Home>Finance>How To Report Solo 401K Contributions On Tax Return

Finance

How To Report Solo 401K Contributions On Tax Return

Modified: February 21, 2024

Learn how to report Solo 401K contributions on your tax return. Navigate the complexities of finance with our helpful guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

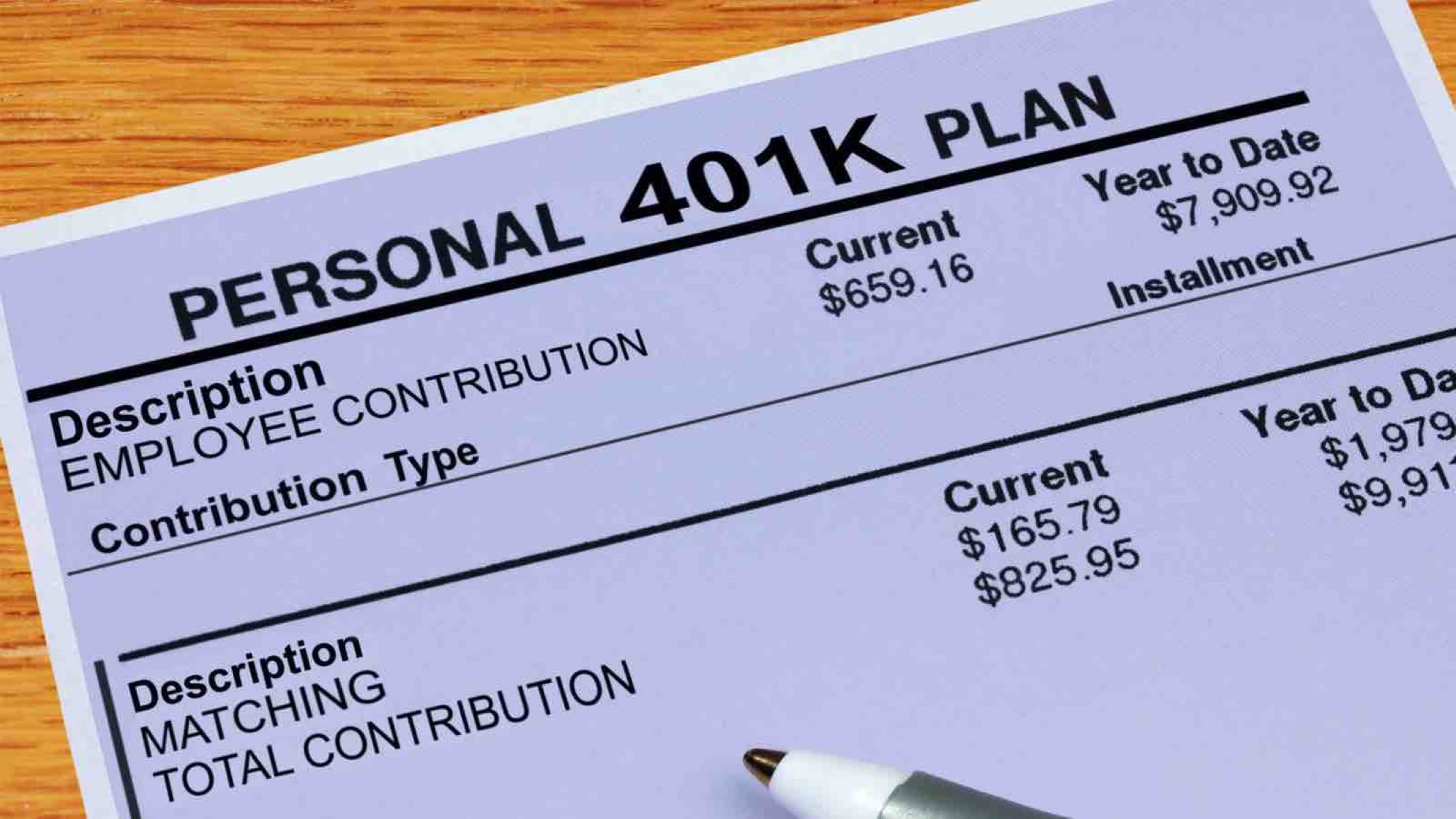

Welcome to our comprehensive guide on how to report Solo 401K contributions on your tax return. If you’re a self-employed individual or a small business owner, you may have opted for a Solo 401K plan to save for retirement while enjoying certain tax advantages. However, it’s vital to understand the proper way to report your Solo 401K contributions to avoid any issues or penalties with the IRS.

As a self-employed individual sponsoring your own retirement plan, you have the flexibility to make both employee and employer contributions to your Solo 401K. These contributions may be tax-deductible, allowing you to lower your taxable income and potentially reduce your overall tax liability.

In this guide, we will delve into the different types of Solo 401K contributions and discuss the specific forms and schedules you need to use to report them on your tax return. Whether you’re filing as a sole proprietor using Schedule C or as a business entity using Form 5500-EZ, we will provide you with step-by-step instructions to ensure you accurately report your Solo 401K contributions.

Understanding how to report your Solo 401K contributions correctly is crucial, as it ensures you comply with tax laws and maximize the benefits of your retirement plan. By following the guidelines outlined in this article, you’ll be able to navigate the reporting process smoothly and avoid any penalties or audits that may arise from improperly reporting your contributions.

So, let’s get started and gain a better understanding of the different types of Solo 401K contributions and the correct reporting procedures for each. By the end of this guide, you’ll have the knowledge and confidence to accurately report your Solo 401K contributions on your tax return, ensuring compliance and peace of mind.

Understanding Solo 401K Contributions

Before we dive into the reporting process, it’s important to have a clear understanding of the different types of contributions that can be made to a Solo 401K. This will help you determine the appropriate reporting method for your specific contribution type.

There are two main types of contributions that can be made to a Solo 401K: employee contributions and employer contributions. Let’s take a closer look at each of these:

- Employee Contributions: As the participant in a Solo 401K plan, you can make elective deferral contributions known as employee contributions. These contributions are made from your own salary and are typically expressed as a percentage of your compensation. The maximum amount you can contribute as an employee to a Solo 401K for the tax year is determined by the IRS and is subject to annual adjustments. It’s important to note that employee contributions are made on a pre-tax basis, meaning they are deducted from your taxable income, reducing your current tax liability.

- Employer Contributions: As the employer in a Solo 401K plan, you have the option to make additional contributions known as employer contributions. These contributions are made on behalf of the participant (i.e., yourself) and are based on a percentage of the participant’s compensation. The maximum amount that can be contributed as an employer to a Solo 401K for the tax year is also determined by the IRS and is subject to certain limitations. Employer contributions can either be made on a pre-tax basis, reducing your taxable income, or on an after-tax basis, depending on the type of contribution you decide to make.

It’s important to consult with a tax professional or financial advisor to determine the optimal contribution strategy for your specific situation. By understanding the different types of contributions and their tax implications, you can make informed decisions that align with your retirement goals and maximize your tax advantages.

Now that we have a clear understanding of the types of Solo 401K contributions, let’s explore the specific reporting requirements for each type on your tax return. Whether you’re filing as a sole proprietor or a business entity, we’ll guide you through the proper reporting procedures to ensure compliance with the IRS.

Types of Solo 401K Contributions

When it comes to Solo 401K contributions, there are several options available to self-employed individuals and small business owners. Understanding the various types of contributions will help you choose the best strategy for your retirement planning and tax benefits. Let’s explore the different types of Solo 401K contributions:

- Elective Deferral Contributions: These contributions, also known as employee contributions, are made on a pre-tax basis. As the participant in a Solo 401K plan, you can defer a portion of your salary and contribute it to your retirement account. The maximum amount you can contribute as an elective deferral is determined by the IRS and may change from year to year. It’s important to note that elective deferral contributions are subject to annual contribution limits, so ensure you stay within the allowed limits to avoid any penalties or compliance issues.

- Roth Deferral Contributions: Unlike elective deferral contributions, Roth deferral contributions are made on an after-tax basis. This means that you pay taxes on the contribution amount in the year you make the contribution, allowing for potential tax-free withdrawals in retirement. Roth deferral contributions can be an attractive option if you anticipate being in a higher tax bracket in the future or if you want to diversify your retirement savings between pre-tax and after-tax contributions.

- Employer Contributions: As the employer in a Solo 401K plan, you can make contributions on behalf of the participant (yourself) as an additional benefit. These contributions are known as employer contributions and can be made on a pre-tax or after-tax basis. The two common types of employer contributions are profit-sharing contributions and matching contributions. Profit-sharing contributions are made based on a percentage of the participant’s compensation, while matching contributions are made to match a certain portion of the participant’s elective deferral contributions.

- Catch-Up Contributions: If you’re age 50 or older, you’re eligible to make catch-up contributions to your Solo 401K. Catch-up contributions allow individuals to contribute additional funds above the regular contribution limits. The catch-up contribution limit is set by the IRS and is subject to change annually. These additional contributions can help boost your retirement savings as you approach your retirement years.

It’s important to consult with a financial advisor or tax professional to determine which types of Solo 401K contributions are best suited to your financial goals and tax situation. They can help you evaluate the advantages and disadvantages of each contribution type and provide guidance on how to optimize your retirement savings.

Now that we’ve explored the different types of Solo 401K contributions, let’s move on to the specific reporting requirements for each contribution type on your tax return.

Reporting Solo 401K Contributions on Schedule C

If you are a self-employed individual filing as a sole proprietor, you will report your Solo 401K contributions on Schedule C of your tax return. Schedule C is the form used to report business income and expenses, including any contributions made to retirement plans.

Here are the steps to report your Solo 401K contributions on Schedule C:

- Calculate your total contributions: Add up all the contributions you made to your Solo 401K plan during the tax year. This includes both your elective deferral contributions and any employer contributions you made on your own behalf.

- Report contributions as an expense: On Schedule C, you will report your Solo 401K contributions as an expense. This expense will reduce your business income, lowering your overall taxable income.

- Use the appropriate line: Look for the specific line on Schedule C where you can report your Solo 401K contributions. The line number may vary depending on the version of the form you are using, so refer to the instructions or consult a tax professional if you’re unsure.

- Enter the total contribution amount: Enter the total contribution amount on the designated line. Be sure to accurately input the correct amount to ensure proper reporting.

- Keep documentation: It’s crucial to keep documentation of your Solo 401K contributions, including contribution statements and records of any employer contributions you made on your own behalf. This documentation will serve as evidence of your contributions in case of an audit or if the IRS requests supporting documentation.

It’s worth noting that if you have employees who also participate in your Solo 401K plan, you may have additional reporting requirements. In such cases, consult a tax professional or review the IRS guidelines to ensure compliance with the reporting obligations for employer contributions for your employees.

By accurately reporting your Solo 401K contributions on Schedule C, you can maximize your tax benefits and ensure compliance with IRS regulations. Remember to keep thorough documentation of your contributions for future reference and potential audits.

Next, we’ll discuss how to report Solo 401K contributions on Form 5500-EZ, which is typically used by business entities.

Reporting Solo 401K Contributions on Form 5500-EZ

If you operate your Solo 401K as a business entity, such as a corporation or partnership, you will need to report your contributions on Form 5500-EZ. This form is used to fulfill the annual reporting requirements for retirement plans, including Solo 401Ks.

Here are the steps to report your Solo 401K contributions on Form 5500-EZ:

- Gather necessary information: Before you start filling out Form 5500-EZ, gather the necessary information such as your Solo 401K plan’s name, employer identification number (EIN), and the plan year for which you are reporting contributions.

- Complete the general information section: Fill out the general information section of Form 5500-EZ, providing details about your business entity and demographic information.

- Report contributions in Part II: In Part II of Form 5500-EZ, you will report contributions made to your Solo 401K plan. Enter the total amount of elective deferral contributions and employer contributions made during the plan year.

- Keep documentation: Retain records of your Solo 401K contributions, including contribution statements and any supporting documentation related to employer contributions. These documents are crucial for accurately reporting contributions and providing evidence in case of an IRS audit.

- File Form 5500-EZ: Once you have completed all the necessary sections and verified the accuracy of your entries, file your Form 5500-EZ with the Department of Labor (DOL) and the IRS by the specified deadline. It’s important to note that the filing deadline may vary based on the plan year and the type of business entity, so consult the IRS guidelines or seek professional assistance if you’re uncertain.

Form 5500-EZ serves as an annual reporting tool for your Solo 401K plan, ensuring compliance with government regulations and providing transparency to the IRS. By accurately reporting your contributions on this form, you demonstrate your commitment to maintaining a compliant retirement plan.

Remember, if you also have employees who participate in your Solo 401K plan, you may have additional reporting obligations. In such cases, consult a tax professional or review the IRS guidelines to ensure compliance with the reporting requirements for employer contributions for your employees.

Now that we’ve covered reporting Solo 401K contributions for business entities, let’s move on to discussing the reporting process for individuals filing their tax returns using Form 1040.

Reporting Solo 401K Contributions on Form 1040

If you are a self-employed individual or a small business owner who files your tax return using Form 1040, you will need to report your Solo 401K contributions on this form. Form 1040 is the standard tax return form used by individuals to report their income and deductions.

Here are the steps to report your Solo 401K contributions on Form 1040:

- Calculate your total contributions: Add up all the contributions you made to your Solo 401K plan during the tax year, including elective deferral contributions and any employer contributions you made on your own behalf.

- Complete the appropriate section: On Form 1040, you will report your Solo 401K contributions in the appropriate section, depending on the type of contribution you made. The two main sections to consider are the “Deductions” section and the “Retirement Plans and Social Security” section.

- Report elective deferral contributions: If you made elective deferral contributions, enter the total amount on the appropriate line in the “Retirement Plans and Social Security” section of Form 1040. This will help reduce your overall taxable income.

- Report employer contributions: If you made employer contributions on your own behalf, enter the total amount on the appropriate line in the “Retirement Plans and Social Security” section. These contributions may also be tax-deductible, providing potential tax benefits.

- Keep documentation: It’s essential to maintain documentation of your Solo 401K contributions, such as contribution statements and records of any employer contributions made. These documents will serve as evidence of your contributions and can be useful in case of an IRS audit or if supporting documentation is requested.

By accurately reporting your Solo 401K contributions on Form 1040, you ensure compliance with IRS regulations and take full advantage of the tax benefits associated with your retirement plan.

Remember, if you have employees who also participate in your Solo 401K plan, you may have additional reporting obligations. In such cases, consult a tax professional or refer to the IRS guidelines to ensure compliance with the reporting requirements for employer contributions for your employees.

Now that we have discussed reporting Solo 401K contributions on Form 1040, let’s address some common mistakes to avoid during the reporting process.

Common Mistakes to Avoid

Reporting Solo 401K contributions on your tax return requires attention to detail and accuracy. Avoiding common mistakes can save you from potential complications, penalties, and even an IRS audit. Here are some key mistakes to avoid when reporting your Solo 401K contributions:

- Miscalculating contribution limits: Make sure you are aware of the annual contribution limits set by the IRS for Solo 401K plans. Exceeding these limits can result in penalties and tax consequences.

- Failing to report all contribution types: Ensure that you report all relevant types of contributions you made to your Solo 401K, including both elective deferral contributions and any employer contributions. Failing to report any contributions accurately could result in underreporting your retirement savings.

- Using incorrect reporting forms: Be aware of the appropriate tax forms to use for reporting your Solo 401K contributions based on your filing status and business structure. Using the wrong forms can lead to errors and possible delays in the processing of your return.

- Not keeping proper documentation: It is vital to maintain thorough documentation of your Solo 401K contributions, including contribution statements, employee information, and any employer contribution records. This documentation serves as evidence in case of an audit or if the IRS requests supporting documentation.

- Missing reporting deadlines: Be aware of the filing deadlines for reporting Solo 401K contributions. Failing to meet these deadlines can result in penalties or the loss of tax benefits associated with your retirement plan.

- Incorrectly calculating tax deductions: Double-check your calculations when deducting Solo 401K contributions on your tax return. An incorrect deduction amount can affect your overall tax liability.

- Not seeking professional guidance: Consider consulting a tax professional or financial advisor who specializes in retirement plans and taxation. They can provide valuable guidance and ensure you accurately report your Solo 401K contributions while optimizing your tax benefits.

Avoiding these common mistakes will help you accurately report your Solo 401K contributions, ensure compliance with tax regulations, and maximize the benefits of your retirement plan. Take the time to review your reporting to minimize errors and gain peace of mind during tax season.

Now that we’ve covered common mistakes to avoid, let’s conclude our comprehensive guide on reporting Solo 401K contributions on your tax return.

Conclusion

Reporting Solo 401K contributions on your tax return is an essential part of properly managing your retirement plan and ensuring compliance with IRS regulations. By understanding the different types of contributions and the specific reporting procedures for each, you can maximize your tax benefits while avoiding penalties or potential audits.

In this comprehensive guide, we discussed the various types of Solo 401K contributions, including elective deferral contributions and employer contributions. We explored how to report these contributions on different tax forms, such as Schedule C for sole proprietors, Form 5500-EZ for business entities, and Form 1040 for individuals.

We also highlighted common mistakes to avoid during the reporting process, such as miscalculating contribution limits, using incorrect reporting forms, and failing to keep proper documentation. By being aware of these potential pitfalls and taking the necessary precautions, you can ensure accurate reporting and a smoother tax filing experience.

Remember, it is always advisable to seek professional guidance from a tax professional or financial advisor who can provide personalized advice based on your specific circumstances. They can help you navigate the complexities of reporting Solo 401K contributions, optimize your tax benefits, and help you stay compliant with IRS regulations.

Reporting Solo 401K contributions correctly not only helps you stay in good standing with the IRS but also allows you to make the most of your retirement savings. By taking the time to understand the reporting requirements and double-checking your entries, you can contribute to a financially secure future.

As you embark on your reporting journey, be sure to keep accurate records, stay informed of any changes in tax laws, and consult with experts when needed. With proper reporting, you can confidently enjoy the advantages of your Solo 401K plan and work towards achieving your retirement goals.