Home>Finance>How Much Does A “Texting While Driving” Ticket Increase Auto Insurance Premiums?

Finance

How Much Does A “Texting While Driving” Ticket Increase Auto Insurance Premiums?

Published: December 19, 2023

Find out how a "Texting While Driving" ticket can impact your auto insurance premiums and learn more about the financial implications of this offense.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Texting while driving is not only dangerous but also against the law in many states. It poses a significant risk to both the driver and other road users, as it diverts attention from the road and increases the likelihood of accidents. To curb this hazardous behavior, law enforcement agencies have implemented strict penalties and fines for individuals caught texting while driving.

One consequence of receiving a texting while driving ticket that often goes unnoticed is the impact it can have on your auto insurance premiums. Many drivers are unaware that a violation of this nature can cause their insurance rates to skyrocket. Insurance companies view texting while driving as a reckless behavior that increases the risk of accidents, and they adjust premiums accordingly.

In this article, we will dive deeper into the subject of texting while driving tickets and explore how they can affect your auto insurance premiums. We will also examine the various factors that insurance companies consider when determining the increase in rates. Additionally, we will provide examples and case studies to illustrate the potential impact on insurance rates.

Furthermore, we will provide you with valuable tips to avoid texting while driving tickets altogether, helping you maintain a clean driving record and keep your insurance premiums at a reasonable level. It’s important to note that the information provided in this article serves as a general guide, and insurance rates can vary depending on individual circumstances and insurance providers.

By understanding the repercussions of texting while driving tickets on your auto insurance premiums and taking necessary precautions, you can protect yourself financially and contribute to safer roads for everyone.

Understanding Texting While Driving Tickets

Texting while driving refers to the act of composing, sending, or reading text messages, emails, or any other form of electronic communication while operating a motor vehicle. This behavior not only takes a driver’s attention away from the road but also impairs their ability to react quickly to potential hazards, increasing the risk of accidents.

The penalties for texting while driving vary from state to state, but they typically involve fines, points on your driver’s license, and even license suspension in some cases. Repeat offenders may face more severe consequences, such as higher fines or mandatory driver safety courses.

In recent years, the enforcement of laws against texting while driving has become more stringent, with law enforcement agencies using various methods to catch distracted drivers. These methods include plainclothes officers, patrol cars positioned to observe and catch offenders, and even the use of surveillance cameras in some areas.

It’s important to note that laws regarding texting while driving may also cover other forms of distraction, such as using social media, browsing the internet, or watching videos on mobile devices. These activities are considered equally dangerous and carry similar penalties and consequences.

To avoid getting a texting while driving ticket, it is crucial to abide by the laws in your state and prioritize the safety of yourself and others on the road. This means refraining from using your cell phone for any purpose while driving, unless you have a hands-free device or are making an emergency call where permitted.

Next, we will explore how receiving a texting while driving ticket can impact your auto insurance premiums and what factors insurance companies take into consideration when determining the increase in rates.

The Impact on Auto Insurance Premiums

Receiving a texting while driving ticket can have a significant impact on your auto insurance premiums. Insurance companies consider this violation as an indicator of risky behavior behind the wheel, which increases the likelihood of accidents and potential insurance claims.

Once you have been issued a texting while driving ticket, your insurance company may reclassify you as a high-risk driver. As a result, you can expect an increase in your insurance premiums. The exact amount of the increase will vary depending on several factors, such as your insurance provider, your driving history, and the specific circumstances of the violation.

In some cases, insurance companies may raise premiums by as much as 30% or even more for drivers with a texting while driving ticket on their record. This increase can be applied at the time of renewal or immediately after the ticket is issued, depending on your policy terms.

It’s worth noting that the impact on your premiums is not limited to just one billing cycle. Most insurance companies will consider the violation when reviewing your driving record for several years, resulting in higher premiums for an extended period of time.

Furthermore, if you already have other traffic violations or accidents on your record, the texting while driving ticket can compound the increase in your insurance premiums. Insurance companies will view this as a pattern of risky behavior, increasing the perceived level of risk associated with insuring you.

However, the impact on your insurance premiums may vary depending on your driving history and other mitigating factors. Some insurance companies offer accident forgiveness or other programs that can lessen the impact of a texting while driving ticket or even temporarily waive the surcharge.

In the next section, we will delve into the various factors that insurance companies take into account when determining the increase in rates after receiving a texting while driving ticket.

Factors that Determine the Increase

The increase in auto insurance premiums after receiving a texting while driving ticket is determined by several factors. Insurance companies take into account various aspects of your driving history and risk profile to calculate the surcharge applied to your premiums. Here are the key factors that influence the increase:

- Driving Record: Insurance companies closely examine your driving record to assess the level of risk you pose as a driver. If you have a history of traffic violations, accidents, or previous texting while driving tickets, the increase in your premiums may be higher.

- Type of Violation: The specific nature and severity of the violation will also impact the increase in your premiums. Texting while driving is considered a serious offense, and insurance companies may view it as a sign of careless or reckless behavior behind the wheel.

- Insurance Provider Policies: Each insurance company has its own policies and guidelines for determining the impact of violations on premiums. Some companies may have more lenient policies, while others may impose substantial surcharges for texting while driving tickets.

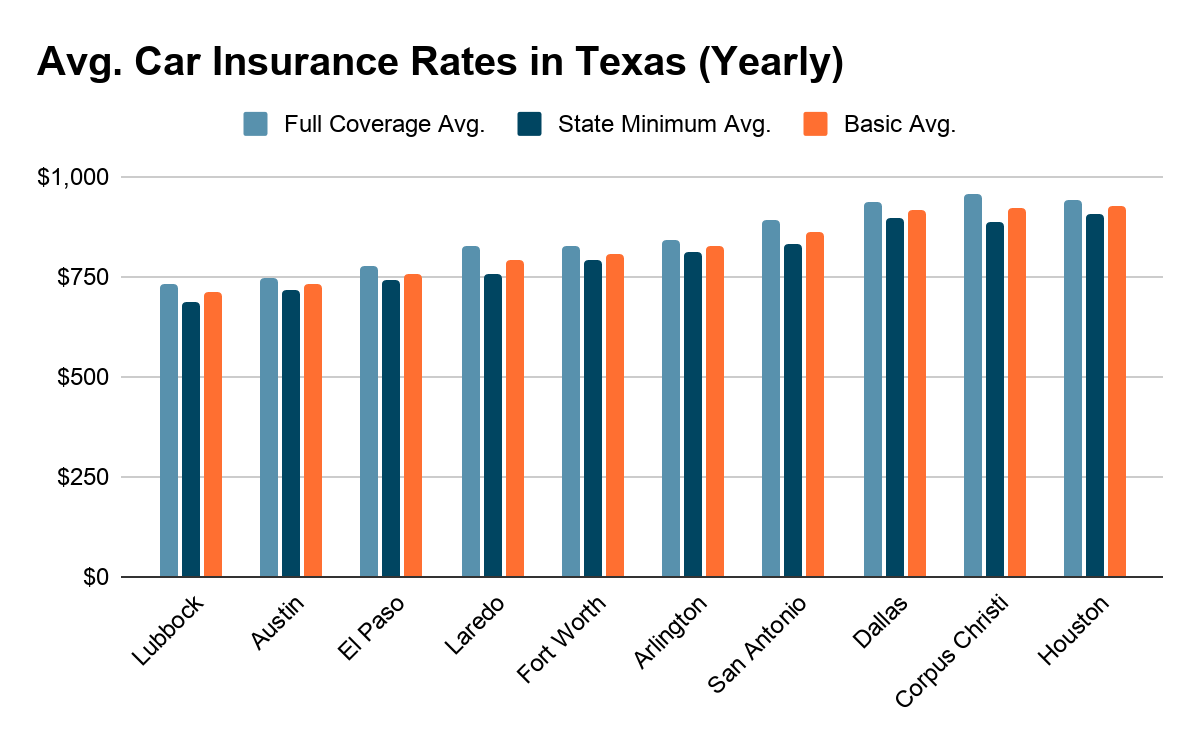

- Location: The state you reside in can also affect the increase in your insurance premiums. Some states have stricter regulations and higher penalties for texting while driving, which can lead to larger surcharges imposed by insurance companies.

- Age and Driving Experience: Younger and less experienced drivers may face a higher increase in premiums after receiving a texting while driving ticket. Insurance companies generally consider younger drivers to be more prone to risky behaviors, which can lead to greater premium surcharges.

- Other Factors: Insurance companies may take additional factors into account, such as the frequency of your violations, any prior claims you have made, and your overall credit history. These factors can further influence the increase in your premiums.

It’s important to be aware that the specific weight given to each factor may vary among insurance companies. This is why it is crucial to review your policy and consult with your insurance provider to fully understand how a texting while driving ticket will impact your premiums.

In the following sections, we will explore real-life case studies and provide examples to illustrate the potential impact of texting while driving tickets on auto insurance premiums.

Case Studies and Examples

Examining real-life case studies and examples can provide a better understanding of how texting while driving tickets can impact auto insurance premiums. While these examples are based on hypothetical situations, they highlight the potential increase in rates that drivers might face:

Case Study 1:

John, a 35-year-old driver with a clean driving record and no prior violations, receives a texting while driving ticket. His insurance company considers this violation and increases his premiums by 15% at his next renewal. John maintains a clean record moving forward and after three years, the surcharge associated with the violation is removed.

Case Study 2:

Lisa, a 23-year-old driver with a history of two speeding tickets, receives a texting while driving ticket. Due to her previous violations, her insurance company deems her a high-risk driver. As a result, her premiums increase by 25%, and her overall insurance cost becomes significantly higher than before the violation.

Case Study 3:

Michael, a 45-year-old driver, receives a texting while driving ticket. His insurance provider offers an accident forgiveness program, which mitigates the surcharge associated with the violation. As a result, Michael’s premiums remain unchanged, and he avoids the increase in rates. However, this program typically applies only to the first violation, and future violations may lead to higher premiums.

These case studies demonstrate how the impact of a texting while driving ticket can vary depending on factors such as driving history, age, and insurance company policies. It is important to note that the actual impact on insurance premiums may differ from these examples, and individual circumstances will play a significant role in determining the final increase.

In the next section, we will provide practical tips on how to avoid texting while driving tickets and maintain affordable auto insurance premiums.

Tips to Avoid Texting While Driving Tickets

To prevent texting while driving tickets and maintain affordable auto insurance premiums, it is essential to adopt safe driving habits. Here are some practical tips to help you avoid distractions and stay focused on the road:

- Put Your Phone Out of Reach: Before you start driving, ensure that your phone is placed in a location that is not easily accessible. This will reduce the temptation to pick it up and check for notifications or messages while driving.

- Use Voice Commands or Hands-Free Systems: If you need to make or answer a call, use hands-free technology or voice commands to ensure your hands remain on the wheel and your eyes on the road.

- Utilize Driving Apps: There are several apps available that can help minimize the distractions caused by your phone. These apps can automatically respond to incoming texts and calls, informing the sender that you’re driving and will respond later.

- Pull Over Safely: If you absolutely need to send a text or respond to a message, find a safe location to pull over and park before using your phone. Only use your phone once your vehicle is stationary.

- Designate a Passenger as a Navigator: If you need assistance with navigation or other tasks on your phone, ask a passenger to handle it for you. This will allow you to concentrate solely on driving.

- Enable Do Not Disturb Mode: Activate the “Do Not Disturb” mode on your phone or utilize the “Driving Mode” feature, if available. This will suppress notifications and prevent distractions while you’re behind the wheel.

- Lead by Example: If you have young or inexperienced drivers in your household, it is important to set a good example by not using your phone while driving. Teach them about the dangers of distracted driving and the importance of safe practices.

By following these tips and maintaining focused and distraction-free driving habits, you can significantly reduce the risk of receiving a texting while driving ticket. Additionally, practicing safe driving behaviors not only protects you and others on the road but also helps maintain lower auto insurance premiums.

In the concluding section, we will summarize the key points discussed in this article.

Conclusion

Texting while driving is a dangerous behavior that not only poses risks to your safety but can also have significant financial consequences. Receiving a texting while driving ticket can lead to an increase in your auto insurance premiums, as insurance companies consider it a reflection of risky driving behavior.

The impact on your premiums depends on various factors, such as your driving record, the severity of the violation, and your insurance provider’s policies. Insurance companies may raise premiums by a significant percentage, potentially affecting your budget for several years.

However, by understanding the consequences of texting while driving tickets and adopting safe driving practices, you can avoid such violations and maintain affordable insurance premiums. Putting your phone out of reach, using hands-free technology, and utilizing driving apps are just a few precautions you can take to minimize distractions and stay focused on the road.

Remember that safe driving not only protects you and others on the road but also helps you maintain a clean driving record and lower insurance premiums. By setting a good example and educating others about the dangers of texting while driving, you contribute to creating a safer driving environment for everyone.

It is important to review your insurance policy and consult with your insurance provider to fully understand how a texting while driving ticket can impact your specific premiums. Each situation is unique, and the increase may vary depending on individual circumstances and insurance company policies.

By prioritizing safety and avoiding distractions while driving, you can protect both your finances and your well-being. Together, let’s work towards reducing the incidents of texting while driving and creating safer roads for all.