Home>Finance>How Do You Calculate The Cash Value Of Whole Life Insurance?

Finance

How Do You Calculate The Cash Value Of Whole Life Insurance?

Published: October 14, 2023

Learn how to calculate the cash value of whole life insurance and manage your finances effectively. Find expert advice and tips on finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Whole Life Insurance?

- The Importance of Knowing the Cash Value

- Factors Affecting the Cash Value of Whole Life Insurance

- How to Calculate the Cash Value of Whole Life Insurance

- Method 1: Use the Policy’s Annual Statement

- Method 2: Utilize the Surrender Value Formula

- Method 3: Consult with the Insurance Company or Agent

- Understanding the Cash Value and its Implications

- Conclusion

Introduction

When it comes to financial planning and securing your future, insurance is an essential component. Among the various types of insurance, whole life insurance is a popular choice for many individuals. While it provides lifelong coverage and a death benefit to your beneficiaries, it also offers a unique feature known as the cash value.

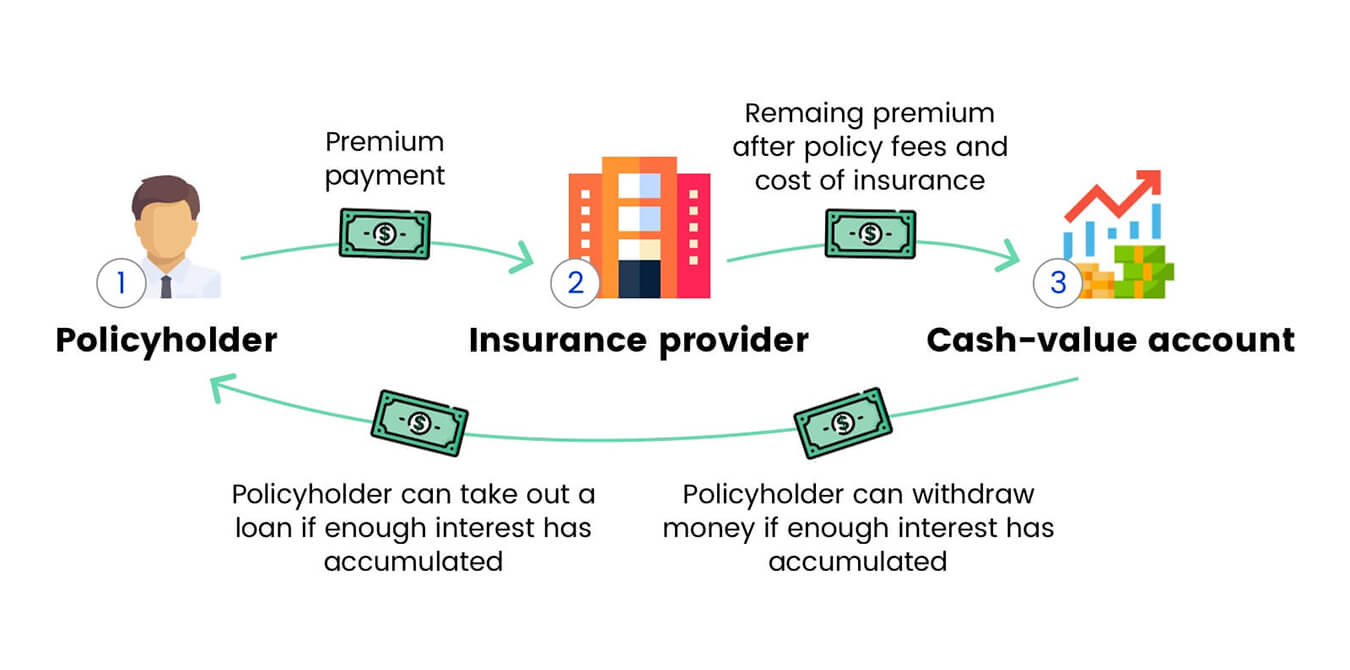

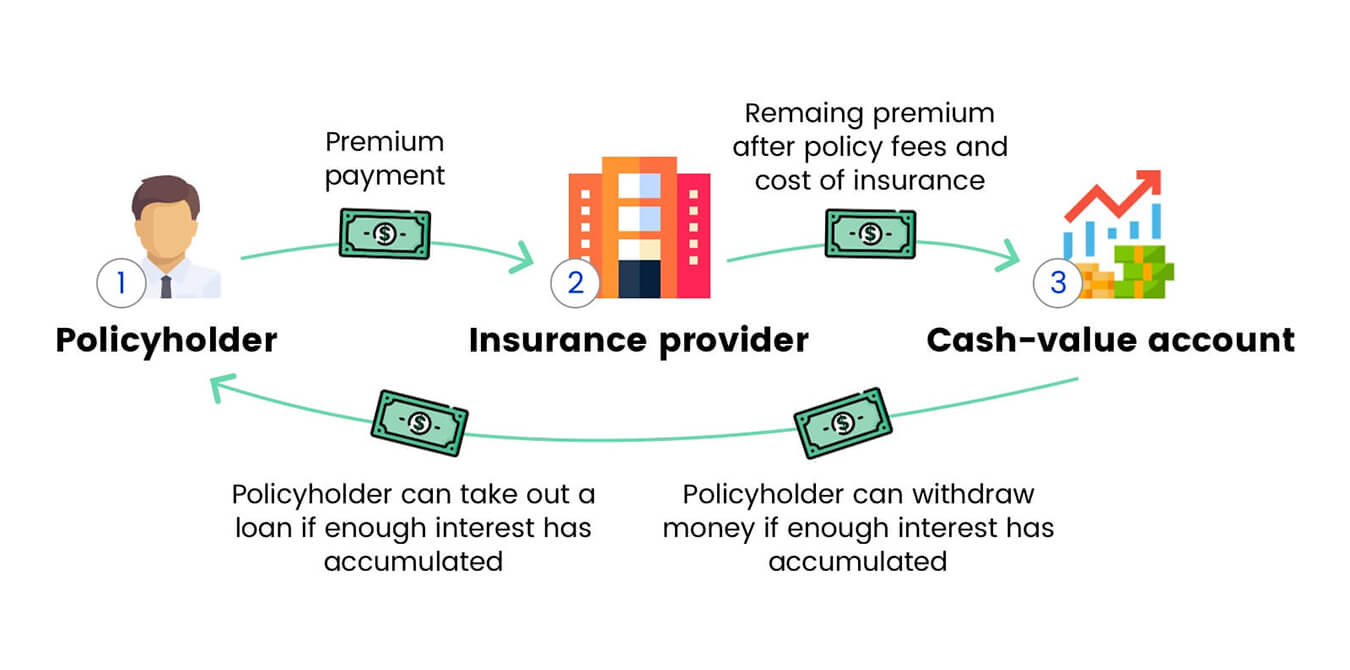

The cash value of a whole life insurance policy is the savings component, which grows over time as you continue to pay premiums. It can serve as a valuable asset that can be accessed during your lifetime for various financial needs, such as emergencies or retirement planning.

Understanding how to calculate the cash value of your whole life insurance policy is crucial. It enables you to make informed decisions regarding your financial goals and assess the potential benefits of your policy. In this article, we will delve into the importance of knowing the cash value, the factors that affect it, and the methods to calculate it.

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance policy that provides coverage for the entirety of your life, as long as the premiums are paid. Unlike term life insurance, which only covers a specific period, whole life insurance offers lifelong protection and includes a savings component known as the cash value.

The cash value is an investment component that grows over time. A portion of the premium payments goes towards the cash value, which accumulates on a tax-deferred basis. This means that the cash value grows without incurring taxes until you withdraw funds from it.

One of the significant benefits of whole life insurance is that it guarantees a death benefit, which is the amount paid to your beneficiaries upon your passing. Additionally, the cash value can also be accessed during your lifetime. This feature allows you to utilize the funds for various purposes, such as supplementing retirement income, funding education expenses, or covering unexpected financial emergencies.

Whole life insurance policies often come with fixed premiums, meaning that the premium amount remains consistent throughout the policy’s duration. This predictability can be advantageous for long-term financial planning, as you can budget for the premium payments without worrying about increases in the future.

It is essential to note that whole life insurance policies may offer different variations or optional features, such as the ability to customize the death benefit amount or add riders for additional coverage. Consulting with an insurance professional can help you understand the specific terms and features of the policy and tailor it to meet your individual needs.

The Importance of Knowing the Cash Value

Understanding the cash value of your whole life insurance policy is crucial for several reasons.

Firstly, knowing the cash value allows you to have a clear understanding of the overall value of your policy. This knowledge can be empowering as it provides a sense of security and peace of mind, knowing that you have built a financial asset that can be tapped into if needed.

Secondly, the cash value can serve as a valuable resource in times of financial need. Life is unpredictable, and unforeseen circumstances such as medical emergencies or unexpected expenses may arise. Being aware of the cash value enables you to assess whether your policy has accumulated sufficient funds to help you navigate such situations without resorting to other costly alternatives like borrowing.

Furthermore, the cash value can play a significant role in your long-term financial planning. As you approach retirement or have other financial goals, the cash value becomes an asset that can be utilized to supplement your income or fund your aspirations. By understanding the amount and growth potential of the cash value, you can make informed decisions about when and how to access these funds.

Another essential aspect of knowing the cash value is the potential to leverage it for loans or withdrawals. Some whole life insurance policies allow policyholders to borrow against the cash value at a low interest rate. This can be particularly beneficial when traditional sources of credit may be inaccessible or costly. However, it’s important to understand the ramifications of borrowing from the cash value, as it may reduce the death benefit and could have tax implications.

In summary, knowing the cash value of your whole life insurance policy allows you to have a comprehensive understanding of its value, provides financial security in times of need, and aids in long-term financial planning. Therefore, it is vital to regularly review and evaluate the cash value of your policy and understand the options available to you.

Factors Affecting the Cash Value of Whole Life Insurance

The cash value of a whole life insurance policy is influenced by several factors. Understanding these factors can help you assess the growth potential and make informed decisions regarding your policy.

1. Premiums: The amount you pay in premiums directly impacts the cash value. Higher premium payments contribute more towards the cash value and can accelerate its growth.

2. Policy Expenses: Whole life insurance policies have administrative and mortality expenses associated with them. These expenses are deducted from the premium payments and can have an impact on the cash value.

3. Interest Rates: The interest rate credited to the cash value is an essential factor in its growth. Insurance companies typically guarantee a minimum interest rate, but there may be opportunities for the cash value to earn a higher rate based on market conditions or policy performance.

4. Dividends: Some whole life insurance policies are eligible for dividends, which are a portion of the insurance company’s profits. Dividends can be used to increase the cash value or provide additional death benefit coverage.

5. Policy Loans and Withdrawals: Borrowing against the cash value or making withdrawals can impact its growth. Outstanding loans reduce the available cash value, and withdrawals may result in surrender charges or tax consequences.

6. Policy Performance: The overall performance of the insurance company and the investment vehicles within the policy can affect the cash value. It’s important to review the historical performance of the insurer and consider any guarantees or riders that may impact the growth potential.

7. Policy Duration: The longer the policy has been in force, the more time there is for the cash value to accumulate and grow.

8. Age and Health: Your age and health at the time of policy initiation can influence the cash value. Younger and healthier individuals may have a longer time horizon for the cash value to grow.

It’s crucial to review your policy documents and speak with your insurance agent or financial advisor to understand how these factors specifically apply to your whole life insurance policy. By considering these factors, you can make informed decisions to optimize the growth and value of your policy’s cash value.

How to Calculate the Cash Value of Whole Life Insurance

Calculating the cash value of your whole life insurance policy can be done using various methods. It is important to note that the specific calculation may vary depending on the insurance company and policy details. Here are three common methods:

Method 1: Use the Policy’s Annual Statement: Your insurance company typically provides an annual statement that outlines the current cash value of your policy. This statement may also include details such as premiums paid, policy expenses, dividends, and any outstanding loans or withdrawals. Reviewing this statement can give you an up-to-date understanding of your policy’s cash value.

Method 2: Utilize the Surrender Value Formula: The surrender value is the amount you would receive if you were to surrender or cancel your policy. This value is typically lower than the cash value, as surrendering your policy often incurs fees and penalties. The surrender value formula takes into account factors such as premiums paid, policy years in force, and any deductions for expenses or loans. You can consult your insurance company or policy documentation to obtain the surrender value formula specific to your policy.

Method 3: Consult with the Insurance Company or Agent: If you are unsure about how to calculate the cash value of your whole life insurance policy or need specific details, it is recommended to reach out to your insurance company or agent. They can provide you with the most accurate and up-to-date information regarding your policy’s cash value.

It’s important to bear in mind that the cash value of your policy is subject to change. Factors such as premium payments, policy expenses, interest rates, and other policy-related factors can impact the growth and value of the cash value over time. Regularly reviewing your policy documents, statements, and communicating with your insurance company or agent can ensure that you stay informed about the cash value of your whole life insurance policy.

Method 1: Use the Policy’s Annual Statement

One of the simplest ways to calculate the cash value of your whole life insurance policy is by using the annual statement provided by your insurance company. The annual statement is a document that outlines the current status and performance of your policy, including the cash value.

Typically, the annual statement will provide detailed information about your premium payments, policy expenses, dividends (if applicable), outstanding loans or withdrawals, and the current cash value of the policy. It will also indicate the growth of the cash value over time.

To calculate the cash value using the annual statement, locate the section that specifically mentions the cash value or cash surrender value. It is usually prominently displayed in the statement.

The cash value listed in the annual statement represents the total amount of money that has accumulated in your policy’s savings component. This value reflects the premiums you have paid, any interest credited to the cash value, and any policy-related deductions or fees.

It is important to note that the cash value mentioned in the annual statement may not be the same as the surrender value. The surrender value may include deductions for surrender charges or penalties if you were to cancel or terminate the policy.

By referencing the policy’s annual statement, you can easily determine the cash value of your whole life insurance policy and track its growth over time. Regularly reviewing the annual statement can help you stay informed about the current value of your policy’s cash value and evaluate its performance in achieving your financial goals.

If you have any questions or need clarification regarding the cash value mentioned in the annual statement, it is advisable to contact your insurance company or agent. They will be able to provide further assistance and address any inquiries you may have.

Method 2: Utilize the Surrender Value Formula

Another method to calculate the cash value of your whole life insurance policy is by utilizing the surrender value formula. The surrender value represents the amount you would receive if you were to surrender or cancel your policy.

The surrender value formula takes into account several factors specific to your policy. These factors may include the total premiums paid, the number of years the policy has been in force, any deductions for policy expenses, outstanding loans or withdrawals, and the interest credited to the cash value.

To obtain the surrender value formula for your policy, you can consult your insurance company or refer to your policy documentation. The surrender value formula outlines the specific calculations used by the insurance company to determine the surrender value.

Calculating the cash value using the surrender value formula typically involves inputting the relevant data, such as the number of years the policy has been in force and the total premiums paid. Once you have the necessary information, you can apply the formula to obtain an estimate of the current cash value.

It’s important to note that the surrender value may be lower than the cash value, as surrendering the policy often incurs fees, penalties, and other deductions. The surrender value formula takes these factors into account.

While the surrender value formula can give you an estimate of the cash value, it is recommended to reach out to your insurance company or agent for the most accurate and up-to-date information. They will have access to the specific details of your policy and can provide you with the precise cash value.

By utilizing the surrender value formula, you can gain insights into the current cash value of your whole life insurance policy and understand the potential impact of surrendering or canceling the policy. It is important to carefully evaluate your policy and consider all the implications before making any decisions regarding the cash value.

Method 3: Consult with the Insurance Company or Agent

If you are unsure about how to calculate the cash value of your whole life insurance policy or need specific details, it is always a good idea to consult with your insurance company or agent. They are the experts in the field and can provide you with the most accurate and up-to-date information regarding your policy’s cash value.

Your insurance company or agent will have access to your policy details and can provide you with the specific calculations and data necessary to determine the cash value. They can explain the various factors affecting the cash value, such as premiums paid, policy expenses, interest rates, dividends (if applicable), and any outstanding loans or withdrawals.

By consulting with your insurance company or agent, you can address any questions or concerns you may have about the cash value of your policy. They can walk you through the process of calculating the cash value and help you understand the implications of making changes, such as taking out a loan against the cash value or making withdrawals.

Additionally, your insurance company or agent can provide valuable guidance on how to optimize the cash value growth and tailor your policy to align with your financial goals. They may suggest strategies to maximize the cash value accumulation or provide options for riders or additional features that can enhance the value of your policy.

When consulting with your insurance company or agent, it’s essential to come prepared with your policy number and any relevant policy documents or statements. This will help facilitate the conversation and ensure that the information provided is accurate and specific to your policy.

Remember, your insurance company or agent is there to assist you and provide guidance. Don’t hesitate to reach out to them whenever you have questions about the cash value or any other aspect of your whole life insurance policy. Their expertise will help you make informed decisions and maximize the benefits of your policy.

Understanding the Cash Value and its Implications

The cash value of a whole life insurance policy holds significant implications for policyholders. It is crucial to have a clear understanding of its meaning and the potential impact it can have on your financial planning. Here’s what you need to know:

1. Asset Accumulation: The cash value accumulates over time as you make premium payments. It grows on a tax-deferred basis, meaning you won’t owe taxes on the growth until you withdraw funds from it. This asset accumulation can be a valuable resource in times of need or for achieving financial goals.

2. Accessibility: The cash value is accessible during your lifetime, providing flexibility and liquidity. You can potentially borrow against it or make withdrawals to meet financial obligations or fund expenses such as education, emergencies, or retirement.

3. Policy Loans: Borrowing against the cash value comes with certain advantages, such as lower interest rates compared to other types of loans. However, it’s important to remember that outstanding loans can reduce the death benefit and potentially impact the cash value growth.

4. Surrender or Termination: Surrendering or terminating a whole life insurance policy means giving up the coverage and forfeiting the policy’s benefits. In such cases, the cash value, minus any applicable fees or surrender charges, may be returned to the policyholder.

5. Tax Implications: While the cash value grows tax-deferred, there may be tax implications when making withdrawals or surrendering the policy. It’s advisable to consult with a tax professional to understand the tax consequences specific to your situation.

6. Impact on Death Benefit: Any outstanding loans or withdrawals against the cash value may reduce the death benefit paid to beneficiaries upon the policyholder’s passing. It’s crucial to monitor and manage the cash value to ensure it aligns with your intended financial legacy.

7. Estate Planning: The cash value of a whole life insurance policy can play a role in estate planning. It can provide a source of financial support for your beneficiaries or be used to cover estate taxes or other expenses.

Understanding the cash value and its implications empowers policyholders to make informed decisions regarding their whole life insurance policies. It allows for effective financial planning, ensures that the policy aligns with individual goals, and maximizes the benefits of this valuable financial asset.

To gain a comprehensive understanding of the cash value and its specific implications within your whole life insurance policy, consult with your insurance company, agent, or a financial advisor. They can provide personalized guidance based on your unique circumstances and financial objectives.

Conclusion

Knowing the cash value of your whole life insurance policy is essential for effective financial planning and understanding the potential benefits it holds. The cash value represents the savings component of your policy and can serve as a valuable asset for various financial needs.

In this article, we explored the importance of understanding the cash value, factors influencing its growth, and how to calculate it using different methods. By referencing your policy’s annual statement, utilizing the surrender value formula, or consulting with your insurance company or agent, you can obtain accurate information about the cash value.

Understanding the cash value empowers you to make informed decisions about your policy, such as leveraging it for loans or withdrawals, supplementing retirement income, or funding other financial goals. It also allows you to assess the impact of surrendering your policy and consider estate planning implications.

Remember, the cash value is a dynamic component that can change over time due to factors like premium payments, policy expenses, interest rates, and policy performance. Regularly reviewing your policy, staying in touch with your insurance company or agent, and seeking professional advice can help you monitor and optimize the cash value.

As with any financial decision, it’s crucial to carefully evaluate your specific needs, goals, and circumstances before taking action. Assessing the cash value and its implications within the context of your overall financial plan will ensure you make the most of your whole life insurance policy.

Therefore, take the time to review your policy documents, consult with experts, and stay informed about the cash value of your policy. By doing so, you can confidently navigate the world of whole life insurance and make decisions that best align with your financial well-being.