Home>Finance>How Much Does Contributing To A 401K Reduce Taxes

Finance

How Much Does Contributing To A 401K Reduce Taxes

Published: October 17, 2023

Learn how contributing to a 401K can significantly reduce taxes and maximize your finance goals. Discover the benefits of long-term savings with expert tips.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Basics of a 401(k)

- The Tax Benefits of Contributing to a 401(k)

- How Contributing to a 401(k) Reduces Taxes

- Pre-Tax vs. Roth Contributions

- Determining the Impact of 401(k) Contributions on Your Tax Liability

- Maximizing Tax Savings through 401(k) Contributions

- Potential Limitations and Considerations

- Conclusion

Introduction

Are you looking for ways to reduce your tax liability while saving for retirement? If so, contributing to a 401(k) can be a smart financial move. A 401(k) is a retirement savings plan offered by employers that allows employees to save and invest a portion of their earnings before taxes are taken out.

In this article, we will explore how contributing to a 401(k) can help reduce your taxes, providing you with potential tax benefits and long-term financial advantages. Understanding the nuances and advantages of 401(k) contributions can empower you to make informed decisions and take advantage of the tax-saving opportunities available.

As the saying goes, “You can’t escape death and taxes.” While that may be true, leveraging tax-advantaged retirement accounts like the 401(k) can help minimize your tax burden and maximize your savings. So, let’s dive into the world of 401(k) contributions and discover how they can reduce your tax liability.

Understanding the Basics of a 401(k)

A 401(k) is a retirement savings plan that allows employees to set aside a portion of their income for future use. It is named after the section of the U.S. Internal Revenue Code that outlines its regulations. This employer-sponsored plan offers a tax-advantaged way to save for retirement, making it a popular choice among workers.

When you contribute to a 401(k), you are redirecting a portion of your pre-tax income into the account. This money is then invested in a variety of financial instruments such as stocks, bonds, and mutual funds. The earnings on these investments are tax-deferred until you withdraw the funds during retirement.

One of the main advantages of a 401(k) is that contributions are made automatically through payroll deductions. This means that you can consistently save for retirement without having to actively manage the process. Additionally, many employers offer matching contributions, where they contribute a certain percentage of the employee’s contributions, effectively boosting their retirement savings.

It’s important to note that 401(k) plans have contribution limits set by the Internal Revenue Service (IRS). As of 2021, the maximum contribution limit for individuals under the age of 50 is $19,500. For individuals aged 50 and above, there is an additional catch-up contribution limit of $6,500, allowing them to contribute a maximum of $26,000.

In summary, a 401(k) is a retirement savings plan that allows employees to save a portion of their pre-tax income through automatic payroll deductions. These contributions are then invested in a variety of financial instruments, and the earnings grow tax-deferred until withdrawals are made during retirement.

The Tax Benefits of Contributing to a 401(k)

Contributing to a 401(k) offers several tax benefits that can have a significant impact on your financial well-being. Here are the key tax advantages of contributing to a 401(k):

- Pre-Tax Contributions: When you contribute to a traditional 401(k), your contributions are made with pre-tax dollars. This means that the money you contribute is deducted from your taxable income for the year, reducing the amount of income that is subject to taxes. The more you contribute, the lower your taxable income will be, which can potentially move you into a lower tax bracket and result in substantial tax savings.

- Tax-Deferred Growth: Another tax benefit of a 401(k) is the ability for your investments to grow tax-deferred. This means that any earnings, dividends, or capital gains generated by your investments within the 401(k) account are not taxed until you withdraw the funds during retirement. This allows your investments to compound over time, potentially resulting in a larger retirement nest egg.

- Employer Matching Contributions: Many employers offer a matching contribution to their employees’ 401(k) accounts. This means that for every dollar you contribute, your employer will match a portion of it, up to a certain percentage of your salary. Employer matching contributions are essentially free money that can boost your retirement savings while providing an additional tax benefit.

- Tax Credit for Saver’s Credit: The IRS provides a tax credit called the Saver’s Credit for eligible individuals who contribute to a retirement account, including a 401(k). This credit can range from 10% to 50% of your contributions, up to a certain limit, depending on your income level and filing status. The Saver’s Credit is a direct reduction of your tax liability, providing further incentive to contribute to a 401(k) and save for retirement.

By taking advantage of these tax benefits, you can effectively lower your current tax bill, accumulate more wealth for retirement, and potentially qualify for additional tax credits. It’s important to consult with a tax advisor or financial professional to fully understand the tax implications of contributing to a 401(k) and to determine the best strategy based on your individual circumstances.

How Contributing to a 401(k) Reduces Taxes

Contributing to a 401(k) can significantly reduce your taxes by lowering your taxable income and taking advantage of tax-deferred growth. Here’s how contributing to a 401(k) can reduce your tax liability:

Lower Taxable Income: When you contribute to a traditional 401(k), the amount you contribute is deducted from your taxable income for the year. For example, if your annual salary is $50,000 and you contribute $5,000 to your 401(k), your taxable income will be reduced to $45,000. This means you will owe less in income taxes, potentially putting you in a lower tax bracket and reducing your overall tax liability.

Tax-Deferred Growth: The earnings on your 401(k) investments grow tax-deferred until you withdraw the funds during retirement. This means that any dividends, interest, or capital gains generated within the account are not subject to current income taxes. By allowing your investments to grow tax-free, you can potentially accumulate more wealth over time and take advantage of the power of compounding.

Delayed Taxation: The tax advantages of a traditional 401(k) come into play during retirement when you begin to withdraw funds. Since your contributions were made with pre-tax dollars, the withdrawals are then subject to income tax at your ordinary tax rate. However, it’s worth noting that many individuals may be in a lower tax bracket during retirement due to a decrease in income, resulting in potentially lower tax liability than when they were working.

Roth 401(k) Contributions: In addition to traditional 401(k) contributions, some employers offer the option to make Roth 401(k) contributions. Unlike traditional contributions, Roth contributions are made with after-tax dollars, meaning they do not provide an immediate tax deduction. However, the benefit of Roth contributions is that qualified withdrawals in retirement are tax-free. This can be advantageous if you anticipate being in a higher tax bracket in the future or if you want to diversify your tax strategies.

Long-Term Tax Planning: Contributing to a 401(k) allows you to take control of your long-term tax planning. By strategically maximizing your contributions and utilizing pre-tax and Roth options, you can optimize your tax savings both now and in the future. It’s important to periodically review your financial situation, adjust your contributions as needed, and take advantage of any potential tax-saving opportunities offered by your employer.

By contributing to a 401(k), you not only save for retirement but also enjoy immediate tax benefits. The tax advantages of contributing to a 401(k) can have a significant impact on your overall tax liability, allowing you to reduce your taxes, grow your wealth, and secure a financially sound future.

Pre-Tax vs. Roth Contributions

When it comes to contributing to a 401(k), you have the option to make either pre-tax or Roth contributions. Understanding the differences between these two types of contributions can help you make an informed decision based on your individual financial goals and tax situation.

Pre-Tax Contributions: Pre-tax contributions are the traditional type of contributions made to a 401(k) plan. When you make pre-tax contributions, the money is deducted from your paycheck before taxes are calculated. This reduces your taxable income for the year, potentially lowering your tax liability. However, keep in mind that when you withdraw the funds in retirement, they will be subject to income tax at your ordinary tax rate.

One of the main advantages of pre-tax contributions is the immediate tax reduction they provide. By lowering your taxable income, you can potentially move into a lower tax bracket, resulting in overall tax savings. Additionally, pre-tax contributions can provide a higher take-home pay in the present, as you are effectively deferring the payment of taxes until retirement.

Roth Contributions: Roth contributions, on the other hand, are made with after-tax dollars. This means that you do not receive an immediate tax deduction for your contributions. However, the key advantage of Roth contributions is that qualified withdrawals in retirement are tax-free.

Roth contributions can be beneficial if you anticipate being in a higher tax bracket during retirement or if you want to diversify your tax strategies. By paying taxes upfront, you can potentially enjoy tax-free growth and withdrawals later on. This can be especially advantageous if you expect your income and tax rates to rise in the future.

The choice between pre-tax and Roth contributions ultimately depends on your individual circumstances and financial goals. If you anticipate being in a higher tax bracket in retirement, Roth contributions may be a more attractive option. On the other hand, if you want to lower your current tax liability and maximize your take-home pay, pre-tax contributions can provide immediate tax savings.

It’s worth noting that some employers offer a combination of both pre-tax and Roth contributions within their 401(k) plans. This allows you to split your contributions between the two options, giving you flexibility and the opportunity to take advantage of the benefits of both types of contributions.

Regardless of which type of contribution you choose, contributing to a 401(k) is a wise financial decision. It allows you to save for retirement in a tax-advantaged manner and can help you secure a comfortable and financially stable future.

Determining the Impact of 401(k) Contributions on Your Tax Liability

Understanding the impact of 401(k) contributions on your tax liability is crucial for effective tax planning. By accurately assessing how your contributions affect your taxable income and the resulting tax savings, you can make informed decisions about your retirement savings. Here are some key factors to consider when determining the impact of 401(k) contributions on your tax liability:

Contribution Amount: The amount you contribute to your 401(k) can directly influence your tax liability. By contributing more to your 401(k), you reduce your taxable income, potentially moving into a lower tax bracket and lowering your overall tax burden. It’s essential to understand the contribution limits set by the IRS and to contribute as much as you can comfortably afford.

Tax Bracket: Your current tax bracket plays a significant role in determining the impact of your 401(k) contributions on your tax liability. If you are in a higher tax bracket, making pre-tax contributions can provide immediate tax savings. Conversely, if you anticipate being in a higher tax bracket in retirement, Roth contributions can be a more favorable option, as qualified withdrawals are tax-free.

Employer Matching Contributions: Employer matching contributions are essentially free money that can positively impact your tax liability. When your employer matches a percentage of your contributions, it boosts your retirement savings while potentially reducing your taxable income. Take full advantage of employer matches, as they provide an immediate return on your investment and increase your overall tax savings.

Year of Contribution: The tax year in which you make your contributions can affect your tax liability. Contributions made before the end of the tax year are typically deductible for that year, allowing you to lower your current tax bill. However, some employers may offer a grace period during the next year to make contributions for the previous tax year, so it’s essential to understand your plan’s specific rules and deadlines.

Tax Credit Eligibility: Contributions to a 401(k) plan may make you eligible for the Retirement Savings Contributions Credit, also known as the Saver’s Credit. This tax credit can directly reduce your tax liability and provide additional incentives for saving for retirement. Depending on your income level and filing status, you may qualify for a credit ranging from 10% to 50% of your contributions, up to certain limits.

Calculating the exact impact of your 401(k) contributions on your tax liability can be complex, as it involves various factors such as income, deductions, credits, and applicable tax rates. Consulting a tax professional or using tax software can help you accurately determine the impact and optimize your tax planning strategies.

In summary, 401(k) contributions can have a meaningful impact on your tax liability. By considering factors such as contribution amount, tax bracket, employer matching, tax year, and eligibility for tax credits, you can make informed decisions to maximize your tax savings and build a solid foundation for your retirement future.

Maximizing Tax Savings through 401(k) Contributions

Contributing to a 401(k) not only allows you to save for retirement but also provides significant tax advantages. Here are some strategies to maximize your tax savings through 401(k) contributions:

Contribute up to the Maximum Limit: Take full advantage of the contribution limits set by the IRS. For 2021, the maximum contribution limit is $19,500 for individuals under the age of 50. If you are aged 50 or above, you can contribute an additional catch-up contribution of $6,500. By contributing the maximum amount, you reduce your taxable income and maximize your potential tax savings.

Employer Matching Contributions: Ensure you contribute enough to your 401(k) to receive the full employer match. Employer matching contributions are essentially free money that directly adds to your retirement savings while reducing your taxable income. Failing to contribute enough to receive the full match means you are leaving valuable tax benefits on the table.

Consider a Roth 401(k) Option: Evaluate the benefits of Roth contributions within a 401(k) if your employer offers this option. While Roth contributions do not provide immediate tax savings, qualified withdrawals in retirement are tax-free. This can be particularly advantageous if you anticipate being in a higher tax bracket in retirement or want to diversify your tax strategies.

Strategize Contributions with Tax Bracket Changes: If you anticipate a significant change in your tax bracket in the coming years, consider adjusting your 401(k) contributions accordingly. For example, if you expect your income to increase in the near future, making pre-tax contributions when you are in a lower tax bracket can yield greater tax savings, as you defer paying taxes until retirement.

Utilize Tax Credits: Contributions to a 401(k) may make you eligible for the Saver’s Credit, a tax credit that directly reduces your tax liability. Determine if you meet the eligibility criteria based on your income level and filing status, and take advantage of this credit to further enhance your tax savings.

Review and Optimize Investment Options: Regularly review and reassess your investment options within your 401(k) to ensure they align with your financial goals. Consider factors such as risk tolerance and long-term growth potential to maximize your investment returns. By growing your investments within the tax-advantaged 401(k) account, you can further compound your tax savings over time.

Consult with a Tax Professional: If you have complex tax circumstances or are unsure about the best strategies for maximizing your tax savings, seek guidance from a tax professional. They can provide personalized advice based on your specific situation and help you make informed decisions to optimize your tax benefits.

By implementing these strategies, you can effectively maximize your tax savings through 401(k) contributions. Remember to stay informed about the latest tax laws and consult with professionals when needed to ensure you are taking full advantage of the tax incentives and opportunities available to you.

Potential Limitations and Considerations

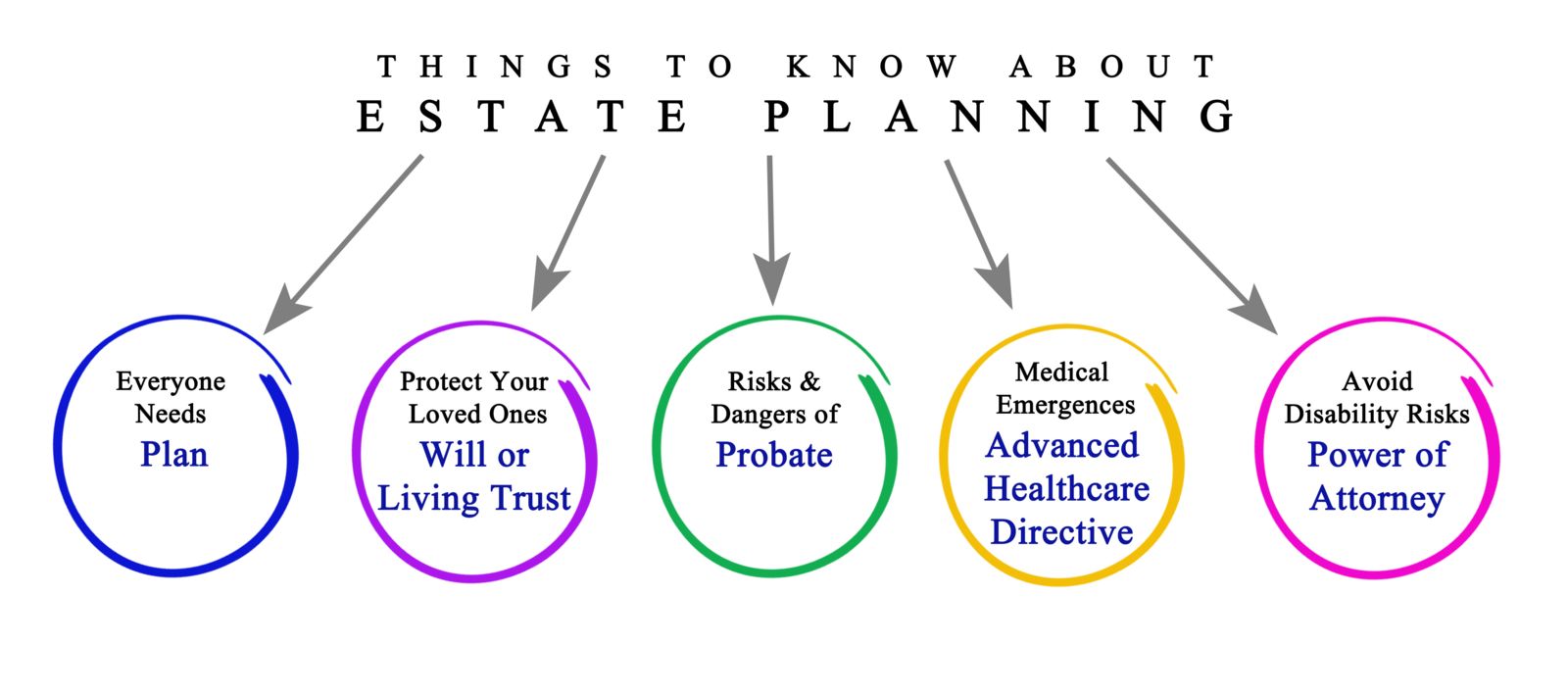

While contributing to a 401(k) offers significant tax advantages, there are a few limitations and considerations to keep in mind. Understanding these factors can help you make informed decisions and maximize the benefits of your retirement savings.

Early Withdrawal Penalties: Withdrawing funds from your 401(k) before reaching the age of 59 ½ typically incurs early withdrawal penalties. In addition to any income tax owed on the withdrawal, you may face a 10% penalty. This discourages early withdrawals and reinforces the idea that a 401(k) should primarily be used for retirement savings.

Limited Access to Funds: Unlike other investment accounts, a 401(k) restricts access to funds until retirement age. This can be both a benefit and a limitation. While it ensures that your retirement savings remain intact, it can be challenging if you face financial emergencies or unexpected expenses. It’s important to have other sources of funds or an emergency savings account in place to cover any unforeseen circumstances.

Required Minimum Distributions (RMDs): Once you reach the age of 72 (or 70 ½ if you were born before July 1, 1949), you are required to take distributions from your 401(k) known as Required Minimum Distributions (RMDs). These RMDs are subject to income tax and failure to take them as required can result in significant penalties. It’s important to factor in these distributions when planning for retirement and managing your tax obligations.

Limited Investment Options: The investment options available within a 401(k) plan are determined by your employer’s selected plan provider. While most plans offer a variety of investment options, they may not align with your specific investment preferences or offer the same level of flexibility as individual brokerage accounts. It’s essential to review and understand the investment options available to make informed decisions about your asset allocation and investment strategy.

Changing Tax Laws: Tax laws can change over time and may impact the rules and regulations surrounding 401(k) plans. These changes can affect contribution limits, tax deductions, and other aspects of retirement savings. Staying informed about tax law updates and consulting with a tax professional can help you navigate any changes and adjust your planning accordingly.

Other Retirement Savings Vehicles: While a 401(k) is a valuable retirement savings tool, it may not be the only option available to you. Consider other retirement savings vehicles, such as Individual Retirement Accounts (IRAs) and Health Savings Accounts (HSAs), to diversify your retirement savings and take advantage of additional tax benefits.

It’s important to carefully review your specific 401(k) plan’s terms and conditions, and to consult with a financial advisor or tax professional to ensure that you fully understand the limitations, regulations, and considerations associated with your particular plan. By having a comprehensive understanding of these factors, you can make informed decisions and optimize your tax advantages while maximizing your long-term retirement savings.

Conclusion

Contributing to a 401(k) offers significant tax benefits and is a powerful way to save for retirement. By understanding the basics of a 401(k) and the tax advantages it provides, you can make informed decisions that will have a positive impact on your financial future.

401(k) contributions can help reduce your current tax liability by lowering your taxable income. Pre-tax contributions allow you to deduct the amount you contribute from your taxable income, potentially putting you in a lower tax bracket and reducing your overall tax burden. Additionally, tax-deferred growth within a 401(k) allows your investments to compound over time, maximizing your retirement savings potential while deferring taxes until withdrawal.

Consider your personal circumstances when deciding between pre-tax and Roth contributions. Pre-tax contributions may be more beneficial if you expect to be in a lower tax bracket during retirement, while Roth contributions can offer tax-free withdrawals in retirement if you anticipate being in a higher tax bracket.

Maximizing your tax savings through 401(k) contributions involves contributing the maximum amount allowed, taking full advantage of employer matching contributions, and considering additional tax credits for which you may qualify. Regularly reviewing and adjusting your investment options within the 401(k) can optimize your tax advantages and help you meet your long-term retirement goals.

However, it’s essential to be aware of potential limitations and consider other retirement savings options. Understanding early withdrawal penalties, required minimum distributions, and the limited access to funds within a 401(k) can help you plan for unexpected circumstances and make the most of your retirement savings.

In conclusion, contributing to a 401(k) is an effective strategy for reducing taxes and building a solid financial foundation for retirement. By taking advantage of the tax benefits, understanding the considerations, and making informed decisions, you can secure a comfortable and financially stable future.