Finance

How Much Does California Owe Pension Funds?

Published: January 22, 2024

Find out the financial implications of California's pension obligations. Learn about the state's debt to pension funds and its impact on public finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

The Looming Pension Crisis: California's Growing Financial Burden

The Looming Pension Crisis: California’s Growing Financial Burden

As the fifth largest economy in the world, California boasts a thriving economy, technological innovation, and cultural diversity. However, beneath the surface of this prosperity lies a significant financial challenge that has been steadily growing over the years. The state’s pension funds are facing a mounting debt that has raised concerns about its long-term financial stability. This issue has gained attention not only within the state but also across the nation, sparking debates and calls for action.

California’s pension system, which provides retirement benefits to public employees, has been grappling with a substantial shortfall. The magnitude of this shortfall has sparked worries about its potential impact on the state’s overall financial health. This article aims to delve into the current state of California’s pension funds, shed light on the growing pension debt, explore its implications for the state’s budget, and consider proposed solutions to address this pressing issue.

Join us as we navigate through the complexities of California’s pension crisis, examining its origins, impact, and potential pathways towards a more secure financial future for the state and its residents.

The Current State of California Pension Funds

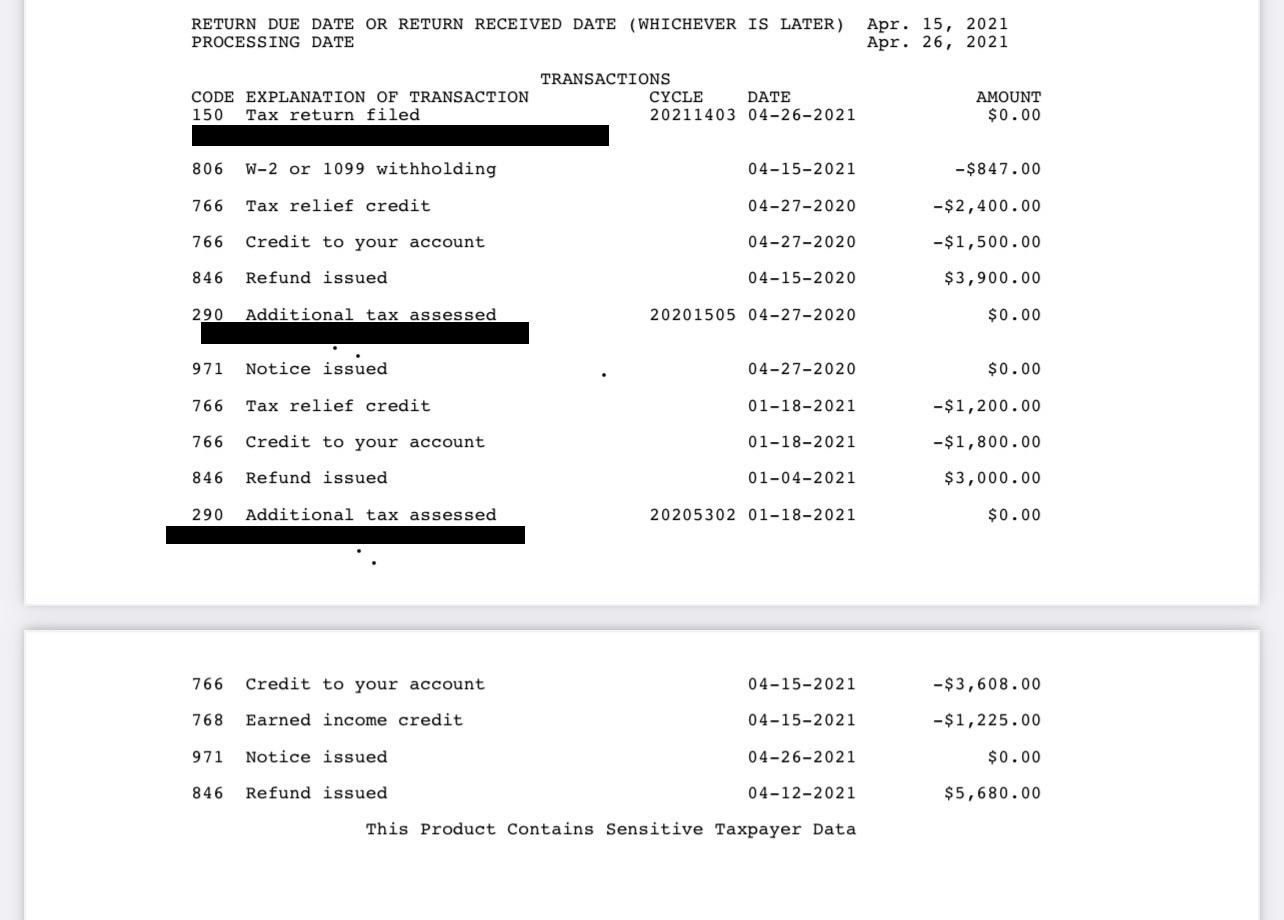

California’s pension funds, including the California Public Employees’ Retirement System (CalPERS) and the California State Teachers’ Retirement System (CalSTRS), play a pivotal role in providing retirement security for public sector employees. These funds are designed to ensure that teachers, state workers, and other public employees receive the benefits they were promised upon retirement.

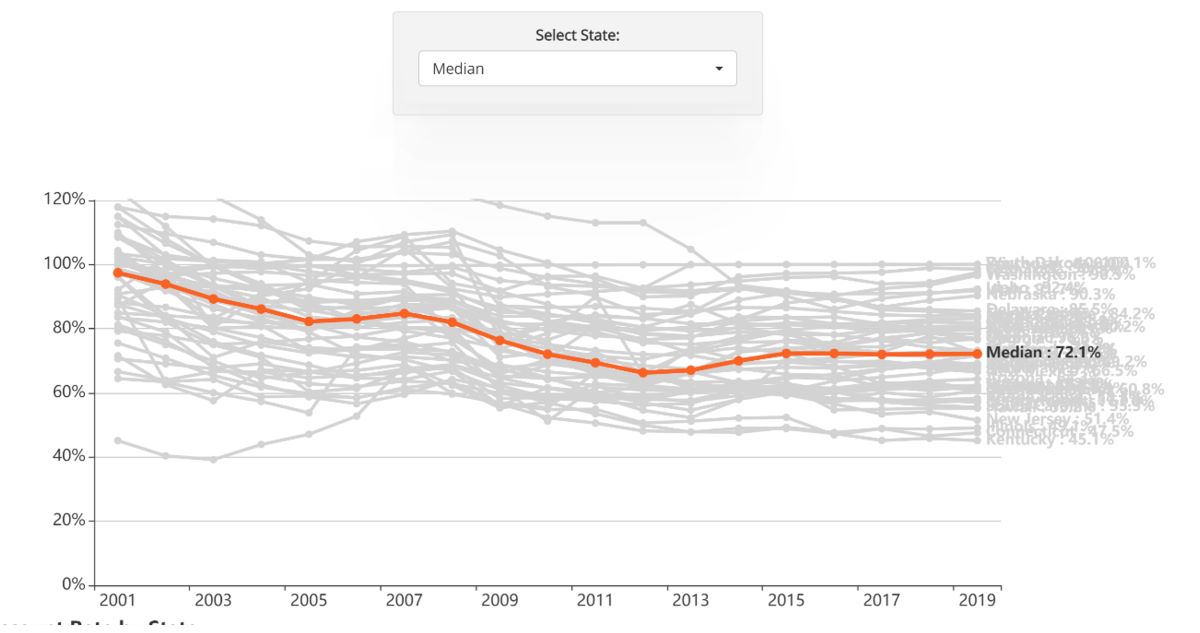

However, the financial health of these pension funds has been a cause for concern in recent years. The sustained low interest rates, inadequate contributions, and investment underperformance have contributed to the growing gap between the funds’ assets and their long-term obligations. This imbalance has led to a substantial unfunded liability, signaling a pressing need for remedial action.

CalPERS, the largest public pension fund in the United States, covers approximately 2 million public employees and retirees. Despite its size and influence, CalPERS has faced challenges in meeting its investment targets, leading to heightened apprehensions about its ability to fulfill its long-term commitments.

Similarly, CalSTRS, which provides retirement benefits to California’s educators, has encountered its own set of financial hurdles. The system’s unfunded liability has raised concerns about the sustainability of pension payments to retired teachers, prompting calls for strategic interventions to safeguard the retirement security of educators.

It is crucial to recognize that the financial well-being of these pension funds directly impacts the retirement security of public employees and teachers who have dedicated their careers to serving the community. The current state of California’s pension funds underscores the need for proactive measures to address the underlying financial challenges and ensure the long-term sustainability of the pension system.

The Growing Pension Debt

California’s pension debt has been steadily mounting, presenting a formidable challenge to the state’s financial stability. The unfunded liabilities of the state’s pension funds have surged in recent years, reflecting a growing gap between the funds’ assets and the benefits promised to public employees and educators upon retirement.

One of the primary contributors to the escalating pension debt is the disparity between the funds’ investment returns and their long-term obligations. Despite efforts to achieve target investment returns, the prolonged low-interest-rate environment and volatile market conditions have impeded the funds’ ability to generate sufficient returns to cover their liabilities.

Furthermore, inadequate contributions from employers and employees have exacerbated the pension debt, as the funds rely on consistent and robust contributions to maintain their financial health. The shortfall in contributions has further widened the gap between the funds’ assets and their obligations, amplifying the financial strain on the pension system.

The growing pension debt has raised concerns about the sustainability of the state’s pension funds and their capacity to fulfill their commitments to retirees. This mounting financial burden has prompted discussions about the long-term implications for public employees, educators, and the state’s overall fiscal outlook.

Addressing the root causes of the pension debt is essential to mitigate the financial risks associated with the unfunded liabilities. Proactive measures and strategic reforms are imperative to stabilize the pension funds and ensure the continued delivery of retirement benefits to public employees and educators. As we delve deeper into the impact of the pension debt on California’s budget, it becomes evident that effective solutions are crucial to safeguard the state’s financial future.

The Impact on California’s Budget

The burgeoning pension debt in California has significant implications for the state’s budgetary framework, exerting pressure on public finances and resource allocation. As the unfunded liabilities of the pension funds continue to escalate, the state faces the challenge of balancing its budget while addressing the mounting financial obligations associated with pension payments.

One of the key repercussions of the pension debt is the diversion of a substantial portion of the state’s budget towards meeting pension obligations. With a larger share of financial resources directed to pension payments, the capacity to fund essential public services and infrastructure projects becomes constrained. This allocation dilemma poses a considerable hurdle in effectively addressing the diverse needs of California’s residents and communities.

Moreover, the escalating pension debt can lead to heightened fiscal stress, potentially triggering difficult decisions related to taxation, expenditure reductions, or borrowing to bridge the budgetary gap. The resultant strain on the state’s financial resources may impede its ability to respond to emergent challenges and invest in critical areas such as education, healthcare, and public safety.

Furthermore, the impact on local governments and school districts within California cannot be overlooked. As pension costs escalate, these entities may face heightened financial burdens, limiting their capacity to deliver essential services and invest in local initiatives. The ripple effect of the pension debt extends beyond the state level, permeating various facets of public governance and service provision.

Addressing the impact of the pension debt on California’s budget necessitates a comprehensive approach that acknowledges the interconnectedness of fiscal responsibilities and public welfare. Mitigating the strain on the state’s budget requires strategic measures to stabilize the pension funds, enhance fiscal sustainability, and optimize resource allocation to support the diverse needs of California’s populace.

As we explore potential solutions to address the pension crisis, it becomes apparent that proactive interventions are essential to safeguard the state’s financial resilience and uphold its commitment to serving the welfare of its residents.

Proposed Solutions

Addressing California’s pension crisis necessitates a multifaceted approach that encompasses strategic reforms, collaborative efforts, and long-term financial planning. Several proposed solutions aim to mitigate the challenges posed by the growing pension debt and foster the sustainability of the state’s pension funds.

- Enhanced Funding Mechanisms: Implementing measures to bolster the funding of pension systems through increased contributions from employers, employees, or alternative revenue sources can help alleviate the strain on the funds and enhance their long-term solvency. By fortifying funding mechanisms, the pension funds can work towards closing the existing gap between assets and liabilities.

- Investment Optimization: Emphasizing prudent investment strategies and diversification of assets can enhance the resilience of pension funds against market volatility and yield more stable, long-term returns. By optimizing investment practices, the funds can strive to meet their financial obligations while mitigating the impact of economic fluctuations.

- Policy Reforms: Enacting legislative reforms to recalibrate pension benefits, retirement age requirements, and contribution structures can contribute to the sustainable management of pension liabilities. Policy adjustments that align pension provisions with demographic shifts and economic realities can play a pivotal role in ensuring the viability of the pension system.

- Transparency and Accountability: Enhancing transparency in pension fund management and fostering accountability in financial stewardship can instill public confidence and facilitate informed decision-making. Transparent reporting on fund performance, liabilities, and funding strategies can engender trust and facilitate constructive dialogue on the management of pension obligations.

- Collaborative Governance: Fostering collaboration among stakeholders, including public sector unions, policymakers, and financial experts, can facilitate the development of sustainable pension solutions. Engaging in constructive dialogue and partnership can yield innovative approaches to address the pension crisis while considering the diverse perspectives and interests of involved parties.

These proposed solutions underscore the imperative of proactive, collaborative, and forward-thinking initiatives to navigate the complexities of California’s pension challenges. By embracing comprehensive reforms and strategic interventions, the state can endeavor to fortify its pension system, mitigate fiscal pressures, and uphold its commitment to ensuring the retirement security of public employees and educators.

Conclusion

California’s pension crisis presents a formidable financial challenge that demands concerted efforts, innovative solutions, and prudent stewardship to secure the state’s fiscal resilience and uphold its commitment to public employees and educators. The escalating pension debt, coupled with its profound implications for the state’s budget and governance, underscores the urgency of addressing this pressing issue.

As the state grapples with the complexities of its pension system, it is imperative to recognize the interconnected nature of financial sustainability, public welfare, and long-term planning. The proposed solutions, ranging from enhanced funding mechanisms to collaborative governance and policy reforms, offer a pathway towards fortifying the pension funds and mitigating the strain on California’s budget.

Embracing transparency, accountability, and strategic investment practices is pivotal in fostering public trust and ensuring the prudent management of pension liabilities. By engaging in constructive dialogue, harnessing collective expertise, and enacting forward-thinking reforms, California can navigate the pension crisis with resilience and foresight.

The commitment to safeguarding the retirement security of public employees and educators remains at the heart of the endeavor to address the pension crisis. Through proactive interventions and collaborative initiatives, the state can strive to uphold its fiduciary responsibilities, bolster its financial foundations, and chart a sustainable course towards a more secure future for its pension system.

Ultimately, the journey towards resolving California’s pension challenges requires a steadfast dedication to fiscal prudence, inclusive governance, and the enduring well-being of the state and its residents. By embracing innovative solutions and collective resolve, California can navigate the complexities of the pension crisis and pave the way for a more resilient and sustainable financial future.