Finance

What Is A Negative Cash Flow

Published: December 21, 2023

Discover what a negative cash flow means in the world of finance and how it can impact your financial situation. Learn how to navigate this challenge and improve your financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, cash flow is a crucial indicator of a company’s financial health. It refers to the movement of money in and out of a business, tracking the inflow and outflow of cash over a specific period of time. While positive cash flow is generally considered favorable, there are instances when businesses experience negative cash flow.

Negative cash flow occurs when a company’s outgoing cash exceeds its incoming cash. In other words, it means that a business is spending more money than it is earning. This can be a worrisome situation for any organization, as it may hinder its ability to pay off debts, meet operational costs, and invest in growth opportunities. Understanding the causes, impact, and management of negative cash flow is essential for businesses to navigate through challenging financial situations.

This article aims to provide a comprehensive understanding of negative cash flow, including its definition, causes, impact, examples, and strategies for managing it. Whether you’re a business owner, investor, or financial professional, having a clear grasp of negative cash flow is crucial for making informed decisions and safeguarding the financial stability of an organization.

Definition of Negative Cash Flow

Negative cash flow refers to a financial situation in which a company’s outflow of cash surpasses its inflow of cash during a specific period of time. It is an indication that a business is spending more money than it is generating, resulting in a deficit in cash reserves. Negative cash flow can occur in both small and large businesses across various industries, and it can have serious implications for the financial viability of an organization.

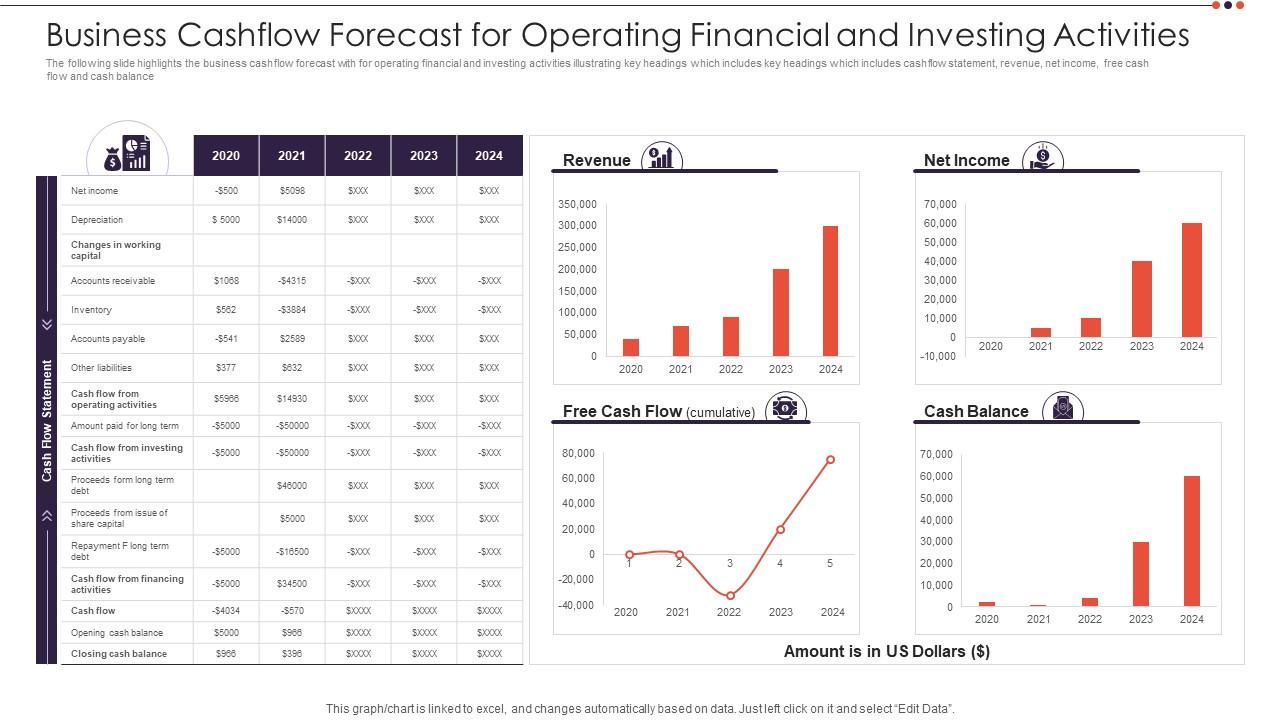

There are two primary types of cash flow: operating cash flow and investing cash flow. Operating cash flow refers to the cash generated or used in the day-to-day operations of a business, including revenue from sales, payment of expenses, and investments in inventory. Investing cash flow, on the other hand, involves cash flows related to the acquisition or sale of long-term assets, such as property, equipment, or investments.

When a company’s cash outflow from operating activities exceeds its cash inflow, it results in negative operating cash flow. On the other hand, negative investing cash flow occurs when the cash used for investments exceeds the cash received from the disposal of assets or investments. These negative cash flow situations can stem from various factors and can impact a company’s financial health and ability to meet its obligations.

It is important to note that negative cash flow is not necessarily an indicator of a failing business. Companies often experience periods of negative cash flow during their growth stages, as they invest heavily in expanding operations, research and development, or marketing. However, sustained negative cash flow without a proper plan for improvement can lead to severe financial difficulties and even bankruptcy.

Understanding the concept of negative cash flow is crucial for businesses, as it allows them to identify potential financial risks, take corrective actions, and ensure they have a sustainable cash flow pattern to support ongoing operations and future growth.

Causes of Negative Cash Flow

Negative cash flow can be attributed to various factors and circumstances within a business. Understanding the causes of negative cash flow is essential for identifying potential financial risks and implementing strategies to address them. Let’s explore some common causes of negative cash flow:

- Low sales or revenue: Insufficient sales or revenue can contribute to negative cash flow. If a company is not generating enough income to cover its operating expenses, it will experience a deficit in cash flow.

- High operational expenses: When a business incurs high operational expenses, such as rent, employee salaries, utilities, or inventory costs, it can lead to negative cash flow. This is especially true if the expenses outweigh the revenue generated.

- Excessive debt payments: If a company has significant debt obligations, such as loan repayments or interest payments, it can put a strain on its cash flow. High debt payments can deplete the available cash, leading to a negative cash flow situation.

- Inefficient inventory management: Poor inventory management can result in tied-up cash and excessive inventory carrying costs. If a company has excessive inventory levels or outdated stock, it can drain its cash flow and contribute to a negative cash flow situation.

- Seasonal fluctuations: Some businesses experience seasonal variations in sales and revenue. For example, retail businesses often see higher sales during the holiday season. If a company relies heavily on seasonal revenue, it may face negative cash flow during off-peak months.

- Slow-paying customers: Delays in receiving payments from clients or customers can significantly impact cash flow. If a company has a high number of slow-paying customers or faces overdue payments, it can lead to negative cash flow as the company struggles to meet its own payment obligations.

- Poor collections processes: Ineffective collections processes, such as lax invoicing procedures or inadequate follow-up on outstanding invoices, can result in delayed or missed payments. This can have a detrimental effect on cash flow, contributing to a negative cash flow situation.

- Market downturn or economic recession: External factors such as a market downturn or an economic recession can impact a company’s cash flow. Reduced consumer spending, decreased demand for products or services, and increased competition can lead to lower sales and negative cash flow.

These are just a few of the many potential causes of negative cash flow. It is crucial for businesses to regularly monitor their cash flow position and proactively address any issues to ensure a stable financial situation.

Impact of Negative Cash Flow

Negative cash flow can have significant consequences for a business, affecting its financial stability and ability to meet its obligations. Understanding the impact of negative cash flow is essential for businesses to address the issue promptly and implement appropriate strategies. Below are some key impacts of negative cash flow:

- Limited liquidity: Negative cash flow indicates a lack of available funds. This limits a company’s liquidity, making it challenging to cover day-to-day expenses, pay suppliers, and meet financial obligations.

- Inability to invest and grow: Negative cash flow restricts a business’s ability to invest in expansion, research and development, or new opportunities. The lack of funds hinders growth potential and reduces competitive advantage in the market.

- Inability to pay debts: Negative cash flow can lead to difficulties in meeting debt obligations, such as loan repayments, interest payments, and credit card bills. This can damage relationships with lenders and negatively impact the company’s creditworthiness.

- Strained supplier relationships: If a company consistently struggles with negative cash flow, it may face challenges in paying suppliers on time. This can strain relationships with suppliers, leading to delayed deliveries, strained negotiations, or even the loss of key suppliers.

- Reduced employee morale: Negative cash flow can also impact employee morale and job security. If a company is unable to meet payroll or provide competitive compensation and benefits, it can lead to demotivation, increased turnover, and decreased productivity.

- Difficulty accessing financing: Negative cash flow makes it challenging for a company to secure financing or obtain credit. Lenders and investors may view negative cash flow as a red flag, making it harder to obtain additional capital when needed.

- Lack of financial flexibility: Negative cash flow limits a company’s financial flexibility to navigate unexpected events or market fluctuations. Without sufficient cash reserves, a business may face challenges in responding to emergencies or seizing growth opportunities.

- Risk of insolvency: In the most severe cases, prolonged negative cash flow can lead to insolvency and potential bankruptcy. A business that consistently operates with negative cash flow may become unable to meet its financial obligations, resulting in the closure of operations.

It is crucial for businesses to take proactive measures to address negative cash flow and mitigate its impact. By identifying the underlying causes and implementing appropriate strategies, businesses can restore financial stability, improve cash flow, and ensure long-term success.

Examples of Negative Cash Flow

Negative cash flow can occur in various industries and business situations. Let’s explore some examples to illustrate how negative cash flow can impact different types of businesses:

- Tech Startup: A tech startup that is investing heavily in research and development, hiring top talent, and marketing their product may experience negative cash flow initially as they work towards product development and market penetration. While they may not see immediate returns, the goal is to eventually generate positive cash flow through increased sales and revenue once their product gains traction in the market.

- Retail Business: A retail store may experience negative cash flow during their initial months or slow seasons. High rent, inventory costs, and operational expenses can outweigh the revenue generated, resulting in a cash flow deficit. However, during peak seasons, such as the holiday season, they may generate significant revenue and offset the previous negative cash flow periods.

- Construction Company: A construction company that takes on large projects may face negative cash flow due to the substantial upfront costs involved. The costs associated with materials, equipment rental, and labor expenses can surpass the revenue received until the project is completed and payments are received from the client.

- Restaurant Business: A restaurant may experience negative cash flow during its early stages of operation as it invests in kitchen equipment, renovations, and marketing. It takes time to build a loyal customer base and generate consistent revenue. However, with proper management and an increase in customer traffic, the restaurant can gradually achieve positive cash flow.

- Manufacturing Company: A manufacturing company that requires substantial investment in machinery, production facilities, and raw materials may experience negative cash flow during the initial setup and production process. The costs involved in establishing the infrastructure often exceed the revenue generated until the production reaches full capacity.

These examples highlight that negative cash flow can be a temporary phase or a strategic investment for long-term growth. It is crucial for businesses to analyze their cash flow patterns, identify the causes behind negative cash flow, and implement effective strategies to mitigate its impact and achieve sustainable positive cash flow.

Managing Negative Cash Flow

Effectively managing negative cash flow is crucial for the financial health and long-term viability of a business. While negative cash flow may be a temporary phase, it is important to implement strategies to improve cash flow and ensure the sustainability of operations. Here are some key strategies for managing negative cash flow:

- Reduce expenses: Carefully review all expenses and identify areas where costs can be reduced without compromising the quality of products or services. This could involve negotiating better deals with suppliers, implementing cost-saving measures, or optimizing operational efficiencies.

- Improve sales and revenue: Focus on increasing sales and revenue to generate more incoming cash. This could involve refining marketing strategies, expanding the customer base, introducing new products or services, or exploring new market opportunities.

- Tighten credit and collections policies: Review credit terms and assess the creditworthiness of customers. Implement stricter credit policies and follow up diligently on overdue payments to ensure prompt collection and improve cash flow.

- Optimize inventory management: Analyze inventory levels and ensure they are aligned with customer demand. Avoid overstocking or carrying obsolete inventory, as this ties up valuable cash. Implement just-in-time inventory management strategies to minimize carrying costs.

- Negotiate payment terms: Revisit payment terms with suppliers to negotiate extended payment periods or discounts for early payments. This can help alleviate immediate cash flow pressures and improve financial flexibility.

- Explore financing options: Consider securing financing options such as a line of credit, business loans, or invoice factoring to bridge short-term cash flow gaps. However, carefully assess the terms and interest rates associated with these financing options to ensure they are viable and sustainable for the business.

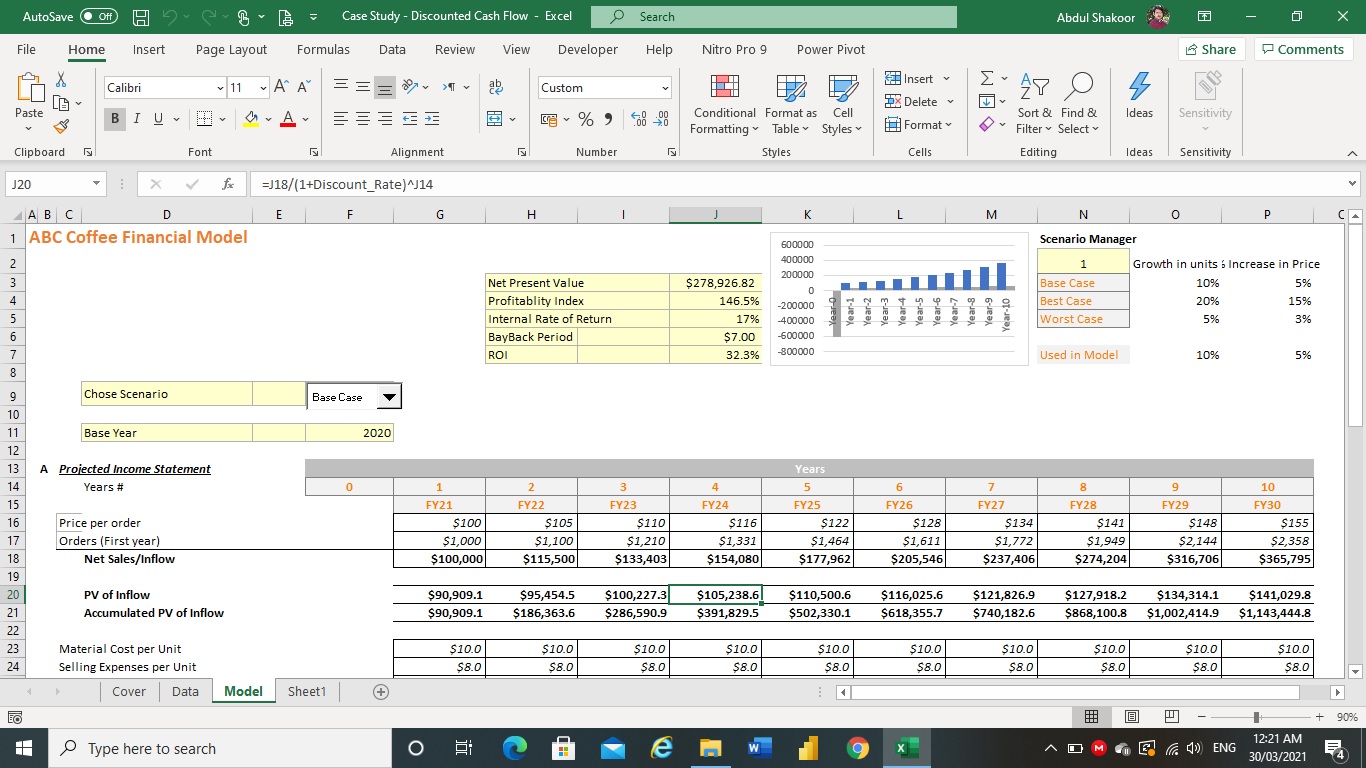

- Create a cash flow projection: Develop a cash flow projection to forecast the expected cash inflows and outflows. This will help anticipate potential cash flow gaps and plan accordingly to ensure sufficient liquidity.

- Improve accounts receivable management: Implement effective invoicing procedures, send out invoices promptly, and follow up on outstanding payments. Consider offering incentives for early payments or implementing a recurring billing system to ensure a steady stream of cash.

- Invest in technology: Utilize digital tools and software to streamline financial operations, automate processes, and track cash flow in real-time. This can help improve efficiency, reduce manual errors, and gain better visibility into the financial situation of the business.

- Seek professional advice: If the negative cash flow situation persists or becomes concerning, it may be beneficial to seek guidance from a financial advisor or accountant. They can provide insight, identify potential issues, and offer tailored solutions based on the specific needs of the business.

By implementing these strategies and regularly monitoring cash flow, businesses can effectively manage and improve their negative cash flow situation. It is crucial to have a proactive approach, continuously evaluate financial performance, and adapt strategies as needed to ensure long-term financial stability and success.

Conclusion

Negative cash flow can present significant challenges for businesses, affecting their financial stability and ability to meet obligations. However, it is important to remember that negative cash flow is not necessarily indicative of a failing business. In fact, many businesses experience negative cash flow during growth phases, investments, or seasonal fluctuations.

To effectively manage negative cash flow, businesses should focus on identifying the underlying causes, implementing strategies to improve cash flow, and ensuring long-term sustainability. This includes reducing expenses, improving sales and revenue, optimizing inventory management, tightening credit and collections policies, exploring financing options, and leveraging technology to streamline financial operations.

Furthermore, businesses should regularly monitor and analyze their cash flow, proactively address challenges, and make informed decisions based on accurate financial data. Seeking professional advice when necessary can provide valuable insights and guidance in managing negative cash flow.

Ultimately, the goal is to achieve positive and sustainable cash flow, ensuring the business’s ability to cover expenses, meet financial obligations, invest in growth opportunities, and maintain financial flexibility. With proper management and strategic planning, businesses can navigate through negative cash flow periods and position themselves for long-term success.

By understanding the causes, impact, and management of negative cash flow, businesses can effectively mitigate financial risks, make informed decisions, and ensure a healthy and thriving financial future.