Finance

What Are Changes In Working Capital

Published: December 19, 2023

Learn how changes in working capital can impact your finance. Discover the importance of managing your working capital effectively to maintain financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Working Capital

- Importance of Working Capital

- Components of Working Capital

- Changes in Working Capital

- Factors Affecting Changes in Working Capital

- Positive Changes in Working Capital

- Negative Changes in Working Capital

- Impact of Changes in Working Capital

- Managing Changes in Working Capital

- Conclusion

Introduction

In the world of finance and accounting, working capital is a vital concept that plays a crucial role in determining the financial health and stability of a business. Understanding how changes in working capital impact a company is essential for both managers and investors. Whether positive or negative, these changes can have significant implications for a company’s liquidity, operational efficiency, and overall profitability.

Working capital refers to the funds a company uses to finance its day-to-day operations. It represents the difference between a company’s current assets, such as cash, inventory, and accounts receivable, and its current liabilities, including accounts payable and short-term debt. Essentially, it measures a company’s ability to meet its short-term obligations.

The importance of working capital cannot be overstated. It serves as a crucial indicator of a company’s financial health and its ability to cover its short-term expenses and liabilities. A well-managed working capital ensures that a company can pay its bills on time, seize business opportunities, and meet unexpected financial obligations.

Working capital consists of various components, each representing a different aspect of a company’s financial position. These components include cash, inventory, accounts receivable, accounts payable, and short-term debt. Efficient management of these components is crucial for maintaining a healthy working capital position.

Changes in working capital refer to the fluctuations that occur in a company’s current assets and current liabilities over a specific period of time. These changes can be positive or negative, depending on various factors and circumstances. Positive changes indicate an increase in current assets or a decrease in current liabilities, while negative changes signify a decrease in current assets or an increase in current liabilities.

Several factors can influence changes in working capital. These factors include changes in sales volume, payment terms with suppliers and customers, inventory management practices, credit policy, and economic conditions. Understanding these factors is vital for effectively managing working capital and making informed financial decisions.

Positive changes in working capital can result from increased sales, improved inventory turnover, efficient collection of accounts receivable, negotiated favorable payment terms with suppliers, or a reduction in short-term debt obligations. These changes can boost a company’s liquidity, enhance its financial position, and provide opportunities for growth and expansion.

On the other hand, negative changes in working capital can occur due to declining sales, slow inventory turnover, delays in collecting accounts receivable, extended payment terms with suppliers, or increased short-term debt. These changes can strain a company’s cash flow, reduce its liquidity, and pose significant financial risks.

As you can see, changes in working capital can have a profound impact on a company’s financial stability and performance. Managing these changes effectively is crucial for ensuring long-term business success. In the following sections, we will explore the factors affecting changes in working capital and discuss strategies for managing and optimizing working capital for sustainable growth.

Definition of Working Capital

Working capital is a financial metric that represents the funds a company has available to finance its day-to-day operations and meet its short-term obligations. It is calculated by subtracting a company’s current liabilities from its current assets. Current assets include cash, accounts receivable, inventory, and other assets expected to be converted into cash within one year. Current liabilities consist of accounts payable, short-term debt, and other obligations due within one year.

Working capital is a vital element in assessing a company’s financial health and liquidity. It serves as a measure of a company’s ability to pay its short-term expenses and debts, as well as its ability to fund its ongoing operations. A positive working capital balance indicates that a company has more current assets than current liabilities, suggesting it has sufficient resources to meet its near-term financial obligations. Conversely, a negative working capital balance implies that a company’s current liabilities exceed its current assets, which may indicate financial difficulties and an increased risk of defaulting on payments.

An ideal working capital position strikes a balance between maintaining sufficient liquidity to cover short-term obligations and avoiding excessive idle cash that could have been invested more effectively. Companies need to ensure that they have enough working capital to support their operating cycle, which typically includes the time it takes to convert inventory into sales, collect accounts receivable, and pay off accounts payable.

It’s important to note that different industries and businesses may have varying working capital requirements. For example, a retail business with high inventory turnover may need to maintain a larger amount of working capital to support its operations, while a service-based company with minimal inventory may require less working capital.

Managing working capital effectively involves optimizing the levels of current assets and current liabilities. A company can achieve this by implementing sound financial practices, such as efficient inventory management, timely collection of receivables, negotiation of favorable payment terms with suppliers, and careful management of cash flow.

Overall, understanding the definition of working capital is crucial for evaluating a company’s financial stability and its ability to meet short-term financial obligations. It is an essential metric that provides valuable insights into a business’s liquidity, operational efficiency, and financial performance.

Importance of Working Capital

Working capital plays a critical role in the financial management of a business, impacting its day-to-day operations, profitability, and long-term sustainability. Here are several key reasons why working capital is of utmost importance:

- Liquidity: Working capital ensures that a company has enough funds to cover its short-term expenses and liabilities. It provides the necessary liquidity to meet the day-to-day financial obligations of the business, such as paying salaries, purchasing inventory, and settling bills with suppliers. Sufficient working capital is essential for maintaining cash flow and avoiding disruptions in business operations.

- Operational Efficiency: An optimal level of working capital allows a company to achieve smooth and efficient operations. It enables the timely purchase of raw materials and supplies, ensuring uninterrupted production and delivery of goods or services to customers. Adequate working capital also helps in managing inventory effectively, allowing businesses to meet customer demand without excess or shortage.

- Exploiting Business Opportunities: Having a healthy working capital position provides a business with the flexibility to seize favorable opportunities that may arise. It allows the company to invest in new projects, expand its operations, or take advantage of market conditions. With access to working capital, businesses can readily respond to changes in the market and capitalize on growth opportunities.

- Dealing with Unexpected Challenges: Unforeseen circumstances or emergencies are inevitable in business. Adequate working capital provides a cushion to address unexpected challenges effectively. It helps companies weather economic downturns, cope with sudden increases in expenses, or handle unforeseen events such as equipment breakdowns or customer payment delays. Businesses with adequate working capital are better equipped to navigate through difficult times and maintain financial stability.

- Building Trust and Credibility: Proper management of working capital is vital for building trust and credibility with suppliers, lenders, and other stakeholders. By ensuring timely payments to suppliers and meeting financial obligations, businesses establish a positive reputation and maintain healthy relationships with key partners. This can lead to better credit terms, favorable supplier relationships, and easier access to financing, which can further strengthen the business’s financial position.

- Investor Confidence: Investors pay close attention to a company’s working capital position as it provides insights into its financial health and management efficiency. A company with sound working capital management is more likely to attract investors and secure additional funding. Investors see a healthy working capital position as an indicator of a company’s ability to generate profits, repay debts, and withstand financial challenges. It can help instill confidence and attract potential investors, leading to potential growth and expansion opportunities.

Overall, working capital plays a crucial role in ensuring the smooth functioning and financial stability of a business. Proper management and optimization of working capital are key to maintaining liquidity, operational efficiency, and seizing growth opportunities.

Components of Working Capital

Working capital is made up of several components, each representing a different aspect of a company’s financial position. Understanding these components is crucial for effectively managing and assessing the overall working capital of a business. Here are the key components:

- Cash: Cash is the most liquid asset and an essential component of working capital. It includes physical currency, bank account balances, and short-term investments that can be readily converted into cash. Cash allows a company to meet immediate financial obligations and supports its day-to-day operations.

- Accounts Receivable: Accounts receivable represents the money owed to a company by its customers for the goods or services provided on credit. It represents the current assets that a company expects to receive in cash within a specified period. Efficient management of accounts receivable is vital for maintaining a healthy working capital position.

- Inventory: Inventory refers to the goods or materials that a company holds for sale, production, or consumption. It includes raw materials, work-in-progress, and finished goods. Managing inventory levels is crucial to ensure smooth operations, meet customer demand, and prevent excess holding costs that could tie up working capital.

- Accounts Payable: Accounts payable represents the money that a company owes to its suppliers for purchases made on credit. It is a liability and a part of the working capital equation. Effectively managing accounts payable is important to maintain good relationships with suppliers while optimizing cash flow and preserving working capital.

- Short-term Debt: Short-term debt includes loans, lines of credit, and other forms of borrowing that are due within a year. It represents a company’s financial obligations that must be settled in the short term. Managing short-term debt is critical for maintaining a healthy working capital position and ensuring the company’s ability to meet its debt obligations.

These components interact with each other and impact the overall working capital position of a business. Efficient management of these components is crucial to maintain a healthy working capital position and ensure the smooth operations and financial stability of the company.

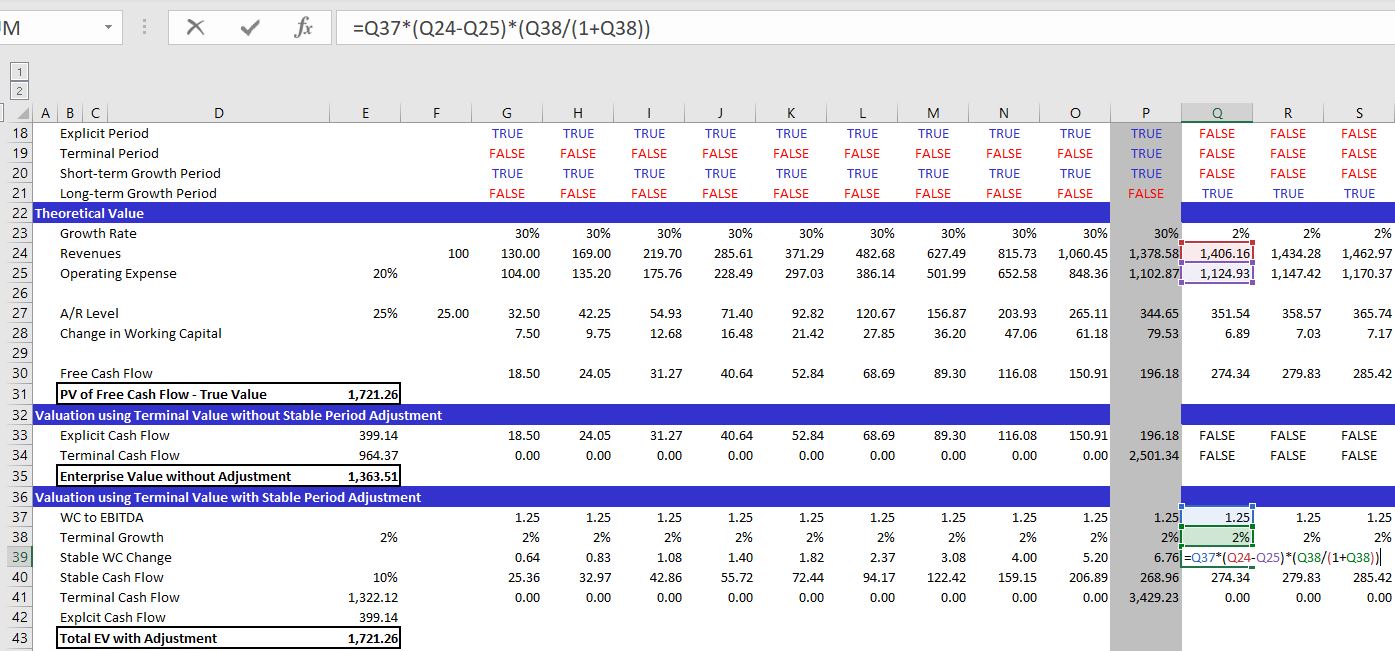

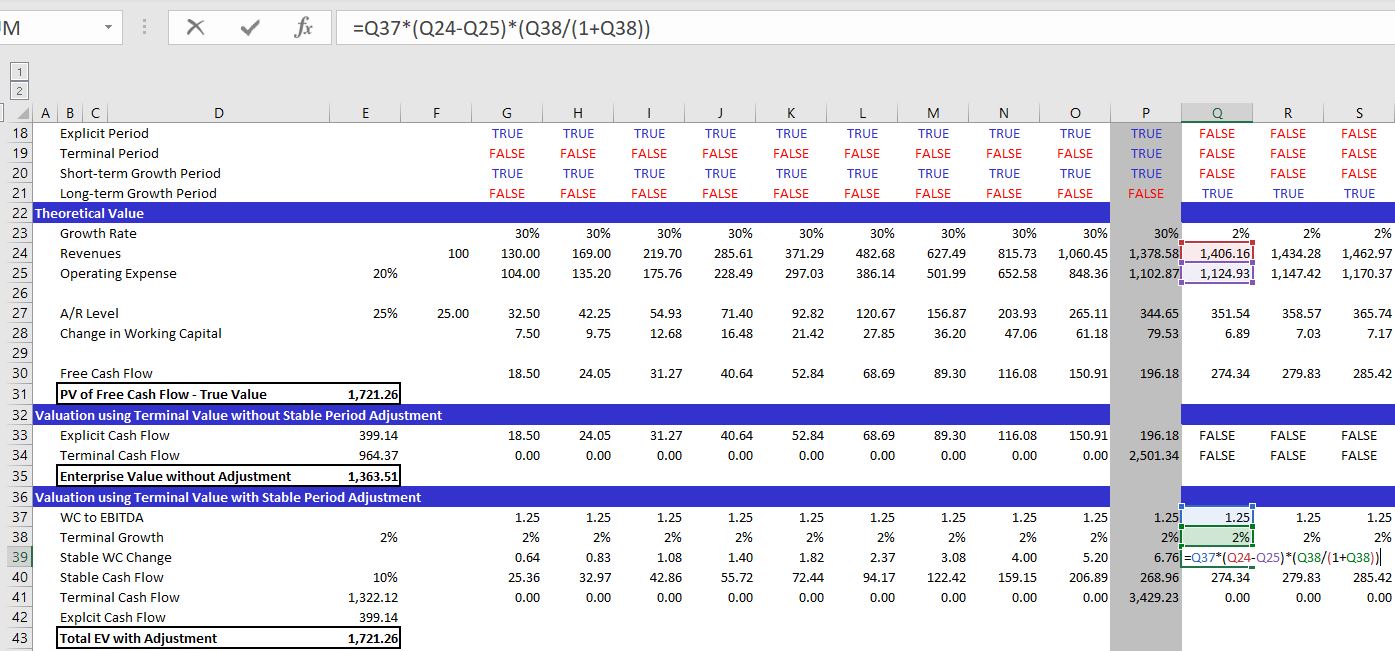

Changes in Working Capital

Changes in working capital refer to the fluctuations that occur in a company’s current assets and current liabilities over a specific period of time. These changes can either be positive or negative, indicating shifts in a company’s financial position and liquidity. Understanding the nature and impact of these changes is crucial for effective financial management. Here are some key points about changes in working capital:

Positive Changes: Positive changes in working capital occur when a company experiences an increase in its current assets or a decrease in its current liabilities. These changes can result from various factors, such as increased sales, efficient inventory management, accelerated collection of accounts receivable, negotiated favorable payment terms with suppliers, or a reduction in short-term debt obligations. Positive changes in working capital indicate improved liquidity and financial strength, providing companies with the resources to invest in growth opportunities and meet their financial obligations.

Negative Changes: Negative changes in working capital occur when a company’s current assets decrease or its current liabilities increase. This can happen due to a decline in sales, slow inventory turnover, delays in collecting accounts receivable, extended payment terms with suppliers, or increased short-term debt. Negative changes in working capital can put a strain on a company’s cash flow, reduce its liquidity, and increase its risk of financial instability. It is imperative for businesses to identify and address the underlying causes of negative changes in working capital to ensure long-term sustainability.

Changes in working capital can be indicative of the financial health and efficiency of a company. Monitoring these changes allows businesses to identify potential red flags, such as excessive inventory levels, slow collection of receivables, or difficulties in managing short-term debt. By analyzing these changes, companies can implement appropriate strategies to optimize their working capital, improve cash flow, and enhance their overall financial performance.

Furthermore, it is essential to note that changes in working capital may vary across different industries and businesses. Factors such as seasonality, economic conditions, and industry-specific dynamics can influence the nature and extent of changes in working capital. Therefore, it is crucial for companies to evaluate their working capital changes in the context of their specific industry and business model.

Managing changes in working capital requires a comprehensive understanding of a company’s financial position, operational efficiency, and market dynamics. By monitoring and analyzing these changes, businesses can make informed decisions to optimize their working capital, maintain financial stability, and enhance their overall competitiveness in the marketplace.

Factors Affecting Changes in Working Capital

Several factors can influence the changes that occur in a company’s working capital. Understanding these factors is crucial for effectively managing and analyzing the fluctuations in working capital. Here are some key factors that can impact changes in working capital:

- Sales Volume: Changes in sales volume can have a significant impact on a company’s working capital. Increasing sales can lead to higher accounts receivable and inventory levels, requiring additional working capital to support the increased business activity. Conversely, declining sales may result in a decrease in accounts receivable and inventory levels, freeing up working capital.

- Payment Terms: The payment terms a company negotiates with its suppliers and customers can affect its working capital. Longer payment terms with suppliers can delay the outflow of cash, providing short-term financing and preserving working capital. On the other hand, if a company offers longer payment terms to customers, it may experience delays in collecting accounts receivable, tying up working capital.

- Inventory Management: Effective inventory management practices can significantly impact working capital. Maintaining optimal inventory levels and minimizing obsolete or slow-moving inventory can free up working capital. Additionally, efficient supply chain management can reduce lead times and minimize inventory holding costs.

- Credit and Collection Policies: The credit policy a company adopts can affect its working capital. Offering more flexible credit terms to customers can increase sales but may also lead to a longer cash conversion cycle and tie up working capital. Implementing effective collection policies and practices is crucial for expediting the collection of accounts receivable and improving working capital.

- Economic Conditions: The overall economic conditions, such as inflation, interest rates, and consumer spending patterns, can impact a company’s working capital. Inflation can affect the cost of raw materials and inventory, affecting working capital requirements. Changes in interest rates can impact borrowing costs and influence short-term debt levels. Consumer spending patterns can influence sales volume and accounts receivable collection.

- Industry Dynamics: Each industry has its own unique characteristics that can impact changes in working capital. For example, industries with high seasonality, such as retail or tourism, may experience significant fluctuations in working capital throughout the year. Understanding industry-specific dynamics is essential for effectively managing working capital.

It is important for businesses to assess these factors and their impact on working capital regularly. By monitoring and analyzing these factors, companies can make informed decisions, implement appropriate strategies, and optimize their working capital position. Proper management of working capital is crucial for maintaining financial stability, supporting growth, and enhancing the overall performance of a business.

Positive Changes in Working Capital

A positive change in working capital refers to an increase in a company’s current assets or a decrease in its current liabilities. Positive changes in working capital can have various benefits for a business, enhancing its liquidity, financial position, and growth prospects. Here are some key factors that can contribute to positive changes in working capital:

- Increased Sales: A surge in sales can lead to an increase in accounts receivable, resulting in a positive change in working capital. Higher sales volume indicates stronger customer demand and increased revenue, bolstering a company’s financial position and providing resources for further growth.

- Efficient Inventory Management: Optimized inventory management can contribute to positive changes in working capital. Streamlining inventory levels, reducing excess or obsolete inventory, and improving inventory turnover can free up working capital. Efficient inventory management ensures that a company has the right amount of inventory to meet customer demand without tying up excessive capital.

- Timely Collection of Accounts Receivable: Accelerating the collection of accounts receivable can result in positive changes in working capital. Implementing effective credit and collection policies, offering incentives for early payment, and closely monitoring overdue accounts can improve cash flow, reduce outstanding receivables, and enhance working capital.

- Favorable Payment Terms with Suppliers: Negotiating favorable payment terms with suppliers can positively impact working capital. Extending payment terms or taking advantage of discounts for early payment can improve cash flow, contributing to positive changes in working capital. These arrangements provide short-term financing options and allow companies to utilize their cash resources more effectively.

- Reduction in Short-Term Debt: Paying off or reducing short-term debt obligations can lead to positive changes in working capital. By decreasing debt levels, a company can improve its liquidity, decrease interest expenses, and free up cash for other operational and growth-related activities.

Positive changes in working capital indicate improved liquidity, enhanced financial stability, and increased resources available for business operations. Such changes provide businesses with the means to invest in new projects, expand their operations, and capitalize on growth opportunities.

However, it is important for businesses to strike a balance in their pursuit of positive changes in working capital. While optimizing current assets and reducing current liabilities can be beneficial, excessively aggressive approaches may result in negative consequences. For example, overly tight credit policies or extended payment terms with suppliers may strain relationships and hinder future growth prospects.

Monitoring and regular analysis of working capital components are essential to ensure sustainable positive changes. By effectively managing working capital, businesses can maintain financial stability, strengthen their competitive position, and achieve long-term profitability.

Negative Changes in Working Capital

Negative changes in working capital occur when a company experiences a decrease in its current assets or an increase in its current liabilities. These changes can have adverse effects on a company’s financial position, liquidity, and operational efficiency. Understanding the factors that contribute to negative changes in working capital is crucial for effective financial management. Here are some key factors that can lead to negative changes in working capital:

- Declining Sales: A decrease in sales volume can result in negative changes in working capital. Lower sales lead to reduced accounts receivable, lower inventory turnover, and decreased revenue. This can strain a company’s cash flow, decrease its liquidity, and pose challenges in meeting short-term financial obligations.

- Slow Inventory Turnover: Poor inventory management practices can contribute to negative changes in working capital. Excessive or slow-moving inventory ties up valuable financial resources, reduces cash flow, and increases holding costs. Inefficient inventory turnover can result in obsolete inventory and reduced profitability.

- Delays in Collecting Accounts Receivable: Slow collection of accounts receivable can have a negative impact on working capital. Extended payment terms, delayed payments from customers, or ineffective credit and collection policies can result in reduced cash flow, increased outstanding receivables, and decreased working capital.

- Extended Payment Terms with Suppliers: Lengthy payment terms with suppliers can strain working capital by delaying the outflow of cash. While negotiating favorable payment terms can be beneficial, excessively long terms may strain relationships and restrict a company’s cash flow, potentially leading to liquidity issues and negative changes in working capital.

- Increased Short-Term Debt: Relying heavily on short-term debt can lead to negative changes in working capital. High levels of short-term borrowing increase interest expenses and financial obligations. This can limit a company’s ability to meet its financial obligations, reduce its liquidity, and negatively impact its working capital position.

Negative changes in working capital can pose challenges for businesses, including cash flow constraints, reduced ability to finance operations, and increased financial risk. It is important for companies to identify and address the underlying causes of negative changes in working capital promptly. This can involve implementing strategies such as improving sales and revenue generation, optimizing inventory management, and enhancing credit and collection practices.

Businesses should also consider implementing cash flow forecasting, regular monitoring of working capital ratios, and comprehensive financial analysis to identify potential issues early on. By proactively managing negative changes in working capital, companies can protect their financial stability, maintain liquidity, and position themselves for long-term success.

Impact of Changes in Working Capital

Changes in working capital can have a significant impact on a company’s financial health, operational efficiency, and overall performance. Whether positive or negative, these changes affect various aspects of a business. Understanding the impact of changes in working capital is crucial for effective financial management. Here are some key impacts of changes in working capital:

- Liquidity: Working capital directly impacts a company’s liquidity, which is its ability to meet short-term obligations. Positive changes in working capital increase a company’s liquidity by providing resources to cover immediate expenses and obligations. Conversely, negative changes in working capital can strain liquidity, leading to difficulties in paying bills, suppliers, and other short-term liabilities.

- Cash Flow: Working capital significantly influences a company’s cash flow. Positive changes in working capital can enhance cash flow by increasing the availability of cash or cash equivalents. This allows a company to meet its financial obligations, invest in growth initiatives, and navigate unforeseen challenges. Negative changes in working capital, on the other hand, can hinder cash flow, causing cash shortages, difficulties in paying expenses, and potential financial risks.

- Operational Efficiency: Changes in working capital can impact a company’s operational efficiency. Effective management of working capital ensures that the right amount of resources is allocated to support day-to-day operations. Positive changes, such as increased sales and efficient inventory turnover, can enhance operational efficiency and enable smooth production and delivery. Conversely, negative changes, like slow inventory turnover or delays in accounts receivable collection, can hinder operations, leading to disruptions and inefficiencies.

- Financial Stability: Working capital is a key indicator of a company’s financial stability. Positive changes in working capital improve a company’s financial stability by strengthening its ability to meet financial obligations, manage unexpected expenses, and weather economic downturns. Negative changes in working capital, however, can increase financial risk, decrease stability, and impact a company’s ability to sustain operations.

- Investor Perception: Changes in working capital can influence investor perception and confidence in a company. Positive changes signal financial strength, effective management, and growth potential, which can attract investors and lead to increased valuation. Conversely, negative changes may raise concerns about a company’s financial health, impacting investor confidence and potentially limiting access to capital and growth opportunities.

It is essential for businesses to proactively manage changes in working capital to mitigate risks and maximize opportunities. This includes regularly monitoring working capital ratios, analyzing cash flow forecasts, optimizing inventory management, and implementing effective credit and collection policies. By effectively managing changes in working capital, companies can enhance their financial stability, maintain liquidity, and position themselves for long-term success.

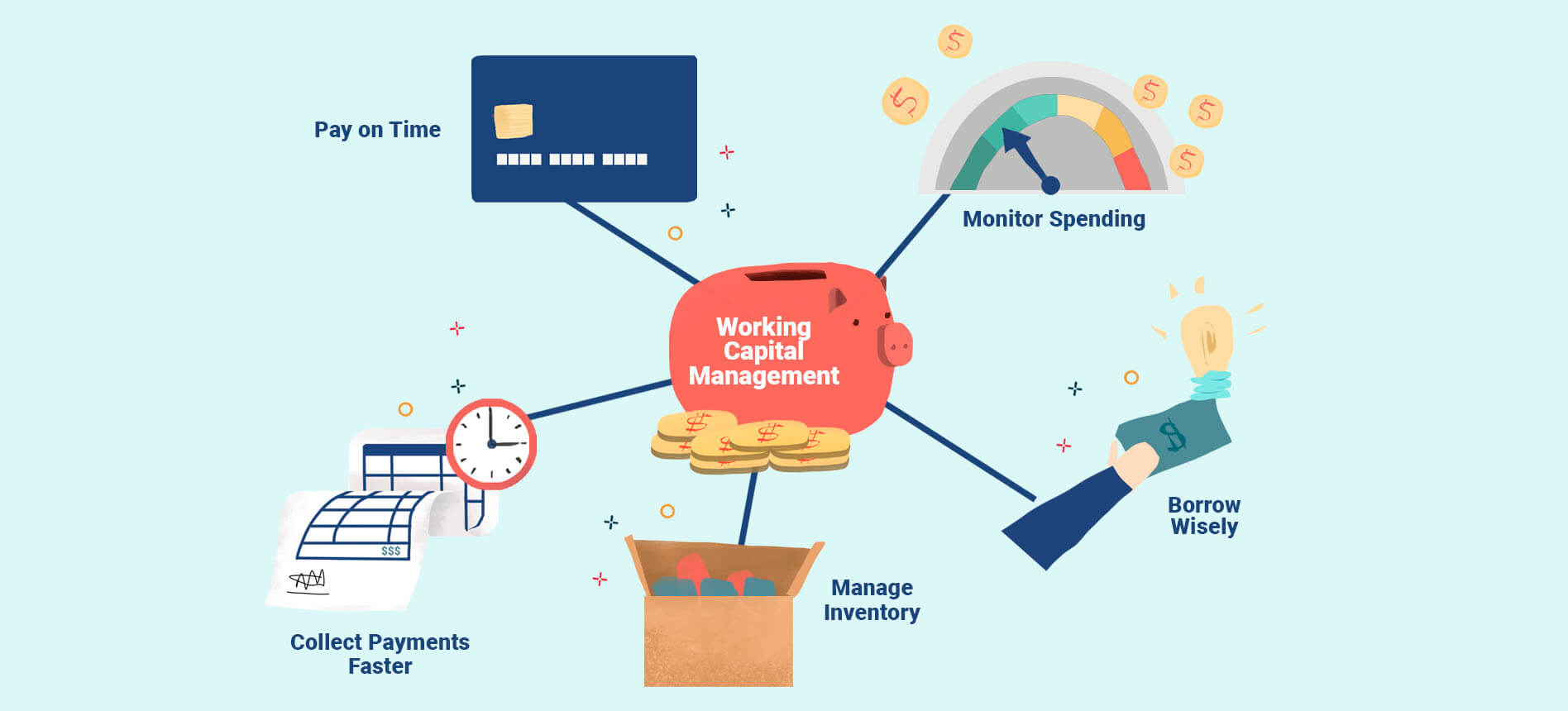

Managing Changes in Working Capital

Effectively managing changes in working capital is essential for businesses to maintain financial stability, optimize operational efficiency, and seize growth opportunities. Here are some key strategies and practices for managing changes in working capital:

- Cash Flow Forecasting: Implementing cash flow forecasting allows businesses to anticipate and plan for changes in working capital. By accurately projecting cash inflows and outflows, companies can identify potential gaps or surpluses in their working capital and take appropriate measures to address them.

- Optimize Inventory Management: Efficient inventory management plays a vital role in managing working capital. Analyze demand patterns, implement just-in-time inventory strategies, and utilize technology to optimize inventory levels. This helps prevent overstocking, reduce carrying costs, and ensure the availability of inventory to meet customer demand.

- Improve Accounts Receivable Collection: Streamline and tighten credit policies, implement effective invoicing and collection procedures, and offer incentives for prompt payment to improve accounts receivable collection. This helps accelerate cash inflows, reduce outstanding receivable balances, and positively impact working capital.

- Negotiate Favorable Payment Terms: Establishing favorable payment terms with suppliers can enhance working capital management. This may involve negotiating longer payment terms or taking advantage of supplier discounts. Timely payments to suppliers are crucial for maintaining good relationships and ensuring the availability of essential goods and services.

- Manage Accounts Payable: Efficient management of accounts payable is essential for optimizing working capital. Pay suppliers within the agreed-upon terms to maintain good relationships and avoid any potential penalties. Consider taking advantage of early payment discounts if offered by suppliers.

- Monitor and Control Expenses: Carefully monitor and control expenses to ensure efficient utilization of working capital. Regularly review expense categories, identify areas where cost reductions can be made, and implement cost-saving measures without compromising the quality of products or services.

- Strengthen Financial Planning and Analysis: Regularly analyze key financial metrics, such as working capital turnover and liquidity ratios, to monitor changes and trends in working capital. This provides insights into the effectiveness of working capital management strategies and allows for adjustments to be made as needed.

- Implement Technology Solutions: Leverage technology solutions, such as enterprise resource planning (ERP) systems, inventory management software, and automated billing systems, to streamline processes and improve the efficiency of working capital management. These tools can enhance accuracy, reduce manual errors, and provide real-time visibility into the financial health of the business.

- Collaborate with Stakeholders: Effective communication and collaboration with key stakeholders, including suppliers, customers, and financial partners, are essential for managing changes in working capital. Collaboratively managing payment terms, inventory planning, and collection efforts can lead to mutually beneficial outcomes and strengthen business relationships.

By implementing these strategies and practices, businesses can optimize their working capital, improve cash flow, and enhance overall financial performance. Regular monitoring, analysis, and adjustment of working capital management efforts are crucial to maintaining a healthy financial position and sustaining long-term success in the marketplace.

Conclusion

Managing working capital is paramount for businesses seeking financial stability, operational efficiency, and long-term growth. Understanding the components, factors, and impact of changes in working capital allows businesses to make informed decisions and implement effective strategies. Positive changes in working capital indicate increased liquidity, improved operational efficiency, and enhanced financial stability. By optimizing inventory, expediting accounts receivable collection, negotiating favorable payment terms, and reducing short-term debt, companies can achieve positive changes in working capital.

On the other hand, negative changes in working capital can strain liquidity, hinder operational efficiency, and elevate financial risk. Proactive management of factors such as declining sales, slow inventory turnover, delays in accounts receivable collection, extended payment terms, and increased short-term debt is crucial to mitigate the negative impact on working capital.

Adopting practices such as cash flow forecasting, efficient inventory management, optimized credit and collection policies, and strategic supplier collaboration are key to effectively manage changes in working capital. Regular monitoring of financial metrics, leveraging technology solutions, and strengthening financial planning and analysis provide businesses with the insights and tools necessary to make informed decisions. Maintaining open communication and collaboration with stakeholders is also essential in managing working capital effectively.

In conclusion, managing changes in working capital is a fundamental aspect of financial management. By implementing sound strategies, businesses can ensure sufficient liquidity, enhance operational efficiency, and position themselves for long-term success in an ever-changing business landscape.