to stay informed about the latest scams and be proactive in protecting themselves from becoming victims.

In this article, we will delve into the world of credit card scamming, exploring the tactics used, the role of technology, the consequences and impact of these scams, the legal penalties and sentencing faced by scammers, the measures taken to combat this issue, and tips for protecting yourself from credit card scamming.

Whether you are a consumer or a business owner, understanding the intricacies of credit card scamming is crucial for safeguarding your financial well-being. So, let’s dive in and explore the dark side of the financial world, uncovering the truth behind credit card scams and learning how to stay one step ahead of the scammers.

Understanding Credit Card Scamming

Credit card scamming is a form of financial fraud that involves the unauthorized use of someone’s credit card information for fraudulent purposes. It is important to have a clear understanding of how these scams work in order to protect yourself and your financial assets.

One common method used by scammers is identity theft. They obtain personal information, such as Social Security numbers, addresses, and birthdates, through various means, including hacking into databases, phishing emails, or even stealing physical documents. With this information, they can impersonate the victim and apply for credit cards in their name or make unauthorized transactions using their existing credit card details.

Skimming is another prevalent technique used by credit card scammers. This involves the use of devices called skimmers, which are placed on ATMs, payment terminals, or even handheld card readers. These devices capture the credit card information when the card is swiped or inserted, allowing scammers to create counterfeit cards or use the stolen data to make fraudulent purchases online.

Phishing is yet another method employed by scammers, typically through deceptive emails or websites. They create fake emails that appear to be from legitimate financial institutions or businesses, tricking recipients into providing their credit card information or login credentials. Once scammers have obtained this information, they can use it to make unauthorized transactions.

Hacking is a more sophisticated technique used by cybercriminals to gain access to credit card information. They exploit vulnerabilities in computer systems or use malware to steal sensitive data stored on servers or in databases. Once they have obtained credit card information, they can sell it on the black market or use it for fraudulent purposes themselves.

Understanding the tactics and techniques used by scammers is crucial for protecting yourself from credit card fraud. By staying vigilant, practicing good cybersecurity habits, and being cautious about sharing your personal and financial information, you can significantly reduce the risk of falling victim to these scams.

Tactics and Techniques Used in Credit Card Scamming

Credit card scammers employ a variety of tactics and techniques to carry out their fraudulent activities. These methods are constantly evolving as scammers adapt to advancements in technology and find new ways to exploit vulnerabilities in the financial system. Understanding these tactics is crucial for recognizing and avoiding potential scams. Here are some common techniques used in credit card scamming:

- Phishing: Scammers send deceptive emails or create fake websites to trick individuals into disclosing their credit card information or login credentials. These phishing attempts often imitate legitimate institutions, such as banks or online retailers.

- Skimming: Skimmers are devices installed on ATMs, payment terminals, or handheld card readers to illegally capture credit card information. The skimmers read and record card details, which scammers then use to make counterfeit cards or carry out fraudulent transactions.

- Identity theft: Scammers steal personal information, such as Social Security numbers and birth dates, to assume someone else’s identity. With this information, they can open fraudulent credit card accounts or make unauthorized charges on existing cards.

- Hacking: Cybercriminals exploit vulnerabilities in computer systems to gain unauthorized access to credit card information stored on servers or in databases. They may use malware or advanced hacking techniques to steal sensitive data, which can then be sold or used for fraudulent purposes.

- Card-not-present fraud: This type of fraud occurs when scammers use stolen credit card information to make purchases online or over the phone, where the physical card is not required. They may create dummy accounts or use unsuspecting individuals’ personal information to carry out these transactions.

- Point-of-sale (POS) compromise: Scammers target vulnerable point-of-sale systems, such as those used in retail stores or restaurants, to steal credit card information. They may install malware or use other techniques to intercept payment card data during transactions.

- Social engineering: Scammers use psychological manipulation to deceive individuals into sharing their credit card information. They may pose as a trusted person or organization and gain the victim’s trust before convincing them to provide their financial details.

- Account takeover: In this scam, scammers gain unauthorized access to someone’s existing credit card account by obtaining their login credentials. They can then make unauthorized transactions or change account information.

It is important to stay vigilant and aware of these tactics and techniques to protect yourself from credit card scams. Be cautious when providing your credit card information, regularly monitor your account statements, and report any suspicious activity to your card issuer or financial institution.

The Role of Technology in Credit Card Scamming

Technology plays a significant role in the world of credit card scamming, enabling scammers to carry out their fraudulent activities with greater ease and sophistication. As technology progresses, so do the tactics and techniques used by these cybercriminals. Understanding the role of technology in credit card scamming is essential for staying informed and protected in an increasingly digital world.

One of the key ways technology aids scammers is through the advancement of skimming devices. Skimmers have become smaller, more inconspicuous, and more effective at capturing credit card information. These devices can be attached to ATMs, payment terminals, or even handheld card readers, allowing scammers to collect data every time a card is swiped or inserted. With the collected data, scammers can create counterfeit cards or make fraudulent online purchases.

Moreover, the rise of the internet and e-commerce has created new opportunities for credit card fraud. Online scams, phishing emails, and fake websites have become prevalent means for scammers to obtain credit card details and personal information. They exploit vulnerabilities in security systems, tricking individuals into revealing their credit card information through deceptive tactics. Advances in web design and coding make it increasingly difficult to distinguish between legitimate and fraudulent websites.

Technology also aids scammers in hacking into systems and databases to steal credit card information. Cybercriminals can exploit vulnerabilities in computer networks to gain unauthorized access to sensitive data, which they can then use for financial gain. The use of malware, such as keyloggers and remote access trojans, allows scammers to capture keystrokes and remotely control compromised systems, providing them with a direct line to valuable credit card information.

Additionally, advancements in data storage and transmission have made it easier for scammers to trade and monetize stolen credit card information. Illicit online marketplaces facilitate the buying and selling of credit card details, providing criminals with a ready-made marketplace for their stolen data. These marketplaces are accessible through hidden services on the dark web, making it difficult for law enforcement to track and shut them down.

The role of technology in credit card scamming is multifaceted. While it provides scammers with new opportunities and tools, it also offers solutions for detecting and preventing fraud. Financial institutions and credit card companies employ advanced technologies, such as artificial intelligence and machine learning, to analyze patterns and detect fraudulent transactions in real-time.

As technology continues to evolve, it is crucial for consumers and businesses to stay informed about the latest trends and security measures. Regularly updating software, implementing strong and unique passwords, and being cautious about sharing personal and financial information are essential steps toward protecting oneself in the digital landscape.

Consequences and Impact of Credit Card Scamming

Credit card scamming has severe consequences for both individuals and businesses. The impact of these fraudulent activities can be financial, emotional, and even reputational. Understanding the consequences of credit card scamming is essential for taking precautionary measures and minimizing the risks associated with such scams.

Financially, credit card scamming can result in significant monetary losses for victims. Scammers may make unauthorized purchases using stolen credit card information, leaving victims to bear the financial burden. In some cases, victims may not even be aware of the fraudulent charges until they receive their billing statements, causing further financial distress.

Besides direct financial losses, victims of credit card scams often face the challenge of reclaiming their money from financial institutions and proving their innocence. The process of disputing fraudulent charges and going through investigations can be time-consuming and stressful. It may involve submitting various documents, participating in interviews, and providing evidence to support the claim of fraud.

Emotionally, credit card scamming can cause significant distress and anxiety. Discovering that one’s personal and financial information has been compromised can lead to feelings of violation and vulnerability. Victims may experience a loss of trust in institutions or individuals, as well as a heightened sense of paranoia regarding their online activities.

The impact of credit card scamming extends beyond the individual level. Businesses can also suffer severe repercussions as a result of these scams. A data breach or a significant number of compromised customer credit card details can damage a business’s reputation, leading to a loss of trust and customer loyalty. This can result in a decrease in sales, potential legal consequences, and costly efforts to rebuild the brand’s reputation.

Moreover, credit card scams contribute to the overall economic burden. Financial institutions, retailers, and businesses incur substantial costs associated with investigating and mitigating fraudulent activities. These costs are often passed on to consumers in the form of increased fees or tighter credit card security measures, impacting the overall economy.

Another significant impact of credit card scamming is the erosion of consumer confidence in financial systems and online transactions. When people feel unsafe or distrustful, they may hesitate to carry out e-commerce transactions or provide their credit card information, hindering the growth of online businesses and negatively affecting economic progress.

Overall, credit card scamming has far-reaching consequences and impacts that extend beyond immediate financial losses. It is crucial for individuals and businesses to be proactive in protecting their personal and financial information, as well as supporting efforts to combat these scams.

Legal Penalties and Sentencing for Credit Card Scamming

Credit card scamming is a serious criminal offense that carries significant legal penalties and sentencing. The exact penalties vary depending on the jurisdiction and the severity of the scamming activities. Understanding the potential consequences scammers face can serve as a deterrent and help protect individuals and businesses from falling victim to these fraudulent acts.

In most countries, credit card scamming is punishable under various laws, including fraud, identity theft, computer crimes, and financial crimes legislation. The penalties range from fines to imprisonment, and in some cases, a combination of both.

For less severe instances of credit card scamming, such as simple unauthorized use of credit card information, scammers can face misdemeanor charges. Misdemeanor convictions can result in moderate fines, probation, community service, or a brief jail sentence, typically less than a year.

On the other hand, for more sophisticated and organized credit card scamming schemes, which involve multiple victims or substantial financial losses, the penalties and sentences become more severe. Scammers who engage in large-scale credit card fraud, identity theft, or hacking can face felony charges.

Felony convictions carry harsher penalties, including substantial fines and lengthy prison sentences. The duration of imprisonment can vary significantly, depending on the jurisdiction and the specific circumstances of the scamming. In some cases, scammers may face several years in prison, and in extreme cases, the sentences can be as long as decades, particularly if the scamming activities are committed across multiple jurisdictions or involve significant financial losses.

Furthermore, restitution is often ordered as part of the sentencing process, requiring scammers to compensate their victims for the financial losses incurred as a result of the scamming. Restitution can involve repaying the stolen funds or compensating victims for any expenses incurred in rectifying the fraud, such as credit monitoring services or legal fees.

It is important to note that legal penalties and sentencing can vary greatly depending on the jurisdiction and the specific circumstances of the case. Some factors that may influence the severity of the penalties include the number of victims involved, the financial losses incurred, the defendant’s criminal history, and the level of planning and organization behind the scamming activities.

Law enforcement agencies, financial institutions, and cybersecurity organizations are actively working to combat credit card scamming. They collaborate on investigations, share information, and employ cutting-edge technologies to identify and apprehend scammers. The goal is not only to bring the perpetrators to justice but also to send a strong message that credit card scamming will not be tolerated.

By imposing significant legal penalties and sentencing, authorities aim to deter potential scammers and protect the public from the devastating consequences of these fraudulent activities.

Measures Taken to Combat Credit Card Scamming

Credit card scamming poses a significant threat to individuals, businesses, and the economy as a whole. As a result, various measures have been implemented to combat this growing problem. From technological advancements to collaborative efforts between law enforcement and financial institutions, these measures aim to detect, prevent, and deter credit card scammers. Here are some key initiatives:

1. Enhanced Fraud Detection Systems: Financial institutions and credit card companies employ advanced fraud detection systems that use artificial intelligence and machine learning algorithms to analyze patterns and identify suspicious transactions in real-time. These systems can flag potentially fraudulent activities, such as unusual spending patterns or transactions in unfamiliar locations, allowing for immediate investigation and action.

2. Chip and PIN Technology: The transition from magnetic stripe cards to chip and PIN technology has significantly improved security. The EMV (Europay, Mastercard, and Visa) chip embedded in credit cards generates a unique code for each transaction, making it more difficult for scammers to clone or counterfeit cards.

3. Two-Factor Authentication: Many financial institutions and online platforms have implemented two-factor authentication (2FA) as an additional layer of security. This requires users to provide a second form of authentication, such as a temporary code sent to their mobile device, to verify their identity before completing a transaction.

4. Education and Awareness Campaigns: Governments, financial institutions, and cybersecurity organizations run educational campaigns to raise awareness about credit card scams. These campaigns aim to inform the public about common scamming techniques, provide tips for protecting personal information, and encourage vigilant behavior when using credit cards online or at physical locations.

5. Collaboration and Information Sharing: Law enforcement agencies, financial institutions, and industry groups collaborate to share information and coordinate efforts in combating credit card scamming. By working together, they can pool resources, collect data, and identify emerging trends and patterns to proactively detect and prevent scams.

6. Enhanced Security Measures: Online retailers and e-commerce platforms have implemented increased security measures to protect customers’ credit card information during online transactions. Secure socket layer (SSL) encryption technology and tokenization help safeguard data by ensuring that it is transmitted securely and stored in an encrypted form.

7. Continuous Monitoring and Surveillance: Financial institutions and card issuers conduct continuous monitoring and surveillance to detect suspicious activities. This includes monitoring account activity, flagging unusual spending behavior, and notifying customers of potential fraudulent activity.

8. Regulatory Compliance: Governments and regulatory bodies impose stringent regulations that financial institutions and businesses must follow to minimize the risks of credit card scamming. Compliance with these regulations ensures the implementation of proper security measures and the responsible handling of customers’ financial information.

While these measures have significantly impacted the fight against credit card scamming, it remains an ongoing battle as scammers continually adapt and develop new tactics. It is crucial for individuals and businesses to stay informed, exercise caution when handling credit card information, and promptly report any suspicions of fraudulent activities to the appropriate authorities or financial institutions.

Tips for Protecting Yourself from Credit Card Scamming

Protecting yourself from credit card scamming is essential in today’s digital landscape. By staying vigilant and implementing preventive measures, you can significantly reduce the risk of falling victim to fraudulent activities. Here are some tips to help safeguard your financial well-being:

- Keep your credit card information confidential: Never share your credit card details, including the card number, expiration date, and security code, with anyone unless you are making a legitimate purchase from a trusted source.

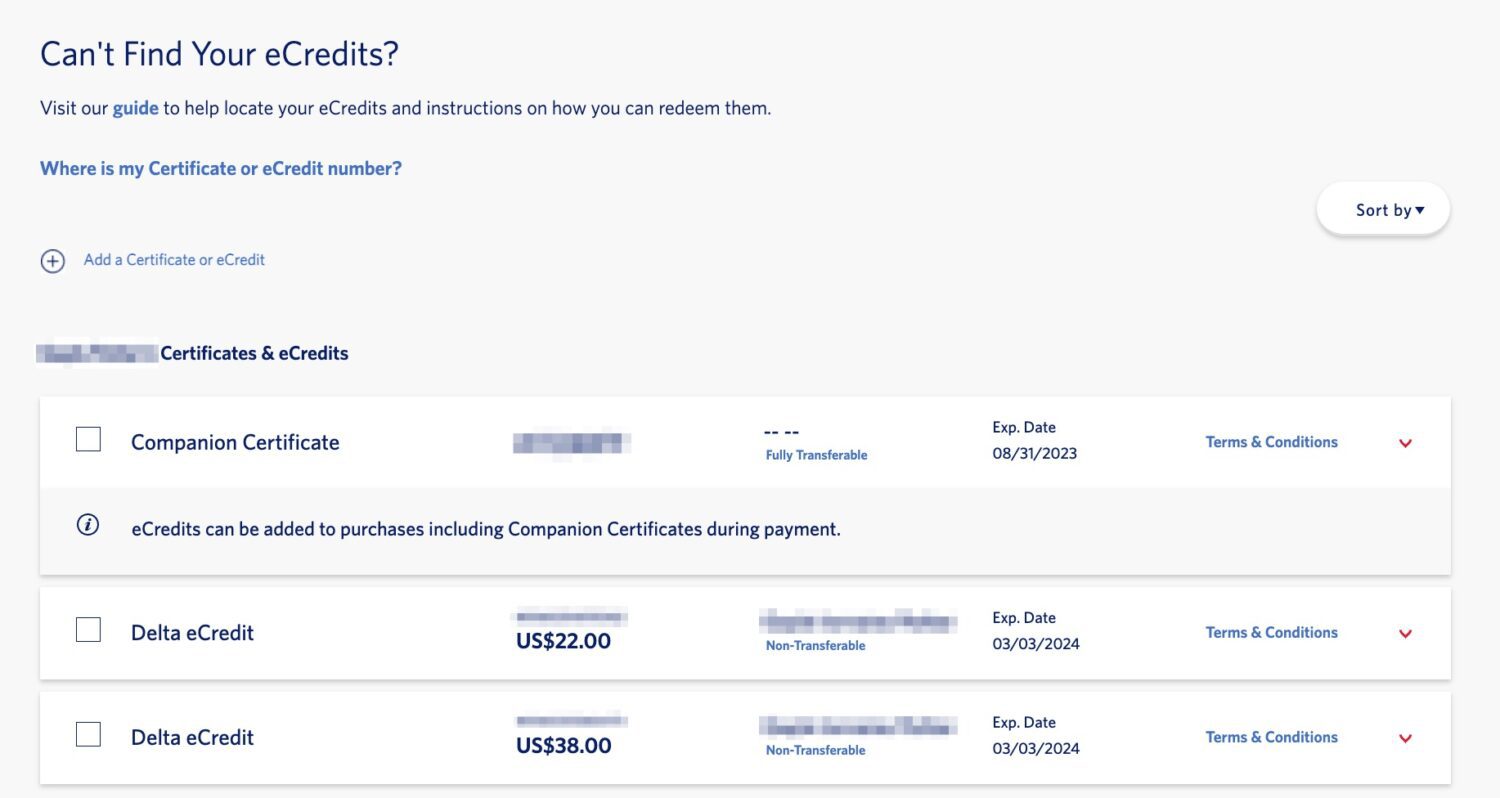

- Regularly monitor your accounts: Check your credit card statements, online banking transactions, and mobile payment apps regularly. Look for any suspicious or unauthorized activity and report it immediately to your card issuer or bank.

- Be cautious of phishing attempts: Be wary of emails, pop-up ads, or messages that request your credit card information or other personal details. Legitimate organizations will never ask for this information through these means. If in doubt, contact the company directly using their official website or phone number.

- Use secure online shopping sites: Ensure that you are making purchases from reputable online retailers with secure websites. Look for the padlock icon in the address bar and “https” in the URL, indicating a secure connection.

- Implement strong passwords: Use unique, complex passwords for your online accounts, including your credit card accounts. Avoid using easily guessable information such as birthdays or simple patterns. Consider using a password manager to securely store and generate strong passwords.

- Protect your devices: Keep your computer, smartphone, and other devices secure by regularly updating software, using antivirus and anti-malware programs, and avoiding suspicious websites or downloads. Use biometric or strong passcodes to secure your mobile devices.

- Be cautious of public Wi-Fi: Avoid making online transactions, accessing your credit card accounts, or providing sensitive information when connected to public Wi-Fi networks. These networks may not be secure, making it easier for scammers to intercept your data.

- Enable transaction alerts: Sign up for text or email alerts from your credit card issuer to receive notifications about any suspicious activity or large transactions. This will allow you to take immediate action if any unauthorized charges occur.

- Regularly review your credit reports: Request your credit reports from major credit bureaus and review them for any inaccuracies or unfamiliar accounts. This can help you identify any fraudulent activity or attempts to open accounts in your name.

- Shred important documents: Dispose of documents that contain sensitive information, such as credit card statements or expired cards, by shredding them. This will help prevent scammers from retrieving your information from discarded documents.

By incorporating these tips into your daily routines, you can significantly reduce the risk of credit card scamming and protect your financial information. Remember, being proactive and staying informed are key elements in maintaining a secure and fraud-free financial environment.

Conclusion

Credit card scamming is a prevalent and ever-evolving issue in today’s digital world. Understanding the tactics used by scammers and the potential consequences of falling victim to these scams is essential for protecting your financial well-being. While technology has provided scammers with new opportunities, it has also enabled increased security measures, collaborative efforts, and advanced fraud detection systems to combat credit card scamming.

By implementing preventive measures and staying informed about the latest scams, you can significantly reduce the risk of becoming a victim. Keeping your credit card information secure, regularly monitoring your accounts for unauthorized activity, and being cautious of phishing attempts are fundamental steps in safeguarding yourself from credit card scams.

Additionally, being mindful of the role technology plays in credit card scamming can help you better understand the vulnerabilities and take necessary precautions. Taking advantage of secure online platforms, using strong passwords, and protecting your devices from malware are crucial in mitigating the risks associated with credit card scams.

Collaborative efforts between law enforcement, financial institutions, and industry organizations are continuously working to combat these scams. Enhanced fraud detection systems, improved security measures, educational campaigns, and stringent regulations serve as essential deterrents and provide a safer environment for consumers and businesses alike.

Remember, staying vigilant, informed, and proactive is key to protecting yourself from credit card scamming. Regularly review your credit card transactions, report suspicious activities immediately, and take advantage of the security features and resources provided by your financial institution.

By following these tips and remaining diligent, you can minimize the risks of credit card scamming and enjoy the convenience and benefits of electronic transactions with peace of mind. Together, we can create a safer financial landscape and outsmart those who seek to exploit it.