Finance

How To Set Up A Money Management Exel Sheet

Published: February 28, 2024

Learn how to set up a comprehensive money management Excel sheet to track your finances effectively. Manage your finances like a pro with this step-by-step guide. Ideal for anyone looking to improve their financial management skills.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Introduction

Welcome to the world of personal finance management! Whether you’re new to the concept of money management or looking to refine your existing strategies, creating a comprehensive money management Excel sheet can be a game-changer. This powerful tool empowers individuals to take control of their finances, track income and expenses, analyze spending habits, set financial goals, and create a savings plan. By harnessing the capabilities of Excel, you can gain valuable insights into your financial habits and make informed decisions to secure your financial future.

Building a money management Excel sheet is akin to crafting a personalized financial roadmap. It enables you to visualize your income, expenses, and savings in a clear and organized manner, laying the foundation for effective financial planning. With the flexibility and customization options offered by Excel, you can tailor the sheet to suit your specific financial goals and priorities, making it a versatile tool for individuals and households of all sizes.

Throughout this guide, we will delve into the step-by-step process of setting up a money management Excel sheet, covering essential aspects such as budget creation, income tracking, expense monitoring, spending habit analysis, goal setting, and savings planning. By the end of this journey, you will have the knowledge and tools to harness the full potential of Excel for managing your finances effectively.

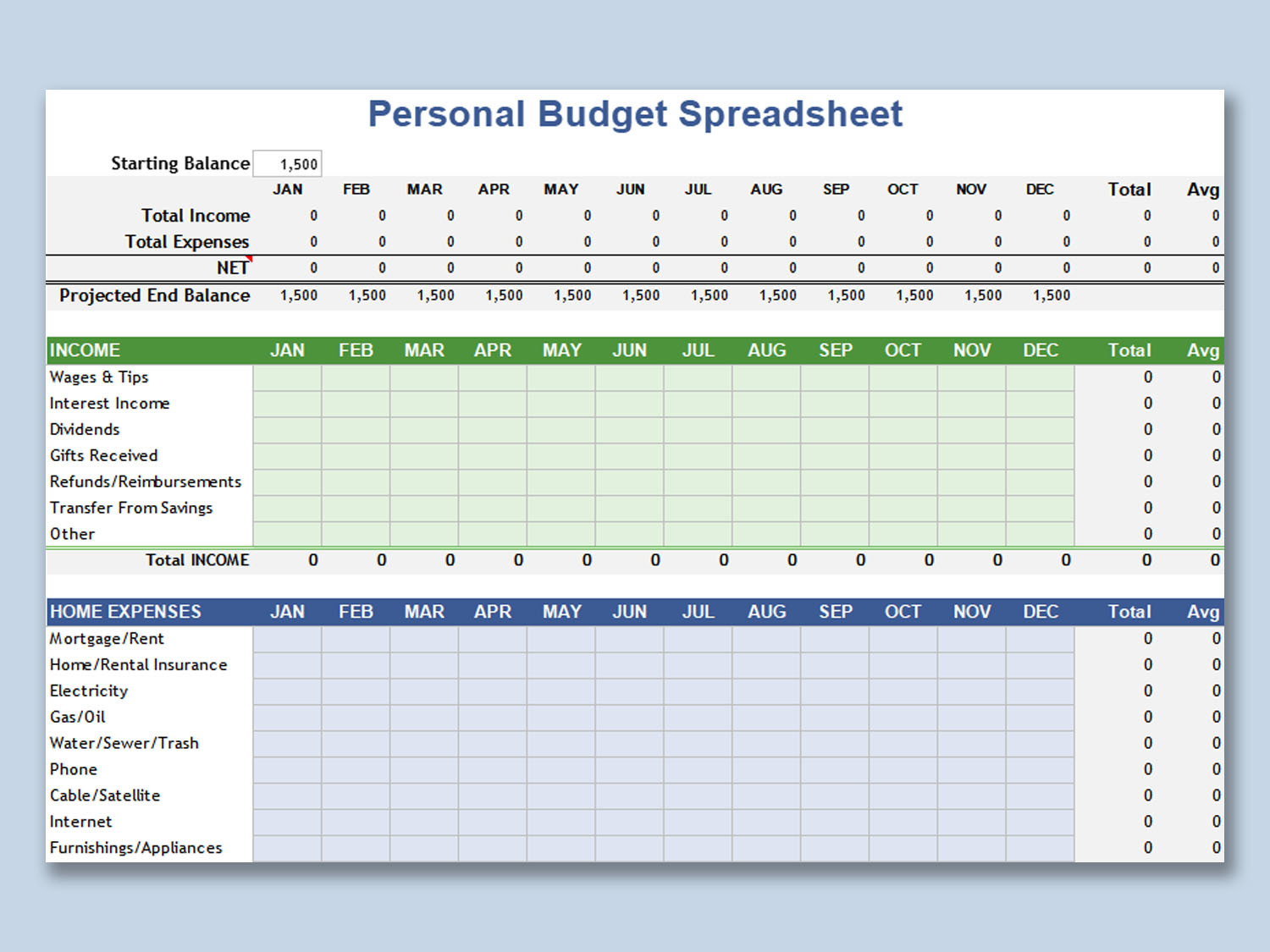

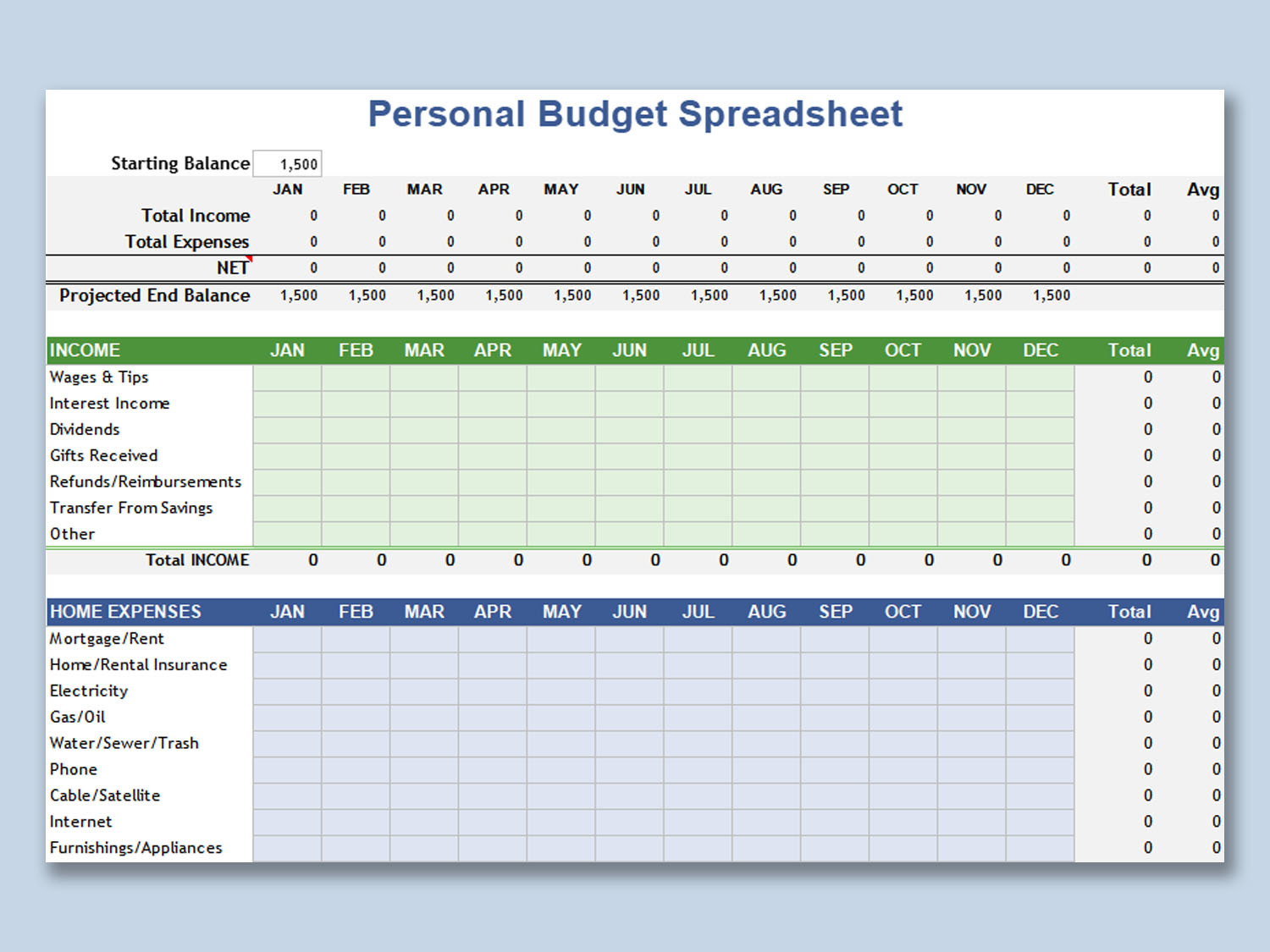

Creating a Budget

At the core of effective money management lies the creation of a comprehensive budget. A budget serves as a financial blueprint, outlining your income and expenses while providing a clear overview of your financial standing. To commence the budgeting process using Excel, start by listing all sources of income, including salaries, bonuses, investments, and any additional revenue streams. Once the income sources are identified, categorize and input them into the designated section of the Excel sheet to establish a clear picture of your financial inflow.

Conversely, the expense section of the budget demands meticulous attention. Categorize your expenses into fixed and variable categories, encompassing essentials such as rent/mortgage, utilities, groceries, transportation, and discretionary spending. By inputting these expenses into the Excel sheet, you can visualize the distribution of your expenditure and identify areas where cost-cutting measures can be implemented.

Excel’s formula capabilities can further enhance the budgeting process by automatically calculating totals, providing insights into your income, expenses, and potential savings. Additionally, conditional formatting can be utilized to highlight budget surplus or deficits, enabling you to make informed decisions and adjustments accordingly. By diligently maintaining and updating your budget within Excel, you can actively monitor your financial health and make proactive choices to align your spending with your financial goals.

Tracking Income

Effectively tracking your income is a fundamental aspect of financial management, and Excel offers a robust platform to streamline this process. Begin by creating a dedicated section within your Excel sheet to record and categorize your various income sources. Whether it’s your primary salary, freelance earnings, investment dividends, or rental income, meticulous categorization allows for a comprehensive overview of your financial inflows.

Excel’s functionality enables users to incorporate formulas that automatically calculate total income, providing a real-time snapshot of your earnings. Moreover, conditional formatting can be applied to visually distinguish different income sources and identify patterns or fluctuations in your earnings. Regularly updating this section with new income streams ensures that your financial overview remains accurate and up-to-date.

Furthermore, leveraging Excel’s graphing capabilities can transform your income data into visual representations, such as pie charts or bar graphs. These visual aids offer a clear and intuitive depiction of your income distribution, fostering a deeper understanding of your financial landscape. By harnessing Excel’s features to track income effectively, you can gain valuable insights into your earning patterns and make informed decisions to optimize your financial resources.

Monitoring Expenses

Tracking and monitoring expenses is a pivotal component of effective money management, and Excel serves as an invaluable tool in this endeavor. By creating a dedicated section within your Excel sheet to meticulously record and categorize your expenses, you can gain a comprehensive understanding of your spending habits. Whether it’s recurring bills, daily necessities, or discretionary purchases, categorizing expenses allows for a granular view of your financial outflows.

Excel’s formula features can be leveraged to automatically calculate total expenses, providing a clear overview of your spending patterns. Additionally, conditional formatting can be applied to highlight excessive spending in specific categories, enabling you to identify areas where cost-cutting measures may be necessary. Regularly updating this section with new expenses ensures that your financial overview remains accurate and reflective of your current spending habits.

Moreover, Excel’s data visualization capabilities can be utilized to transform your expense data into insightful charts and graphs. Visual representations such as pie charts or trend graphs offer a compelling visual overview of your expenditure, facilitating a deeper comprehension of your spending patterns. By utilizing Excel to monitor expenses, you can gain valuable insights into your financial habits and make informed decisions to optimize your spending and achieve greater financial efficiency.

Analyzing Spending Habits

Delving into the realm of personal finance, analyzing your spending habits is a crucial step towards achieving financial stability and growth. Excel provides a powerful platform to dissect and comprehend your expenditure patterns, enabling you to make informed decisions and implement positive financial changes.

By utilizing Excel to categorize and visualize your expenses, you can gain a comprehensive overview of your spending habits. Identify recurring trends in your expenditure, such as excessive dining out, impulsive shopping, or subscription services. Excel’s sorting and filtering features can aid in isolating specific spending categories, allowing you to pinpoint areas where adjustments are necessary.

Furthermore, Excel’s pivot table functionality empowers you to summarize and analyze your expenses dynamically. This feature facilitates a deeper exploration of your spending habits, unveiling insights such as the percentage of income allocated to different expense categories or identifying peak spending periods throughout the year.

Moreover, Excel’s ability to create trend lines and perform regression analysis on your spending data offers a proactive approach to understanding your financial behavior. By identifying trends and patterns, you can make informed decisions to curtail excessive spending and reallocate resources towards savings or investment goals.

Through the lens of Excel, analyzing your spending habits transcends the realm of number crunching, evolving into a dynamic process of self-discovery and financial empowerment. By harnessing the capabilities of Excel to dissect and comprehend your spending habits, you can pave the way towards a more mindful and purposeful approach to managing your finances.

Setting Financial Goals

Embarking on a journey towards financial empowerment entails the establishment of clear and achievable financial goals. Excel serves as an exceptional tool for delineating, tracking, and realizing these objectives, providing a structured approach to financial goal setting.

Begin by defining your short-term, mid-term, and long-term financial aspirations within your Excel sheet. Whether it’s building an emergency fund, saving for a down payment on a home, or planning for retirement, articulating these goals sets the stage for focused and intentional financial planning.

Excel’s formula capabilities can be harnessed to calculate the amount needed to achieve each financial goal, factoring in variables such as time horizon, expected returns, and regular contributions. This dynamic feature enables you to visualize the financial milestones required to reach each goal, providing a tangible roadmap for your financial journey.

By integrating progress trackers and visual indicators within your Excel sheet, you can actively monitor and measure your advancement towards each financial goal. Whether it’s a simple progress bar or conditional formatting that changes based on milestone achievements, these visual cues offer a sense of accomplishment and motivation, propelling you closer to your aspirations.

Furthermore, Excel’s scenario analysis capabilities empower you to evaluate different financial scenarios and assess their impact on your goals. This feature enables you to make informed decisions regarding allocation of resources, investment strategies, and potential adjustments to your financial objectives.

Through the utilization of Excel as a platform for setting financial goals, you can transform abstract aspirations into tangible targets, fostering a sense of purpose and direction in your financial endeavors. By leveraging the dynamic features of Excel to delineate, monitor, and adapt your financial goals, you can embark on a purposeful and structured path towards financial fulfillment.

Creating a Savings Plan

Establishing a robust savings plan is a cornerstone of financial security and resilience. Excel offers a versatile platform to craft and execute a tailored savings strategy, enabling individuals to fortify their financial foundations and work towards their long-term aspirations.

Commence the savings planning process within Excel by designating specific saving goals, whether it’s an emergency fund, a vacation fund, or a down payment for a major purchase. By categorizing these objectives within your Excel sheet, you can systematically allocate funds towards each goal, fostering a disciplined approach to saving.

Excel’s formula functions can be employed to calculate the amount required to reach each savings goal, factoring in variables such as time horizon and regular contributions. This dynamic feature provides clarity on the savings milestones to be achieved, empowering you to track your progress and make informed adjustments as necessary.

Utilize Excel’s graphing capabilities to visually represent your savings plan, transforming raw data into compelling charts or graphs. These visual aids offer a clear depiction of your savings trajectory, instilling a sense of motivation and accomplishment as you witness your savings grow over time.

Moreover, Excel’s scenario analysis functionality enables you to simulate different saving scenarios, allowing for an informed comparison of potential strategies and their impact on your financial objectives. This feature empowers you to make strategic decisions regarding allocation of resources and the optimization of your savings plan.

By leveraging Excel as a platform for creating a savings plan, you can infuse intentionality and structure into your financial journey. The dynamic capabilities of Excel enable you to articulate, monitor, and adapt your savings strategy, fostering a proactive and purposeful approach towards building a robust financial safety net and realizing your long-term aspirations.

Conclusion

Embarking on the journey of setting up a money management Excel sheet unveils a transformative approach to personal finance. Through the meticulous organization of income, expenses, savings goals, and spending habits, individuals can gain valuable insights into their financial landscape and make informed decisions to bolster their financial well-being.

Excel serves as a dynamic canvas for financial empowerment, offering a plethora of tools and functionalities to streamline the management of personal finances. From creating comprehensive budgets to tracking income, monitoring expenses, and analyzing spending habits, Excel provides a robust platform for individuals to gain clarity and control over their financial resources.

Moreover, the process of setting financial goals within Excel fosters a sense of purpose and direction, enabling individuals to articulate their aspirations and chart a deliberate course towards financial fulfillment. By integrating progress trackers and visual indicators, Excel transforms abstract objectives into tangible milestones, instilling a sense of accomplishment and motivation.

Furthermore, the creation of a savings plan within Excel underscores the importance of disciplined saving and prudent financial planning. By leveraging Excel’s capabilities to calculate, visualize, and adapt savings strategies, individuals can fortify their financial foundations and work towards their long-term aspirations with confidence.

In conclusion, the journey of setting up a money management Excel sheet transcends the realm of number crunching, evolving into a dynamic process of self-discovery, intentionality, and financial empowerment. By harnessing the versatile features of Excel, individuals can navigate their financial landscapes with clarity, purpose, and resilience, paving the way towards a more secure and prosperous financial future.