Home>Finance>How Much Equity To Give Up For Initial Investment

Finance

How Much Equity To Give Up For Initial Investment

Published: October 19, 2023

Find out how much equity you should offer for initial investment. Learn the best financing strategies for your business. Finance your growth effectively with expert guidance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When starting a business, securing the necessary funds to get off the ground is often a top priority. Whether it’s funding for product development, marketing efforts, or operational expenses, finding investors willing to provide the initial investment is crucial. However, determining how much equity to give up in exchange for that investment can be a challenging task.

Equity refers to the ownership interest or stake in a company. It represents the proportion of the business that an investor or founder holds. In the context of securing an initial investment, deciding how much equity to offer can significantly impact the future success and control of the business.

There are several factors to consider when determining the appropriate amount of equity to give up. Understanding the value of your business, evaluating the potential growth prospects, and negotiating with investors are all key components of this process.

In this article, we will walk you through the important factors to consider when deciding how much equity to give up for an initial investment. We will guide you through the steps of assessing your business’s value, determining the initial investment needed, negotiating the equity split, and allocating equity among investors. We will also highlight some common mistakes to avoid in order to ensure a fair and successful arrangement.

By the end of this article, you will have a clearer understanding of how to strike the right balance between securing the required investments and maintaining control of your business through a well-negotiated equity agreement.

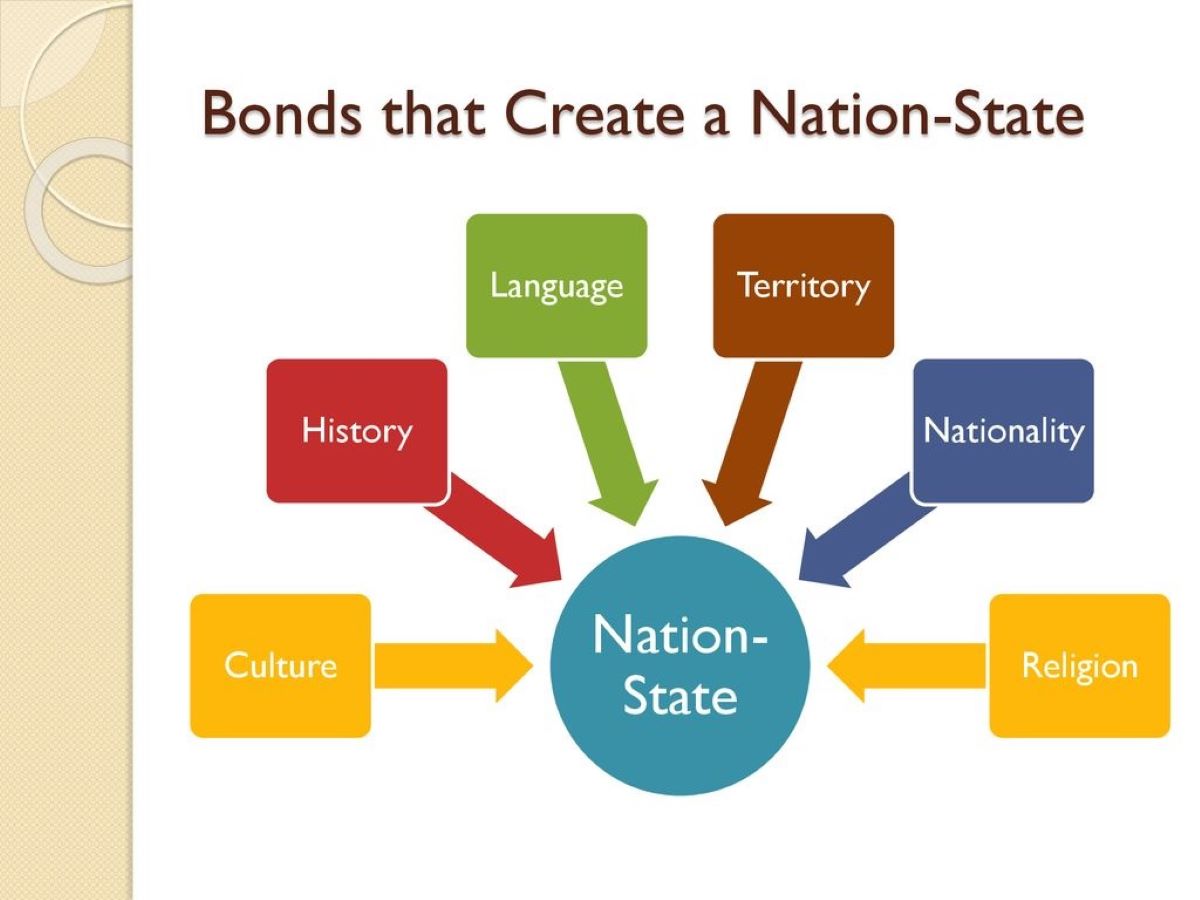

Understanding Equity

Before delving into the specifics of how much equity to give up for an initial investment, it’s essential to have a solid understanding of what equity represents in the context of a business. Equity refers to the ownership interest or stake in a company and is typically expressed as a percentage.

Equity represents the value that founders and investors hold in a business. It entitles the owner to a share of the company’s profits and assets, as well as a say in the decision-making processes. When an investor contributes capital to a business, they receive a portion of the equity proportional to their investment.

The allocation of equity benefits both the founders and investors. For founders, equity allows them to raise capital without incurring debt, and it provides investors with the opportunity to participate in the growth and success of the business.

As a founder, it’s important to recognize that giving up equity means relinquishing a portion of control and ownership in the business. Therefore, it’s crucial to carefully consider the amount of equity to offer investors, ensuring it aligns with your long-term goals and intentions for the company.

Equity can be divided into different classes, such as common equity and preferred equity. Common equity is the most basic form of ownership in a company and typically provides voting rights to the owners. Preferred equity, on the other hand, grants certain preferences or rights to the owners, such as priority in receiving dividends or assets in the event of a liquidation.

Additionally, equity can be subject to vesting schedules, which outline the time frame in which an individual earns their ownership stake. Vesting schedules are commonly used to incentivize founders and key employees to remain with the company for a specific period.

Understanding the nuances of equity and its potential implications on ownership and control is essential when considering how much equity to give up for an initial investment. By having a clear comprehension of these concepts, you will be better equipped to navigate the negotiation process and make informed decisions that align with your business objectives.

Factors to Consider

Deciding how much equity to give up for an initial investment is a critical decision that requires careful consideration. Here are some key factors to take into account when determining the appropriate equity allocation:

- Business Industry and Growth Potential: The industry your business operates in and its growth potential play a significant role in determining the value and attractiveness to potential investors. If your business operates in a high-growth industry, investors may be more willing to invest and accept a smaller equity stake. Conversely, if your business is in a saturated or slower-growth industry, investors may expect a higher equity percentage to compensate for the perceived risk.

- Current Valuation: A thorough assessment of your business’s current value is crucial in determining the equity to offer. Conducting a comprehensive valuation analysis, which may include reviewing financial statements, evaluating assets, and considering future revenue projections, will give you a clearer understanding of the worth of your business. This assessment will help you negotiate an appropriate equity allocation with potential investors.

- Investor Expectations: Understanding the expectations and motivations of potential investors is essential. Some investors may be looking for a high return on investment and may require a larger equity stake, while others may be more interested in taking an advisory role rather than focusing solely on equity. Communicating openly with potential investors to align on their expectations will help you determine the appropriate equity allocation.

- Funding Needs: Assessing your business’s financial requirements is crucial in determining how much equity to give up. Carefully analyze the amount of initial investment needed and the anticipated future funding needs. It’s important to strike a balance between securing the necessary funds to grow your business and maintaining a reasonable equity stake.

- Founder’s Vision and Long-Term Goals: Consider your long-term goals for the business and the level of control and ownership you want to maintain. Your vision for the company will influence the amount of equity you’re willing to give up. It’s important to ensure that the equity split aligns with your aspirations, allowing you to remain motivated and committed to the business.

These factors are not exhaustive, and the weight you assign to each will depend on your specific circumstances. It’s crucial to carefully assess these considerations and strike a balance that aligns with your business objectives and the expectations of potential investors. By doing so, you can create a fair and mutually beneficial equity agreement that sets your business on the path to success.

Assessing the Business’s Value

Before determining how much equity to offer for an initial investment, it is crucial to assess the value of your business. Conducting a thorough evaluation will provide a clear understanding of your business’s worth and help you negotiate an appropriate equity allocation with potential investors. Here are some key steps to assess your business’s value:

- Financial Analysis: Begin by conducting a comprehensive financial analysis of your business. Review your financial statements, including income statements, balance sheets, and cash flow statements, to gain insights into your company’s financial health and performance. Consider factors such as revenue growth, profitability, and recurring income streams, as these will impact the perceived value of your business.

- Industry Comparisons: Compare your business to others in your industry to gain a benchmark of its value. Research similar companies in terms of size, market share, and growth trajectory. Analyze their valuation multiples, such as price-to-earnings (P/E) ratio or price-to-sales (P/S) ratio, to determine how your business measures up against comparable companies.

- Growth Potential: Assess the growth potential of your business and its scalability. Consider factors such as your target market, competitive landscape, and any innovative products or services you offer. A business with strong growth prospects is likely to be more attractive to investors and may warrant a higher valuation.

- Intellectual Property and Assets: Take into account the value of any intellectual property (IP) your business owns, such as patents or trademarks. Intellectual property can significantly contribute to the overall value of your business. Additionally, evaluate your tangible assets, such as equipment, inventory, and real estate, as they can also impact valuation.

- Future Projections: Consider your business’s future revenue projections and growth trajectory. Develop a realistic and well-supported forecast that outlines your anticipated revenue, expenses, and profitability over a certain period. Investors will closely evaluate these projections when assessing the value of your business and determining their desired equity stake.

It’s important to note that assessing the value of a business is a complex and subjective process. Different valuation methods can be employed, such as the discounted cash flow (DCF) analysis, market approach, or asset-based approach. Consider seeking professional guidance from a financial advisor or valuations expert to ensure a robust and accurate assessment.

By conducting a comprehensive evaluation of your business’s value, you will have a solid foundation for negotiating the appropriate equity allocation with potential investors. Remember that the valuation is just one piece of the puzzle, and other factors such as industry dynamics, investors’ expectations, and your long-term goals should also be taken into account when determining how much equity to give up.

Determining the Initial Investment

Once you have assessed the value of your business and have a clearer understanding of its worth, the next step is to determine the amount of initial investment required. The initial investment is the capital needed to kickstart your business, cover startup costs, and fuel early growth. Here are some key considerations when determining the initial investment:

- Startup Costs: Evaluate the specific costs involved in starting your business. This may include expenses such as equipment, office space, legal fees, marketing, and hiring key personnel. Identify all the necessary expenditures to calculate the initial capital required.

- Operational Expenses: Consider the ongoing operational expenses that your business will incur. This includes rent, utilities, salaries, inventory, marketing, and other day-to-day costs. Estimating these expenses will help you determine the initial investment needed to sustain your business until it becomes self-sufficient.

- Growth Initiatives: Factor in any growth initiatives or expansion plans you have for your business. This could include entering new markets, developing new products, or scaling up marketing efforts. Consider the capital needed to support these growth initiatives and adjust the initial investment accordingly.

- Contingency Funds: It’s wise to have a contingency fund to account for unexpected expenses or any challenges that may arise. Building a buffer into your initial investment will provide a safety net and ensure you have sufficient funds to navigate unforeseen circumstances.

- Funding Rounds: Consider the potential need for future funding rounds. While determining the initial investment, you should also plan for subsequent rounds of funding to support your business’s growth. Ensure that the equity offered during the initial investment phase leaves room for future investors to participate.

When determining the initial investment, it’s essential to strike a balance between securing enough capital to launch and grow your business and offering a fair equity stake to potential investors. Make sure to carefully calculate all the required expenses and consider any potential risks or uncertainties that may impact the financial needs of your business.

Remember that the initial investment is just the beginning, and the subsequent financial requirements to sustain and expand your business should also be taken into account. By accurately determining the initial investment, you can establish a strong foundation for your business’s growth and attract the right investors who are aligned with your financial needs and objectives.

Negotiating the Equity Split

Once you have assessed the value of your business and determined the initial investment required, the next step is to negotiate the equity split with potential investors. The equity split refers to the allocation of ownership stakes among the founders and investors. Here are some important considerations when negotiating the equity split:

- Founder’s Stake: Start by establishing the founder’s stake in the business. As the founder, you should maintain a significant ownership percentage to retain control and align your interests with the success of the company. Consider the level of time, effort, and expertise you have invested in building the business when determining your stake.

- Investor’s Contribution: Assess the value that the investor brings to the table, beyond just capital. Consider their industry expertise, connections, or any other resources they can contribute to help grow your business. The level of value they provide can influence the equity stake they receive.

- Future Growth Potential: Contemplate the long-term growth potential of your business and how that may affect the equity split. If you expect significant growth and foresee the need for future funding rounds, you may need to allocate a smaller initial equity stake to leave room for the participation of future investors.

- Negotiation Leverage: Evaluate the negotiation leverage you have. If you have multiple investors interested in funding your business, you may have more flexibility to negotiate favorable terms. Conversely, if you have limited options, you may need to be more cautious with the equity offered.

- Vesting and Milestones: Consider implementing vesting schedules and milestones to incentivize investor commitment and align interests. Vesting schedules can ensure that shares are earned over time, incentivizing investors to remain dedicated to the success of the business. Milestones can be set, linking equity release to the achievement of specific goals or targets.

- Legal and Professional Advice: Seek legal and professional advice during the negotiation process to ensure compliance with regulations and to protect your interests. Lawyers and financial advisors specialized in startups and equity agreements can provide valuable guidance and help navigate the complexities of negotiating the equity split.

Remember that negotiating the equity split should involve open and transparent communication between all parties involved. Clearly articulate your expectations and ensure that all terms are documented in a legally binding agreement. Striking a fair and balanced equity split is crucial for establishing a strong foundation for your business and building positive relationships with investors.

Keep in mind that every negotiation is unique, and the specific circumstances of your business will influence the equity split. Be prepared to be flexible and open to compromise while still protecting your interests and maintaining a clear vision for the future of your business.

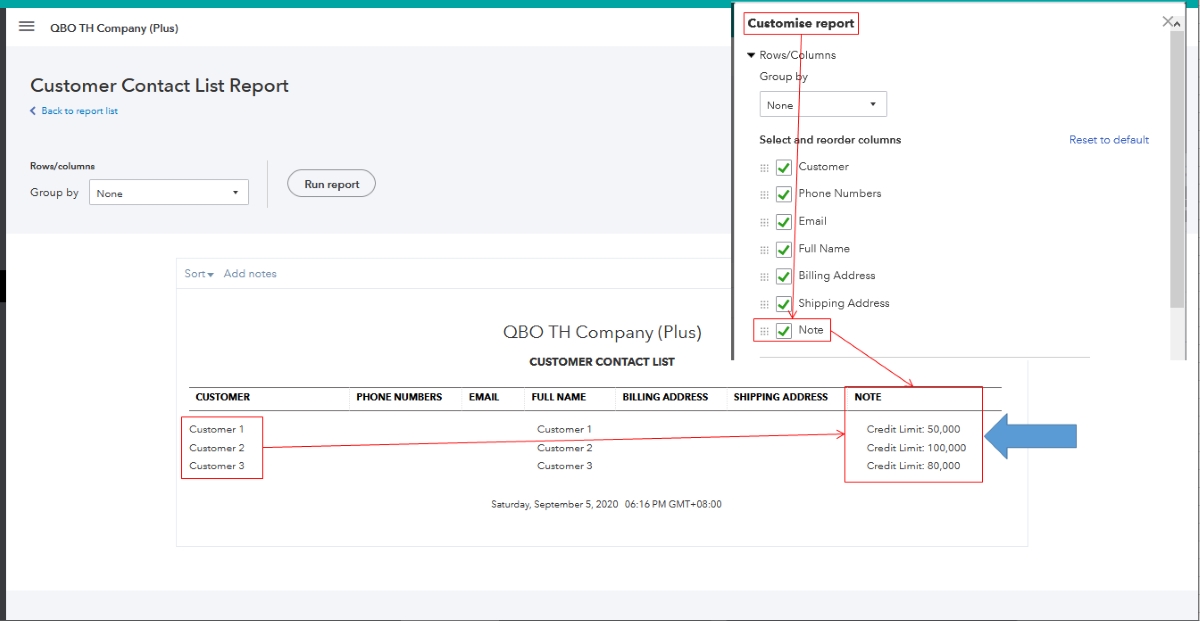

Allocating Equity among Investors

When allocating equity among investors, it’s important to create a fair and equitable distribution that aligns with the value each investor brings to the business. Here are some key considerations to keep in mind when allocating equity:

- Investor Contributions: Evaluate the contributions that each investor brings to the table. This can include not only the financial investment but also their expertise, network, and resources. Consider the synergy between their skills and your business needs and allocate equity accordingly.

- Investor Risk Appetite: Take into account the risk appetite of each investor. Some investors may be more risk-averse and prefer a larger equity stake to compensate for perceived risk, while others may be willing to take on higher risk for a smaller equity share. Consider individual preferences when determining the allocation.

- Investment Timing: Factor in the timing of the investment. Investors who enter at an earlier stage when the business carries more risk and uncertainty may expect a larger equity stake compared to those who invest at a later stage when the business has shown more stability and growth potential.

- Evaluation of Investor Expertise: Assess the expertise and experience of each investor in the specific industry or market of your business. Investors who bring significant industry knowledge and networks may provide added value beyond the financial investment. This expertise can warrant a larger equity allocation.

- Future Dilution: Consider the potential dilution of equity when allocating among investors. If you anticipate additional rounds of funding in the future, ensure that the initial equity allocation leaves room for new investors to participate without overly diluting the ownership stakes of existing investors.

- Alignment of Interests: Seek to align the interests of the investors with the long-term goals of the business. This can be achieved through the use of vesting schedules, milestones, and other performance-based criteria. Aligning interests ensures that all investors are motivated to actively contribute to the success of the business.

It’s crucial to approach the allocation of equity with transparency and fairness, ensuring that all investors understand the reasoning behind the distribution. Clearly document the allocation in an equity agreement to avoid any future disputes or misunderstandings.

Remember that the allocation of equity should not only be based on financial contributions but should also consider the value and expertise each investor brings to your business. By carefully considering these factors, you can create a balanced and mutually beneficial equity allocation among investors that sets the stage for future growth and success.

Common Mistakes to Avoid

When determining how much equity to give up for an initial investment, there are several common mistakes that entrepreneurs should avoid. By being aware of these pitfalls, you can make more informed decisions and establish a solid foundation for your business. Here are some common mistakes to watch out for:

- Overvaluing or Undervaluing the Business: Failing to accurately assess and value your business can lead to offering too much or too little equity. Conducting a comprehensive evaluation of your business’s worth is crucial to ensure a fair and realistic equity split.

- Ignoring Investor Expectations: Neglecting to understand and align with investor expectations can lead to miscommunication and dissatisfaction. Take the time to clearly communicate and discuss investment terms and expectations with potential investors to ensure mutual understanding.

- Not Considering Long-Term Growth: Focusing solely on the initial investment and neglecting to consider the future funding needs can result in giving up too much equity too soon. Plan for future funding rounds and leave room for subsequent investors to participate.

- Not Protecting Founder’s Interests: It’s important to strike a balance between attracting investors and protecting the founder’s interests and control. Giving away too much equity can dilute the founder’s ownership and decision-making authority. Ensure that the founder’s stake is sufficient to maintain their vision and motivation in growing the business.

- Not Seeking Professional Advice: Attempting to navigate the equity allocation process without seeking legal and financial advice can lead to costly mistakes. Engage professionals who specialize in startup financing and equity agreements to ensure compliance and protection of your interests.

- Underestimating Future Dilution: Failing to anticipate future dilution can result in significant ownership reductions for founders and early-stage investors. Evaluate the potential impact of future rounds of funding and ensure that the initial equity allocation leaves room for new investors.

- Neglecting Vesting Schedules and Milestones: Forgetting to implement vesting schedules and milestones can put the business at risk if key team members or investors exit prematurely. Establishing vesting schedules and tying equity release to performance milestones can safeguard against unexpected departures.

By avoiding these common mistakes, you can make sound decisions regarding equity allocation and protect the long-term interests of your business. Remember that each decision should be carefully considered and aligned with your specific business goals and values.

Conclusion

Determining how much equity to give up for an initial investment is a critical decision that can significantly impact the future success of your business. By carefully considering the factors discussed in this article, you can strike a balance between securing the necessary funds and maintaining control and ownership.

Understanding equity and its implications, assessing your business’s value, and accurately determining the initial investment are crucial steps in the process. Additionally, negotiating the equity split and allocating equity among investors should be approached with fairness and transparency.

Avoiding common mistakes such as overvaluing or undervaluing your business, neglecting investor expectations, and underestimating future dilution can help you make more informed decisions and protect the long-term interests of your business.

Remember to seek professional advice when needed, engage in open and transparent communication with investors, and align the equity allocation with your long-term goals and vision for the business.

By carefully navigating the equity allocation process, you can secure the necessary funds to fuel the growth of your business while maintaining a fair and solid ownership structure. Striking the right balance will enable you to attract investors, motivate your team, and position your business for long-term success.