Finance

How Much Is Savings Interest Taxed

Published: January 16, 2024

Learn how savings interest is taxed and understand the implications for your finances. Find out how much you may owe in taxes on your savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of personal finance! One of the fundamental objectives of many individuals is to save and grow their money. Whether it’s for an emergency fund, a down payment on a house, or a dream vacation, saving money is an essential component of financial stability and success.

When you save money in a bank account, one of the benefits you reap is the interest earned on your savings. Savings interest is the additional money that accumulates over time due to the bank paying you a percentage of your account balance as a reward for keeping your money with them.

However, when it comes to earning interest on your savings, it’s essential to be aware of the tax implications. Yes, you read that right – the interest you earn on your savings is subject to taxation.

In this article, we will explore the topic of how much savings interest is taxed and its impact on your financial planning. We will delve into the taxability of different types of savings accounts and discuss strategies to minimize the tax on your savings interest.

So, let’s dive into the world of savings interest taxation and uncover the key details you need to know to make informed financial decisions.

Understanding savings interest

Before we explore the taxation of savings interest, let’s first have a clear understanding of what savings interest is and how it works.

Savings interest is the return or income you earn on the money you deposit into a savings account. It is essentially the reward you receive for lending your money to the bank. The interest rate is expressed as a percentage and is applied to your account balance over a specific period of time, such as annually or monthly.

The interest you earn on your savings can be a significant component of your overall financial growth. While it may seem small at first, over time, compound interest can have a powerful impact on your savings. Compound interest refers to the interest earned not only on your initial deposit but also on the accumulated interest from previous periods.

For example, let’s say you deposit $1,000 into a savings account with an annual interest rate of 5%. At the end of the first year, you would earn $50 in interest, bringing your total balance to $1,050. In the second year, you would earn 5% interest on $1,050, resulting in an additional $52.50. Over time, this compounding effect can significantly boost your savings.

It’s important to note that savings interest rates vary among financial institutions and may fluctuate over time. Factors such as market conditions and prevailing interest rates influence the rates offered by banks. When comparing savings accounts, it’s advisable to consider the interest rate along with other account features, such as minimum balance requirements, fees, and accessibility.

Now that we have a solid understanding of savings interest, let’s delve into the taxation aspect and explore how the government treats the interest earned on your savings.

Taxation on savings interest

When it comes to the taxation of savings interest, the general rule is that it is considered taxable income. This means that the interest you earn on your savings is subject to taxation by the government.

The specific taxation rules for savings interest may vary depending on the country you reside in and the tax laws in place. In many countries, including the United States, the interest earned on savings is considered part of your overall income and is subject to income tax.

Typically, the interest earned on your savings is reported to tax authorities by the financial institutions, such as banks, through annual statements, such as Form 1099-INT in the U.S. This information is used by tax authorities to determine your taxable income and calculate the amount of tax you owe.

The exact tax rate applied to your savings interest depends on your income level and the tax brackets in your country. In progressive tax systems, the more income you earn, the higher your tax rate. Therefore, your savings interest is taxed at the applicable tax rate based on your total income.

It’s important to note that not all savings interest may be subject to taxation. In some cases, there may be tax exemptions or deductions available for certain types of savings accounts or specific purposes, such as education or retirement savings. Consulting with a tax professional or researching the tax laws in your country can help you understand if you qualify for any exemptions or deductions.

Now that we know that savings interest is taxable, let’s explore how different types of savings accounts are treated for tax purposes and whether savings interest is taxed at the state level.

Taxability of different types of savings accounts

When it comes to the taxability of savings interest, different types of savings accounts may have varying implications. Let’s take a closer look at a few common types of savings accounts and how they are treated for tax purposes.

1. Traditional Savings Accounts:

Traditional savings accounts, offered by banks and credit unions, are the most common type of savings accounts. The interest earned on these accounts is typically subject to income tax at the applicable tax rate. It’s important to report the interest earned on these accounts accurately on your annual tax return.

2. High-Yield Savings Accounts:

High-yield savings accounts, as the name suggests, offer higher interest rates compared to traditional savings accounts. These accounts function similarly to traditional savings accounts in terms of taxability. The interest earned on high-yield savings accounts is considered taxable income and should be reported accordingly.

3. Money Market Accounts:

Money market accounts are a type of savings account that often offers a higher interest rate than traditional savings accounts. From a tax perspective, the interest earned on money market accounts is subject to the same rules as traditional savings accounts. It is considered taxable income and should be reported on your tax return.

4. Certificates of Deposit (CDs):

A certificate of deposit, or CD, is a savings tool where you deposit a fixed amount of money for a specific term, often ranging from a few months to a few years. CDs typically offer a fixed interest rate. When it comes to taxation, the interest earned on a CD is subject to income tax. Depending on the maturity of the CD, the interest may be taxed in the year it is earned or upon maturity.

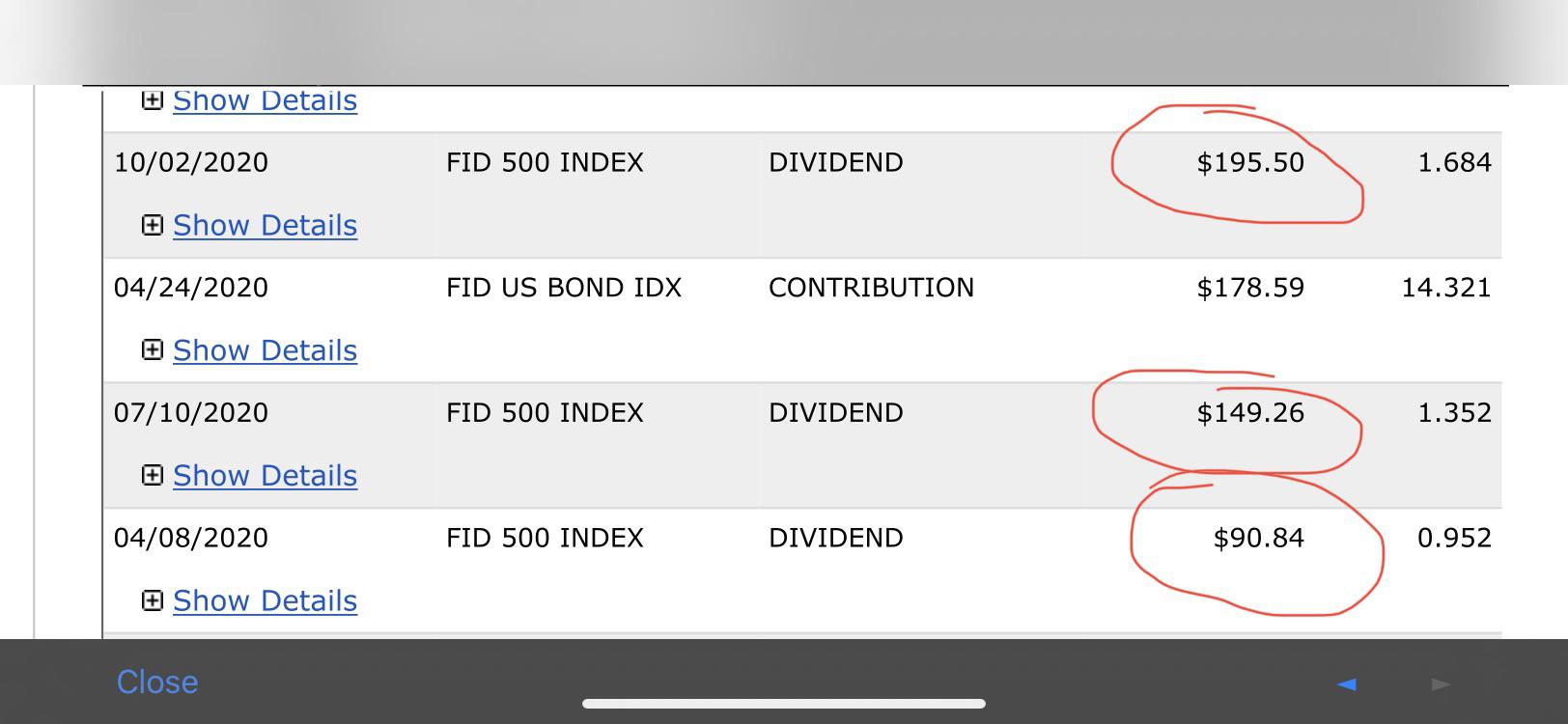

5. Retirement Savings Accounts:

Retirement savings accounts such as Individual Retirement Accounts (IRAs) and 401(k) plans have specific tax advantages. Contributions to these accounts are often tax-deductible, and the interest or investment gains are tax-deferred until retirement. When you withdraw money from these accounts, the withdrawals are generally subject to income tax. It’s important to understand the specific tax rules and limits associated with retirement savings accounts in your country.

It’s crucial to consult with a tax professional or research the tax laws in your country to understand the exact tax implications of different types of savings accounts and how they align with your financial goals.

Is savings interest taxed at the state level?

When it comes to the taxation of savings interest, the rules can vary not only at the national level but also at the state level. While savings interest is generally subject to income tax at the federal level, whether or not it is taxed at the state level depends on the tax laws of your specific state.

Some states do not impose income tax at all, which means that the interest earned on your savings is not subject to state income tax. These states, often referred to as “income tax-free states,” include Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

On the other hand, most states do impose some form of income tax, and the tax treatment of savings interest can vary among them. In some states, such as California, New York, and Oregon, savings interest is taxed at the same rate as your regular income. Other states may have specific provisions or exemptions for savings interest, allowing you to exclude a certain amount from your taxable income.

It’s important to research the tax laws in your state or consult with a tax professional to understand the specific tax treatment of savings interest in your locality. Familiarizing yourself with the state’s tax rules will help you accurately report your savings interest and fulfill your tax obligations.

Moreover, for individuals who reside in different states throughout the year or earn interest from out-of-state savings accounts, it may be necessary to navigate the complexities of multi-state taxation. Some states have reciprocal agreements that allow residents to avoid double taxation on their savings interest, while others may require you to file separate tax returns for each state where you earn income.

Understanding the state-level taxation rules on savings interest is crucial for proper financial planning and compliance with tax laws. Keeping track of your savings interest income, reporting it accurately, and staying updated on any changes to state tax regulations will ensure that you effectively manage your tax liability.

Implications of taxation on savings interest

The taxation of savings interest has several implications that can affect your overall financial strategy and goals. Understanding these implications will empower you to make informed decisions regarding your savings and tax planning. Let’s explore some of the key implications:

1. Reduced Net Returns:

When your savings interest is subject to taxation, it reduces the overall net return on your savings. The amount of tax deducted from your savings interest will depend on your tax rate and the amount of interest earned. This reduced net return can impact your plans for achieving specific financial milestones, as it may take longer to accumulate the desired amount of savings.

2. Shift in Investment Strategies:

Taxation on savings interest may influence your investment strategies. If the tax rate on savings interest is relatively high, you might consider exploring other investment options that offer tax advantages, such as tax-advantaged retirement accounts or tax-efficient investment vehicles. By doing so, you can potentially reduce your tax liability and maximize your after-tax returns.

3. Asset Allocation Considerations:

Taxation on savings interest can also impact your asset allocation decisions. If the tax rate on savings interest is significant, you may consider investing in assets that offer potential capital gains instead. Capital gains are usually taxed at a different rate than ordinary income and may provide a more tax-efficient way to grow your wealth.

4. Planning for Estimated Taxes:

If you earn a significant amount of savings interest, you may need to plan for estimated tax payments. This is especially true if the financial institution holding your savings does not withhold taxes on your behalf. Failing to make required estimated tax payments can result in penalties and interest charges. Therefore, staying aware of your tax obligations and making timely payments is crucial.

5. Impact on Budgeting and Cash Flow:

When savings interest is subject to taxation, it’s essential to account for the tax liability in your budgeting and cash flow planning. Depending on the timing of tax payments, it may be necessary to set aside funds regularly throughout the year to ensure you have enough to cover your tax obligation. Proper budgeting will prevent any surprises when tax season arrives.

Understanding the implications of taxation on savings interest allows you to take a proactive approach to your financial planning. By considering the tax implications, you can make informed decisions about saving, investing, and managing your overall financial well-being.

Strategies to minimize tax on savings interest

While savings interest is generally subject to taxation, there are several strategies you can employ to minimize the tax impact and maximize your after-tax returns. Here are some effective strategies to consider:

1. Utilize Tax-Advantaged Accounts:

One of the most effective ways to minimize taxes on savings interest is to take advantage of tax-advantaged accounts. These accounts, such as Individual Retirement Accounts (IRAs) or 401(k) plans, offer tax benefits. Contributions to these accounts may be tax-deductible, and the interest or investment gains grow tax-free until you make withdrawals in retirement. By utilizing these accounts, you can defer taxes on your savings interest and potentially benefit from lower tax rates in retirement.

2. Take Advantage of Tax Exemptions and Deductions:

Research and understand the tax laws in your country to identify any exemptions or deductions available for savings interest. Some countries provide tax breaks for specific purposes, such as education or healthcare savings. By taking advantage of these exemptions or deductions, you can reduce your taxable income and lower the amount of tax owed on your savings interest.

3. Invest in Tax-Free Savings Accounts:

Some countries offer tax-free savings accounts specifically designed to encourage savings. These accounts allow you to earn interest on your savings without being subject to income tax. By investing in tax-free savings accounts, you can enjoy the full benefits of your savings interest without worrying about tax implications.

4. Consider Municipal Bonds:

Municipal bonds are debt securities issued by local governments and are generally tax-exempt at the federal level. If you are in a higher tax bracket, investing in municipal bonds can be a tax-efficient way to generate income that is not subject to federal income tax. However, it’s essential to evaluate the risks associated with municipal bonds and consult with a financial advisor before making any investment decisions.

5. Gift or Transfer Money to Lower Tax-Bracket Individuals:

If you have family members or loved ones in a lower tax bracket, you might consider gifting or transferring funds to them. By doing so, the savings interest earned on those funds will be taxed at their lower tax rate. However, it’s crucial to consult with a tax professional and be aware of any gift tax regulations that may apply.

6. Timing of Interest Payments:

Depending on the tax laws in your country, you may have the option to time interest payments to optimize your tax liability. For example, if you expect your income to be lower in a particular year, you might consider deferring interest payments to that year to minimize the tax impact.

It’s important to note that taxation strategies can be complex, and their effectiveness may be influenced by individual circumstances and changing tax regulations. Consulting with a qualified tax advisor or financial professional is highly recommended to ensure you employ the most appropriate strategies for your specific situation.

Conclusion

Understanding the taxation of savings interest is crucial for effective financial planning and maximizing your overall returns. While savings interest is generally subject to income tax, the specific rules and rates may vary depending on your country and state. Being aware of the tax implications allows you to make informed decisions about saving, investing, and minimizing your tax liability.

Throughout this article, we explored the concept of savings interest and how it works. We discussed the taxability of different types of savings accounts, including traditional savings accounts, high-yield savings accounts, money market accounts, certificates of deposit (CDs), and retirement savings accounts. Furthermore, we examined whether savings interest is taxed at the state level, as this can vary depending on your place of residence.

The implications of taxation on savings interest can influence your investment strategies, asset allocation decisions, and budgeting. It’s important to consider these implications when planning for your financial goals and consider strategies to minimize tax on savings interest.

Strategies such as utilizing tax-advantaged accounts, taking advantage of exemptions and deductions, investing in tax-free savings accounts, considering municipal bonds, gifting or transferring money to lower tax-bracket individuals, and timing interest payments can help minimize taxes on your savings interest and maximize your after-tax returns.

Remember, tax laws are dynamic and can change over time. Consulting with a tax professional or financial advisor is recommended to ensure you stay updated on the latest regulations and make informed decisions based on your specific financial situation.

In conclusion, while taxation on savings interest may reduce your net returns, implementing appropriate strategies and staying informed can help mitigate the impact on your overall financial plan. By understanding the rules, exploring tax-efficient options, and making informed choices, you can navigate the world of savings interest taxation with confidence and optimize your financial well-being.