Finance

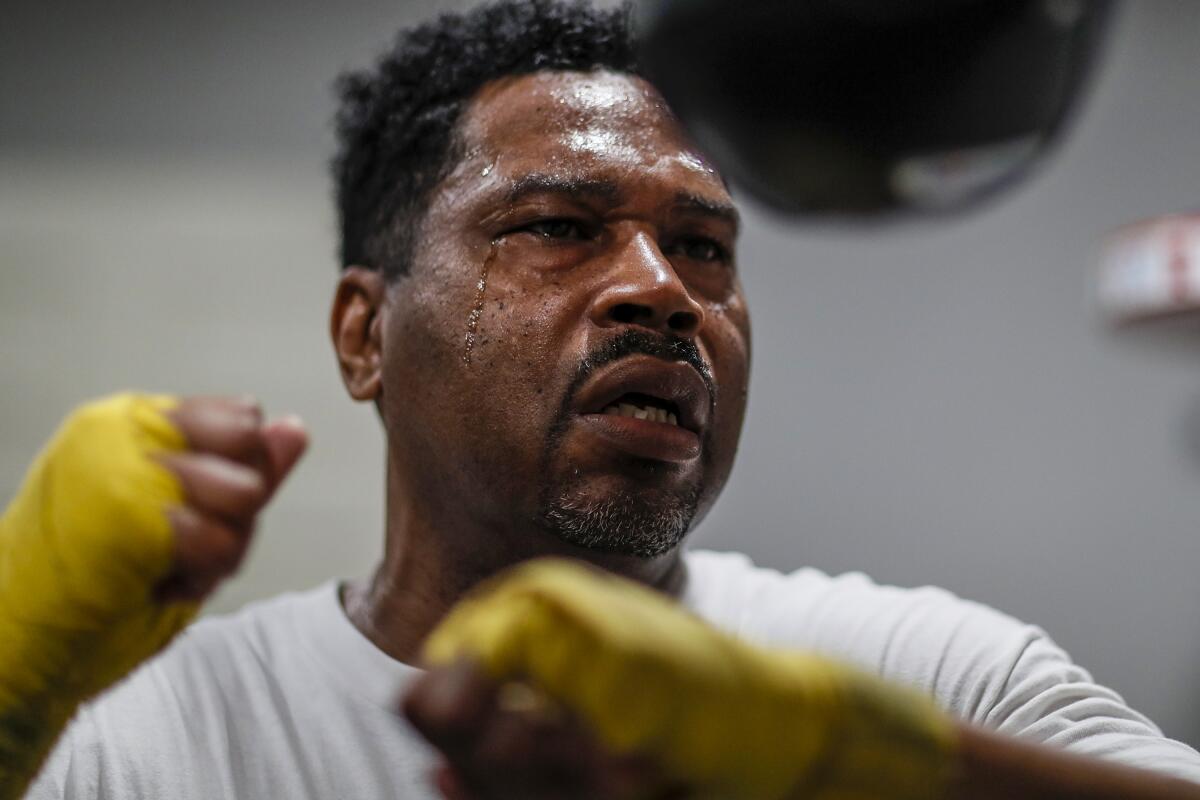

How Much Does Mayweather Owe The IRS?

Published: October 30, 2023

Discover how much boxing legend Floyd Mayweather owes the IRS and learn about the financial impact it may have on his career. Stay informed on the latest finance news in boxing.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Money and fame often come hand in hand, but they can also bring about a host of financial challenges. Floyd Mayweather Jr., the renowned boxing champion, is no stranger to this reality. While he has earned vast sums of money throughout his career, Mayweather’s financial troubles have been making headlines in recent years. Specifically, his issues with the Internal Revenue Service (IRS) have become a point of concern and speculation.

Mayweather’s journey to becoming one of the greatest boxers of all time has been well-documented. With an unbeaten record spanning over 50 fights, Mayweather has amassed a fortune with lucrative earnings from fights, endorsement deals, and business ventures. However, his lavish lifestyle and flamboyant spending habits have caught up with him, resulting in a hefty tax debt owed to the IRS.

In this article, we will explore the magnitude of Mayweather’s tax troubles, examine the factors contributing to his debt, delve into his legal battle with the IRS, analyze the strategies he may employ to repay his dues, and assess the impact of this financial predicament on his career and legacy.

By shedding light on Mayweather’s financial situation, we can gain insights into the challenges faced by high-earning individuals and the importance of prudent financial management even in the face of immense wealth.

Mayweather’s Tax Troubles

Despite earning hundreds of millions of dollars over the course of his career, Floyd Mayweather has found himself in the midst of a significant tax predicament. Reports suggest that he owes a staggering amount to the IRS, with estimates ranging from $22 million to $50 million in unpaid taxes.

This substantial debt can be attributed to Mayweather’s failure to settle his tax obligations over several years. The boxer’s lavish lifestyle, which includes luxury cars, private jets, mansions, and extravagant jewelry, has undoubtedly contributed to his financial woes. While his earnings have been substantial, his extravagant spending habits and lack of financial discipline have led to a situation where his tax obligations have fallen behind.

Furthermore, Mayweather’s income is primarily derived from boxing purses and endorsement deals, which often come in the form of lump sum payments. Unlike individuals who receive regular paychecks and have income taxes deducted automatically, Mayweather is responsible for setting aside funds to pay his tax liability. Unfortunately, it appears that he has failed to meet this responsibility, resulting in the accumulation of a substantial unpaid tax bill.

The IRS takes tax non-compliance seriously and will take necessary action to collect outstanding debts. Mayweather’s failure to fulfill his tax obligations could potentially lead to severe consequences, such as wage garnishments, the seizure of assets, and even criminal charges. It is a stark reminder that even the most successful individuals must prioritize their financial responsibilities, including paying taxes, to avoid legal and financial repercussions.

Mayweather’s Estimated Tax Debt

While the exact amount of Floyd Mayweather’s tax debt is not publicly disclosed, it is estimated to be in the range of tens of millions of dollars. The IRS typically keeps tax information confidential, but various reports and sources have provided insight into the magnitude of Mayweather’s financial obligation.

The estimated tax debt stems from several years of unpaid taxes and penalties. Mayweather’s extravagant lifestyle and substantial income have resulted in substantial tax liabilities. The staggering sum owed to the IRS raises questions not only about Mayweather’s financial management but also about the potential consequences he may face if the debt remains unresolved.

The exact breakdown of Mayweather’s tax debt remains unknown, but it likely includes federal income taxes, state taxes, and potentially even additional penalties and interest for late payments. The IRS has the authority to impose penalties for failure to pay taxes on time, failure to file tax returns, and accuracy-related issues. These penalties can significantly increase the overall amount owed, adding to Mayweather’s financial burden.

The IRS has a variety of methods to collect unpaid taxes, including wage garnishments, bank levies, and property seizures. Given the high-profile nature of Mayweather’s case, it is likely that the IRS will be eager to pursue aggressive collection actions to recoup the outstanding debt.

Mayweather’s tax debt serves as a cautionary tale for high-earning individuals who may be tempted to neglect their tax obligations. It emphasizes the importance of proper financial planning and ensuring that sufficient funds are set aside to pay taxes, regardless of an individual’s income level.

As Mayweather navigates this challenging financial situation, it remains to be seen how he will address his tax debt and whether he will take the necessary steps to resolve his obligations with the IRS.

Reasons Behind Mayweather’s Debt

Several factors contribute to the substantial tax debt owed by Floyd Mayweather. While his financial success is undeniable, his spending habits, legal issues, and personal choices have all played a role in the accumulation of his tax obligations.

One of the primary reasons behind Mayweather’s debt is his extravagant lifestyle. The boxer has a reputation for living a lavish and opulent life, indulging in luxury cars, designer clothes, and extravagant vacations. While these expenses may be understandable for someone with Mayweather’s wealth, they can quickly deplete one’s income and result in a lack of funds set aside for tax payments.

In addition to his spending habits, Mayweather has faced legal troubles that have had a significant impact on his finances. He has been involved in several high-profile lawsuits, including charges of domestic violence and defamation, which have resulted in substantial legal expenses. These legal battles, coupled with his tax liabilities, have put immense strain on Mayweather’s financial resources.

Furthermore, Mayweather’s choice to operate his own promotional company, Mayweather Promotions, has added to his financial burden. As the founder and owner of the company, Mayweather has additional financial responsibilities, including paying his employees and covering various business expenses. When financial obligations in both his personal and professional life are not met, it only exacerbates his overall debt.

Another factor contributing to Mayweather’s tax debt is the nature of his income. As a professional boxer, his earnings come in large lump sums from prize purses, endorsement deals, and pay-per-view revenues. Unlike individuals who receive consistent income throughout the year, Mayweather’s irregular cash flow can make it challenging to manage his expenses and allocate funds for tax payments.

Ultimately, Mayweather’s debt is the result of a combination of factors, including his lavish lifestyle, legal expenses, business ventures, and irregular income. However, it is essential to note that being a high-earning individual does not exempt one from fulfilling their tax obligations. Understanding the need for financial discipline and responsible money management is critical for long-term financial stability, regardless of one’s income level.

Mayweather’s Legal Battle with the IRS

Floyd Mayweather’s tax troubles have escalated into a legal battle with the Internal Revenue Service (IRS). The IRS is responsible for enforcing tax laws and collecting unpaid taxes, and they have taken legal action against Mayweather to recover the substantial amount he owes.

When someone fails to pay their taxes, the IRS typically starts by sending notices and demands for payment. If these efforts are unsuccessful, the IRS may file a federal tax lien to protect their interests and ensure that they have a legal claim against the taxpayer’s property and assets.

In Mayweather’s case, it is reported that the IRS has placed tax liens on his properties. These liens serve as a legal claim against Mayweather’s assets, including real estate, vehicles, bank accounts, and other valuable possessions.

If the tax debt remains unpaid, the IRS has the authority to take further collection action, such as wage garnishment or seizing assets. Wage garnishment involves the IRS deducting a portion of the taxpayer’s wages directly from their paycheck to settle the outstanding debt. Asset seizure, on the other hand, allows the IRS to take ownership and sell the taxpayer’s assets to generate funds to cover the unpaid taxes and penalties.

Mayweather’s high-profile status and significant wealth have drawn attention to his legal battle with the IRS. The public scrutiny surrounding his financial situation adds another layer of pressure and urgency to resolve the outstanding tax debt.

To address his tax issues, Mayweather has reportedly hired legal representation to negotiate with the IRS and explore possible resolutions. This may involve negotiating a settlement or payment plan with the IRS to repay the debt over time. However, it is crucial for Mayweather to take swift and decisive action to prevent further escalation of his legal battle and potential consequences.

It is worth noting that the IRS has a range of options to encourage taxpayers to fulfill their tax obligations, but they can also be flexible in finding solutions. By proactively engaging with the IRS and demonstrating a willingness to resolve the issue, Mayweather can potentially navigate a path towards resolving his legal battle and easing his tax burden.

Strategies to Repay the IRS

When faced with a substantial tax debt, like Floyd Mayweather’s, there are several strategies that can be employed to repay the Internal Revenue Service (IRS) and resolve the outstanding liabilities. It is crucial for Mayweather to work closely with financial advisors, tax professionals, and legal counsel to determine the most suitable approach for his situation.

1. Negotiating a Payment Plan: Mayweather can work with the IRS to establish a payment plan, also known as an installment agreement. This allows him to pay off the debt in monthly installments over an extended period. The payment plan can be based on his financial capacity and may involve showing proof of income and expenses to support a feasible repayment structure.

2. Offer in Compromise: Another option is to explore an Offer in Compromise (OIC). This involves negotiating with the IRS to settle the debt for less than the full amount owed. To qualify for an OIC, Mayweather would need to demonstrate that he does not have the means to pay the entire debt and that accepting a reduced amount is a reasonable compromise.

3. Seeking Penalty Abatement: Mayweather can request a penalty abatement if he believes that the reason behind his tax debt is due to circumstances beyond his control, such as health issues or financial hardship. The IRS may reduce or eliminate penalties, which can significantly reduce the total amount owed.

4. Proactive Communication: Maintaining open lines of communication with the IRS is essential. Mayweather should promptly respond to any notices or correspondences and provide requested documentation in a timely manner. This shows a willingness to cooperate and find a resolution.

5. Selling Assets: Mayweather could consider selling valuable assets to generate funds to repay the IRS. This may involve liquidating real estate properties, luxury vehicles, or high-end valuables. Selling assets can provide a lump sum payment and accelerate the repayment process.

6. Increasing Income: Mayweather could explore opportunities to increase his income through endorsements, partnerships, or business ventures. By generating additional revenue streams, he can allocate more funds towards repayment and expedite the process of settling his tax debt.

7. Engaging Professional Help: Seeking guidance from financial advisors and tax professionals who specialize in tax resolution can provide Mayweather with invaluable expertise and support. These professionals can navigate the complexities of tax laws, negotiate with the IRS on his behalf, and develop a comprehensive repayment strategy tailored to his unique circumstances.

It is critical for Mayweather to act proactively and diligently address his tax debt. By implementing a combination of these strategies and working closely with professionals, he can establish a plan to repay the IRS, resolve his outstanding liabilities, and regain financial stability.

Mayweather’s Financial Situation

Despite his significant earnings throughout his boxing career, Floyd Mayweather’s financial situation has come under scrutiny due to his tax troubles and extravagant spending habits. While exact details of his current financial status are not publicly disclosed, it is essential to understand the broader context surrounding Mayweather’s finances.

Mayweather’s multi-million dollar fight purses and endorsement deals have undoubtedly generated substantial wealth. However, his extravagant lifestyle and penchant for luxurious indulgences have been well-documented. From expensive cars to extravagant homes and flashy jewelry, Mayweather has never shied away from showcasing his wealth and success.

It is worth noting that Mayweather has made investments in various business ventures throughout his career. For instance, he owns Mayweather Promotions, his own boxing promotional company. While these ventures have the potential for profit, they also come with additional financial responsibilities and risks.

However, Mayweather’s financial situation has been brought to the forefront due to his tax debt. The substantial unpaid taxes have raised questions about his overall financial management and ability to fulfill his financial obligations. It highlights the challenges of handling significant wealth and the importance of proper financial planning and fiscal responsibility.

While Mayweather’s financial troubles are undoubtedly significant, it is important to remember that his financial situation is not entirely characterized by these challenges. He has still amassed a considerable fortune throughout his career, and his earning potential remains substantial.

To address his financial situation, Mayweather will need to adopt a more disciplined approach to money management, prioritize his tax obligations, and seek the guidance of financial professionals who can assist him in creating a sustainable financial plan. By implementing sound financial strategies and taking proactive steps towards resolving his tax issues, Mayweather can regain control over his finances and secure a more stable future.

It is crucial for Mayweather to learn from his past financial missteps and make the necessary adjustments to ensure long-term financial stability. By focusing on both reducing expenses and maximizing income opportunities, he can work towards building a solid financial foundation and avoiding future financial pitfalls.

Impact on Mayweather’s Career and Legacy

The tax troubles and financial challenges faced by Floyd Mayweather can have a significant impact on both his career and legacy. Here are some key aspects to consider:

Career: Mayweather’s financial issues could potentially disrupt his boxing career. If he is unable to resolve his tax debt, the IRS may resort to collection actions such as wage garnishment or asset seizure, which could affect Mayweather’s income and financial stability. These distractions and financial constraints may impact his ability to focus on training and competing at the highest level.

Moreover, sponsors and potential business partners may be hesitant to collaborate with Mayweather due to the negative publicity surrounding his financial situation. Companies often seek to associate their brand with individuals who have a positive image and are seen as responsible and financially savvy.

Legacy: Mayweather’s legacy, both inside and outside the boxing ring, could be tarnished by his financial woes. While his boxing prowess is undisputed, his inability to manage his finances and fulfill his tax obligations may raise questions about his overall financial acumen and responsibility.

Success in the sport of boxing goes beyond just athletic achievements. The public’s perception of Mayweather as a role model, a champion, and a responsible individual can be affected by his financial troubles. It is essential for athletes and public figures to exemplify financial responsibility and good judgment to maintain their reputation and legacy.

This financial setback may also impact Mayweather’s post-boxing career opportunities. Building a successful career beyond boxing often relies on a positive public image, business acumen, and financial stability. Potential ventures in broadcasting, promotion, or entrepreneurship may become more challenging if potential partners or investors have concerns about Mayweather’s ability to manage finances effectively.

Despite these challenges, Mayweather still has the opportunity to turn things around. By proactively addressing his tax debt, demonstrating financial discipline, and seeking professional guidance, he can potentially rebuild his image and protect his legacy.

Furthermore, Mayweather’s financial journey can serve as a cautionary tale for others, highlighting the importance of responsible financial management, even amidst great success. It underscores the significance of financial literacy and the need for athletes and high-earning individuals to surround themselves with knowledgeable advisors who can help navigate the complexities of wealth and taxes.

Ultimately, Mayweather’s career and legacy will be shaped not only by his achievements in the boxing ring but also by how he addresses and overcomes his financial challenges. With careful planning and a commitment to financial responsibility, Mayweather can rebuild his reputation and leave a lasting legacy beyond his athletic accomplishments.

Conclusion

Floyd Mayweather’s tax troubles have brought to the forefront the importance of responsible financial management and the potential consequences of neglecting tax obligations, even for high-earning individuals. His journey serves as a stark reminder that financial success does not guarantee financial stability.

The magnitude of Mayweather’s tax debt and his ongoing legal battle with the IRS have undoubtedly had a significant impact on his career and legacy. It highlights the need for financial discipline, proper tax planning, and effective money management, regardless of one’s income level.

To navigate his financial challenges, Mayweather must prioritize resolving his tax debt and work closely with financial advisors, tax professionals, and legal counsel. Strategies such as negotiating payment plans, exploring settlement options, and increasing income can assist in repaying the IRS and regaining financial stability.

Additionally, Mayweather’s case highlights the importance of proactive communication with the IRS and complying with tax regulations. It is crucial to meet financial responsibilities and avoid legal consequences, such as asset seizures or wage garnishments.

Mayweather’s financial situation also has implications for his career and legacy. It may disrupt his boxing pursuits and impact potential sponsorship and business opportunities. Maintaining a positive public image and exemplifying financial responsibility are critical for long-term success beyond the boxing ring.

Despite the challenges Mayweather faces, there is an opportunity for him to learn from his past mistakes and rebuild his financial reputation. By demonstrating financial discipline, making responsible financial decisions, and seeking professional guidance, he can work towards regaining control over his finances and protecting his legacy.

Ultimately, Mayweather’s story serves as a cautionary tale for all individuals, emphasizing the importance of prudent financial management and the impact that financial decisions can have on one’s career and overall reputation. By applying the lessons learned from Mayweather’s experiences, we can all strive for financial stability and success.