Home>Finance>How Much Can You Borrow From Whole Life Insurance?

Finance

How Much Can You Borrow From Whole Life Insurance?

Modified: February 21, 2024

Discover how much you can borrow from Whole Life Insurance and secure your financial future. Get expert advice on financing options with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Whole Life Insurance?

- How Does Whole Life Insurance Work?

- Understanding the Cash Value of Whole Life Insurance

- Borrowing Against Your Whole Life Insurance Policy

- Factors to Consider Before Borrowing from Whole Life Insurance

- How Much Can You Borrow from Whole Life Insurance?

- The Repayment Process for Whole Life Insurance Loans

- Advantages of Borrowing from Whole Life Insurance

- Risks and Limitations of Borrowing from Whole Life Insurance

- Conclusion

Introduction

Whole life insurance is a popular type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which only provides coverage for a specific period of time, whole life insurance combines a death benefit with a savings component known as cash value.

Many policyholders appreciate the added benefit of accumulating cash value over time, which can be used for various purposes, such as supplementing retirement income, paying off debts, or even funding a child’s education. One of the unique advantages of whole life insurance is its ability to allow policyholders to borrow against the cash value accumulated in their policy.

In this article, we will explore how whole life insurance works, the concept of cash value, and delve into the process of borrowing against your whole life insurance policy. We will also discuss the factors to consider before borrowing, how much you can borrow, as well as the repayment process and the advantages and risks associated with borrowing from whole life insurance.

Whether you already have a whole life insurance policy or are considering getting one, understanding how to leverage its cash value is a crucial aspect of financial planning. So let’s dive into the world of whole life insurance and discover how it can help you meet your financial goals.

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that offers lifelong coverage for the insured individual. Unlike term life insurance, which provides coverage for a specific period of time, whole life insurance guarantees a death benefit payout to beneficiaries upon the death of the insured, regardless of when it occurs.

One key feature of whole life insurance is its cash value component. A portion of the premium payments made by the policyholder goes towards building cash value. This cash value grows over time on a tax-deferred basis, meaning the policyholder does not have to pay taxes on the growth until it is withdrawn.

The cash value can be accessed through a withdrawal or loan against the policy. This provides policyholders with the flexibility to use the funds to meet various financial needs, such as paying off debts, funding a child’s education, supplementing retirement income, or covering unexpected expenses.

Furthermore, whole life insurance offers a level premium that remains the same throughout the duration of the policy. This means that the premium payments do not increase as the individual gets older. This can be advantageous for individuals looking for long-term financial stability and predictable expenses.

Another benefit of whole life insurance is its potential to earn dividends. Dividends are not guaranteed, but if they are declared by the insurance company, policyholders have the option to receive them as cash, use them to reduce their premiums, accumulate them with interest, or purchase additional coverage.

Whole life insurance is typically more expensive than term life insurance due to its permanent coverage and cash value component. However, it offers a range of benefits that can make it an attractive option for individuals looking for lifelong coverage and the potential for cash value accumulation.

Now that we have a general understanding of what whole life insurance is, let’s dive deeper into how it works and the concept of cash value.

How Does Whole Life Insurance Work?

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It works by combining a death benefit with a cash value component. Let’s explore the mechanics of how whole life insurance works.

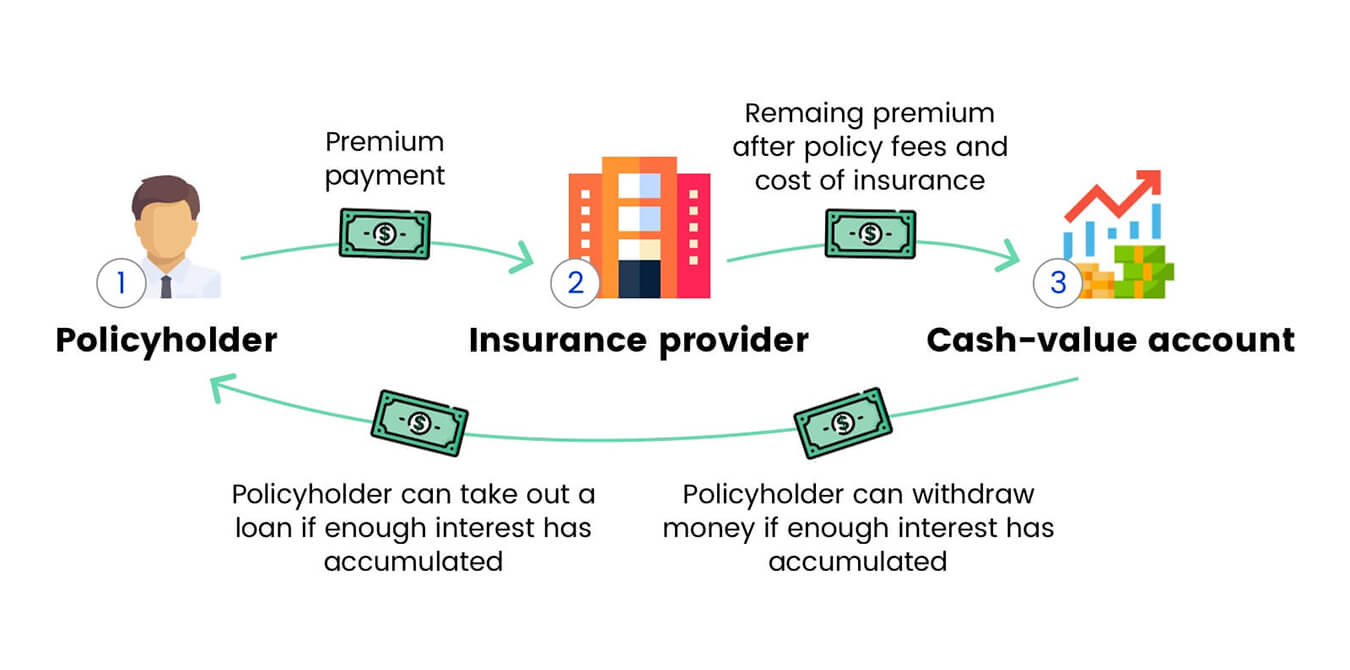

When you purchase a whole life insurance policy, you agree to pay regular premium payments to the insurance company. These premium payments are used to provide both the death benefit and contribute to the cash value of the policy.

A part of each premium payment goes towards covering the cost of insurance, which provides the death benefit. The remaining portion of the premium is allocated towards building the policy’s cash value. The cash value grows over time based on the performance of the insurance company’s investment portfolio and is guaranteed to increase at a predetermined rate.

The cash value of a whole life insurance policy offers several benefits. First, it provides a form of savings or investment component within the policy. As the cash value grows, you have the option to access it through withdrawals or loans. This can be especially useful during times of financial need or when you want to leverage the value of your policy to meet other financial goals.

Furthermore, the cash value has the potential to earn dividends. Dividends are not guaranteed, but if the insurance company’s financial performance allows, they may be declared and distributed to policyholders. These dividends can be used to increase the cash value, purchase additional coverage, or even be received as cash.

It’s important to note that the cash value is separate from the death benefit of the policy. If you were to pass away, your beneficiaries would receive the death benefit amount, which is typically tax-free.

One of the distinguishing features of whole life insurance is its level premiums. Unlike term life insurance, where premiums can increase over time, whole life insurance policies have fixed premiums that remain the same throughout the life of the policy. This can provide financial stability and predictability for policyholders, as they know exactly how much they need to pay each month or year to maintain their coverage.

In summary, whole life insurance works by combining a death benefit with a cash value component. Policyholders make regular premium payments, which are used to provide both the death benefit and contribute to the cash value of the policy. The cash value grows over time and can be accessed through withdrawals or loans. Additionally, whole life insurance offers level premiums, providing stable and predictable premium payments for policyholders.

Now that we understand how whole life insurance works, let’s dive deeper into the concept of cash value and its significance.

Understanding the Cash Value of Whole Life Insurance

The cash value is a unique feature of whole life insurance that sets it apart from other types of insurance. It represents the accumulated savings component of the policy and can provide several financial benefits to the policyholder. Let’s delve into the details of cash value and its significance in whole life insurance.

When you pay the premium for your whole life insurance policy, a portion of it goes towards building the cash value. This cash value grows over time, typically at a guaranteed rate determined by the insurance company. The growth of the cash value is tax-deferred, which means you don’t have to pay taxes on it until you withdraw or access the funds.

The cash value can be seen as a form of savings or investment within the policy. It offers a range of benefits and potential uses for policyholders. Here are some key aspects to understand about the cash value:

1. Access to Funds: The cash value acts as a reserve that you can tap into when needed. You can access the cash value through withdrawals or loans against the policy. This can be particularly helpful during times of financial need or when you want to leverage the value of your policy for other purposes, such as paying off debts or supplementing retirement income.

2. Loan Provisions: Whole life insurance policies often have loan provisions that allow you to borrow against the cash value. The loan is typically tax-free and does not require approval or credit checks since you are essentially borrowing from yourself. However, it’s important to note that the loan will accrue interest, which needs to be repaid.

3. Flexibility: The cash value provides flexibility and control over your financial resources. Unlike other savings or investment accounts, there are no restrictions on how you can use the cash value. Whether you want to fund a major purchase, pay for education expenses, or finance a business venture, the cash value offers versatility in addressing various financial goals.

4. Dividend Earnings: Some whole life insurance policies have the potential to earn dividends. Dividends represent a share of the insurance company’s profits and are not guaranteed. If declared, dividends can be used to increase the cash value, purchase additional coverage, or receive as cash. They provide an opportunity for the cash value to grow even faster.

5. Protection Against Policy Lapses: If you encounter financial difficulties and are unable to pay the premium of your whole life insurance policy, the cash value can help prevent the policy from lapsing. The insurance company may allow you to use the cash value to cover the premium payments, ensuring that your coverage remains in force.

6. Inheritance: In addition to the death benefit, the cash value can be passed down to your beneficiaries upon your death. This can provide a financial legacy and help your loved ones meet their own financial needs.

Understanding the cash value of your whole life insurance policy is crucial for maximizing its potential benefits. It offers a range of advantages, including access to funds, flexibility, and potential dividend earnings. However, it’s important to remember that accessing the cash value can have an impact on your policy’s death benefit and may incur interest or other fees.

Now that we have explored the concept of cash value, let’s move on to understanding how you can borrow against your whole life insurance policy.

Borrowing Against Your Whole Life Insurance Policy

One of the unique features of whole life insurance is the ability to borrow against the cash value of your policy. This flexibility can provide you with access to funds when needed, while still allowing your policy to continue growing. Let’s explore how you can borrow against your whole life insurance policy and the considerations involved.

When you borrow against your whole life insurance policy, you essentially are tapping into the cash value that has accumulated over time. Unlike a traditional loan from a bank or financial institution, borrowing against your policy is typically more straightforward and does not require approval or credit checks since you are essentially borrowing from yourself.

Here’s how the borrowing process typically works:

1. Contact the insurance company: To initiate a loan against your policy, you will need to contact your insurance company and inform them of your intention to borrow against your cash value. They will provide you with the necessary forms and instructions to proceed.

2. Determine the loan amount: The maximum amount you can borrow is typically a percentage of your policy’s cash value, as determined by your insurance company. It’s essential to understand the limitations and guidelines set by the insurance company to have a clear idea of how much you can borrow.

3. Interest rates and repayment terms: The loan from your whole life insurance policy will accrue interest. The interest rate may be predetermined by the insurance company, and it’s important to understand the terms and conditions of repayment. The loan can typically be repaid over a specific period, and the insurance company may require regular payments of interest or principal.

4. Impact on cash value and death benefit: It’s important to note that borrowing against your policy will impact both the cash value and the death benefit. The amount you borrow is subtracted from the cash value, reducing its growth potential. In addition, the death benefit may be reduced by the outstanding loan balance if you pass away before repaying the loan.

5. Loan repayment: Repaying the loan is essential to maintain the financial integrity of your policy. Failure to repay the loan and interest can result in the reduction of the cash value, policy lapses, or a reduced death benefit. It’s crucial to understand the repayment terms and ensure you have a plan in place to repay the loan.

6. Tax implications: The loan from your whole life insurance policy is typically tax-free, as long as the policy remains in force. However, it’s important to consult with a tax professional to fully understand the potential tax consequences of borrowing from your policy.

Borrowing against your whole life insurance policy can provide you with access to funds for various purposes. It offers convenience, flexibility, and may have more favorable terms compared to traditional loans. However, it’s crucial to carefully consider your borrowing needs, repayment capacity, and the impact on your policy’s cash value and death benefit before proceeding.

Now that we understand how to borrow against a whole life insurance policy, let’s explore the factors to consider before making the decision to borrow.

Factors to Consider Before Borrowing from Whole Life Insurance

Borrowing against your whole life insurance policy can provide you with financial flexibility and access to funds when needed. However, it’s essential to carefully consider several factors before making the decision to borrow. Here are some key factors to evaluate:

1. Purpose of the Loan: Determine the specific reason for borrowing from your whole life insurance policy. Is it for an essential expense, such as unexpected medical bills or home repairs, or is it for discretionary spending? Having a clear purpose for the loan will help you determine if it’s a necessary and responsible financial decision.

2. Repayment Plan: Before borrowing from your policy, develop a solid plan for repaying the loan. Consider your current financial situation, income stability, and cash flow. Ensure that you have the means to make regular loan payments, including interest, without jeopardizing your day-to-day living expenses or other financial obligations.

3. Impact on Cash Value and Death Benefit: Understand that borrowing against your whole life insurance policy will reduce the cash value and potentially the death benefit. Consider the long-term implications of this reduction and evaluate if it aligns with your overall financial goals and protection needs.

4. Interest Rates: Familiarize yourself with the interest rates associated with borrowing from your policy. It’s important to compare these rates with other borrowing options, such as personal loans or lines of credit, to determine if borrowing from your policy is the most cost-effective solution for your specific needs.

5. Alternative Sources of Funding: Explore other avenues for obtaining funds before borrowing from your whole life insurance policy. This could include tapping into emergency savings, negotiating payment arrangements with creditors, or seeking assistance from family or friends. Evaluating alternative options can help you assess the necessity of borrowing against your policy.

6. Potential Impact on Policy Performance: Consider how borrowing from your policy may affect its long-term performance and growth. Evaluate the historical performance of the policy, including dividends and cash value growth. Assess if the potential impact on policy returns outweighs the benefits of accessing the funds through a loan.

7. Consultation with Financial Advisor: It’s always advantageous to seek guidance from a financial advisor before making significant financial decisions. A professional can evaluate your overall financial situation, assess the suitability of borrowing from your whole life insurance policy, and provide personalized advice based on your unique circumstances.

Considering these factors will help you make an informed decision about borrowing against your whole life insurance policy. Balancing your immediate financial needs with the long-term implications on policy value and protection is critical for maintaining financial stability while leveraging the benefits of your insurance policy.

Now that we have explored the factors to consider, let’s dive into the question of how much you can borrow from your whole life insurance policy.

How Much Can You Borrow from Whole Life Insurance?

The amount you can borrow from your whole life insurance policy depends on several factors, including the cash value of your policy and the borrowing provisions set by your insurance company. Here’s an overview of how the borrowing amount is typically determined:

1. Percentage of Cash Value: Most insurance companies set a borrowing limit as a percentage of your policy’s cash value. This percentage may vary, but it’s common for insurers to offer loans between 70-90% of the cash value. For example, if your policy has a cash value of $100,000 and the borrowing limit is 80%, you could potentially borrow up to $80,000.

2. Outstanding Policy Loans: If you have existing policy loans or outstanding loan balances, the amount you can borrow may be reduced. The insurance company will consider the total outstanding loan balance when determining the available borrowing amount.

3. Policy Terms and Provisions: The specific terms and provisions of your whole life insurance policy will also impact the borrowing amount. Some policies may have restrictions or limitations on the borrowing provisions, so it’s crucial to review your policy documents or consult with your insurance company to understand any specific conditions or limitations.

4. Age and Health of the Insured: Although not directly related to the borrowing amount, it’s important to consider that the age and health of the insured individual can impact the overall cash value accumulation. Younger policyholders tend to have more time for the cash value to grow, potentially resulting in larger borrowing amounts in the future.

Keep in mind that the borrowing amount from your whole life insurance policy is not a lump sum disbursement. Instead, it is typically accessed through loans, allowing you to borrow only what you need at any given time. Depending on your policy and specific circumstances, you may have the option to take multiple loans over the life of the policy, up to the allowable borrowing limit.

Before making any borrowing decisions, it’s important to carefully evaluate your financial needs, repayment capacity, and the impact on the cash value and death benefit of your policy. It’s also recommended to consult with your insurance company or a financial advisor to fully understand the borrowing provisions and any potential consequences associated with borrowing against your policy.

Now that we have discussed how much you can borrow from your whole life insurance policy, let’s move on to the repayment process for these loans.

The Repayment Process for Whole Life Insurance Loans

When you borrow against your whole life insurance policy, it’s crucial to understand the repayment process for the loans taken. Repaying the loan is important to maintain the financial integrity of your policy and ensure the long-term benefits of the coverage. Let’s explore the repayment process for whole life insurance loans:

1. Loan Repayment Options: Whole life insurance policies generally provide various options for loan repayment. The most common repayment options include paying only the interest on the loan, making regular principal and interest payments, or allowing the loan to accrue interest and be repaid upon policy surrender or death. It is essential to discuss these options with your insurance company to determine the best repayment strategy for your specific needs.

2. Interest Accrual: Similar to traditional loans, whole life insurance loans accrue interest. The interest rate is typically determined by the insurance company and stated in the policy terms. It’s crucial to understand the interest rate being charged and the frequency at which it is compounded. By making regular interest payments, you can help minimize the impact of interest accumulation on the outstanding loan balance.

3. Impact on Cash Value and Death Benefit: Loan repayment affects both the cash value and the death benefit of your whole life insurance policy. As you repay the loan, the cash value gradually increases, and the policy’s death benefit is restored to its original amount. This balancing act between loan repayment and maintaining the desired level of coverage is essential to consider when managing your policy and loan repayment strategy.

4. Repayment Period: Whole life insurance loans typically have a specified repayment period. The repayment period can range from a few years to the remainder of the insured’s lifetime. It’s important to understand the duration of the repayment period and ensure that the loan can be repaid within the specified timeframe.

5. Flexibility in Repayment: Whole life insurance loans usually offer flexibility in repayment. You can typically make additional principal payments or even repay the loan in full at any time without incurring penalties. Taking advantage of this flexibility can help reduce the overall interest paid and shorten the repayment period.

6. Consequences of Non-repayment: It’s crucial to prioritize loan repayment to maintain the financial integrity of your policy. Failure to repay the loan and interest can result in a reduction of the cash value, policy lapses, or a reduced death benefit. Before taking a loan, it’s vital to assess your ability to meet the repayment obligations and obligations to avoid potential adverse effects on the policy.

Understanding the repayment process and your responsibilities as a borrower is essential for the long-term success of your whole life insurance policy. It’s recommended to stay in regular communication with your insurance company, monitor the outstanding loan balance, and ensure timely loan repayments.

Now that we’ve explored the repayment process for whole life insurance loans, let’s discuss the advantages of borrowing from your policy.

Advantages of Borrowing from Whole Life Insurance

Borrowing from your whole life insurance policy offers several advantages that can provide financial flexibility and convenience. Let’s explore the benefits of tapping into the cash value of your policy:

1. Access to Funds: Borrowing from your whole life insurance policy allows you to access funds when you need them most. Whether you’re facing unexpected medical expenses, education costs, or a financial emergency, having the ability to borrow against your policy provides a readily available source of funds.

2. No Credit Checks or Loan Approvals: Unlike traditional loans, borrowing from your whole life insurance policy doesn’t require credit checks or loan approvals. Since you are essentially borrowing from yourself and using the cash value as collateral, the process is typically much simpler and faster.

3. Lower Interest Rates: Whole life insurance policy loans often come with lower interest rates compared to other forms of borrowing, such as personal loans or credit cards. This can result in significant interest savings over time, making it a more cost-effective borrowing option.

4. Flexibility in Repayment: Whole life insurance loans offer flexibility in repayment. You have the ability to choose repayment options, such as making interest-only payments or paying both interest and principal. Additionally, there is often no set repayment schedule, allowing you to repay the loan at your own pace.

5. Tax Advantages: The loan proceeds from your whole life insurance policy are typically tax-free. This means that you don’t have to pay income taxes on the borrowed amount. However, it’s important to consult with a tax advisor to understand the potential tax implications based on your specific circumstances.

6. Continuous Coverage and Cash Value Growth: Borrowing from your policy allows you to maintain your life insurance coverage and keep the cash value portion of your policy intact. By repaying the loan, you ensure that the death benefit remains intact and the cash value continues to grow over time.

7. Preserve Other Investments: By borrowing from your whole life insurance policy, you can preserve other investments or savings you may have. Instead of tapping into other assets or depleting your emergency fund, you can leverage the available cash value without disrupting your other financial goals.

8. No Restrictions on Use: There are typically no restrictions on how you can use the loan proceeds from your whole life insurance policy. Whether you need the funds for personal expenses, debt consolidation, or business purposes, you have the freedom to allocate the borrowed amount as per your specific needs.

Borrowing from your whole life insurance policy can provide you with financial flexibility, favorable repayment terms, and the ability to leverage the cash value of your policy. However, it’s important to carefully consider your repayment capacity, the impact on policy performance, and the long-term implications of borrowing before making any decisions.

Now that we’ve explored the advantages of borrowing from your policy, let’s discuss the risks and limitations associated with borrowing from whole life insurance.

Risks and Limitations of Borrowing from Whole Life Insurance

While borrowing from your whole life insurance policy can offer financial flexibility, it’s important to be aware of the risks and limitations involved. Consider the following factors before deciding to borrow against your policy:

1. Reduction in Death Benefit: When you borrow from your whole life insurance policy, the outstanding loan balance is deducted from the death benefit. This means that if you were to pass away before repaying the loan, your beneficiaries would receive a reduced death benefit amount. It’s crucial to weigh the potential impact on your loved ones’ financial security if you need the full death benefit for their well-being.

2. Lower Cash Value Growth: Borrowing against your policy reduces the cash value available for growth. The loan amount is deducted from the cash value, limiting its potential growth over time. It’s important to evaluate the impact on your long-term financial goals and consider if the reduction in cash value growth is outweighed by the immediate need for funds.

3. Repayment Obligations: Failing to repay the loan or not making regular interest payments can have negative consequences. It can result in the reduction of the cash value, policy lapses, or a reduced death benefit. Ensure that you have a realistic repayment plan in place and consider the impact on your budget and overall financial stability before taking a loan.

4. Interest Accumulation: Just like any other loan, borrowing from your whole life insurance policy incurs interest. If not managed properly, the interest can accumulate over time, adding to your overall debt burden. It’s important to understand the interest rate, repayment terms, and consider the impact of interest accrual on the loan balance.

5. Potential Policy Surrender: If the loan balance and interest accrual become unmanageable, you may be forced to surrender or terminate your whole life insurance policy. Surrendering the policy can result in the loss of coverage, the cash value accumulated, and potential tax consequences. Carefully evaluate your financial situation and ability to meet the loan obligations to avoid the risk of policy surrender.

6. Impact on Policy Performance: Borrowing from your policy can impact its overall performance. The cash value growth may be hindered, reducing the potential returns and dividends. Before taking a loan, consider the long-term implications on the policy’s financial benefits and assess if the short-term borrowing needs outweigh the potential reduction in policy performance.

7. Loss of Dividend Earnings: By borrowing against your whole life insurance policy, you may forego the opportunity to earn dividends on the loaned portion. Dividends can enhance the growth of the cash value, so it’s important to consider how missing out on dividend earnings may impact the overall value of your policy.

Understanding and managing these risks and limitations will help you make an informed decision about borrowing against your whole life insurance policy. It’s advisable to consult with your insurance company or a financial advisor to fully grasp the potential consequences and implications specific to your policy and personal circumstances.

Now that we have explored the risks and limitations of borrowing from whole life insurance, let’s summarize the key points we’ve discussed in this article.

Conclusion

Whole life insurance offers a unique combination of lifelong coverage and a cash value component, providing policyholders with both financial protection and a savings or investment element. Borrowing against your whole life insurance policy can be a valuable option when you need access to funds, offering advantages such as convenience, lower interest rates, and flexible repayment terms.

However, before making the decision to borrow from your policy, it’s essential to carefully evaluate the factors involved. Consider the purpose of the loan, your ability to repay, and the potential impact on the cash value and death benefit of your policy.

Advantages of borrowing from whole life insurance include the ability to access funds without credit checks, lower interest rates compared to traditional loans, and the preservation of other investments. Additionally, the cash value continues to grow, and there are no restrictions on how you use the loan proceeds.

However, there are risks and limitations to be aware of, including a reduction in the death benefit and potential impact on cash value growth. Failure to repay the loan can lead to adverse consequences, such as a decrease in the cash value, policy lapse, or loss of coverage. It’s crucial to carefully manage the repayment obligations and consider the long-term implications on policy performance.

In conclusion, borrowing from your whole life insurance policy can be a valuable tool that offers financial flexibility and access to funds when needed. However, it should be approached with careful consideration of the risks and limitations involved. It’s recommended to consult with your insurance company or a financial advisor to fully understand the implications specific to your policy and individual circumstances.

By understanding the benefits, risks, and considerations associated with borrowing from whole life insurance, you can make an informed decision that aligns with your financial goals and needs.