Finance

How Many Stamps For A Tax Return

Published: October 28, 2023

Find out how many stamps you need for mailing your tax return. Get expert advice and tips on finance, taxes, and mailing requirements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Importance of Stamps for a Tax Return

- Factors to Consider When Determining the Number of Stamps Required

- Different Types of Tax Returns and their Corresponding Stamp Requirements

- Tips for Ensuring Sufficient Postage for Mailing Tax Returns

- Alternatives to Stamps for Mailing Tax Returns

- Conclusion

Introduction

When tax season rolls around, it’s crucial to dot all your i’s and cross all your t’s to ensure your tax return is filed accurately and on time. One often overlooked aspect of the tax filing process is the need for postage. Many taxpayers ponder the question, “How many stamps do I need for a tax return?” The answer can vary depending on a few different factors.

In this article, we will dive into the world of stamps for tax returns and explore the factors that determine the number of stamps required. Understanding these factors can save you from the frustration of a returned tax return due to insufficient postage.

Before we delve into the specifics, it’s essential to recognize the importance of ensuring your tax return has the appropriate amount of postage. An insufficiently stamped tax return can lead to delays in processing, penalties, and even potential audits in extreme cases. Therefore, it’s crucial to get it right the first time.

Now, let’s examine the factors that come into play when determining the number of stamps needed for a tax return.

Understanding the Importance of Stamps for a Tax Return

When you file your tax return, it is essential to ensure that it reaches the appropriate IRS processing center on time. One of the key components of successfully mailing your tax return is having the correct amount of postage. This may seem like a trivial detail, but it can make a significant difference in the timely processing of your tax return.

First and foremost, having the right amount of postage ensures that your tax return is delivered to the IRS without any hiccups. If you underpay or incorrectly estimate the postage required, your tax return might be returned to you, resulting in delays and potential penalties. On the other hand, overpaying for postage means wasting resources that could have been utilized elsewhere.

Another crucial reason to pay attention to the postage is the potential consequences of an insufficiently stamped tax return. If your tax return arrives at the IRS with insufficient postage, it may not be processed in a timely manner. This can lead to late filing, and in some cases, it might be considered as missing the filing deadline altogether. The IRS can impose penalties and interest charges for late filing, which can result in a significant financial burden.

Furthermore, an insufficiently stamped tax return can trigger an audit or scrutiny from the IRS. While this may not be a common occurrence, it’s important to remember that the IRS receives a massive influx of tax returns during tax season. To ensure that their operations run smoothly, they rely on the correct postage to process tax returns efficiently. If your return is flagged due to insufficient postage, it could draw additional attention and potentially lead to further investigation.

Therefore, it is crucial to pay attention to the importance of stamps for a tax return. By ensuring the correct amount of postage, you can minimize the chances of your tax return being delayed, penalized, or subjected to additional scrutiny. Now that we understand the significance of postage, let’s explore the factors that determine the number of stamps required for your tax return.

Factors to Consider When Determining the Number of Stamps Required

Figuring out how many stamps you need for your tax return involves considering several factors. Taking these factors into account will help ensure that you have the correct amount of postage and can avoid any complications or delays in the processing of your tax return.

1. Weight and Size: The weight and size of your tax return play a significant role in determining the number of stamps needed. Typically, tax returns are mailed in standard letter-sized envelopes. This means that as long as your tax return and any additional documents fit within the weight and size restrictions specified by the postal service for letter-sized mail, you can use standard postage rates.

2. Number of Pages: The number of pages in your tax return can also affect the amount of postage required. More pages mean a heavier envelope, which may warrant additional postage. Be sure to count all the pages, including any schedules, attachments, or supporting documents.

3. Destination: The destination of your tax return can impact the postage required. If you are mailing your tax return within the same country, the standard domestic postage rates will apply. However, if you are mailing your tax return internationally, you will need to use international postage rates, which may be different.

4. Postal Service Pricing: It’s important to stay up to date with the current pricing for postage. Postal service rates can change periodically, so be sure to check the official website of your postal service provider or contact your local post office for the most accurate and up-to-date information on postage rates.

5. Additional Services: If you choose to include additional services such as registered mail, certified mail, or return receipt, these services may incur additional fees in addition to the standard postage rate. Consider whether you need any of these services and factor in the additional cost when determining the total amount of postage required.

Remember, the factors mentioned above are general guidelines to consider when determining the number of stamps needed for your tax return. It is always recommended to consult with your local post office or refer to the postal service’s official website for specific guidelines and rates applicable to your situation.

Now that you understand the factors to consider when determining the number of stamps required, let’s explore the different types of tax returns and their corresponding stamp requirements.

Different Types of Tax Returns and their Corresponding Stamp Requirements

When it comes to tax returns, there are various types and forms that individuals and businesses may need to file. Different types of tax returns may have specific requirements when it comes to the number of stamps needed for mailing. Let’s take a look at some common tax returns and their corresponding stamp requirements:

1. Individual Income Tax Returns (Form 1040-Series): The most common type of tax return for individuals is the Form 1040 series, which includes Form 1040, 1040A, and 1040EZ. These returns are typically mailed in standard letter-sized envelopes and can be mailed using the standard domestic postage rates. However, if you have additional schedules or attachments, which may increase the weight, you may need additional postage.

2. Business Tax Returns: Businesses may need to file various tax returns, such as the Form 1120 for corporations, Form 1065 for partnerships, or Form 1041 for estates and trusts. The postage requirements for these returns can vary depending on factors such as size, weight, and destination. It is essential to consider these factors and consult with your local post office or refer to the official postal service website for the most accurate postage rates.

3. International Tax Returns: If you are filing an international tax return, you will need to pay attention to international postage rates. The postage requirements for international mail can be higher than domestic rates, especially if you are sending your tax return to a destination outside your country. It is advisable to verify the current international postage rates and any specific mailing instructions from the postal service.

4. Overweight or Oversized Tax Returns: In some cases, tax returns may be too large or heavy to fit within the standard letter-sized envelopes. If you have an overweight or oversized tax return, you may need to use larger envelopes or even mail it as a package. In such cases, you will need to consider the postage rates for packages, which may differ from standard letter rates.

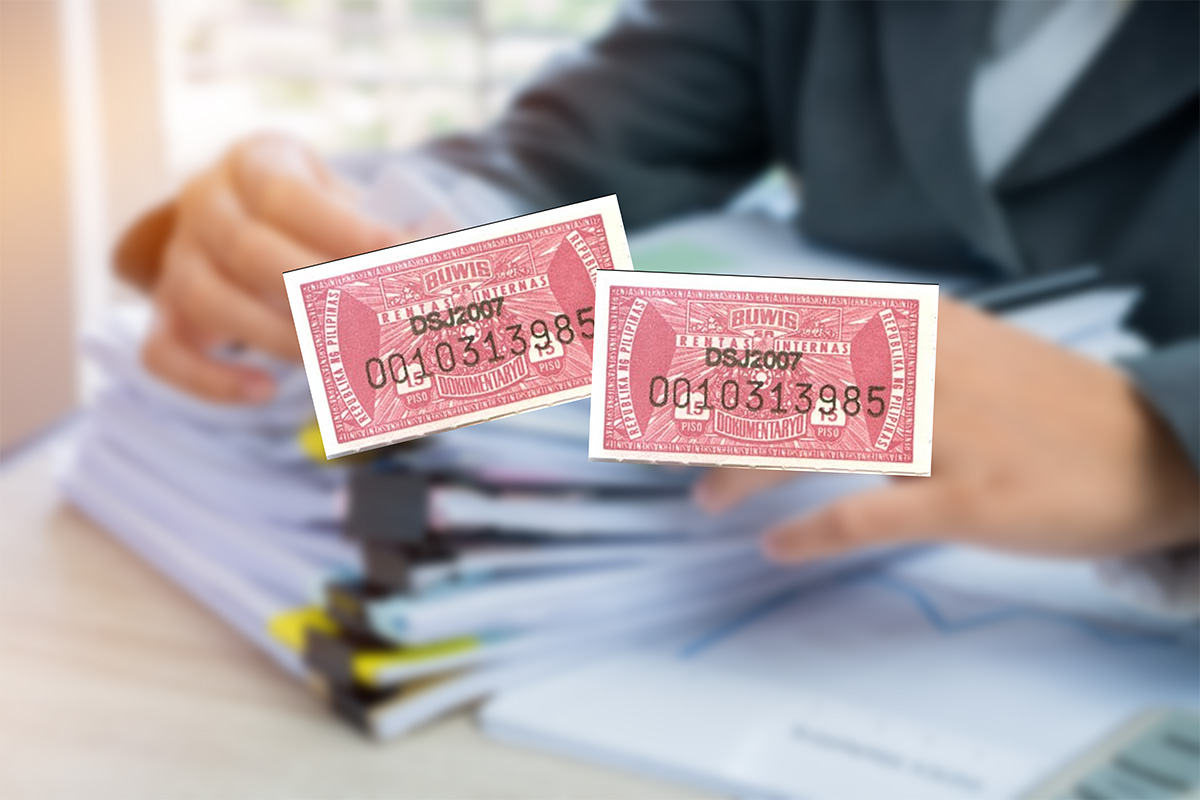

5. Special Mailing Services: Some taxpayers choose to use special mailing services, such as certified mail or registered mail, for added security and proof of delivery. These services often require additional fees on top of the standard postage rates. If you opt for these services, be sure to include the applicable fees in your postage calculations.

Remember, these are general guidelines, and the specific postage requirements for different types of tax returns may vary. It is essential to consult with your local post office or refer to the official postal service website to determine the accurate amount of postage required for your specific tax return.

Now that we have explored the different types of tax returns and their corresponding stamp requirements, let’s move on to some tips for ensuring sufficient postage when mailing your tax return.

Tips for Ensuring Sufficient Postage for Mailing Tax Returns

When it comes to mailing your tax return, ensuring sufficient postage is crucial to avoid delays, penalties, and potential audits. Here are some helpful tips to ensure you have the correct amount of postage:

1. Weigh and Measure: Before preparing your tax return for mailing, weigh it using a postal scale. Be sure to include all necessary documents, schedules, and attachments. Additionally, measure the dimensions of your envelope to ensure it falls within the limits for standard letter-sized mail. This will help you determine the appropriate postage rate.

2. Check Postal Service Rates: Keep yourself informed about the current postage rates by visiting the official website of your postal service or contacting your local post office. Postage rates can change annually or even more frequently, so it’s essential to be up to date to avoid under- or overpaying for postage.

3. Use Online Postage Calculators: Many postal service websites offer online postage calculators that can help you determine the correct amount of postage based on the weight, size, and destination of your tax return. These calculators take into account the latest rates, ensuring accuracy.

4. Consider Special Services: If you want added security or proof of delivery, you may choose to use special services like certified mail, registered mail, or return receipt. However, remember that these services come with additional fees on top of the standard postage rate. Be sure to include the cost of these services when calculating the total amount of postage required.

5. Double-Check Postage Requirements: Different types of tax returns may have specific postage requirements. For example, international tax returns or oversized tax returns may have different postage rates. Make sure to review the guidelines provided by your postal service to ensure you meet all the necessary requirements.

6. Take Your Tax Return to the Post Office: To guarantee the accuracy of your postage, consider taking your tax return to the post office directly. The postal staff can assist you in determining the correct postage and answer any questions you may have. They can also provide guidance on any special mailing considerations, such as customs forms for international mail.

By following these tips, you can ensure that your tax return has sufficient postage, avoiding any potential issues that may arise from underpaying or overpaying for postage. Remember, it’s always better to be proactive and double-check your postage rather than risk mailing your tax return with insufficient postage.

Now, let’s explore some alternatives to using stamps for mailing your tax return.

Alternatives to Stamps for Mailing Tax Returns

While stamps are the traditional method of paying for postage, there are alternative options available for mailing your tax return. These alternatives can offer convenience, tracking capabilities, and faster delivery. Here are a few alternatives you may consider:

1. Online Postage: Many postal services provide online postage options that allow you to pay for postage directly from your computer. You can purchase and print postage labels, complete with tracking information, from the comfort of your home or office. This eliminates the need for physical stamps and provides you with proof of mailing.

2. Postal Service Websites: Some postal services offer online services where you can create an account and pay for postage using a credit or debit card. These websites often have tools that allow you to calculate the exact amount of postage needed based on the weight and destination of your tax return. You can then print the postage label and affix it to your envelope.

3. Metered Mail: Businesses may have access to postage meters, which allow for more efficient and streamlined mailing. A postage meter prints a specific amount of postage directly onto the envelope or label, eliminating the need for stamps. Check with your local post office or mailing service provider to see if metered mail is an option for your tax return.

4. Prepaid Shipping Labels: Another option is to use prepaid shipping labels. These labels can be purchased online or from authorized retail locations. They include the necessary postage for specific mailing services, such as First Class or Priority Mail. Simply attach the label to your envelope or package and drop it off at your local post office or a designated mailing location.

5. Certified Mail or Registered Mail: If you require additional security or proof of delivery for your tax return, you can opt for certified mail or registered mail services. These services provide a unique tracking number and require the recipient to sign for the delivery. You can purchase the necessary services and obtain the appropriate mailing labels from your local post office.

Remember, it’s essential to check with your specific postal service to understand the available alternatives for mailing your tax return. Each postal service may have different offerings and requirements. Consider factors such as convenience, tracking capabilities, and cost when deciding which alternative method to use for mailing your tax return.

Now that we have explored the alternatives to using stamps for mailing tax returns, let’s wrap up our discussion.

Conclusion

Mailing your tax return with the correct amount of postage is a crucial step in ensuring its timely processing and avoiding penalties or audits. Throughout this article, we have explored the importance of stamps for tax returns and the factors that determine the number of stamps required. We have also discussed different types of tax returns and their corresponding stamp requirements, as well as provided tips for ensuring sufficient postage.

Understanding the weight and size of your tax return, checking postal service rates, and utilizing online postage calculators are essential steps in determining the correct amount of postage. Consider special services like certified mail or registered mail for added security and proof of delivery if needed.

It is important to note that there are alternative methods to using stamps for mailing your tax return, such as online postage, prepaid shipping labels, or metered mail. These options offer convenience, tracking capabilities, and faster delivery.

Remember to consult your specific postal service for the most accurate and up-to-date information on postage rates and requirements. Paying close attention to the postage ensures that your tax return reaches the appropriate IRS processing center without any complications or delays.

By following these guidelines and being proactive with your postage, you can confidently send your tax return, knowing that it is properly prepared. Take the time to weigh and measure your tax return, check postal service rates, and consider any special requirements based on the type of tax return you are filing.

As tax season approaches, keep in mind the significance of ensuring sufficient postage for mailing your tax return. By doing so, you can ensure that your tax filing process proceeds smoothly and avoid any unnecessary complications. Take advantage of the tips and alternatives discussed in this article, and make the necessary arrangements to ensure your tax return is accurately and securely mailed.

With careful attention to postage and mailing details, you can have peace of mind knowing that your tax return is on its way to the IRS, meeting all requirements for a successful filing.